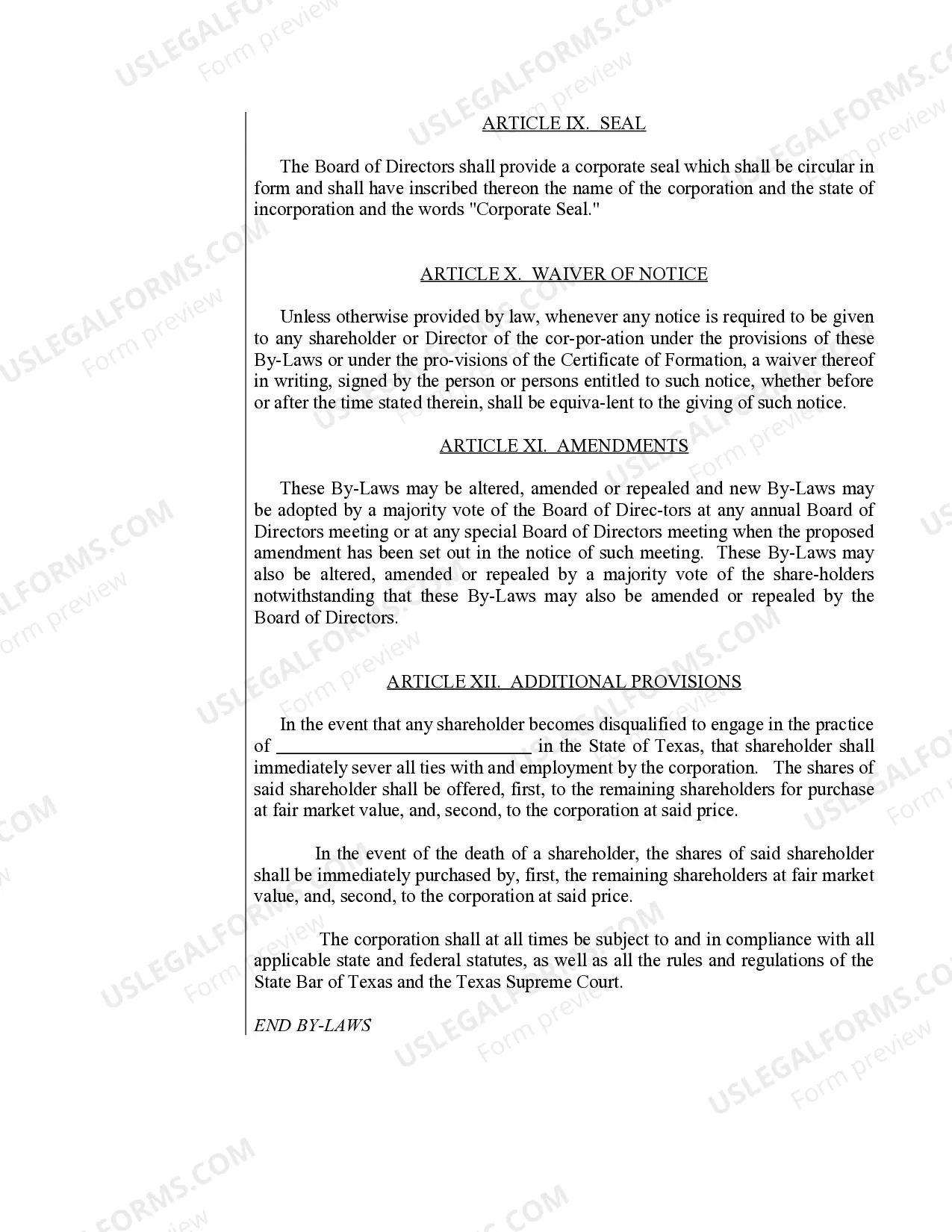

By-laws describe the agreed rules governing the operations of the Professional Corporation.

Fort Worth Sample Bylaws for a Texas Professional Corporation

Description

How to fill out Sample Bylaws For A Texas Professional Corporation?

Irrespective of one's social or professional standing, filling out law-related documents is a regrettable requirement in the modern world.

Frequently, it’s nearly impossible for someone without a legal background to draft such papers from scratch, primarily due to the intricate terminology and legal subtleties they encompass.

This is where US Legal Forms can come to the rescue.

Make sure the template you select is appropriate for your location, as the laws of one state or county may not apply to another.

Review the document and read a brief overview (if accessible) of the situations in which the document can be utilized.

- Our platform offers an extensive library with over 85,000 ready-to-use state-specific forms suitable for nearly any legal situation.

- US Legal Forms is also a valuable resource for associates or legal advisors looking to save time with our DIY forms.

- Whether you need the Fort Worth Sample Bylaws for a Texas Professional Corporation or other documentation pertinent to your state or county, US Legal Forms has everything available.

- Here’s how to obtain the Fort Worth Sample Bylaws for a Texas Professional Corporation within minutes using our reliable platform.

- If you’re already a customer, feel free to Log In to your account to download the required form.

- However, if you are new to our platform, please ensure to follow these steps before acquiring the Fort Worth Sample Bylaws for a Texas Professional Corporation.

Form popularity

FAQ

I am occasionally asked who should sign the bylaws. The question presumes that bylaws must be signed. Although the California General Corporation Law requires that the original or a copy of the bylaws be available to shareholders (Section 213), it does not require that corporate bylaws be signed.

The Texas Business Organizations Code requires that for-profit corporations and professional corporations have at least one director, one president, and one secretary.

Corporate bylaws are legally required in Texas. Texas law states that the board of directors must adopt initial bylaws for a corporation?per TX Bus Orgs § 21.057 (2019).

A professional corporation is a corporation that is formed for the purpose of providing a professional service that by law a for-profit or nonprofit corporation is prohibited from rendering.

Some of the most essential elements that need to be included in a draft bylaw are your organization's name and purpose, information about memberships, the roles and duties of board members, how to handle financial information, and an outline of how to keep the bylaws up to date or amended.

If your business meets the qualifications, S corporation status allows you to avoid double taxation, thus increasing your net profits. In many states, licensed professionals are not permitted to operate as regular corporations. However, a professional corporation is an alternative that provides limited liability.

Corporate bylaws are a detailed set of rules adopted by a corporation's board of directors after the company has been incorporated. They are an important legal document for a corporation to have in place as they specify its internal management structure and how it will be run.

These continuous requirements include those related to the following: Taxes. Corporations must file their annual tax returns. Securities. Corporations must issue stock as their security laws and articles of incorporation mandate. Bookkeeping.Board meetings.Meeting minutes.State registration.Licensing.

Here are eight key things to include when writing bylaws. Basic Corporate Information. The bylaws should include your corporation's formal name and the address of its main place of business.Board of Directors.Officers.Shareholders.Committees.Meetings.Conflicts of Interest.Amendment.

Professional corporations provide a limit on the owners' personal liability for business debts and claims. Incorporating can't protect a professional against liability for his or her negligence or malpractice, but it can protect against liability for the negligence or malpractice of an associate.