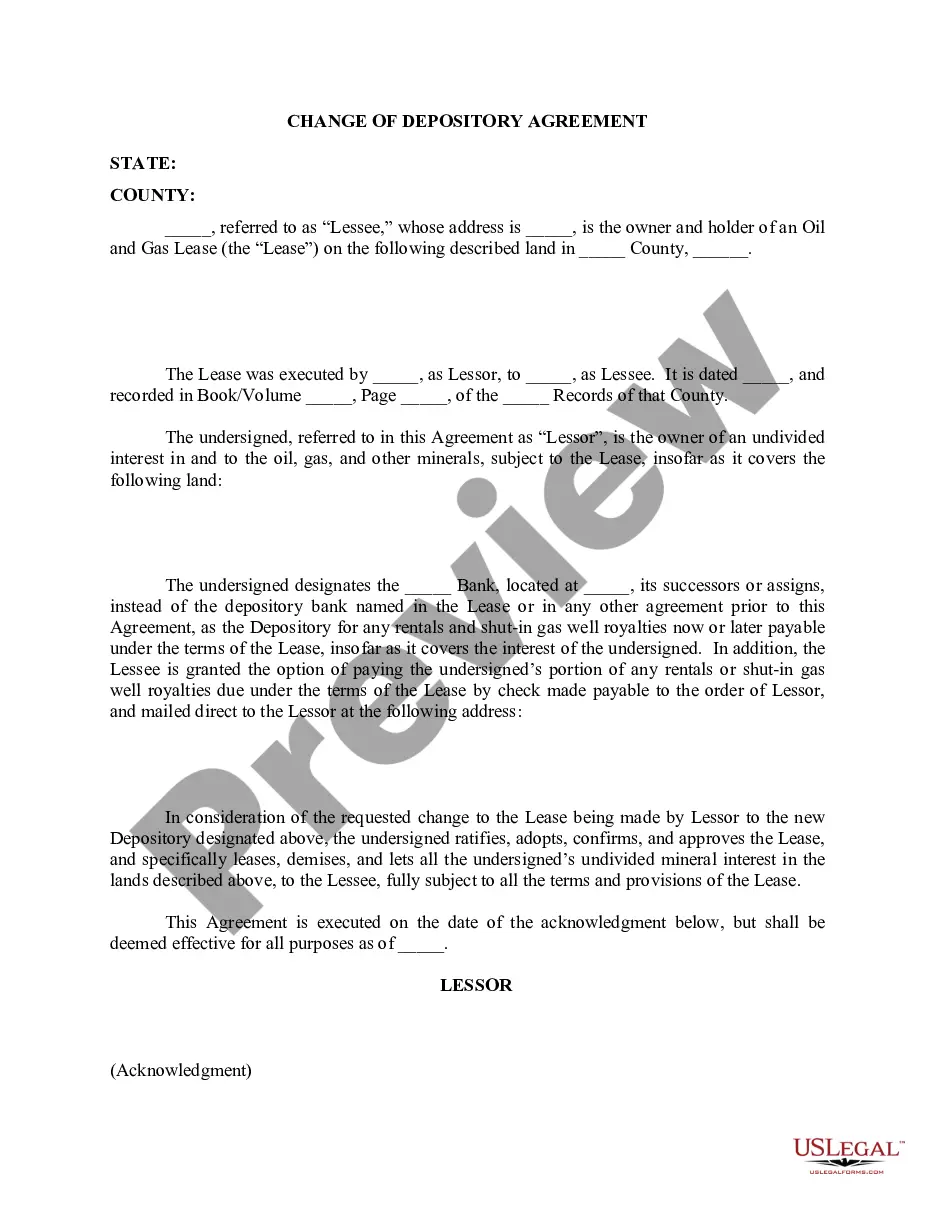

This form is used when the Lessor is the owner of an undivided interest in and to the oil, gas, and other minerals, subject to a Lease designates another bank, its successors or assigns, instead of the depository bank named in the Lease or in any other agreement prior to this Agreement, as the Depository for any rentals and shut-in gas well royalties payable under the terms of the Lease.

The Fort Worth Texas Change of Depository Agreement is a legal document that outlines the process and terms by which a financial institution holding public funds under the jurisdiction of the City of Fort Worth in Texas is replaced or switched to a different depository institution. This agreement typically includes various clauses and provisions that govern the transfer of funds and associated responsibilities between the City of Fort Worth and the chosen depository institution. The purpose of this agreement is to ensure a smooth transition from one depository institution to another, protecting and optimizing the city's financial interests. It is usually executed when the City decides to change its primary depository for reasons such as improving services, obtaining better interest rates, reducing costs, or compliance with legal regulations. Key elements typically included in a Fort Worth Texas Change of Depository Agreement include: 1. Parties involved: The agreement identifies the City of Fort Worth as the withdrawing public entity and the new depository institution as the receiving financial institution. 2. Effective date: The specific date from which the new depository institution will assume responsibility for holding the City's public funds is stated in the agreement. 3. Scope of services: The agreement details the services to be provided by the new depository institution, including the acceptance of deposits, availability of funds, banking services, electronic transactions, reporting requirements, and other financial services. 4. Transfer of funds: The agreement outlines the procedures and timelines for transferring existing funds held by the previous depository institution to the new one. This may involve the closure of accounts, wire transfers, or other methods. 5. Account structure: The agreement defines the types and structure of accounts to be maintained by the new depository institution, such as general operating accounts, payroll accounts, investment accounts, or any other specific accounts required by the City. 6. Interest rates: If applicable, the agreement sets forth the terms and conditions governing the payment of interest on City funds held by the new depository institution. 7. Security measures: The agreement may include provisions related to the security of funds, risk management, insurance, and fraud prevention measures to protect the City's financial assets. Types of Fort Worth Texas Change of Depository Agreement — Primary Depository Agreement: This is the most common type where the City of Fort Worth designates a primary depository institution to hold its public funds. — Secondary Depository Agreement: In certain cases, the City may decide to establish a secondary depository relationship with another financial institution to accommodate specific needs, such as specialized services or segregated funds for specific projects or purposes. It is important to note that the specific content and terminology of the Fort Worth Texas Change of Depository Agreement may vary depending on the particular circumstances, financial regulations, and contractual arrangements between the City and the selected depository institution.The Fort Worth Texas Change of Depository Agreement is a legal document that outlines the process and terms by which a financial institution holding public funds under the jurisdiction of the City of Fort Worth in Texas is replaced or switched to a different depository institution. This agreement typically includes various clauses and provisions that govern the transfer of funds and associated responsibilities between the City of Fort Worth and the chosen depository institution. The purpose of this agreement is to ensure a smooth transition from one depository institution to another, protecting and optimizing the city's financial interests. It is usually executed when the City decides to change its primary depository for reasons such as improving services, obtaining better interest rates, reducing costs, or compliance with legal regulations. Key elements typically included in a Fort Worth Texas Change of Depository Agreement include: 1. Parties involved: The agreement identifies the City of Fort Worth as the withdrawing public entity and the new depository institution as the receiving financial institution. 2. Effective date: The specific date from which the new depository institution will assume responsibility for holding the City's public funds is stated in the agreement. 3. Scope of services: The agreement details the services to be provided by the new depository institution, including the acceptance of deposits, availability of funds, banking services, electronic transactions, reporting requirements, and other financial services. 4. Transfer of funds: The agreement outlines the procedures and timelines for transferring existing funds held by the previous depository institution to the new one. This may involve the closure of accounts, wire transfers, or other methods. 5. Account structure: The agreement defines the types and structure of accounts to be maintained by the new depository institution, such as general operating accounts, payroll accounts, investment accounts, or any other specific accounts required by the City. 6. Interest rates: If applicable, the agreement sets forth the terms and conditions governing the payment of interest on City funds held by the new depository institution. 7. Security measures: The agreement may include provisions related to the security of funds, risk management, insurance, and fraud prevention measures to protect the City's financial assets. Types of Fort Worth Texas Change of Depository Agreement — Primary Depository Agreement: This is the most common type where the City of Fort Worth designates a primary depository institution to hold its public funds. — Secondary Depository Agreement: In certain cases, the City may decide to establish a secondary depository relationship with another financial institution to accommodate specific needs, such as specialized services or segregated funds for specific projects or purposes. It is important to note that the specific content and terminology of the Fort Worth Texas Change of Depository Agreement may vary depending on the particular circumstances, financial regulations, and contractual arrangements between the City and the selected depository institution.