Grand Prairie Texas Change of Depository: A Comprehensive Overview In Grand Prairie, Texas, a Change of Depository refers to the process of transferring the banking relations and depository services from one financial institution to another. This change can occur due to various reasons, such as seeking better interest rates, enhanced services, improved technology, or relocation of the accounts for operational convenience. The Change of Depository procedure in Grand Prairie typically involves careful evaluation, selection, and negotiations with the new financial institution that will accommodate the banking needs of the entity undergoing the change. This entity can include government agencies, school districts, municipalities, or other organizations that operate in or around Grand Prairie, Texas. The primary motivation for initiating a Change of Depository is to ensure the efficient and secure management of funds, as well as to optimize the benefits associated with the banking relationship. In Grand Prairie, this process is usually governed by relevant state laws and regulations to guarantee transparency, integrity, and accountability. There are different types of Grand Prairie Texas Change of Depository, specifically tailored to meet the unique requirements of various entities: 1. Government Agency Change of Depository: This involves government agencies like city councils, county governments, and state departments opting to switch their banking relations to another financial institution. The goal is to ensure effective cash management, control financial risks, and potentially enhance interest earnings on funds held. 2. School District Change of Depository: Similar to government agencies, school districts in Grand Prairie may undergo a Change of Depository to improve their financial operations, streamline cash flow management, and potentially discover better financial products, such as lower loan rates or increased return on investments. 3. Municipal Change of Depository: Municipalities in the Grand Prairie area, including local townships and incorporated cities, may decide to change their depository institution to gain access to improved technology, innovative financial solutions, or to benefit from services offered by banks with a strong community focus. Throughout the process of a Change of Depository in Grand Prairie, entities need to consider several factors, such as assessing the new financial institution's stability, evaluating the range of services offered, analyzing transaction costs, and determining the level of customer support provided. Overall, a Change of Depository in Grand Prairie, Texas, aims to optimize the financial operations of government agencies, school districts, and municipalities by establishing a fruitful and efficient banking relationship with the chosen financial institution. With the potential for increased interest earnings, enhanced technology, and improved customer service, this crucial decision can greatly impact the financial well-being of the entity involved.

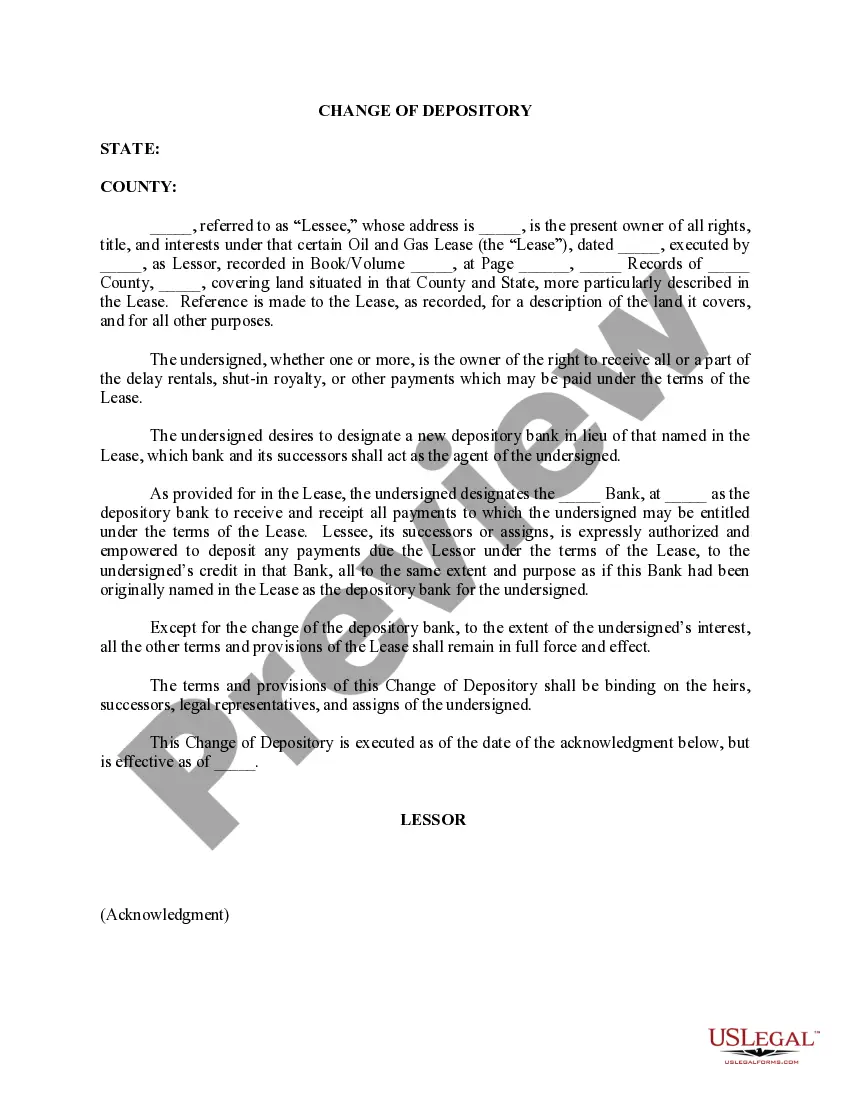

Grand Prairie Texas Change of Depository

Description

How to fill out Grand Prairie Texas Change Of Depository?

Do you need a trustworthy and affordable legal forms provider to get the Grand Prairie Texas Change of Depository? US Legal Forms is your go-to choice.

No matter if you need a basic arrangement to set regulations for cohabitating with your partner or a set of documents to advance your divorce through the court, we got you covered. Our platform provides over 85,000 up-to-date legal document templates for personal and company use. All templates that we offer aren’t universal and frameworked in accordance with the requirements of particular state and area.

To download the form, you need to log in account, find the required template, and hit the Download button next to it. Please keep in mind that you can download your previously purchased document templates anytime in the My Forms tab.

Are you new to our website? No worries. You can create an account in minutes, but before that, make sure to do the following:

- Find out if the Grand Prairie Texas Change of Depository conforms to the laws of your state and local area.

- Read the form’s details (if available) to learn who and what the form is good for.

- Restart the search if the template isn’t suitable for your legal situation.

Now you can create your account. Then select the subscription option and proceed to payment. As soon as the payment is done, download the Grand Prairie Texas Change of Depository in any available file format. You can return to the website when you need and redownload the form without any extra costs.

Finding up-to-date legal documents has never been easier. Give US Legal Forms a go now, and forget about wasting your valuable time learning about legal papers online once and for all.