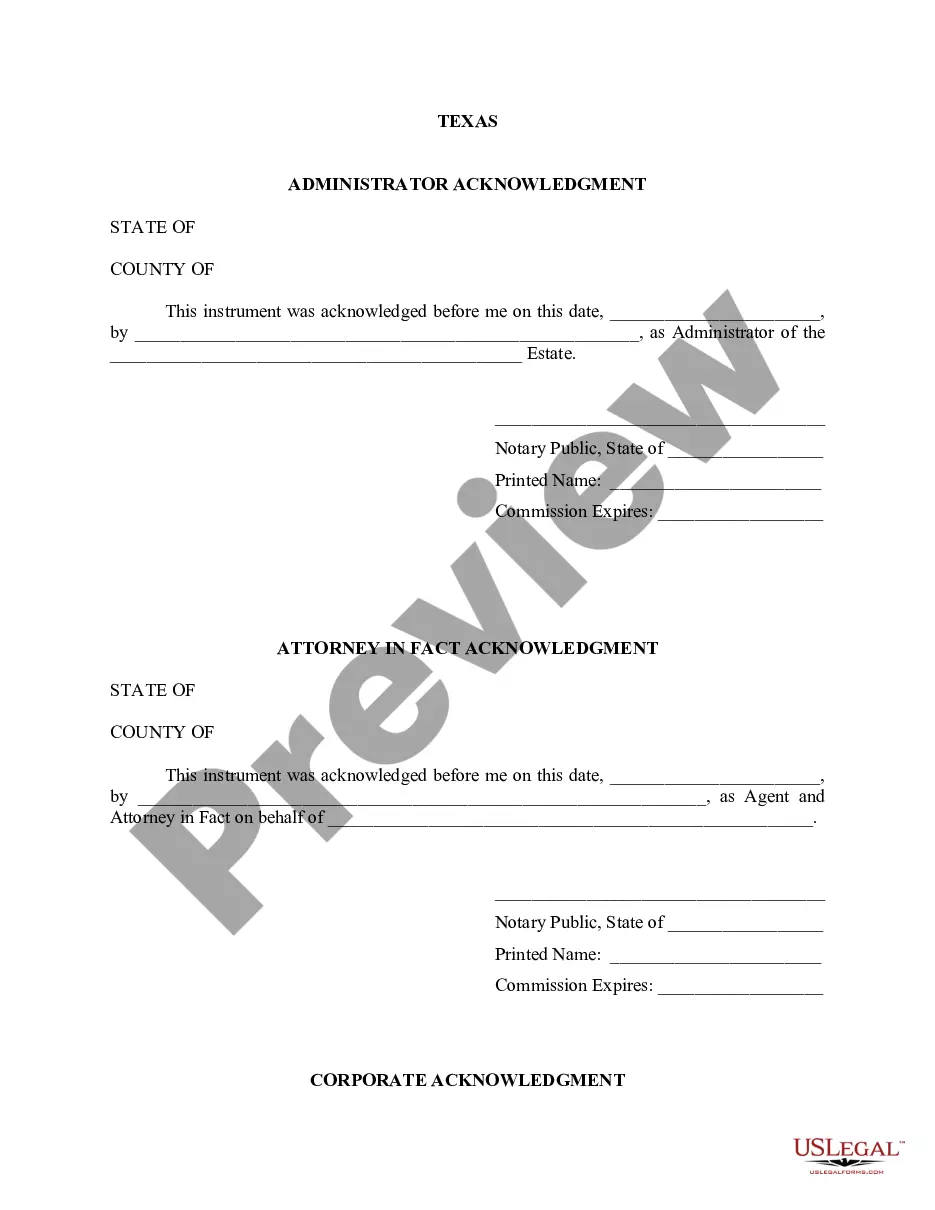

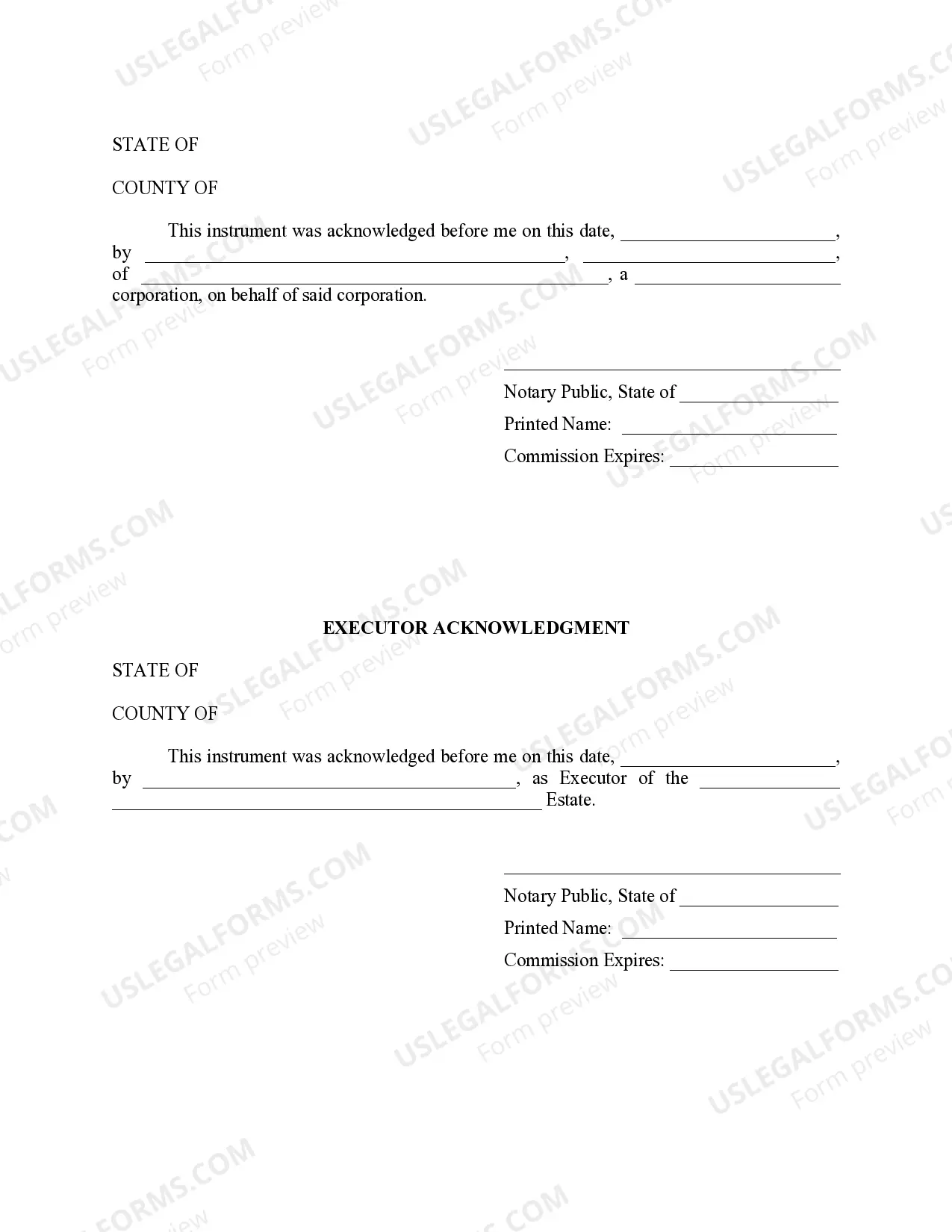

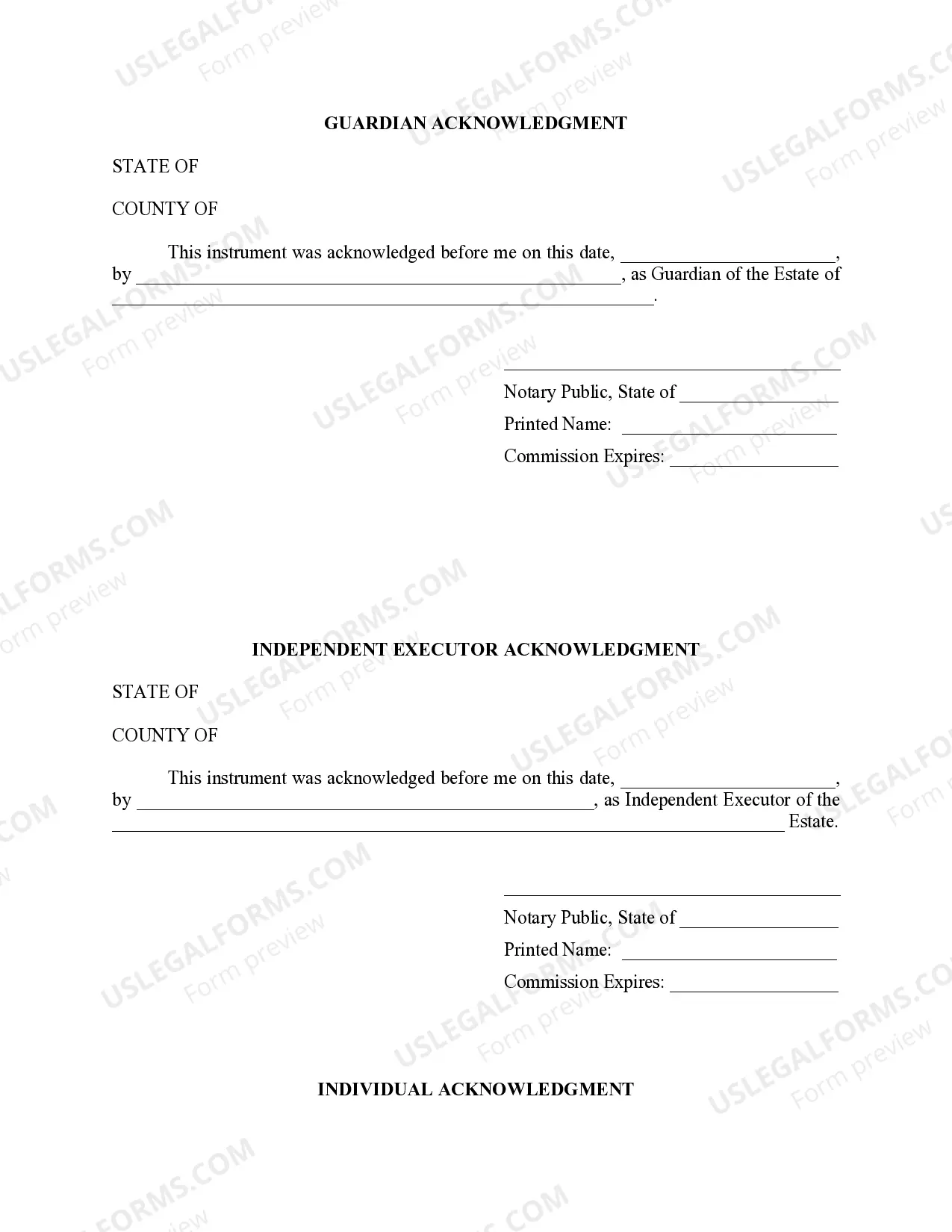

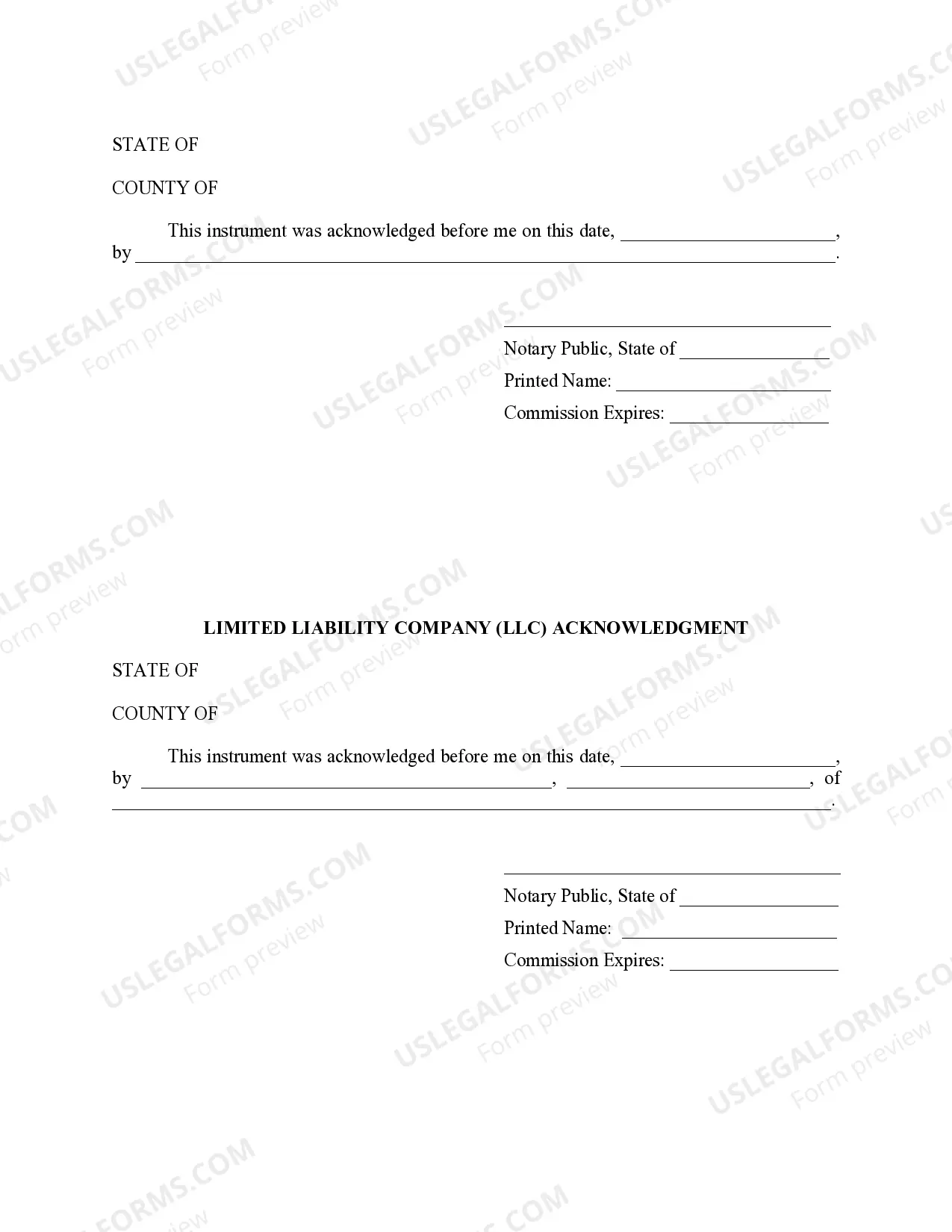

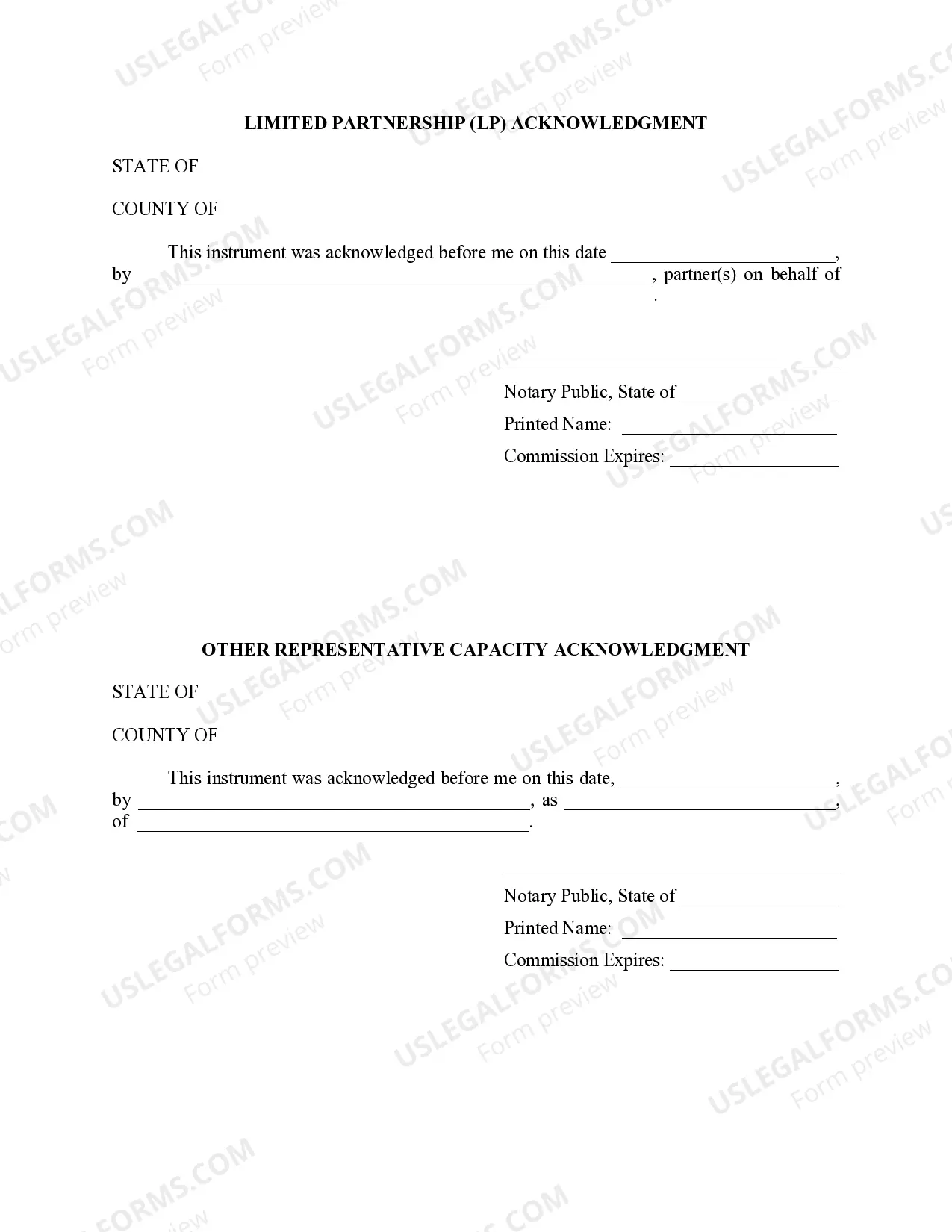

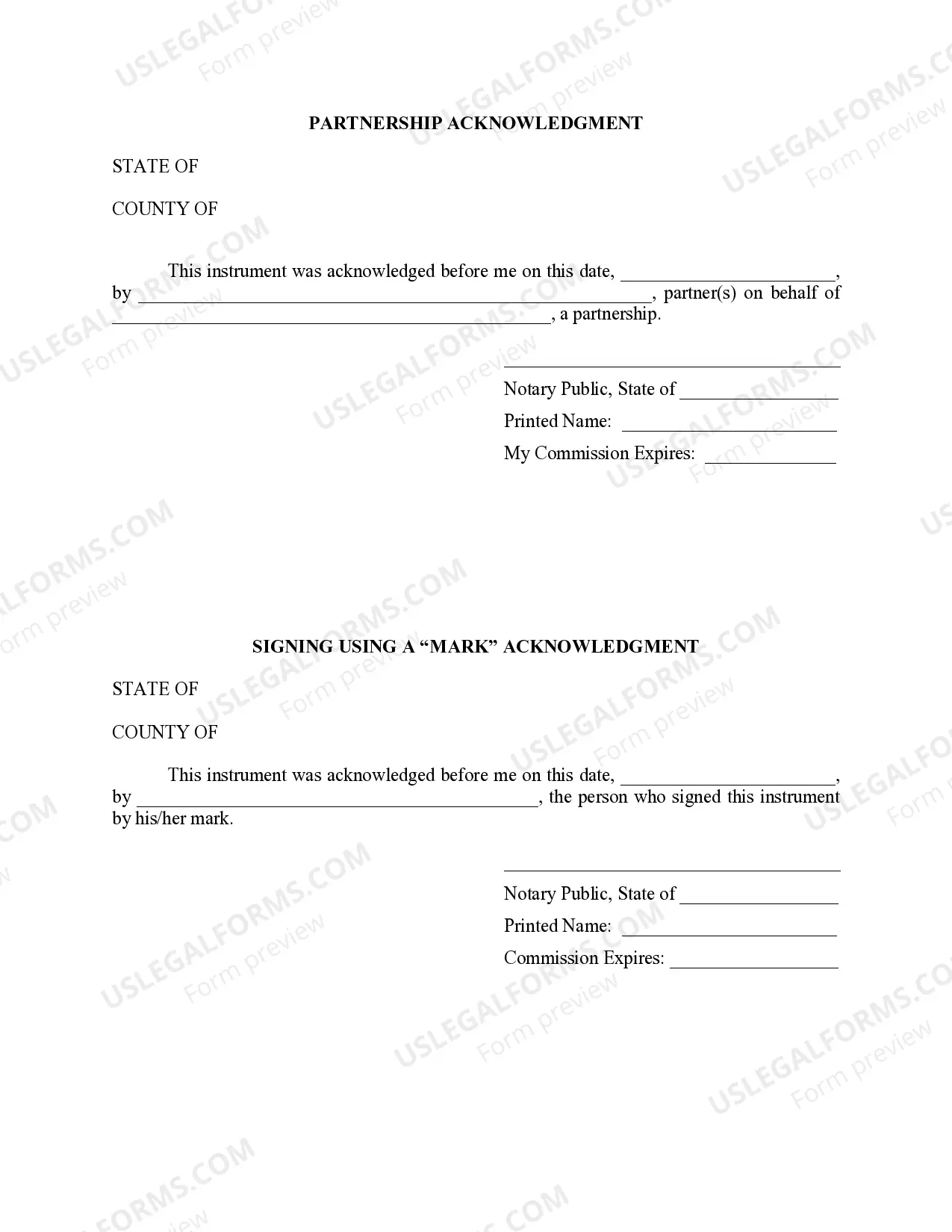

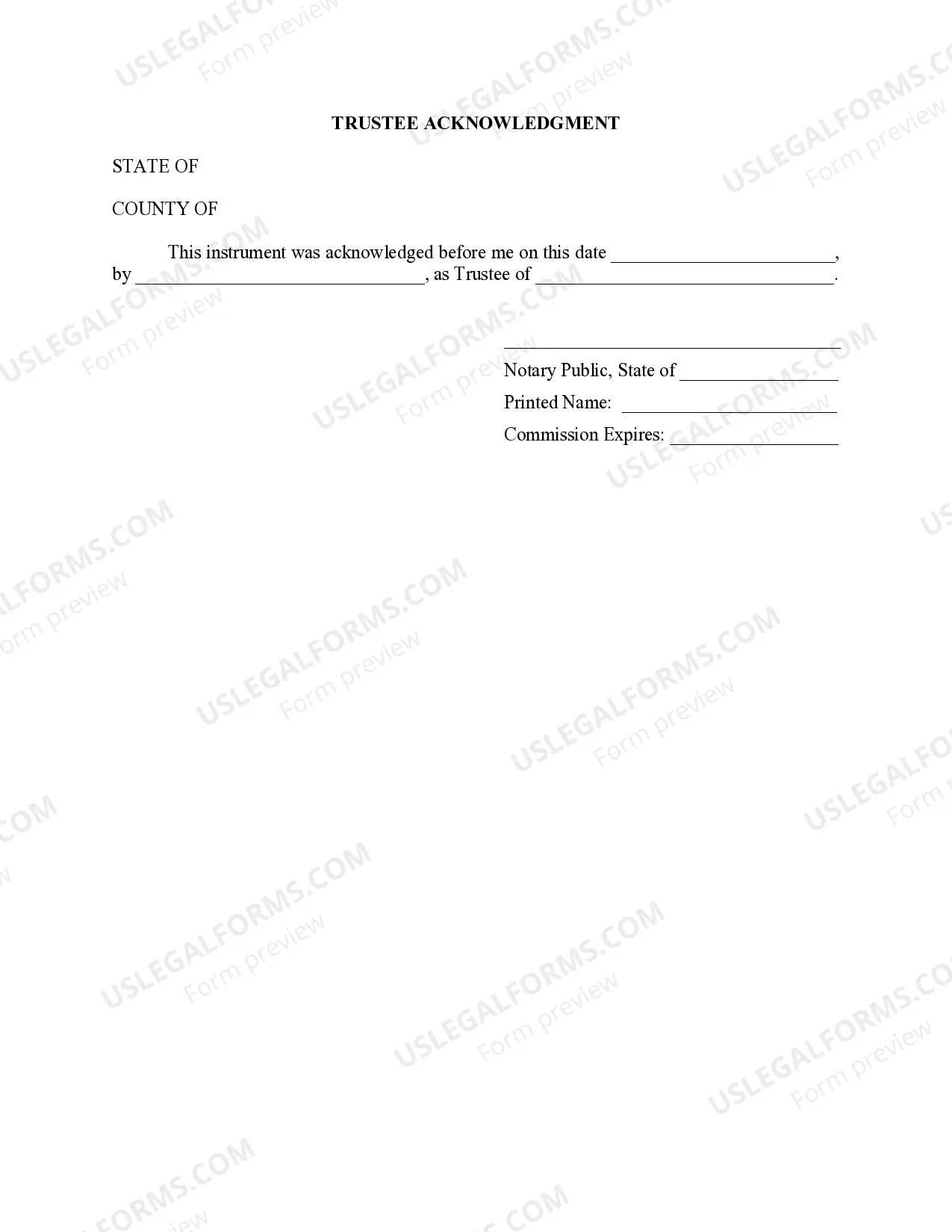

Collin Texas Oil and Gas Acknowledgment is a legal document that confirms an individual's awareness and understanding of the rights and responsibilities associated with oil and gas operations in the county of Collin, Texas. This acknowledgment serves as evidence that the individual, typically a property owner, has been informed about the implications of allowing oil and gas activities on their property. Keywords: Collin Texas, oil and gas acknowledgment, legal document, property owner, oil and gas operations, rights and responsibilities, awareness, implications There are several types of Collin Texas Oil and Gas Acknowledgment that may be specific to different situations: 1. Surface Use Agreement Acknowledgment: This type of acknowledgment is used when a property owner allows oil and gas companies to access and use their property for drilling operations. It outlines the terms and conditions under which the company can operate on the surface of the property. 2. Mineral Rights Acknowledgment: This acknowledgment is relevant when a property owner is granting the rights to extract minerals, including oil and gas, from their property. It includes details about the duration of the rights, financial arrangements, and other considerations. 3. Royalty Interest Acknowledgment: In the context of oil and gas, royalties are a percentage of revenue paid to the mineral rights' owner(s) for allowing extraction. This acknowledgment outlines the agreement between the property owner and the company regarding the payment of royalties. 4. Environmental Protection Acknowledgment: This type of acknowledgment emphasizes the property owner's responsibility to ensure compliance with environmental regulations and safeguarding the surrounding environment during oil and gas operations. It addresses issues such as waste management, water protection, and restoration obligations. 5. Indemnification Acknowledgment: This acknowledgment deals with provisions related to the liability of the property owner and the oil and gas company. It often includes clauses stating that the property owner will indemnify and hold harmless the company against any claims, damages, or losses arising from the operations. In conclusion, Collin Texas Oil and Gas Acknowledgment is an essential legal document that outlines the rights, responsibilities, and implications of oil and gas operations on a property located in Collin County, Texas. It is crucial for property owners to carefully review and understand the specific type of acknowledgment they are presented with, ensuring they are fully informed and protected when entering into agreements with oil and gas companies.

Collin Texas Oil and Gas Acknowledgment

Description

How to fill out Collin Texas Oil And Gas Acknowledgment?

Are you looking for a reliable and inexpensive legal forms provider to buy the Collin Texas Oil and Gas Acknowledgment? US Legal Forms is your go-to choice.

No matter if you need a simple agreement to set regulations for cohabitating with your partner or a set of forms to move your divorce through the court, we got you covered. Our website provides over 85,000 up-to-date legal document templates for personal and business use. All templates that we offer aren’t generic and frameworked in accordance with the requirements of separate state and county.

To download the document, you need to log in account, find the needed form, and click the Download button next to it. Please keep in mind that you can download your previously purchased document templates anytime from the My Forms tab.

Are you new to our website? No worries. You can set up an account with swift ease, but before that, make sure to do the following:

- Find out if the Collin Texas Oil and Gas Acknowledgment conforms to the regulations of your state and local area.

- Read the form’s description (if provided) to learn who and what the document is intended for.

- Restart the search if the form isn’t good for your legal situation.

Now you can register your account. Then pick the subscription plan and proceed to payment. As soon as the payment is done, download the Collin Texas Oil and Gas Acknowledgment in any provided format. You can get back to the website when you need and redownload the document without any extra costs.

Getting up-to-date legal forms has never been easier. Give US Legal Forms a go today, and forget about wasting your valuable time learning about legal paperwork online once and for all.