Sample Corporate Notices of Meetings, Resolutions, Simple Stock Ledger & Certificate.

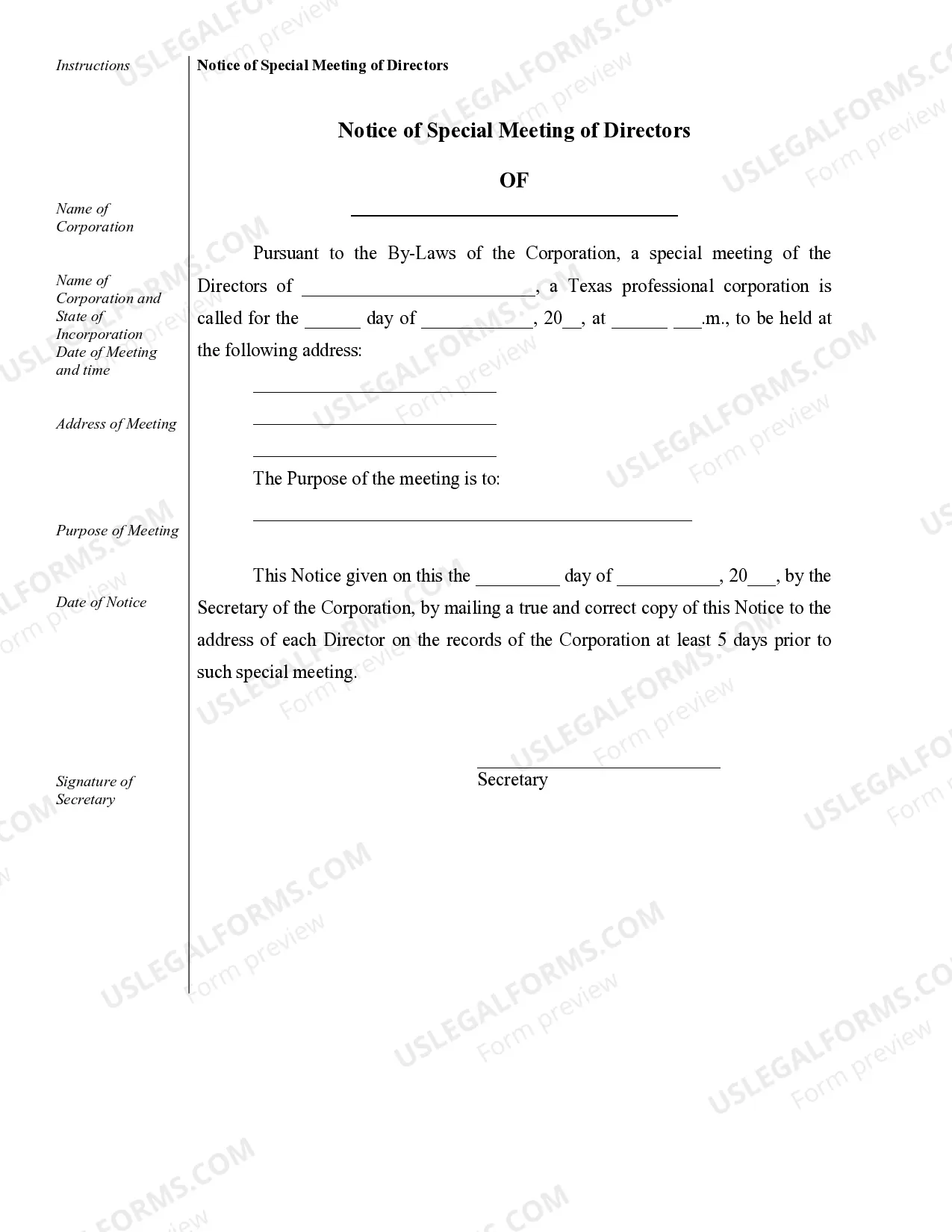

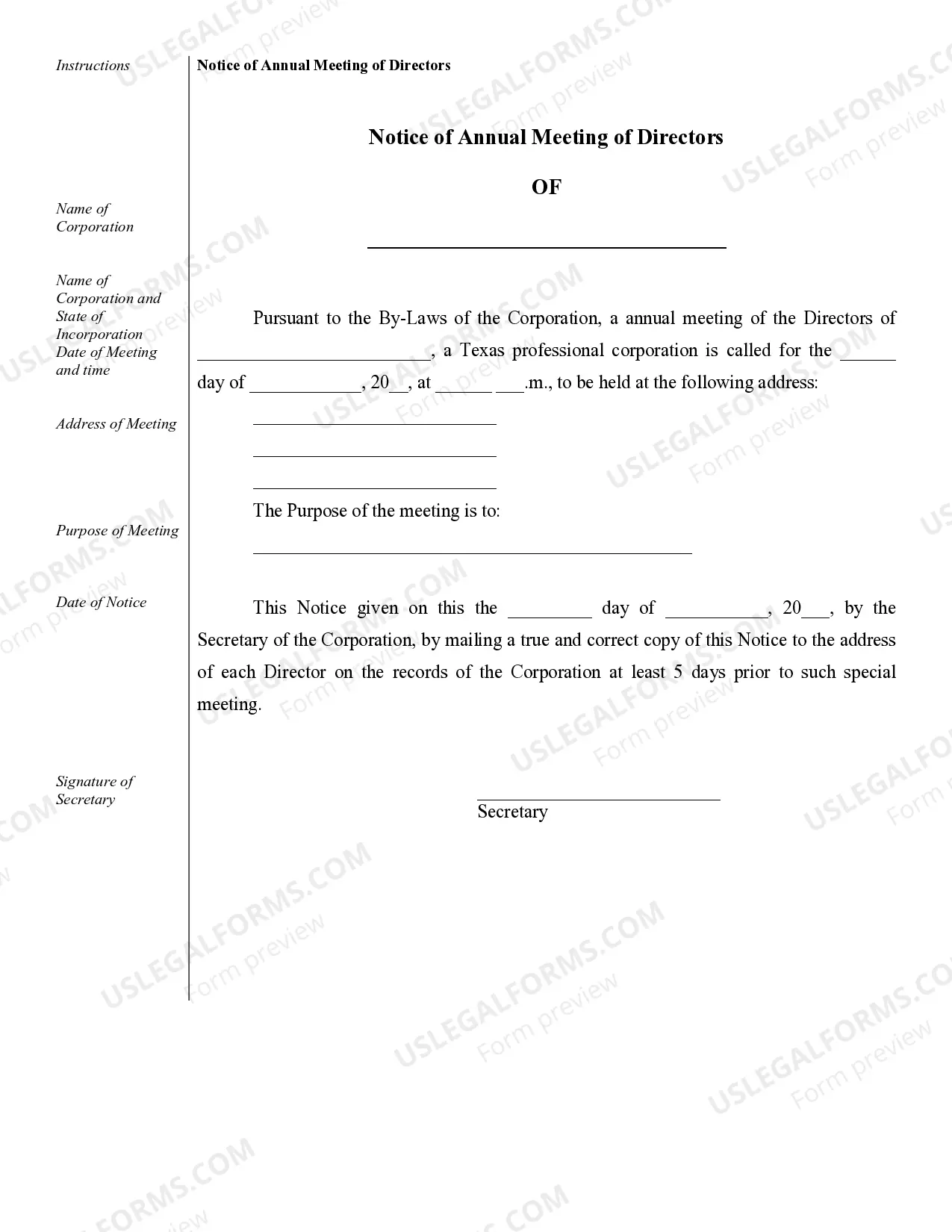

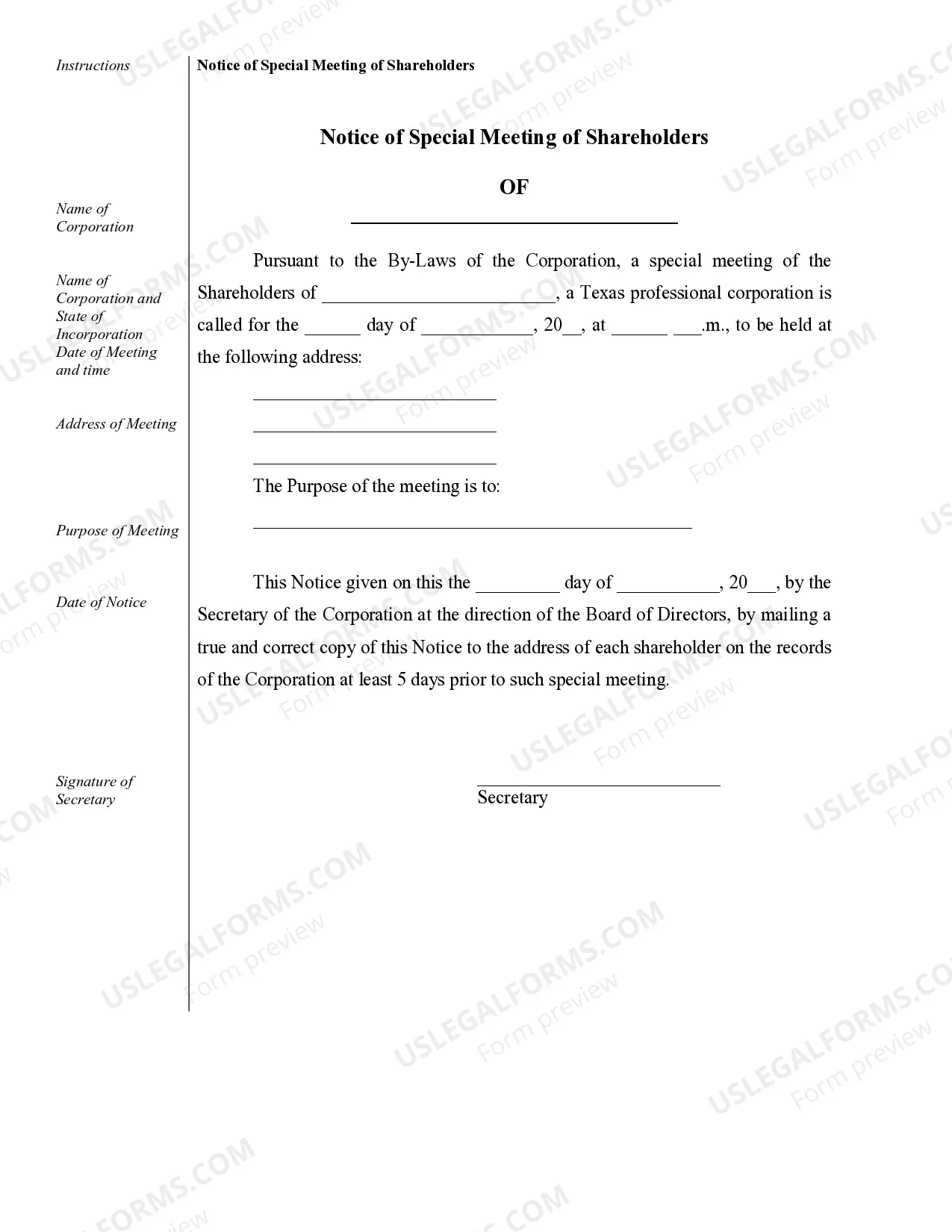

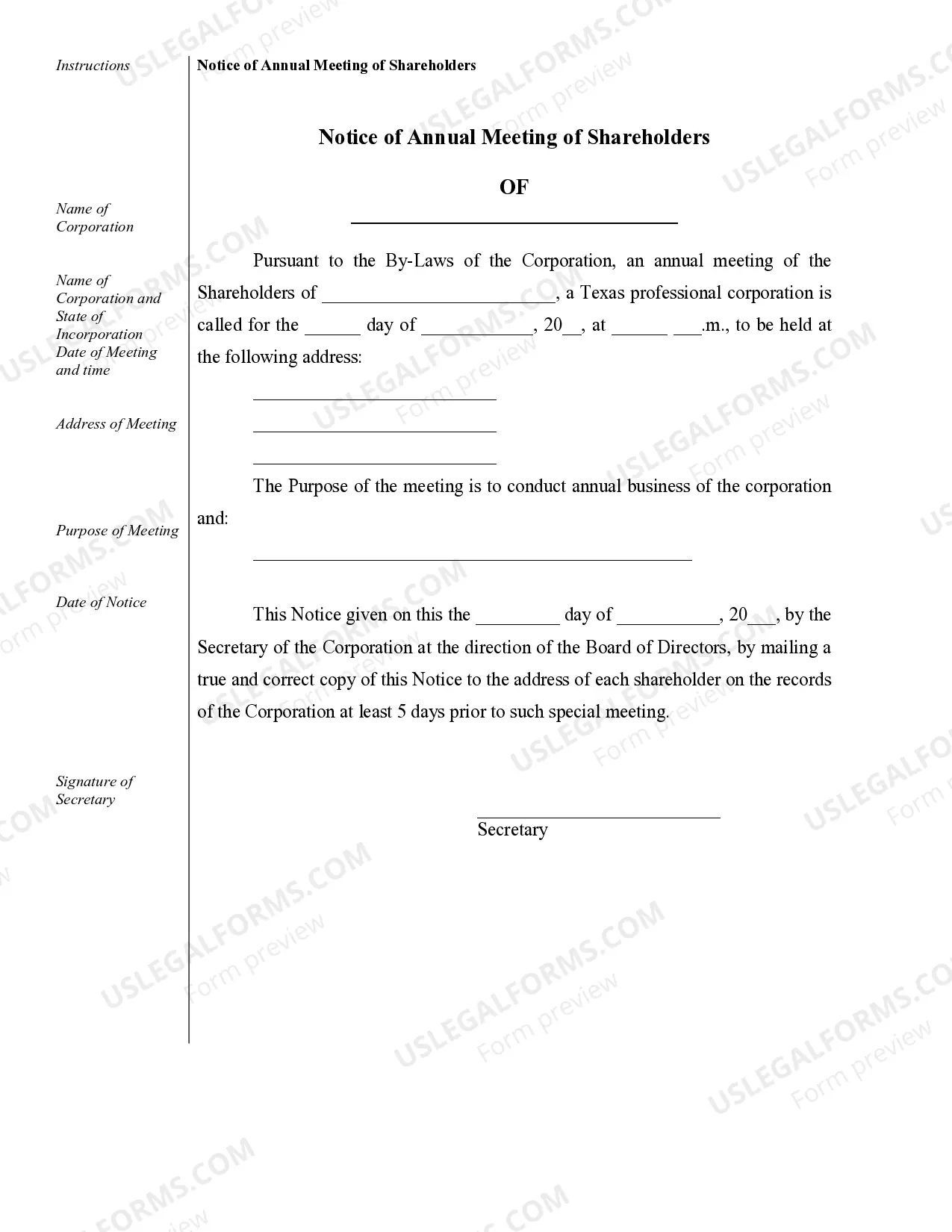

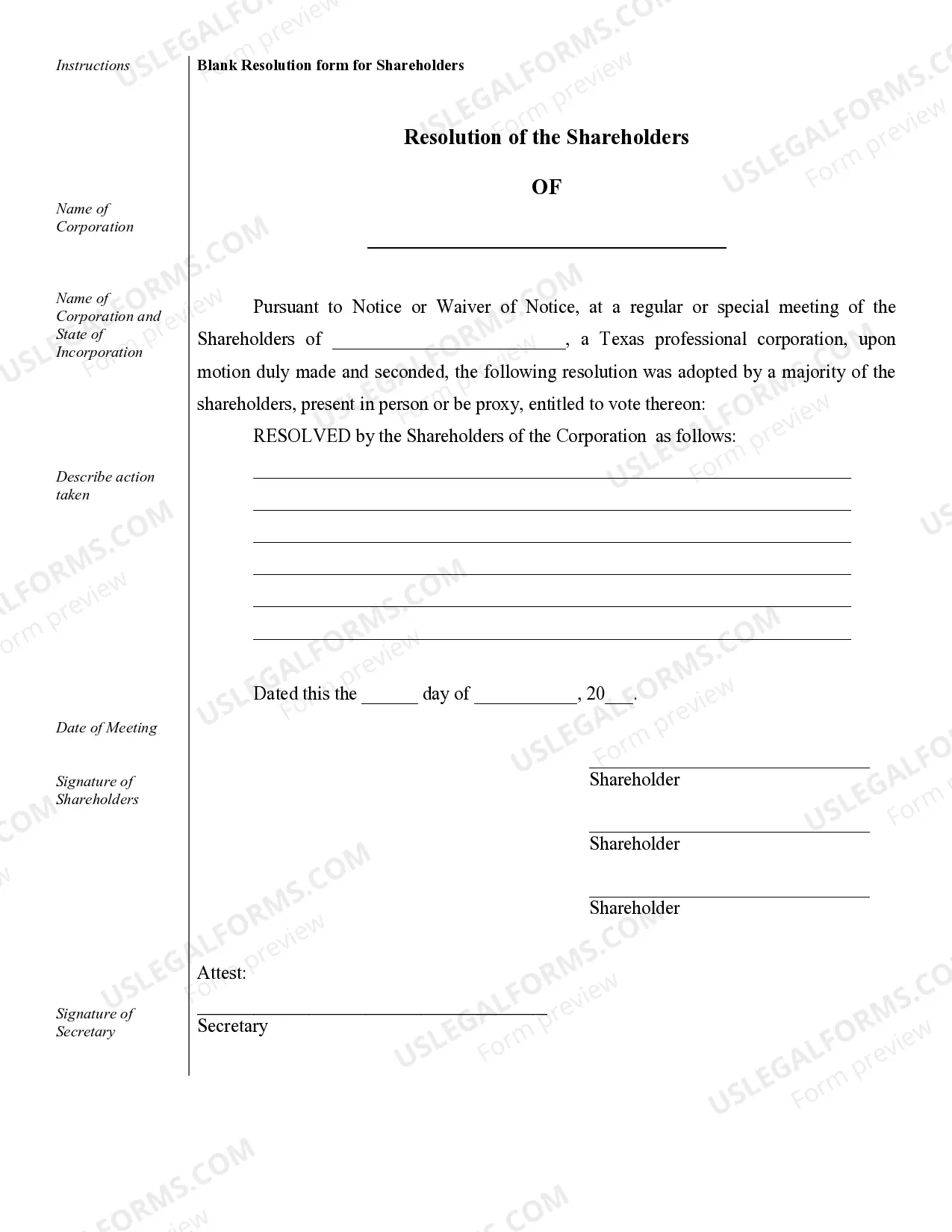

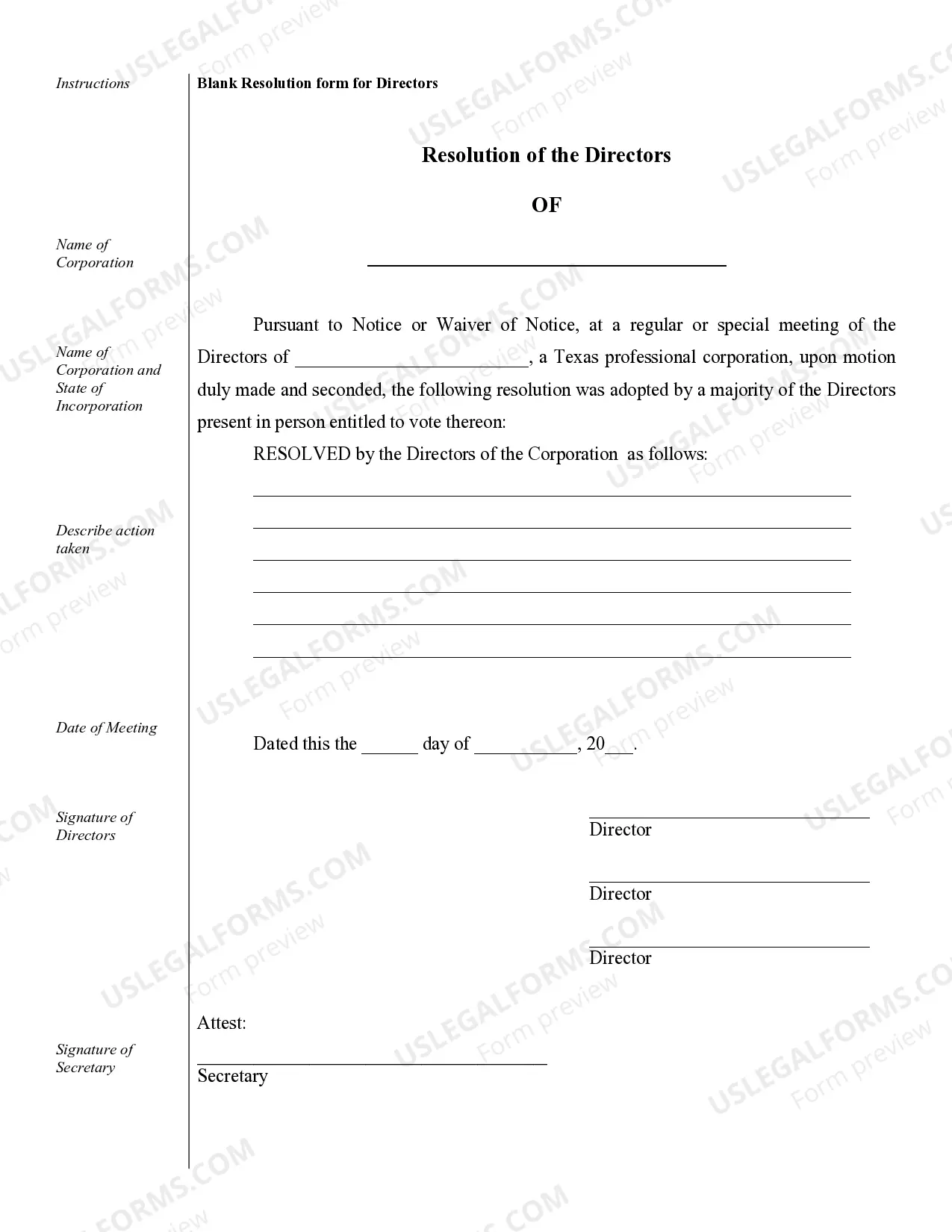

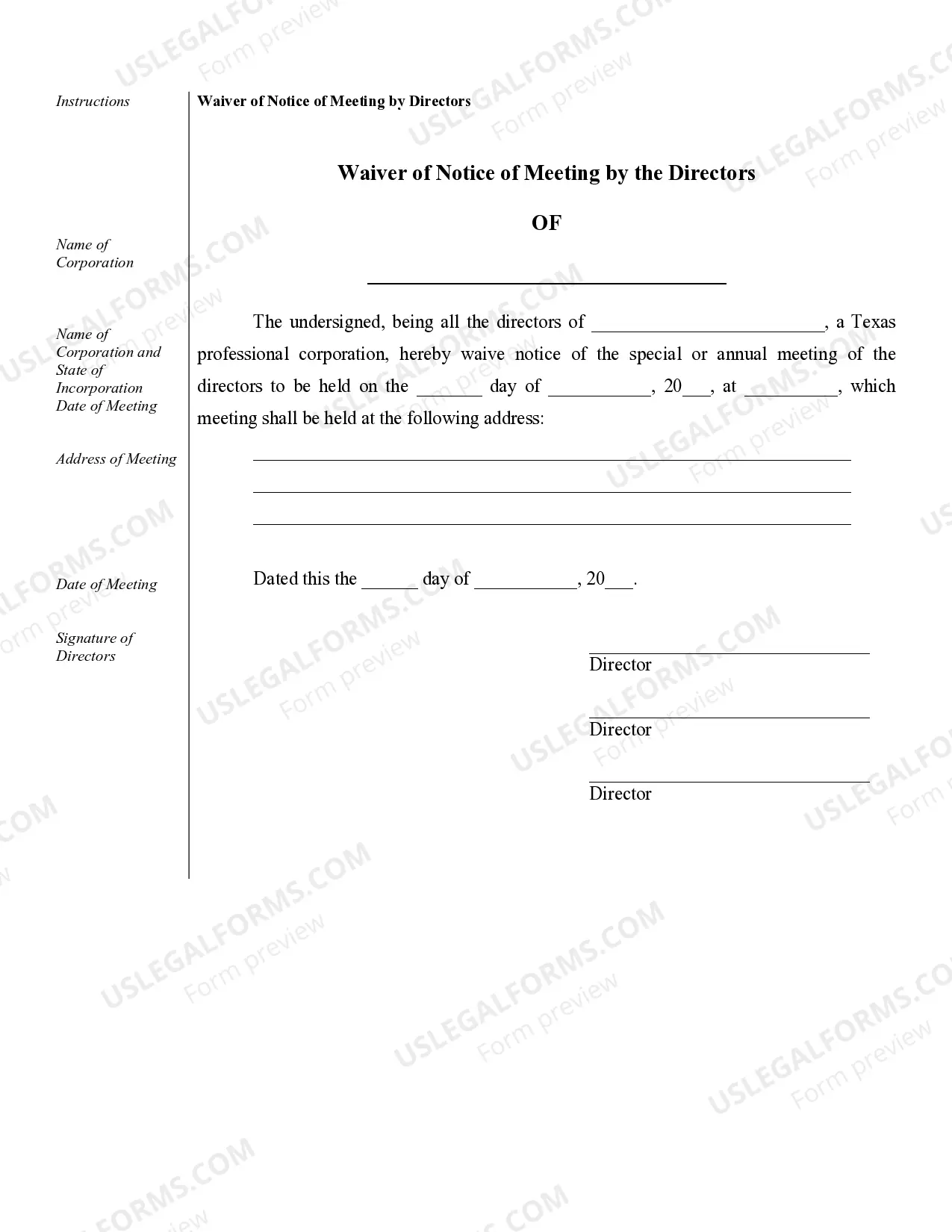

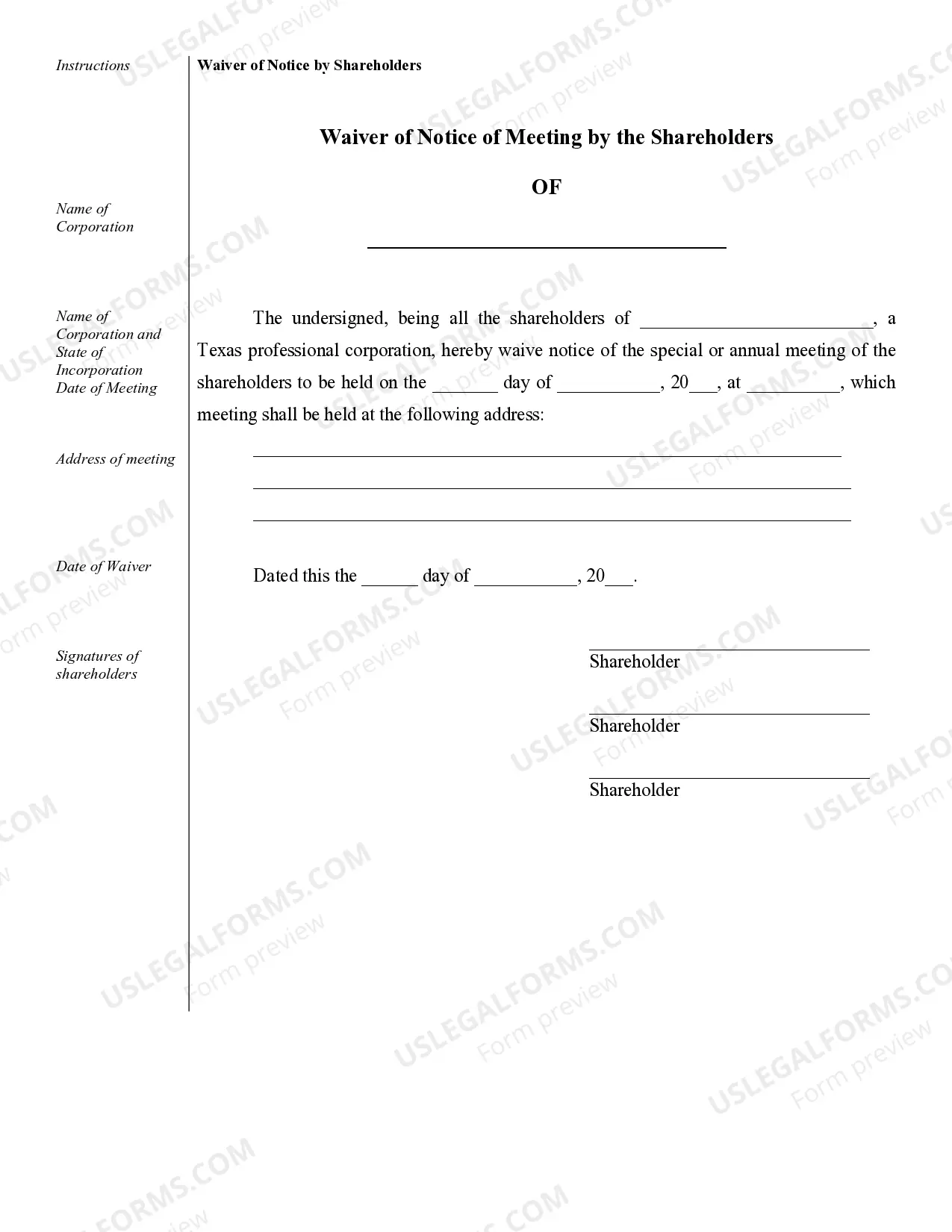

Edinburg Sample Corporate Records for a Texas Professional Corporation play a crucial role in maintaining the legal and financial integrity of the company. These records serve as a comprehensive documentation system that provides a clear and concise overview of the corporation's activities, ensuring compliance with state laws and regulations. The following are some essential types of Edinburg Sample Corporate Records for a Texas Professional Corporation: 1. Articles of Incorporation: These records contain the fundamental information about the company, such as its name, purpose, registered agent, shareholders' names, and other key details. The Articles of Incorporation set the groundwork for the corporation's existence and are filed with the Texas Secretary of State. 2. Bylaws: Bylaws serve as the internal rules and regulations that govern how the corporation operates. They define the roles and responsibilities of directors, officers, and shareholders, outline meeting procedures, and address voting rights. Edinburg Sample Corporate Records for a Texas Professional Corporation should include a clear and up-to-date copy of the company's bylaws. 3. Board of Directors Meeting Minutes: These records document the discussions, decisions, and actions taken during board meetings. They serve as an official record of the board's deliberations, including annual meetings, special sessions, and emergency meetings. Detailed meeting minutes are crucial for legal and historical purposes and should accurately reflect the board's activities. 4. Shareholder Meeting Minutes: Similar to board meeting minutes, shareholder meeting minutes record the discussions, decisions, and voting results during annual and special meetings. These records reflect the shareholders' involvement in the company and provide evidence of their participation in corporate matters. 5. Stock Ledgers: A stock ledger is a register that tracks the ownership of shares in a corporation. It provides a comprehensive overview of the shareholders, their contact information, the number of shares they own, and any changes in ownership, such as transfers or issuance. 6. Financial Statements: These records include the corporation's balance sheet, income statement, and cash flow statement. Financial statements provide an overview of the company's financial performance, including assets, liabilities, revenues, and expenses. Accurate and up-to-date financial statements are essential for tax reporting, auditing, and analyzing the company's financial health. 7. Annual Reports: Edinburg Sample Corporate Records for a Texas Professional Corporation should include annual reports, which summarize the company's operations, financial status, and achievements over the past year. Annual reports are typically provided to shareholders and filed with the Texas Secretary of State. By maintaining these essential Edinburg Sample Corporate Records, a Texas Professional Corporation can ensure compliance with legal requirements, keep stakeholders informed, facilitate corporate decision-making, and protect the corporation's interests.Edinburg Sample Corporate Records for a Texas Professional Corporation play a crucial role in maintaining the legal and financial integrity of the company. These records serve as a comprehensive documentation system that provides a clear and concise overview of the corporation's activities, ensuring compliance with state laws and regulations. The following are some essential types of Edinburg Sample Corporate Records for a Texas Professional Corporation: 1. Articles of Incorporation: These records contain the fundamental information about the company, such as its name, purpose, registered agent, shareholders' names, and other key details. The Articles of Incorporation set the groundwork for the corporation's existence and are filed with the Texas Secretary of State. 2. Bylaws: Bylaws serve as the internal rules and regulations that govern how the corporation operates. They define the roles and responsibilities of directors, officers, and shareholders, outline meeting procedures, and address voting rights. Edinburg Sample Corporate Records for a Texas Professional Corporation should include a clear and up-to-date copy of the company's bylaws. 3. Board of Directors Meeting Minutes: These records document the discussions, decisions, and actions taken during board meetings. They serve as an official record of the board's deliberations, including annual meetings, special sessions, and emergency meetings. Detailed meeting minutes are crucial for legal and historical purposes and should accurately reflect the board's activities. 4. Shareholder Meeting Minutes: Similar to board meeting minutes, shareholder meeting minutes record the discussions, decisions, and voting results during annual and special meetings. These records reflect the shareholders' involvement in the company and provide evidence of their participation in corporate matters. 5. Stock Ledgers: A stock ledger is a register that tracks the ownership of shares in a corporation. It provides a comprehensive overview of the shareholders, their contact information, the number of shares they own, and any changes in ownership, such as transfers or issuance. 6. Financial Statements: These records include the corporation's balance sheet, income statement, and cash flow statement. Financial statements provide an overview of the company's financial performance, including assets, liabilities, revenues, and expenses. Accurate and up-to-date financial statements are essential for tax reporting, auditing, and analyzing the company's financial health. 7. Annual Reports: Edinburg Sample Corporate Records for a Texas Professional Corporation should include annual reports, which summarize the company's operations, financial status, and achievements over the past year. Annual reports are typically provided to shareholders and filed with the Texas Secretary of State. By maintaining these essential Edinburg Sample Corporate Records, a Texas Professional Corporation can ensure compliance with legal requirements, keep stakeholders informed, facilitate corporate decision-making, and protect the corporation's interests.