Sample Corporate Notices of Meetings, Resolutions, Simple Stock Ledger & Certificate.

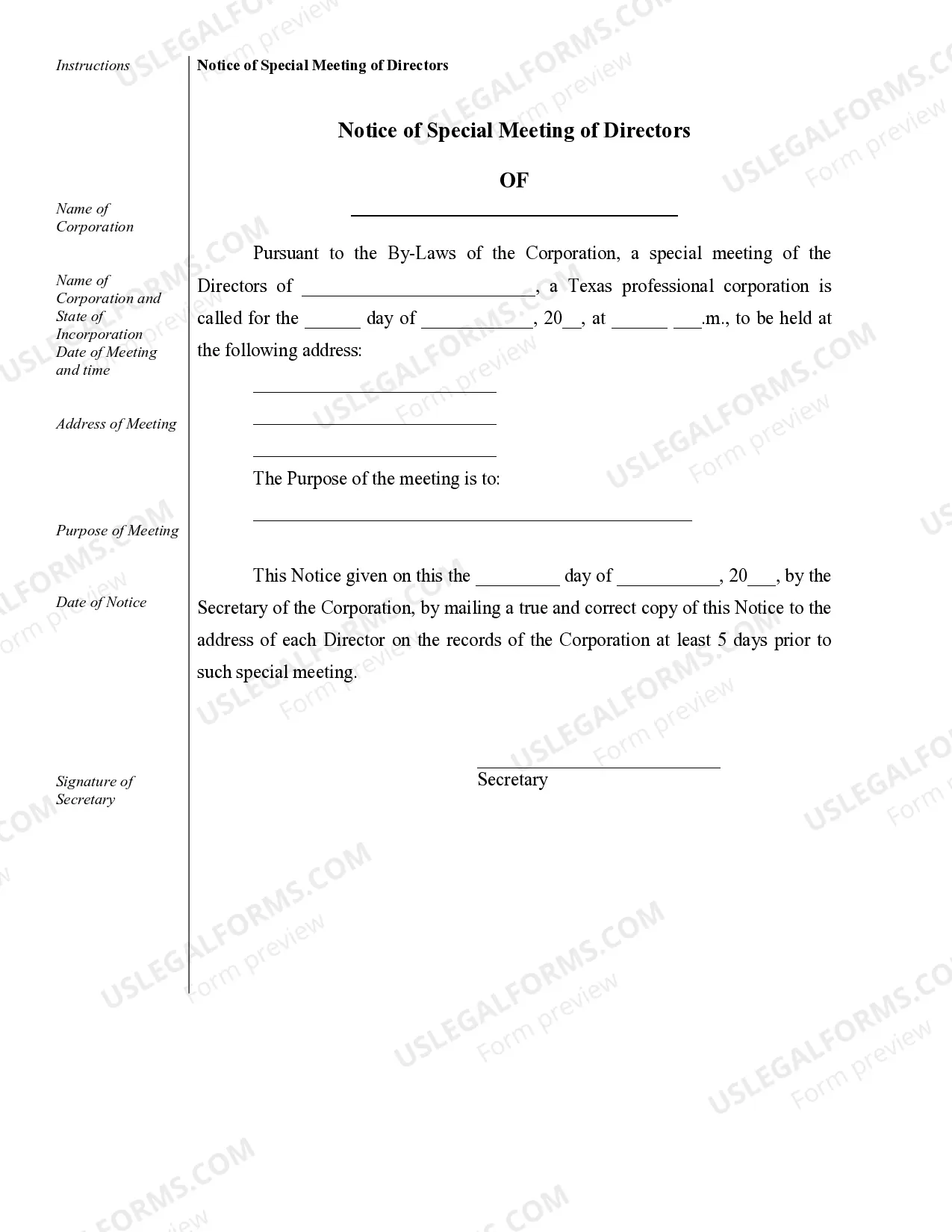

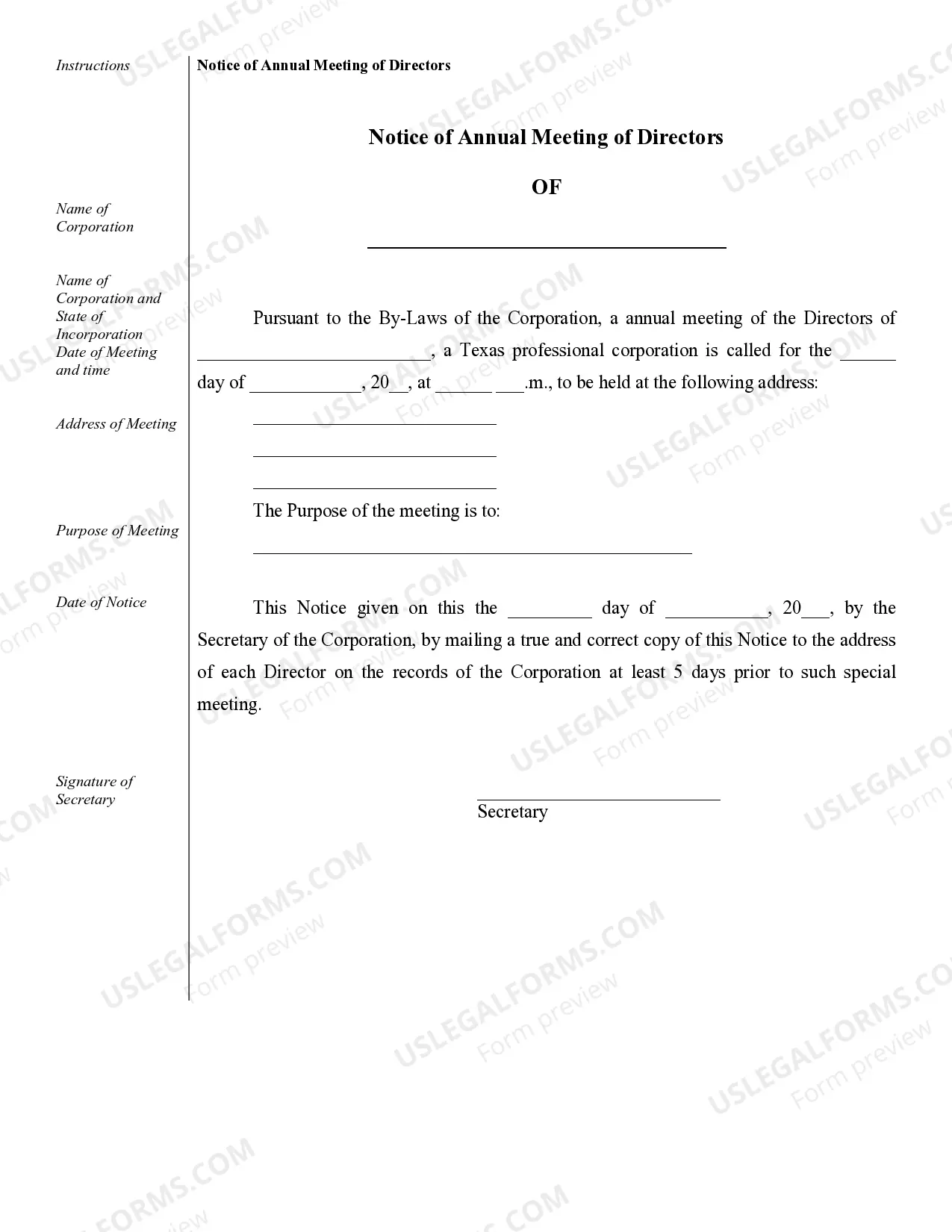

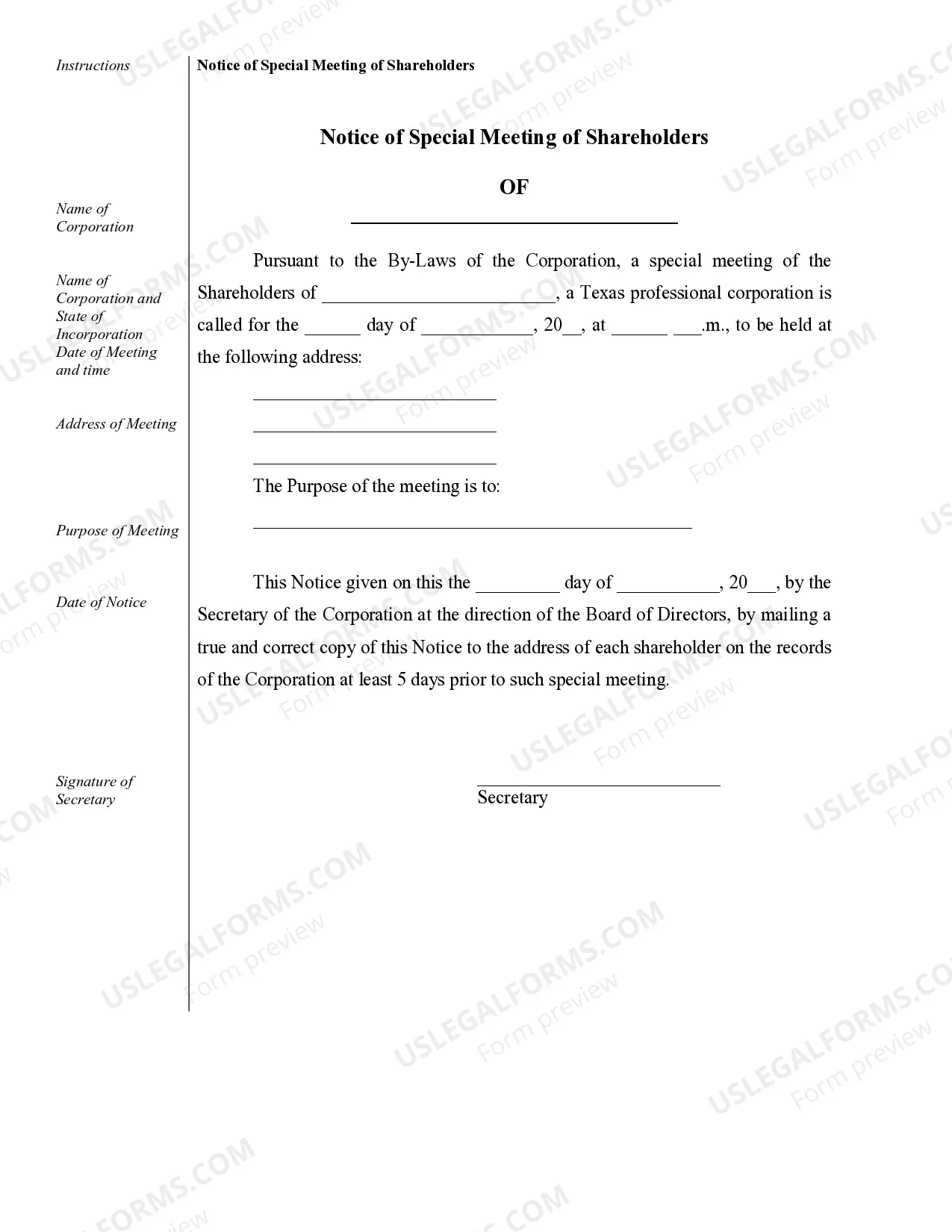

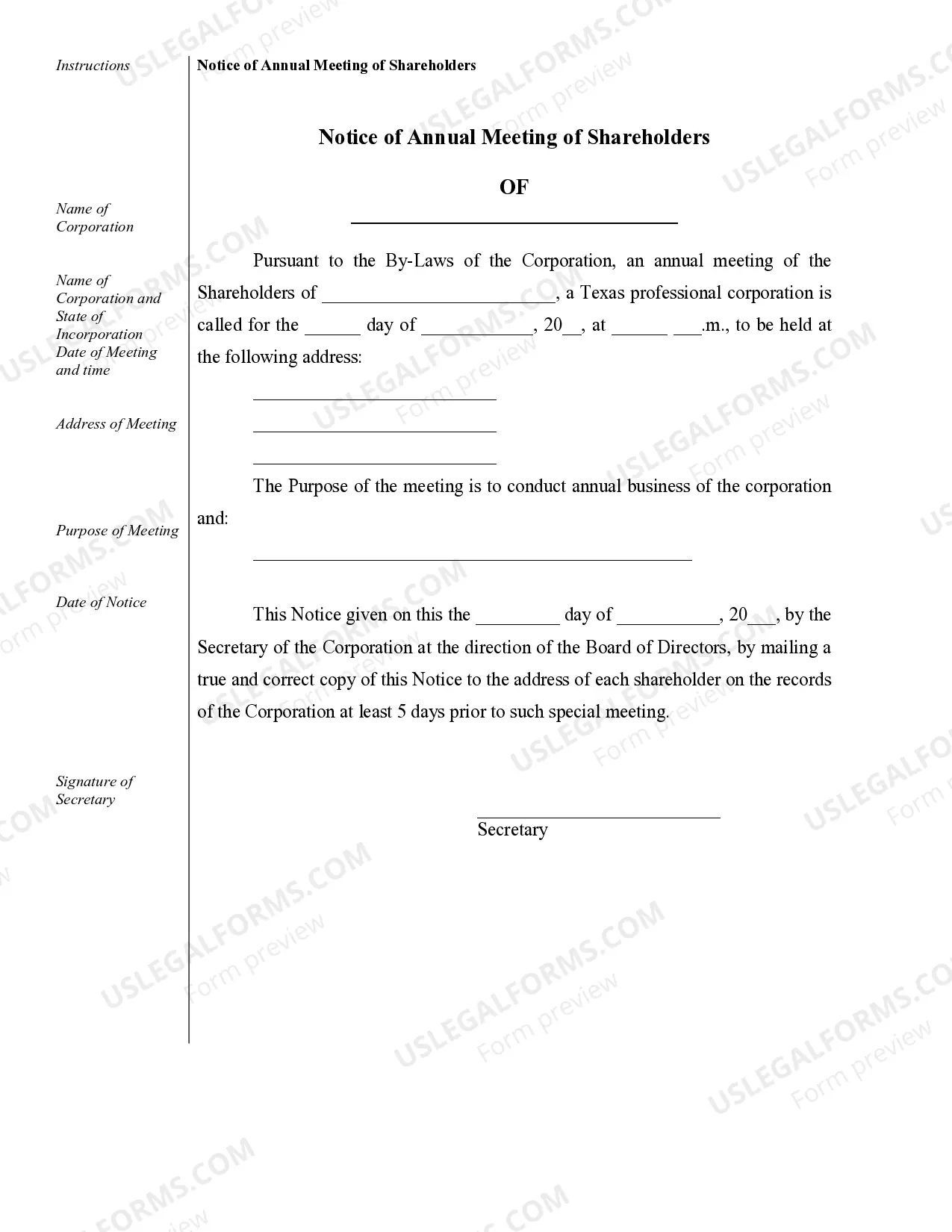

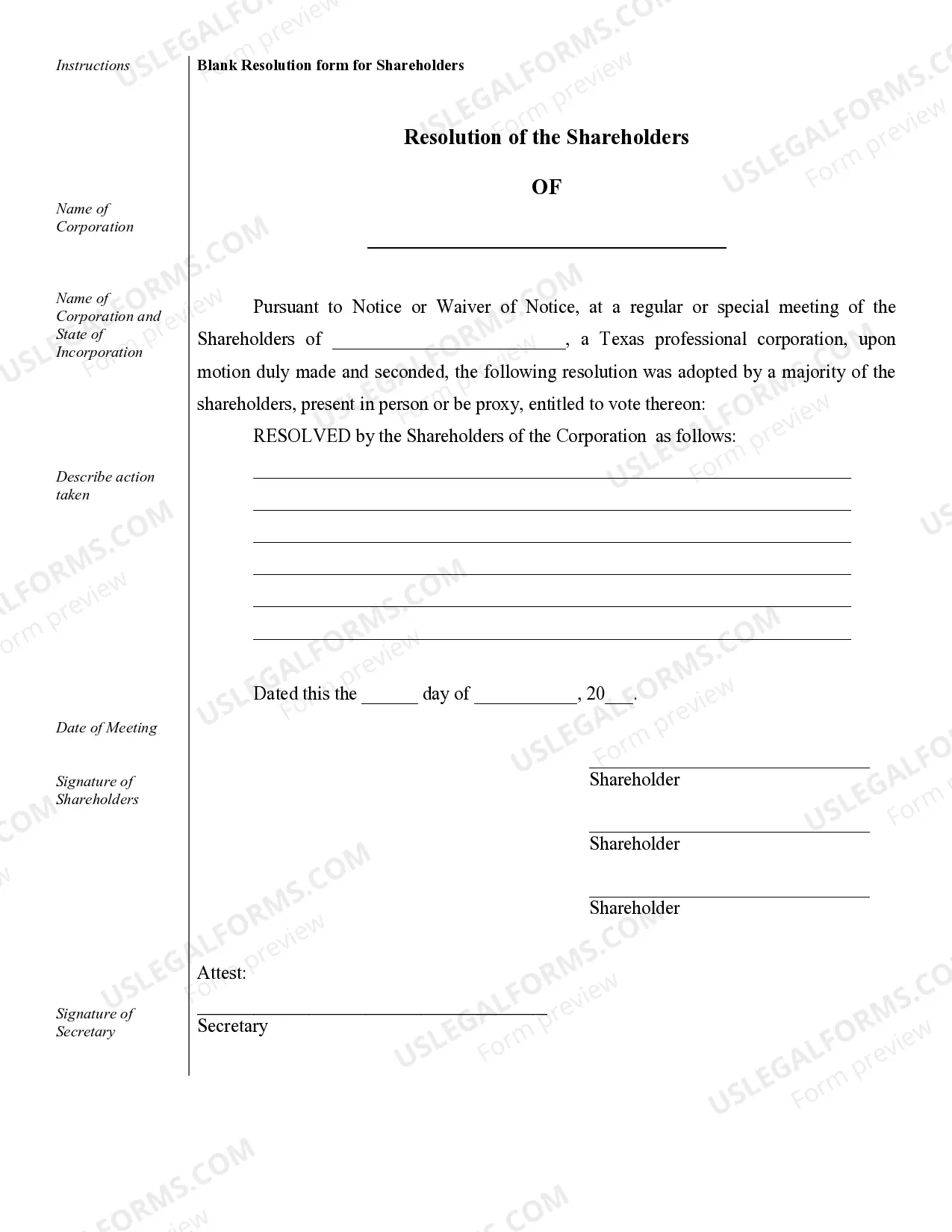

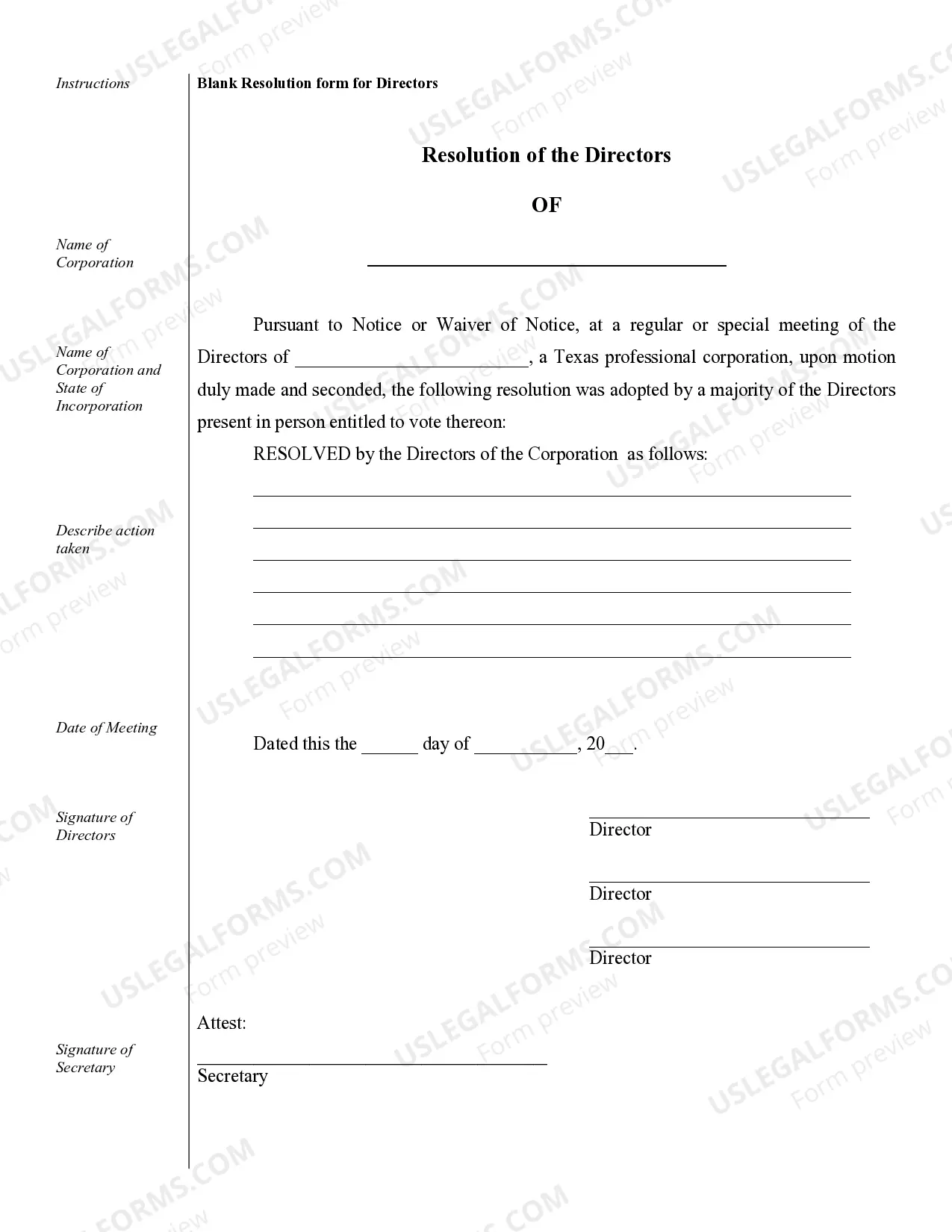

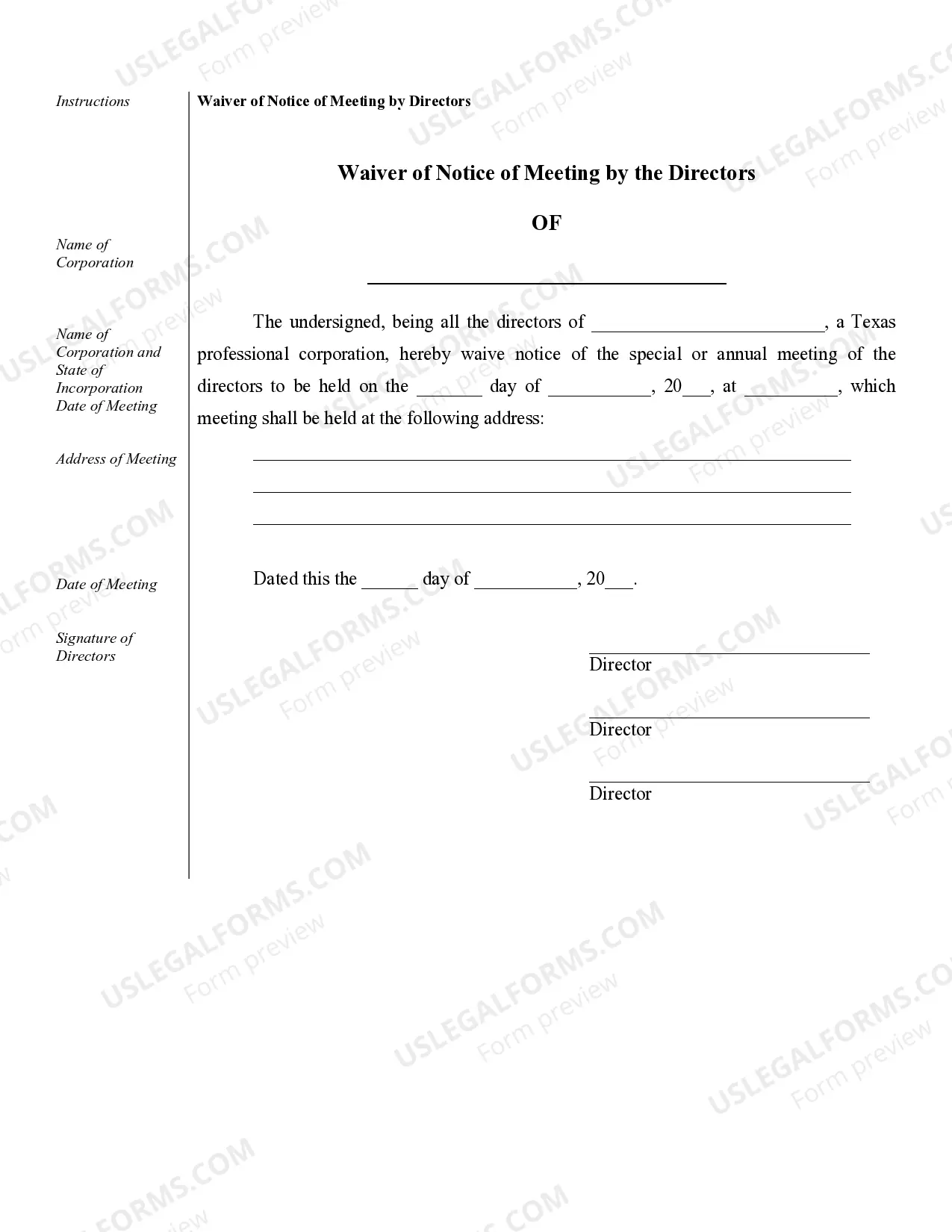

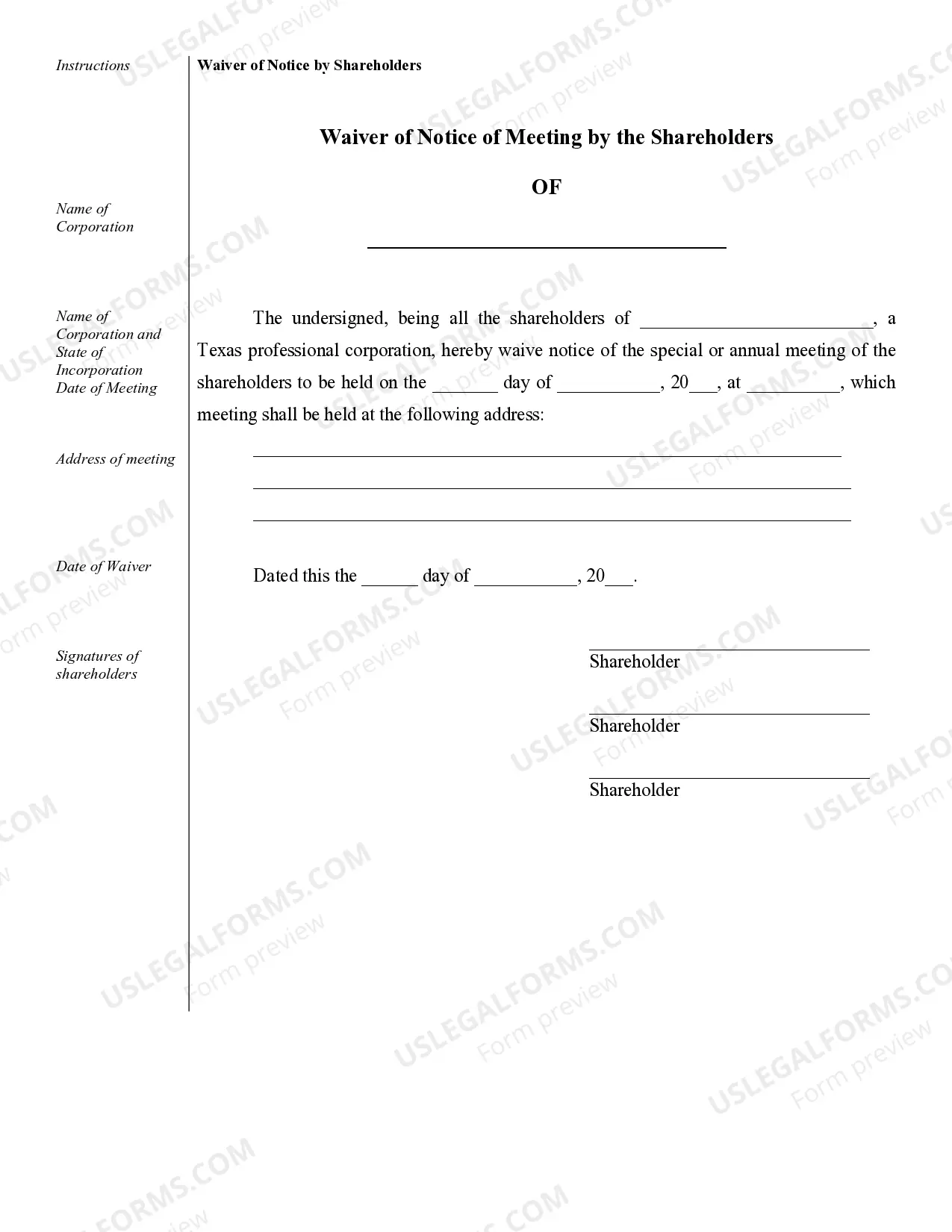

Bexar Sample Corporate Records for a Texas Professional Corporation refer to the necessary documentation that must be maintained and organized by a professional corporation (PC) operating in Bexar County, Texas. These records are crucial for demonstrating compliance with legal and regulatory requirements, maintaining the corporation's operational transparency, and protecting the interests of shareholders, directors, and officers. Various types of Bexar Sample Corporate Records for a Texas Professional Corporation may include: 1. Articles of Incorporation: This document is filed with the Texas Secretary of State and outlines the fundamental details of the professional corporation, such as its name, purpose, registered office address, duration, and more. 2. Bylaws: These are the internal operating rules and regulations established by the professional corporation, governing matters like shareholder meetings, director qualification, officer roles, voting procedures, and more. 3. Shareholder Records: These records capture details about shareholders, including their names, contact information, number of shares held, and any stock certificates issued. Shareholder agreements, if applicable, may also be included here. 4. Board of Directors Records: These records encompass information about the corporation's board members, such as names, contact details, terms of service, and board meeting minutes highlighting discussions, decisions made, and voting outcomes. 5. Minutes of Shareholder Meetings: Detailed minutes of all shareholder meetings, including annual meetings and special meetings, should be maintained. These minutes should cover all important matters discussed, resolutions passed, voting results, and any other significant actions taken. 6. Minutes of Board of Directors Meetings: Similarly, minutes of the board of directors' meetings should document the discussions held, decisions taken, and voting outcomes. These minutes are crucial for proving that the board acted in the corporation's best interests. 7. Financial Statements: The sample corporate records may include financial statements, such as balance sheets, income statements, cash flow statements, and retained earnings statements, which provide an overview of the corporation's financial performance. 8. Contracts and Agreements: Copies of contracts, agreements, and legal documents that the professional corporation has entered into, including leases, employment contracts, client agreements, vendor contracts, and intellectual property rights documents, may also be part of these records. 9. Stock Ledger: A stock ledger tracks the details of the corporation's shares, including the issuance, transfer, and cancellation of shares. It includes information about the shareholders, the number of shares held, and any changes in ownership. 10. Licenses and Permits: Copies of any licenses or permits obtained by the professional corporation to operate legally within Bexar County may also be included in the corporate records. Maintaining accurate and up-to-date Bexar Sample Corporate Records is crucial to meeting legal requirements, facilitating smooth audits, ensuring accountability, and protecting the professional corporation, its directors, officers, and shareholders from potential legal and financial risks.Bexar Sample Corporate Records for a Texas Professional Corporation refer to the necessary documentation that must be maintained and organized by a professional corporation (PC) operating in Bexar County, Texas. These records are crucial for demonstrating compliance with legal and regulatory requirements, maintaining the corporation's operational transparency, and protecting the interests of shareholders, directors, and officers. Various types of Bexar Sample Corporate Records for a Texas Professional Corporation may include: 1. Articles of Incorporation: This document is filed with the Texas Secretary of State and outlines the fundamental details of the professional corporation, such as its name, purpose, registered office address, duration, and more. 2. Bylaws: These are the internal operating rules and regulations established by the professional corporation, governing matters like shareholder meetings, director qualification, officer roles, voting procedures, and more. 3. Shareholder Records: These records capture details about shareholders, including their names, contact information, number of shares held, and any stock certificates issued. Shareholder agreements, if applicable, may also be included here. 4. Board of Directors Records: These records encompass information about the corporation's board members, such as names, contact details, terms of service, and board meeting minutes highlighting discussions, decisions made, and voting outcomes. 5. Minutes of Shareholder Meetings: Detailed minutes of all shareholder meetings, including annual meetings and special meetings, should be maintained. These minutes should cover all important matters discussed, resolutions passed, voting results, and any other significant actions taken. 6. Minutes of Board of Directors Meetings: Similarly, minutes of the board of directors' meetings should document the discussions held, decisions taken, and voting outcomes. These minutes are crucial for proving that the board acted in the corporation's best interests. 7. Financial Statements: The sample corporate records may include financial statements, such as balance sheets, income statements, cash flow statements, and retained earnings statements, which provide an overview of the corporation's financial performance. 8. Contracts and Agreements: Copies of contracts, agreements, and legal documents that the professional corporation has entered into, including leases, employment contracts, client agreements, vendor contracts, and intellectual property rights documents, may also be part of these records. 9. Stock Ledger: A stock ledger tracks the details of the corporation's shares, including the issuance, transfer, and cancellation of shares. It includes information about the shareholders, the number of shares held, and any changes in ownership. 10. Licenses and Permits: Copies of any licenses or permits obtained by the professional corporation to operate legally within Bexar County may also be included in the corporate records. Maintaining accurate and up-to-date Bexar Sample Corporate Records is crucial to meeting legal requirements, facilitating smooth audits, ensuring accountability, and protecting the professional corporation, its directors, officers, and shareholders from potential legal and financial risks.