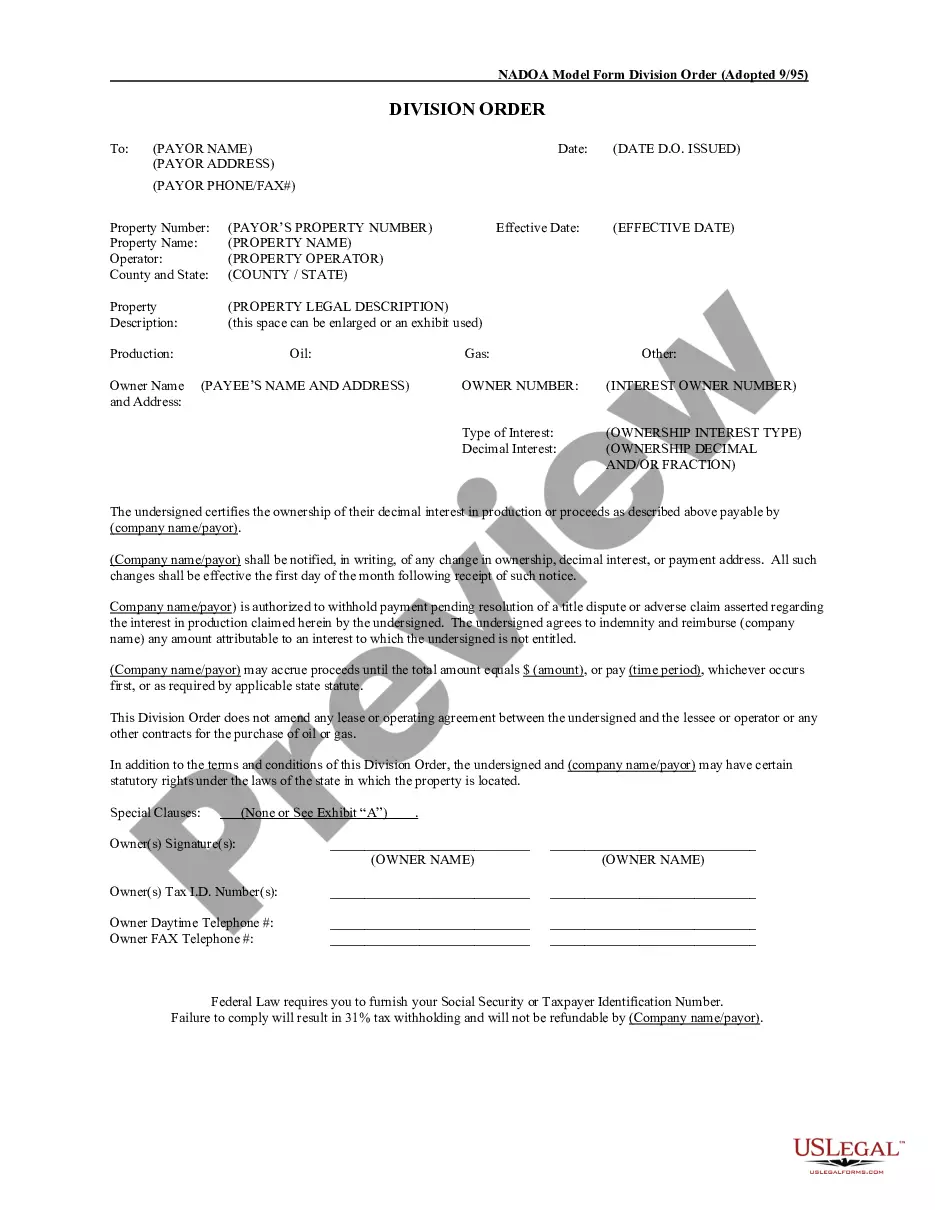

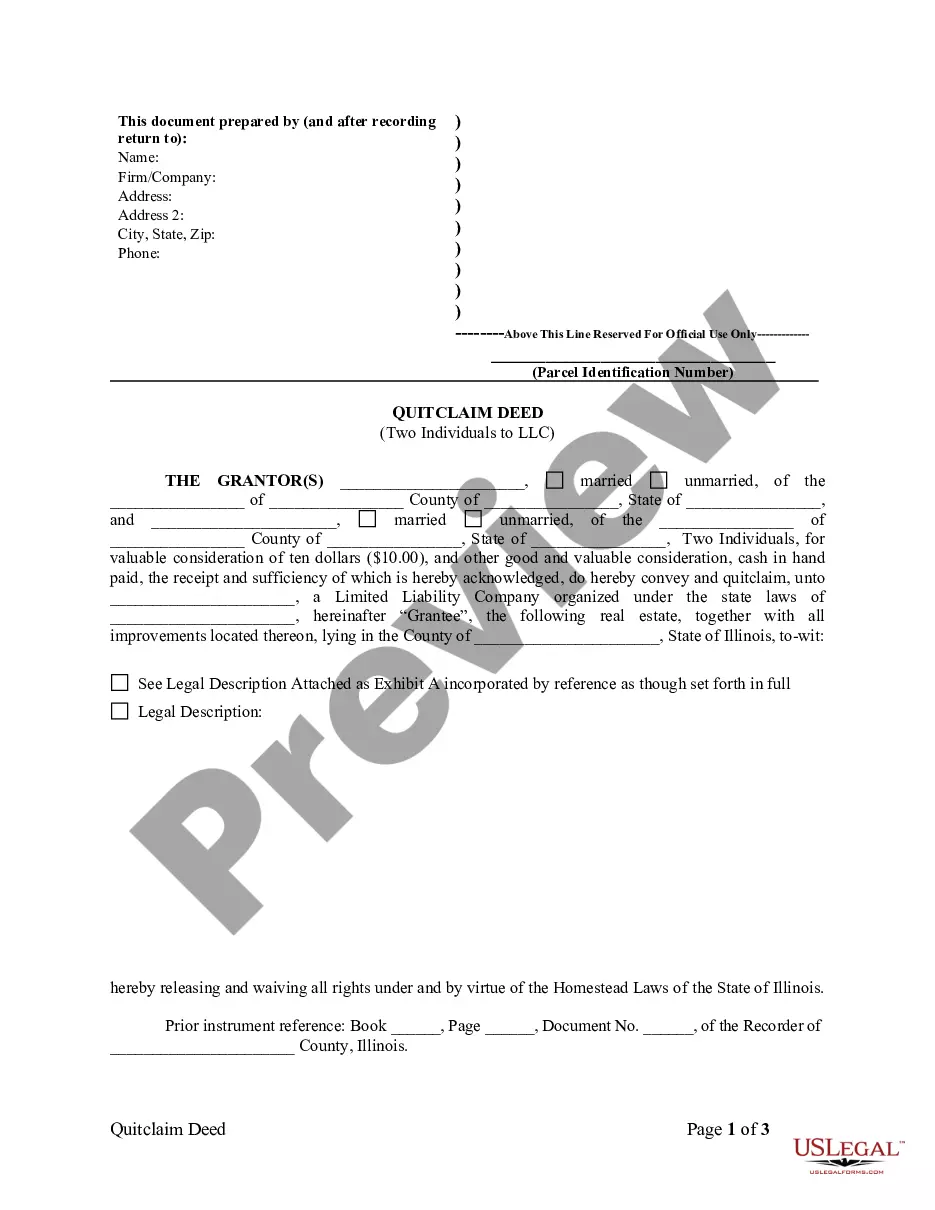

This lease rider form may be used when none of the provisions contained in the division order shall diminish, alter, or affect the rights, titles, or interests vested in Lessor by the terms of this Lease. No division order which Lessor may be requested to sign shall contain terms other than those terms and provisions expressly allowed by any applicable statute of the state in which the lands subject to this Lease are located.

Collin Texas Division Orders are legal documents used in the oil and gas industry that determine the proportional ownership interests and revenue distribution among mineral rights owners within a specific area in Collin County, Texas. These orders are essential for ensuring fair distribution of royalties and facilitating proper accounting in the production and extraction of oil and gas resources. Some relevant keywords associated with Collin Texas Division Orders include: 1. Oil and gas: Collin Texas Division Orders primarily deal with the ownership and distribution of resources within the oil and gas industry, specifically in Collin County, Texas. 2. Mineral rights: These rights refer to the legal ownership of the mineral resources beneath the surface of a property. Collin Texas Division Orders outline the proportional interests each mineral rights owner holds. 3. Ownership interests: Division orders determine the percentage of ownership each individual or entity has in the resources being extracted. Ownership interests play a crucial role in calculating revenue distribution. 4. Revenue distribution: Division orders outline the allocation of royalties and income generated from the production and sale of oil and gas resources. These distributions are based on the proportional ownership interests determined in the division order. 5. Collin County, Texas: Collin County is a region within Texas known for its significant oil and gas reserves. Division orders specific to this area help manage and streamline the resource extraction process. Types of Collin Texas Division Orders: 1. Standard division orders: These are the most common type of division orders used in Collin County, Texas. They determine the proportional ownership interests and revenue distribution among mineral rights owners. 2. Customized division orders: Some division orders can be tailored to meet specific requirements or unique circumstances. These orders may address additional factors such as pooled units, joint ventures, or specific terms and conditions agreed upon by the involved parties. 3. Amended division orders: In certain cases, changes or amendments need to be made to the original division orders. Amended division orders update the ownership interests and revenue distribution as per agreed-upon changes or negotiated terms. 4. Unitization division orders: When oil and gas operations span multiple properties or units, unitization division orders are used. These orders consolidate the ownership interests and revenue distribution across the units, streamlining the process for efficient extraction and distribution. In conclusion, Collin Texas Division Orders are essential legal documents used in the oil and gas industry within Collin County, Texas. These orders determine proportional ownership interests, revenue distribution, and help ensure the fair and efficient management of oil and gas resources.