This form is provided in the Texas Probate Code. It gives your attorney in fact (your agent) broad powers to make decisions regarding property, financial, business, insurance and other matters that remain in effect even if you are incapacitated.

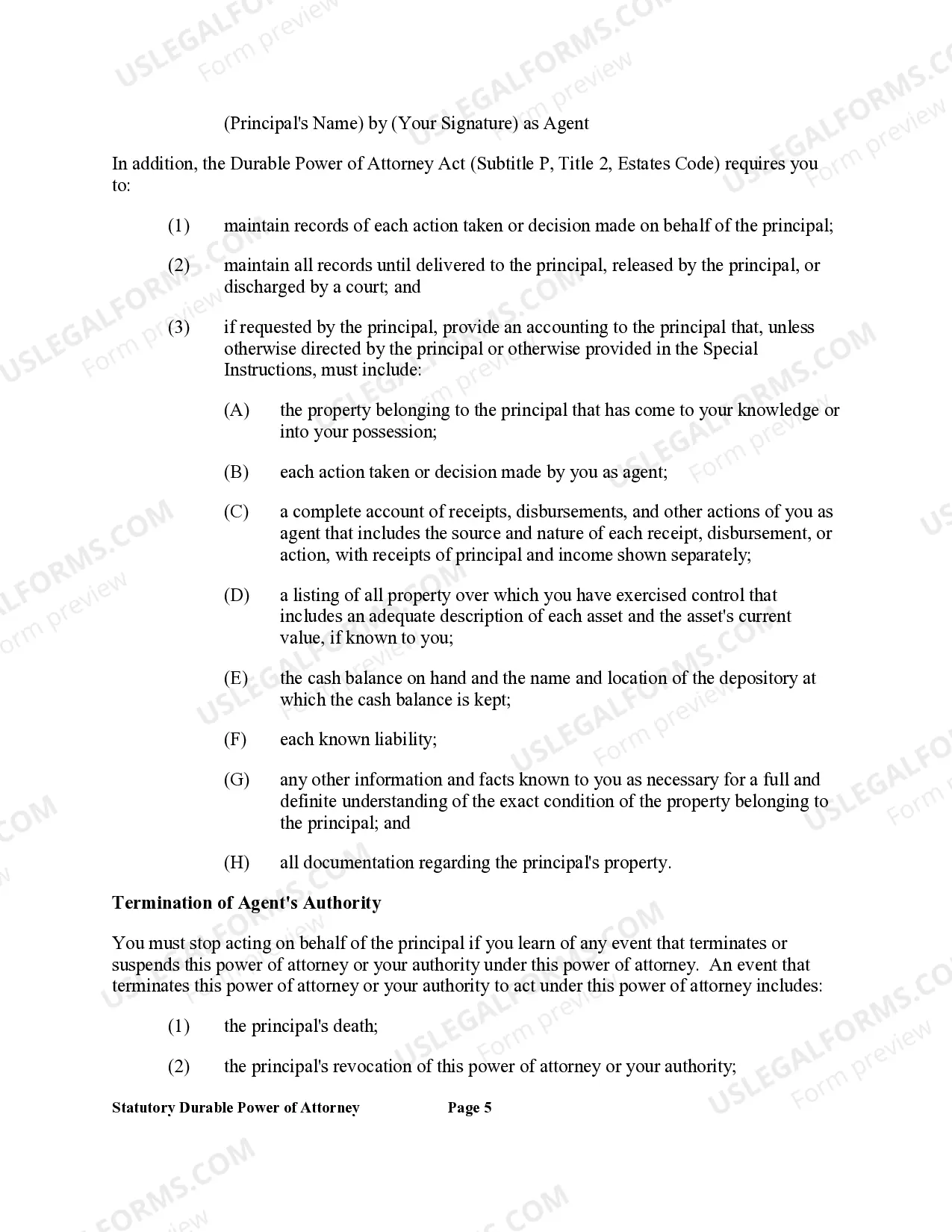

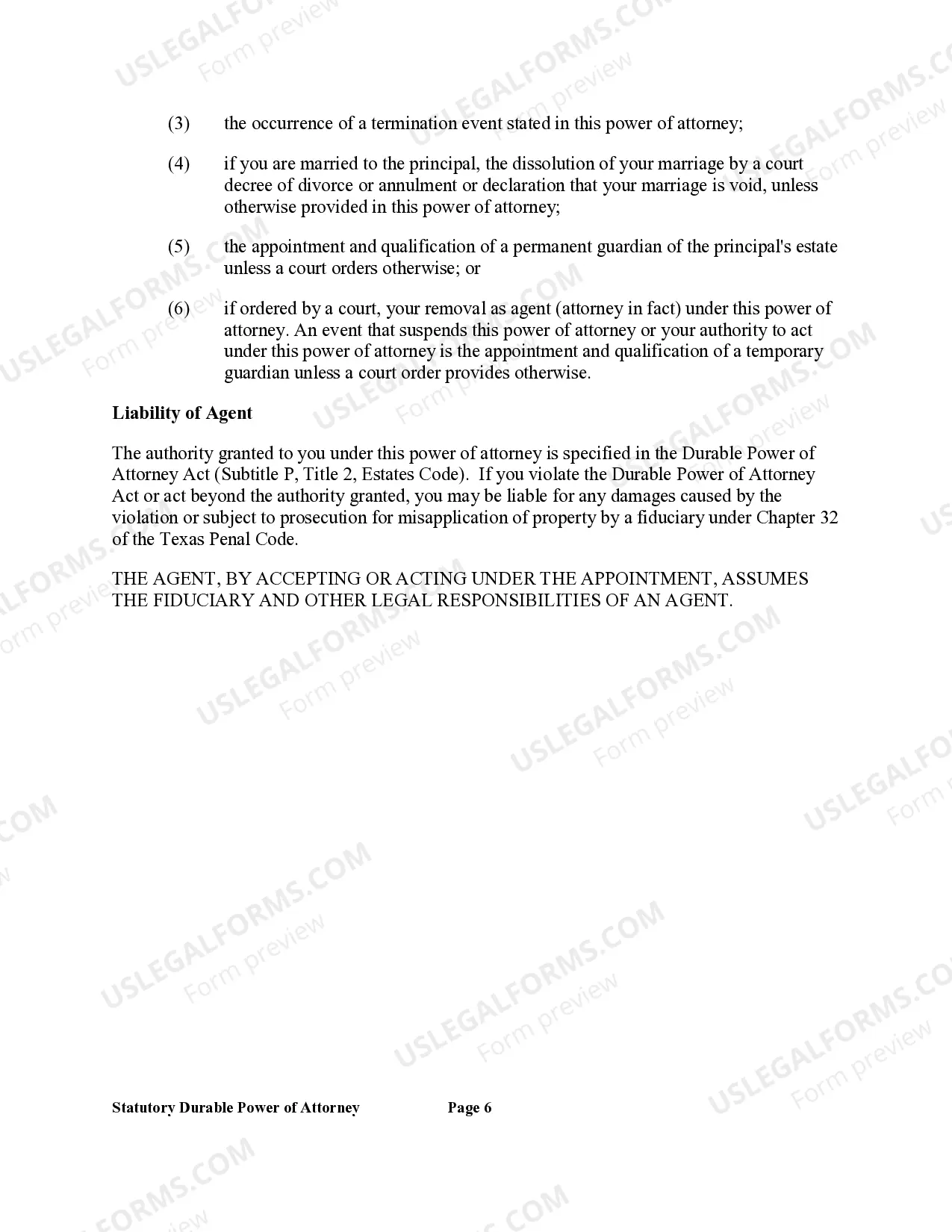

The Fort Worth Texas Statutory General Power of Attorney with Durable Provisions is a legal document that grants an individual, referred to as the "agent" or "attorney-in-fact," the authority to act on behalf of another person, known as the "principal," in various financial and legal matters. This power of attorney is regulated by Texas state statutes and ensures that the agent can continue making decisions for the principal even if they become incapacitated or unable to make decisions themselves. The General Power of Attorney encompasses a wide range of powers and allows the agent to handle an array of financial affairs on behalf of the principal. This may include managing bank accounts, making investments, paying bills, filing taxes, managing real estate, and even making medical decisions in certain cases. The agent is granted the authority to do anything that the principal could do themselves, given the necessary legal capacity. The inclusion of "durable provisions" in the power of attorney implies that it remains valid even if the principal becomes mentally or physically incapacitated. These provisions are crucial as they allow the agent to continue acting on behalf of the principal, providing peace of mind and uninterrupted management of affairs during incapacitation. Different types or variations of the Fort Worth Texas Statutory General Power of Attorney with Durable Provisions may include specific provisions tailored for a particular purpose or limited powers of attorney for specific transactions. For example, a limited power of attorney may grant authority to the agent to sell a specific property or make investments on behalf of the principal but not have the authority to handle other financial affairs. It is important to note that executing a power of attorney requires careful consideration, as it grants significant authority to the agent. It is advisable to consult with an attorney experienced in estate planning or elder law to ensure that the document accurately reflects the principal's intentions and provides adequate protection for their interests.The Fort Worth Texas Statutory General Power of Attorney with Durable Provisions is a legal document that grants an individual, referred to as the "agent" or "attorney-in-fact," the authority to act on behalf of another person, known as the "principal," in various financial and legal matters. This power of attorney is regulated by Texas state statutes and ensures that the agent can continue making decisions for the principal even if they become incapacitated or unable to make decisions themselves. The General Power of Attorney encompasses a wide range of powers and allows the agent to handle an array of financial affairs on behalf of the principal. This may include managing bank accounts, making investments, paying bills, filing taxes, managing real estate, and even making medical decisions in certain cases. The agent is granted the authority to do anything that the principal could do themselves, given the necessary legal capacity. The inclusion of "durable provisions" in the power of attorney implies that it remains valid even if the principal becomes mentally or physically incapacitated. These provisions are crucial as they allow the agent to continue acting on behalf of the principal, providing peace of mind and uninterrupted management of affairs during incapacitation. Different types or variations of the Fort Worth Texas Statutory General Power of Attorney with Durable Provisions may include specific provisions tailored for a particular purpose or limited powers of attorney for specific transactions. For example, a limited power of attorney may grant authority to the agent to sell a specific property or make investments on behalf of the principal but not have the authority to handle other financial affairs. It is important to note that executing a power of attorney requires careful consideration, as it grants significant authority to the agent. It is advisable to consult with an attorney experienced in estate planning or elder law to ensure that the document accurately reflects the principal's intentions and provides adequate protection for their interests.