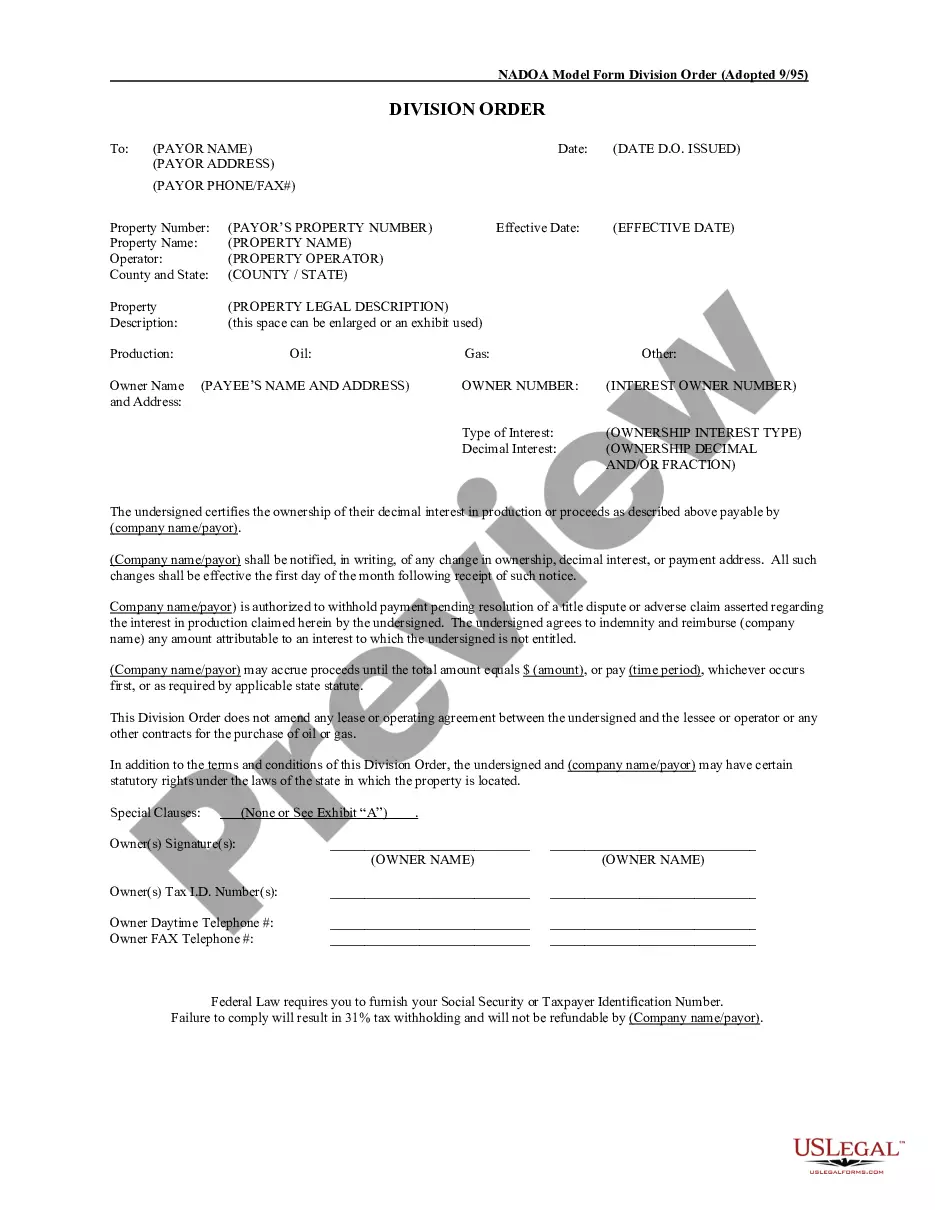

This lease rider form may be used when none of the provisions contained in the division order shall diminish, alter, or affect the rights, titles, or interests vested in Lessor by the terms of this Lease. No division order which Lessor may be requested to sign shall contain terms other than those terms and provisions expressly allowed by any applicable statute of the state in which the lands subject to this Lease are located.

Harris Texas Division Orders play a crucial role in the oil and gas industry, ensuring proper allocation and distribution of royalty payments to mineral owners and interest holders in Harris County, Texas. Division orders are legal documents that outline the proportionate share of production revenue that each owner receives. The Harris Texas Division Orders typically contain important information such as the owner's name, address, social security number or tax identification number, and decimal interest. The decimal interest represents the owner's percentage of ownership in a specific tract or lease. This crucial data allows oil and gas operators to accurately calculate and disburse royalty payments to the rightful owners. There are several types of Harris Texas Division Orders, including: 1. Individual Division Orders: These are issued to individual owners who have a direct interest in the oil and gas production. Each owner receives a personalized division order that reflects their specific ownership share. 2. Joint Ownership Division Orders: In cases where multiple parties jointly own the mineral rights, joint ownership division orders are issued. These documents specify the proportionate share of production revenue each owner should receive. 3. Warship Division Orders: When the original owner of the mineral rights passes away, warship division orders are issued to determine the distribution of royalties amongst the legal heirs in accordance with the deceased owner's will or Texas intestate succession laws. 4. Assignee Division Orders: In cases where the original owner assigns or transfers their interest to another party, assignee division orders are issued to ensure that the assignee receives the rightful share of production revenue. 5. Non-Participating Royalty Interest Division Orders: These division orders are issued to non-participating mineral owners who do not have the right to lease their mineral rights directly but are entitled to receive a specified percentage or fraction of the royalty paid by the lessee. It is important for mineral owners in Harris County, Texas, to carefully review and understand the details mentioned in their division orders. They should promptly respond to the operator by signing and returning the division order to ensure timely and accurate royalty payments. Should any discrepancies or concerns arise, it is advisable for owners to consult with an experienced attorney or oil and gas professional well-versed in division order matters. Overall, Harris Texas Division Orders are crucial legal documents that establish the rights and responsibilities of mineral owners, ensuring transparent and fair distribution of royalty payments in the oil and gas industry.Harris Texas Division Orders play a crucial role in the oil and gas industry, ensuring proper allocation and distribution of royalty payments to mineral owners and interest holders in Harris County, Texas. Division orders are legal documents that outline the proportionate share of production revenue that each owner receives. The Harris Texas Division Orders typically contain important information such as the owner's name, address, social security number or tax identification number, and decimal interest. The decimal interest represents the owner's percentage of ownership in a specific tract or lease. This crucial data allows oil and gas operators to accurately calculate and disburse royalty payments to the rightful owners. There are several types of Harris Texas Division Orders, including: 1. Individual Division Orders: These are issued to individual owners who have a direct interest in the oil and gas production. Each owner receives a personalized division order that reflects their specific ownership share. 2. Joint Ownership Division Orders: In cases where multiple parties jointly own the mineral rights, joint ownership division orders are issued. These documents specify the proportionate share of production revenue each owner should receive. 3. Warship Division Orders: When the original owner of the mineral rights passes away, warship division orders are issued to determine the distribution of royalties amongst the legal heirs in accordance with the deceased owner's will or Texas intestate succession laws. 4. Assignee Division Orders: In cases where the original owner assigns or transfers their interest to another party, assignee division orders are issued to ensure that the assignee receives the rightful share of production revenue. 5. Non-Participating Royalty Interest Division Orders: These division orders are issued to non-participating mineral owners who do not have the right to lease their mineral rights directly but are entitled to receive a specified percentage or fraction of the royalty paid by the lessee. It is important for mineral owners in Harris County, Texas, to carefully review and understand the details mentioned in their division orders. They should promptly respond to the operator by signing and returning the division order to ensure timely and accurate royalty payments. Should any discrepancies or concerns arise, it is advisable for owners to consult with an experienced attorney or oil and gas professional well-versed in division order matters. Overall, Harris Texas Division Orders are crucial legal documents that establish the rights and responsibilities of mineral owners, ensuring transparent and fair distribution of royalty payments in the oil and gas industry.