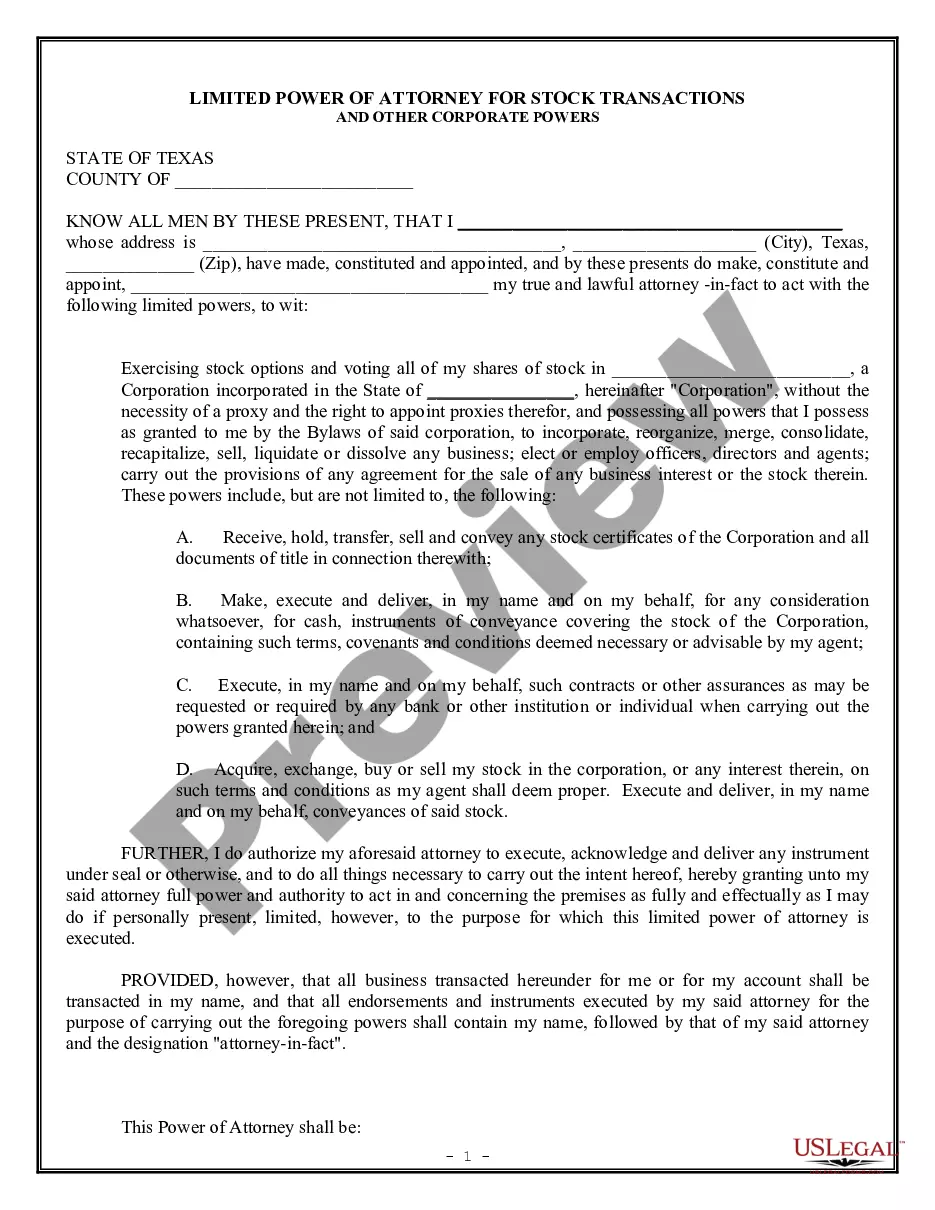

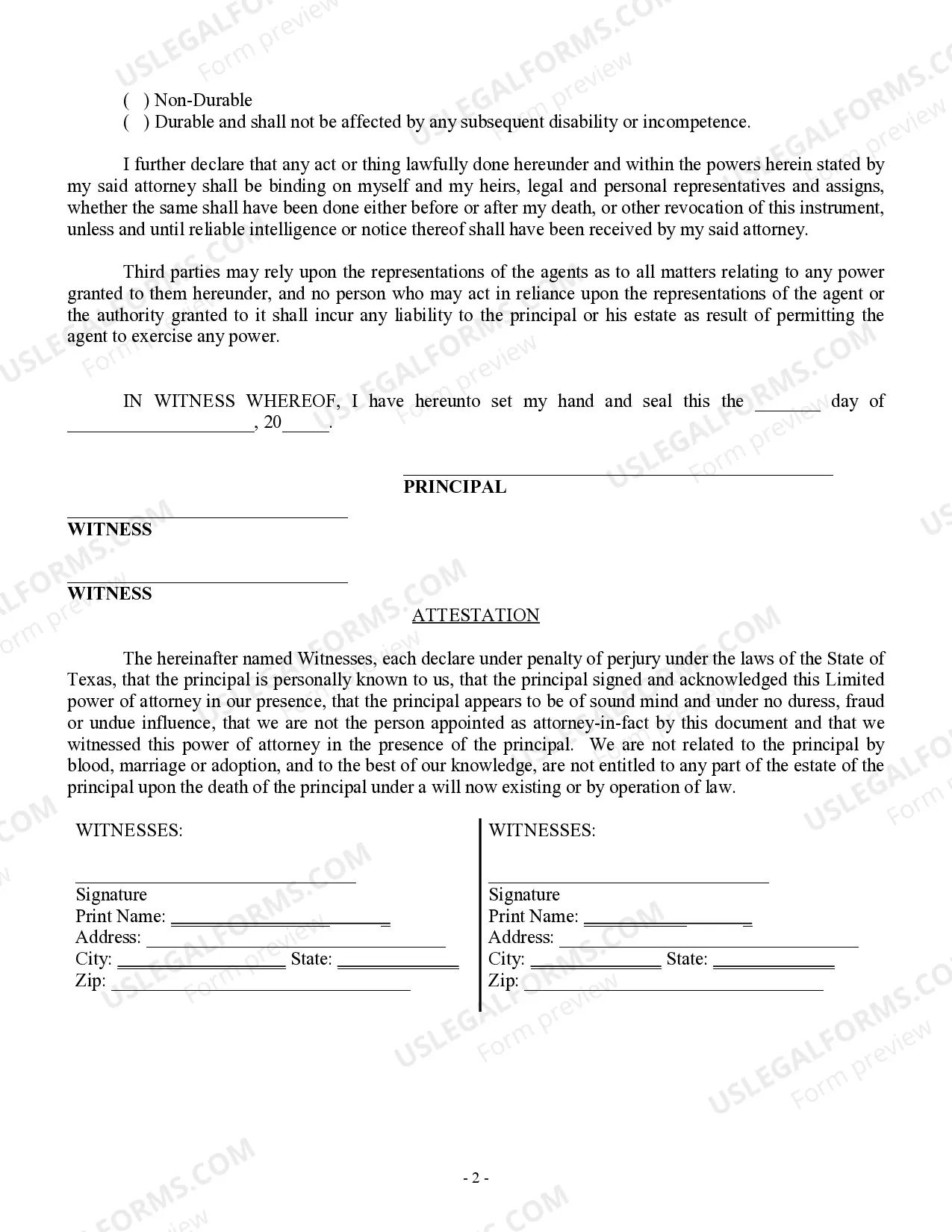

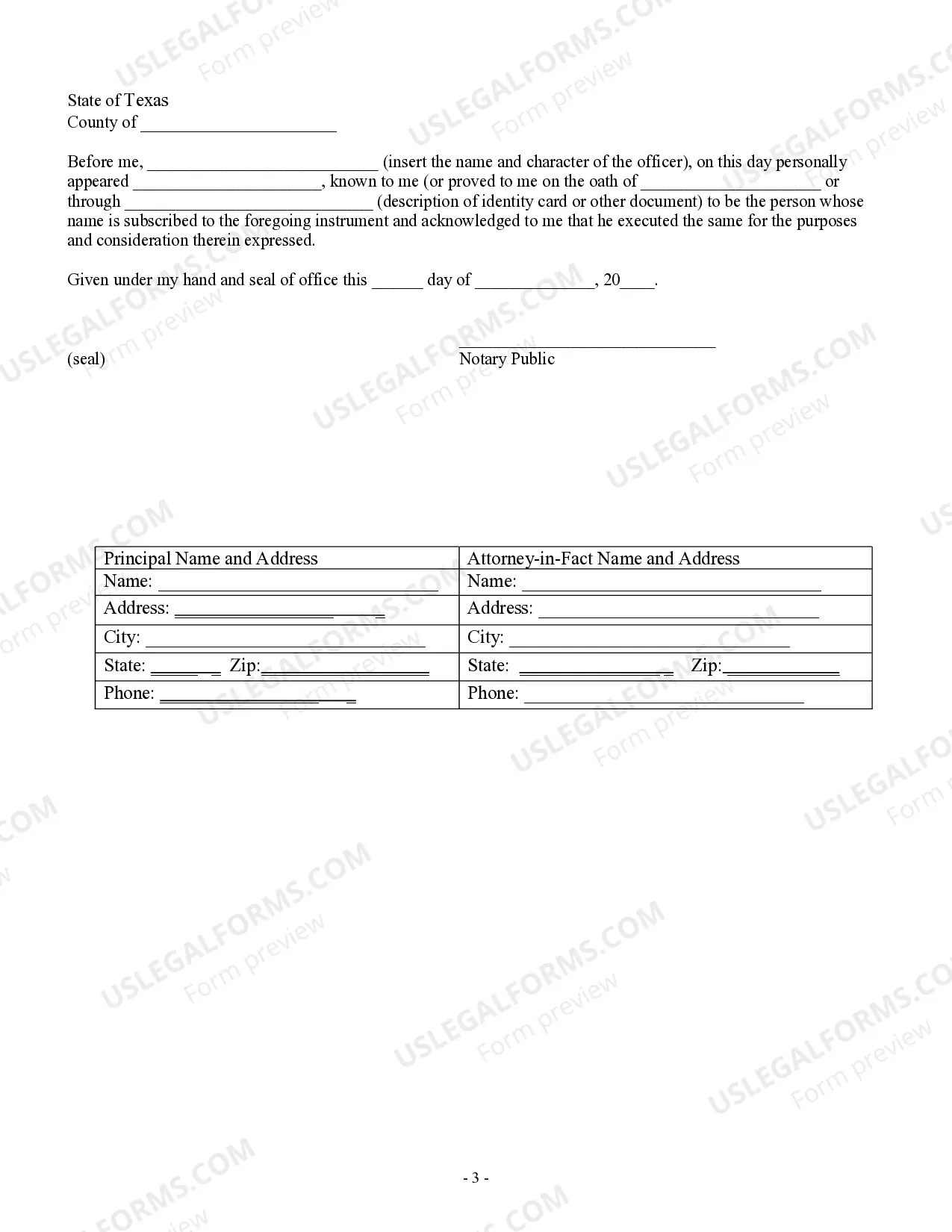

This Limited Power of Attorney form provides for a limited power of attorney for stock transactions only. It used by a shareholder to authorize another person to vote stock and to conduct other corporate powers. The document must be signed before two witnesses.

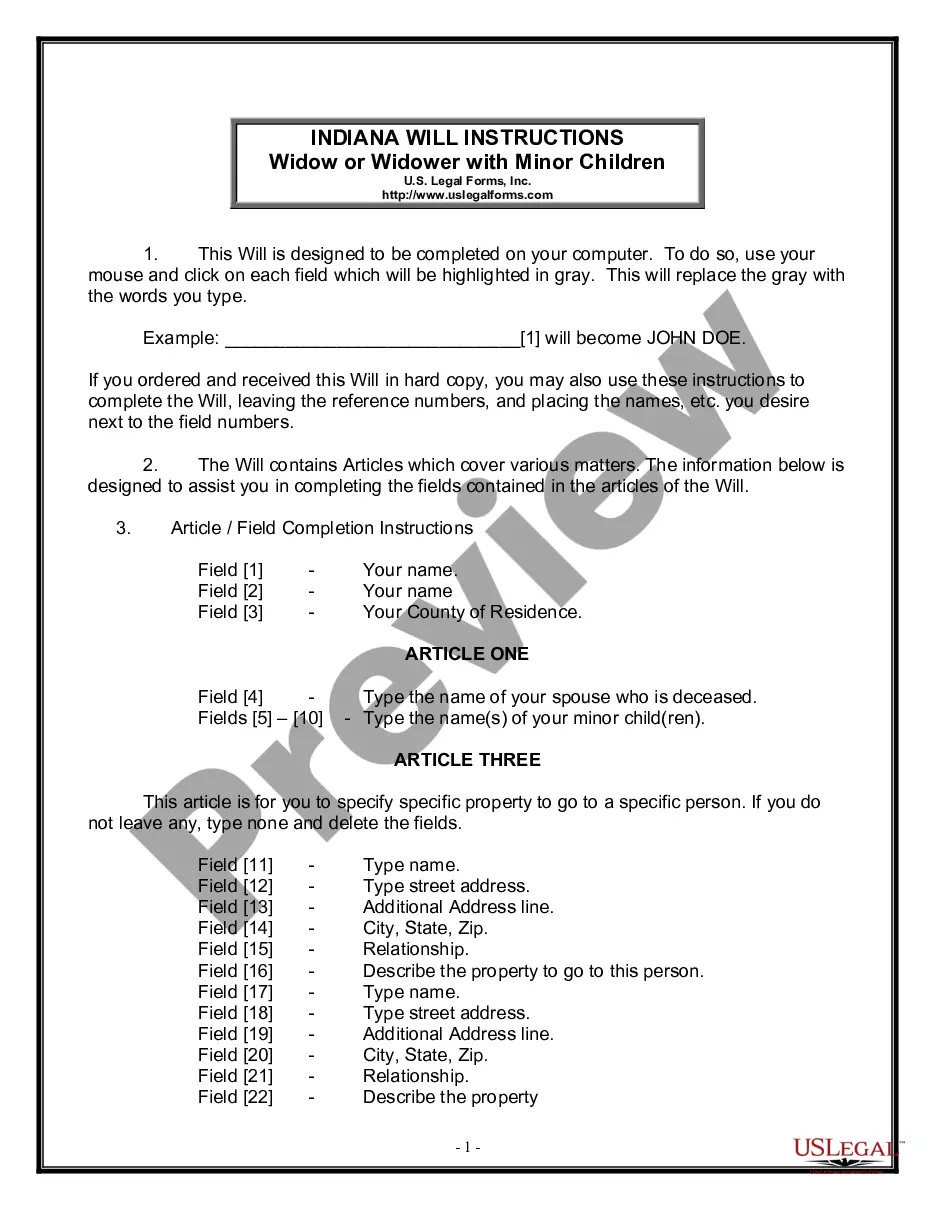

Title: Understanding the Tarrant Texas Limited Power of Attorney for Stock Transactions and Corporate Powers Introduction: The Tarrant Texas Limited Power of Attorney for Stock Transactions and Corporate Powers is a legal document granting an individual, known as the "attorney-in-fact," the authority to make specific decisions and take actions on behalf of another person or business entity, known as the "principal." This authority specifically pertains to managing stock transactions and exercising corporate powers related to a Texas-based corporation. This comprehensive and meticulously crafted authorizing document ensures efficient and convenient handling of important stock-related matters. Types of Tarrant Texas Limited Power of Attorney for Stock Transactions and Corporate Powers: 1. Stock Trading Power of Attorney: This type of limited power of attorney empowers the attorney-in-fact to buy, sell, transfer, or exchange stocks or securities on behalf of the principal. The attorney-in-fact acts as an authorized agent while carrying out specified stock trading activities as defined by the principal. 2. Corporate Decision-Making Power of Attorney: This variant of the limited power of attorney grants the attorney-in-fact the authority to make essential decisions and take actions related to the operations and management of the principal's Texas-based corporation. It includes powers such as voting on corporate matters, signing corporate documents, appointing directors or officers, and making decisions for the corporation's financial affairs. 3. Stock Certificate Power of Attorney: This limited power of attorney enables the attorney-in-fact to endorse, reassign, or otherwise manage the principal's stock certificates on behalf of the principal. The attorney-in-fact holds the power to sign and execute stock certificates and related legal documentation, ensuring seamless stock ownership transition or transfer. Key Elements and Importance: 1. Appointing the Attorney-in-fact: The principal needs to assign a trustworthy and knowledgeable individual as the attorney-in-fact. This person should understand the intricacies of stock transactions and corporate powers to act in the best interest of the principal. 2. Detailed Description of Authority: The limited power of attorney document should explicitly outline the specific powers, limitations, and restrictions granted to the attorney-in-fact, pertaining to stock transactions and corporate decisions. This ensures clarity and avoid any ambiguity. 3. Principal's Revocation Rights: The principal has the authority to revoke or modify the limited power of attorney at any time, providing the flexibility to reassess their choice of attorney-in-fact or alter the granted powers, as per changing circumstances. 4. Confidentiality and Security: The limited power of attorney document should emphasize the importance of maintaining confidentiality and the security of all sensitive information related to stock transactions and corporate affairs, safeguarding against misuse or unauthorized access. Conclusion: The Tarrant Texas Limited Power of Attorney for Stock Transactions and Corporate Powers serves as a legally binding framework allowing trusted individuals to act on behalf of a principal in managing stock transactions and exercising corporate powers. Whether it is active participation in stock trading or making important decisions pertaining to the operation and governance of a Texas-based corporation, this document offers a clear and well-defined scope of authority while ensuring the principal retains control over their interests.Title: Understanding the Tarrant Texas Limited Power of Attorney for Stock Transactions and Corporate Powers Introduction: The Tarrant Texas Limited Power of Attorney for Stock Transactions and Corporate Powers is a legal document granting an individual, known as the "attorney-in-fact," the authority to make specific decisions and take actions on behalf of another person or business entity, known as the "principal." This authority specifically pertains to managing stock transactions and exercising corporate powers related to a Texas-based corporation. This comprehensive and meticulously crafted authorizing document ensures efficient and convenient handling of important stock-related matters. Types of Tarrant Texas Limited Power of Attorney for Stock Transactions and Corporate Powers: 1. Stock Trading Power of Attorney: This type of limited power of attorney empowers the attorney-in-fact to buy, sell, transfer, or exchange stocks or securities on behalf of the principal. The attorney-in-fact acts as an authorized agent while carrying out specified stock trading activities as defined by the principal. 2. Corporate Decision-Making Power of Attorney: This variant of the limited power of attorney grants the attorney-in-fact the authority to make essential decisions and take actions related to the operations and management of the principal's Texas-based corporation. It includes powers such as voting on corporate matters, signing corporate documents, appointing directors or officers, and making decisions for the corporation's financial affairs. 3. Stock Certificate Power of Attorney: This limited power of attorney enables the attorney-in-fact to endorse, reassign, or otherwise manage the principal's stock certificates on behalf of the principal. The attorney-in-fact holds the power to sign and execute stock certificates and related legal documentation, ensuring seamless stock ownership transition or transfer. Key Elements and Importance: 1. Appointing the Attorney-in-fact: The principal needs to assign a trustworthy and knowledgeable individual as the attorney-in-fact. This person should understand the intricacies of stock transactions and corporate powers to act in the best interest of the principal. 2. Detailed Description of Authority: The limited power of attorney document should explicitly outline the specific powers, limitations, and restrictions granted to the attorney-in-fact, pertaining to stock transactions and corporate decisions. This ensures clarity and avoid any ambiguity. 3. Principal's Revocation Rights: The principal has the authority to revoke or modify the limited power of attorney at any time, providing the flexibility to reassess their choice of attorney-in-fact or alter the granted powers, as per changing circumstances. 4. Confidentiality and Security: The limited power of attorney document should emphasize the importance of maintaining confidentiality and the security of all sensitive information related to stock transactions and corporate affairs, safeguarding against misuse or unauthorized access. Conclusion: The Tarrant Texas Limited Power of Attorney for Stock Transactions and Corporate Powers serves as a legally binding framework allowing trusted individuals to act on behalf of a principal in managing stock transactions and exercising corporate powers. Whether it is active participation in stock trading or making important decisions pertaining to the operation and governance of a Texas-based corporation, this document offers a clear and well-defined scope of authority while ensuring the principal retains control over their interests.