With this Satisfaction, Cancellation or Release of Mortgage Package,you will find the forms and letters necessary for the satisfaction or release of a mortgage for the state of Texas. The described real estate is therefore released from the mortgage.

Included in your package are the following forms:

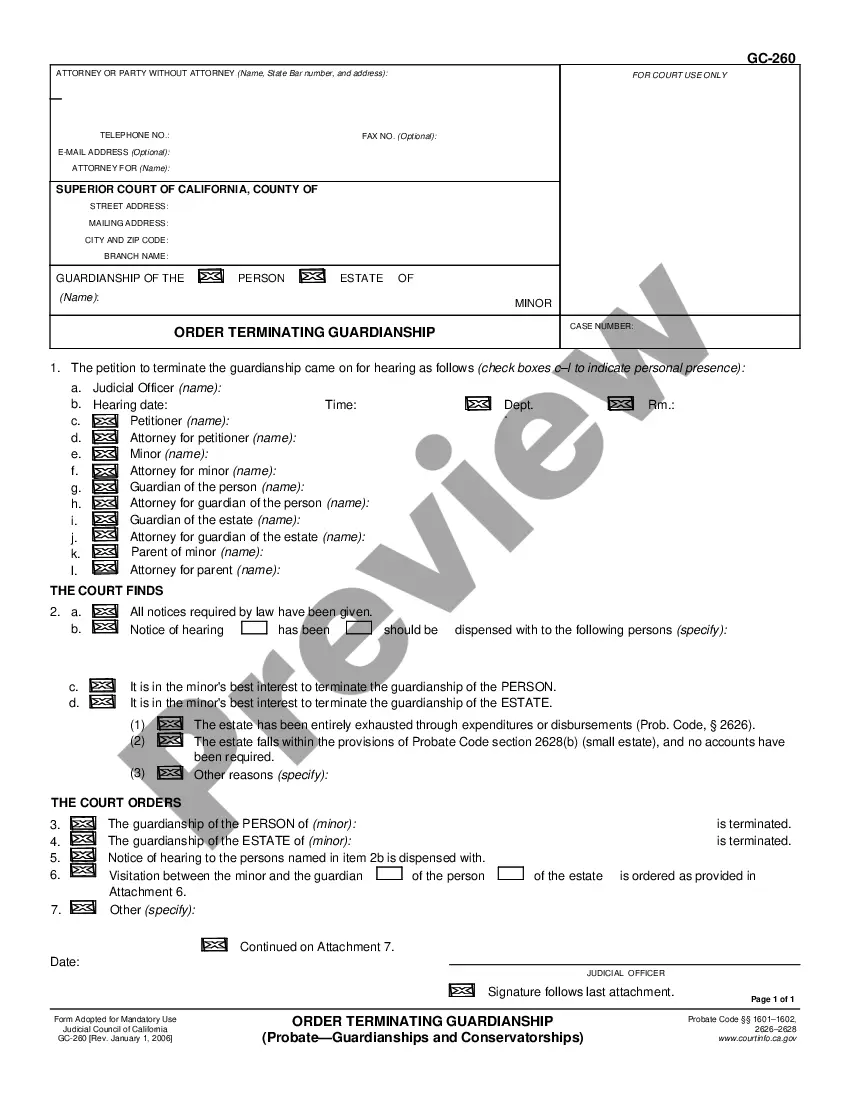

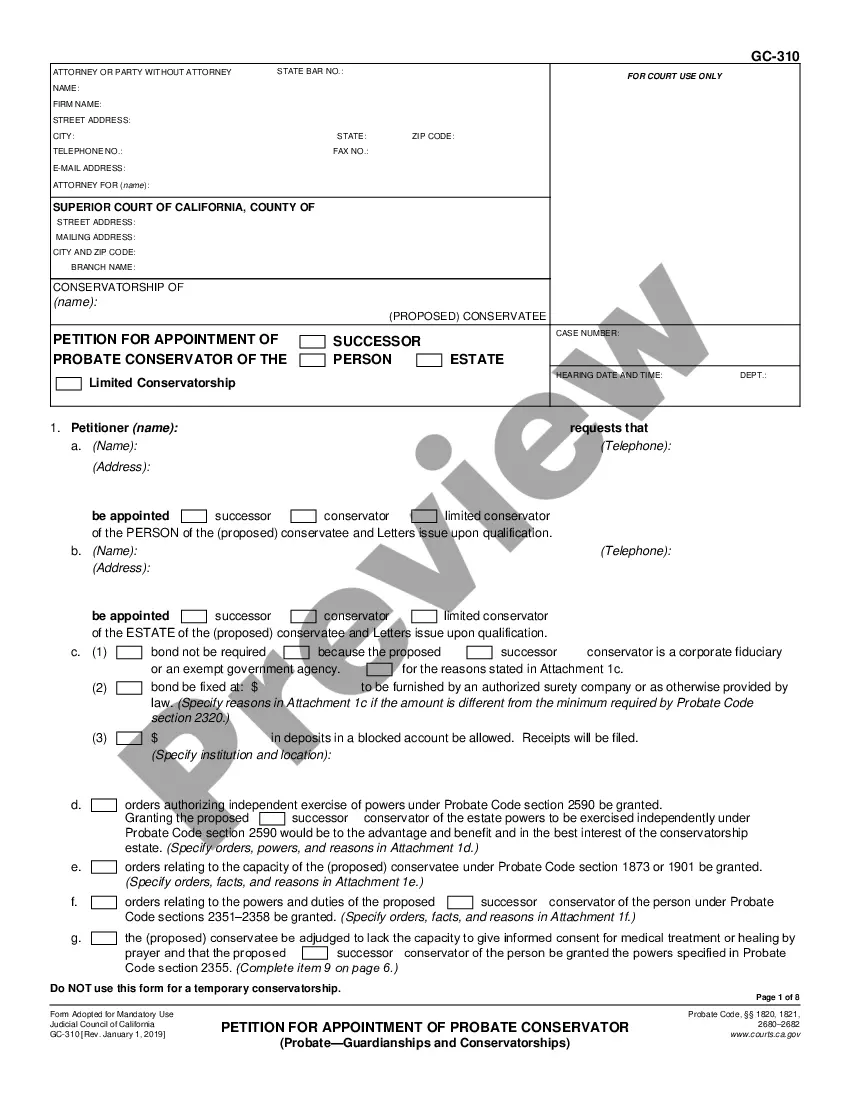

1. Satisfaction, Release or Cancellation of a Deed of Trust by a Corporation;The Fort Worth Texas Satisfaction, Cancellation or Release of Mortgage Package refers to a set of legally binding documents used to declare the satisfaction, cancellation, or release of a mortgage in Fort Worth, Texas. These packages are essential when a borrower has paid off their mortgage, sold the property, or wishes to remove the lien from the property title. The package typically includes various forms and certificates that need to be completed accurately and signed by both the borrower and the lender. Keywords related to the Fort Worth Texas Satisfaction, Cancellation or Release of Mortgage Package may include: 1. Satisfaction of Mortgage: This document is used to officially acknowledge that the borrower has satisfied their mortgage obligation and paid off the loan in full. It typically specifies the borrower's details, lender's details, property information, and the date of satisfaction. 2. Cancellation of Mortgage: This form is utilized when the mortgage has been canceled due to reasons such as refinancing, error in the original documentation, or legislative changes. It requires the borrower and lender to agree on the cancellation terms and may involve additional supporting documents. 3. Release of Mortgage: Similar to the Satisfaction of Mortgage form, this document is used when the borrower has fulfilled their mortgage obligation and requests the lender to release the lien on the property. It typically includes details such as the property description, lender's information, borrower's information, and a clear statement of mortgage release. Different types of Fort Worth Texas Satisfaction, Cancellation or Release of Mortgage Package may vary based on specific circumstances or requirements. These might include additional forms and certificates, such as: — Affidavit of Satisfaction: If the original mortgagee (lender) cannot be located or is no longer in business, an affidavit may be required to state that the mortgage has been satisfied and provide evidence of the satisfaction. — Subordination Agreement: If the borrower wishes to obtain another loan or mortgage while the original mortgage is still in effect, they may need a subordination agreement to ensure the priority of the new loan. — Lien Release Certificate: In some cases, a separate certificate may be required to record the release of the mortgage lien with the county recorder's office, ensuring its removal from public records. It is important to carefully review the specific requirements of the Fort Worth Texas Satisfaction, Cancellation or Release of Mortgage Package, as these may vary depending on the county and state regulations. Additionally, consulting with a legal professional or a mortgage specialist can ensure the correct completion and submission of these documents.

2. Satisfaction, Release or Cancellation of a Deed of Trust by an Individual;

3. Letter of Notice to Borrower of Status of Mortgage;

4. Letter to Recording Office for Recording Satisfaction of a Mortgage

The Fort Worth Texas Satisfaction, Cancellation or Release of Mortgage Package refers to a set of legally binding documents used to declare the satisfaction, cancellation, or release of a mortgage in Fort Worth, Texas. These packages are essential when a borrower has paid off their mortgage, sold the property, or wishes to remove the lien from the property title. The package typically includes various forms and certificates that need to be completed accurately and signed by both the borrower and the lender. Keywords related to the Fort Worth Texas Satisfaction, Cancellation or Release of Mortgage Package may include: 1. Satisfaction of Mortgage: This document is used to officially acknowledge that the borrower has satisfied their mortgage obligation and paid off the loan in full. It typically specifies the borrower's details, lender's details, property information, and the date of satisfaction. 2. Cancellation of Mortgage: This form is utilized when the mortgage has been canceled due to reasons such as refinancing, error in the original documentation, or legislative changes. It requires the borrower and lender to agree on the cancellation terms and may involve additional supporting documents. 3. Release of Mortgage: Similar to the Satisfaction of Mortgage form, this document is used when the borrower has fulfilled their mortgage obligation and requests the lender to release the lien on the property. It typically includes details such as the property description, lender's information, borrower's information, and a clear statement of mortgage release. Different types of Fort Worth Texas Satisfaction, Cancellation or Release of Mortgage Package may vary based on specific circumstances or requirements. These might include additional forms and certificates, such as: — Affidavit of Satisfaction: If the original mortgagee (lender) cannot be located or is no longer in business, an affidavit may be required to state that the mortgage has been satisfied and provide evidence of the satisfaction. — Subordination Agreement: If the borrower wishes to obtain another loan or mortgage while the original mortgage is still in effect, they may need a subordination agreement to ensure the priority of the new loan. — Lien Release Certificate: In some cases, a separate certificate may be required to record the release of the mortgage lien with the county recorder's office, ensuring its removal from public records. It is important to carefully review the specific requirements of the Fort Worth Texas Satisfaction, Cancellation or Release of Mortgage Package, as these may vary depending on the county and state regulations. Additionally, consulting with a legal professional or a mortgage specialist can ensure the correct completion and submission of these documents.