This lease rider form may be used when none of the provisions contained in the division order shall diminish, alter, or affect the rights, titles, or interests vested in Lessor by the terms of this Lease. No division order which Lessor may be requested to sign shall contain terms other than those terms and provisions expressly allowed by any applicable statute of the state in which the lands subject to this Lease are located.

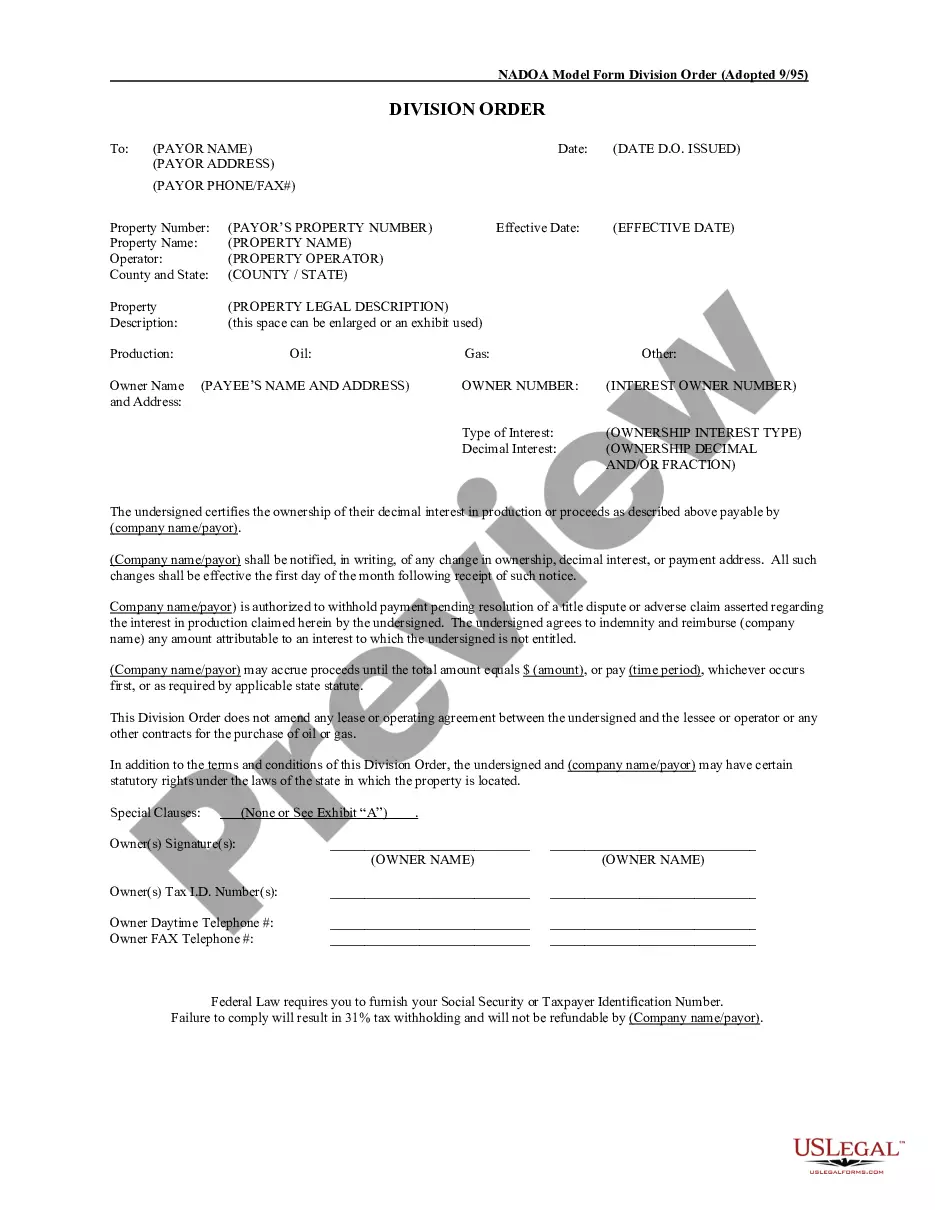

Abilene Texas Division Orders: A Comprehensive Overview In the oil and gas industry, division orders play a vital role in establishing legal ownership and distributing production revenues to mineral rights owners. Abilene, a city in Texas known for its rich energy resources, follows the same framework with a specific set of division orders. Let's delve into Abilene Texas Division Orders, their significance, and the different types available. Description: Abilene Texas Division Orders are legal agreements signed between the operator of an oil or gas well (the mayor) and the mineral rights owners (the payees) in Abilene, Texas. These documents provide a comprehensive outline of ownership percentages, revenue distribution rights, and other crucial terms related to the production and distribution of hydrocarbons. Keywords: 1. Abilene, Texas: The city where Abilene Texas Division Orders are applicable, located in the state of Texas. 2. Division Orders: Legal agreements specifying ownership percentages and revenue distribution rights between operators and mineral rights owners. 3. Oil and Gas: The industry for which Abilene Texas Division Orders hold relevance. 4. Mayor: The operator or company responsible for the production and payment of revenues. 5. Payees: Mineral rights owners entitled to receive revenue distributions. 6. Hydrocarbons: Naturally occurring compounds found in oil and gas reserves. Types of Abilene Texas Division Orders: 1. Lease Division Orders: These division orders establish the terms and conditions specific to a particular lease, outlining the revenue distribution among the mineral rights owners associated with that lease. They define the ownership percentages for each party involved and provide a framework for revenue disbursement. 2. Unit Division Orders: Unit division orders are applicable when multiple leases are combined into a unit for development or production purposes. These division orders establish the revenue distribution among the mineral rights owners in the entire unit rather than individual leases. They determine ownership percentages for unit production and facilitate revenue distribution accordingly. 3. Pooling Division Orders: Pooling division orders are essential when a property's mineral rights are pooled with adjacent properties or units for more efficient drilling and production. These division orders outline the distribution of revenues among the mineral rights owners involved and determine the ownership percentages for the pooled production. 4. Division Orders for Royalty Interests: This type of division order specifies the revenue distribution among mineral rights owners who have a royalty interest in a particular lease, rather than ownership interest. Royalty interests are typically granted to landowners who allow companies to extract minerals from their land in exchange for a percentage of the revenue. 5. Division Orders for Working Interests: Working interest division orders are aimed at determining revenue distribution among mineral rights owners who have a working interest in a lease. Unlike royalty interests, working interests involve active participation and financial responsibility in the operations, including costs associated with drilling, production, and maintenance. By understanding the various types of Abilene Texas Division Orders and their significance within the oil and gas industry, landowners and operators can ensure a fair and transparent distribution of revenues while complying with legal requirements.Abilene Texas Division Orders: A Comprehensive Overview In the oil and gas industry, division orders play a vital role in establishing legal ownership and distributing production revenues to mineral rights owners. Abilene, a city in Texas known for its rich energy resources, follows the same framework with a specific set of division orders. Let's delve into Abilene Texas Division Orders, their significance, and the different types available. Description: Abilene Texas Division Orders are legal agreements signed between the operator of an oil or gas well (the mayor) and the mineral rights owners (the payees) in Abilene, Texas. These documents provide a comprehensive outline of ownership percentages, revenue distribution rights, and other crucial terms related to the production and distribution of hydrocarbons. Keywords: 1. Abilene, Texas: The city where Abilene Texas Division Orders are applicable, located in the state of Texas. 2. Division Orders: Legal agreements specifying ownership percentages and revenue distribution rights between operators and mineral rights owners. 3. Oil and Gas: The industry for which Abilene Texas Division Orders hold relevance. 4. Mayor: The operator or company responsible for the production and payment of revenues. 5. Payees: Mineral rights owners entitled to receive revenue distributions. 6. Hydrocarbons: Naturally occurring compounds found in oil and gas reserves. Types of Abilene Texas Division Orders: 1. Lease Division Orders: These division orders establish the terms and conditions specific to a particular lease, outlining the revenue distribution among the mineral rights owners associated with that lease. They define the ownership percentages for each party involved and provide a framework for revenue disbursement. 2. Unit Division Orders: Unit division orders are applicable when multiple leases are combined into a unit for development or production purposes. These division orders establish the revenue distribution among the mineral rights owners in the entire unit rather than individual leases. They determine ownership percentages for unit production and facilitate revenue distribution accordingly. 3. Pooling Division Orders: Pooling division orders are essential when a property's mineral rights are pooled with adjacent properties or units for more efficient drilling and production. These division orders outline the distribution of revenues among the mineral rights owners involved and determine the ownership percentages for the pooled production. 4. Division Orders for Royalty Interests: This type of division order specifies the revenue distribution among mineral rights owners who have a royalty interest in a particular lease, rather than ownership interest. Royalty interests are typically granted to landowners who allow companies to extract minerals from their land in exchange for a percentage of the revenue. 5. Division Orders for Working Interests: Working interest division orders are aimed at determining revenue distribution among mineral rights owners who have a working interest in a lease. Unlike royalty interests, working interests involve active participation and financial responsibility in the operations, including costs associated with drilling, production, and maintenance. By understanding the various types of Abilene Texas Division Orders and their significance within the oil and gas industry, landowners and operators can ensure a fair and transparent distribution of revenues while complying with legal requirements.