Pearland Texas Change of Depository is a process where the governing body of Pearland, Texas, decides to switch its depository bank. This change is typically initiated to explore better banking services, more advantageous interest rates, or enhanced financial services for the city. One type of Pearland Texas Change of Depository is governmental. This occurs when the city's government decides to switch its depository bank, which is responsible for handling various financial transactions, such as payroll deposits, tax collections, and other city-related banking needs. The decision to change the depository is based on factors like the bank's track record, services offered, and competitive interest rates. Another type of Pearland Texas Change of Depository is public. This refers to the switch of the Texas Public Funds Investment Act (AFIA) depository, which manages public funds, including those of Pearland, Texas. This change aims to ensure better investment returns and effective management of public funds while adhering to the guidelines set by the Texas Treasury Safekeeping Trust Company. When undergoing a Pearland Texas Change of Depository, the governing body of Pearland, Texas follows a rigorous process. Firstly, they evaluate the current depository's performance, conduct thorough research, and invite proposals from potential depository banks. The selection process involves assessing the proposed services, fees, interest rates, and financial stability of the banks. The chosen bank is then recommended to the governing body for further evaluation and final approval. The Pearland Texas Change of Depository may result in significant benefits for the city. By exploring other banking options, Pearland can secure better interest rates, lower fees, and improved financial resources. Additionally, a change of depository can foster healthy competition among banks, encouraging them to offer competitive banking services and technology advancements, which can ultimately elevate the financial infrastructure of Pearland, Texas. In conclusion, Pearland Texas Change of Depository is a process through which the governing body of Pearland, Texas decides to switch its depository bank, aiming to enhance its financial services. This change can lead to improved interest rates, reduced fees, and upgraded banking services. By carefully evaluating different proposals, Pearland ensures that the selected depository bank can effectively handle its financial transactions while complying with relevant regulations.

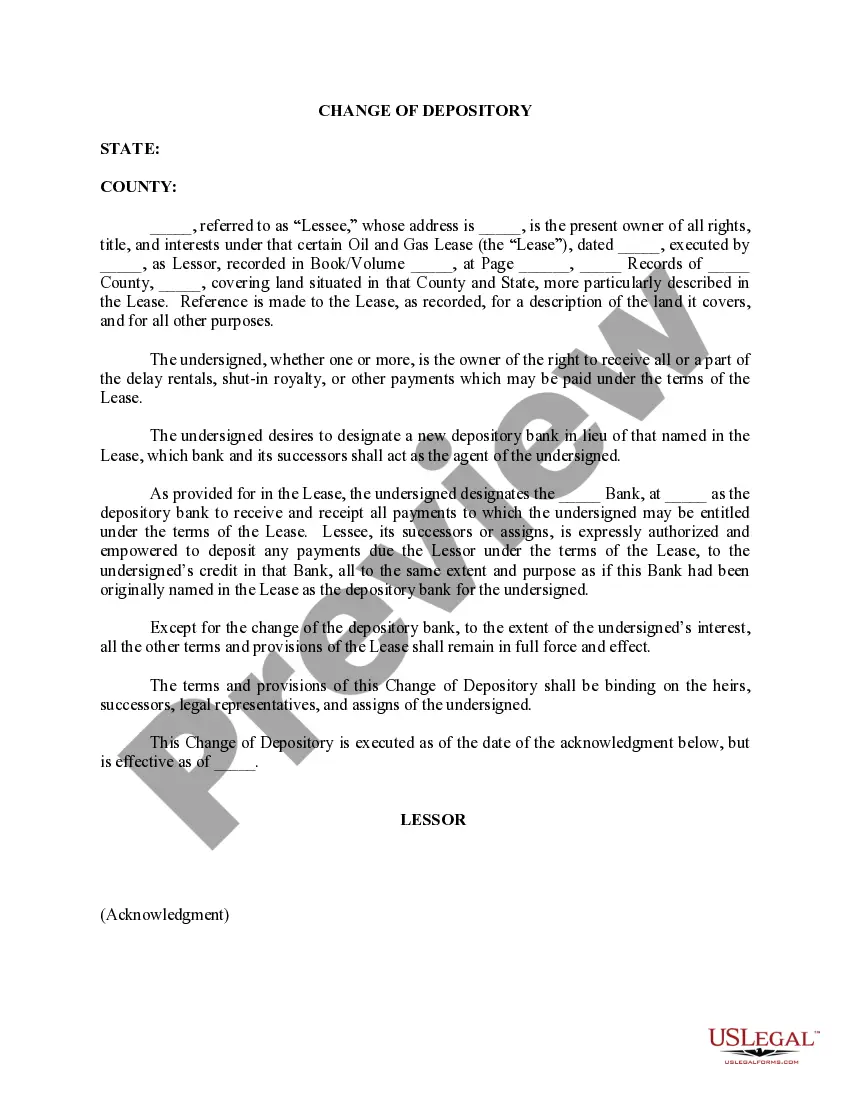

Pearland Texas Change of Depository

Description

How to fill out Pearland Texas Change Of Depository?

Are you looking for a trustworthy and affordable legal forms supplier to buy the Pearland Texas Change of Depository? US Legal Forms is your go-to option.

No matter if you require a basic agreement to set regulations for cohabitating with your partner or a set of documents to move your divorce through the court, we got you covered. Our website offers over 85,000 up-to-date legal document templates for personal and company use. All templates that we give access to aren’t universal and framed in accordance with the requirements of specific state and area.

To download the form, you need to log in account, locate the needed template, and click the Download button next to it. Please remember that you can download your previously purchased form templates at any time in the My Forms tab.

Is the first time you visit our platform? No worries. You can set up an account with swift ease, but before that, make sure to do the following:

- Find out if the Pearland Texas Change of Depository conforms to the regulations of your state and local area.

- Go through the form’s description (if provided) to learn who and what the form is intended for.

- Restart the search if the template isn’t good for your legal scenario.

Now you can register your account. Then choose the subscription plan and proceed to payment. As soon as the payment is done, download the Pearland Texas Change of Depository in any provided format. You can get back to the website at any time and redownload the form without any extra costs.

Finding up-to-date legal documents has never been easier. Give US Legal Forms a try today, and forget about spending hours learning about legal paperwork online once and for all.