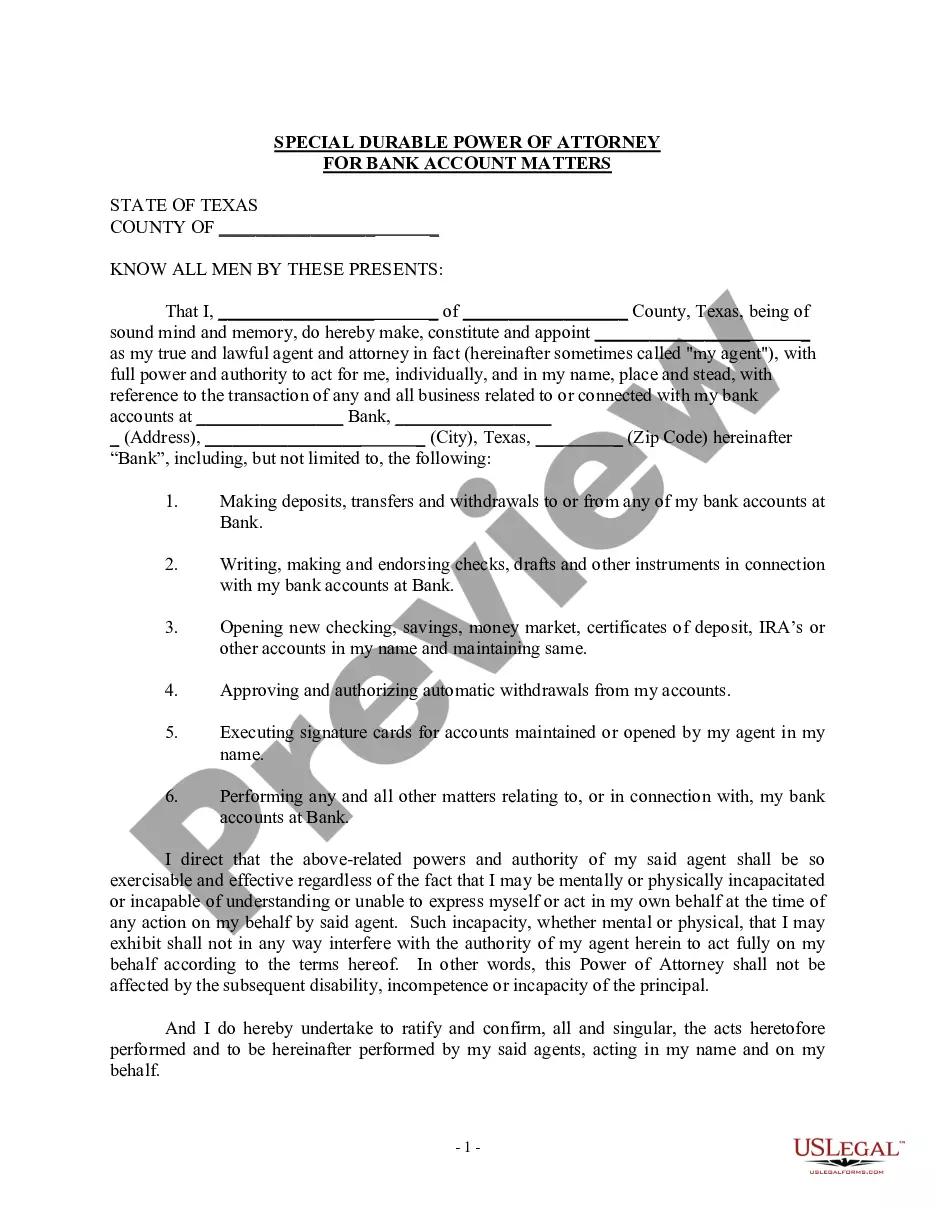

This special or limited power of attorney is for your agent to handle bank account matters for you, including, making deposits, writing checks, opening accounts, etc. A limited power of attorney allows the principal to give only specific powers to the agent. The limited power of attorney is used to allow the agent to handle specific matters when the principal is unavailable or unable to do so.

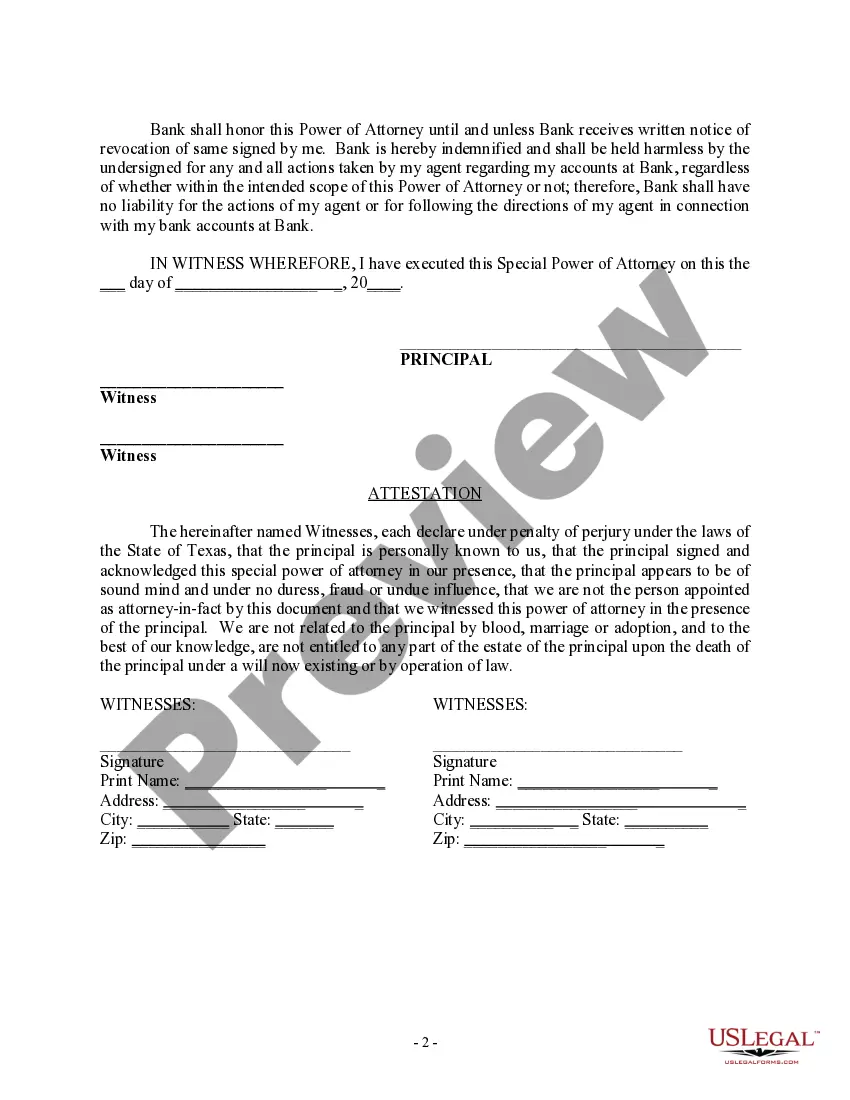

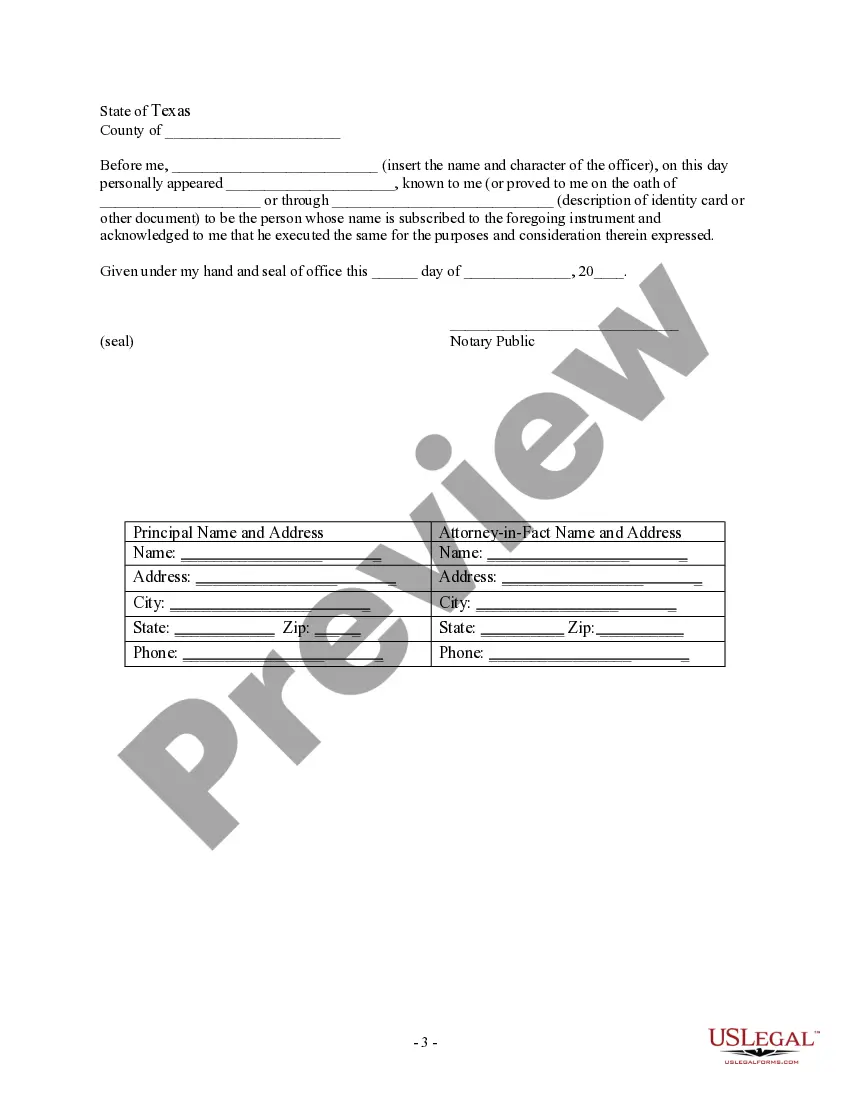

The Pasadena Texas Special Durable Power of Attorney for Bank Account Matters is a legal document that grants a designated individual, known as the attorney-in-fact, the authority to manage and make decisions regarding specific bank accounts on behalf of the principal. This power of attorney is specifically tailored for bank account matters and provides the attorney-in-fact with the necessary powers to handle various financial transactions and responsibilities related to the principal's bank accounts. One of the key features of the Pasadena Texas Special Durable Power of Attorney for Bank Account Matters is its durability, meaning it remains in effect even if the principal becomes incapacitated or mentally incompetent. This ensures that the attorney-in-fact can continue to manage the principal's bank account matters in such situations, offering peace of mind to both parties involved. The specific powers granted under this power of attorney may vary depending on the circumstances or preferences of the principal. However, some common provisions often included in a Pasadena Texas Special Durable Power of Attorney for Bank Account Matters involve the authority to: 1. Make deposits and withdrawals: The attorney-in-fact can carry out routine banking transactions such as depositing or withdrawing funds from the principal's bank accounts. This allows for efficient management of day-to-day financial matters. 2. Pay bills and expenses: The attorney-in-fact can handle the payment of bills, expenses, and other financial obligations on behalf of the principal, ensuring that all financial responsibilities are managed promptly and correctly. 3. Sign checks and execute agreements: The power of attorney may authorize the attorney-in-fact to sign checks, draft or endorse agreements, contracts, or any other financial documents relating to the principal's bank accounts. This authority streamlines the process of handling banking transactions without the principal's direct involvement. 4. Access account information: The attorney-in-fact may be granted access to the principal's account information, including balances, statements, and transaction history, enabling them to effectively monitor the accounts and make informed decisions. It's important to note that there may be various types of Pasadena Texas Special Durable Power of Attorney for Bank Account Matters, each catering to specific banking needs or circumstances. Some examples of these specialized forms may include: 1. Limited Bank Account Power of Attorney: This type of power of attorney grants the attorney-in-fact limited authority to handle specific banking matters for a defined period. It might be suitable when the principal needs assistance for a short-term purpose, such as during a vacation or hospitalization. 2. Comprehensive Bank Account Power of Attorney: This broader form bestows the attorney-in-fact with comprehensive powers to manage all aspects of the principal's bank accounts, including more complex financial transactions and investments. It is suitable for those who require extensive assistance with their banking affairs on an ongoing basis. 3. Joint Bank Account Power of Attorney: In cases where the principal has a joint bank account with another individual, this power of attorney allows the attorney-in-fact to act on behalf of the principal regarding their share of the jointly owned account. It might be useful for couples or business partners who want to ensure seamless management of their finances. In any case, obtaining legal advice or consulting an attorney while drafting or executing a Pasadena Texas Special Durable Power of Attorney for Bank Account Matters is highly recommended ensuring compliance with state regulations and the specific needs of the principal.The Pasadena Texas Special Durable Power of Attorney for Bank Account Matters is a legal document that grants a designated individual, known as the attorney-in-fact, the authority to manage and make decisions regarding specific bank accounts on behalf of the principal. This power of attorney is specifically tailored for bank account matters and provides the attorney-in-fact with the necessary powers to handle various financial transactions and responsibilities related to the principal's bank accounts. One of the key features of the Pasadena Texas Special Durable Power of Attorney for Bank Account Matters is its durability, meaning it remains in effect even if the principal becomes incapacitated or mentally incompetent. This ensures that the attorney-in-fact can continue to manage the principal's bank account matters in such situations, offering peace of mind to both parties involved. The specific powers granted under this power of attorney may vary depending on the circumstances or preferences of the principal. However, some common provisions often included in a Pasadena Texas Special Durable Power of Attorney for Bank Account Matters involve the authority to: 1. Make deposits and withdrawals: The attorney-in-fact can carry out routine banking transactions such as depositing or withdrawing funds from the principal's bank accounts. This allows for efficient management of day-to-day financial matters. 2. Pay bills and expenses: The attorney-in-fact can handle the payment of bills, expenses, and other financial obligations on behalf of the principal, ensuring that all financial responsibilities are managed promptly and correctly. 3. Sign checks and execute agreements: The power of attorney may authorize the attorney-in-fact to sign checks, draft or endorse agreements, contracts, or any other financial documents relating to the principal's bank accounts. This authority streamlines the process of handling banking transactions without the principal's direct involvement. 4. Access account information: The attorney-in-fact may be granted access to the principal's account information, including balances, statements, and transaction history, enabling them to effectively monitor the accounts and make informed decisions. It's important to note that there may be various types of Pasadena Texas Special Durable Power of Attorney for Bank Account Matters, each catering to specific banking needs or circumstances. Some examples of these specialized forms may include: 1. Limited Bank Account Power of Attorney: This type of power of attorney grants the attorney-in-fact limited authority to handle specific banking matters for a defined period. It might be suitable when the principal needs assistance for a short-term purpose, such as during a vacation or hospitalization. 2. Comprehensive Bank Account Power of Attorney: This broader form bestows the attorney-in-fact with comprehensive powers to manage all aspects of the principal's bank accounts, including more complex financial transactions and investments. It is suitable for those who require extensive assistance with their banking affairs on an ongoing basis. 3. Joint Bank Account Power of Attorney: In cases where the principal has a joint bank account with another individual, this power of attorney allows the attorney-in-fact to act on behalf of the principal regarding their share of the jointly owned account. It might be useful for couples or business partners who want to ensure seamless management of their finances. In any case, obtaining legal advice or consulting an attorney while drafting or executing a Pasadena Texas Special Durable Power of Attorney for Bank Account Matters is highly recommended ensuring compliance with state regulations and the specific needs of the principal.