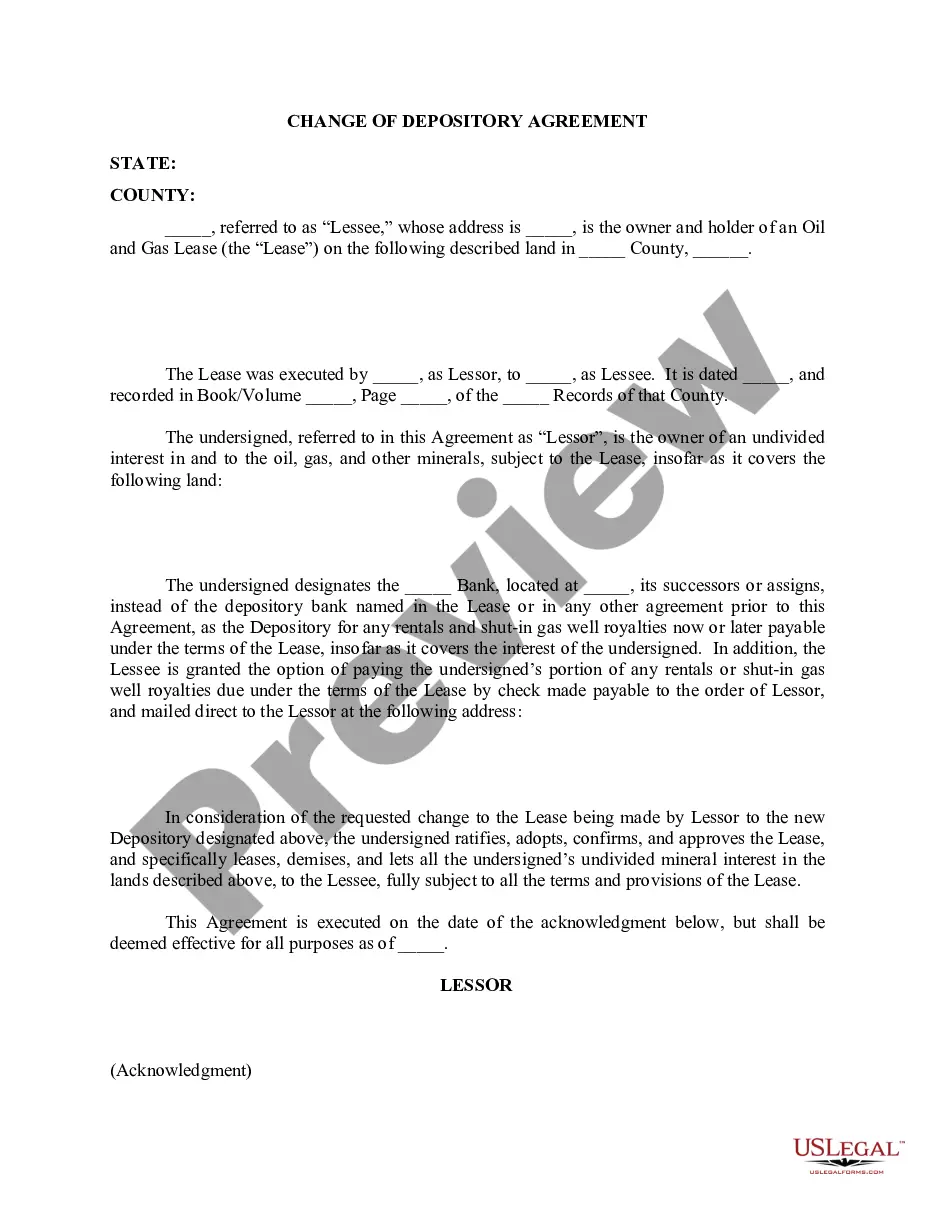

This form is used when the Lessor is the owner of an undivided interest in and to the oil, gas, and other minerals, subject to a Lease designates another bank, its successors or assigns, instead of the depository bank named in the Lease or in any other agreement prior to this Agreement, as the Depository for any rentals and shut-in gas well royalties payable under the terms of the Lease.

Title: Exploring Tarrant Texas Change of Depository Agreement: Types and Detailed Description Introduction: The Tarrant Texas Change of Depository Agreement serves as a vital aspect of financial operations for entities operating in Tarrant County, Texas. This comprehensive agreement outlines the terms and conditions necessary to change or modify the designated depository institution for various entities, such as local government bodies, educational institutions, and governmental organizations. This article aims to delve into the intricacies of the Tarrant Texas Change of Depository Agreement, exploring its types and providing a detailed description of its purpose and implications. Types of Tarrant Texas Change of Depository Agreement: 1. Municipal Change of Depository Agreement: This specific type of agreement primarily caters to local governmental entities within Tarrant County, Texas. These entities may include cities, towns, or any political subdivision that entrusts funds to a designated depository institution. 2. School District Change of Depository Agreement: Educational institutions, such as school districts and educational administrative bodies, frequently require their own change of depository agreements. This type of agreement ensures that the funds collected by educational entities are securely maintained and managed by an accredited depository institution. 3. Governmental Change of Depository Agreement: Governmental organizations, including state agencies, special districts, and county departments, are subject to their distinct type of change of depository agreement. These agreements allow these entities to safeguard their financial assets by designating a reliable depository institution. Detailed Description of Tarrant Texas Change of Depository Agreement: The Tarrant Texas Change of Depository Agreement outlines the process and terms involved in transitioning funds from one depository institution to another, emphasizing the importance of maintaining financial transparency and security. Key components of the agreement include: 1. Parties Involved: The agreement identifies and delineates the roles and responsibilities of the parties involved, including the governmental entity initiating the change, the depository institution currently holding the funds, and the proposed new depository institution. 2. Depository Institution Evaluation: The agreement may specify the criteria for evaluating potential depository institutions, such as financial stability, experience, technological capabilities, and compliance with applicable regulations. The evaluation process ensures that the entity's financial assets are entrusted to a reputable and secure institution. 3. Transition Plan: A detailed transition plan is devised to ensure seamless transfer of funds. This entails outlining the timeline, logistics, and any potential legal or administrative requirements involved in the depository change. 4. Asset Transfer and Account Management: The agreement addresses the methodology by which funds will be transferred from the current depository institution to the new institution. It also clarifies the procedures for managing existing accounts, opening new accounts, and transitioning financial assets. 5. Public Notification: In the interest of transparency, the agreement may require the governmental entity to publicly announce the change of depository institution, ensuring stakeholders are informed and any necessary notice periods are fulfilled. Conclusion: The Tarrant Texas Change of Depository Agreement plays a crucial role in facilitating the secure transition of funds from one depository institution to another for various entities within Tarrant County. Whether it is a municipal, school district, or governmental change, this comprehensive agreement ensures transparency, compliance, and financial stability throughout the process while safeguarding the financial assets of the entity involved.Title: Exploring Tarrant Texas Change of Depository Agreement: Types and Detailed Description Introduction: The Tarrant Texas Change of Depository Agreement serves as a vital aspect of financial operations for entities operating in Tarrant County, Texas. This comprehensive agreement outlines the terms and conditions necessary to change or modify the designated depository institution for various entities, such as local government bodies, educational institutions, and governmental organizations. This article aims to delve into the intricacies of the Tarrant Texas Change of Depository Agreement, exploring its types and providing a detailed description of its purpose and implications. Types of Tarrant Texas Change of Depository Agreement: 1. Municipal Change of Depository Agreement: This specific type of agreement primarily caters to local governmental entities within Tarrant County, Texas. These entities may include cities, towns, or any political subdivision that entrusts funds to a designated depository institution. 2. School District Change of Depository Agreement: Educational institutions, such as school districts and educational administrative bodies, frequently require their own change of depository agreements. This type of agreement ensures that the funds collected by educational entities are securely maintained and managed by an accredited depository institution. 3. Governmental Change of Depository Agreement: Governmental organizations, including state agencies, special districts, and county departments, are subject to their distinct type of change of depository agreement. These agreements allow these entities to safeguard their financial assets by designating a reliable depository institution. Detailed Description of Tarrant Texas Change of Depository Agreement: The Tarrant Texas Change of Depository Agreement outlines the process and terms involved in transitioning funds from one depository institution to another, emphasizing the importance of maintaining financial transparency and security. Key components of the agreement include: 1. Parties Involved: The agreement identifies and delineates the roles and responsibilities of the parties involved, including the governmental entity initiating the change, the depository institution currently holding the funds, and the proposed new depository institution. 2. Depository Institution Evaluation: The agreement may specify the criteria for evaluating potential depository institutions, such as financial stability, experience, technological capabilities, and compliance with applicable regulations. The evaluation process ensures that the entity's financial assets are entrusted to a reputable and secure institution. 3. Transition Plan: A detailed transition plan is devised to ensure seamless transfer of funds. This entails outlining the timeline, logistics, and any potential legal or administrative requirements involved in the depository change. 4. Asset Transfer and Account Management: The agreement addresses the methodology by which funds will be transferred from the current depository institution to the new institution. It also clarifies the procedures for managing existing accounts, opening new accounts, and transitioning financial assets. 5. Public Notification: In the interest of transparency, the agreement may require the governmental entity to publicly announce the change of depository institution, ensuring stakeholders are informed and any necessary notice periods are fulfilled. Conclusion: The Tarrant Texas Change of Depository Agreement plays a crucial role in facilitating the secure transition of funds from one depository institution to another for various entities within Tarrant County. Whether it is a municipal, school district, or governmental change, this comprehensive agreement ensures transparency, compliance, and financial stability throughout the process while safeguarding the financial assets of the entity involved.