This lease rider form may be used when none of the provisions contained in the division order shall diminish, alter, or affect the rights, titles, or interests vested in Lessor by the terms of this Lease. No division order which Lessor may be requested to sign shall contain terms other than those terms and provisions expressly allowed by any applicable statute of the state in which the lands subject to this Lease are located.

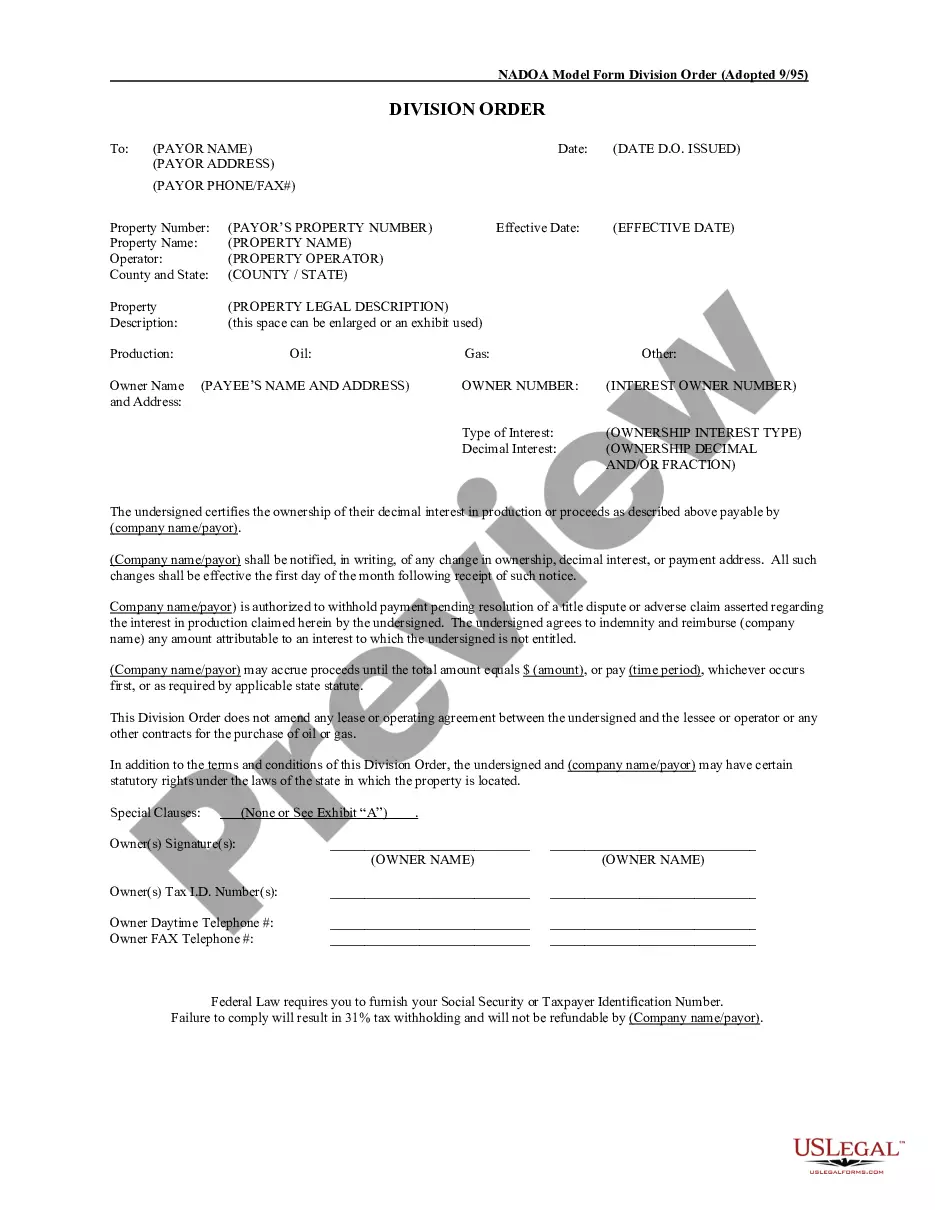

Odessa Texas Division Orders are legal documents that detail the ownership and distribution of proceeds from oil and gas production in Odessa, Texas. These orders are key in determining the rights and responsibilities of various interest owners in a specific oil or gas field. The purpose of Odessa Texas Division Orders is to allocate the revenues generated from the sale of oil and gas among the various individuals or entities with an ownership interest in the mineral rights. These division orders ensure a fair and equitable distribution of funds, allowing for smooth and efficient financial transactions within the oil and gas industry. There are several types of Odessa Texas Division Orders, depending on the specific characteristics of the oil or gas field and the interests involved. Some common types include: 1. Royalty Division Orders: These orders outline the share of proceeds that will be distributed to the mineral rights owners as royalties. Royalty owners typically have a percentage interest in the production and receive a portion of the revenues without being responsible for production costs. 2. Working Interest Division Orders: These orders specify the distribution of proceeds among the working interest owners who actively participate in the drilling, development, and operation of the oil or gas well. Working interest owners are responsible for part of the production costs and receive a share of the revenue accordingly. 3. Overriding Royalty Interest Division Orders: These orders pertain to individuals or entities who possess overriding royalty interests, which are separate and distinct from the mineral rights. Overriding royalty interests are usually granted to those who have an interest in a lease or well as compensation or incentive for managing or financing operations. 4. Surface Owners Division Orders: These orders determine the allocation of proceeds to the surface owners, who own the land where the oil or gas well is located. Surface owners may receive compensation for providing access to the mineral rights owners. In Odessa, Texas, Division Orders play an essential role in establishing clear guidelines for revenue distribution, ensuring transparency and facilitating efficient operations in the oil and gas industry.Odessa Texas Division Orders are legal documents that detail the ownership and distribution of proceeds from oil and gas production in Odessa, Texas. These orders are key in determining the rights and responsibilities of various interest owners in a specific oil or gas field. The purpose of Odessa Texas Division Orders is to allocate the revenues generated from the sale of oil and gas among the various individuals or entities with an ownership interest in the mineral rights. These division orders ensure a fair and equitable distribution of funds, allowing for smooth and efficient financial transactions within the oil and gas industry. There are several types of Odessa Texas Division Orders, depending on the specific characteristics of the oil or gas field and the interests involved. Some common types include: 1. Royalty Division Orders: These orders outline the share of proceeds that will be distributed to the mineral rights owners as royalties. Royalty owners typically have a percentage interest in the production and receive a portion of the revenues without being responsible for production costs. 2. Working Interest Division Orders: These orders specify the distribution of proceeds among the working interest owners who actively participate in the drilling, development, and operation of the oil or gas well. Working interest owners are responsible for part of the production costs and receive a share of the revenue accordingly. 3. Overriding Royalty Interest Division Orders: These orders pertain to individuals or entities who possess overriding royalty interests, which are separate and distinct from the mineral rights. Overriding royalty interests are usually granted to those who have an interest in a lease or well as compensation or incentive for managing or financing operations. 4. Surface Owners Division Orders: These orders determine the allocation of proceeds to the surface owners, who own the land where the oil or gas well is located. Surface owners may receive compensation for providing access to the mineral rights owners. In Odessa, Texas, Division Orders play an essential role in establishing clear guidelines for revenue distribution, ensuring transparency and facilitating efficient operations in the oil and gas industry.