This lease rider form may be used when none of the provisions contained in the division order shall diminish, alter, or affect the rights, titles, or interests vested in Lessor by the terms of this Lease. No division order which Lessor may be requested to sign shall contain terms other than those terms and provisions expressly allowed by any applicable statute of the state in which the lands subject to this Lease are located.

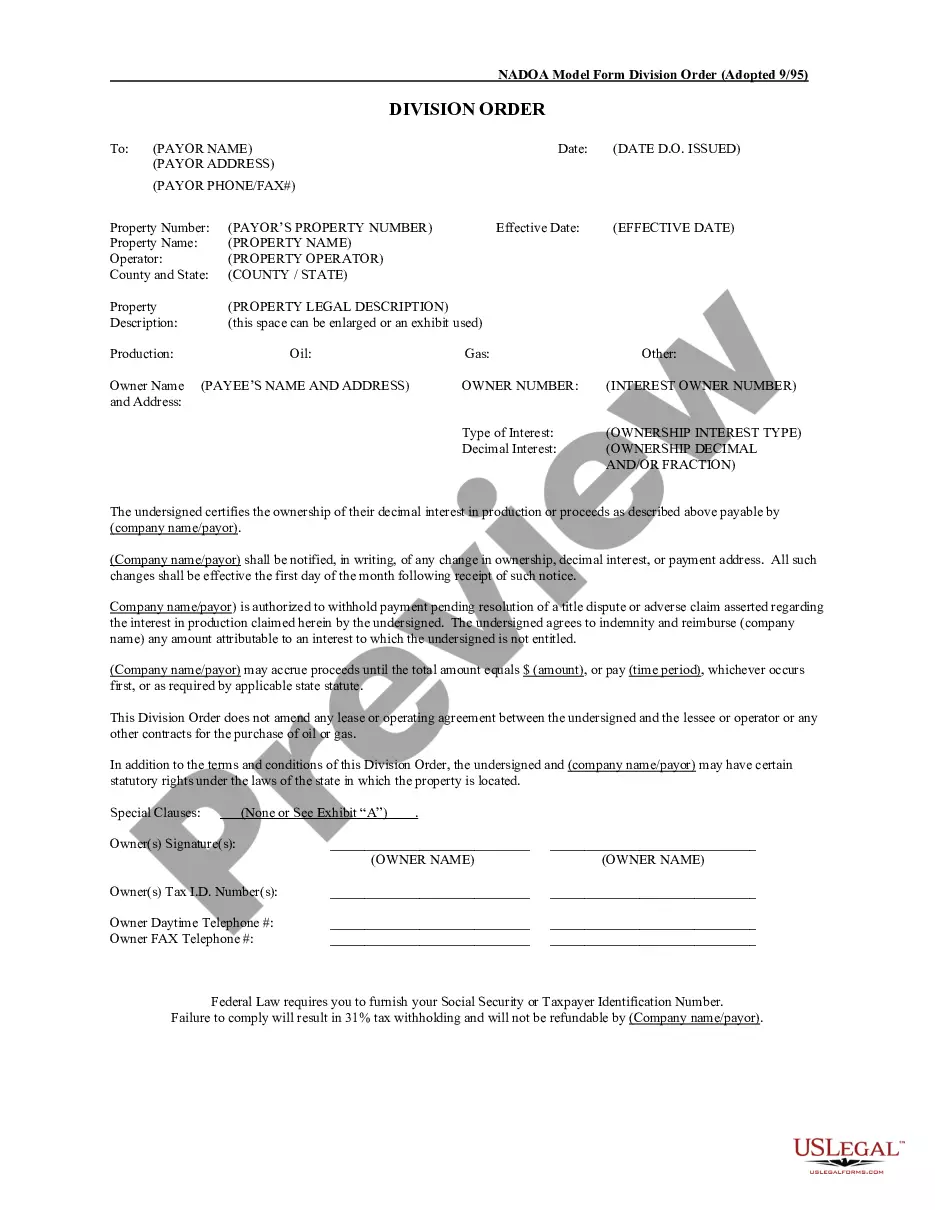

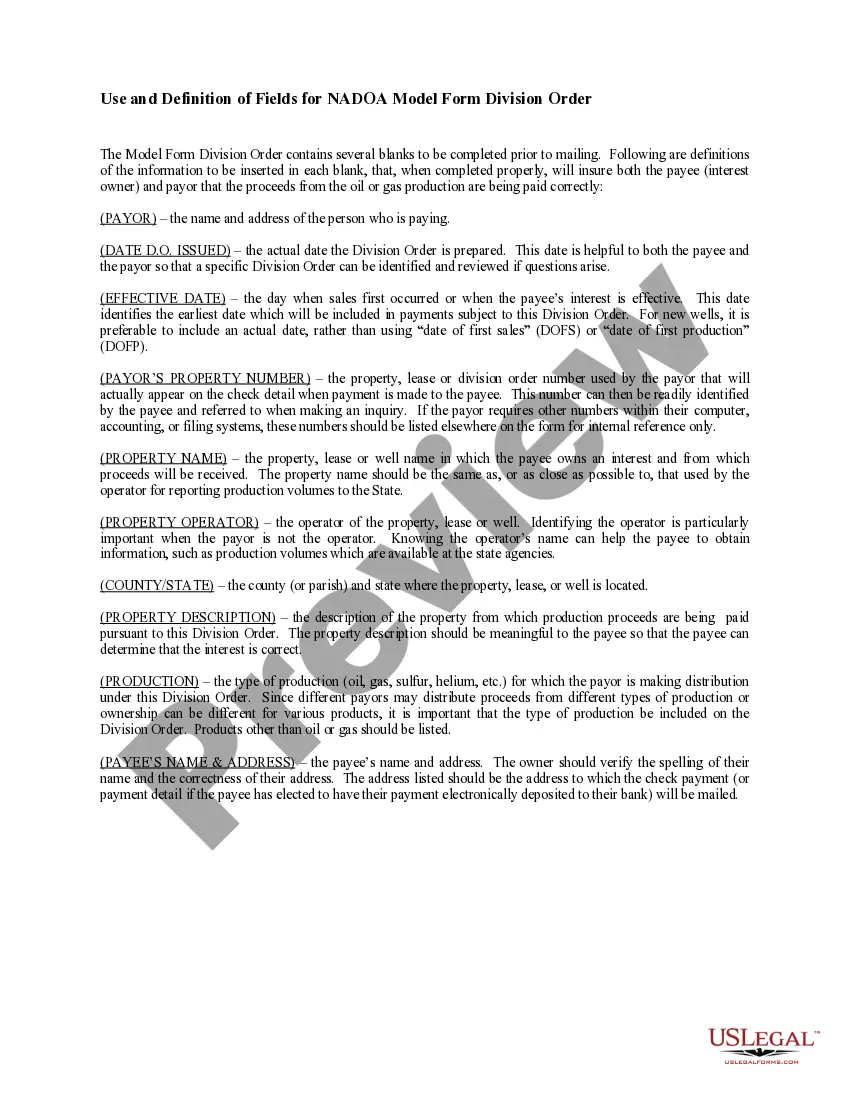

Edinburg Texas Division Orders refer to legal documents that establish the ownership interests and distribution of revenues among multiple stakeholders in the oil and gas industry within Edinburg, Texas. Division orders are typically issued by petroleum operators or production companies to individuals or entities entitled to receive royalty payments or other monetary benefits from the production of oil and gas wells. These documents contain detailed information about the property, including the legal description, tract identification, and specific location of the oil and gas well. They also outline the names and addresses of the interest owners, their respective ownership interests, and the percentage of revenue they are entitled to receive. The primary purpose of Edinburg Texas Division Orders is to define the rights, responsibilities, and obligations of all parties involved in the production and distribution of oil and gas proceeds. By signing and returning the division order, the interest owner acknowledges their agreement with the information provided and allows the operator to commence with the distribution of royalties from the production. To ensure accurate and timely payments, it is crucial for interest owners to carefully review the division order's terms and ensure the correctness of their ownership interest, as any errors or discrepancies may result in delays or underpayment of royalties. If an interest owner believes there is an error, they should promptly notify the operator and provide supporting documentation for review and correction. In Edinburg, Texas, there may be different types of division orders, including Leasehold Interest Division Orders and Overriding Royalty Interest Division Orders. Leasehold Interest Division Orders are typically issued to the mineral or leasehold owners who hold the working interest in the oil and gas property. They are entitled to receive a share of the revenue based on their ownership percentage. On the other hand, Overriding Royalty Interest Division Orders are issued to entities or individuals who own an interest in the property, not based on the mineral rights, but rather a separate agreement, often overriding the leasehold or working interest. In conclusion, Edinburg Texas Division Orders are crucial legal documents that play a vital role in the oil and gas industry. They ensure transparent and proper distribution of royalties among interest owners and provide a framework for efficient and accurate revenue allocation.Edinburg Texas Division Orders refer to legal documents that establish the ownership interests and distribution of revenues among multiple stakeholders in the oil and gas industry within Edinburg, Texas. Division orders are typically issued by petroleum operators or production companies to individuals or entities entitled to receive royalty payments or other monetary benefits from the production of oil and gas wells. These documents contain detailed information about the property, including the legal description, tract identification, and specific location of the oil and gas well. They also outline the names and addresses of the interest owners, their respective ownership interests, and the percentage of revenue they are entitled to receive. The primary purpose of Edinburg Texas Division Orders is to define the rights, responsibilities, and obligations of all parties involved in the production and distribution of oil and gas proceeds. By signing and returning the division order, the interest owner acknowledges their agreement with the information provided and allows the operator to commence with the distribution of royalties from the production. To ensure accurate and timely payments, it is crucial for interest owners to carefully review the division order's terms and ensure the correctness of their ownership interest, as any errors or discrepancies may result in delays or underpayment of royalties. If an interest owner believes there is an error, they should promptly notify the operator and provide supporting documentation for review and correction. In Edinburg, Texas, there may be different types of division orders, including Leasehold Interest Division Orders and Overriding Royalty Interest Division Orders. Leasehold Interest Division Orders are typically issued to the mineral or leasehold owners who hold the working interest in the oil and gas property. They are entitled to receive a share of the revenue based on their ownership percentage. On the other hand, Overriding Royalty Interest Division Orders are issued to entities or individuals who own an interest in the property, not based on the mineral rights, but rather a separate agreement, often overriding the leasehold or working interest. In conclusion, Edinburg Texas Division Orders are crucial legal documents that play a vital role in the oil and gas industry. They ensure transparent and proper distribution of royalties among interest owners and provide a framework for efficient and accurate revenue allocation.