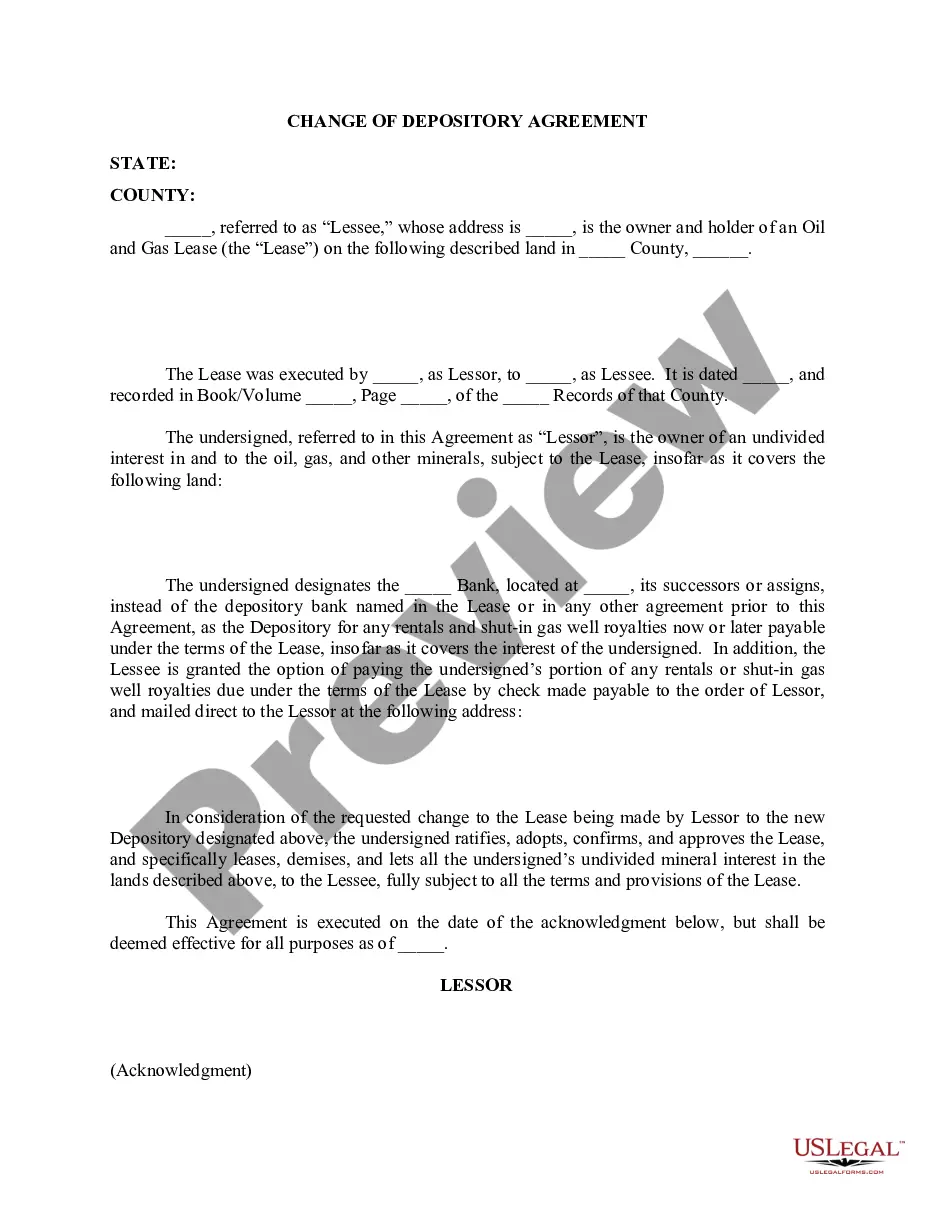

This form is used when the Lessor is the owner of an undivided interest in and to the oil, gas, and other minerals, subject to a Lease designates another bank, its successors or assigns, instead of the depository bank named in the Lease or in any other agreement prior to this Agreement, as the Depository for any rentals and shut-in gas well royalties payable under the terms of the Lease.

The Collin Texas Change of Depository Agreement refers to a legally binding document that governs the transfer of funds from one financial institution to another in the county of Collin, Texas. This agreement typically occurs when a school district or government entity decides to change its primary depository bank. This detailed description will shed light on the purpose, provisions, and intricacies of the Collin Texas Change of Depository Agreement. The Collin Texas Change of Depository Agreement serves as a pivotal contract that facilitates the seamless transition of monetary transactions between the government entity and the new depository bank. It outlines the terms and conditions under which the funds will be managed, safeguarded, and disbursed by the selected financial institution. One primary objective of the Collin Texas Change of Depository Agreement is to ensure the stability and security of funds held by the government entity. It establishes the responsibilities and obligations of both parties involved, setting forth guidelines for accurate record-keeping, reporting requirements, and proper utilization of funds. Additionally, this agreement may include provisions to protect against unauthorized access, fraud, or misappropriation of funds. Collin Texas Change of Depository Agreements can be categorized into two main types based on the type of entity involved: school district and government entity agreements. 1. Collin Texas School District Change of Depository Agreement: This agreement specifically refers to the detachment of a school district from its existing depository bank and the selection of a new financial institution to serve as its primary depository. With the aim of safeguarding public funds allocated for educational purposes, this agreement regulates the flow of funds and ensures compliance with applicable laws and regulations. 2. Collin Texas Government Entity Change of Depository Agreement: This type of agreement is similar to the school district agreement but encompasses a broader range of government entities. Municipalities, counties, water districts, or any other governmental bodies within Collin County undergo the Change of Depository Agreement process to transfer their funds to a new financial institution. The agreement guarantees the protection of public funds and provides a framework for efficient cash management and financial accountability. In conclusion, the Collin Texas Change of Depository Agreement is a vital legal document that facilitates the transfer of funds, ensures financial security, and establishes clear guidelines for proper fund management for school districts and various government entities in Collin County. The agreement plays a significant role in protecting public funds and maintaining transparency in monetary transactions. Compliance with this agreement is essential for all parties involved to effectively manage and utilize the available financial resources.The Collin Texas Change of Depository Agreement refers to a legally binding document that governs the transfer of funds from one financial institution to another in the county of Collin, Texas. This agreement typically occurs when a school district or government entity decides to change its primary depository bank. This detailed description will shed light on the purpose, provisions, and intricacies of the Collin Texas Change of Depository Agreement. The Collin Texas Change of Depository Agreement serves as a pivotal contract that facilitates the seamless transition of monetary transactions between the government entity and the new depository bank. It outlines the terms and conditions under which the funds will be managed, safeguarded, and disbursed by the selected financial institution. One primary objective of the Collin Texas Change of Depository Agreement is to ensure the stability and security of funds held by the government entity. It establishes the responsibilities and obligations of both parties involved, setting forth guidelines for accurate record-keeping, reporting requirements, and proper utilization of funds. Additionally, this agreement may include provisions to protect against unauthorized access, fraud, or misappropriation of funds. Collin Texas Change of Depository Agreements can be categorized into two main types based on the type of entity involved: school district and government entity agreements. 1. Collin Texas School District Change of Depository Agreement: This agreement specifically refers to the detachment of a school district from its existing depository bank and the selection of a new financial institution to serve as its primary depository. With the aim of safeguarding public funds allocated for educational purposes, this agreement regulates the flow of funds and ensures compliance with applicable laws and regulations. 2. Collin Texas Government Entity Change of Depository Agreement: This type of agreement is similar to the school district agreement but encompasses a broader range of government entities. Municipalities, counties, water districts, or any other governmental bodies within Collin County undergo the Change of Depository Agreement process to transfer their funds to a new financial institution. The agreement guarantees the protection of public funds and provides a framework for efficient cash management and financial accountability. In conclusion, the Collin Texas Change of Depository Agreement is a vital legal document that facilitates the transfer of funds, ensures financial security, and establishes clear guidelines for proper fund management for school districts and various government entities in Collin County. The agreement plays a significant role in protecting public funds and maintaining transparency in monetary transactions. Compliance with this agreement is essential for all parties involved to effectively manage and utilize the available financial resources.