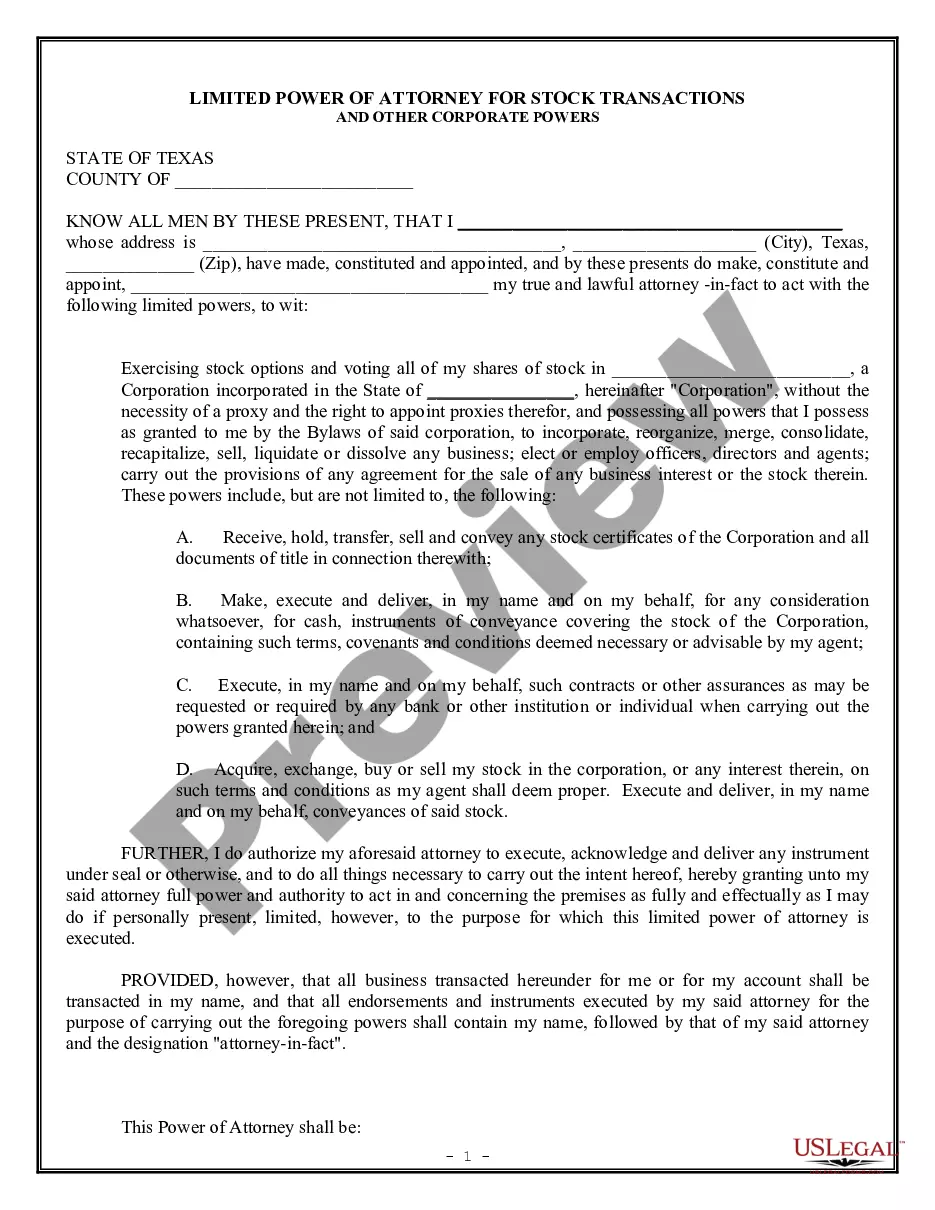

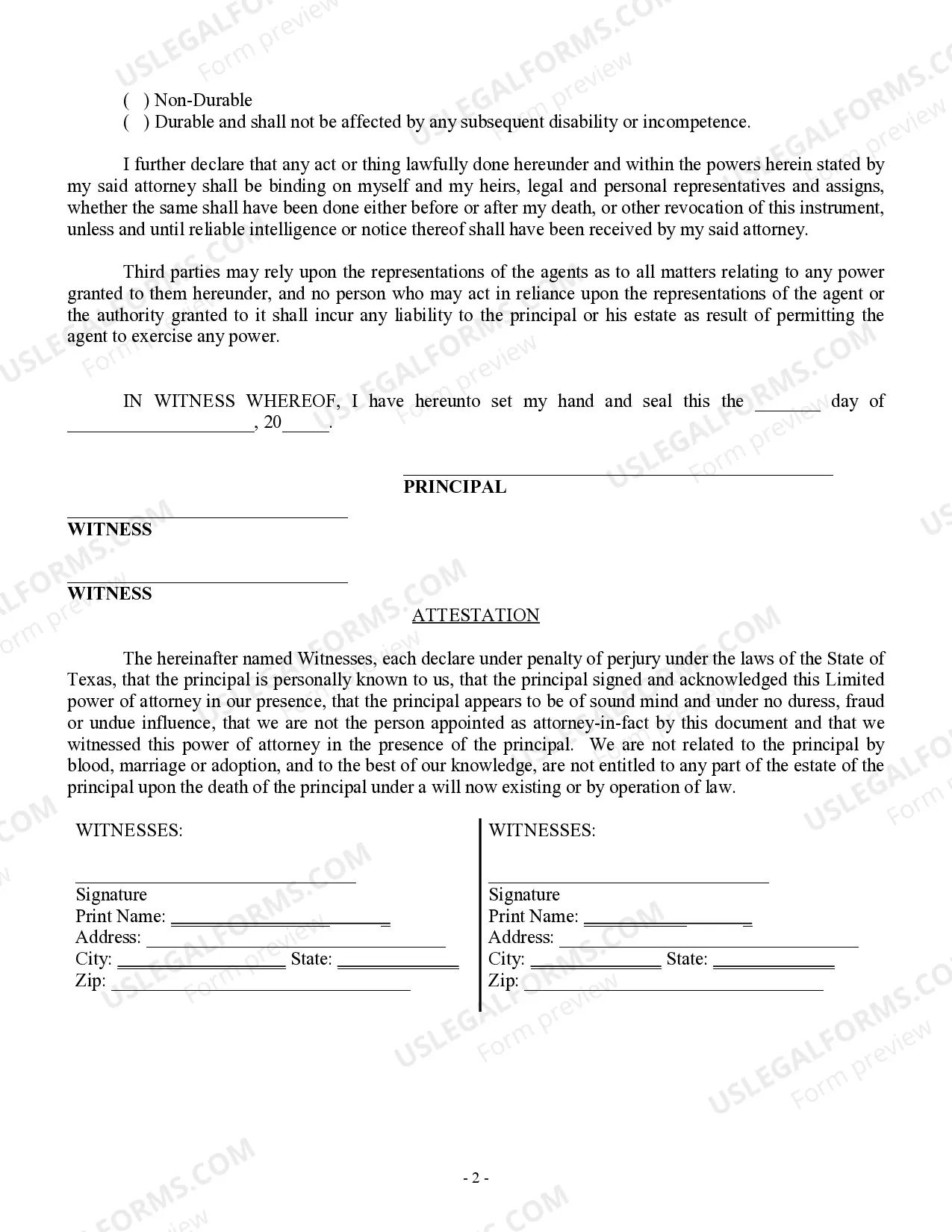

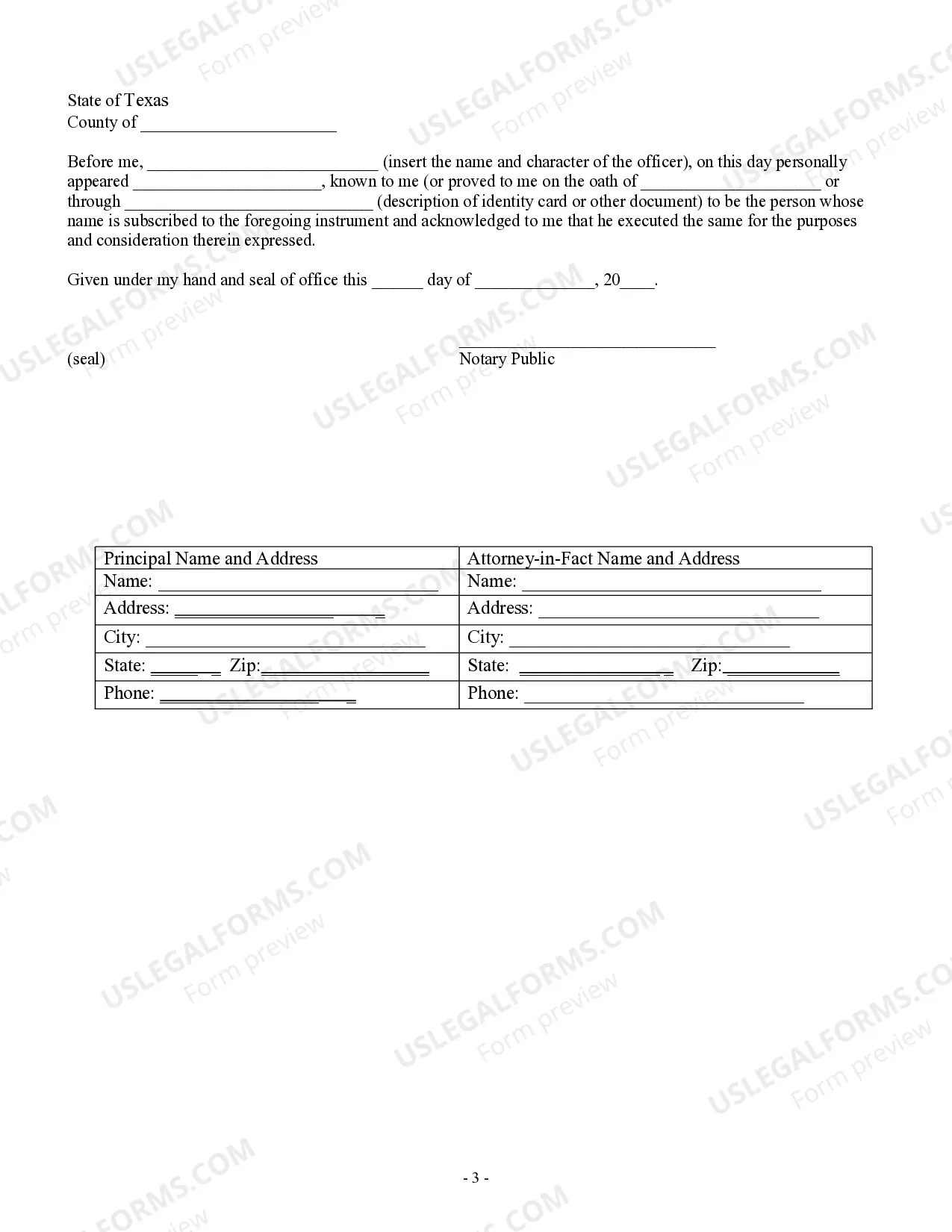

This Limited Power of Attorney form provides for a limited power of attorney for stock transactions only. It used by a shareholder to authorize another person to vote stock and to conduct other corporate powers. The document must be signed before two witnesses.

A Grand Prairie Texas Limited Power of Attorney for Stock Transactions and Corporate Powers is a legal document that grants limited authority to an individual (the agent or attorney-in-fact) to handle specific stock transactions and exercise corporate powers on behalf of the principal (the person granting the power of attorney). This document is commonly used in business and financial settings, where the principal may require assistance with managing or conducting stock transactions and related corporate activities. The Grand Prairie Texas Limited Power of Attorney for Stock Transactions and Corporate Powers outlines the powers and limitations granted to the agent. It typically includes provisions specifying the specific stock transactions the agent is authorized to perform, such as buying, selling, transferring, or managing stocks, as well as engaging in other corporate activities on behalf of the principal, like attending shareholder meetings, voting on corporate matters, or acting as a proxy for the principal. The limited power of attorney ensures that the agent's authority is restricted only to the designated stock transactions and corporate powers explicitly outlined in the document. It is crucial to draft the power of attorney carefully, including specific instructions, restrictions, and any time limits or expiration dates. This specificity ensures that the agent does not exceed their granted authority or misuse their powers. Different types of Grand Prairie Texas Limited Power of Attorney for Stock Transactions and Corporate Powers may exist to cater to various circumstances or specific requirements. Some examples include: 1. Limited Power of Attorney for Stock Trading: This type of power of attorney focuses specifically on stock trading activities, such as buying and selling stocks on exchanges, executing trades, and managing stock portfolios. 2. Limited Power of Attorney for Corporate Governance: This type of power of attorney enables the agent to represent the principal in corporate governance activities, such as attending board meetings, voting on shareholder proposals, and participating in decision-making processes. 3. Limited Power of Attorney for Stock and Securities Transfer: This power of attorney allows the agent to handle stock and securities transfers on behalf of the principal, including transferring shares between brokerage accounts or gifting stocks to other parties. 4. Limited Power of Attorney for Proxy Voting: With this power of attorney, the agent can vote on behalf of the principal in shareholder meetings, acting as a proxy to exercise voting rights and make decisions regarding corporate matters. When creating a Grand Prairie Texas Limited Power of Attorney for Stock Transactions and Corporate Powers, it is essential to consult with a qualified attorney to ensure compliance with state laws, consideration of specific circumstances, and protection of the principal's interests. This legal document holds significant weight and should be executed with caution, emphasizing clear communication and understanding between the principal and their chosen agent.A Grand Prairie Texas Limited Power of Attorney for Stock Transactions and Corporate Powers is a legal document that grants limited authority to an individual (the agent or attorney-in-fact) to handle specific stock transactions and exercise corporate powers on behalf of the principal (the person granting the power of attorney). This document is commonly used in business and financial settings, where the principal may require assistance with managing or conducting stock transactions and related corporate activities. The Grand Prairie Texas Limited Power of Attorney for Stock Transactions and Corporate Powers outlines the powers and limitations granted to the agent. It typically includes provisions specifying the specific stock transactions the agent is authorized to perform, such as buying, selling, transferring, or managing stocks, as well as engaging in other corporate activities on behalf of the principal, like attending shareholder meetings, voting on corporate matters, or acting as a proxy for the principal. The limited power of attorney ensures that the agent's authority is restricted only to the designated stock transactions and corporate powers explicitly outlined in the document. It is crucial to draft the power of attorney carefully, including specific instructions, restrictions, and any time limits or expiration dates. This specificity ensures that the agent does not exceed their granted authority or misuse their powers. Different types of Grand Prairie Texas Limited Power of Attorney for Stock Transactions and Corporate Powers may exist to cater to various circumstances or specific requirements. Some examples include: 1. Limited Power of Attorney for Stock Trading: This type of power of attorney focuses specifically on stock trading activities, such as buying and selling stocks on exchanges, executing trades, and managing stock portfolios. 2. Limited Power of Attorney for Corporate Governance: This type of power of attorney enables the agent to represent the principal in corporate governance activities, such as attending board meetings, voting on shareholder proposals, and participating in decision-making processes. 3. Limited Power of Attorney for Stock and Securities Transfer: This power of attorney allows the agent to handle stock and securities transfers on behalf of the principal, including transferring shares between brokerage accounts or gifting stocks to other parties. 4. Limited Power of Attorney for Proxy Voting: With this power of attorney, the agent can vote on behalf of the principal in shareholder meetings, acting as a proxy to exercise voting rights and make decisions regarding corporate matters. When creating a Grand Prairie Texas Limited Power of Attorney for Stock Transactions and Corporate Powers, it is essential to consult with a qualified attorney to ensure compliance with state laws, consideration of specific circumstances, and protection of the principal's interests. This legal document holds significant weight and should be executed with caution, emphasizing clear communication and understanding between the principal and their chosen agent.