Sample Corporate Notices of Meetings, Resolutions, Simple Stock Ledger & Certificate.

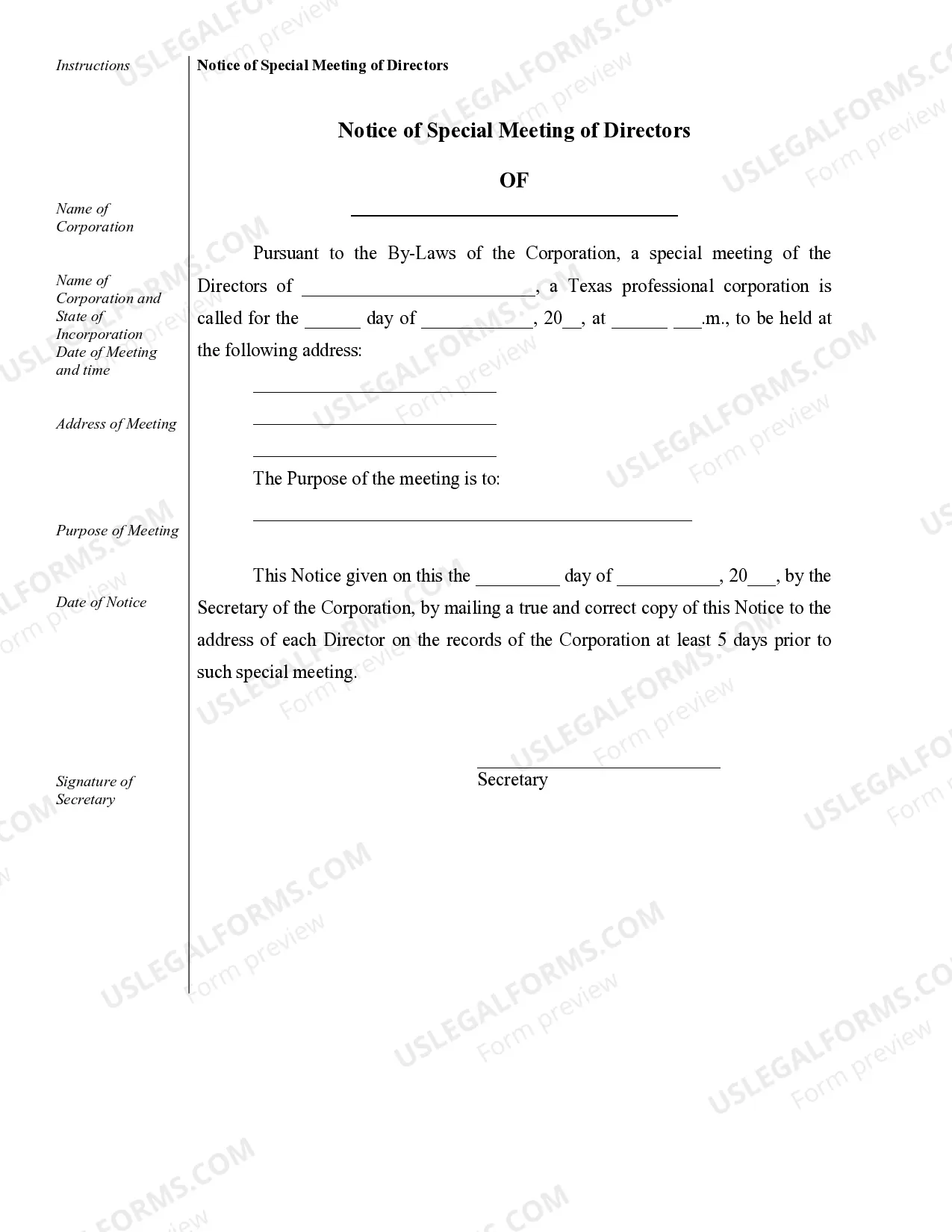

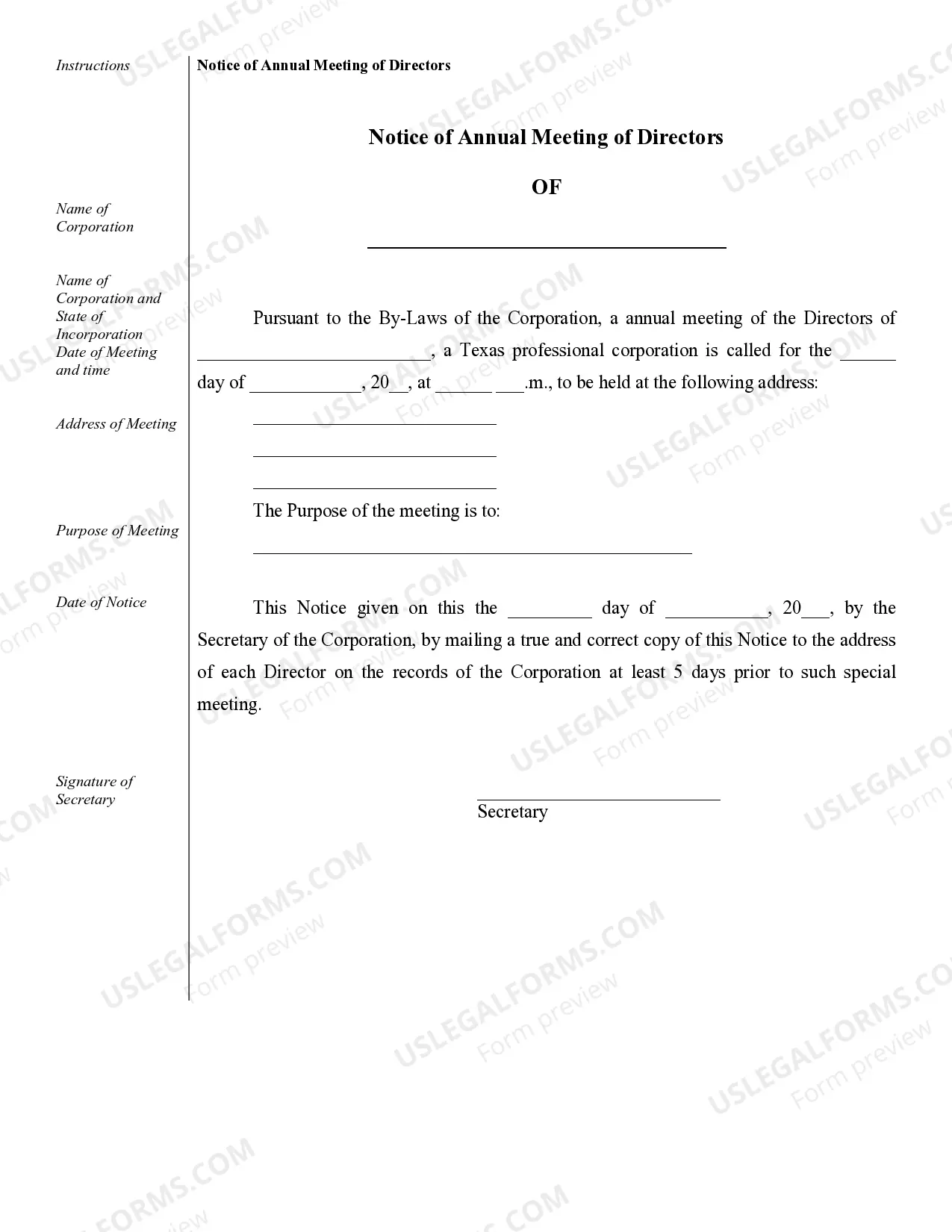

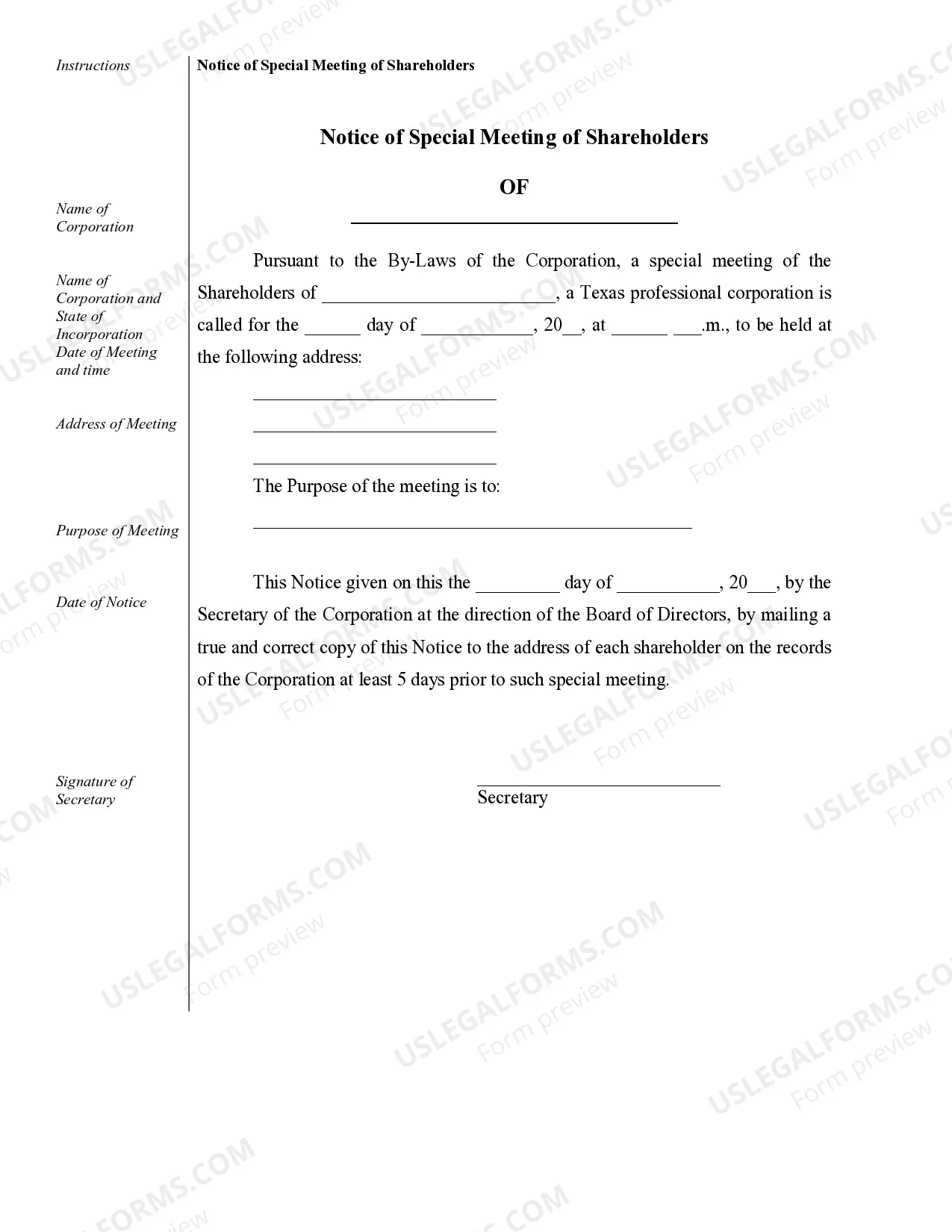

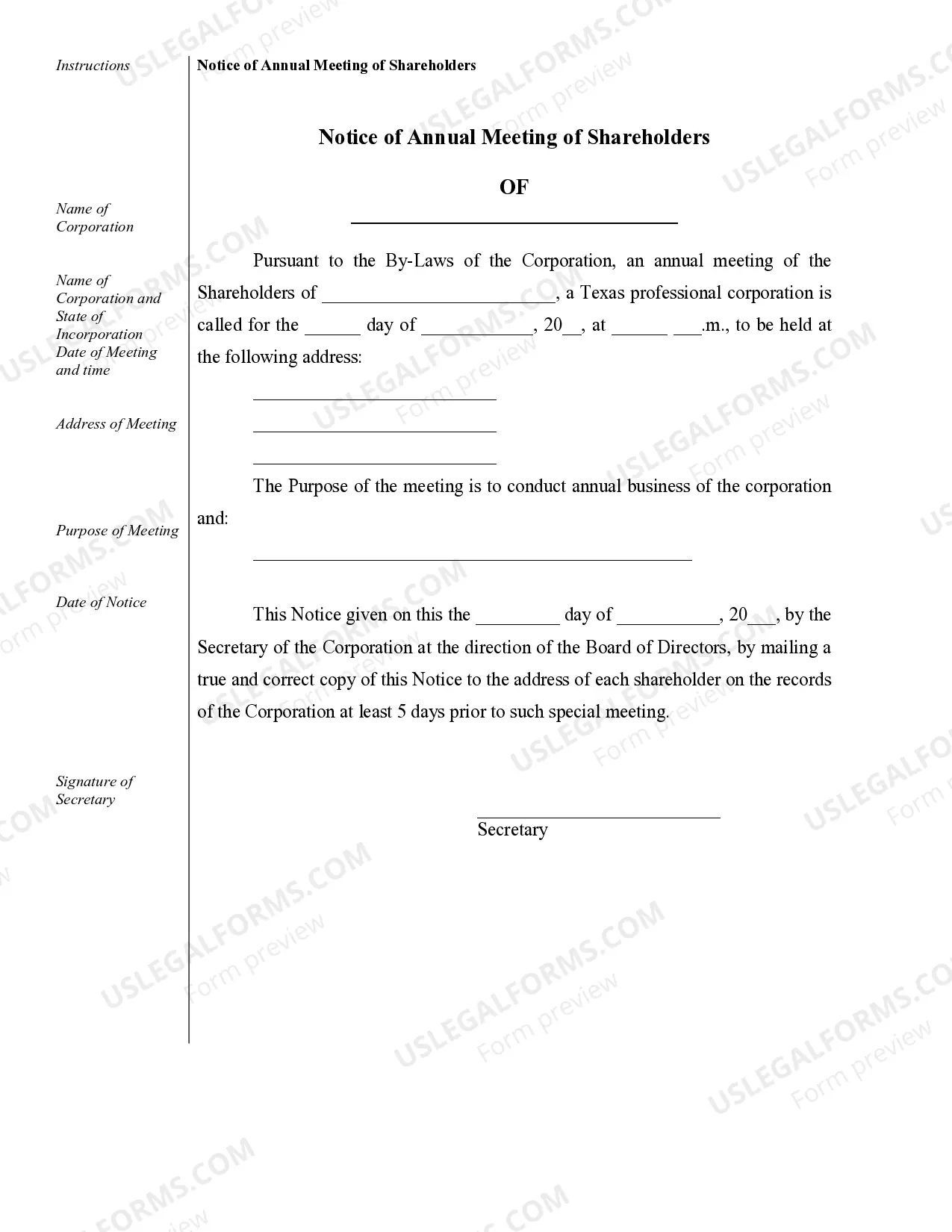

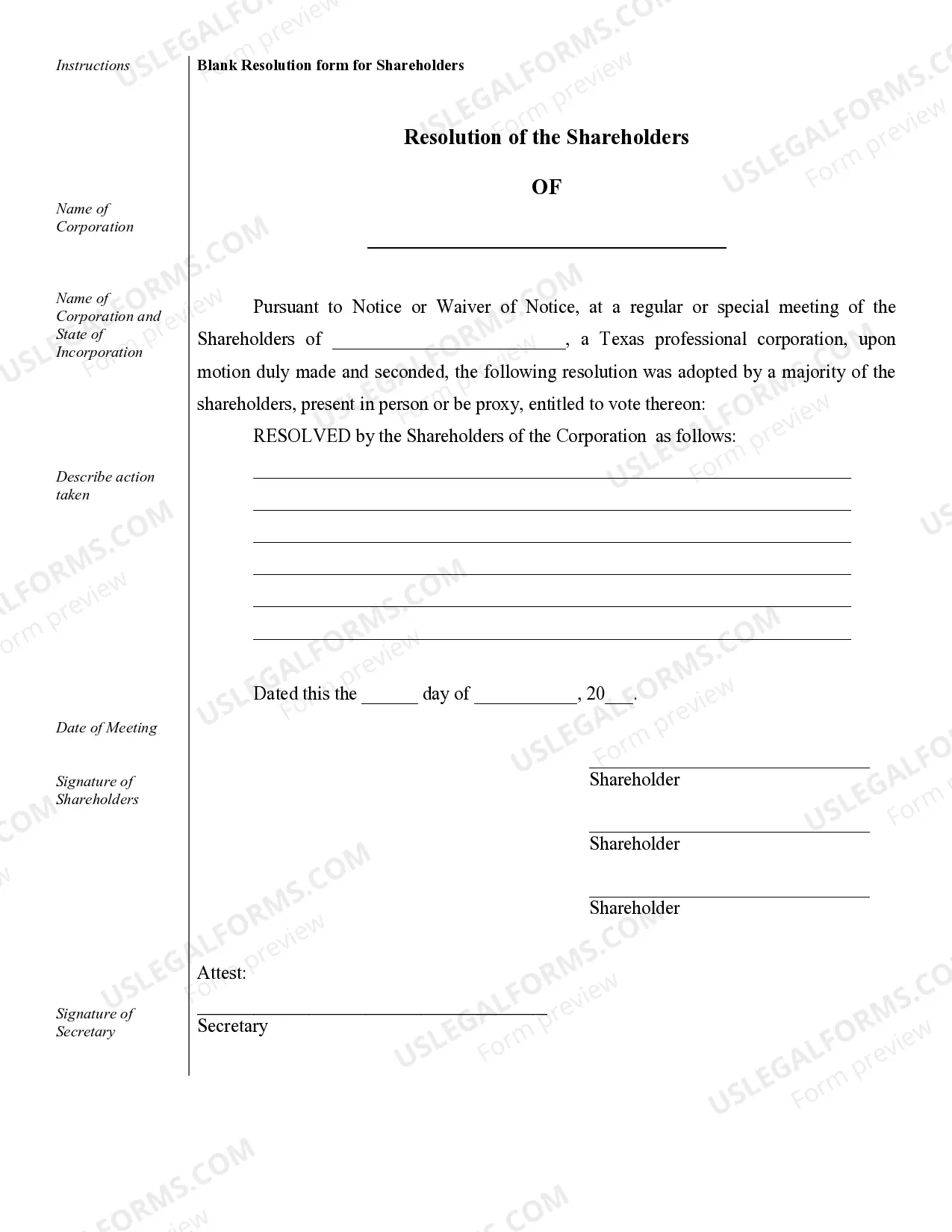

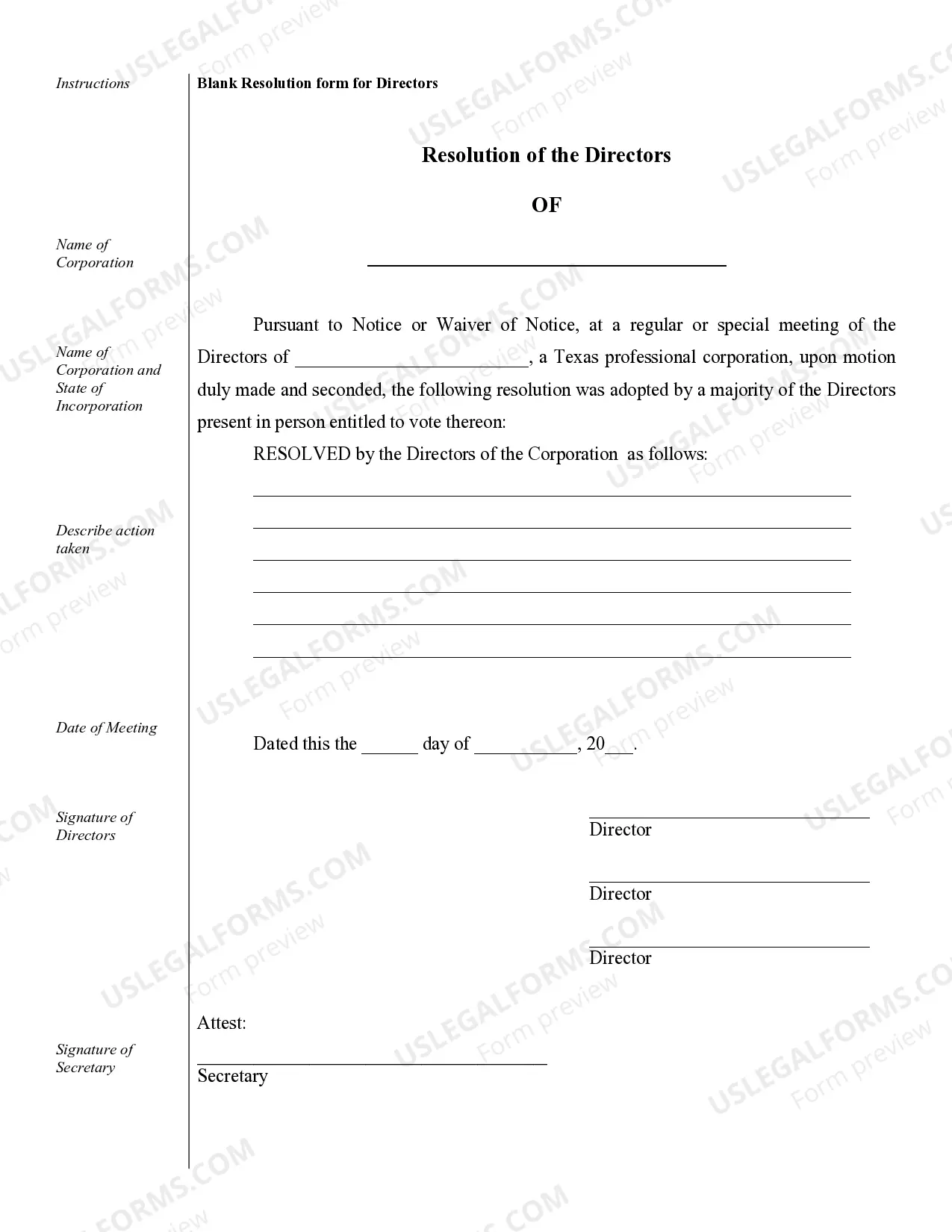

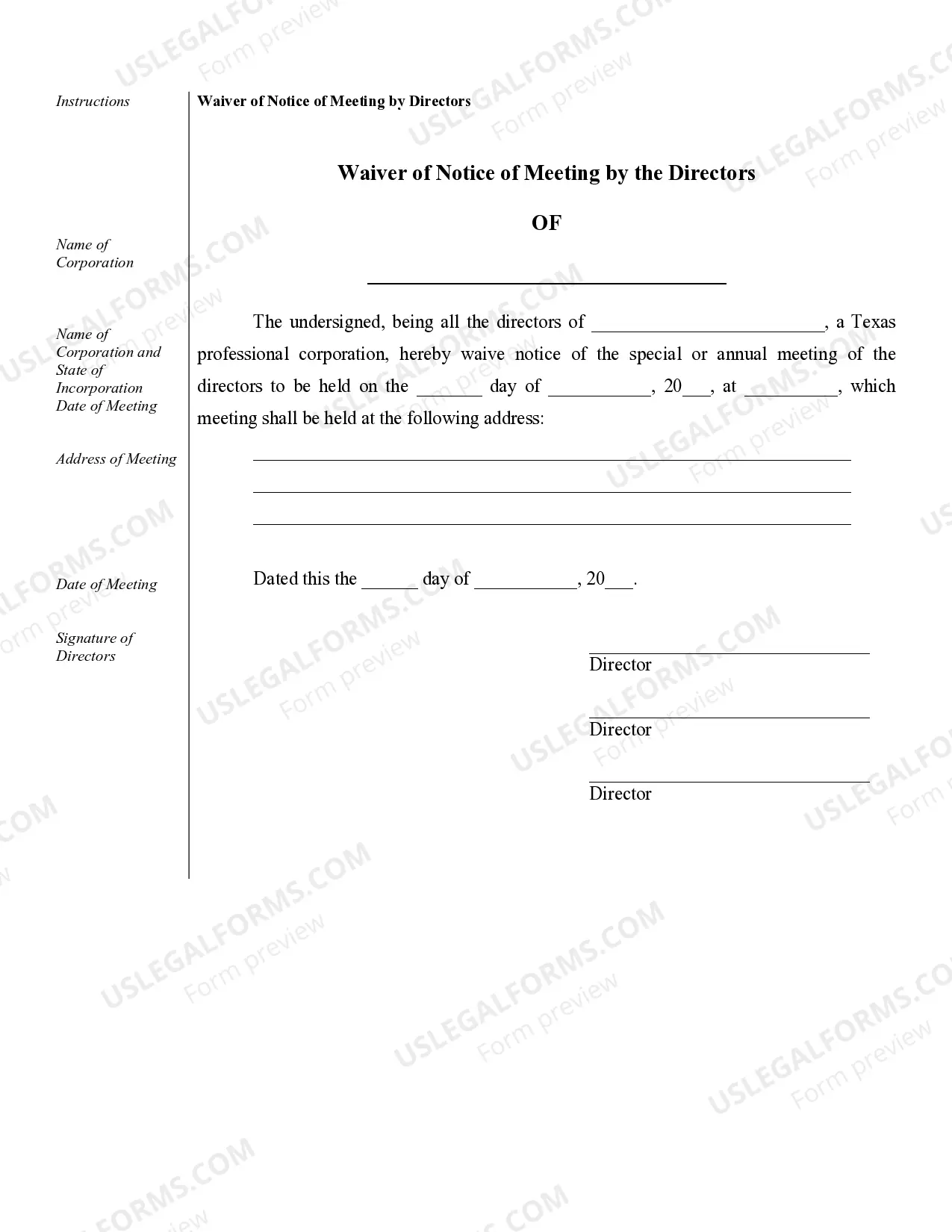

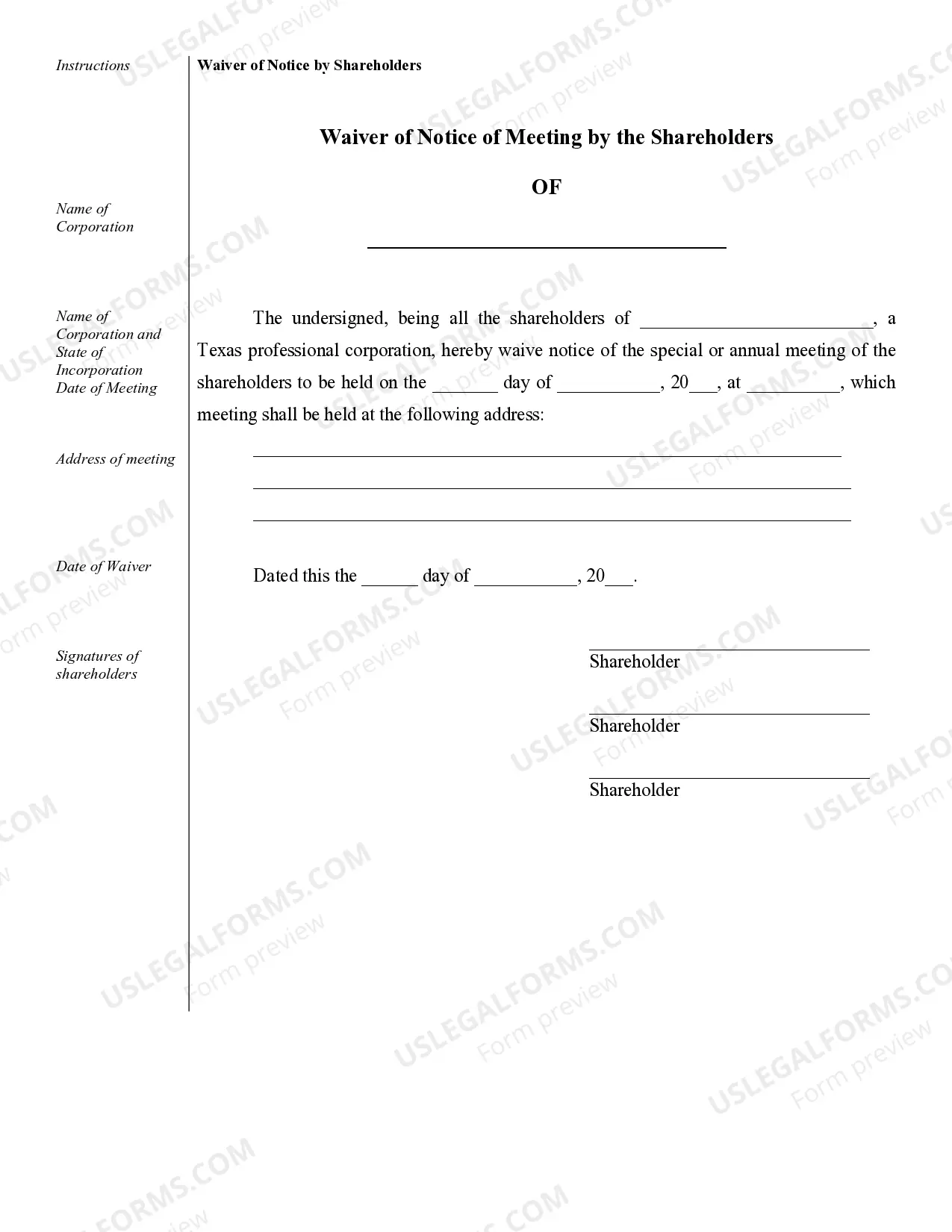

Dallas Sample Corporate Records is a term used to refer to the official documentation and records that a Texas Professional Corporation must maintain to comply with corporate governance rules and regulations. These records are crucial for maintaining transparency, accountability, and legal compliance within the corporation. Keywords: Dallas, sample corporate records, Texas Professional Corporation, documentation, records, corporate governance, transparency, accountability, legal compliance. When it comes to Dallas Sample Corporate Records for a Texas Professional Corporation, there are several types of records that must be prepared, organized, and maintained. These records serve as evidence of the corporation's existence, activities, and decision-making processes. Here are some important types of corporate records to consider: 1. Articles of Incorporation: This is the primary document that creates the Texas Professional Corporation and includes important information such as the corporation's name, purpose, registered agent, and duration. 2. Bylaws: Bylaws are the governing rules and regulations that outline the internal operations of the corporation. They include provisions on matters such as elections, director and shareholder meetings, voting rights, and other corporate procedures. 3. Board of Directors' Meeting Minutes: These are detailed records that document the discussions, decisions, and actions taken during board meetings. Meeting minutes should include attendance, voting results, resolutions, and any other relevant discussion points. 4. Shareholder Meeting Minutes: These records document the proceedings of general meetings where shareholders discuss and make decisions on corporate matters such as electing directors, approving financial statements, or voting on important resolutions. 5. Stock Certificates and Stock Ledger: Stock certificates represent ownership in the corporation and should be issued to shareholders. The stock ledger keeps track of the ownership of shares, including information on shareholders' names, addresses, and the number of shares they hold. 6. Financial Statements: These documents include the balance sheet, income statement, and cash flow statement, providing an overview of the corporation's financial position, performance, and cash flows. Financial statements should be prepared regularly and in accordance with generally accepted accounting principles (GAAP). 7. Annual Reports: Texas Professional Corporations are required to file annual reports with the Texas Secretary of State. These reports update information on the corporation's registered agent, directors, and other key details. 8. Tax Returns: The corporation must maintain copies of all filed tax returns, including federal, state, and local tax returns. These records demonstrate compliance with tax regulations and provide a historical record of the corporation's financial activities. 9. Contracts and Agreements: Corporations should keep copies of all contracts and agreements entered into, such as leases, employment contracts, vendor agreements, and client contracts. These documents are essential for clarifying the rights and obligations of the corporation and other parties involved. 10. Intellectual Property Documentation: If the corporation owns trademarks, copyrights, or patents, it should maintain documentation to prove ownership and monitor their validity. Properly organizing and maintaining Dallas Sample Corporate Records for a Texas Professional Corporation is essential for both legal compliance and efficient corporate administration. These records not only provide a historical record of the corporation's activities but also serve as evidence of good corporate governance practices. By keeping thorough and accurate corporate records, a Texas Professional Corporation can ensure transparency, protect shareholder rights, and mitigate potential legal issues.Dallas Sample Corporate Records is a term used to refer to the official documentation and records that a Texas Professional Corporation must maintain to comply with corporate governance rules and regulations. These records are crucial for maintaining transparency, accountability, and legal compliance within the corporation. Keywords: Dallas, sample corporate records, Texas Professional Corporation, documentation, records, corporate governance, transparency, accountability, legal compliance. When it comes to Dallas Sample Corporate Records for a Texas Professional Corporation, there are several types of records that must be prepared, organized, and maintained. These records serve as evidence of the corporation's existence, activities, and decision-making processes. Here are some important types of corporate records to consider: 1. Articles of Incorporation: This is the primary document that creates the Texas Professional Corporation and includes important information such as the corporation's name, purpose, registered agent, and duration. 2. Bylaws: Bylaws are the governing rules and regulations that outline the internal operations of the corporation. They include provisions on matters such as elections, director and shareholder meetings, voting rights, and other corporate procedures. 3. Board of Directors' Meeting Minutes: These are detailed records that document the discussions, decisions, and actions taken during board meetings. Meeting minutes should include attendance, voting results, resolutions, and any other relevant discussion points. 4. Shareholder Meeting Minutes: These records document the proceedings of general meetings where shareholders discuss and make decisions on corporate matters such as electing directors, approving financial statements, or voting on important resolutions. 5. Stock Certificates and Stock Ledger: Stock certificates represent ownership in the corporation and should be issued to shareholders. The stock ledger keeps track of the ownership of shares, including information on shareholders' names, addresses, and the number of shares they hold. 6. Financial Statements: These documents include the balance sheet, income statement, and cash flow statement, providing an overview of the corporation's financial position, performance, and cash flows. Financial statements should be prepared regularly and in accordance with generally accepted accounting principles (GAAP). 7. Annual Reports: Texas Professional Corporations are required to file annual reports with the Texas Secretary of State. These reports update information on the corporation's registered agent, directors, and other key details. 8. Tax Returns: The corporation must maintain copies of all filed tax returns, including federal, state, and local tax returns. These records demonstrate compliance with tax regulations and provide a historical record of the corporation's financial activities. 9. Contracts and Agreements: Corporations should keep copies of all contracts and agreements entered into, such as leases, employment contracts, vendor agreements, and client contracts. These documents are essential for clarifying the rights and obligations of the corporation and other parties involved. 10. Intellectual Property Documentation: If the corporation owns trademarks, copyrights, or patents, it should maintain documentation to prove ownership and monitor their validity. Properly organizing and maintaining Dallas Sample Corporate Records for a Texas Professional Corporation is essential for both legal compliance and efficient corporate administration. These records not only provide a historical record of the corporation's activities but also serve as evidence of good corporate governance practices. By keeping thorough and accurate corporate records, a Texas Professional Corporation can ensure transparency, protect shareholder rights, and mitigate potential legal issues.