This special or limited power of attorney is for your agent to handle bank account matters for you, including, making deposits, writing checks, opening accounts, etc. A limited power of attorney allows the principal to give only specific powers to the agent. The limited power of attorney is used to allow the agent to handle specific matters when the principal is unavailable or unable to do so.

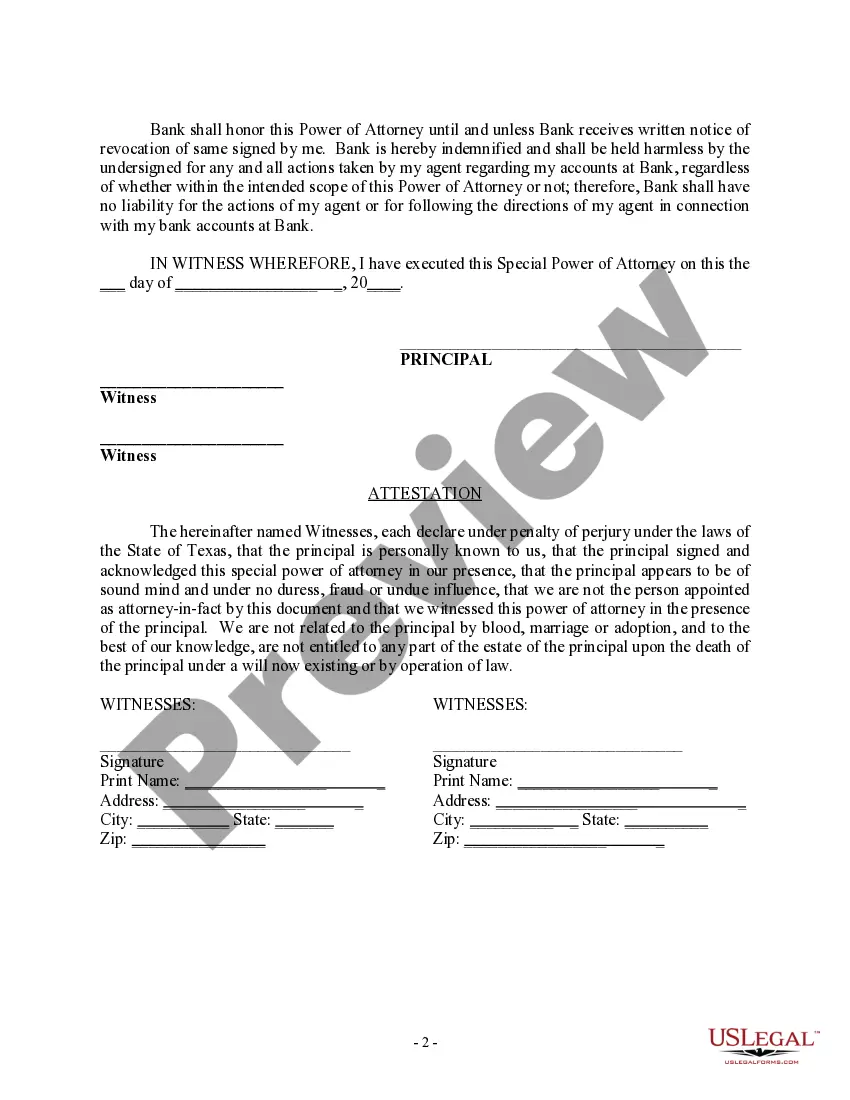

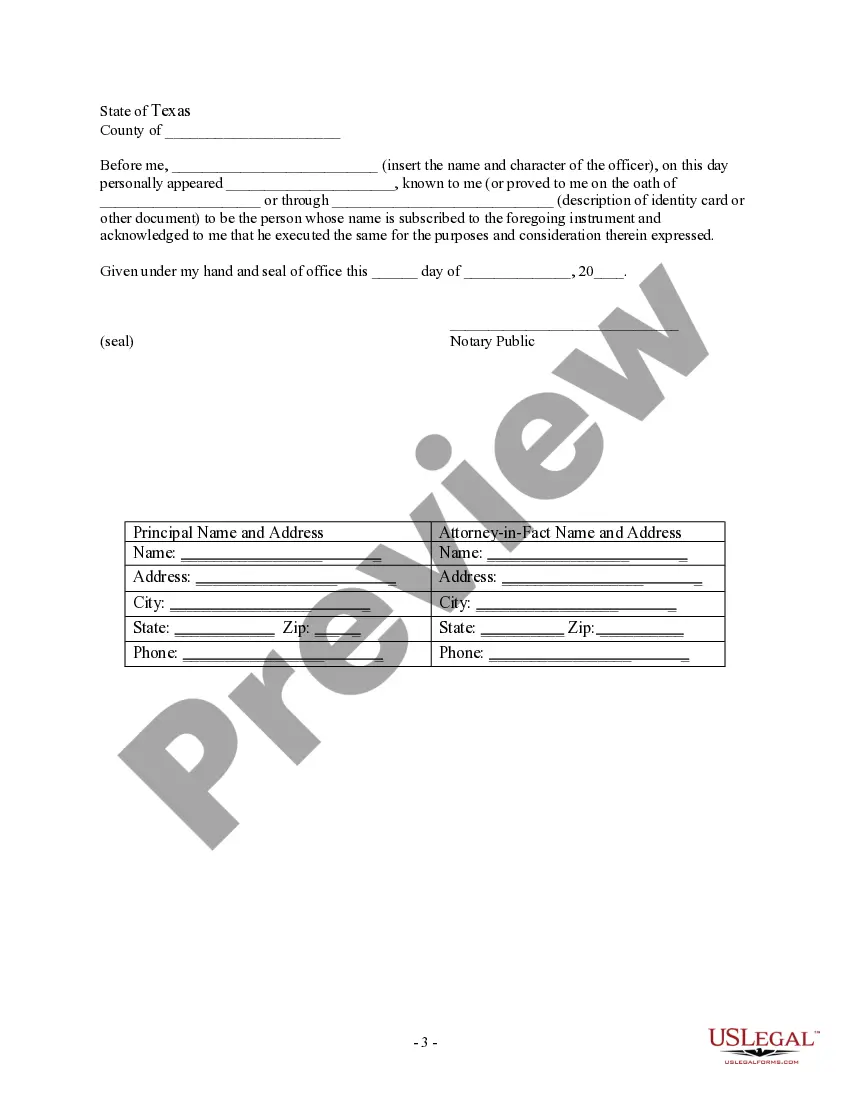

A College Stations Texas Special Durable Power of Attorney for Bank Account Matters is a legal document that grants a designated person, referred to as the "attorney-in-fact" or "agent," the authority to make financial decisions and manage bank accounts on behalf of the principal. This type of power of attorney is crucial in situations where an individual becomes incapacitated or unable to handle their own financial affairs. The College Stations Texas Special Durable Power of Attorney for Bank Account Matters allows the agent to perform a wide range of tasks related to the principal's bank account. These include, but are not limited to: 1. Accessing Bank Accounts: The attorney-in-fact can access the principal's bank accounts, view transaction history, and manage funds. 2. Deposits and Withdrawals: The agent has the authority to deposit and withdraw funds from the principal's bank accounts as needed. 3. Paying Bills: The designated person can pay bills on behalf of the principal using their bank account funds. This includes utilities, rent, mortgages, and other financial obligations. 4. Managing Investments: If the principal has investments tied to their bank account, the attorney-in-fact can manage these investments and make investment decisions. 5. Handling Financial Transactions: The agent is empowered to handle various financial transactions, such as transferring funds between accounts, setting up automatic payments, and closing or opening bank accounts. 6. Tax Matters: The attorney-in-fact can file taxes and handle any related matters involving the principal's bank accounts. The College Stations Texas Special Durable Power of Attorney for Bank Account Matters can be customized to suit the specific needs and preferences of the principal. Different types of Special Durable Power of Attorney for Bank Account Matters in College Station, Texas may include: 1. Limited Special Durable Power of Attorney for Bank Account Matters: This type of power of attorney grants limited authority to the agent and specifies certain restrictions or limitations on their powers. 2. General Special Durable Power of Attorney for Bank Account Matters: In contrast to the limited power of attorney, the general power of attorney grants broader authority to the agent, allowing them to handle all financial matters related to the principal's bank accounts. 3. Springing Special Durable Power of Attorney for Bank Account Matters: This type of power of attorney becomes effective only when a specific event or condition, such as the principal's incapacity, occurs. It provides a safeguard to ensure that the agent's powers are not activated unless and until necessary. 4. Joint Special Durable Power of Attorney for Bank Account Matters: This power of attorney allows the principal to appoint multiple attorneys-in-fact who will work together to manage the bank accounts. When creating a College Station Texas Special Durable Power of Attorney for Bank Account Matters, it is essential to consult with a qualified attorney who can assist in understanding and adhering to the legal requirements and considerations involved in drafting this type of legal document.A College Stations Texas Special Durable Power of Attorney for Bank Account Matters is a legal document that grants a designated person, referred to as the "attorney-in-fact" or "agent," the authority to make financial decisions and manage bank accounts on behalf of the principal. This type of power of attorney is crucial in situations where an individual becomes incapacitated or unable to handle their own financial affairs. The College Stations Texas Special Durable Power of Attorney for Bank Account Matters allows the agent to perform a wide range of tasks related to the principal's bank account. These include, but are not limited to: 1. Accessing Bank Accounts: The attorney-in-fact can access the principal's bank accounts, view transaction history, and manage funds. 2. Deposits and Withdrawals: The agent has the authority to deposit and withdraw funds from the principal's bank accounts as needed. 3. Paying Bills: The designated person can pay bills on behalf of the principal using their bank account funds. This includes utilities, rent, mortgages, and other financial obligations. 4. Managing Investments: If the principal has investments tied to their bank account, the attorney-in-fact can manage these investments and make investment decisions. 5. Handling Financial Transactions: The agent is empowered to handle various financial transactions, such as transferring funds between accounts, setting up automatic payments, and closing or opening bank accounts. 6. Tax Matters: The attorney-in-fact can file taxes and handle any related matters involving the principal's bank accounts. The College Stations Texas Special Durable Power of Attorney for Bank Account Matters can be customized to suit the specific needs and preferences of the principal. Different types of Special Durable Power of Attorney for Bank Account Matters in College Station, Texas may include: 1. Limited Special Durable Power of Attorney for Bank Account Matters: This type of power of attorney grants limited authority to the agent and specifies certain restrictions or limitations on their powers. 2. General Special Durable Power of Attorney for Bank Account Matters: In contrast to the limited power of attorney, the general power of attorney grants broader authority to the agent, allowing them to handle all financial matters related to the principal's bank accounts. 3. Springing Special Durable Power of Attorney for Bank Account Matters: This type of power of attorney becomes effective only when a specific event or condition, such as the principal's incapacity, occurs. It provides a safeguard to ensure that the agent's powers are not activated unless and until necessary. 4. Joint Special Durable Power of Attorney for Bank Account Matters: This power of attorney allows the principal to appoint multiple attorneys-in-fact who will work together to manage the bank accounts. When creating a College Station Texas Special Durable Power of Attorney for Bank Account Matters, it is essential to consult with a qualified attorney who can assist in understanding and adhering to the legal requirements and considerations involved in drafting this type of legal document.