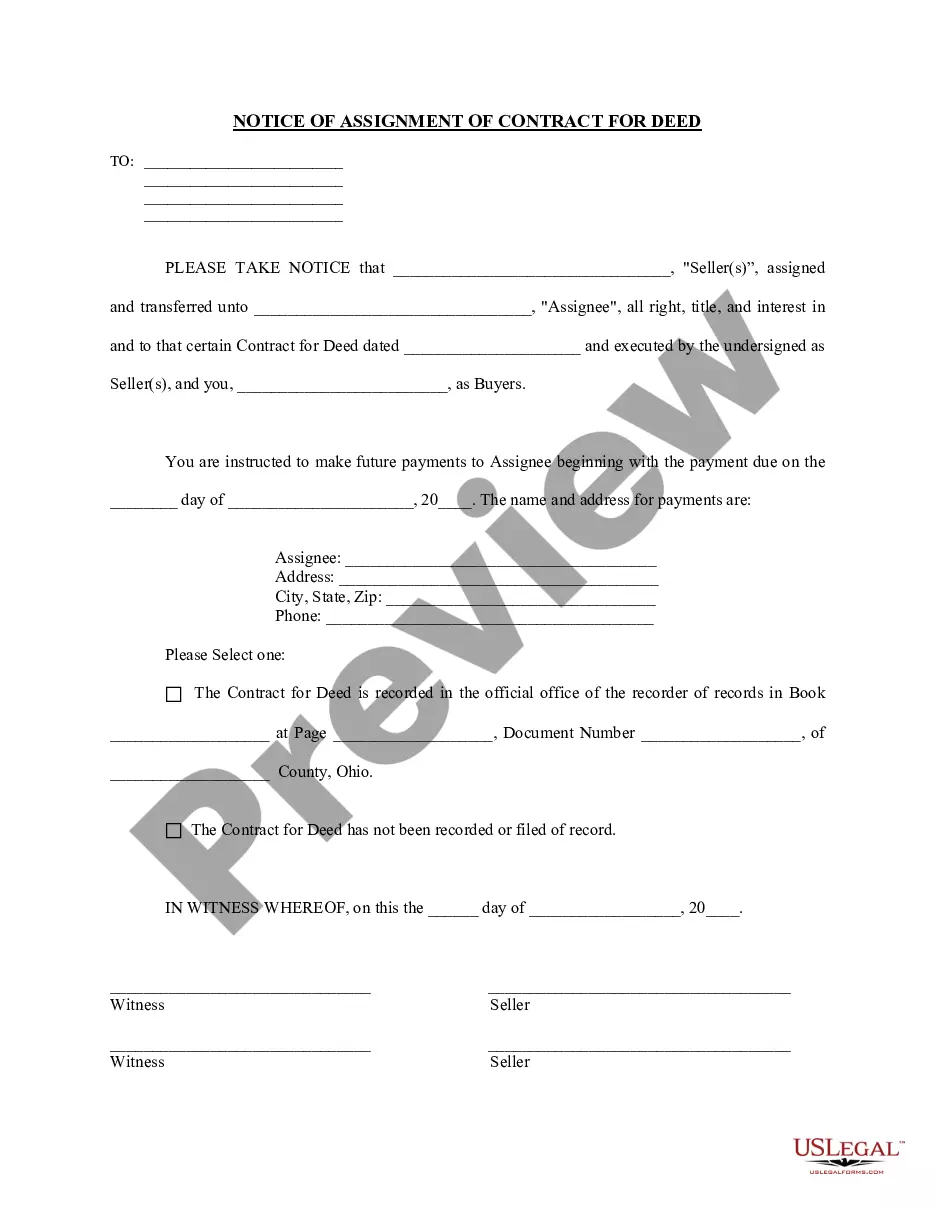

With this Satisfaction, Cancellation or Release of Mortgage Package,you will find the forms and letters necessary for the satisfaction or release of a mortgage for the state of Texas. The described real estate is therefore released from the mortgage.

Included in your package are the following forms:

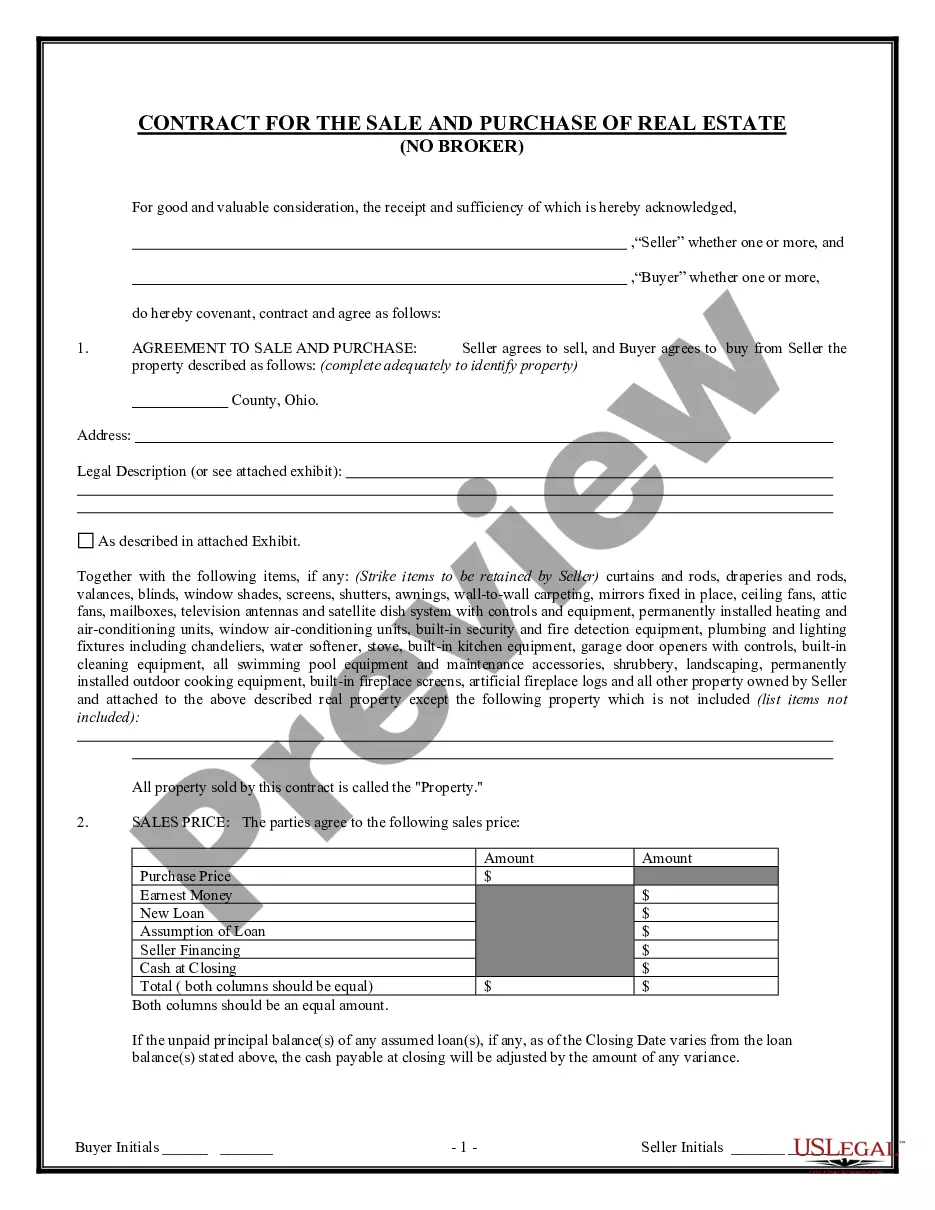

1. Satisfaction, Release or Cancellation of a Deed of Trust by a Corporation;

2. Satisfaction, Release or Cancellation of a Deed of Trust by an Individual;

3. Letter of Notice to Borrower of Status of Mortgage;

4. Letter to Recording Office for Recording Satisfaction of a Mortgage

The Houston Texas Satisfaction, Cancellation, or Release of Mortgage Package refers to a set of legal documents required when a mortgage on a property located in Houston, Texas needs to be satisfied, cancelled, or released. These packages typically consist of various forms and affidavits that provide evidence of the mortgage's fulfillment or termination. In Houston, Texas, there are different types of Satisfaction, Cancellation, or Release of Mortgage Packages, which can vary depending on the specific circumstances and entities involved. Some possible variations may include: 1. Individual Borrower Release Package: This package is used when an individual borrower has successfully paid off their mortgage and requires the lender to release the lien or claim on the property. The package may include documents such as a Satisfaction of Mortgage form, where the lender acknowledges that the borrower has satisfied their debt. 2. Corporate Borrower Satisfaction Package: When a corporation or business entity has fulfilled the terms of their mortgage agreement, a Corporate Borrower Satisfaction Package is utilized. It may include additional forms and documents, such as a Corporate Resolution approving the satisfaction of the mortgage and attesting to the authority of the individuals executing the release. 3. Partial Release Package: In cases where the property associated with the mortgage is only partially released from the lien, such as when a portion of the property is sold or subdivided, a Partial Release Package may be required. This package typically includes specific legal descriptions of the released portion, along with an agreement signed by both the lender and borrower outlining the details of the partial release. 4. Lender's Satisfaction or Release Package: When a lender has agreed to satisfy or release the mortgage due to various reasons, such as refinancing or full repayment, a Lender's Satisfaction or Release Package is put together. This package might include a document signed by the lender, indicating their consent to release the mortgage lien, as well as any additional supporting documents required by specific lending institutions. In all these variations, the Houston Texas Satisfaction, Cancellation, or Release of Mortgage Package plays a critical role in finalizing the legalities associated with fulfilling or terminating a mortgage in Houston, Texas. These packages ensure that all parties involved have completed the necessary steps to release any claim or encumbrance on the property, providing the borrower with clear ownership and title rights. It is essential to consult with legal professionals or mortgage experts to navigate the specific requirements and execute the correct documents relevant to individual situations.