Pasadena Texas Change of Depository refers to the process of transferring or switching the financial institution where funds or assets are held in Pasadena, Texas. This change typically occurs when an individual, organization, or government entity wishes to move their deposit accounts or investments from one bank or financial institution to another within the Pasadena area. The Pasadena Texas Change of Depository can encompass various types of accounts such as checking accounts, savings accounts, money market accounts, certificates of deposit (CDs), retirement accounts, or investment portfolios. Individuals or entities may decide to execute a Change of Depository for a multitude of reasons including better interest rates, improved customer service, access to additional financial products, or simply to consolidate their financial holdings. If we consider specific types of Pasadena Texas Change of Depository, they may include the following: 1. Personal Change of Depository: This occurs when an individual decides to switch their personal checking or savings accounts from one bank to another within the Pasadena region. It could be driven by factors such as high fees, dissatisfaction with service, or wanting to take advantage of better interest rates or promotional offers. 2. Business Change of Depository: When a business, whether small, medium, or large, chooses to move their business accounts, loans, merchant services, or treasury management services from one Pasadena-based bank to another. This decision might be influenced by factors like lower transaction fees, enhanced cash management tools, dedicated business support, or tailored business financing options. 3. Government Change of Depository: Municipalities, governmental agencies, or public organizations may opt to conduct a Change of Depository to manage their public funds more efficiently. This process may involve transferring city or county accounts, payroll services, procurement cards, or investment portfolios from one financial institution to another with the intention to improve financial services, streamline operations, or gain better returns on invested funds. 4. Institutional Change of Depository: Non-profit organizations, educational institutions, healthcare facilities, or other institutions operating in the Pasadena area may also undertake a Change of Depository to optimize their financial resources. This change could involve endowment funds, grant accounts, trust funds, or general operational accounts, aiming to consolidate accounts, improve investment strategies, or align with financial institutions more aligned with their specific needs. Executing a Pasadena Texas Change of Depository typically involves opening new accounts at the desired financial institution, transferring funds or assets from existing accounts at the current institution, and updating automatic payments or direct deposits to reflect the new banking relationship. It may also involve closing accounts at the previous institution once all funds have been successfully moved. In conclusion, the Pasadena Texas Change of Depository encompasses the process of transferring financial accounts and assets from one institution to another within Pasadena, Texas. It can include various types such as personal, business, government, or institutional Change of Depository, driven by the need for improved financial services, better rates, advanced cash management tools, or tailored investment options.

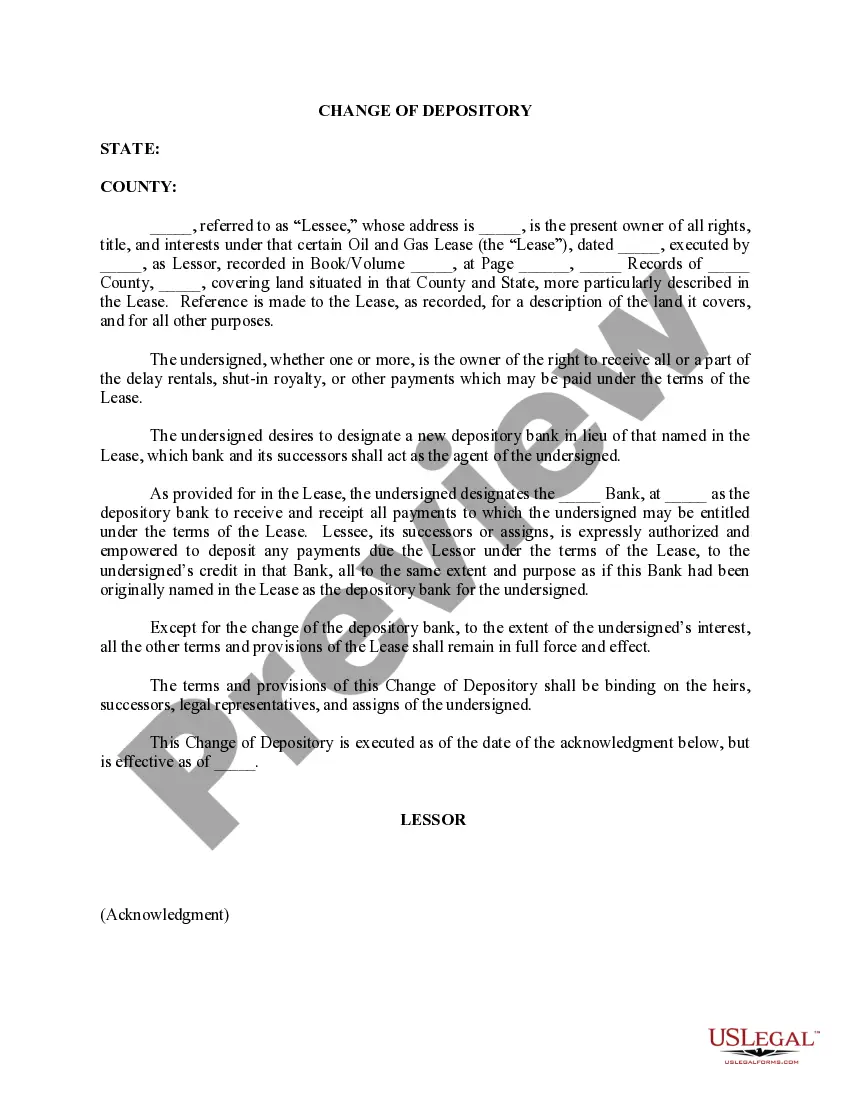

Pasadena Texas Change of Depository

Description

How to fill out Pasadena Texas Change Of Depository?

No matter what social or professional status, completing legal documents is an unfortunate necessity in today’s professional environment. Very often, it’s almost impossible for a person with no law background to create such paperwork cfrom the ground up, mostly because of the convoluted terminology and legal nuances they come with. This is where US Legal Forms comes to the rescue. Our service provides a huge catalog with more than 85,000 ready-to-use state-specific documents that work for practically any legal case. US Legal Forms also is a great asset for associates or legal counsels who want to to be more efficient time-wise using our DYI tpapers.

No matter if you want the Pasadena Texas Change of Depository or any other paperwork that will be good in your state or county, with US Legal Forms, everything is at your fingertips. Here’s how to get the Pasadena Texas Change of Depository quickly using our trustworthy service. If you are already an existing customer, you can proceed to log in to your account to get the needed form.

Nevertheless, in case you are new to our platform, ensure that you follow these steps prior to obtaining the Pasadena Texas Change of Depository:

- Be sure the template you have found is specific to your location since the rules of one state or county do not work for another state or county.

- Preview the document and read a brief outline (if available) of cases the document can be used for.

- If the one you picked doesn’t suit your needs, you can start again and look for the suitable form.

- Click Buy now and pick the subscription plan that suits you the best.

- utilizing your login information or register for one from scratch.

- Pick the payment gateway and proceed to download the Pasadena Texas Change of Depository as soon as the payment is done.

You’re all set! Now you can proceed to print out the document or complete it online. If you have any problems getting your purchased documents, you can quickly find them in the My Forms tab.

Whatever situation you’re trying to sort out, US Legal Forms has got you covered. Try it out now and see for yourself.