Sample Corporate Notices of Meetings, Resolutions, Simple Stock Ledger & Certificate.

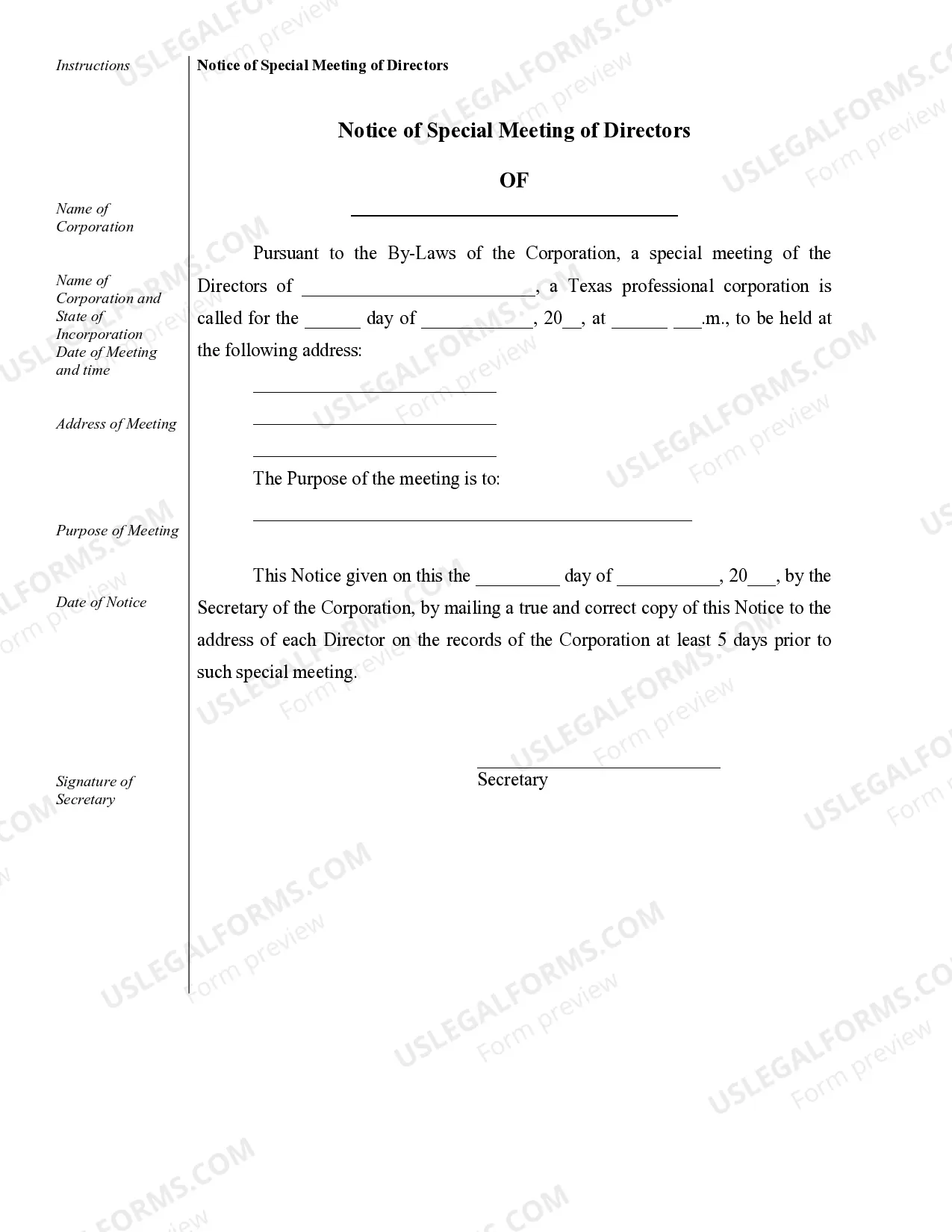

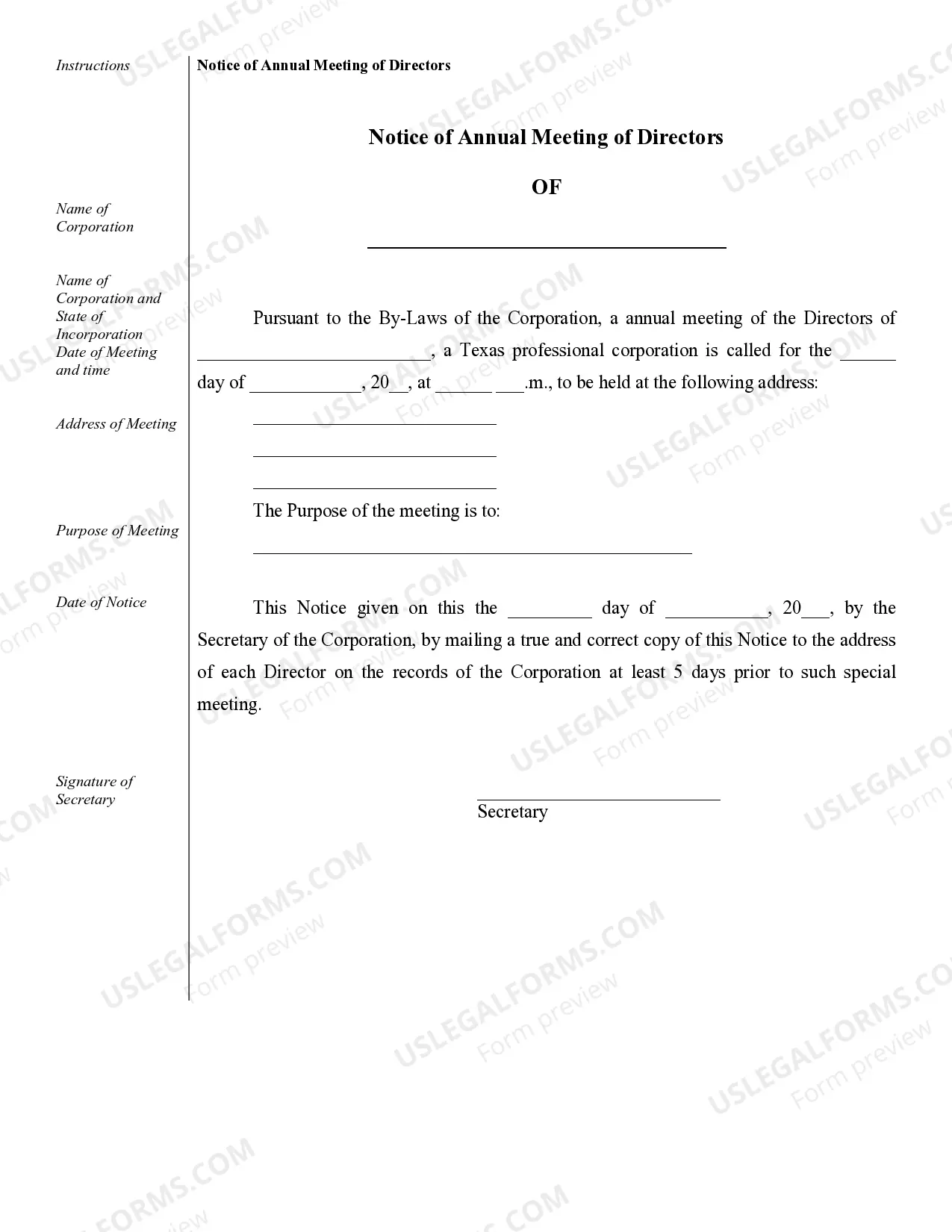

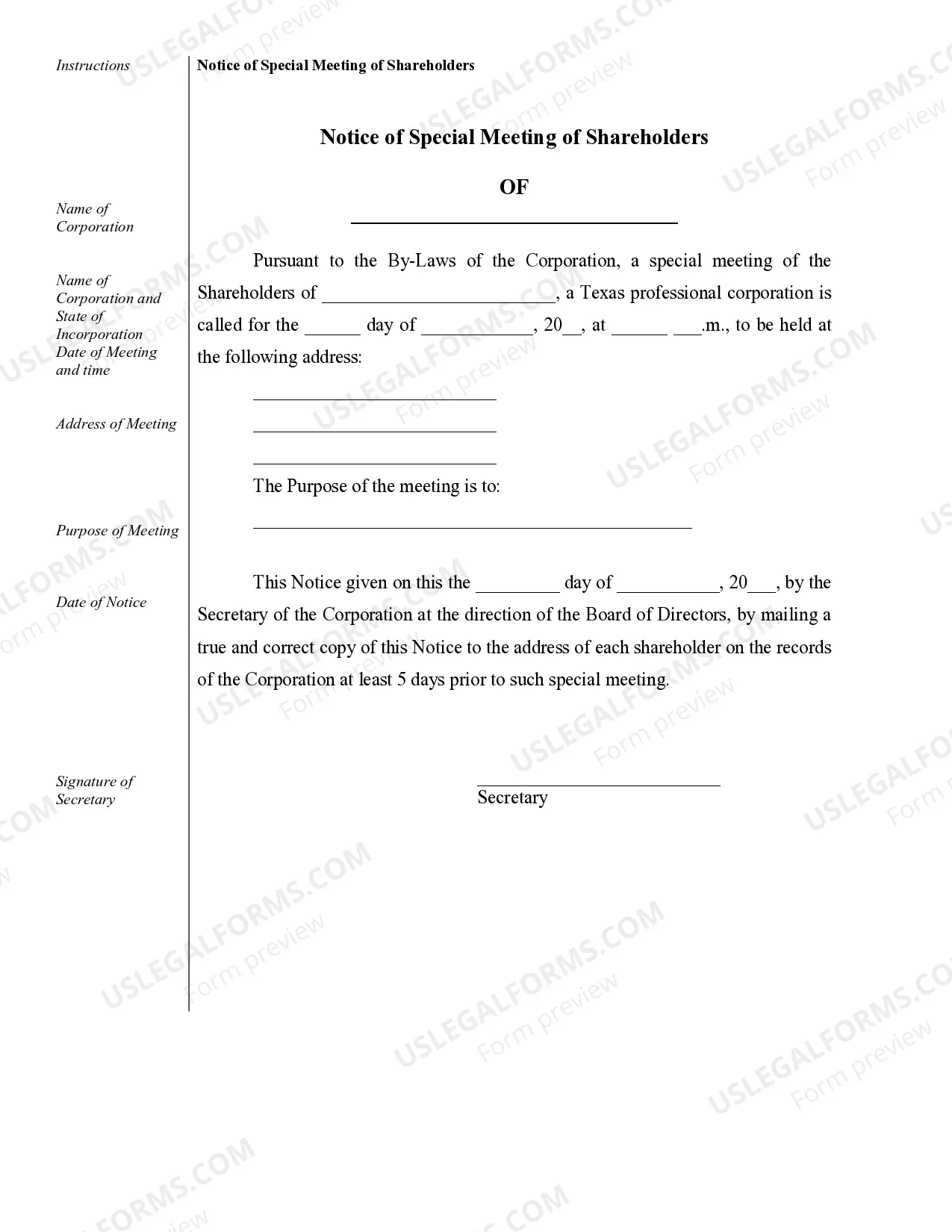

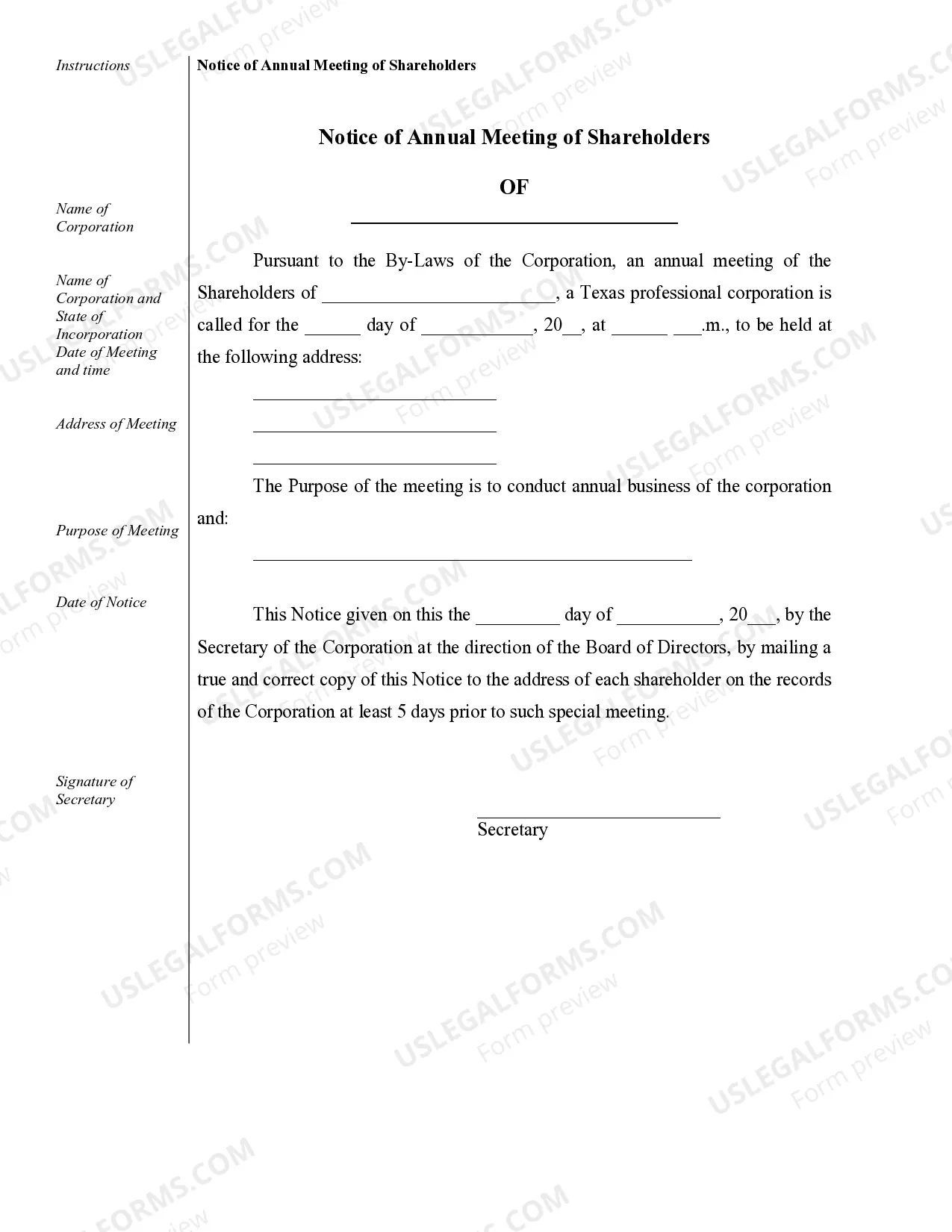

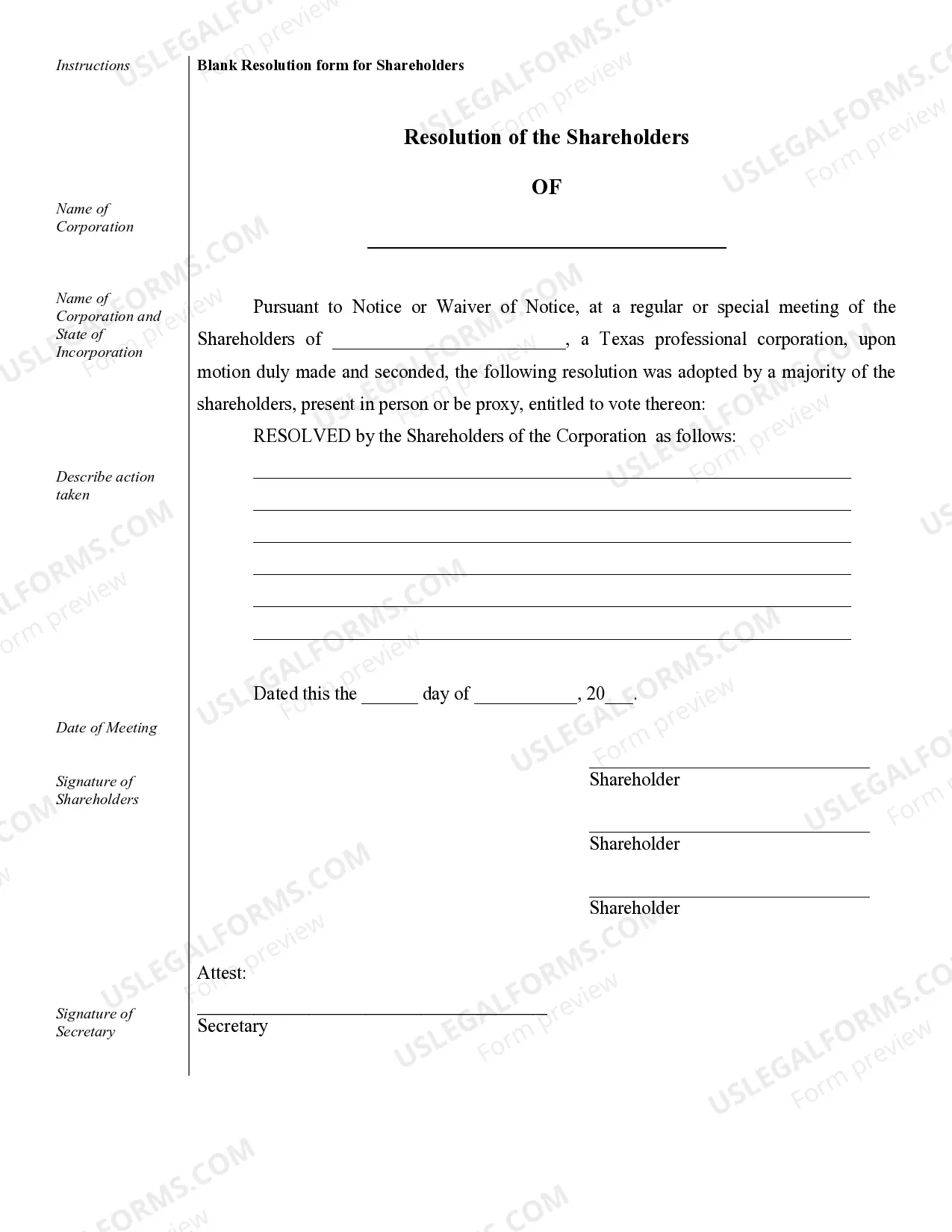

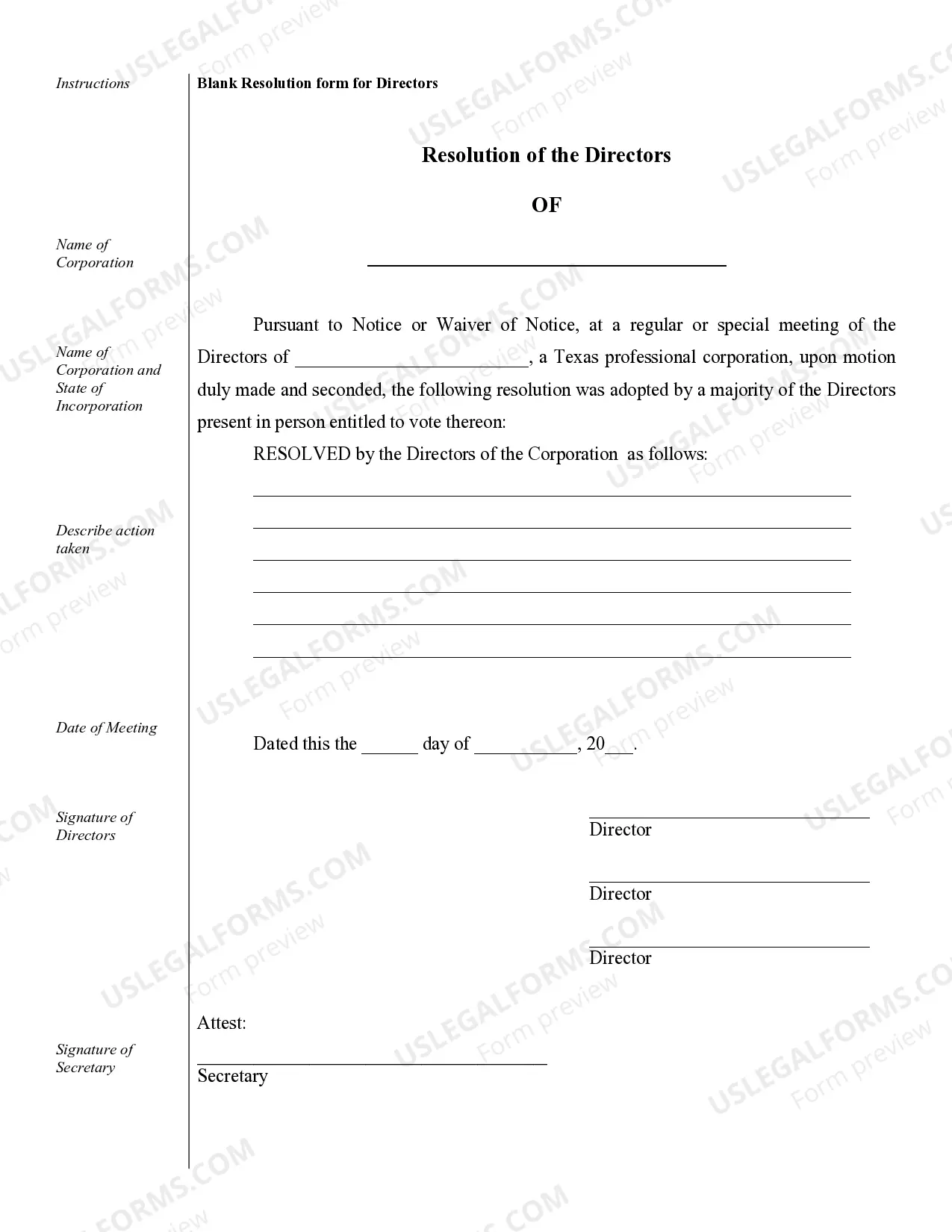

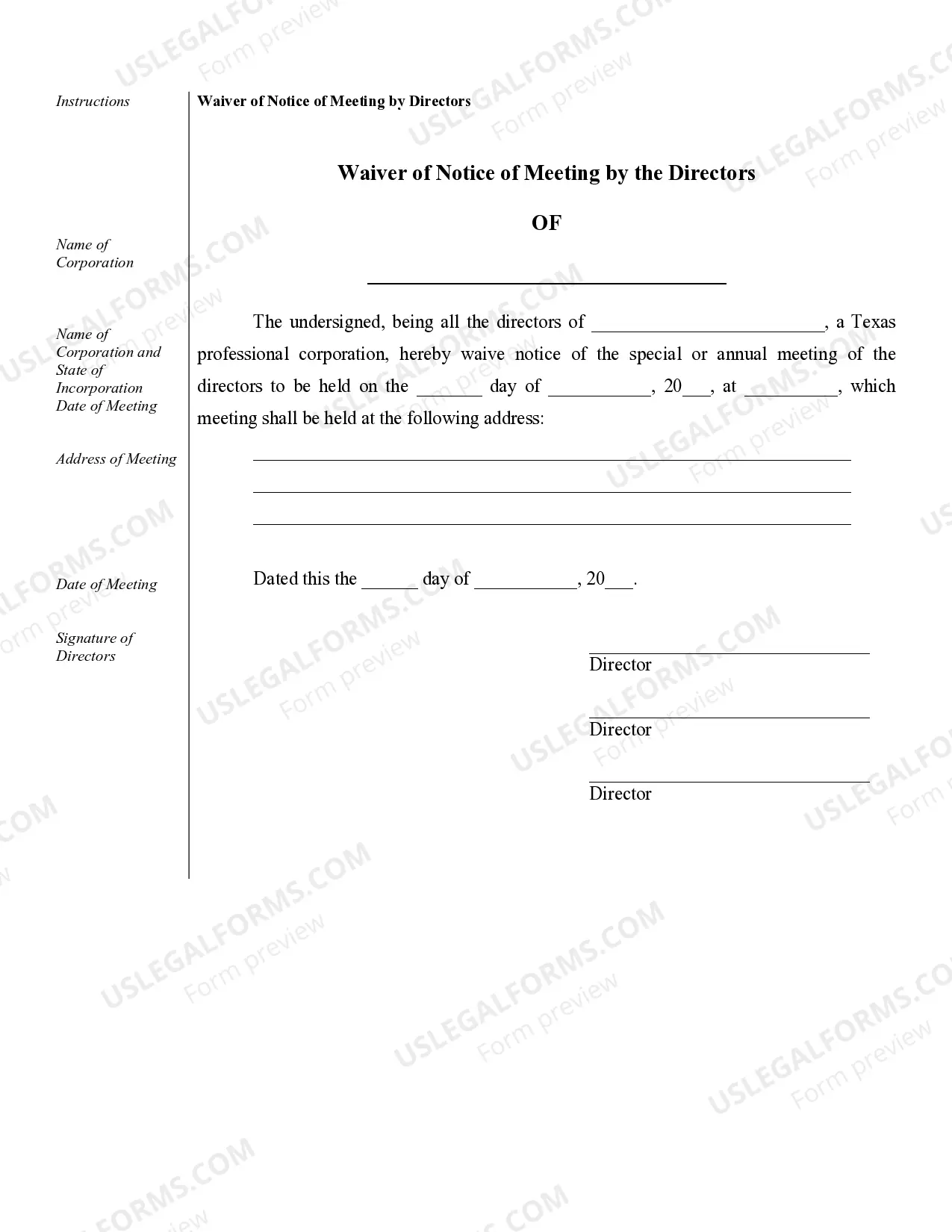

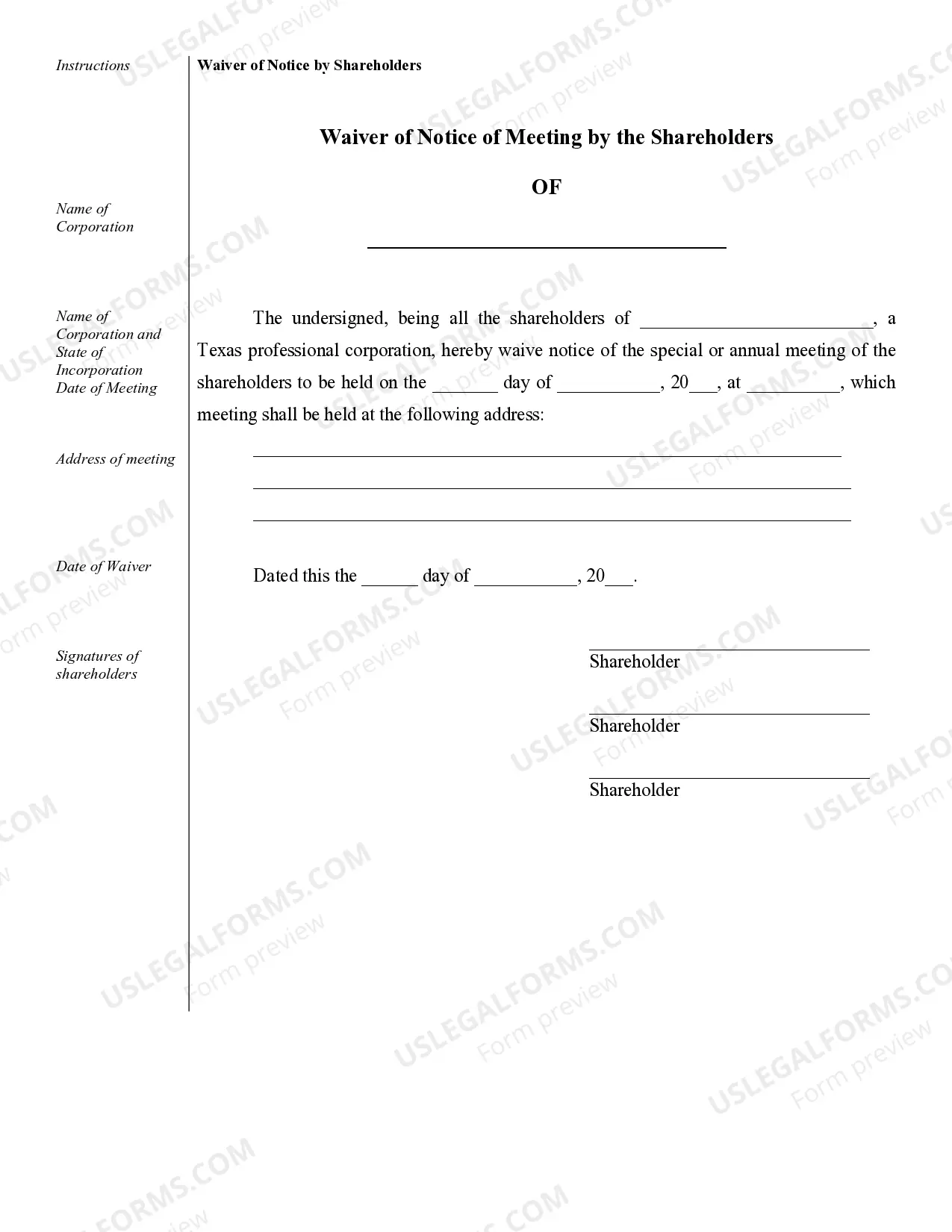

Grand Prairie Sample Corporate Records for a Texas Professional Corporation play a significant role in documenting and maintaining the legal and financial aspects of such entities. These records serve as an evidence of the corporation's activities and compliance with state regulations. Below, we will delve into the various types of Grand Prairie Sample Corporate Records that are commonly associated with Texas Professional Corporations. 1. Certificate of Formation: Also known as the Articles of Incorporation, this record is the initial document filed with the Texas Secretary of State to officially establish the Texas Professional Corporation. It includes essential information such as the corporation's name, purpose, registered agent, shareholders, and directors. 2. Bylaws: Bylaws are internal guidelines that outline how the Texas Professional Corporation functions and operates. These extensive documents cover various aspects including the corporation's structure, meeting procedures, voting rights, and responsibilities of shareholders, directors, and officers. 3. Shareholder Agreements: These agreements delineate the rights, obligations, and relationships between the shareholders of the Texas Professional Corporation. They typically cover topics such as ownership structure, share transfer restrictions, buy-sell provisions, and dividend policies. 4. Stock Certificates: Stock certificates represent ownership interests in the Texas Professional Corporation. These documents are issued to shareholders and contain essential details such as the shareholder's name, the number of shares owned, and the class of shares. 5. Meeting Minutes: Detailed minutes of meetings held by the shareholders and the board of directors is an important part of corporate records. They provide a record of discussions, decisions, and voting outcomes. Directors' meeting minutes may cover topics such as election of officers, major contracts, and financial matters, while shareholders' meeting minutes include items like annual elections and amendments to the bylaws. 6. Financial Statements: Accurate financial statements are necessary to demonstrate the financial health of the Texas Professional Corporation. These statements include the income statement, balance sheet, and cash flow statement, providing a comprehensive overview of the corporation's revenue, expenses, assets, and liabilities. 7. Annual Reports: Texas Professional Corporations are required to file annual reports with the Secretary of State. These reports summarize the corporation's operations and financial performance throughout the year. They usually include information on the registered agent, officers, and directors, as well as any changes to the corporation's capital structure. 8. Shareholder Resolutions: Shareholder resolutions document significant decisions made by the shareholders that affect the Texas Professional Corporation. Examples of matters covered in these resolutions might include approving the issuance of additional shares, amendments to the bylaws, or changes to the corporation's capital structure. 9. Employee Contracts: Texas Professional Corporations often enter into employment contracts with their directors, officers, and other key employees. These contracts outline the terms of employment, including compensation, benefits, job responsibilities, and confidentiality provisions. 10. Intellectual Property Records: If the Texas Professional Corporation owns intellectual property such as trademarks or patents, it is essential to maintain records proving ownership, registration, and any related licensing agreements. By keeping these types of Grand Prairie Sample Corporate Records organized and up-to-date, Texas Professional Corporations can ensure compliance with legal regulations, facilitate decision-making processes, and present a clear picture of their operations and financial performance.Grand Prairie Sample Corporate Records for a Texas Professional Corporation play a significant role in documenting and maintaining the legal and financial aspects of such entities. These records serve as an evidence of the corporation's activities and compliance with state regulations. Below, we will delve into the various types of Grand Prairie Sample Corporate Records that are commonly associated with Texas Professional Corporations. 1. Certificate of Formation: Also known as the Articles of Incorporation, this record is the initial document filed with the Texas Secretary of State to officially establish the Texas Professional Corporation. It includes essential information such as the corporation's name, purpose, registered agent, shareholders, and directors. 2. Bylaws: Bylaws are internal guidelines that outline how the Texas Professional Corporation functions and operates. These extensive documents cover various aspects including the corporation's structure, meeting procedures, voting rights, and responsibilities of shareholders, directors, and officers. 3. Shareholder Agreements: These agreements delineate the rights, obligations, and relationships between the shareholders of the Texas Professional Corporation. They typically cover topics such as ownership structure, share transfer restrictions, buy-sell provisions, and dividend policies. 4. Stock Certificates: Stock certificates represent ownership interests in the Texas Professional Corporation. These documents are issued to shareholders and contain essential details such as the shareholder's name, the number of shares owned, and the class of shares. 5. Meeting Minutes: Detailed minutes of meetings held by the shareholders and the board of directors is an important part of corporate records. They provide a record of discussions, decisions, and voting outcomes. Directors' meeting minutes may cover topics such as election of officers, major contracts, and financial matters, while shareholders' meeting minutes include items like annual elections and amendments to the bylaws. 6. Financial Statements: Accurate financial statements are necessary to demonstrate the financial health of the Texas Professional Corporation. These statements include the income statement, balance sheet, and cash flow statement, providing a comprehensive overview of the corporation's revenue, expenses, assets, and liabilities. 7. Annual Reports: Texas Professional Corporations are required to file annual reports with the Secretary of State. These reports summarize the corporation's operations and financial performance throughout the year. They usually include information on the registered agent, officers, and directors, as well as any changes to the corporation's capital structure. 8. Shareholder Resolutions: Shareholder resolutions document significant decisions made by the shareholders that affect the Texas Professional Corporation. Examples of matters covered in these resolutions might include approving the issuance of additional shares, amendments to the bylaws, or changes to the corporation's capital structure. 9. Employee Contracts: Texas Professional Corporations often enter into employment contracts with their directors, officers, and other key employees. These contracts outline the terms of employment, including compensation, benefits, job responsibilities, and confidentiality provisions. 10. Intellectual Property Records: If the Texas Professional Corporation owns intellectual property such as trademarks or patents, it is essential to maintain records proving ownership, registration, and any related licensing agreements. By keeping these types of Grand Prairie Sample Corporate Records organized and up-to-date, Texas Professional Corporations can ensure compliance with legal regulations, facilitate decision-making processes, and present a clear picture of their operations and financial performance.