This lease rider form may be used when none of the provisions contained in the division order shall diminish, alter, or affect the rights, titles, or interests vested in Lessor by the terms of this Lease. No division order which Lessor may be requested to sign shall contain terms other than those terms and provisions expressly allowed by any applicable statute of the state in which the lands subject to this Lease are located.

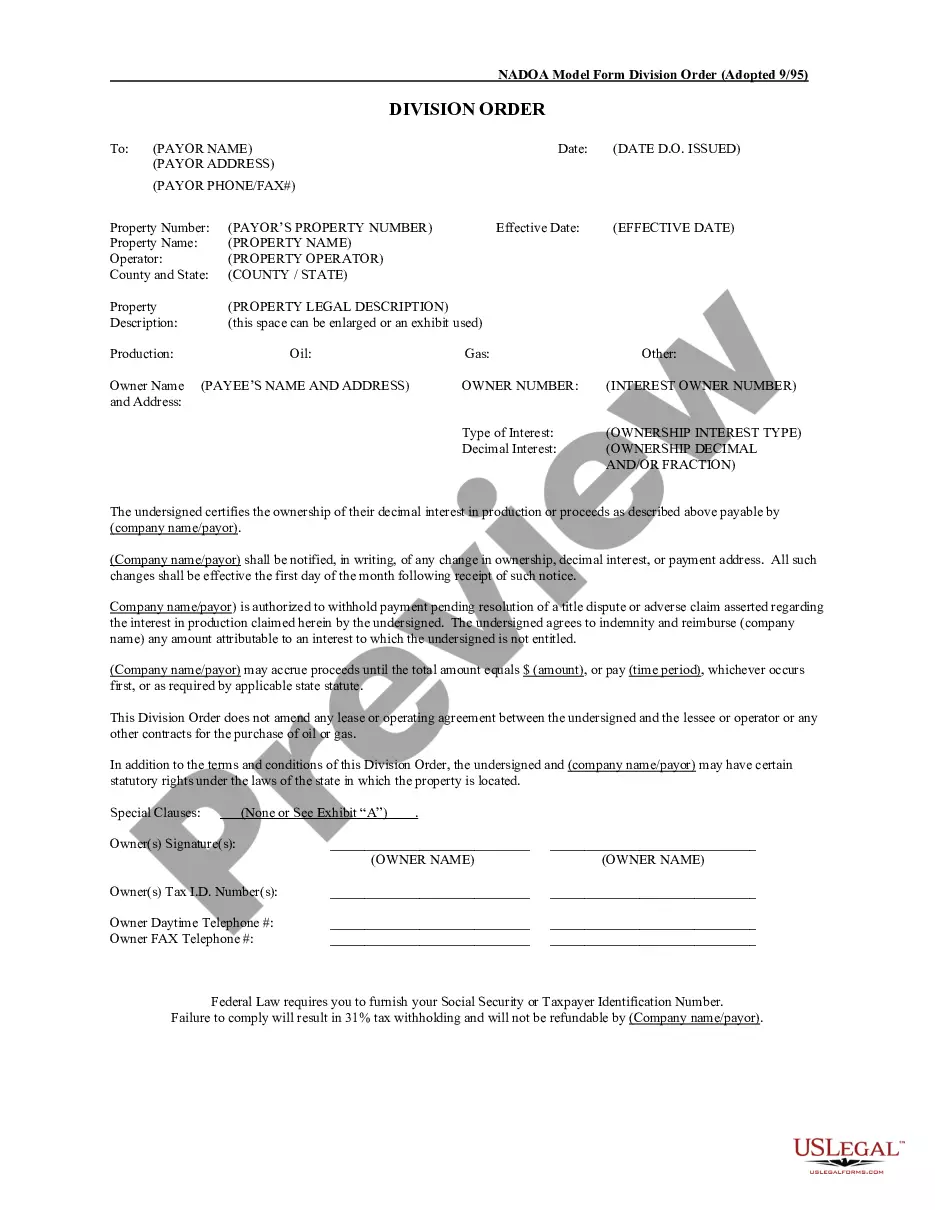

Round Rock Texas Division Orders refer to legal documents that outline the terms and conditions regarding the division of mineral interests or royalties among multiple parties in the Round Rock, Texas region. These division orders play a crucial role in the oil and gas industry, ensuring fair distribution of profits and providing clarity on ownership rights. The purpose of Round Rock Texas Division Orders is to establish the precise interests and ownership percentages of each party involved in the drilling and production of oil or natural gas in the area. These orders are typically prepared by energy companies or operators and are sent to each person or entity entitled to a share of the proceeds. Keywords: Round Rock, Texas, Division Orders, mineral interests, royalties, oil and gas industry, fair distribution, ownership rights, drilling, production, energy companies. Types of Round Rock Texas Division Orders: 1. Royalty Division Orders: These division orders specifically pertain to the division of royalty payments among mineral rights owners. Royalty division orders are created when a property owner leases their mineral rights to an energy company and receives a percentage of the produced oil or gas revenue. 2. Working Interest Division Orders: Working interest division orders are relevant for those who have invested in or have been designated a percentage of a working interest in an oil or gas lease in Round Rock, Texas. These orders outline the division of costs, expenses, and income generated from the production of oil or gas wells. 3. Overriding Royalty Interest Division Orders: Overriding royalty interest division orders are created when a party holds an interest in a lease that is separate from the primary royalty owner. These orders outline the percentage distribution of the overriding royalty interest, which is typically a non-participating royalty interest carved out of the working interest. 4. Net Revenue Interest Division Orders: Net revenue interest division orders define the percentage share of revenue that each party is entitled to after deducting costs associated with extraction, processing, and transportation of oil or gas. These orders are determined by considering the working interest and any overriding royalty interest. In summary, Round Rock Texas Division Orders are legal documents used in the oil and gas industry to determine ownership rights and ensure fair distribution of mineral interests and royalties. It is crucial to understand the different types of division orders, such as royalty division orders, working interest division orders, overriding royalty interest division orders, and net revenue interest division orders, to accurately allocate profits and expenses among the parties involved.Round Rock Texas Division Orders refer to legal documents that outline the terms and conditions regarding the division of mineral interests or royalties among multiple parties in the Round Rock, Texas region. These division orders play a crucial role in the oil and gas industry, ensuring fair distribution of profits and providing clarity on ownership rights. The purpose of Round Rock Texas Division Orders is to establish the precise interests and ownership percentages of each party involved in the drilling and production of oil or natural gas in the area. These orders are typically prepared by energy companies or operators and are sent to each person or entity entitled to a share of the proceeds. Keywords: Round Rock, Texas, Division Orders, mineral interests, royalties, oil and gas industry, fair distribution, ownership rights, drilling, production, energy companies. Types of Round Rock Texas Division Orders: 1. Royalty Division Orders: These division orders specifically pertain to the division of royalty payments among mineral rights owners. Royalty division orders are created when a property owner leases their mineral rights to an energy company and receives a percentage of the produced oil or gas revenue. 2. Working Interest Division Orders: Working interest division orders are relevant for those who have invested in or have been designated a percentage of a working interest in an oil or gas lease in Round Rock, Texas. These orders outline the division of costs, expenses, and income generated from the production of oil or gas wells. 3. Overriding Royalty Interest Division Orders: Overriding royalty interest division orders are created when a party holds an interest in a lease that is separate from the primary royalty owner. These orders outline the percentage distribution of the overriding royalty interest, which is typically a non-participating royalty interest carved out of the working interest. 4. Net Revenue Interest Division Orders: Net revenue interest division orders define the percentage share of revenue that each party is entitled to after deducting costs associated with extraction, processing, and transportation of oil or gas. These orders are determined by considering the working interest and any overriding royalty interest. In summary, Round Rock Texas Division Orders are legal documents used in the oil and gas industry to determine ownership rights and ensure fair distribution of mineral interests and royalties. It is crucial to understand the different types of division orders, such as royalty division orders, working interest division orders, overriding royalty interest division orders, and net revenue interest division orders, to accurately allocate profits and expenses among the parties involved.