Sample Corporate Notices of Meetings, Resolutions, Simple Stock Ledger & Certificate.

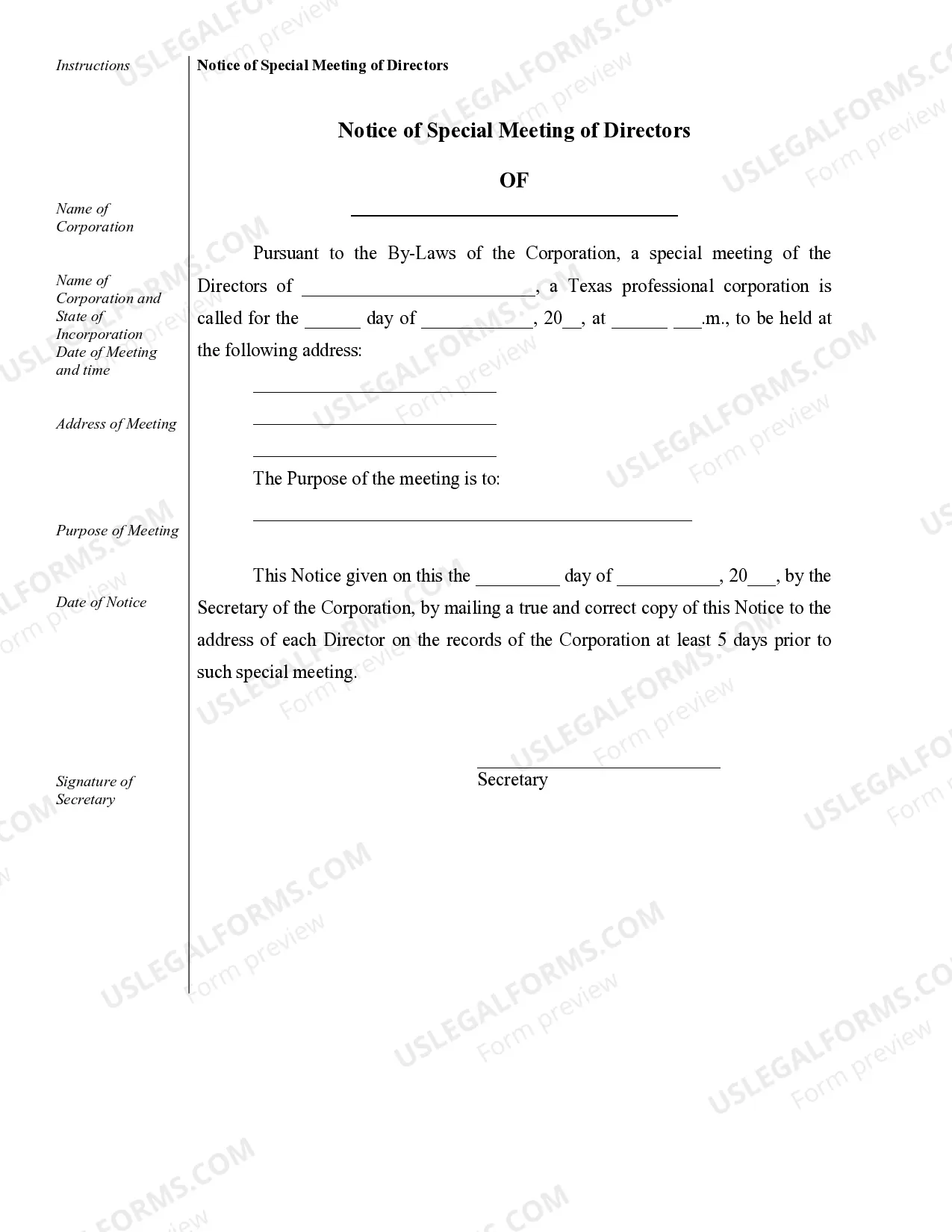

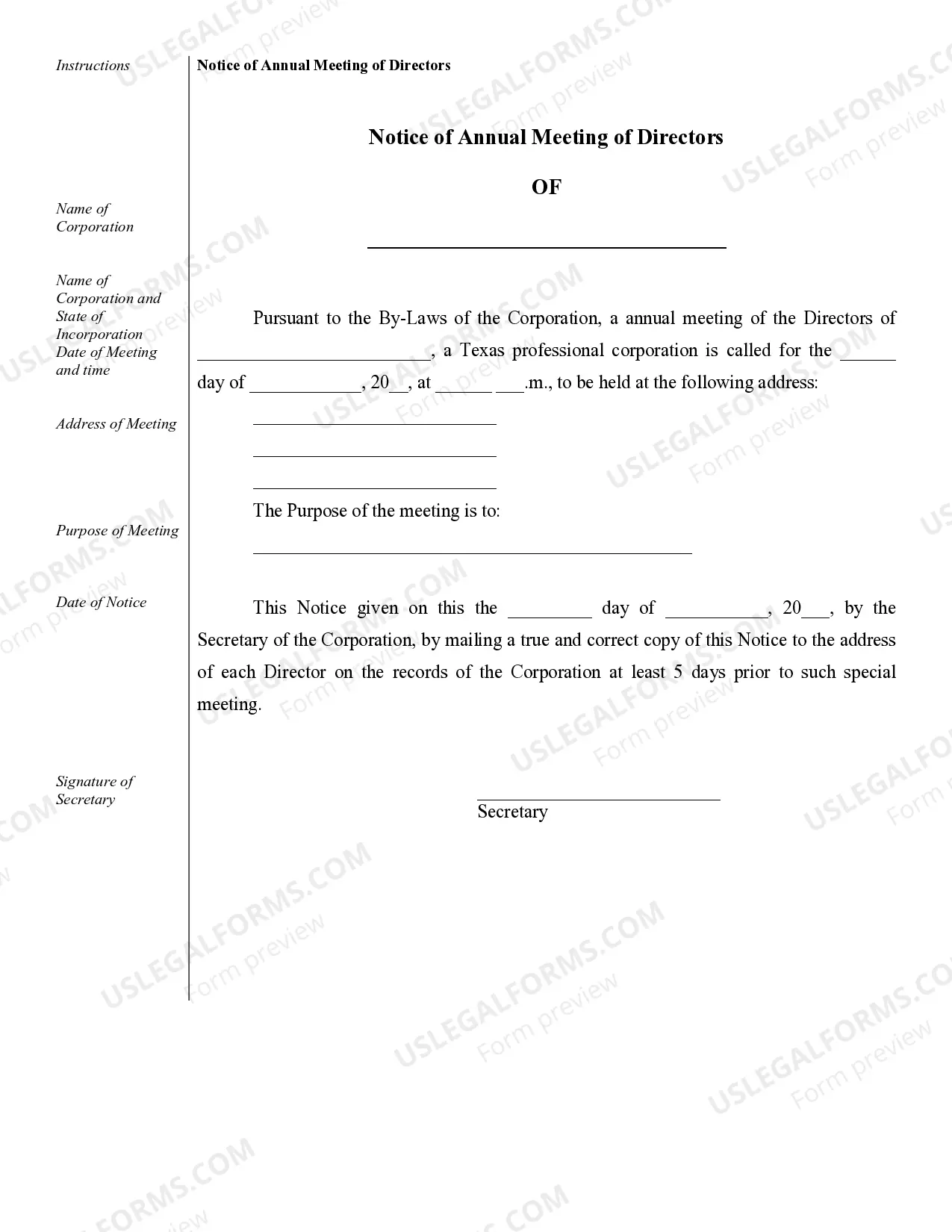

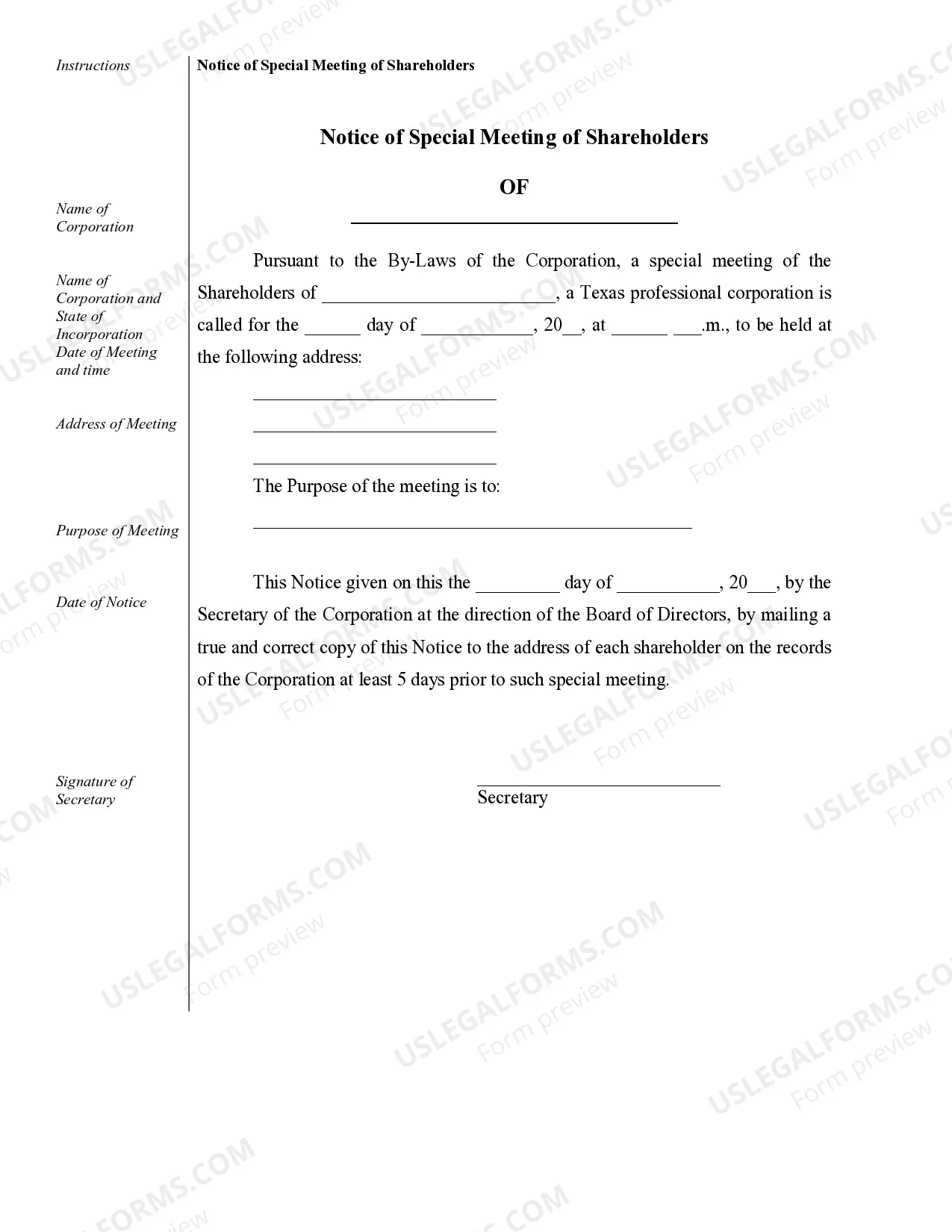

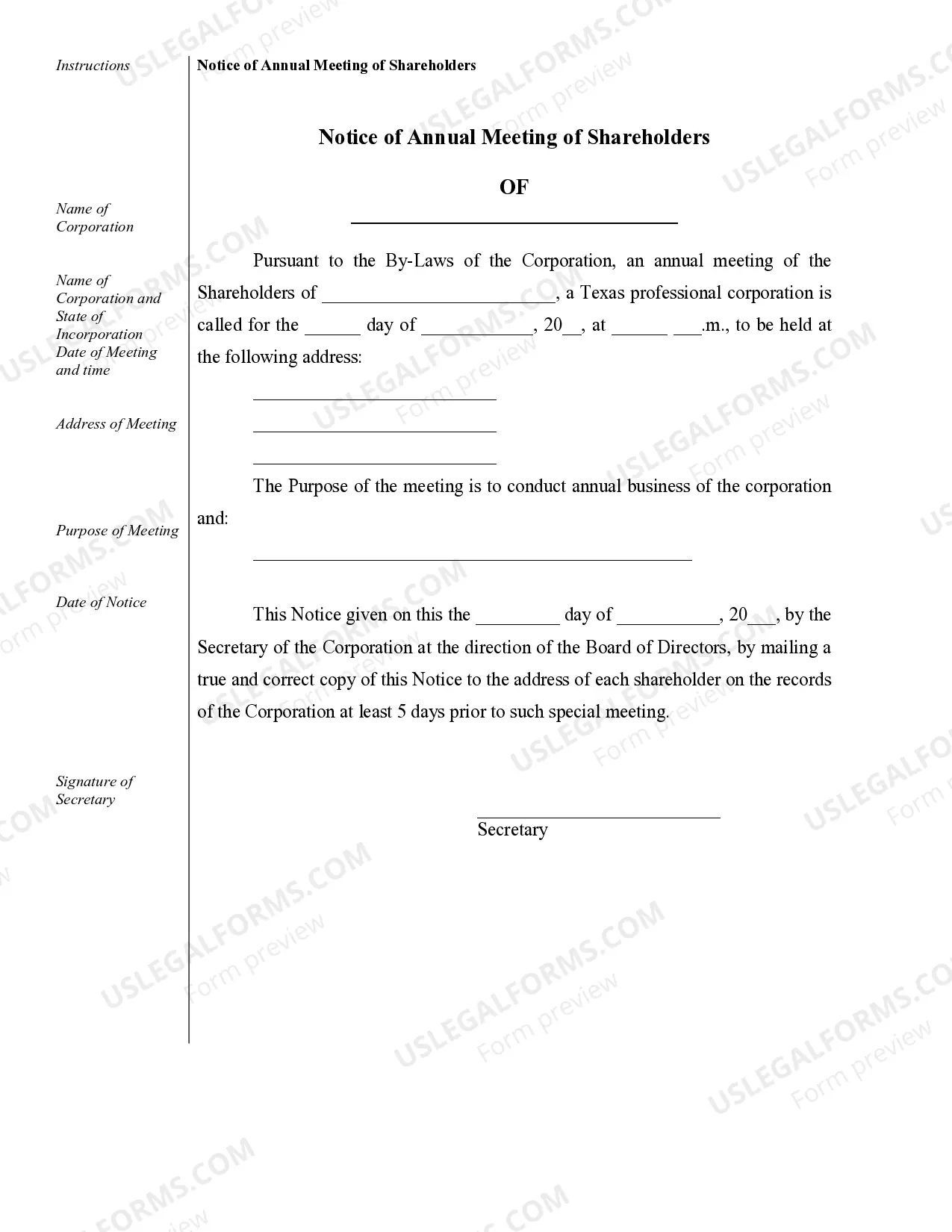

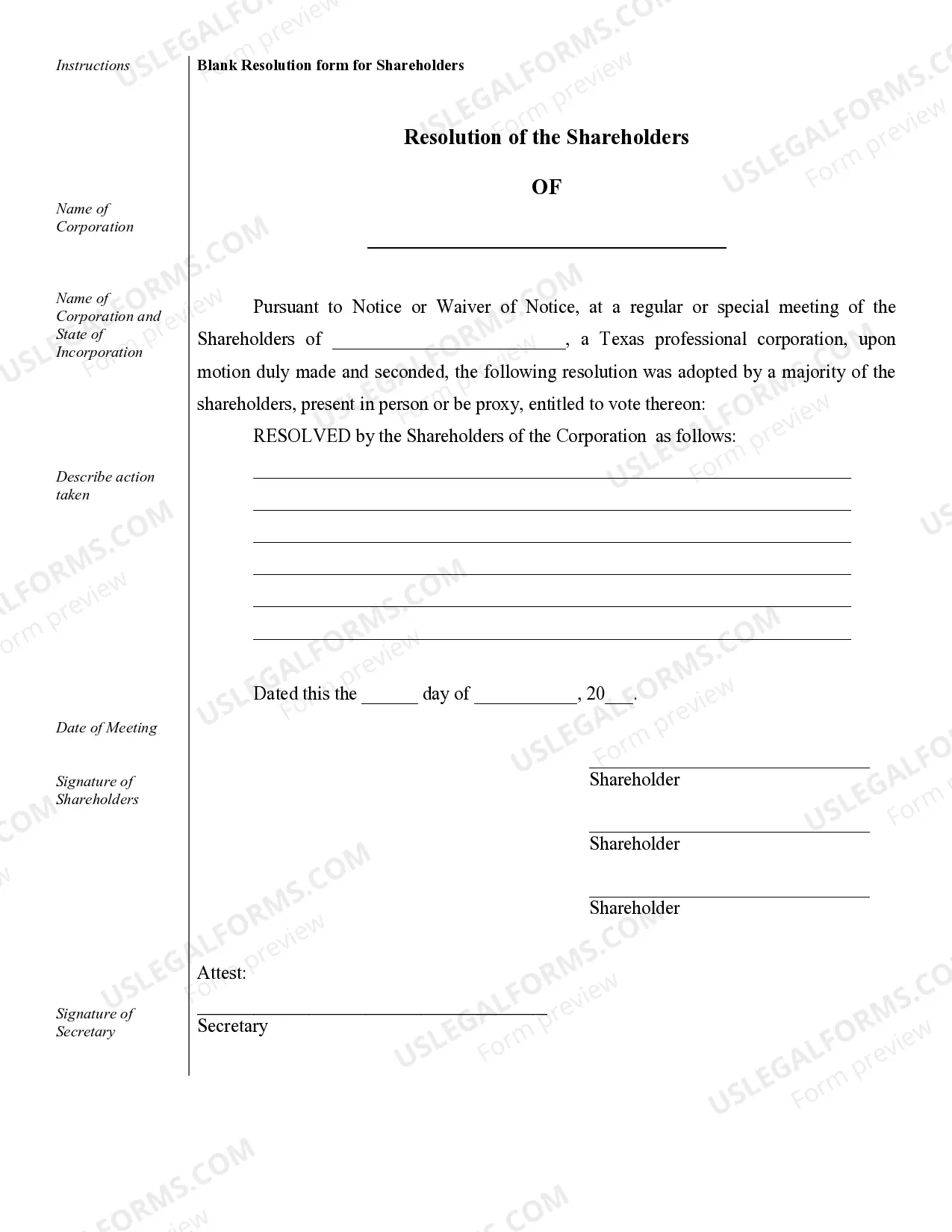

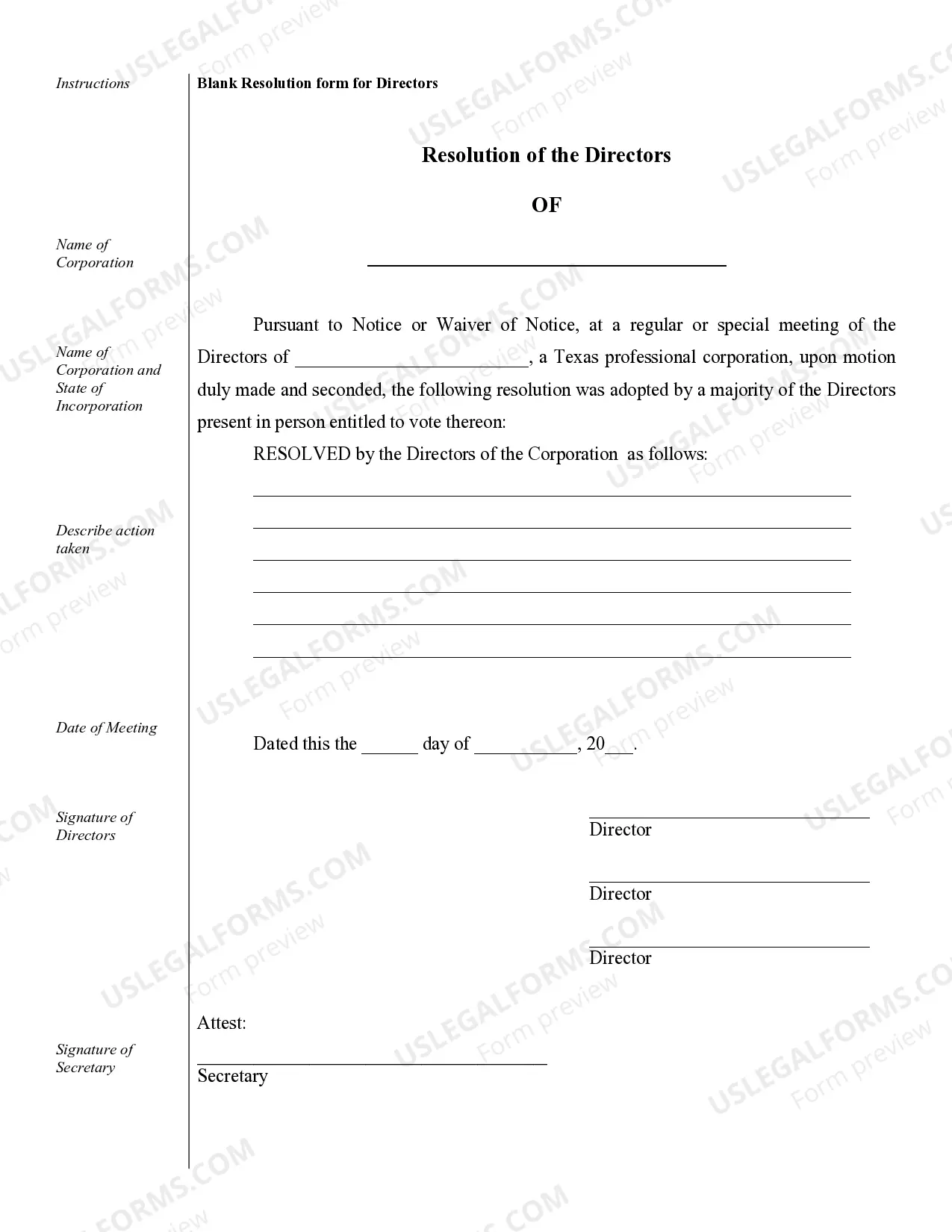

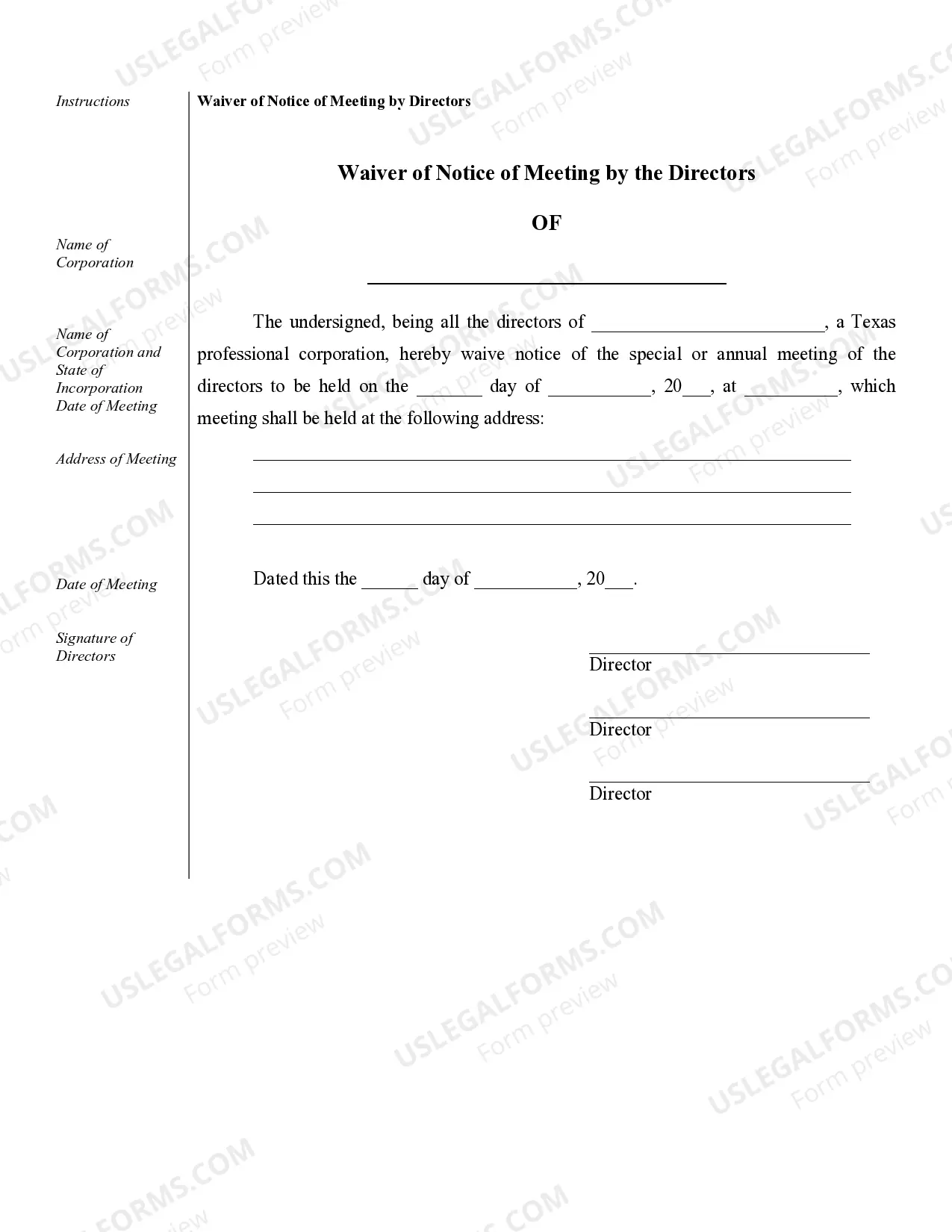

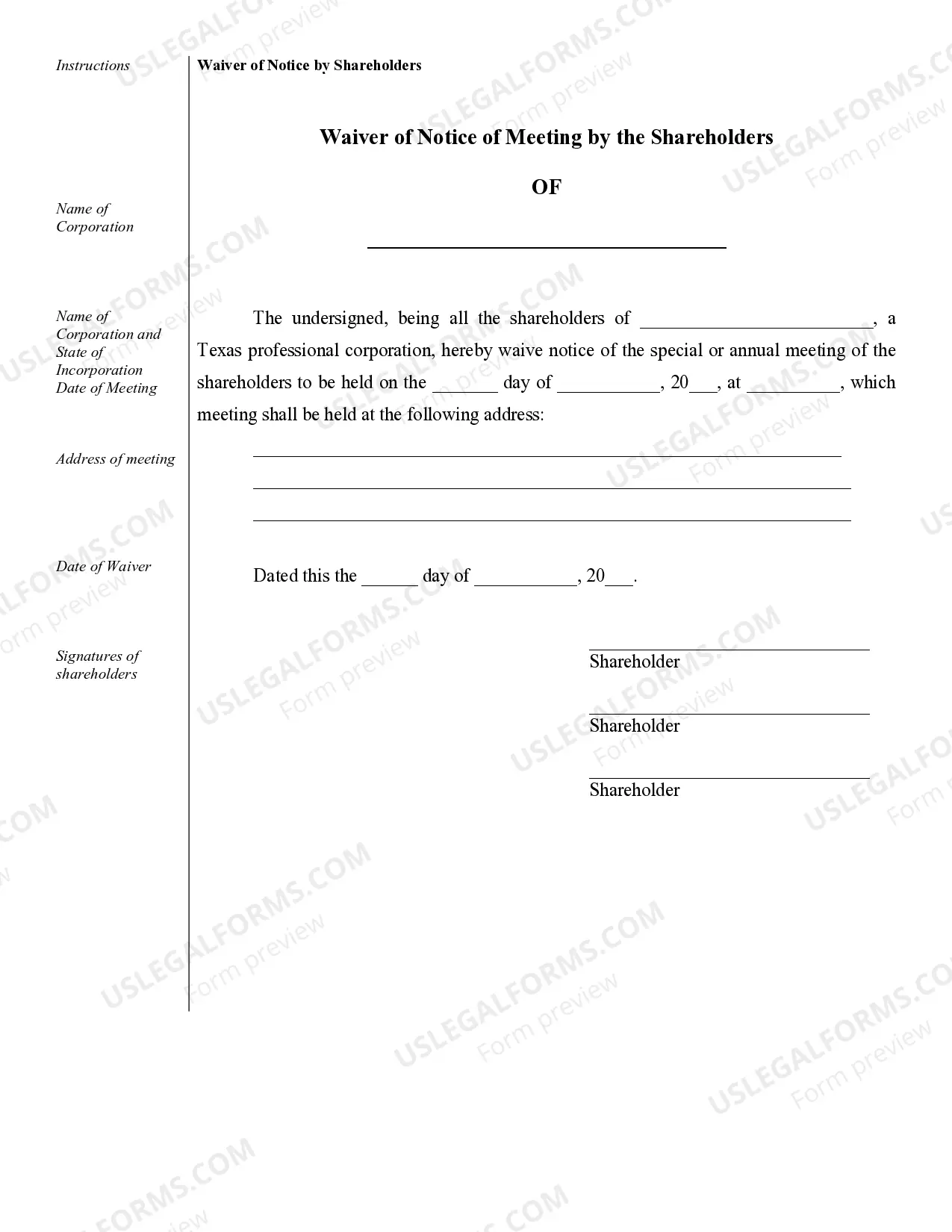

Amarillo Sample Corporate Records for Texas Professional Corporation are essential documents that provide detailed information about the legal and financial activities of a professional corporation based in Amarillo, Texas. These records are crucial for ensuring compliance with state regulations and maintaining transparency in the corporation's operations. Here are some types of Amarillo Sample Corporate Records that a Texas Professional Corporation may maintain: 1. Articles of Incorporation: This document establishes the legal existence of the professional corporation and includes information such as the corporation's name, purpose, registered agent, and the names of initial shareholders. 2. Bylaws: These records outline the corporation's internal rules and regulations. They cover important aspects like the board of directors' structure, voting procedures, meeting protocols, and the roles and responsibilities of officers and shareholders. 3. Stock Ledger: This record maintains accurate and up-to-date information about the corporation's stock ownership. It includes details like the names and addresses of shareholders, number of shares owned, dates of stock issuance, transfers, and cancellations. 4. Shareholder Agreements: These documents lay out the rights and obligations of shareholders, including voting rights, profit-sharing arrangements, and restrictions on share transfers. Shareholders' agreement may also specify rules for dispute resolution and succession planning. 5. Meeting Minutes: Detailed minutes of board of directors' and shareholders' meetings are essential records that reflect the corporation's decision-making process. These include discussions, resolutions, voting outcomes, and any actions taken during the meetings. 6. Financial Statements: These records provide a comprehensive overview of the corporation's financial position, including income statements, balance sheets, and cash flow statements. Financial statements must comply with generally accepted accounting principles (GAAP). 7. Tax Filings: A Texas Professional Corporation is required to file various tax-related records such as federal and state income tax returns, payroll tax filings, and sales tax reports. These records demonstrate compliance with tax regulations and help manage the corporation’s tax liabilities. 8. Licensing and Permits: If applicable, the professional corporation should maintain records related to professional licenses, permits, and certificates required by specific industries or professions in Amarillo, Texas. It's important to note that this list is not exhaustive, and the specific corporate records required may vary based on the nature of the professional corporation's business, industry, and legal obligations. Overall, maintaining comprehensive Amarillo Sample Corporate Records for a Texas Professional Corporation ensures legal compliance, transparency, and effective corporate governance. These records play a vital role in reinforcing the corporation's credibility, protecting shareholders' rights, and facilitating external audits or reviews.Amarillo Sample Corporate Records for Texas Professional Corporation are essential documents that provide detailed information about the legal and financial activities of a professional corporation based in Amarillo, Texas. These records are crucial for ensuring compliance with state regulations and maintaining transparency in the corporation's operations. Here are some types of Amarillo Sample Corporate Records that a Texas Professional Corporation may maintain: 1. Articles of Incorporation: This document establishes the legal existence of the professional corporation and includes information such as the corporation's name, purpose, registered agent, and the names of initial shareholders. 2. Bylaws: These records outline the corporation's internal rules and regulations. They cover important aspects like the board of directors' structure, voting procedures, meeting protocols, and the roles and responsibilities of officers and shareholders. 3. Stock Ledger: This record maintains accurate and up-to-date information about the corporation's stock ownership. It includes details like the names and addresses of shareholders, number of shares owned, dates of stock issuance, transfers, and cancellations. 4. Shareholder Agreements: These documents lay out the rights and obligations of shareholders, including voting rights, profit-sharing arrangements, and restrictions on share transfers. Shareholders' agreement may also specify rules for dispute resolution and succession planning. 5. Meeting Minutes: Detailed minutes of board of directors' and shareholders' meetings are essential records that reflect the corporation's decision-making process. These include discussions, resolutions, voting outcomes, and any actions taken during the meetings. 6. Financial Statements: These records provide a comprehensive overview of the corporation's financial position, including income statements, balance sheets, and cash flow statements. Financial statements must comply with generally accepted accounting principles (GAAP). 7. Tax Filings: A Texas Professional Corporation is required to file various tax-related records such as federal and state income tax returns, payroll tax filings, and sales tax reports. These records demonstrate compliance with tax regulations and help manage the corporation’s tax liabilities. 8. Licensing and Permits: If applicable, the professional corporation should maintain records related to professional licenses, permits, and certificates required by specific industries or professions in Amarillo, Texas. It's important to note that this list is not exhaustive, and the specific corporate records required may vary based on the nature of the professional corporation's business, industry, and legal obligations. Overall, maintaining comprehensive Amarillo Sample Corporate Records for a Texas Professional Corporation ensures legal compliance, transparency, and effective corporate governance. These records play a vital role in reinforcing the corporation's credibility, protecting shareholders' rights, and facilitating external audits or reviews.