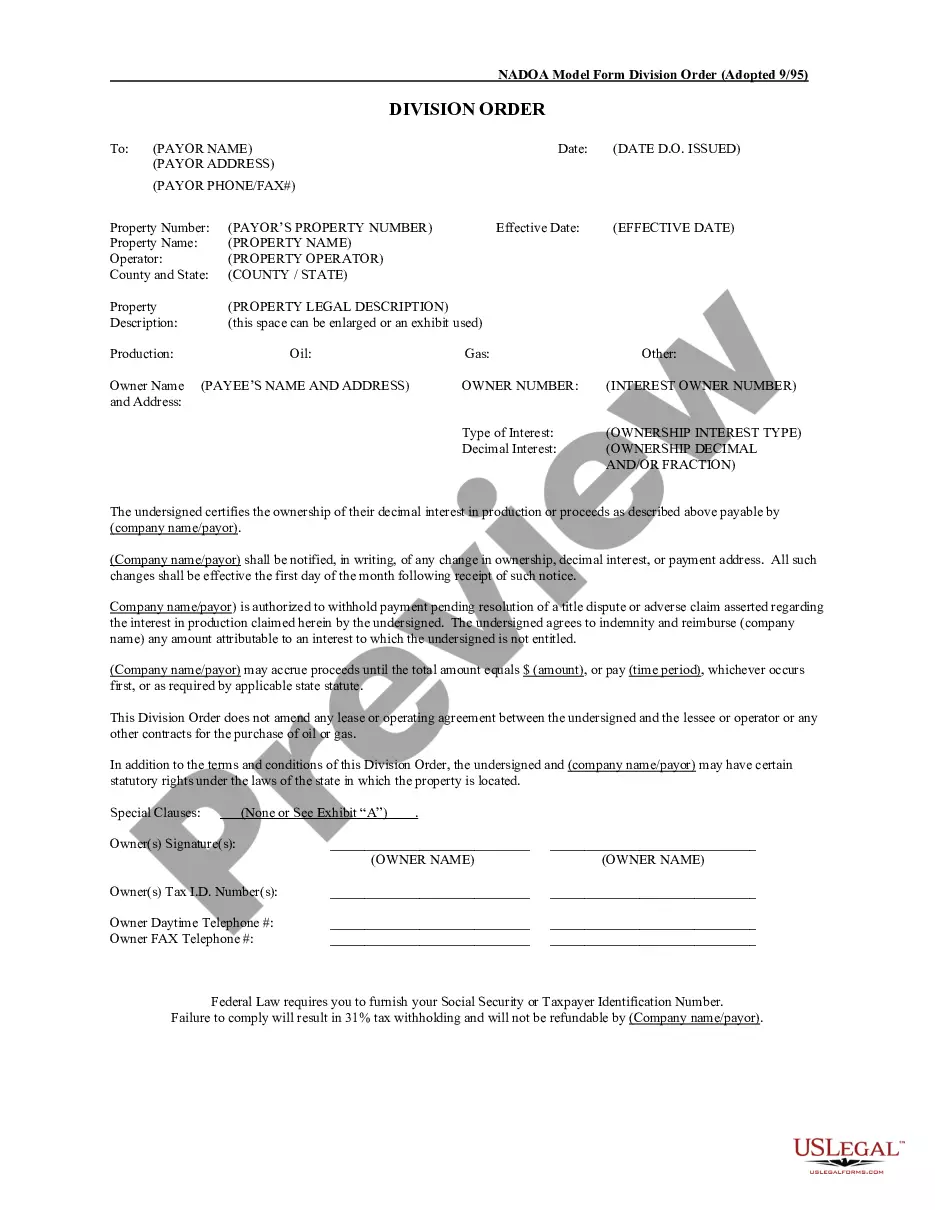

This lease rider form may be used when none of the provisions contained in the division order shall diminish, alter, or affect the rights, titles, or interests vested in Lessor by the terms of this Lease. No division order which Lessor may be requested to sign shall contain terms other than those terms and provisions expressly allowed by any applicable statute of the state in which the lands subject to this Lease are located.

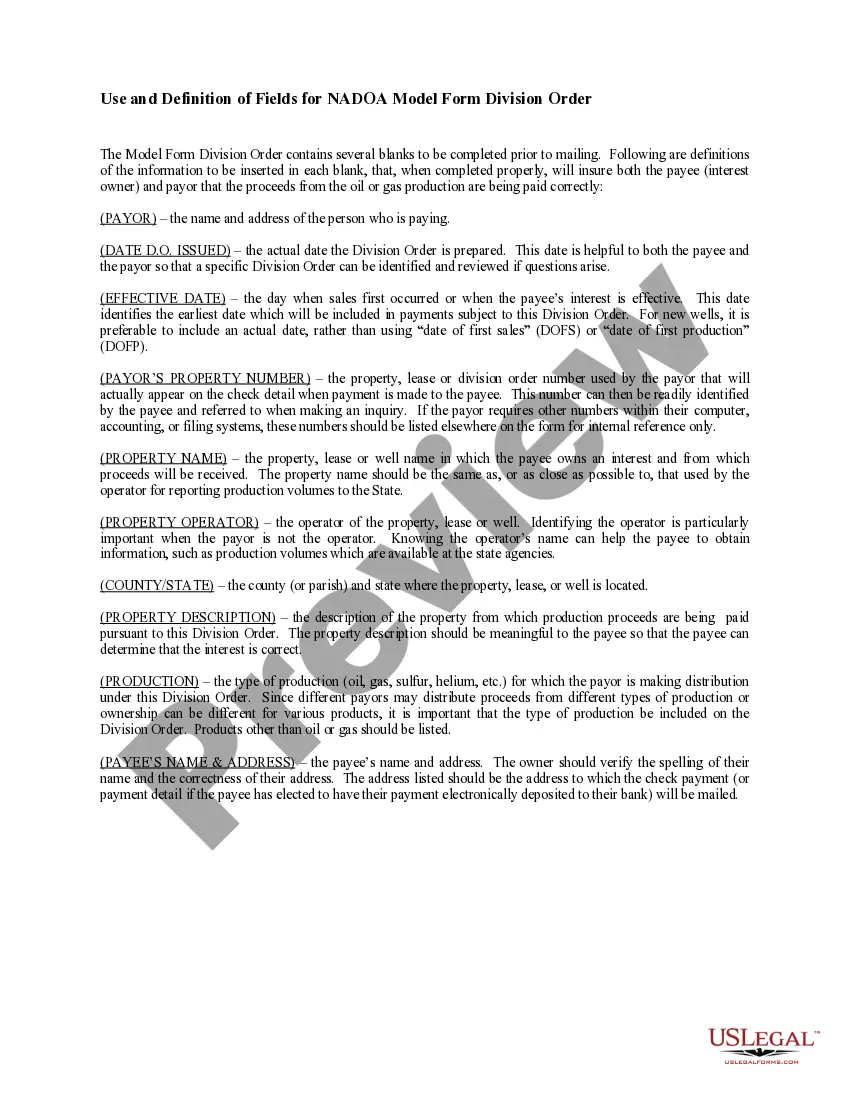

Fort Worth Texas Division Orders refer to legally binding agreements that outline the ownership and distribution of proceeds from oil and gas production in the Fort Worth area of Texas. These orders play a crucial role in the oil and gas industry, ensuring that mineral rights owners receive their fair share of revenue from the production of natural resources. There are different types of Fort Worth Texas Division Orders based on the nature of the underlying agreement or lease. One such type is the Operating Agreement Division Order, which delineates the rights and responsibilities of all parties involved in the exploration and extraction process. It typically includes provisions related to well spacing, drilling operations, royalty payments, and revenue distribution among the working interest owners, royalty owners, and other stakeholders. Another type is the Non-Participating Royalty Interest (NPR) Division Order, which applies when an individual or entity possesses a fractional interest in the minerals but is not an active participant in the associated lease or agreements. The NPR owner is entitled to a share of the royalty payments but does not bear the financial burden or have any control over operating costs. Additionally, there are Division Orders specific to override royalty interest (ORRIS). An ORRIS is created when an individual or entity possesses a percentage interest in the mineral proceeds, but without the responsibility for any costs related to exploration, production, or operation. ORRIS provides a share of the revenue to the interest owner, typically at a higher percentage than the working interest or royalty interest owners. Fort Worth Texas Division Orders serve as an essential framework for maintaining transparency, accuracy, and fairness in the distribution of oil and gas proceeds. They include pertinent information such as legal descriptions of the involved properties, the percentage of ownership held by each party, the net revenue interest, and the decimal interest. To enforce compliance, Division Orders often contain an affidavit, where the owner confirms the accuracy of the provided information, indemnifies the operator against claims made by other interest owners, and authorizes the payment of proceeds to the designated payee. These Division Orders also play a role in the determination of payment frequency, tax withholding, and any other financial obligations arising from the extraction and sale of minerals. They provide a clear understanding of the financial arrangement for all parties involved, mitigating disputes and ensuring a smooth flow of revenue within the Fort Worth Texas oil and gas industry.Fort Worth Texas Division Orders refer to legally binding agreements that outline the ownership and distribution of proceeds from oil and gas production in the Fort Worth area of Texas. These orders play a crucial role in the oil and gas industry, ensuring that mineral rights owners receive their fair share of revenue from the production of natural resources. There are different types of Fort Worth Texas Division Orders based on the nature of the underlying agreement or lease. One such type is the Operating Agreement Division Order, which delineates the rights and responsibilities of all parties involved in the exploration and extraction process. It typically includes provisions related to well spacing, drilling operations, royalty payments, and revenue distribution among the working interest owners, royalty owners, and other stakeholders. Another type is the Non-Participating Royalty Interest (NPR) Division Order, which applies when an individual or entity possesses a fractional interest in the minerals but is not an active participant in the associated lease or agreements. The NPR owner is entitled to a share of the royalty payments but does not bear the financial burden or have any control over operating costs. Additionally, there are Division Orders specific to override royalty interest (ORRIS). An ORRIS is created when an individual or entity possesses a percentage interest in the mineral proceeds, but without the responsibility for any costs related to exploration, production, or operation. ORRIS provides a share of the revenue to the interest owner, typically at a higher percentage than the working interest or royalty interest owners. Fort Worth Texas Division Orders serve as an essential framework for maintaining transparency, accuracy, and fairness in the distribution of oil and gas proceeds. They include pertinent information such as legal descriptions of the involved properties, the percentage of ownership held by each party, the net revenue interest, and the decimal interest. To enforce compliance, Division Orders often contain an affidavit, where the owner confirms the accuracy of the provided information, indemnifies the operator against claims made by other interest owners, and authorizes the payment of proceeds to the designated payee. These Division Orders also play a role in the determination of payment frequency, tax withholding, and any other financial obligations arising from the extraction and sale of minerals. They provide a clear understanding of the financial arrangement for all parties involved, mitigating disputes and ensuring a smooth flow of revenue within the Fort Worth Texas oil and gas industry.