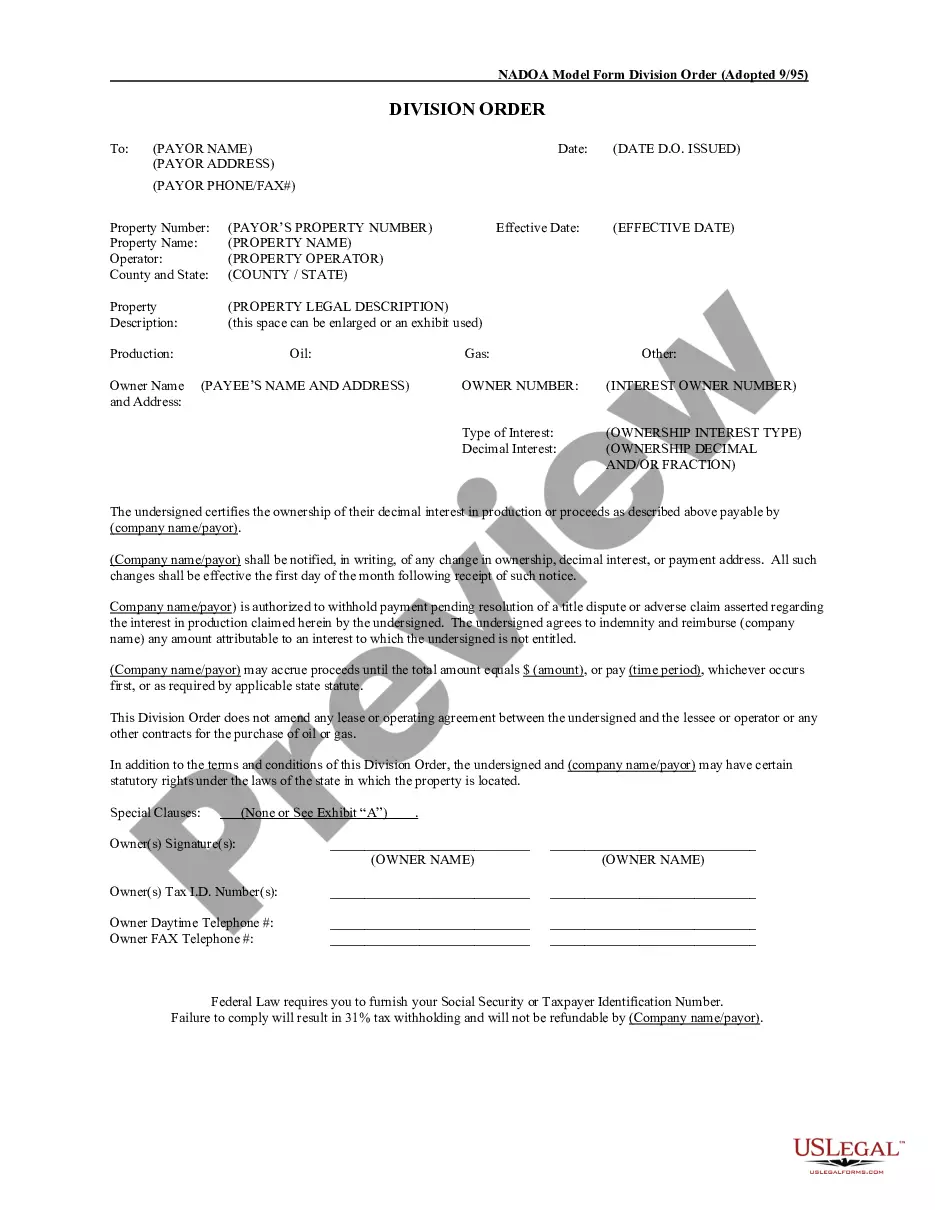

This lease rider form may be used when none of the provisions contained in the division order shall diminish, alter, or affect the rights, titles, or interests vested in Lessor by the terms of this Lease. No division order which Lessor may be requested to sign shall contain terms other than those terms and provisions expressly allowed by any applicable statute of the state in which the lands subject to this Lease are located.

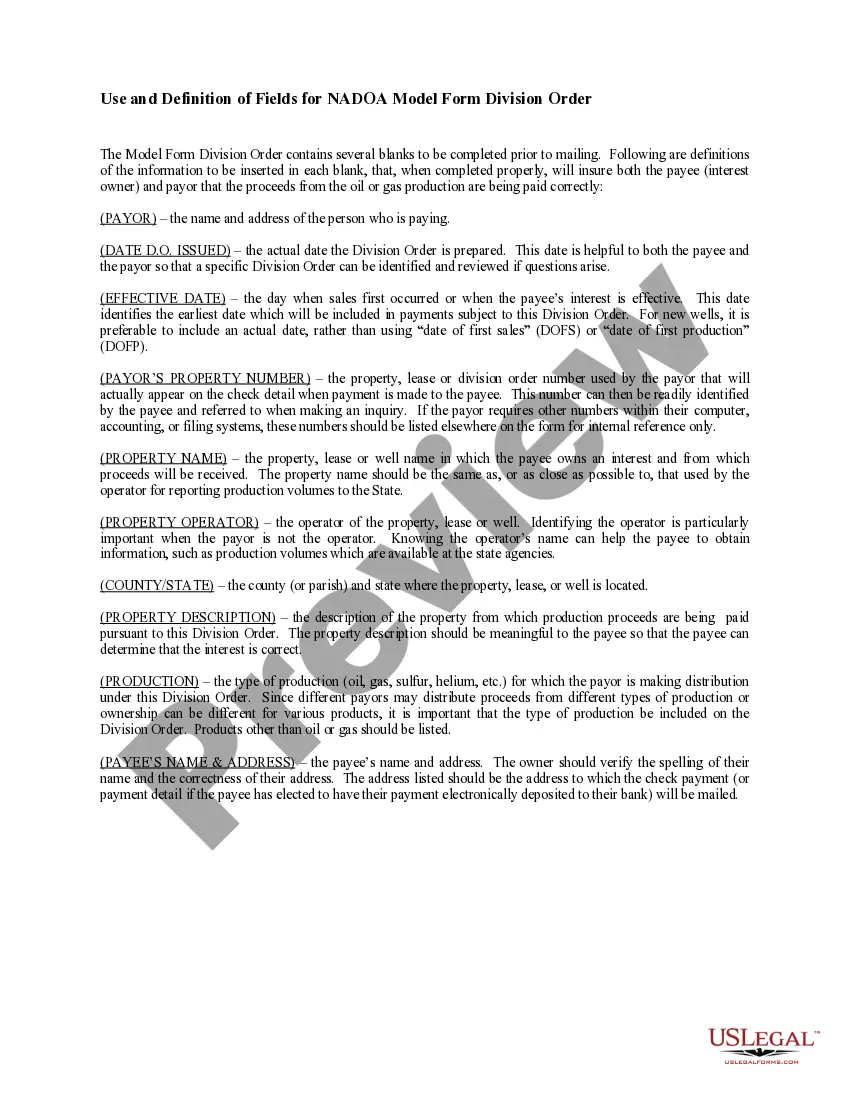

Grand Prairie, Texas Division Orders: A Comprehensive Overview Division orders are crucial legal documents used in the oil and gas industry to determine the rights and interests of various parties involved in the production and sale of oil and gas resources. Specifically focusing on Grand Prairie, Texas, division orders play a pivotal role in facilitating the smooth operation of oil and gas wells and ensuring equitable distribution of royalties to all parties involved. Keywords: Grand Prairie, Texas, division orders, oil and gas industry, rights, interests, production, sale, resources, wells, royalties. Types of Grand Prairie, Texas Division Orders: 1. Mineral Interest Division Orders: These division orders pertain to the parties who hold the mineral rights to a specific tract of land in Grand Prairie, Texas. These individuals or entities are entitled to receive a portion of the revenues generated from oil and gas production on their property. 2. Non-Participating Royalty Interest Division Orders: Non-participating royalty interest (NPR) division orders are relevant when the owner of the mineral rights has leased their land to an oil and gas company, granting them the right to explore, produce, and sell resources. In such cases, the NPR owner is entitled to a royalty interest, but does not participate in the operations or expenses of the well. 3. Overriding Royalty Interest Division Orders: Overriding royalty interest (ORRIS) division orders are significant when someone other than the mineral rights' owner is entitled to a fraction of the royalties from a well in Grand Prairie, Texas. ORRIS owners typically hold a specific percentage interest in the revenues generated by the well, which is separate from the mineral rights' owner. 4. Working Interest Division Orders: Working interest division orders involve parties who are directly involved in the exploration, production, and expenses of an oil or gas well in Grand Prairie, Texas. These individuals or entities shoulder a portion of the financial risk and costs associated with operating the well, but also receive a corresponding share of the revenues generated. In summary, Grand Prairie, Texas division orders are essential legal documents that define the rights, interests, and distribution of profits in the oil and gas industry. By understanding the various types of division orders — mineral interest, non-participating royalty interest, overriding royalty interest, and working interest — all parties involved can ensure fair and transparent operations in Grand Prairie's oil and gas sector.Grand Prairie, Texas Division Orders: A Comprehensive Overview Division orders are crucial legal documents used in the oil and gas industry to determine the rights and interests of various parties involved in the production and sale of oil and gas resources. Specifically focusing on Grand Prairie, Texas, division orders play a pivotal role in facilitating the smooth operation of oil and gas wells and ensuring equitable distribution of royalties to all parties involved. Keywords: Grand Prairie, Texas, division orders, oil and gas industry, rights, interests, production, sale, resources, wells, royalties. Types of Grand Prairie, Texas Division Orders: 1. Mineral Interest Division Orders: These division orders pertain to the parties who hold the mineral rights to a specific tract of land in Grand Prairie, Texas. These individuals or entities are entitled to receive a portion of the revenues generated from oil and gas production on their property. 2. Non-Participating Royalty Interest Division Orders: Non-participating royalty interest (NPR) division orders are relevant when the owner of the mineral rights has leased their land to an oil and gas company, granting them the right to explore, produce, and sell resources. In such cases, the NPR owner is entitled to a royalty interest, but does not participate in the operations or expenses of the well. 3. Overriding Royalty Interest Division Orders: Overriding royalty interest (ORRIS) division orders are significant when someone other than the mineral rights' owner is entitled to a fraction of the royalties from a well in Grand Prairie, Texas. ORRIS owners typically hold a specific percentage interest in the revenues generated by the well, which is separate from the mineral rights' owner. 4. Working Interest Division Orders: Working interest division orders involve parties who are directly involved in the exploration, production, and expenses of an oil or gas well in Grand Prairie, Texas. These individuals or entities shoulder a portion of the financial risk and costs associated with operating the well, but also receive a corresponding share of the revenues generated. In summary, Grand Prairie, Texas division orders are essential legal documents that define the rights, interests, and distribution of profits in the oil and gas industry. By understanding the various types of division orders — mineral interest, non-participating royalty interest, overriding royalty interest, and working interest — all parties involved can ensure fair and transparent operations in Grand Prairie's oil and gas sector.