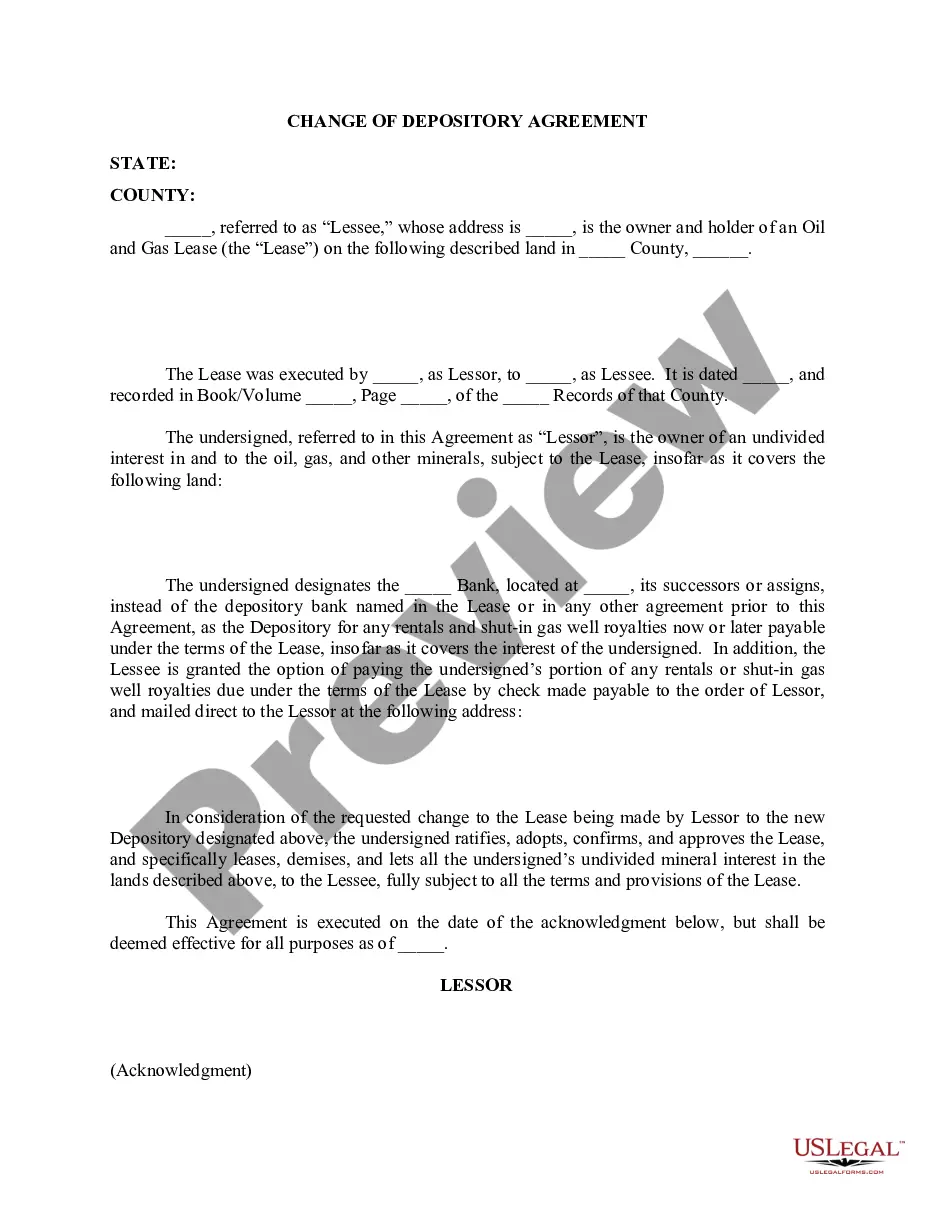

This form is used when the Lessor is the owner of an undivided interest in and to the oil, gas, and other minerals, subject to a Lease designates another bank, its successors or assigns, instead of the depository bank named in the Lease or in any other agreement prior to this Agreement, as the Depository for any rentals and shut-in gas well royalties payable under the terms of the Lease.

A Round Rock Texas Change of Depository Agreement is a legally binding document that outlines the process and terms involved in transferring funds or assets from one depository institution to another in the city of Round Rock, Texas. This agreement is commonly used in various financial transactions such as changing banks or switching investment accounts. The Round Rock Texas Change of Depository Agreement provides a comprehensive set of guidelines to ensure a smooth and secure transfer of funds. It may include details such as the effective date of the agreement, the identities of the parties involved, the types and amounts of funds being transferred, and any necessary approvals or authorizations required. This agreement is often recommended when an individual or business entity intends to change their primary banking institution, perhaps due to factors like better interest rates, improved services, or enhanced online banking facilities offered by another depository institution. By formalizing the transfer through a Change of Depository Agreement, both parties can have clear expectations and protect their interests during the process. In Round Rock, Texas, there are several types of Change of Depository Agreements available depending on the specific context and purpose: 1. Personal Change of Depository Agreement: This type of agreement is used when an individual wants to switch their personal banking relationship to a different financial institution within Round Rock, Texas. 2. Business Change of Depository Agreement: This agreement is suitable for businesses in Round Rock, Texas, that want to change their primary banking relationship for various reasons such as cost-efficiency, better cash management services, or improved business loan offerings. 3. Investment Account Change of Depository Agreement: Investors may use this type of agreement when they wish to transfer their investment account from one financial institution to another in Round Rock, Texas, to take advantage of better investment opportunities, lower fees, or improved customer support. 4. Governmental Agency Change of Depository Agreement: Government entities or agencies in Round Rock, Texas, may utilize this agreement to formalize the transfer of funds from one depository institution to another, ensuring compliance with legal requirements and optimizing financial management practices. In conclusion, a Round Rock Texas Change of Depository Agreement is a crucial legal document, allowing individuals, businesses, and government entities in the city to smoothly change their banking relationships, ensuring a secure and efficient transfer of funds or assets.A Round Rock Texas Change of Depository Agreement is a legally binding document that outlines the process and terms involved in transferring funds or assets from one depository institution to another in the city of Round Rock, Texas. This agreement is commonly used in various financial transactions such as changing banks or switching investment accounts. The Round Rock Texas Change of Depository Agreement provides a comprehensive set of guidelines to ensure a smooth and secure transfer of funds. It may include details such as the effective date of the agreement, the identities of the parties involved, the types and amounts of funds being transferred, and any necessary approvals or authorizations required. This agreement is often recommended when an individual or business entity intends to change their primary banking institution, perhaps due to factors like better interest rates, improved services, or enhanced online banking facilities offered by another depository institution. By formalizing the transfer through a Change of Depository Agreement, both parties can have clear expectations and protect their interests during the process. In Round Rock, Texas, there are several types of Change of Depository Agreements available depending on the specific context and purpose: 1. Personal Change of Depository Agreement: This type of agreement is used when an individual wants to switch their personal banking relationship to a different financial institution within Round Rock, Texas. 2. Business Change of Depository Agreement: This agreement is suitable for businesses in Round Rock, Texas, that want to change their primary banking relationship for various reasons such as cost-efficiency, better cash management services, or improved business loan offerings. 3. Investment Account Change of Depository Agreement: Investors may use this type of agreement when they wish to transfer their investment account from one financial institution to another in Round Rock, Texas, to take advantage of better investment opportunities, lower fees, or improved customer support. 4. Governmental Agency Change of Depository Agreement: Government entities or agencies in Round Rock, Texas, may utilize this agreement to formalize the transfer of funds from one depository institution to another, ensuring compliance with legal requirements and optimizing financial management practices. In conclusion, a Round Rock Texas Change of Depository Agreement is a crucial legal document, allowing individuals, businesses, and government entities in the city to smoothly change their banking relationships, ensuring a secure and efficient transfer of funds or assets.