Sample Corporate Notices of Meetings, Resolutions, Simple Stock Ledger & Certificate.

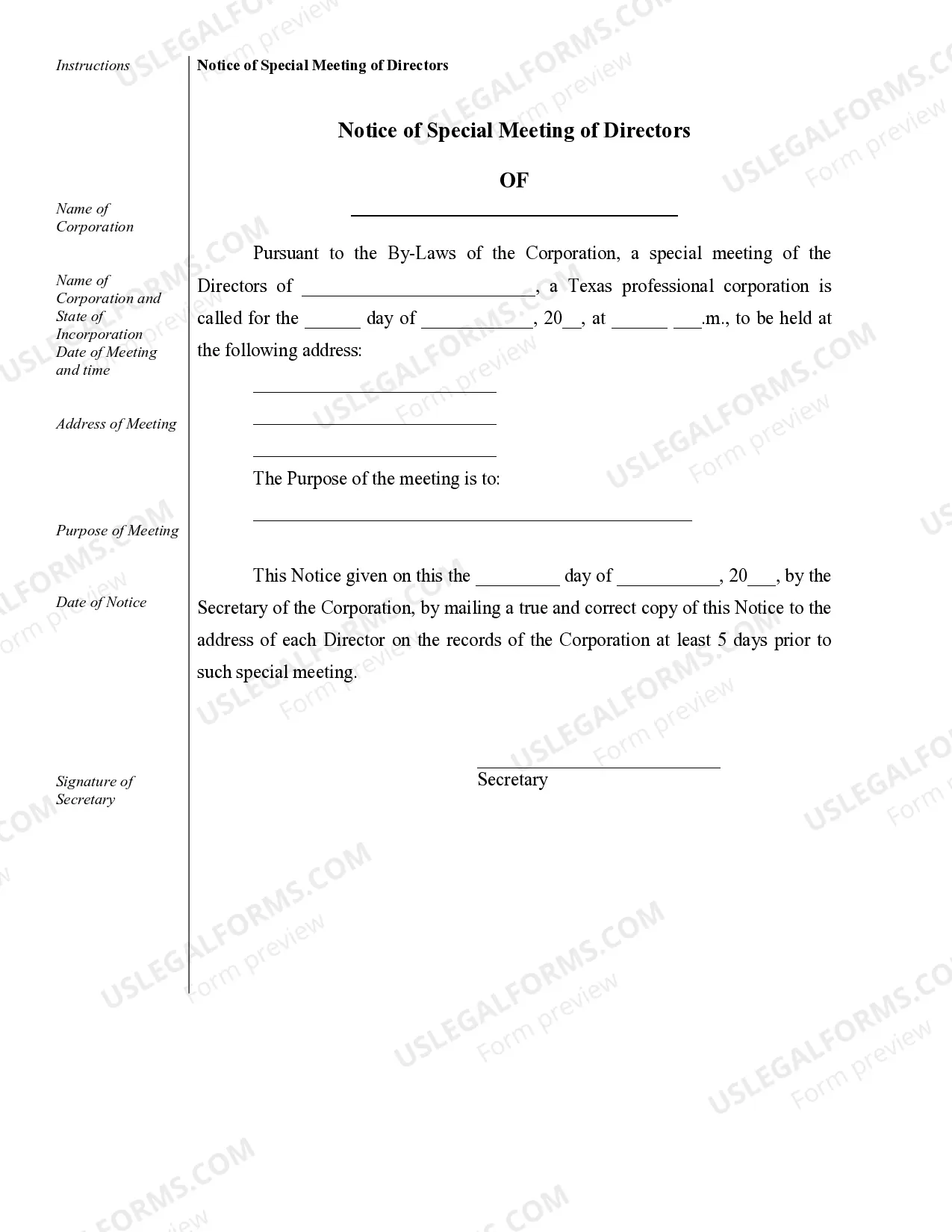

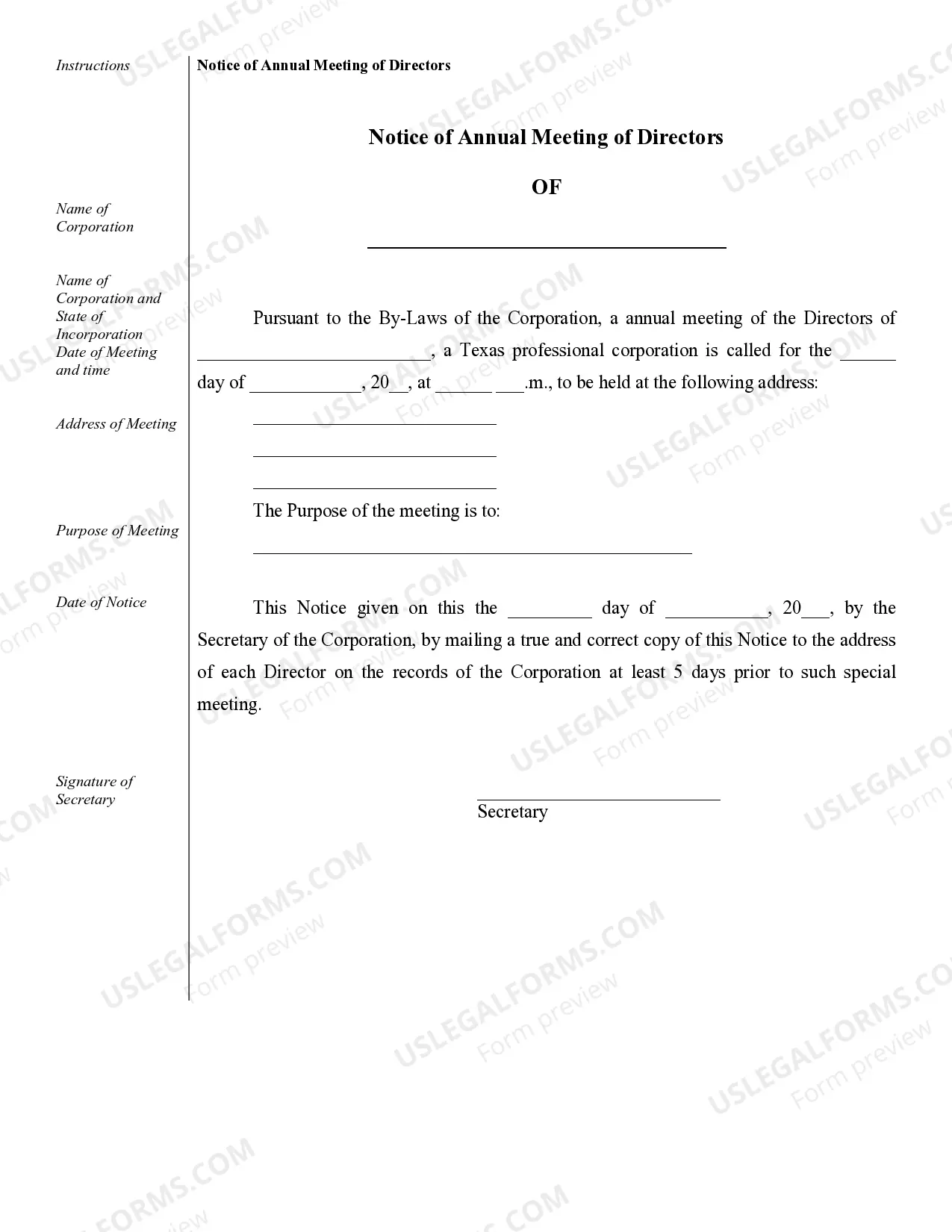

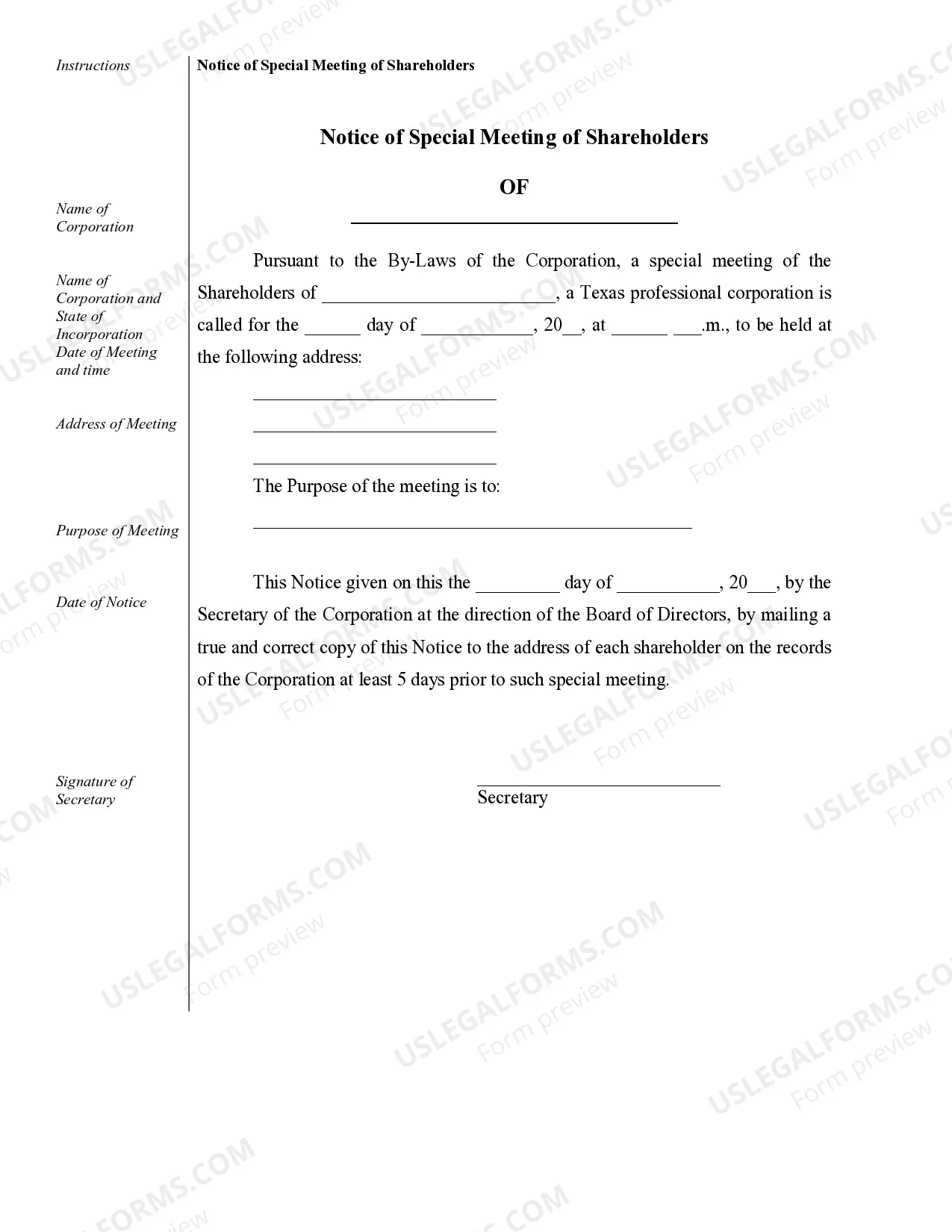

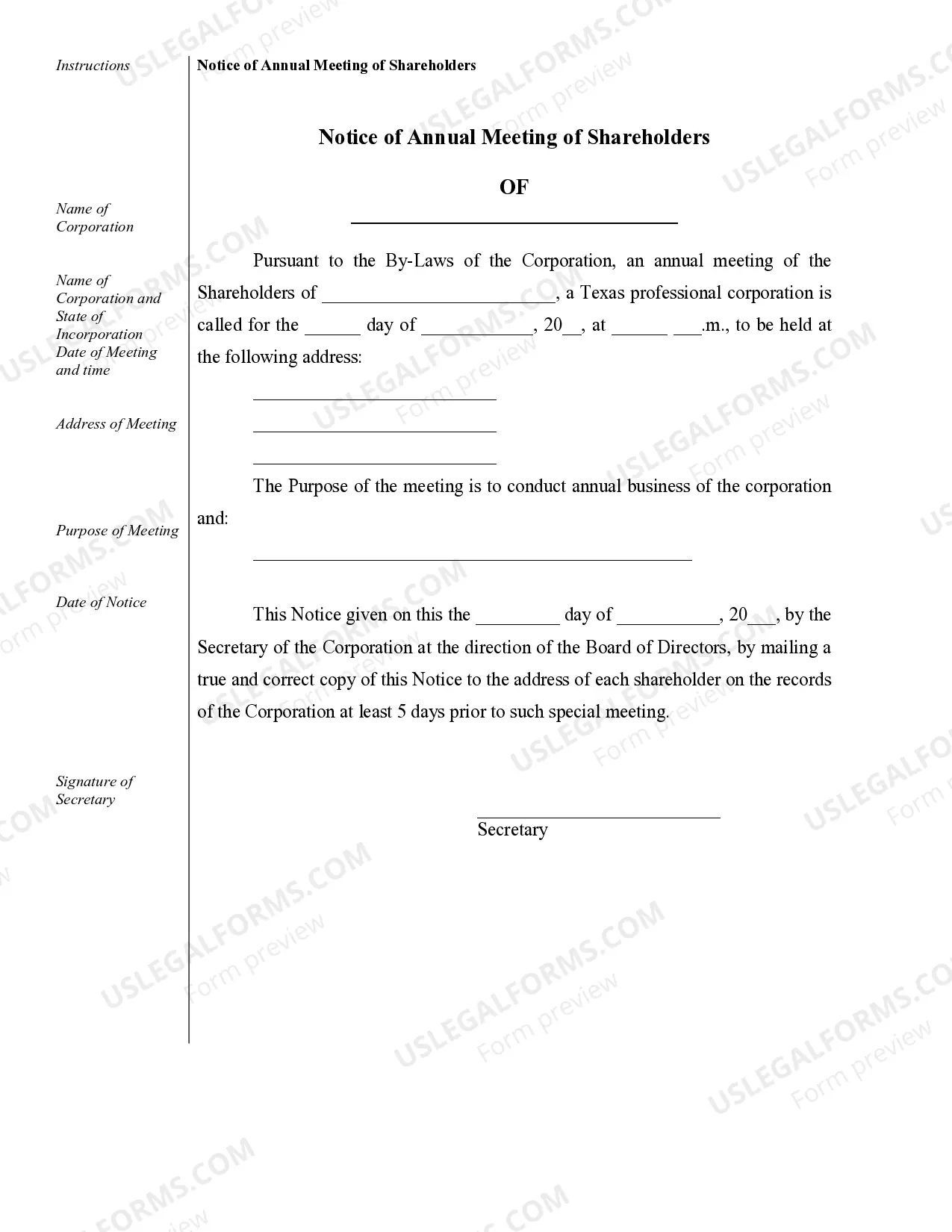

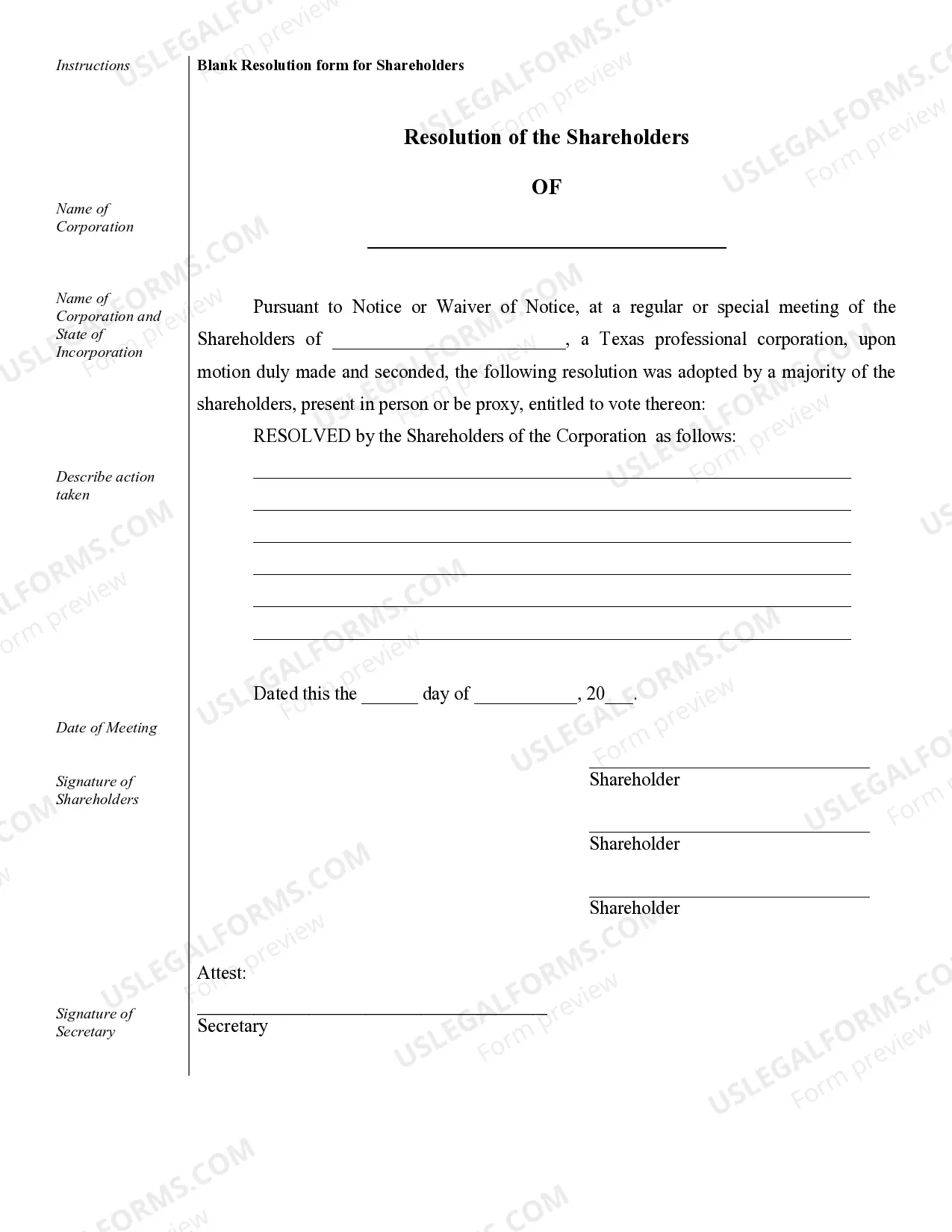

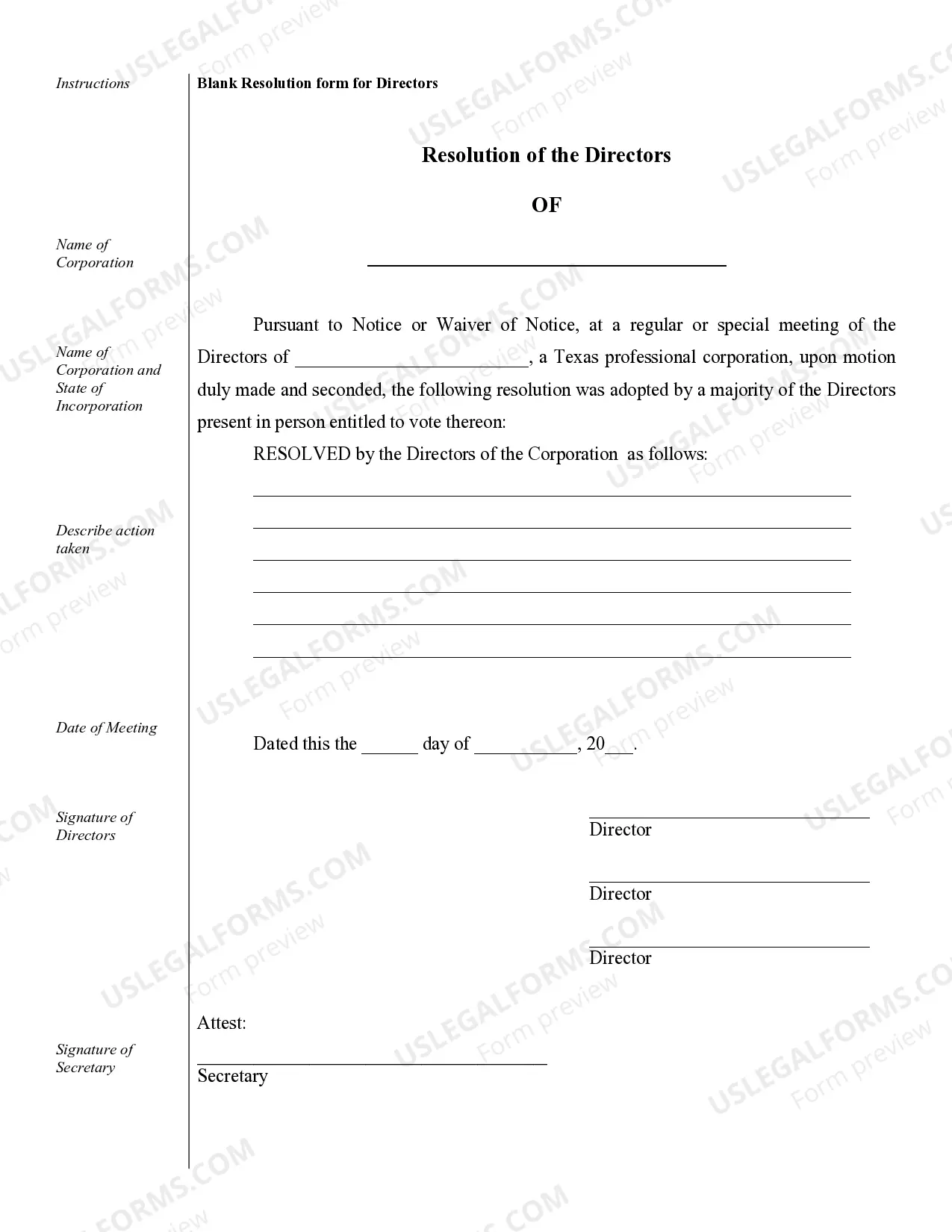

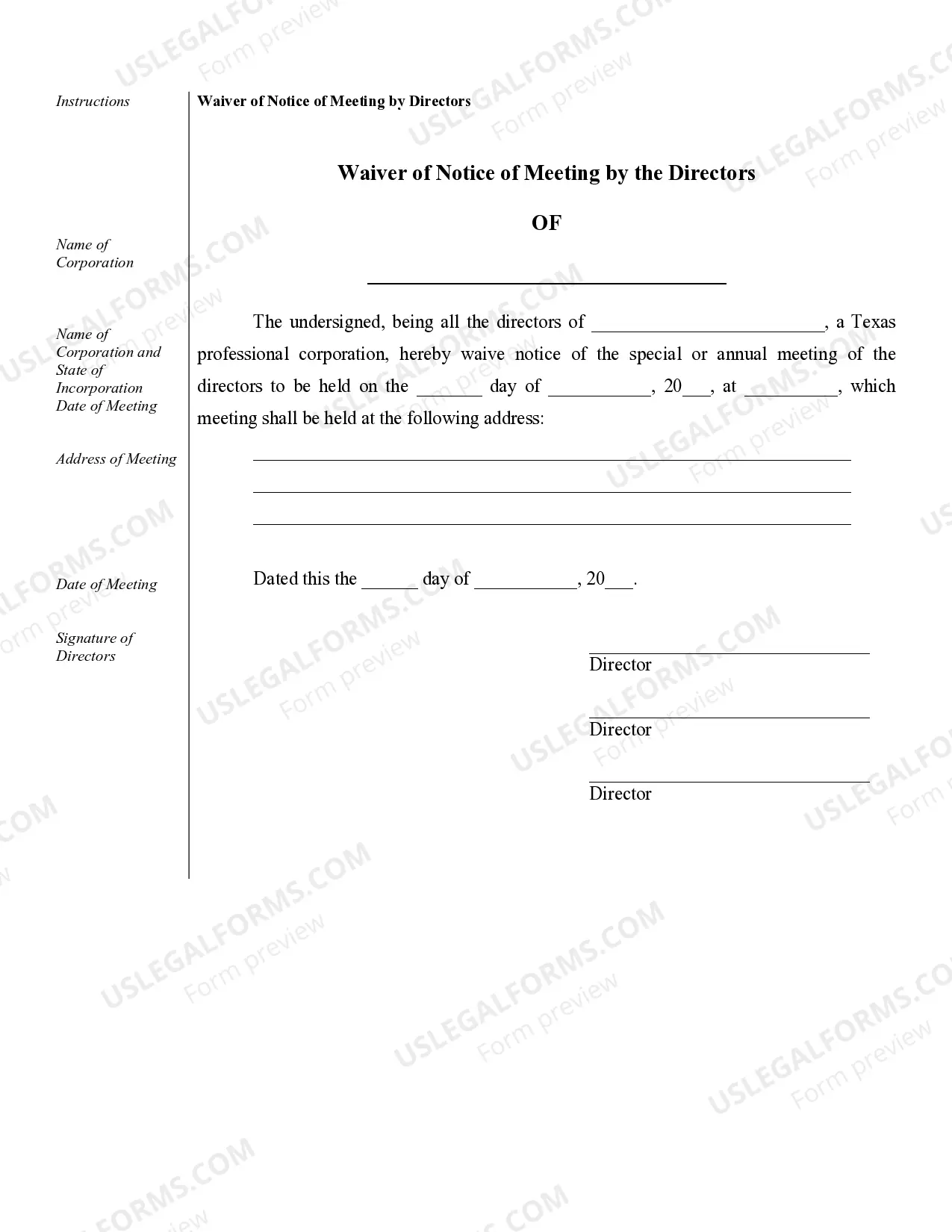

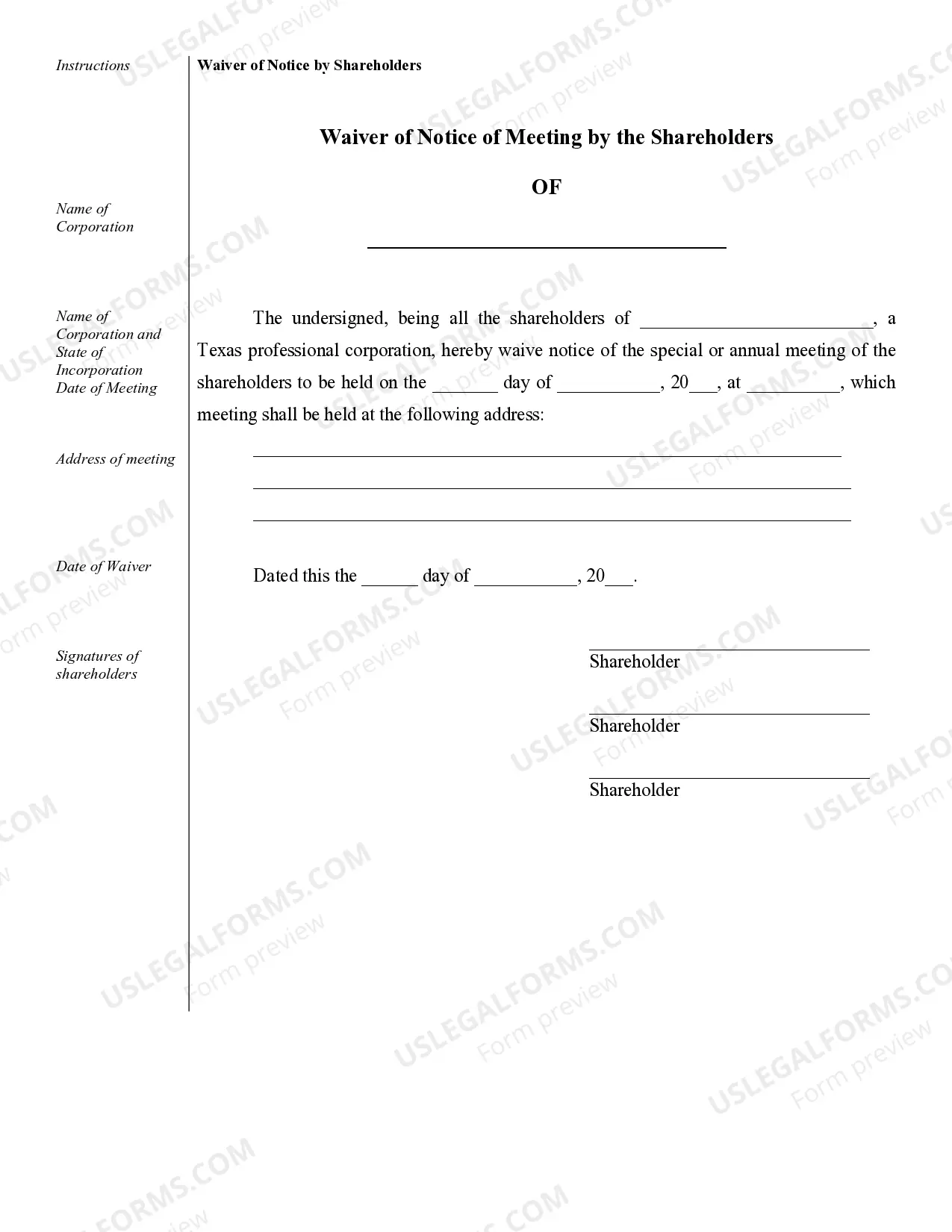

Beaumont Sample Corporate Records for a Texas Professional Corporation play a crucial role in the maintenance and organization of important legal documents and financial records. These records provide a comprehensive overview of the corporation's activities and are essential for ensuring compliance with state laws and regulations. One type of Beaumont Sample Corporate Record for a Texas Professional Corporation is the Articles of Incorporation. These documents formally establish the existence of the corporation and outline its purpose, structure, and governance. They are filed with the Secretary of State and typically include the corporation's name, registered agent, and the names of the initial directors and officers. Another important record is the Bylaws of the Corporation. These documents outline the rules and procedures for the internal management of the corporation, including the responsibilities and powers of shareholders, directors, and officers. Bylaws provide the framework for decision-making processes, shareholder meetings, and the appointment of officers and directors. Minute Books are additional records that contain the minutes of meetings held by the corporation's shareholders, directors, and committees. These books are used to document the discussions, decisions, and resolutions made during these meetings. Minute Books serve as a historical record of the corporation's activities and are invaluable for maintaining transparency and accountability. Stock Ledgers or Shareholder Registers are yet another essential document that tracks the ownership and transfer of shares within the corporation. They document the names, addresses, and number of shares held by each shareholder, as well as any changes in ownership over time. Stock ledgers are crucial for maintaining accurate and up-to-date records of the corporation's ownership structure. Financial Statements, including the Income Statement, Balance Sheet, and Cash Flow Statement, are also important Beaumont Sample Corporate Records for a Texas Professional Corporation. These documents provide critical information about the corporation's financial health, performance, and liquidity. They are typically prepared annually and are necessary for taxation purposes, financial analysis, and decision-making. Lastly, Compliance Documents play a vital role in meeting legal requirements and ensuring adherence to state regulations. These documents may include annual reports, corporate resolutions, and any filings or permits required by state agencies. Compliance documents demonstrate the corporation's commitment to transparency and regulatory compliance. In summary, Beaumont Sample Corporate Records for a Texas Professional Corporation encompass a range of documents that are essential for maintaining the corporation's legal standing, governance structure, financial records, and compliance with state laws. These records include Articles of Incorporation, Bylaws, Minute Books, Stock Ledgers, Financial Statements, and Compliance Documents. By properly organizing and maintaining these records, corporations can effectively manage their operations, demonstrate accountability, and ensure legal compliance.Beaumont Sample Corporate Records for a Texas Professional Corporation play a crucial role in the maintenance and organization of important legal documents and financial records. These records provide a comprehensive overview of the corporation's activities and are essential for ensuring compliance with state laws and regulations. One type of Beaumont Sample Corporate Record for a Texas Professional Corporation is the Articles of Incorporation. These documents formally establish the existence of the corporation and outline its purpose, structure, and governance. They are filed with the Secretary of State and typically include the corporation's name, registered agent, and the names of the initial directors and officers. Another important record is the Bylaws of the Corporation. These documents outline the rules and procedures for the internal management of the corporation, including the responsibilities and powers of shareholders, directors, and officers. Bylaws provide the framework for decision-making processes, shareholder meetings, and the appointment of officers and directors. Minute Books are additional records that contain the minutes of meetings held by the corporation's shareholders, directors, and committees. These books are used to document the discussions, decisions, and resolutions made during these meetings. Minute Books serve as a historical record of the corporation's activities and are invaluable for maintaining transparency and accountability. Stock Ledgers or Shareholder Registers are yet another essential document that tracks the ownership and transfer of shares within the corporation. They document the names, addresses, and number of shares held by each shareholder, as well as any changes in ownership over time. Stock ledgers are crucial for maintaining accurate and up-to-date records of the corporation's ownership structure. Financial Statements, including the Income Statement, Balance Sheet, and Cash Flow Statement, are also important Beaumont Sample Corporate Records for a Texas Professional Corporation. These documents provide critical information about the corporation's financial health, performance, and liquidity. They are typically prepared annually and are necessary for taxation purposes, financial analysis, and decision-making. Lastly, Compliance Documents play a vital role in meeting legal requirements and ensuring adherence to state regulations. These documents may include annual reports, corporate resolutions, and any filings or permits required by state agencies. Compliance documents demonstrate the corporation's commitment to transparency and regulatory compliance. In summary, Beaumont Sample Corporate Records for a Texas Professional Corporation encompass a range of documents that are essential for maintaining the corporation's legal standing, governance structure, financial records, and compliance with state laws. These records include Articles of Incorporation, Bylaws, Minute Books, Stock Ledgers, Financial Statements, and Compliance Documents. By properly organizing and maintaining these records, corporations can effectively manage their operations, demonstrate accountability, and ensure legal compliance.