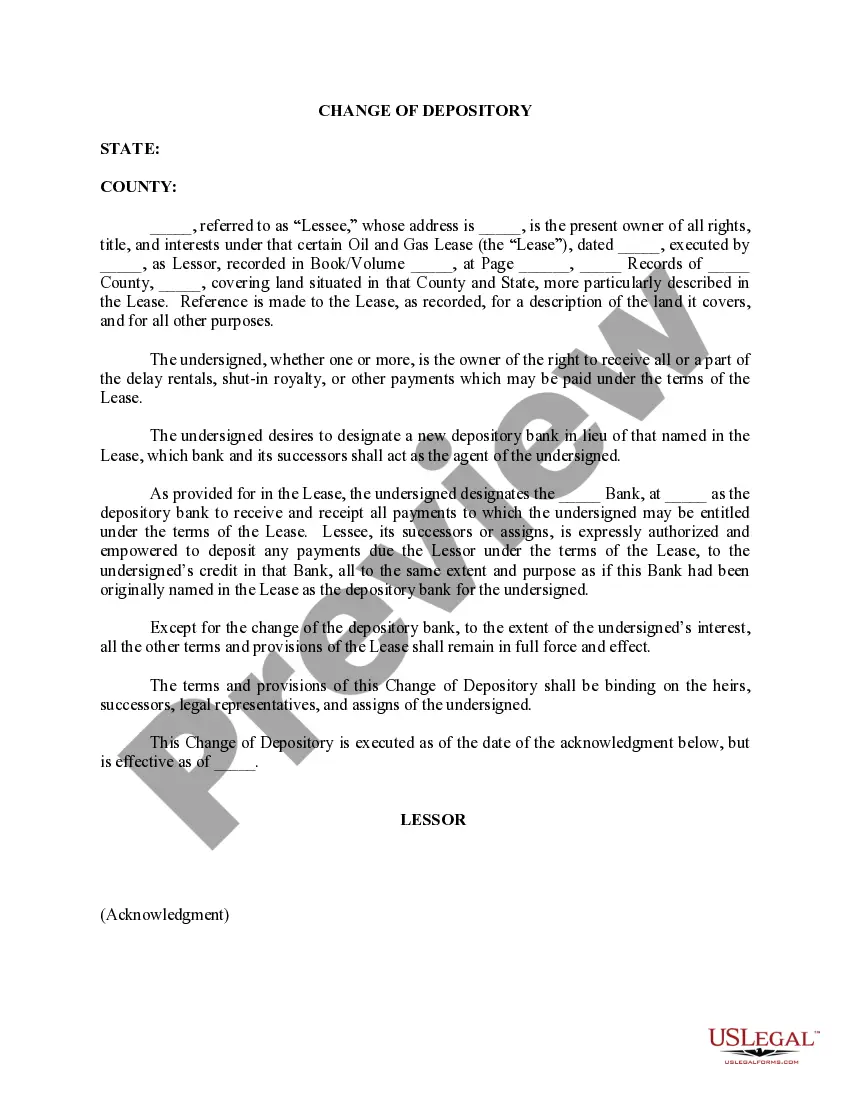

Travis Texas Change of Depository refers to the process of transferring or relocating financial assets from one banking institution to another within Travis County, Texas. This change can include various types of depositor accounts such as personal savings accounts, checking accounts, certificates of deposit (CDs), money market accounts, and more. One type of Travis Texas Change of Depository is the relocation of personal savings accounts. This involves moving funds from one bank to another within Travis County, Texas, while ensuring that the account holder's funds remain secure and easily accessible. By switching to a different depository, individuals may benefit from better interest rates, lower fees, or improved customer service. Another type of Travis Texas Change of Depository is the transfer of checking accounts. This process involves shifting an individual's primary transactional account, used for everyday expenses and bill payments, to a different banking institution. By switching depositories, account holders may find advantages such as mobile banking apps, ATM access, rewards programs, or other perks that enhance their banking experience. Certificates of Deposit (CDs) are also subject to Travis Texas Change of Depository. These time deposits offer fixed interest rates over a specified period, and account holders may opt to switch their existing CDs from one bank to another in Travis County, Texas. Such a change may be motivated by seeking higher interest rates, more flexible terms, or better renewal options with a different depository. Travis Texas Change of Depository can also apply to money market accounts. These accounts typically offer higher interest rates than regular savings accounts and provide limited check-writing abilities. Account holders may choose to switch their money market accounts to a different banking institution within Travis County, Texas, to take advantage of better interest rates, lower minimum balance requirements, or additional features such as online money market management services. In summary, Travis Texas Change of Depository encompasses the process of transferring various types of depositor accounts, including personal savings accounts, checking accounts, certificates of deposit (CDs), and money market accounts, from one banking institution to another within Travis County, Texas. The primary motivations for such changes can range from seeking better interest rates, improved customer service, enhanced banking features, or lower fees.

Travis Texas Change of Depository

Description

How to fill out Travis Texas Change Of Depository?

Take advantage of the US Legal Forms and get immediate access to any form template you want. Our beneficial platform with thousands of documents makes it easy to find and obtain almost any document sample you require. You can download, fill, and sign the Travis Texas Change of Depository in just a matter of minutes instead of surfing the Net for many hours looking for an appropriate template.

Using our catalog is a great way to raise the safety of your document submissions. Our professional attorneys on a regular basis review all the documents to make sure that the forms are appropriate for a particular state and compliant with new acts and regulations.

How can you obtain the Travis Texas Change of Depository? If you have a subscription, just log in to the account. The Download option will be enabled on all the samples you view. Additionally, you can find all the earlier saved records in the My Forms menu.

If you haven’t registered a profile yet, follow the instructions listed below:

- Open the page with the template you need. Make sure that it is the form you were looking for: check its title and description, and make use of the Preview option if it is available. Otherwise, utilize the Search field to find the appropriate one.

- Start the saving procedure. Click Buy Now and choose the pricing plan that suits you best. Then, create an account and process your order utilizing a credit card or PayPal.

- Export the document. Choose the format to get the Travis Texas Change of Depository and change and fill, or sign it for your needs.

US Legal Forms is one of the most considerable and reliable template libraries on the internet. We are always ready to assist you in virtually any legal process, even if it is just downloading the Travis Texas Change of Depository.

Feel free to benefit from our service and make your document experience as efficient as possible!

Form popularity

FAQ

The clerk is the county recorder and as such accepts for filing and recording a wide variety of documents from deeds to marriage licenses to cattle brands. The clerk is also clerk to the County Court, a court of limited jurisdiction in civil and criminal matters, but the principal court for probate matters.

Contact Us Main Phone. Email. recording@traviscountytx.gov. Postal Mail. Travis County Clerk. P.O. Box 149325. Austin, TX 78714. Commercial Carrier. Recording Division. Travis County Clerk. 5501 Airport Boulevard, #100B. Austin, TX 78751.

Real Property documents may be filed and recorded with the Travis County Clerk's Office in person or by mail. The original documents with original signatures are required for the recording. The County Clerk's Office will not record a copy. Recordings are completed immediately once received in the County Clerk's Office.

You can E-File using this link: eFileTexas.Gov Official E-Filing System for Texas, mail to Travis County District Clerk, PO Box 679003, Austin, TX 78767 or hand deliver documents to us by appointment only. Call (512) 854-9457 or send an email to District.eFile@traviscountytx.gov for any questions.

You can file your mechanics liens with the Travis County Clerk's Recording Division by postal mail, by courier, or in person. The County Clerk also accepts electronic filings of documents from an authorized eRecording submitter.

You can E-File using this link: eFileTexas.Gov Official E-Filing System for Texas, mail to Travis County District Clerk, PO Box 679003, Austin, TX 78767 or hand deliver documents to us by appointment only. Call (512) 854-9457 or send an email to District.eFile@traviscountytx.gov for any questions.

Uniform Commercial Code - Fees Initial Filing Form ? Mail and Fax FilingsFiling FeeAgricultural Lien$15 for Two pages or less; $30 for Three pages or moreAircraft Maintenance LienContract Agricultural LienTransition Property Notice (TPN1) - PDF8 more rows

The Austin County, Texas requirements for recording a mechanics lien are: Verify you have the right to file a valid lien.Draft your Texas affidavit of lien form (mechanics lien claim) for your specific role on the job.File your lien claim with the County Recorder's office where work was performed.

Rebecca Guerrero is honored to serve as County Clerk for the 5th largest county in the State of Texas with a population of over 1.3 million citizens. She is the first Hispanic woman to be appointed by Commissioners' Court in Travis County to serve in this role.