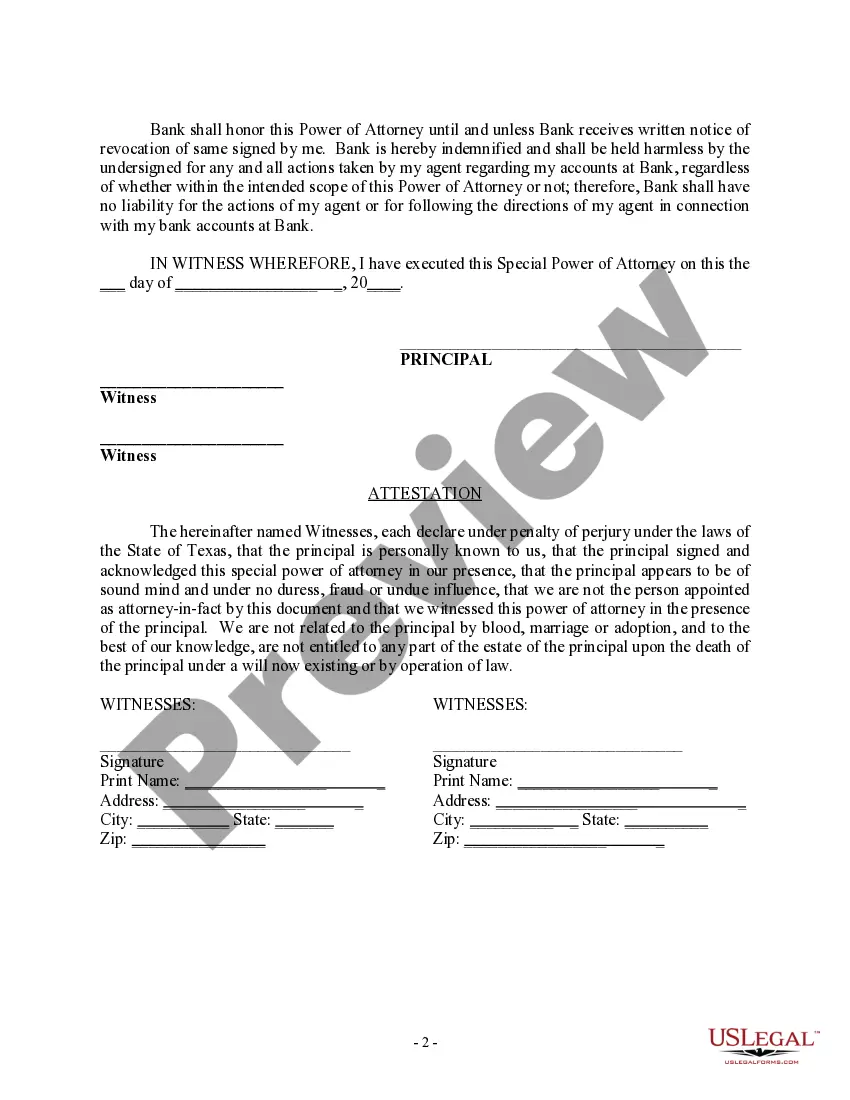

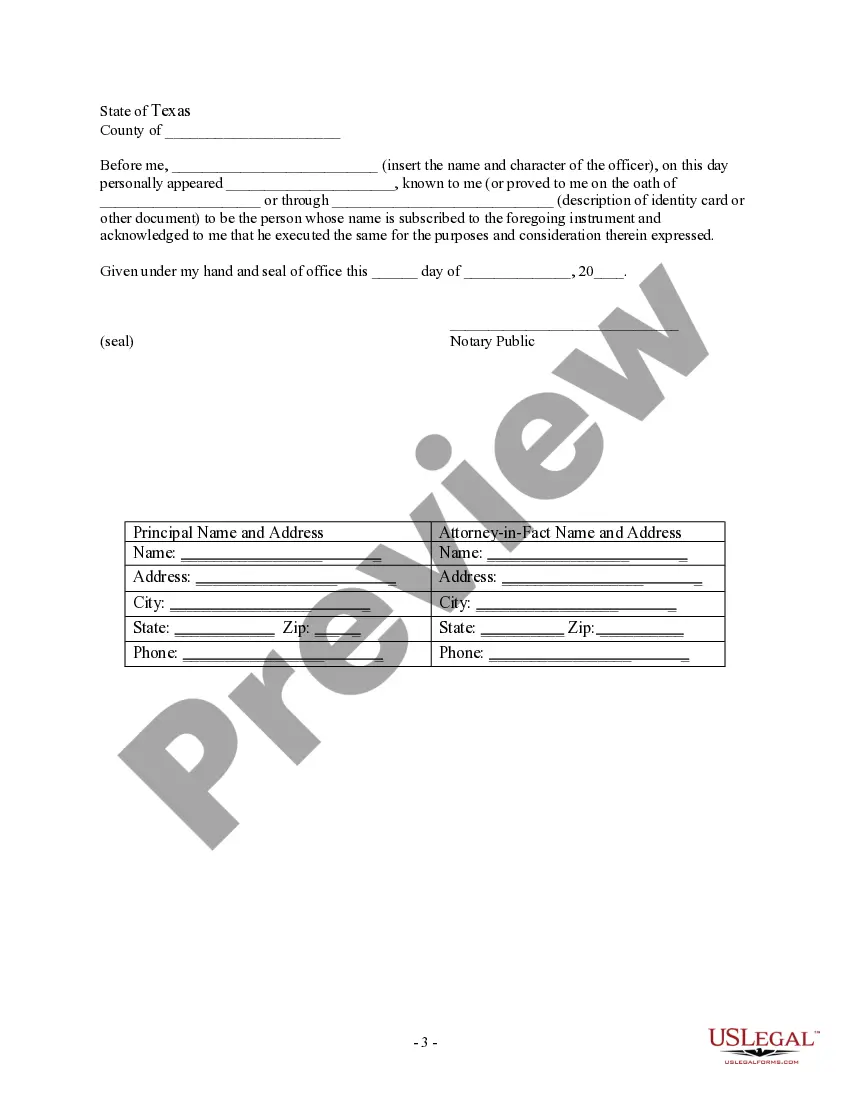

This special or limited power of attorney is for your agent to handle bank account matters for you, including, making deposits, writing checks, opening accounts, etc. A limited power of attorney allows the principal to give only specific powers to the agent. The limited power of attorney is used to allow the agent to handle specific matters when the principal is unavailable or unable to do so.

The San Antonio Texas Special Durable Power of Attorney for Bank Account Matters is a legal document that grants a designated individual (known as the agent or attorney-in-fact) the authority to make financial decisions and conduct transactions on behalf of the principal (the person creating the power of attorney) specifically related to their bank accounts. This type of power of attorney is designed to be durable, meaning it remains in effect even if the principal becomes incapacitated or unable to handle their own financial matters. It emphasizes the agent's powers over the principal's bank accounts and allows them to act on the principal's behalf in various banking matters. The San Antonio Texas Special Durable Power of Attorney for Bank Account Matters provides the agent with a wide range of powers, which may include but are not limited to: 1. Depositing and withdrawing funds: The agent can deposit funds into the principal's bank accounts and withdraw funds from them as necessary. They can also transfer funds between different accounts held by the principal. 2. Paying bills and managing expenses: The agent can pay bills, manage monthly expenses, and handle financial obligations on behalf of the principal. This includes everything from utility bills to mortgage payments. 3. Managing investments: If the principal has investments linked to their bank accounts, the agent may have the power to manage and make decisions related to those investments. 4. Accessing account information: The agent can access account statements, balances, and transaction history to keep track of the principal's financial situation. 5. Opening and closing accounts: In certain situations, the agent may have the power to open or close bank accounts in the principal's name. It is important to note that this special durable power of attorney is specific to bank account matters and does not grant authority in areas such as healthcare or real estate matters. Different types of San Antonio Texas Special Durable Power of Attorney for Bank Account Matters may include variations based on the specific needs and preferences of the principal. Some variations may specify limitations on the agent's powers or additional instructions for the agent to follow. It is recommended to consult an attorney to customize the power of attorney document to fit the specific requirements and circumstances of the principal.The San Antonio Texas Special Durable Power of Attorney for Bank Account Matters is a legal document that grants a designated individual (known as the agent or attorney-in-fact) the authority to make financial decisions and conduct transactions on behalf of the principal (the person creating the power of attorney) specifically related to their bank accounts. This type of power of attorney is designed to be durable, meaning it remains in effect even if the principal becomes incapacitated or unable to handle their own financial matters. It emphasizes the agent's powers over the principal's bank accounts and allows them to act on the principal's behalf in various banking matters. The San Antonio Texas Special Durable Power of Attorney for Bank Account Matters provides the agent with a wide range of powers, which may include but are not limited to: 1. Depositing and withdrawing funds: The agent can deposit funds into the principal's bank accounts and withdraw funds from them as necessary. They can also transfer funds between different accounts held by the principal. 2. Paying bills and managing expenses: The agent can pay bills, manage monthly expenses, and handle financial obligations on behalf of the principal. This includes everything from utility bills to mortgage payments. 3. Managing investments: If the principal has investments linked to their bank accounts, the agent may have the power to manage and make decisions related to those investments. 4. Accessing account information: The agent can access account statements, balances, and transaction history to keep track of the principal's financial situation. 5. Opening and closing accounts: In certain situations, the agent may have the power to open or close bank accounts in the principal's name. It is important to note that this special durable power of attorney is specific to bank account matters and does not grant authority in areas such as healthcare or real estate matters. Different types of San Antonio Texas Special Durable Power of Attorney for Bank Account Matters may include variations based on the specific needs and preferences of the principal. Some variations may specify limitations on the agent's powers or additional instructions for the agent to follow. It is recommended to consult an attorney to customize the power of attorney document to fit the specific requirements and circumstances of the principal.