Sample Corporate Notices of Meetings, Resolutions, Simple Stock Ledger & Certificate.

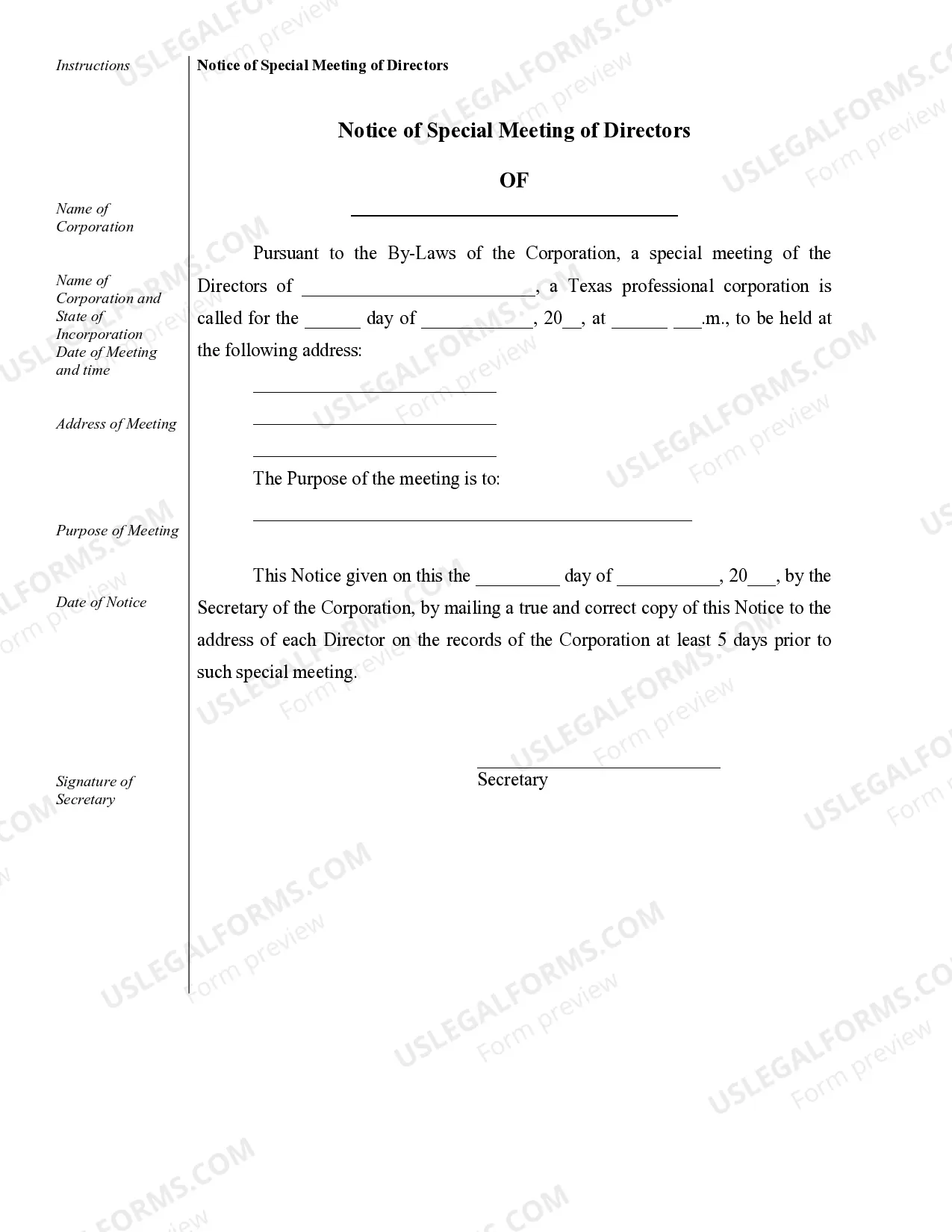

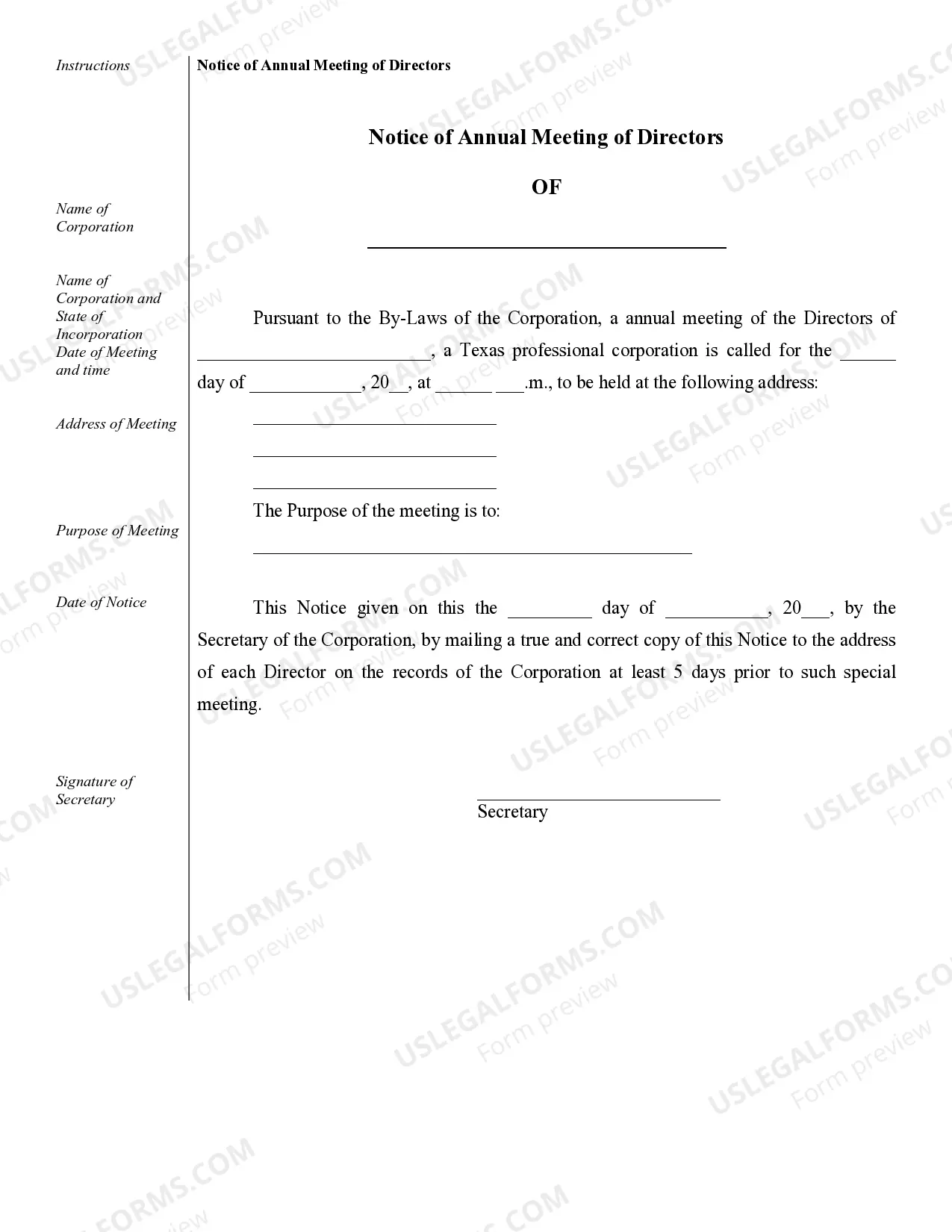

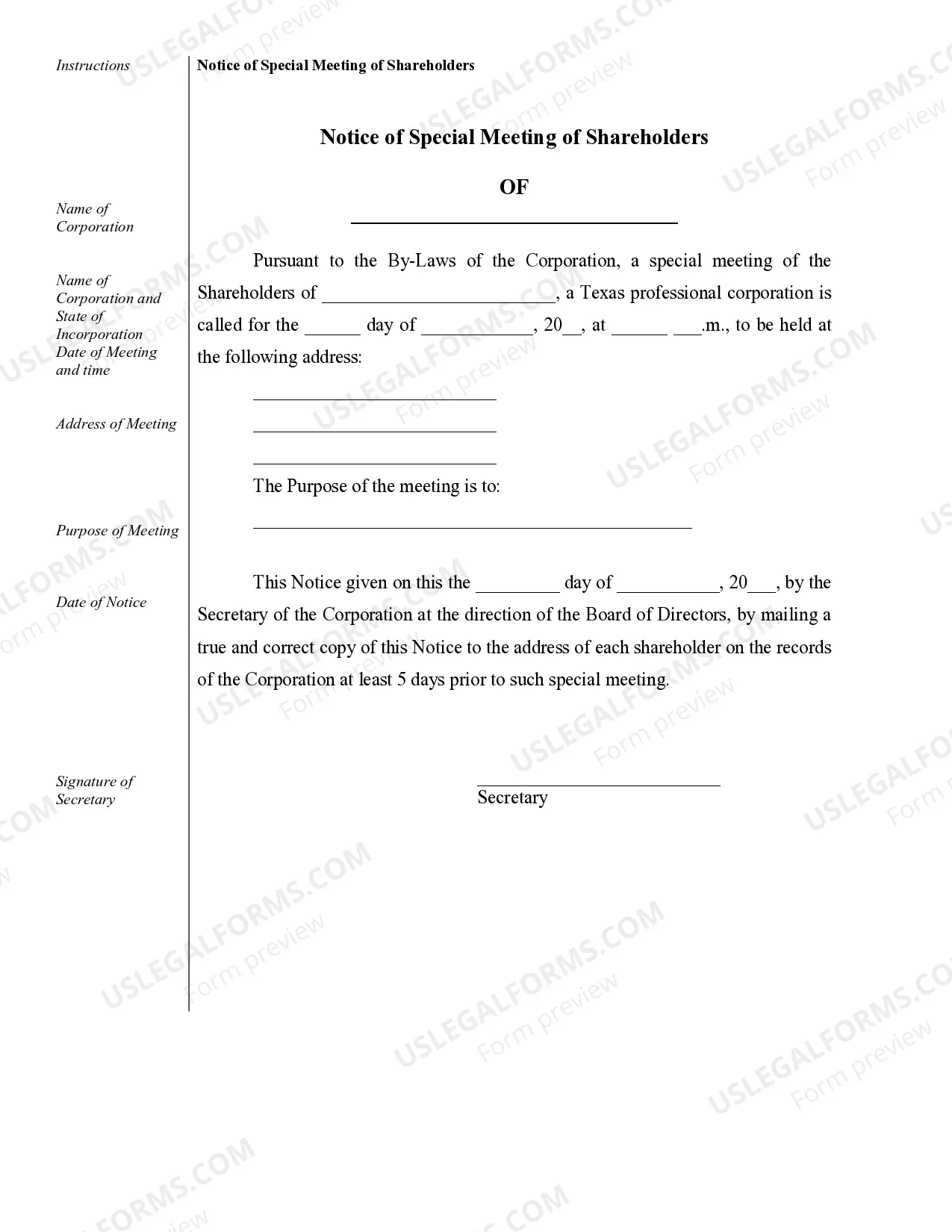

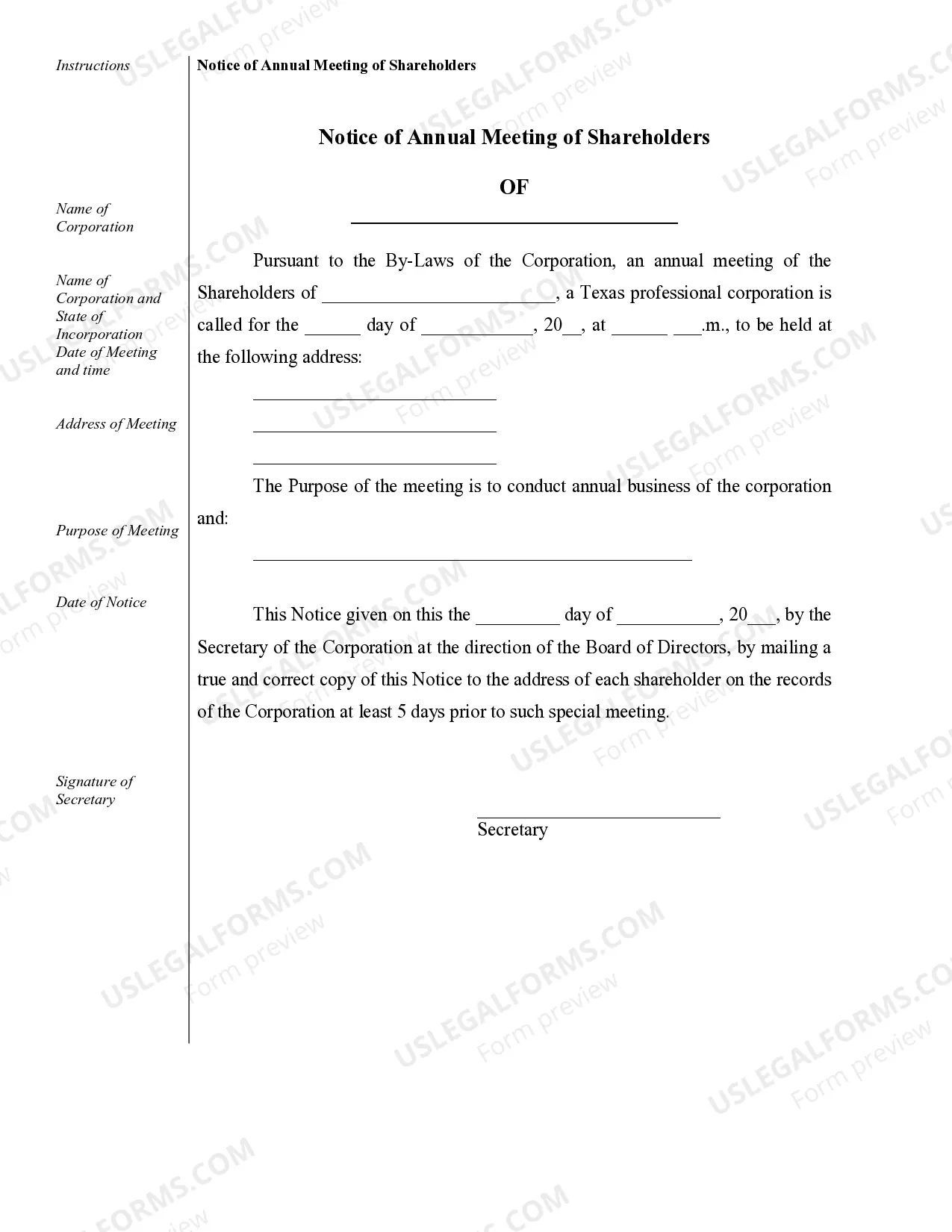

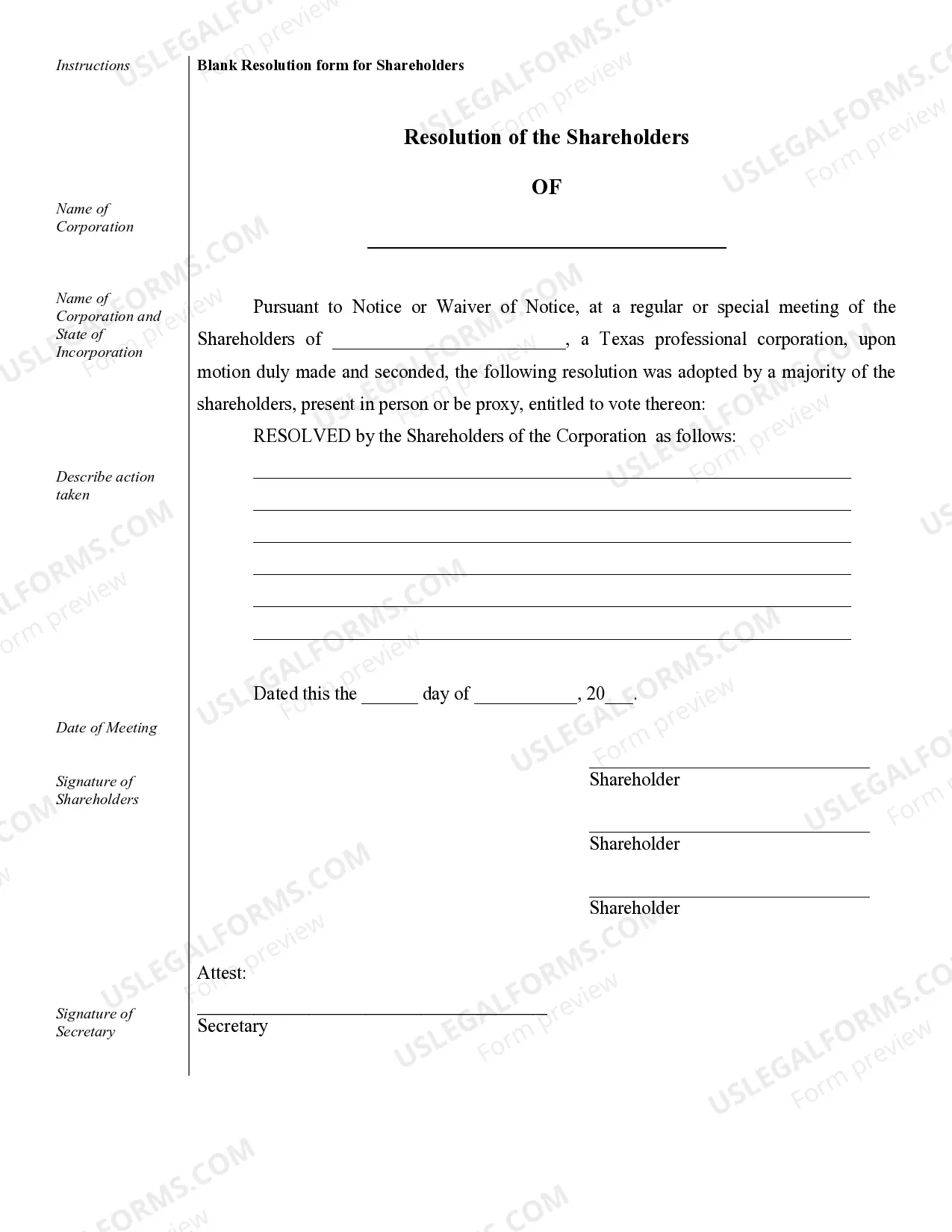

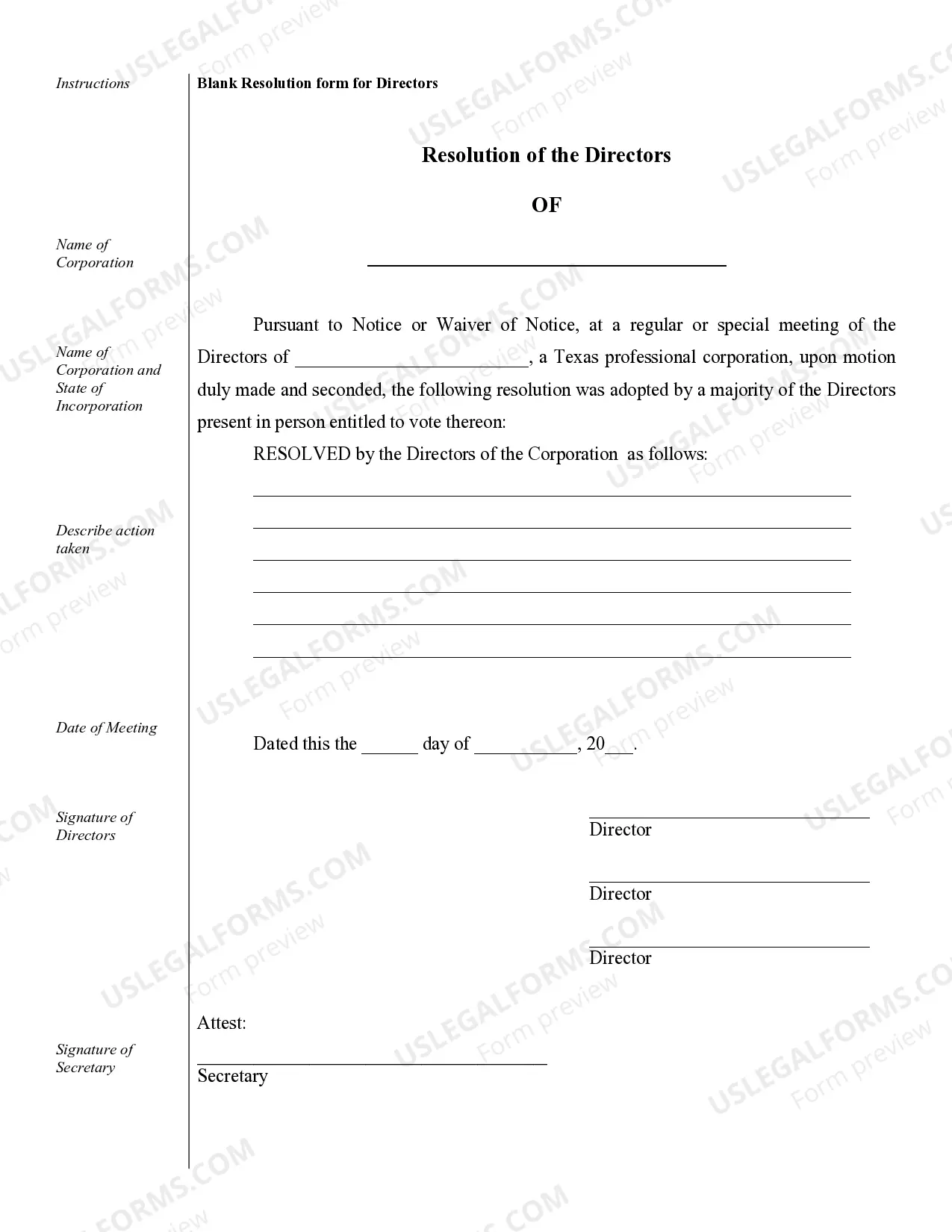

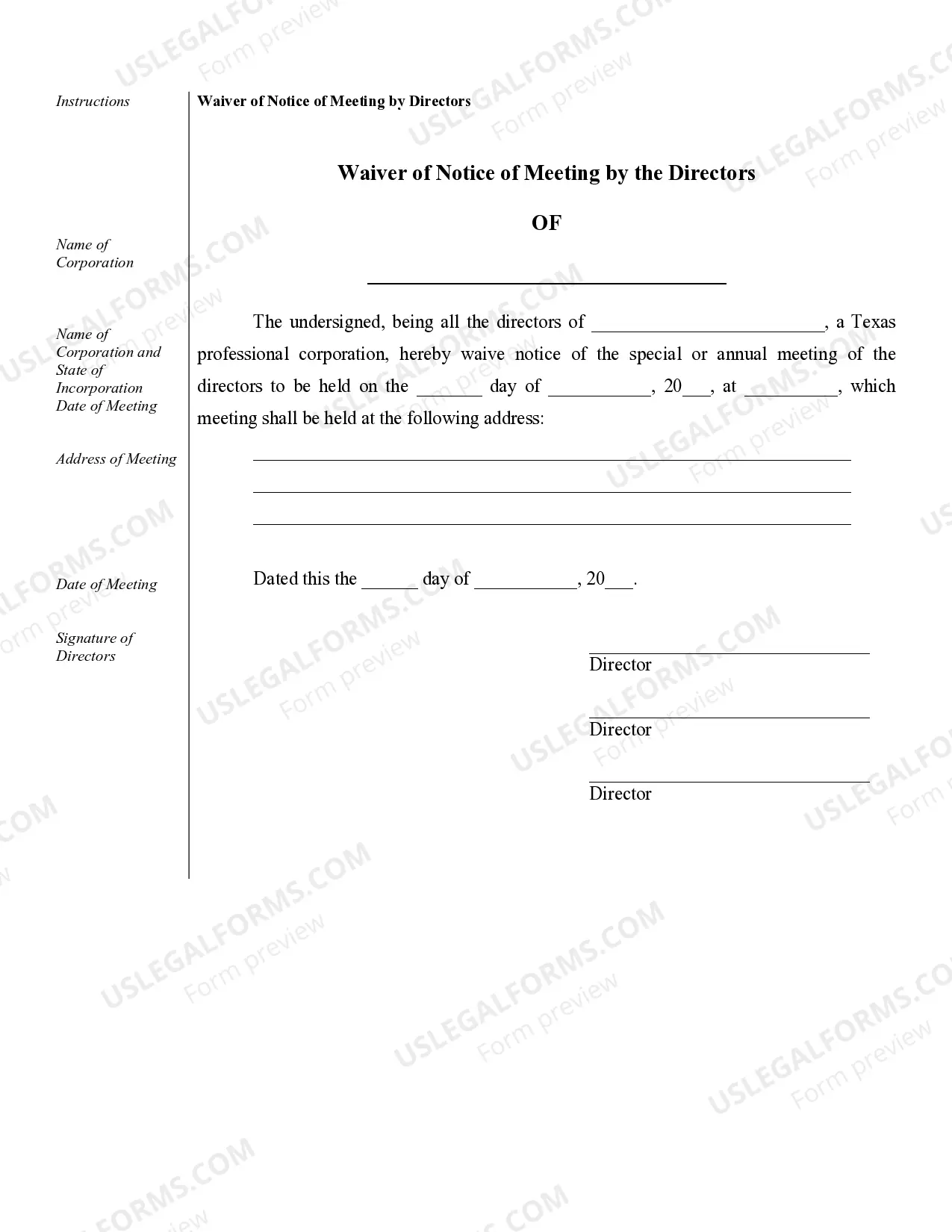

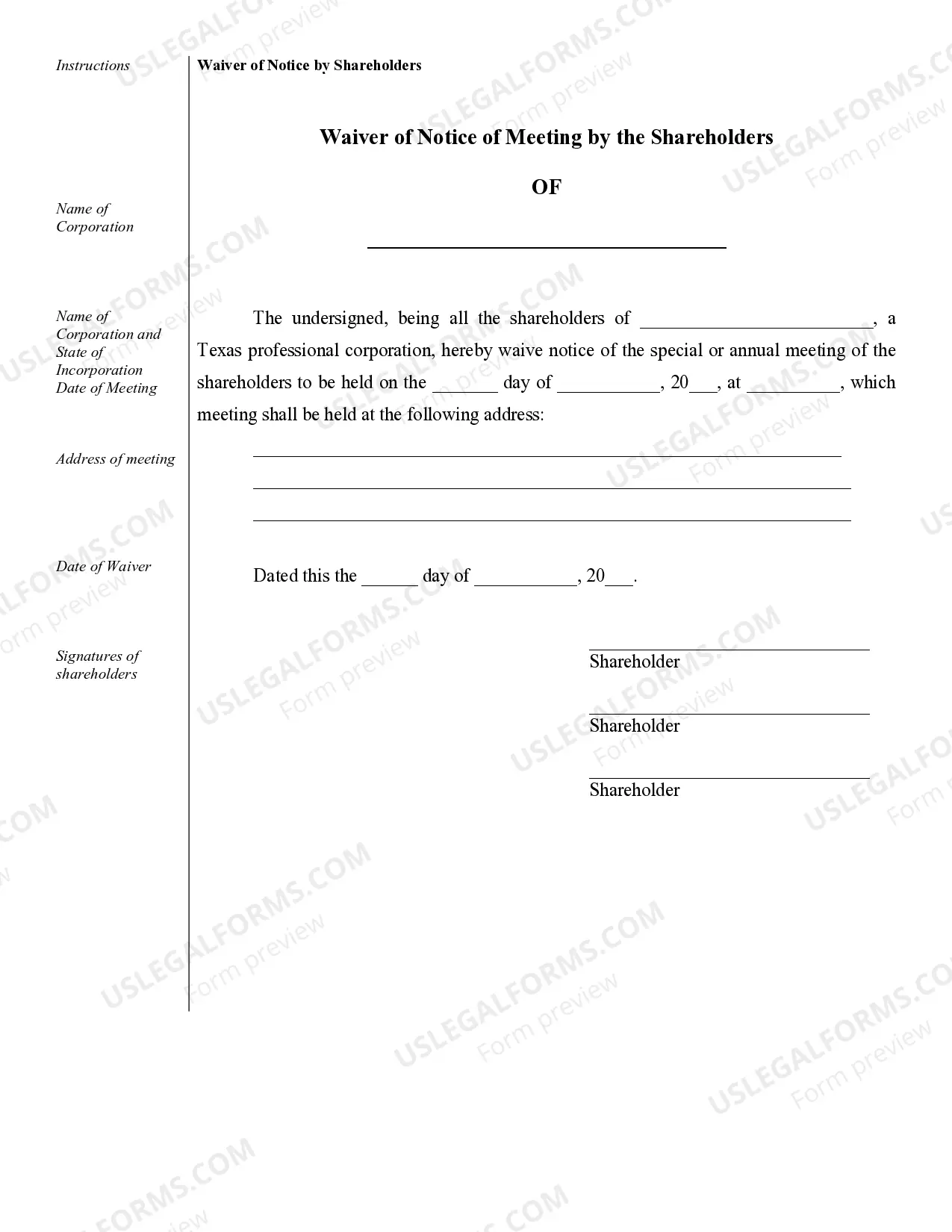

Collin Sample Corporate Records for a Texas Professional Corporation serve as crucial documents that provide a comprehensive overview of the company's essential information, activities, and legal compliance. These records showcase the transparency and organizational structure of the corporation, making them vital for maintaining legal standing, managing operations, and ensuring accountability. Here, we will explore the various types of Collin Sample Corporate Records applicable to a Texas Professional Corporation, along with their purposes and significance. 1. Articles of Incorporation: The Articles of Incorporation are the foundational document that establishes the corporation as a legal entity. They include key details such as the corporation's name, purpose, registered agent information, and the number and type of authorized shares. These records are required for incorporating a Texas Professional Corporation and must be filed with the Secretary of State. 2. Bylaws: Bylaws are the rules and regulations that outline the internal governance and operational procedures of the corporation. These records typically cover areas such as meetings, decision-making processes, officer roles and responsibilities, and shareholder rights. Bylaws act as a framework to ensure consistency, transparency, and compliance within the corporation. 3. Shareholder Agreements: Shareholder agreements are contracts between the corporation and its shareholders, stipulating their rights, obligations, and ownership interests. These records establish guidelines for various crucial aspects, including share transfer restrictions, dividend distribution policies, decision-making mechanisms, and dispute resolution methods. Shareholder agreements provide clarity and avoid potential conflicts among shareholders. 4. Stock Certificates and Ledger: Stock certificates represent ownership in the corporation and serve as evidence of shareholders' equity interests. These certificates specify the number of shares held by each shareholder. The stock ledger is a record where all the issued stock certificates and transfer information are maintained, ensuring accurate ownership details and facilitating any future stock transfers. 5. Annual Reports: Annual reports are essential records that provide an overview of the corporation's financial performance, including income statements, balance sheets, and cash flow statements. These reports demonstrate the corporation's financial solvency and compliance with reporting requirements. They are typically filed with the Secretary of State and play a crucial role in maintaining the corporation's legal standing. 6. Meeting Minutes: Meeting minutes are detailed records of the discussions, decisions, and actions taken during board of directors' meetings, shareholder meetings, and committee meetings. These records document voting outcomes, resolutions, and any matters requiring attention or follow-up actions. Meeting minutes provide an accurate historical record and evidence of compliance with corporate formalities. 7. Shareholder and Director Resolutions: Resolutions refer to formal decisions made by either the board of directors or the shareholders for significant matters affecting the corporation. These resolutions are recorded and included in the corporate record book. They serve as evidence of the corporation's decision-making process and legal compliance. By diligently maintaining all these Collin Sample Corporate Records, a Texas Professional Corporation can ensure compliance with legal requirements, enhance operational integrity, and establish a solid foundation for future growth and success.Collin Sample Corporate Records for a Texas Professional Corporation serve as crucial documents that provide a comprehensive overview of the company's essential information, activities, and legal compliance. These records showcase the transparency and organizational structure of the corporation, making them vital for maintaining legal standing, managing operations, and ensuring accountability. Here, we will explore the various types of Collin Sample Corporate Records applicable to a Texas Professional Corporation, along with their purposes and significance. 1. Articles of Incorporation: The Articles of Incorporation are the foundational document that establishes the corporation as a legal entity. They include key details such as the corporation's name, purpose, registered agent information, and the number and type of authorized shares. These records are required for incorporating a Texas Professional Corporation and must be filed with the Secretary of State. 2. Bylaws: Bylaws are the rules and regulations that outline the internal governance and operational procedures of the corporation. These records typically cover areas such as meetings, decision-making processes, officer roles and responsibilities, and shareholder rights. Bylaws act as a framework to ensure consistency, transparency, and compliance within the corporation. 3. Shareholder Agreements: Shareholder agreements are contracts between the corporation and its shareholders, stipulating their rights, obligations, and ownership interests. These records establish guidelines for various crucial aspects, including share transfer restrictions, dividend distribution policies, decision-making mechanisms, and dispute resolution methods. Shareholder agreements provide clarity and avoid potential conflicts among shareholders. 4. Stock Certificates and Ledger: Stock certificates represent ownership in the corporation and serve as evidence of shareholders' equity interests. These certificates specify the number of shares held by each shareholder. The stock ledger is a record where all the issued stock certificates and transfer information are maintained, ensuring accurate ownership details and facilitating any future stock transfers. 5. Annual Reports: Annual reports are essential records that provide an overview of the corporation's financial performance, including income statements, balance sheets, and cash flow statements. These reports demonstrate the corporation's financial solvency and compliance with reporting requirements. They are typically filed with the Secretary of State and play a crucial role in maintaining the corporation's legal standing. 6. Meeting Minutes: Meeting minutes are detailed records of the discussions, decisions, and actions taken during board of directors' meetings, shareholder meetings, and committee meetings. These records document voting outcomes, resolutions, and any matters requiring attention or follow-up actions. Meeting minutes provide an accurate historical record and evidence of compliance with corporate formalities. 7. Shareholder and Director Resolutions: Resolutions refer to formal decisions made by either the board of directors or the shareholders for significant matters affecting the corporation. These resolutions are recorded and included in the corporate record book. They serve as evidence of the corporation's decision-making process and legal compliance. By diligently maintaining all these Collin Sample Corporate Records, a Texas Professional Corporation can ensure compliance with legal requirements, enhance operational integrity, and establish a solid foundation for future growth and success.