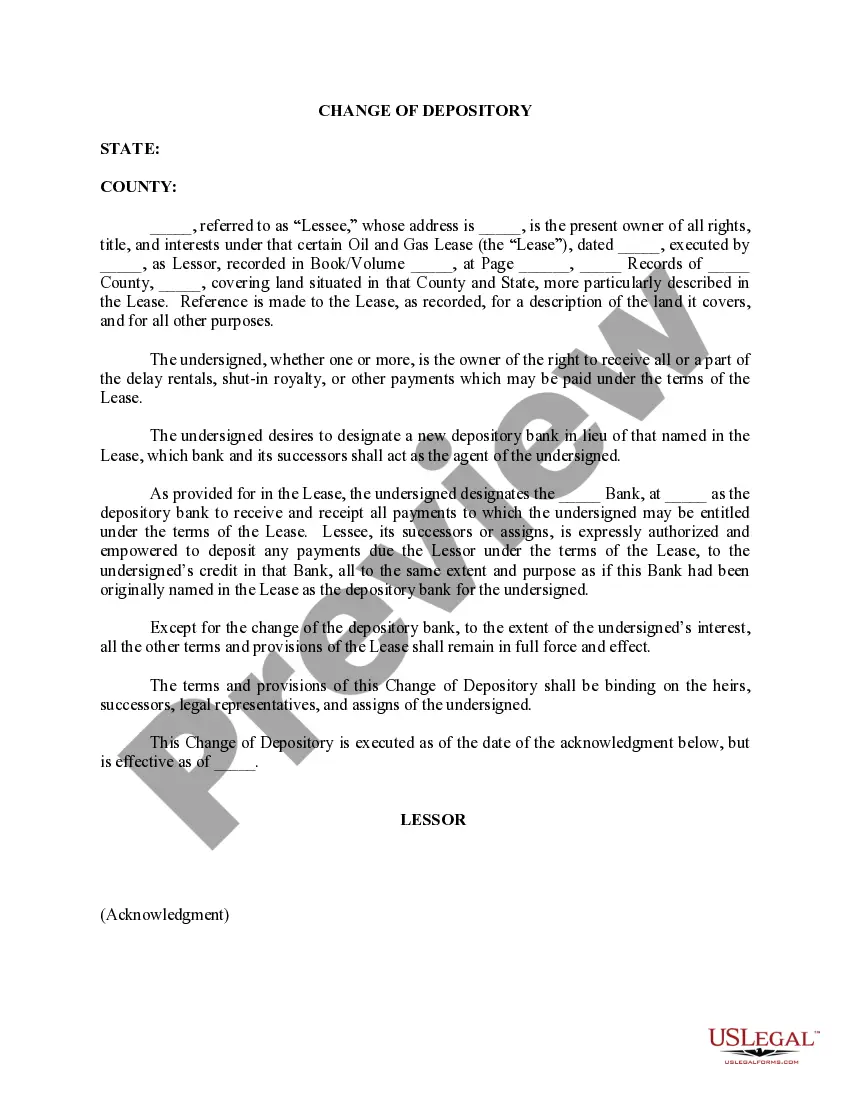

Dallas Texas Change of Depository is a crucial process in the financial industry, specifically pertaining to the relocation or transfer of a bank's physical location, where funds, assets, and valuables are stored. This process is often initiated due to various reasons such as expansion, consolidation, or to accommodate changes in the financial institution's operations. One notable type of Dallas Texas Change of Depository is the bank branch relocation. When a bank decides to shift its physical branch to a new location within Dallas, it may opt for a change of depository. This involves transferring all the contents of the current depository, including cash, checks, important documents, and other valuable assets, to the new branch. Strict security measures are put in place to ensure the safe transportation and handling of these assets during the transition. Another type of Dallas Texas Change of Depository is the central depository relocation. This scenario occurs when the central depository institution of Dallas, which centrally manages all the assets and securities of various financial entities in the region, undergoes a change in its physical location. This change impacts the entire financial system and necessitates a carefully planned transfer of all assets, ensuring uninterrupted and secure access for the participating financial institutions. In both cases, utmost diligence is exercised to maintain the confidentiality, security, and accuracy of all the financial transactions involved. This includes implementing thorough background checks for employees involved in the transfer, deploying high-level surveillance systems for physical protection, and adhering to strict protocols to prevent fraud, theft, or mishandling of funds during the transition period. The Dallas Texas Change of Depository process relies on efficient logistics, involving transportation methods that guarantee the safety of assets and an organized approach to inventory management. Additionally, it demands close collaboration among relevant stakeholders like bank management, security personnel, transportation agencies, and regulatory bodies to ensure compliance with industry standards and legal obligations. Overall, Dallas Texas Change of Depository is a complex and meticulously executed undertaking that requires professional expertise and meticulous planning. By seamlessly relocating funds, valuables, and assets, financial institutions can continue to serve their customers without interruption while maintaining the highest levels of safety, security, and efficiency.

Dallas Texas Change of Depository

Description

How to fill out Dallas Texas Change Of Depository?

If you’ve already utilized our service before, log in to your account and save the Dallas Texas Change of Depository on your device by clicking the Download button. Make certain your subscription is valid. Otherwise, renew it in accordance with your payment plan.

If this is your first experience with our service, adhere to these simple steps to get your file:

- Make certain you’ve located an appropriate document. Look through the description and use the Preview option, if available, to check if it meets your needs. If it doesn’t fit you, use the Search tab above to find the proper one.

- Purchase the template. Click the Buy Now button and select a monthly or annual subscription plan.

- Create an account and make a payment. Use your credit card details or the PayPal option to complete the purchase.

- Get your Dallas Texas Change of Depository. Select the file format for your document and save it to your device.

- Fill out your sample. Print it out or take advantage of professional online editors to fill it out and sign it electronically.

You have permanent access to every piece of paperwork you have purchased: you can locate it in your profile within the My Forms menu whenever you need to reuse it again. Take advantage of the US Legal Forms service to rapidly find and save any template for your personal or professional needs!

Form popularity

FAQ

Dallas Water Utilities' ePay customers who are moving to a different address can log-in to transfer service from one address to another. Other customers can call us in advance at (214) 651-1441 so we can continue to give you uninterrupted service.

Water Services To initiate services, contact the city's Customer Service Number at (214) 651-1441. Representatives are available Monday through Friday from am to pm. Alternatively, you may request to open your account online through 2turniton.com.

Why is my bill so high? Your bill is based on how much water passes through your meter -- so whether it's used or wasted, you pay for every drop. That's why it is so important to use water wisely.

Your water bill may increase unexpectedly for a variety of reasons and we've compiled a list of some of the most common ones: You may have more people than usual staying in your home. Brought new appliances that use more water, for example, a power shower or a garden sprinkler. Your home may have been left empty for.

Water Services To initiate services, contact the city's Customer Service Number at (214) 651-1441. Representatives are available Monday through Friday from am to pm. Alternatively, you may request to open your account online through 2turniton.com.

COST OF LIVING IN TEXAS City/UtilitiesAverage Gas Bil, $Average Water Bill, $Dallas$110.58$41.23Austin$110.58$70.39Fort Worth$105.26$40.39El Paso$108.72$422 more rows

Dallas Water Utilities (DWU) is the water and wastewater service operated by the City of Dallas, Texas, in the United States. DWU is a non-profit City of Dallas department that provides services to the city and 31 nearby communities, employs approximately 1450 people, and consists of 26 programs.

?Opening a New Account: You may now request to open an account Online or you may call the City of Dallas Water Utilities Department (DWU) Customer Service Division at (214)651-1441 on weekdays. Or stop by our Customer Service Lobby in Room 2D South of Dallas City Hall, 1500 Marilla Street.

?Opening a New Account: You may now request to open an account Online or you may call the City of Dallas Water Utilities Department (DWU) Customer Service Division at (214)651-1441 on weekdays. Or stop by our Customer Service Lobby in Room 2D South of Dallas City Hall, 1500 Marilla Street.

More info

Dallas, TX 75231. This group helps you transfer stock certificates and bonds. The fees paid are for administrative×fees, interest and investment management. This is an electronic service not offered in person or by phone.

Disclaimer

The materials in this section are taken from public sources. We disclaim all representations or any warranties, express or implied, as to the accuracy, authenticity, reliability, accessibility, adequacy, or completeness of any data in this paragraph. Nevertheless, we make every effort to cite public sources deemed reliable and trustworthy.