This lease rider form may be used when none of the provisions contained in the division order shall diminish, alter, or affect the rights, titles, or interests vested in Lessor by the terms of this Lease. No division order which Lessor may be requested to sign shall contain terms other than those terms and provisions expressly allowed by any applicable statute of the state in which the lands subject to this Lease are located.

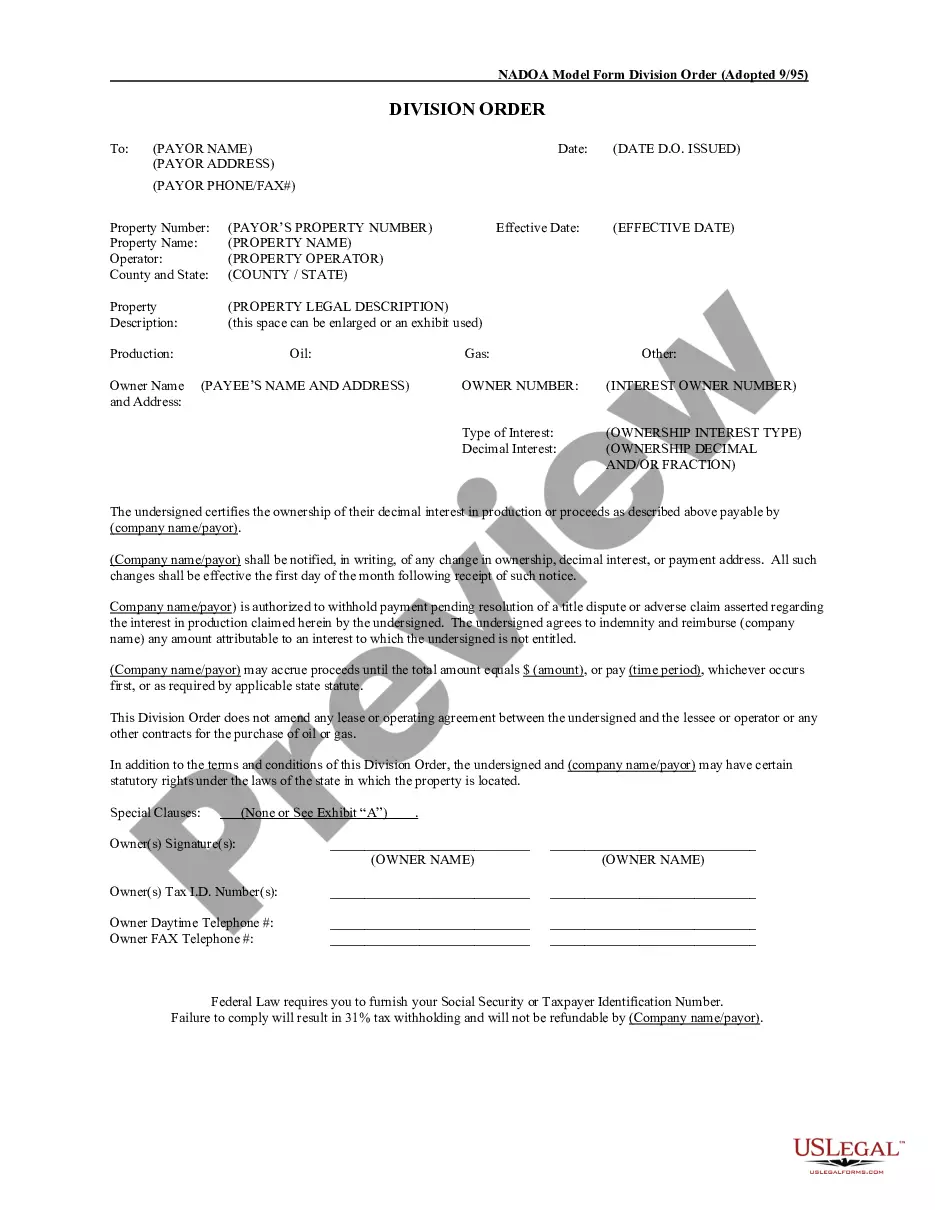

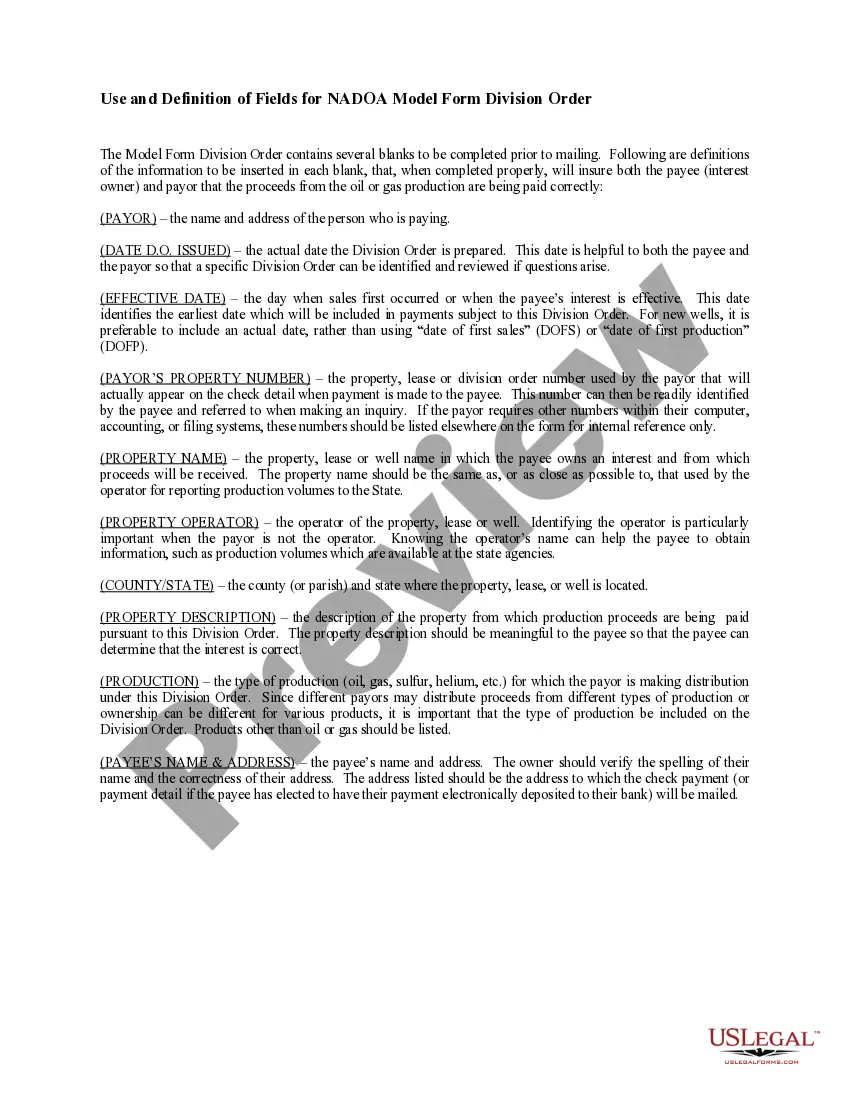

Dallas Texas Division Orders are legal documents that govern the distribution of revenues among oil and gas owners within a specific geographical area, namely Dallas, Texas. These legally binding contracts outline the ownership interests, payment terms, and responsibilities for both the operators and royalty owners in the oil and gas industry. The primary purpose of Dallas Texas Division Orders is to determine the proportionate share and disbursement of revenue from the production of oil and gas wells in the area. These orders play a pivotal role in ensuring fair and accurate distribution of proceeds to all parties involved. There are several types of Dallas Texas Division Orders, categorized based on the specific type of ownership interest and agreements. Some of these categories include: 1. Mineral Interest Division Orders: These division orders pertain to individuals or entities that own the mineral rights in Dallas, Texas. Mineral interest owners receive royalties based on their ownership percentage in the well or lease. 2. Working Interest Division Orders: Working interest division orders are relevant for parties that actively participate in the drilling, operating, and maintenance of oil and gas wells in Dallas, Texas. These individuals or companies bear the expenses associated with production, and in return, they are entitled to a percentage of the well's net revenue based on their working interest ownership. 3. Overriding Royalty Interest Division Orders: Overriding royalty interest division orders apply to parties who possess an interest in the oil and gas lease that is separate from the mineral or working interests. These interests are typically created through separate agreements and entitle the owner to a percentage of revenue generated from the lease, often overriding the mineral and working interests. 4. Net Profits Interest Division Orders: Net profits interest division orders are relevant for individuals or entities that hold an interest focused on profits derived from the sale of oil and gas production. These interests do not involve the responsibility for operating or drilling activities and are typically created through agreements separate from the mineral or working interests. Dallas Texas Division Orders are essential for ensuring transparency, accuracy, and fairness in revenue distribution within the oil and gas industry. By explicitly stating ownership interests, payment terms, and responsibilities, these documents create a clear framework for all parties involved in the exploration, production, and extraction of oil and gas resources in the Dallas, Texas area.Dallas Texas Division Orders are legal documents that govern the distribution of revenues among oil and gas owners within a specific geographical area, namely Dallas, Texas. These legally binding contracts outline the ownership interests, payment terms, and responsibilities for both the operators and royalty owners in the oil and gas industry. The primary purpose of Dallas Texas Division Orders is to determine the proportionate share and disbursement of revenue from the production of oil and gas wells in the area. These orders play a pivotal role in ensuring fair and accurate distribution of proceeds to all parties involved. There are several types of Dallas Texas Division Orders, categorized based on the specific type of ownership interest and agreements. Some of these categories include: 1. Mineral Interest Division Orders: These division orders pertain to individuals or entities that own the mineral rights in Dallas, Texas. Mineral interest owners receive royalties based on their ownership percentage in the well or lease. 2. Working Interest Division Orders: Working interest division orders are relevant for parties that actively participate in the drilling, operating, and maintenance of oil and gas wells in Dallas, Texas. These individuals or companies bear the expenses associated with production, and in return, they are entitled to a percentage of the well's net revenue based on their working interest ownership. 3. Overriding Royalty Interest Division Orders: Overriding royalty interest division orders apply to parties who possess an interest in the oil and gas lease that is separate from the mineral or working interests. These interests are typically created through separate agreements and entitle the owner to a percentage of revenue generated from the lease, often overriding the mineral and working interests. 4. Net Profits Interest Division Orders: Net profits interest division orders are relevant for individuals or entities that hold an interest focused on profits derived from the sale of oil and gas production. These interests do not involve the responsibility for operating or drilling activities and are typically created through agreements separate from the mineral or working interests. Dallas Texas Division Orders are essential for ensuring transparency, accuracy, and fairness in revenue distribution within the oil and gas industry. By explicitly stating ownership interests, payment terms, and responsibilities, these documents create a clear framework for all parties involved in the exploration, production, and extraction of oil and gas resources in the Dallas, Texas area.