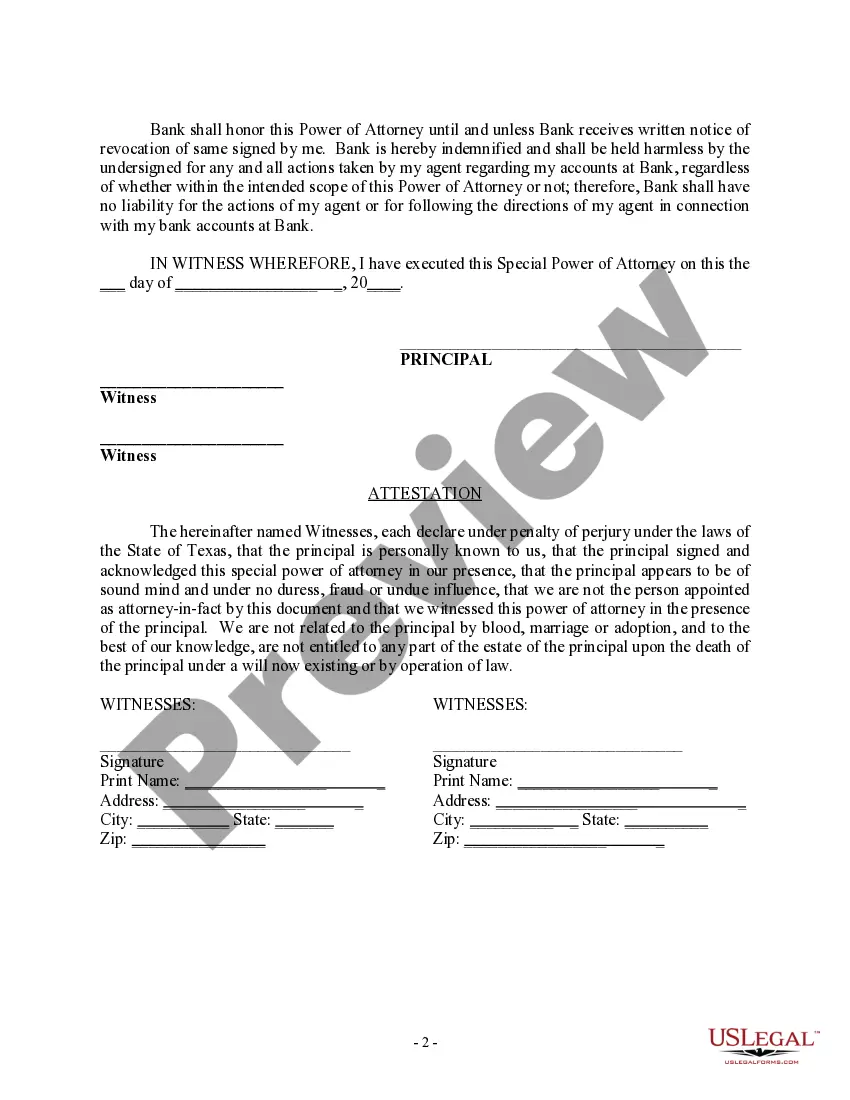

This special or limited power of attorney is for your agent to handle bank account matters for you, including, making deposits, writing checks, opening accounts, etc. A limited power of attorney allows the principal to give only specific powers to the agent. The limited power of attorney is used to allow the agent to handle specific matters when the principal is unavailable or unable to do so.

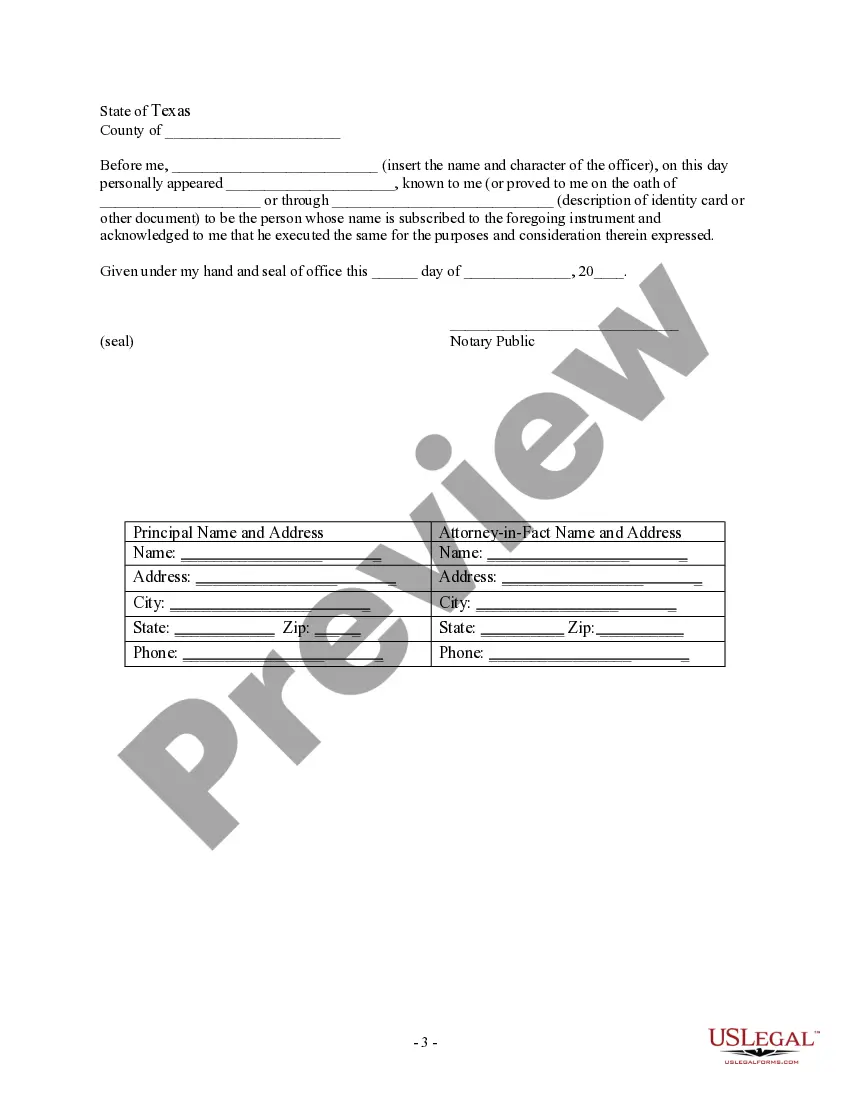

The Beaumont Texas Special Durable Power of Attorney for Bank Account Matters is a legal document that grants a designated person, known as the agent or attorney-in-fact, the authority to make financial decisions and manage specific bank accounts on behalf of the principal. This power of attorney form is specifically designed for the residents of Beaumont, Texas, and is legally binding according to the state's laws. This special durable power of attorney is beneficial for individuals who may become incapacitated or unable to handle their financial affairs due to illness, disability, or any other circumstance. By executing this document, the principal can ensure that their bank accounts are effectively managed and their financial interests are safeguarded. The agent appointed under this power of attorney has a fiduciary duty to act in the principal's best interests and make decisions as if they were the principal themselves. Keywords: Beaumont Texas, special durable power of attorney, bank account matters, legal document, agent, attorney-in-fact, financial decisions, manage, specific bank accounts, principal, incapacitated, illness, disability, circumstances, execute, financial affairs, safeguarded, fiduciary duty, best interests. Different types of Beaumont Texas Special Durable Power of Attorney for Bank Account Matters may include: 1. General Special Durable Power of Attorney for Bank Account Matters: This type of power of attorney grants the agent broad authority to manage all bank accounts belonging to the principal in Beaumont, Texas, including making deposits, withdrawals, transfers, and investment decisions. 2. Limited Special Durable Power of Attorney for Bank Account Matters: This power of attorney limits the agent's authority to specific bank accounts only. The principal can designate which accounts the agent can access and the specific tasks they can perform, such as paying bills, managing expenses, or handling transactions related to those accounts. 3. Healthcare Special Durable Power of Attorney for Bank Account Matters: This specialized power of attorney focuses on managing bank accounts specifically for healthcare-related expenses. The agent appointed under this power of attorney has the authority to handle medical bills, insurance claims, and other financial aspects related to the principal's healthcare needs. 4. Real Estate Special Durable Power of Attorney for Bank Account Matters: This power of attorney is designed for individuals who own real estate properties in Beaumont, Texas. The agent appointed under this type of power of attorney can manage rental payments, mortgage payments, property taxes, and other financial matters related to the principal's real estate assets. It is important to consult with a legal professional familiar with the laws of Beaumont, Texas, when drafting or executing any power of attorney document to ensure compliance and to tailor the document to meet your specific needs.