Sample Corporate Notices of Meetings, Resolutions, Simple Stock Ledger & Certificate.

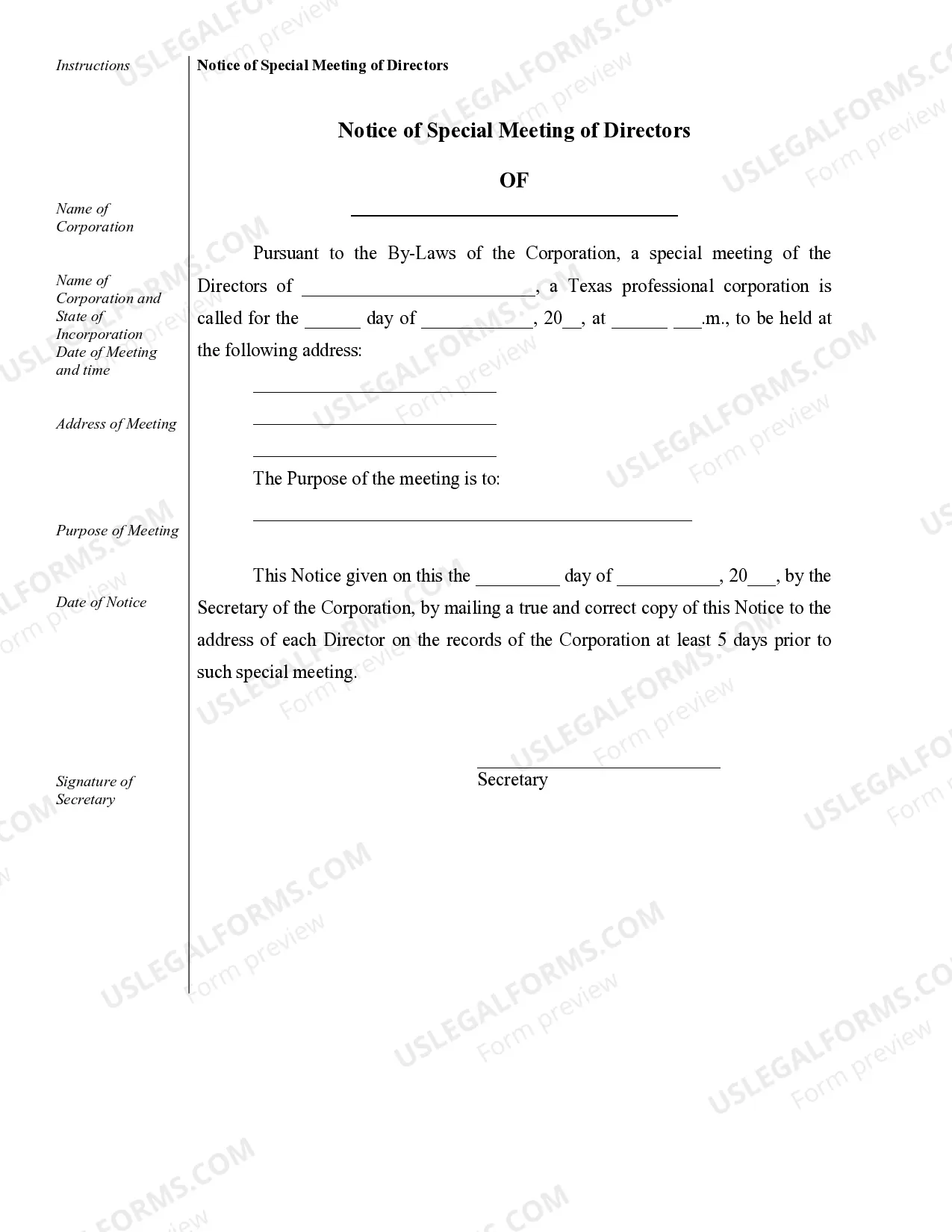

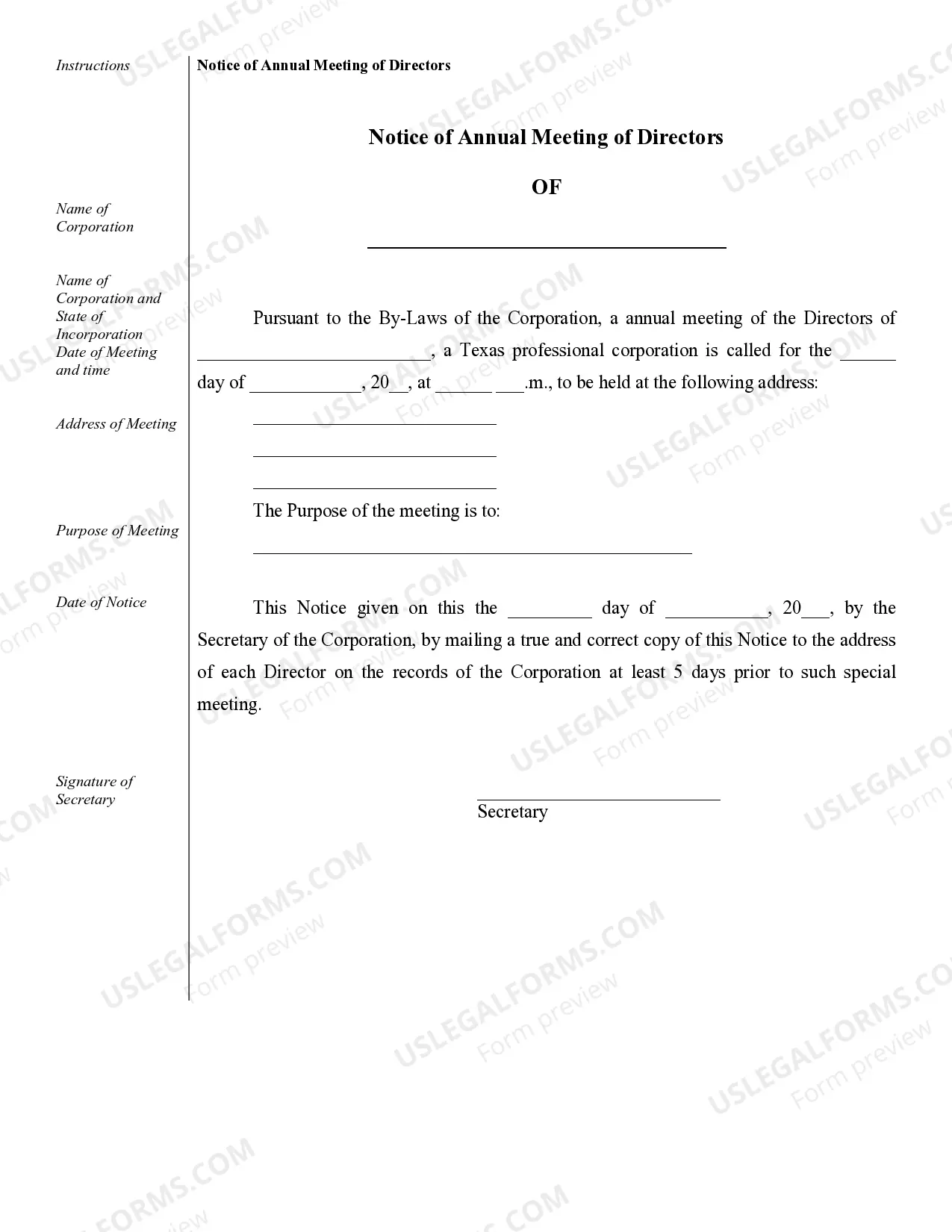

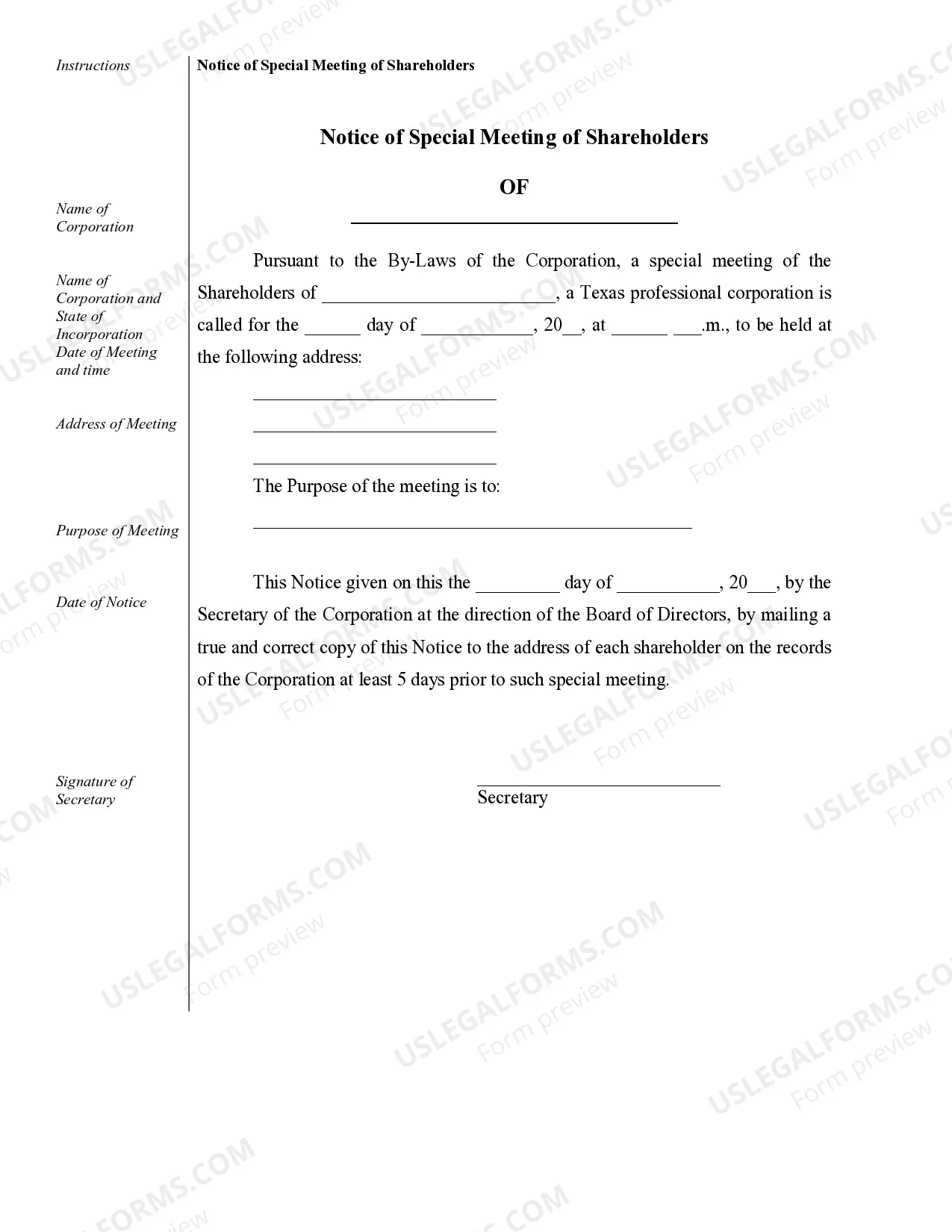

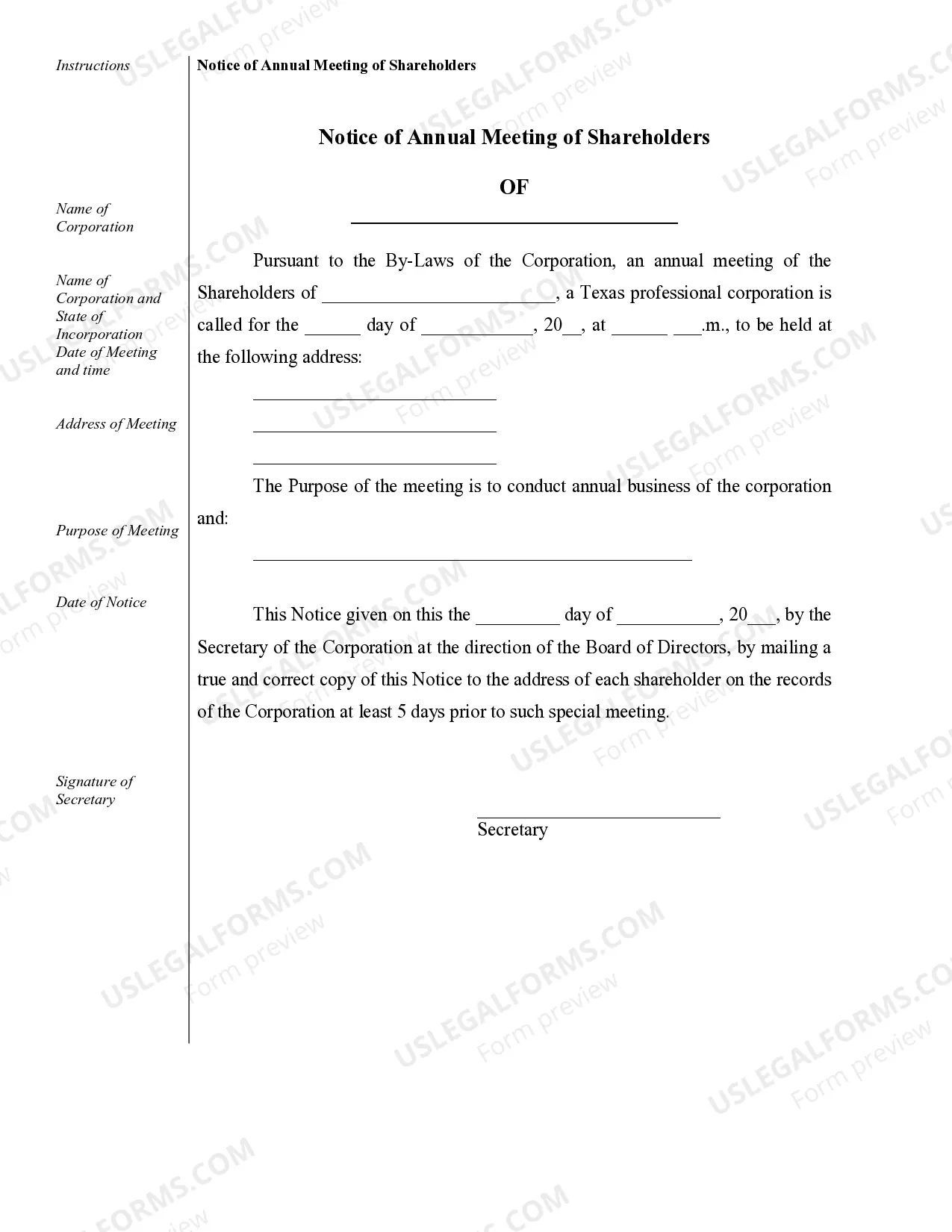

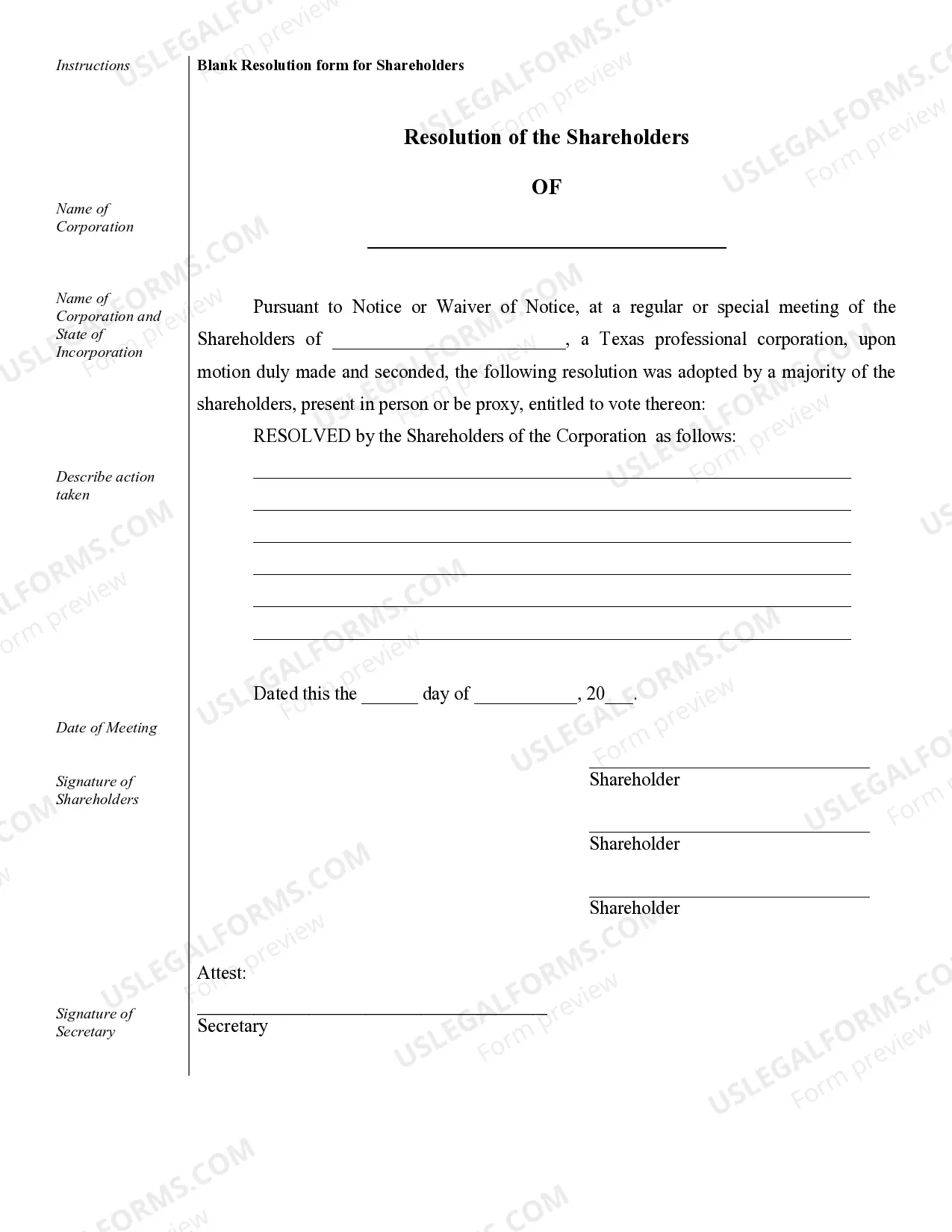

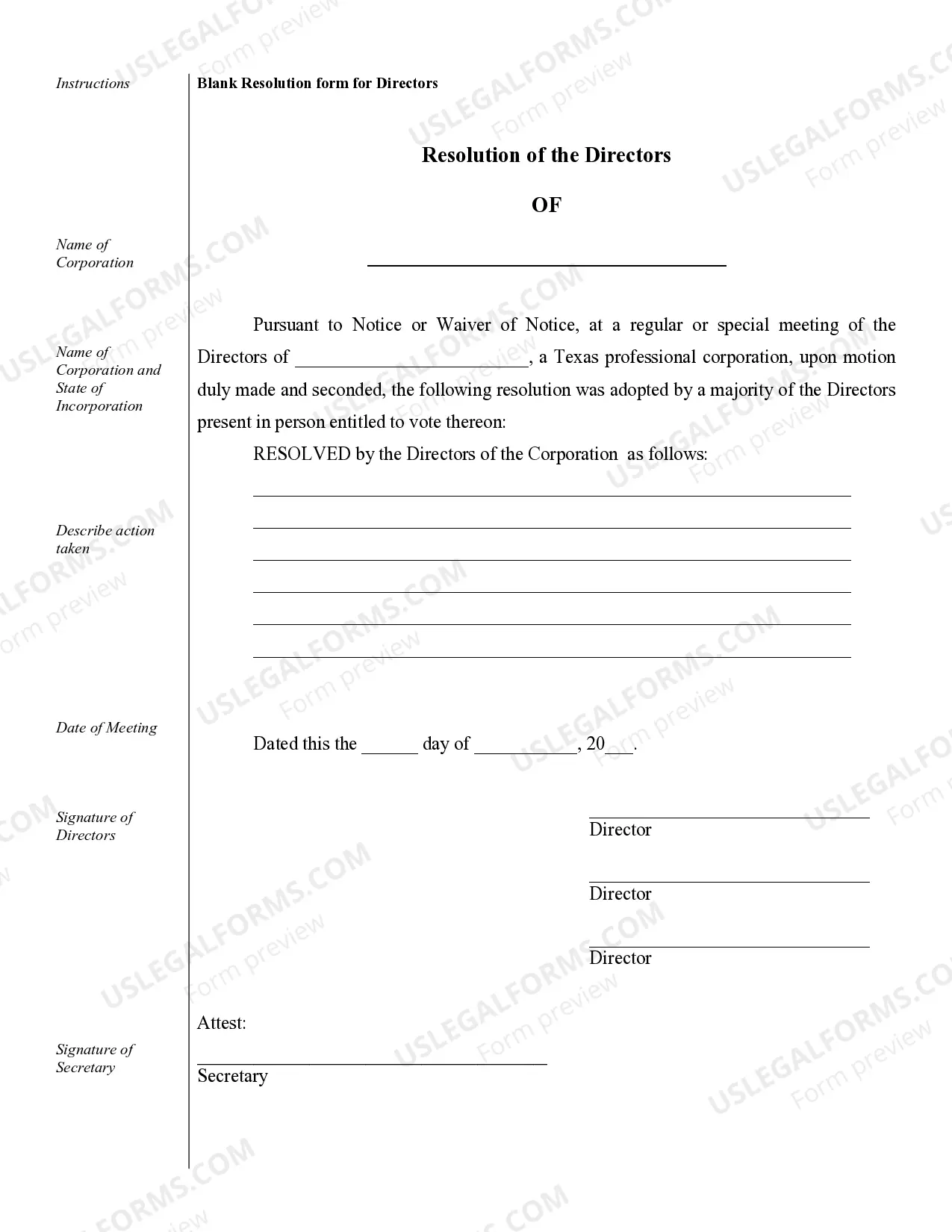

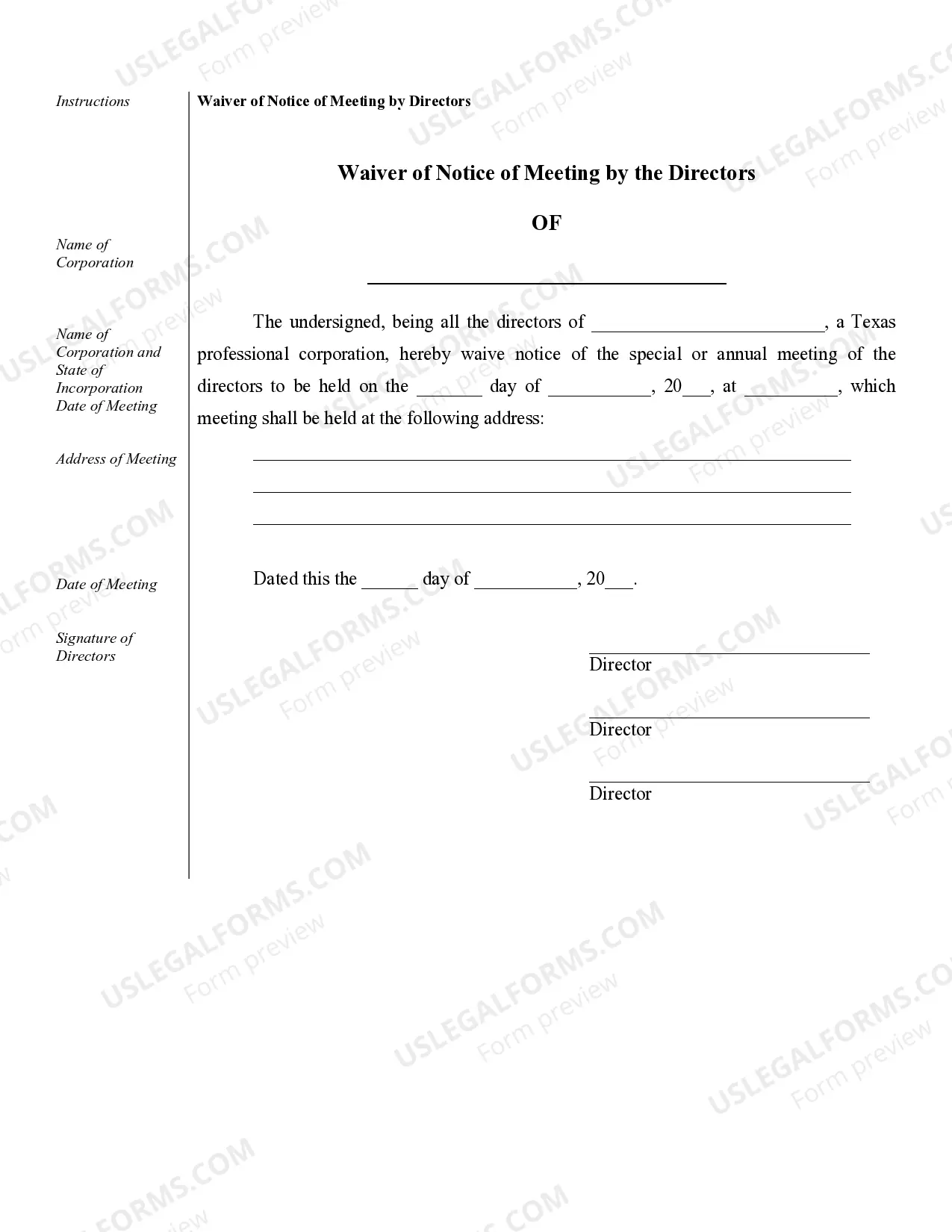

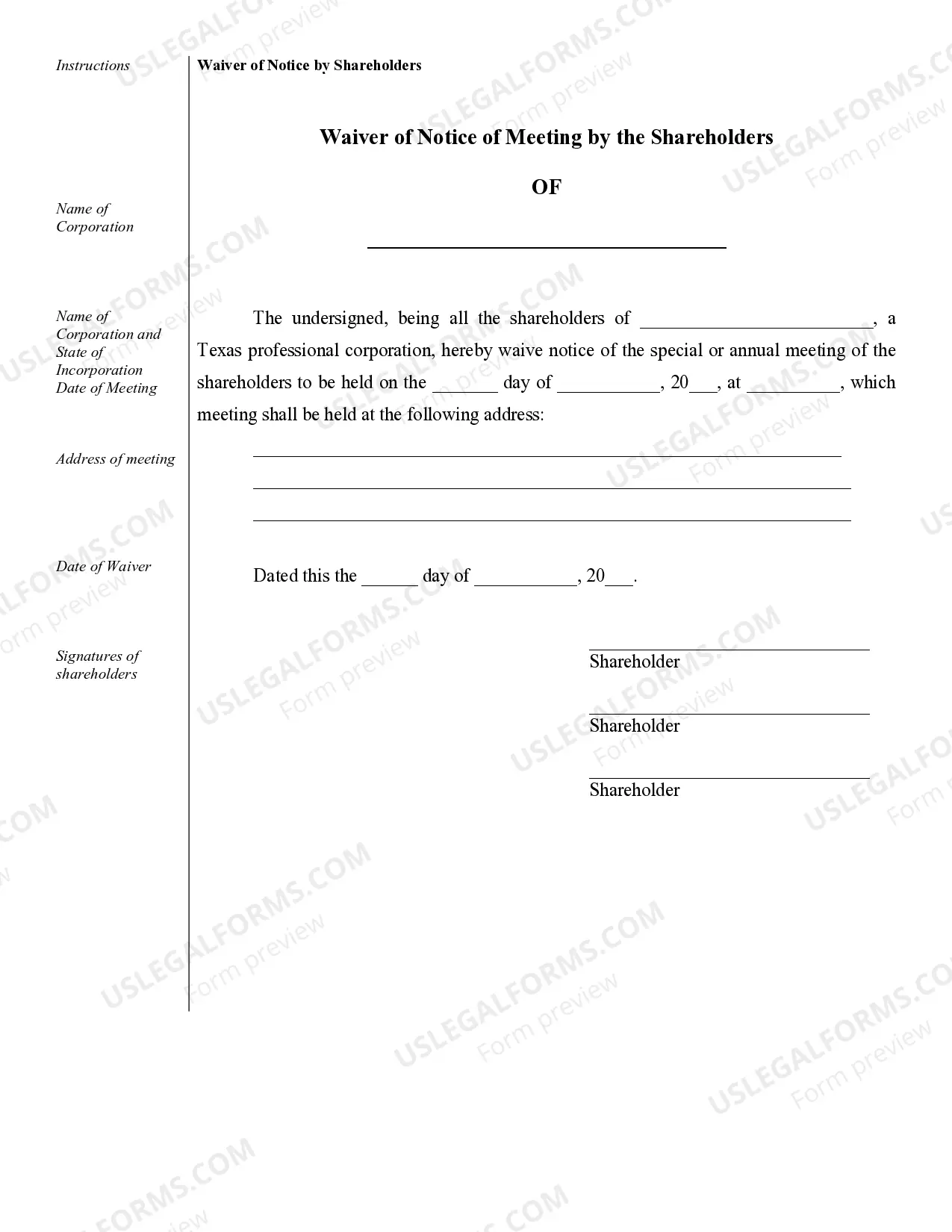

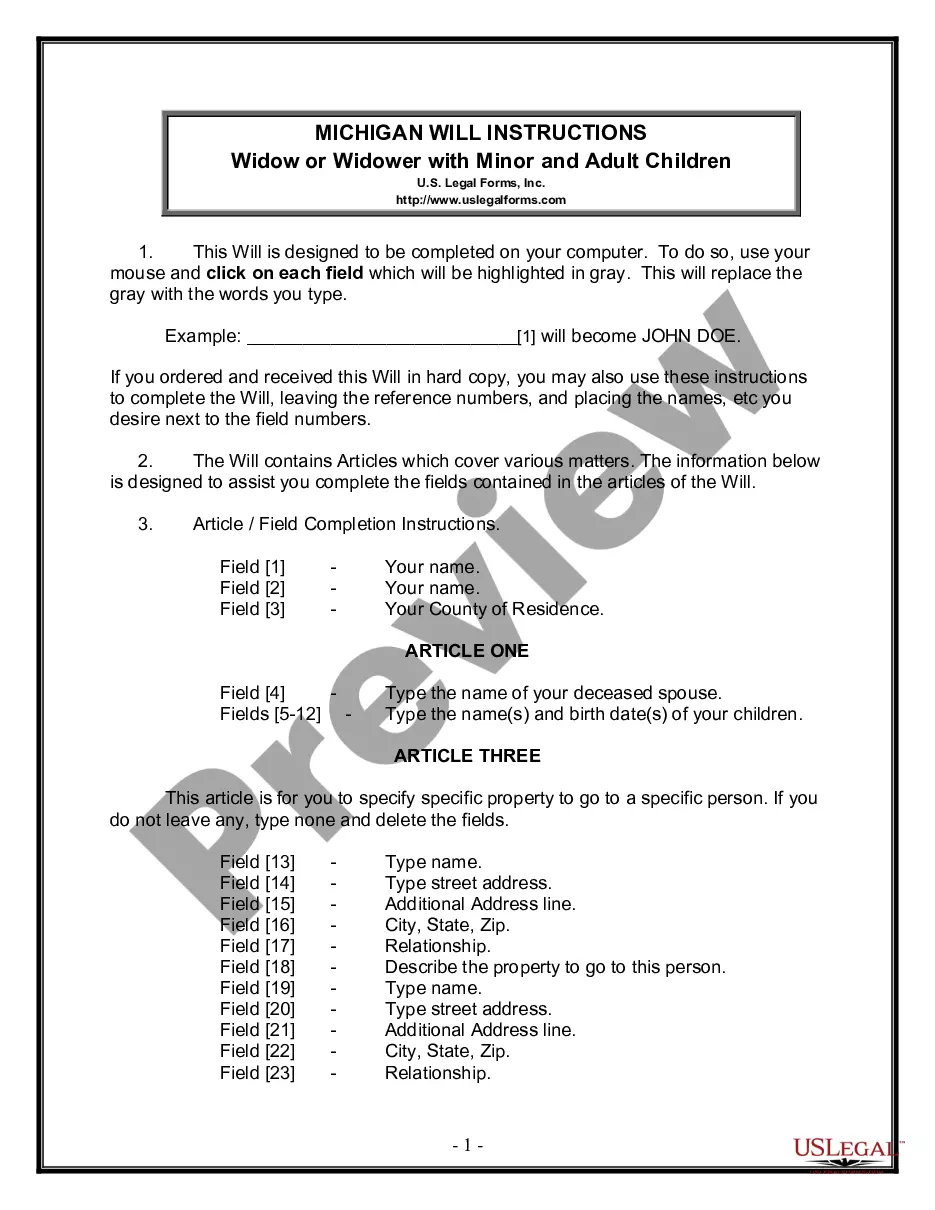

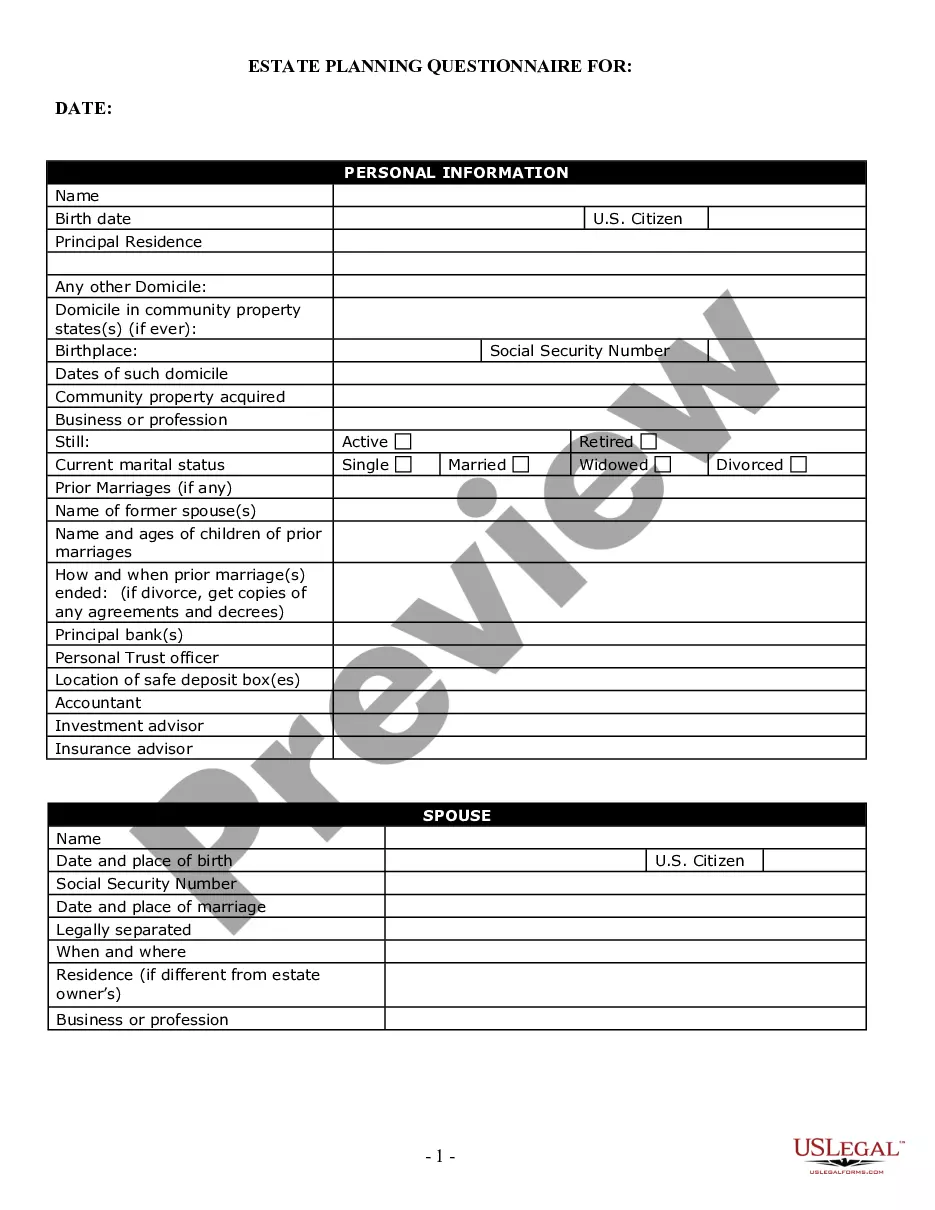

Corpus Christi Sample Corporate Records for a Texas Professional Corporation serve as essential documentation to keep the company compliant with state regulations and maintain transparency in all business operations. These records provide a detailed account of the corporation's activities, financial transactions, and corporate governance. Here are some of the different types of Corpus Christi Sample Corporate Records that should be maintained: 1. Articles of Incorporation: These are the official documents submitted to the Texas Secretary of State to establish the professional corporation. They contain essential information such as the corporation's name, purpose, registered agent details, and authorized shares. 2. Bylaws: The bylaws of a professional corporation outline its internal organization and governance structure. They establish guidelines for shareholder meetings, director qualifications, voting procedures, and other corporate matters. 3. Shareholder Agreement: This agreement governs the relationship between shareholders and outlines their rights, responsibilities, and restrictions. It may include provisions related to share transfers, dividend distributions, preemptive rights, and dispute resolution mechanisms. 4. Meeting Minutes: Detailed records of all shareholder and board of directors' meetings, including annual meetings and special sessions, should be maintained. These minutes should document attendees, decisions made, voting outcomes, and other significant discussions. 5. Shareholder and Director Register: A register containing relevant information about each shareholder and director, such as their name, contact details, and shareholdings, should be updated regularly. This helps track ownership changes and contact persons for corporate communication. 6. Financial Statements: Comprehensive financial records, including balance sheets, income statements, and cash flow statements, should be prepared periodically. These statements provide an overview of the corporation's financial health, performance, and trends over time. 7. Stock Ledger: The stock ledger serves as a record of all stock issuance, transfers, cancellations, and ownership changes. It should include details like the shareholder's name, number of shares held, certificate numbers, and dates of transactions. 8. Tax Records: Documentation related to tax filings, including federal, state, and local tax returns, supporting schedules, and payment records should be maintained. This ensures compliance with tax laws and facilitates audits or inquiries, if necessary. 9. Licenses and Permits: Copies of any licenses or permits obtained by the professional corporation, such as professional licenses, should be included as part of the corporate records to demonstrate legal compliance. 10. Contracts and Agreements: Any legally binding contracts or agreements entered into by the corporation should be filed and kept as part of the corporate records. Examples may include client contracts, vendor agreements, lease agreements, and employment contracts. It is crucial for a professional corporation in Corpus Christi, Texas, to maintain accurate and up-to-date corporate records as failure to do so may result in legal and operational consequences. These records enable transparent decision-making, protect shareholders' interests, and ensure compliance with corporate and regulatory requirements.Corpus Christi Sample Corporate Records for a Texas Professional Corporation serve as essential documentation to keep the company compliant with state regulations and maintain transparency in all business operations. These records provide a detailed account of the corporation's activities, financial transactions, and corporate governance. Here are some of the different types of Corpus Christi Sample Corporate Records that should be maintained: 1. Articles of Incorporation: These are the official documents submitted to the Texas Secretary of State to establish the professional corporation. They contain essential information such as the corporation's name, purpose, registered agent details, and authorized shares. 2. Bylaws: The bylaws of a professional corporation outline its internal organization and governance structure. They establish guidelines for shareholder meetings, director qualifications, voting procedures, and other corporate matters. 3. Shareholder Agreement: This agreement governs the relationship between shareholders and outlines their rights, responsibilities, and restrictions. It may include provisions related to share transfers, dividend distributions, preemptive rights, and dispute resolution mechanisms. 4. Meeting Minutes: Detailed records of all shareholder and board of directors' meetings, including annual meetings and special sessions, should be maintained. These minutes should document attendees, decisions made, voting outcomes, and other significant discussions. 5. Shareholder and Director Register: A register containing relevant information about each shareholder and director, such as their name, contact details, and shareholdings, should be updated regularly. This helps track ownership changes and contact persons for corporate communication. 6. Financial Statements: Comprehensive financial records, including balance sheets, income statements, and cash flow statements, should be prepared periodically. These statements provide an overview of the corporation's financial health, performance, and trends over time. 7. Stock Ledger: The stock ledger serves as a record of all stock issuance, transfers, cancellations, and ownership changes. It should include details like the shareholder's name, number of shares held, certificate numbers, and dates of transactions. 8. Tax Records: Documentation related to tax filings, including federal, state, and local tax returns, supporting schedules, and payment records should be maintained. This ensures compliance with tax laws and facilitates audits or inquiries, if necessary. 9. Licenses and Permits: Copies of any licenses or permits obtained by the professional corporation, such as professional licenses, should be included as part of the corporate records to demonstrate legal compliance. 10. Contracts and Agreements: Any legally binding contracts or agreements entered into by the corporation should be filed and kept as part of the corporate records. Examples may include client contracts, vendor agreements, lease agreements, and employment contracts. It is crucial for a professional corporation in Corpus Christi, Texas, to maintain accurate and up-to-date corporate records as failure to do so may result in legal and operational consequences. These records enable transparent decision-making, protect shareholders' interests, and ensure compliance with corporate and regulatory requirements.