This lease rider form may be used when none of the provisions contained in the division order shall diminish, alter, or affect the rights, titles, or interests vested in Lessor by the terms of this Lease. No division order which Lessor may be requested to sign shall contain terms other than those terms and provisions expressly allowed by any applicable statute of the state in which the lands subject to this Lease are located.

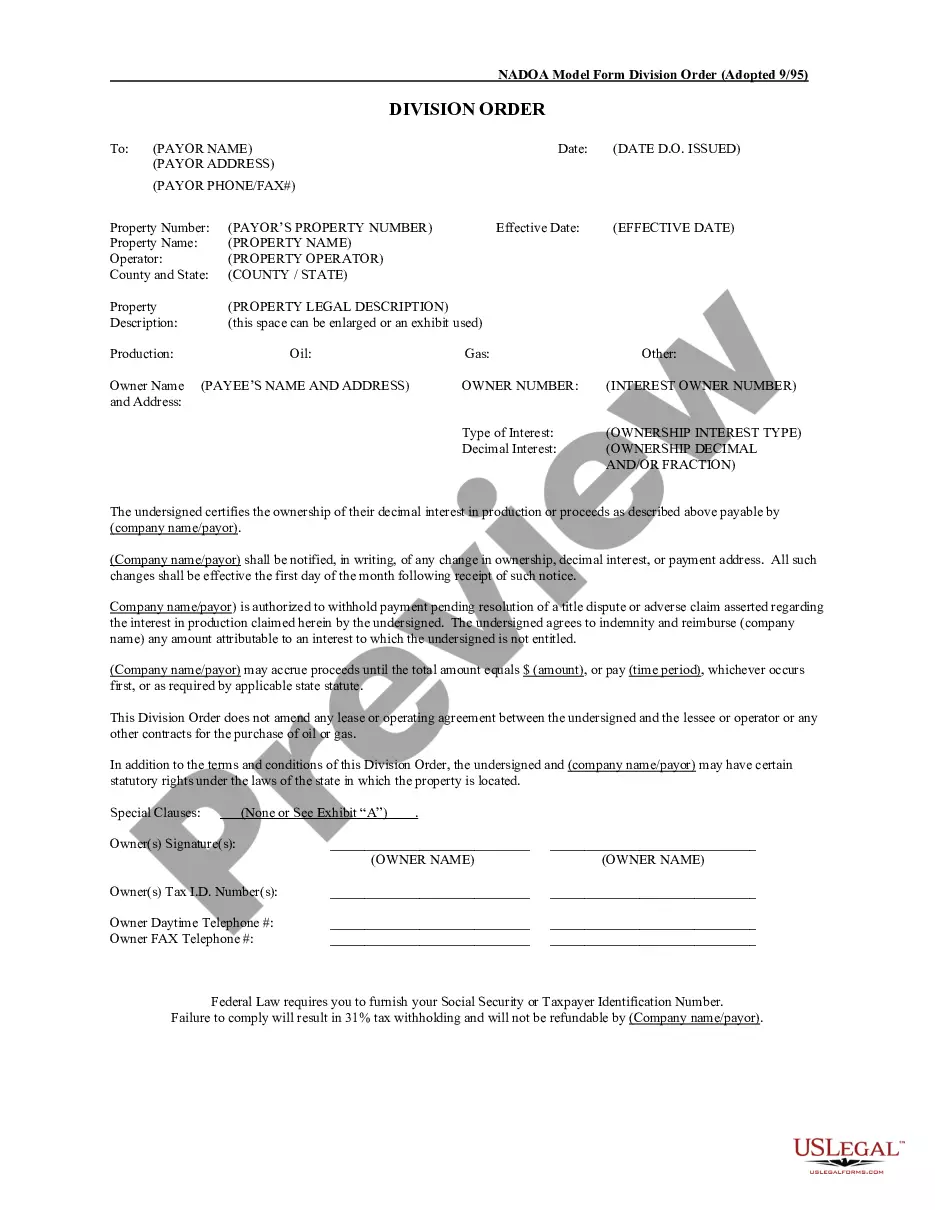

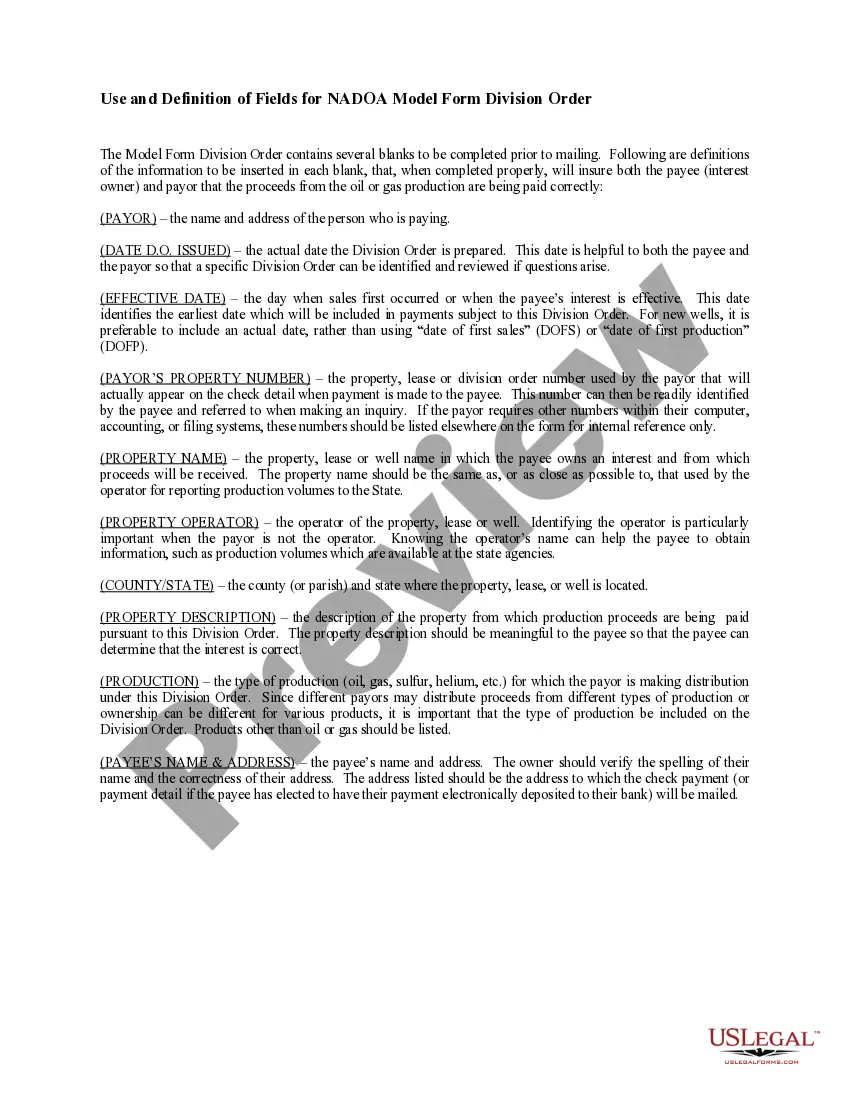

Travis Texas Division Orders: A Comprehensive Overview of its Types and Importance Overview: Travis Texas Division Orders serve as legally binding documents, ensuring accurate distribution of revenues earned from oil and gas production among mineral owners and leaseholders in Travis County, Texas. These orders play a critical role in the oil and gas industry, providing a means to define ownership interests and allocate financial obligations fairly. Keywords: Travis Texas Division Orders, oil and gas production, mineral owners, leaseholders, revenues, ownership interests, financial obligations. Types of Travis Texas Division Orders: 1. Standard Division Orders: Standard division orders establish the proper proportionate ownership interest and revenue allocation among all parties involved in the oil and gas lease. They include essential information such as legal descriptions, royalty interest percentages, and land ownership details. These division orders serve as a foundation for revenue distribution and are often used as legal evidence in disputes. 2. Supplemental Division Orders: Supplemental division orders are required when additional interests or changes in ownership occur after the execution of standard division orders. These orders update the existing division order to reflect any modifications, such as changes in mineral ownership, acquisitions, mergers, or amendments to lease agreements. Supplemental division orders ensure accuracy and transparency in revenue distribution. 3. Division Orders with Deductions: Division orders may also incorporate provisions for deductions related to post-production costs, such as transportation, processing, and marketing expenses. These division orders with deductions outline how these costs are allocated among the royalty and working interest owners. These deductions ensure consistency and transparency in calculating net revenue distributions, promoting equitable sharing of expenses. Importance of Travis Texas Division Orders: 1. Clarity and Transparency: Travis Texas Division Orders provide clarity, ensuring all parties involved understand their respective ownership interests and the revenue distribution process. These orders outline the details of agreements, rights, obligations, and costs, minimizing confusion and preventing disputes. 2. Legal Protection: Division orders offer legal protection to both the royalty owners and operators. By signing these documents, mineral owners confirm their agreement to the proposed revenue distribution plan, protecting their rights to receive payments accurately. These orders serve as legal evidence during any ownership disputes or challenges. 3. Efficient Revenue Distribution: Travis Texas Division Orders establish a systematic approach to revenue distribution. By defining ownership interests and obligations, they facilitate accurate calculation and timely payments of royalties to all parties involved. This ensures smooth operations and minimizes delays or errors in payment processing. 4. Changes in Ownership: Division orders play a crucial role when changes in mineral ownership occur. They provide a mechanism to update the ownership details promptly, avoid disruptions, and ensure uninterrupted royalty payments. Supplemental division orders allow for seamless adjustments to the revenue distribution structure. To conclude, Travis Texas Division Orders are essential in the oil and gas industry, facilitating accurate and fair revenue distribution among mineral owners and leaseholders. They provide clarity, legal protection, and an efficient framework for allocating revenues while adapting to changes in ownership.Travis Texas Division Orders: A Comprehensive Overview of its Types and Importance Overview: Travis Texas Division Orders serve as legally binding documents, ensuring accurate distribution of revenues earned from oil and gas production among mineral owners and leaseholders in Travis County, Texas. These orders play a critical role in the oil and gas industry, providing a means to define ownership interests and allocate financial obligations fairly. Keywords: Travis Texas Division Orders, oil and gas production, mineral owners, leaseholders, revenues, ownership interests, financial obligations. Types of Travis Texas Division Orders: 1. Standard Division Orders: Standard division orders establish the proper proportionate ownership interest and revenue allocation among all parties involved in the oil and gas lease. They include essential information such as legal descriptions, royalty interest percentages, and land ownership details. These division orders serve as a foundation for revenue distribution and are often used as legal evidence in disputes. 2. Supplemental Division Orders: Supplemental division orders are required when additional interests or changes in ownership occur after the execution of standard division orders. These orders update the existing division order to reflect any modifications, such as changes in mineral ownership, acquisitions, mergers, or amendments to lease agreements. Supplemental division orders ensure accuracy and transparency in revenue distribution. 3. Division Orders with Deductions: Division orders may also incorporate provisions for deductions related to post-production costs, such as transportation, processing, and marketing expenses. These division orders with deductions outline how these costs are allocated among the royalty and working interest owners. These deductions ensure consistency and transparency in calculating net revenue distributions, promoting equitable sharing of expenses. Importance of Travis Texas Division Orders: 1. Clarity and Transparency: Travis Texas Division Orders provide clarity, ensuring all parties involved understand their respective ownership interests and the revenue distribution process. These orders outline the details of agreements, rights, obligations, and costs, minimizing confusion and preventing disputes. 2. Legal Protection: Division orders offer legal protection to both the royalty owners and operators. By signing these documents, mineral owners confirm their agreement to the proposed revenue distribution plan, protecting their rights to receive payments accurately. These orders serve as legal evidence during any ownership disputes or challenges. 3. Efficient Revenue Distribution: Travis Texas Division Orders establish a systematic approach to revenue distribution. By defining ownership interests and obligations, they facilitate accurate calculation and timely payments of royalties to all parties involved. This ensures smooth operations and minimizes delays or errors in payment processing. 4. Changes in Ownership: Division orders play a crucial role when changes in mineral ownership occur. They provide a mechanism to update the ownership details promptly, avoid disruptions, and ensure uninterrupted royalty payments. Supplemental division orders allow for seamless adjustments to the revenue distribution structure. To conclude, Travis Texas Division Orders are essential in the oil and gas industry, facilitating accurate and fair revenue distribution among mineral owners and leaseholders. They provide clarity, legal protection, and an efficient framework for allocating revenues while adapting to changes in ownership.