This Small Business Accounting Package contains many of the business forms needed to operate and maintain a small business, including a variety of accounting forms. These forms may be adapted to suit your particular business or situation.

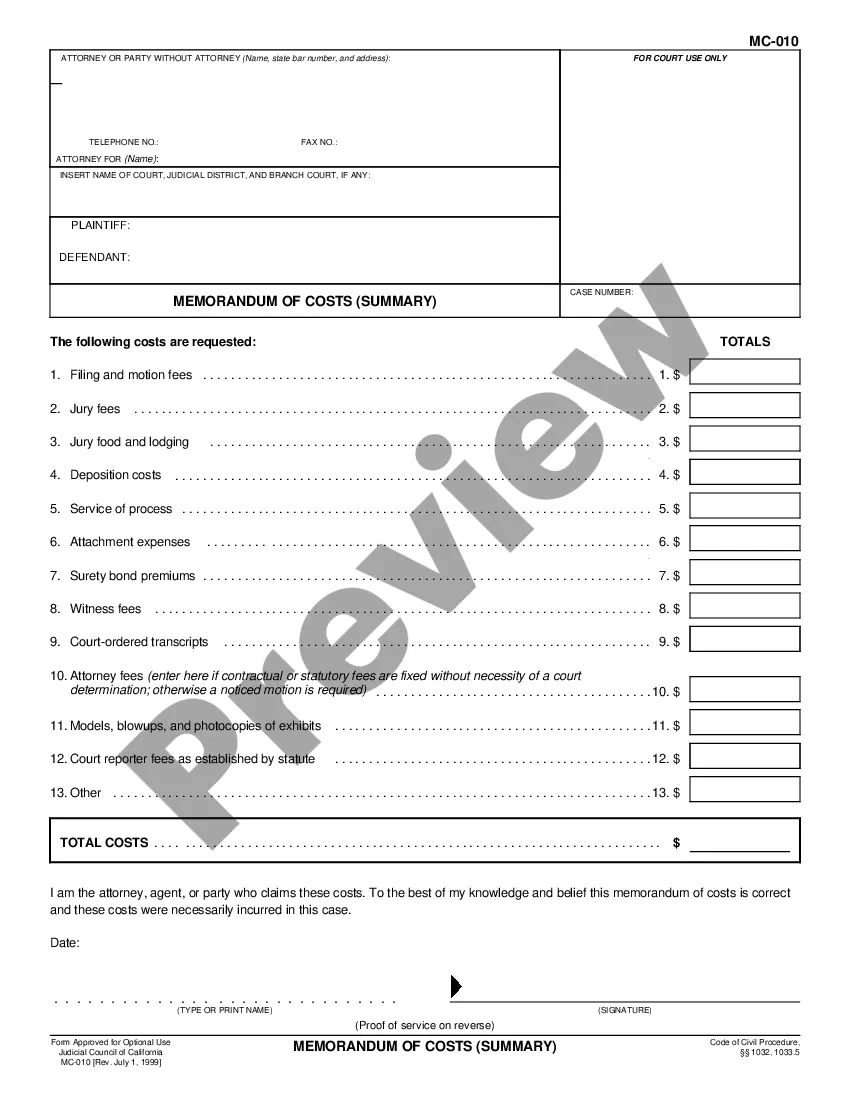

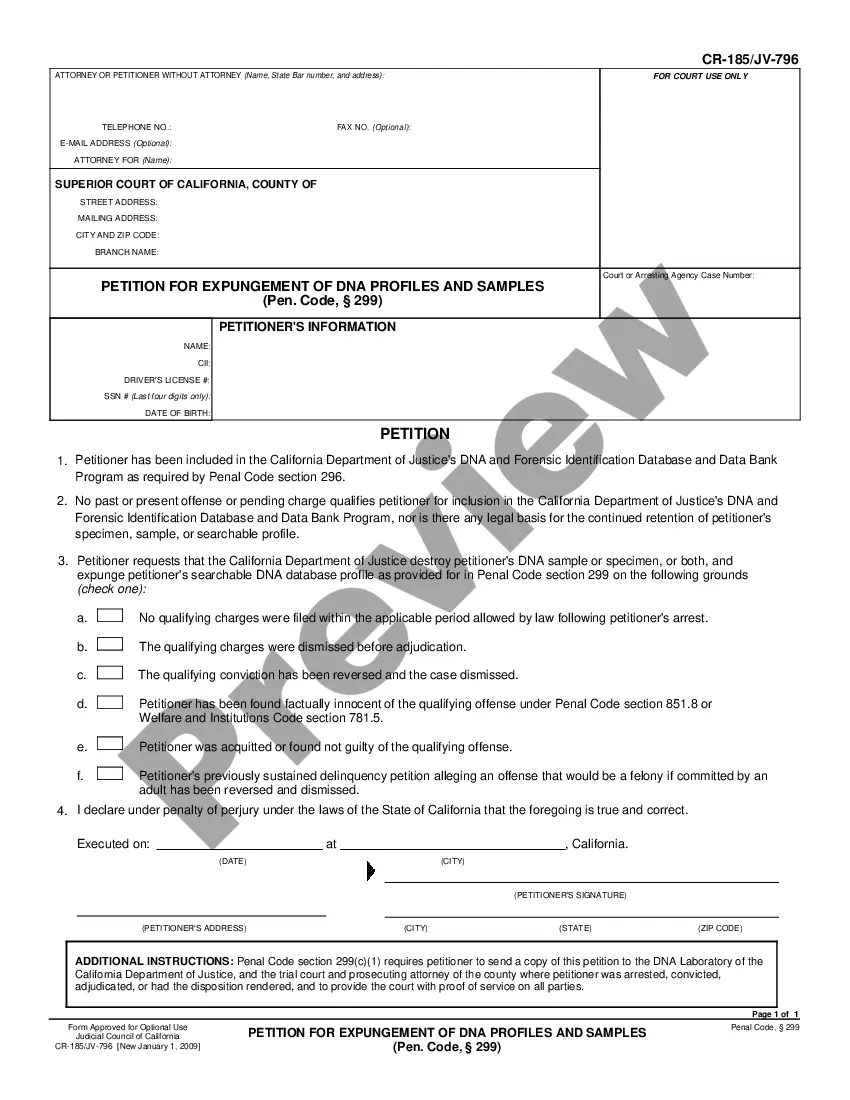

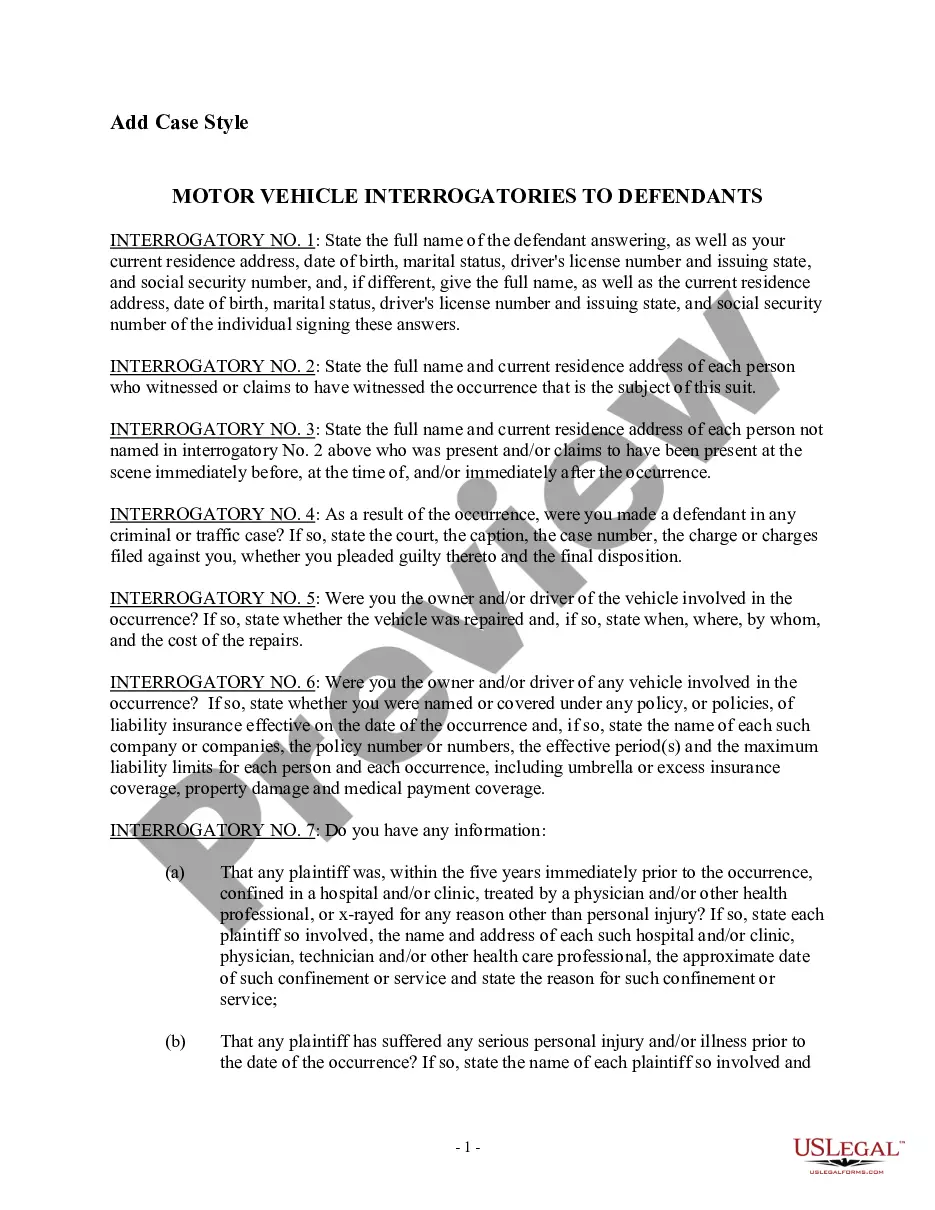

Included in your package are the following forms:

1. Profit and Loss Statement

2. Aging Accounts Payable form

3. Balance Sheet Deposit

4. Cash Disbursements and Receipts form

5. Check Request form

6. Daily Accounts Receivables form

7. Depreciation Schedule

8. Invoice

9. Petty Cash form

10. Purchase Order

11. Purchasing Cost Estimate

12. Records Management form

13. Yearly Expenses form

14. Yearly Expenses form by Quarter

Purchase this package and save up to 50% over purchasing the forms separately!

Austin Texas Small Business Accounting Package is a comprehensive financial management solution designed specifically for small businesses in Austin, Texas. This package offers a range of accounting tools and features to help businesses efficiently manage their finances, track expenses, analyze profitability, and streamline bookkeeping processes. The Austin Texas Small Business Accounting Package includes various modules and functionalities tailored to meet the specific needs of small businesses in the local market. These modules cover essential accounting areas such as invoicing, accounts payable and receivable, bank reconciliation, financial reporting, tax preparation, payroll management, and inventory tracking. One notable feature of this accounting package is its user-friendly interface, which makes it easy for small business owners and their staff to navigate and use the software effectively. This ensures that even those without extensive accounting knowledge can easily handle their financial tasks and generate accurate financial reports. The package also provides customizable templates for invoices, purchase orders, and other financial documents, allowing businesses to personalize and brand their transactions. These templates help maintain a professional and consistent look for all financial communications, enhancing the company's image and credibility. Additionally, Austin Texas Small Business Accounting Package allows for seamless integration with other commonly used software and applications, enabling businesses to streamline workflows and improve overall efficiency. This includes integration with popular e-commerce platforms, payment gateways, and CRM systems to automate data syncing and minimize manual data entry. Furthermore, this accounting package offers different versions tailored to specific business sizes and needs. For instance, there may be a basic package suitable for small startups or home-based businesses with limited accounting requirements. In contrast, an advanced package may cater to more established and growing small enterprises that require sophisticated features like multi-currency support, project tracking, and advanced financial analysis. In conclusion, Austin Texas Small Business Accounting Package provides a robust and comprehensive solution for small businesses in Austin, Texas, to effectively manage their finances. With its range of accounting modules, user-friendly interface, customizable templates, integration capabilities, and different versions to meet specific needs, this accounting package is a valuable tool for businesses seeking efficient financial management and growth.