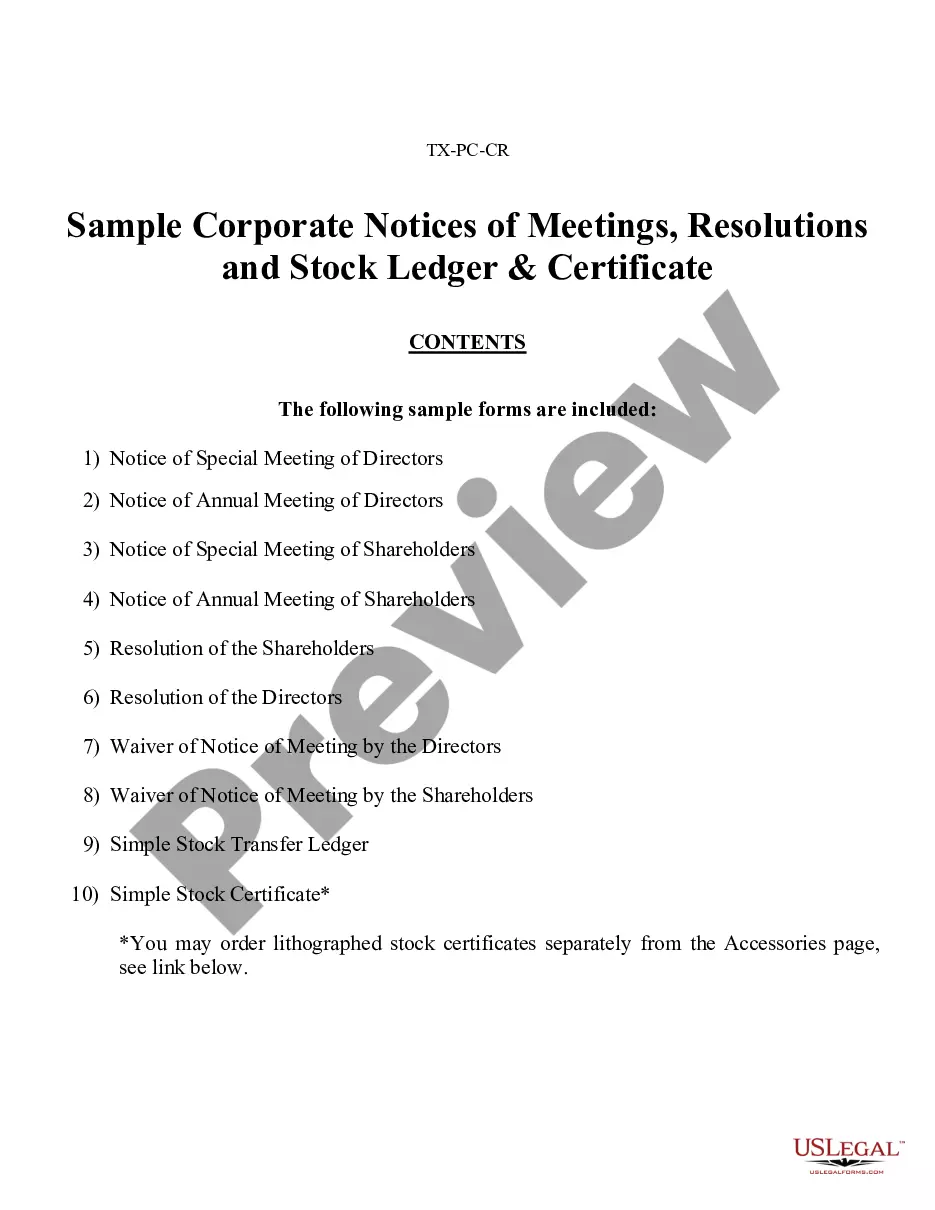

Sample Corporate Notices of Meetings, Resolutions, Simple Stock Ledger & Certificate.

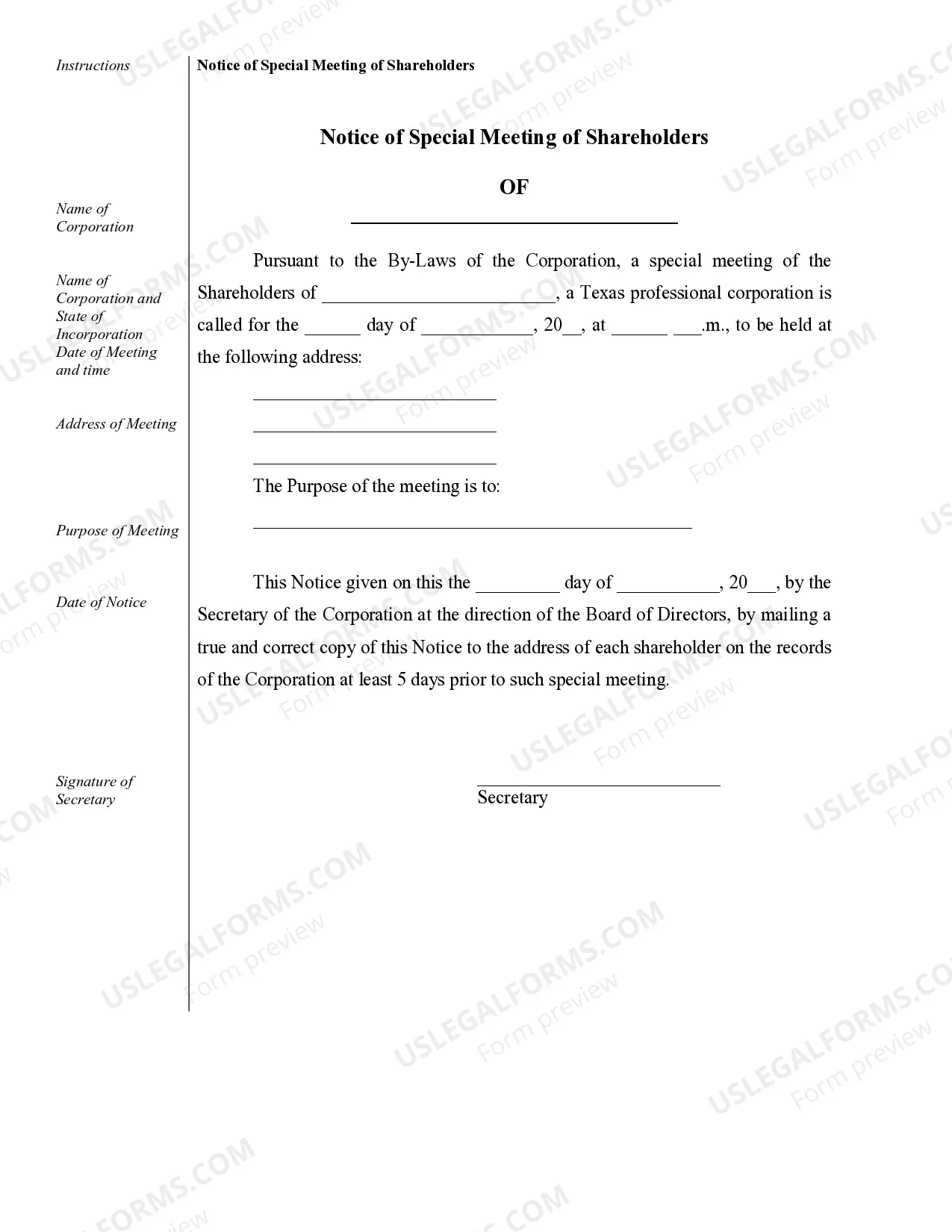

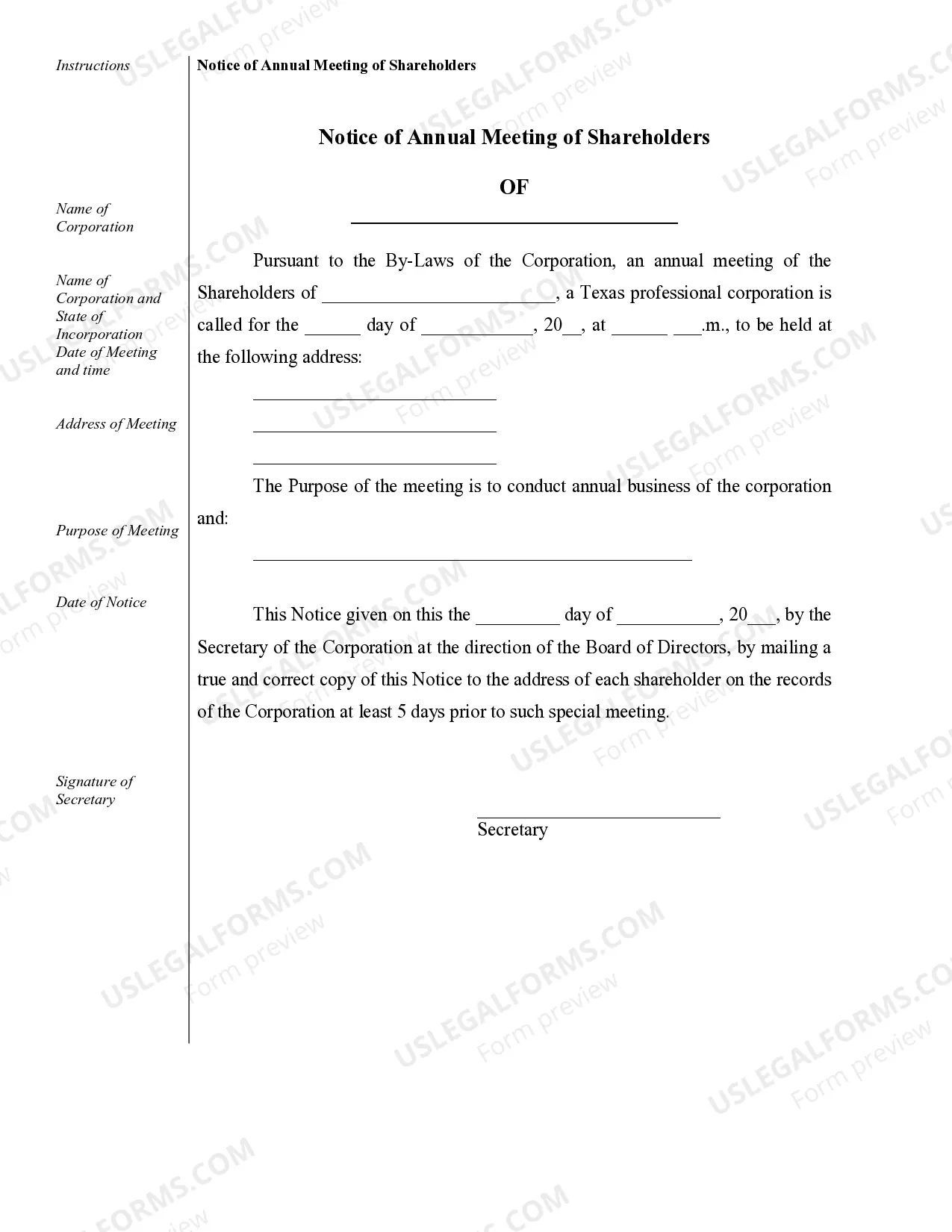

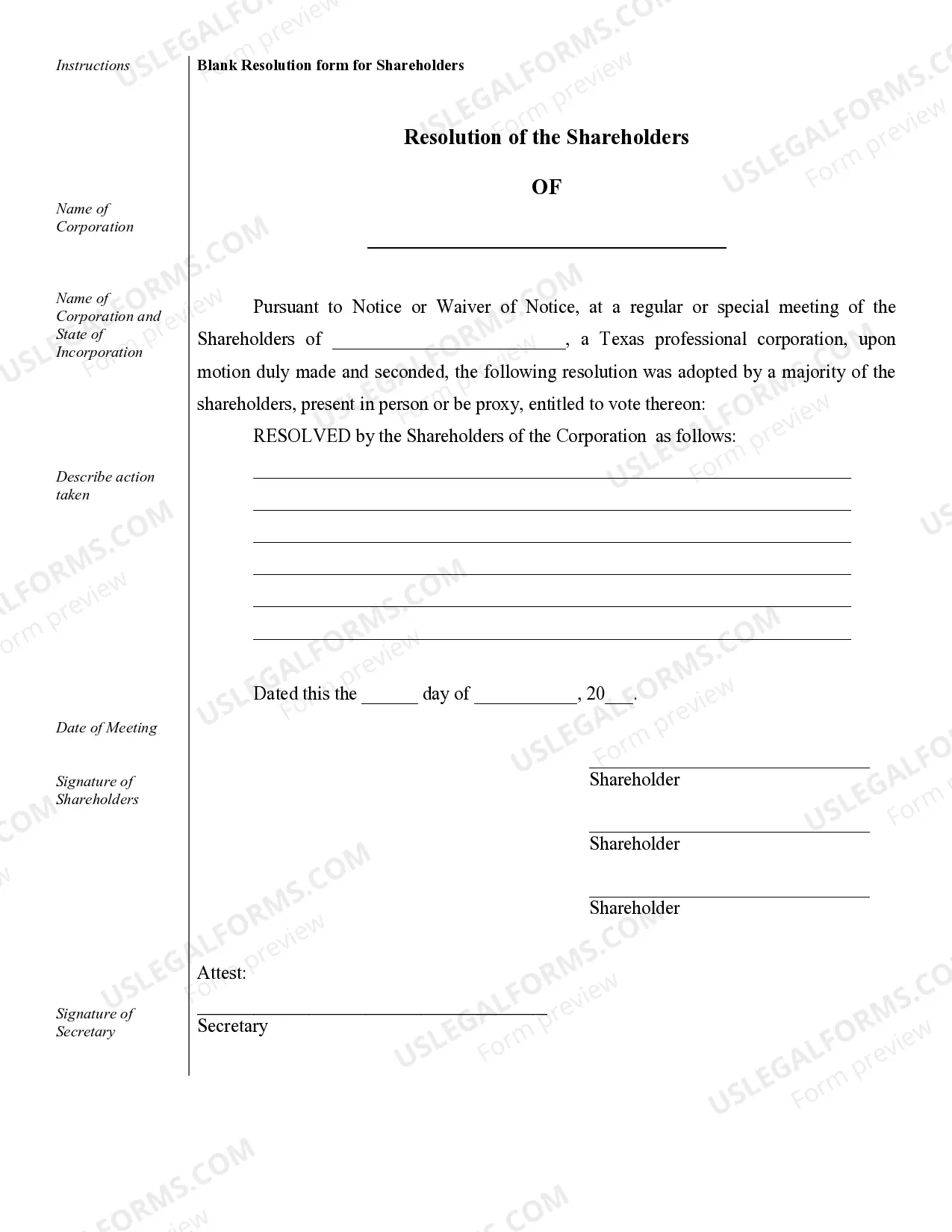

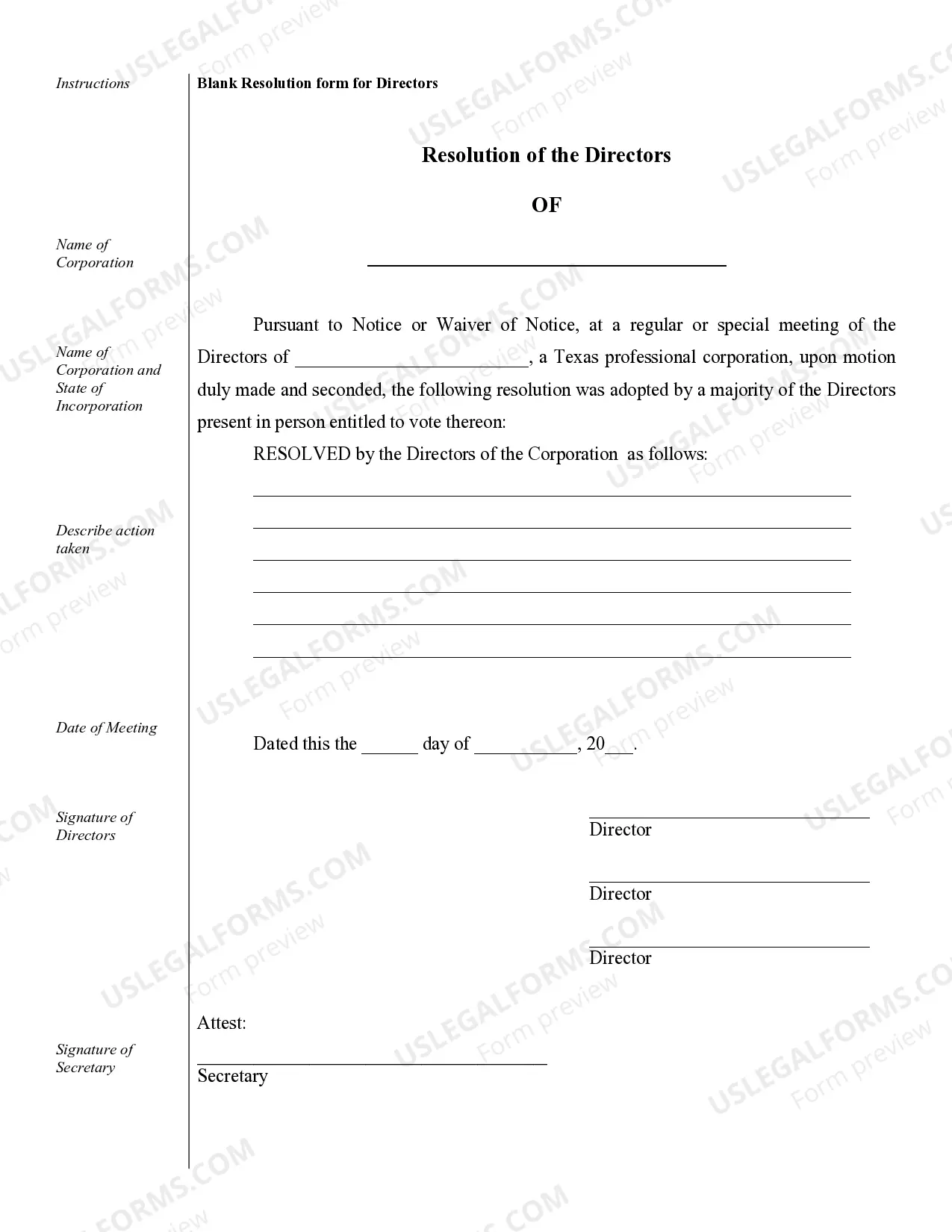

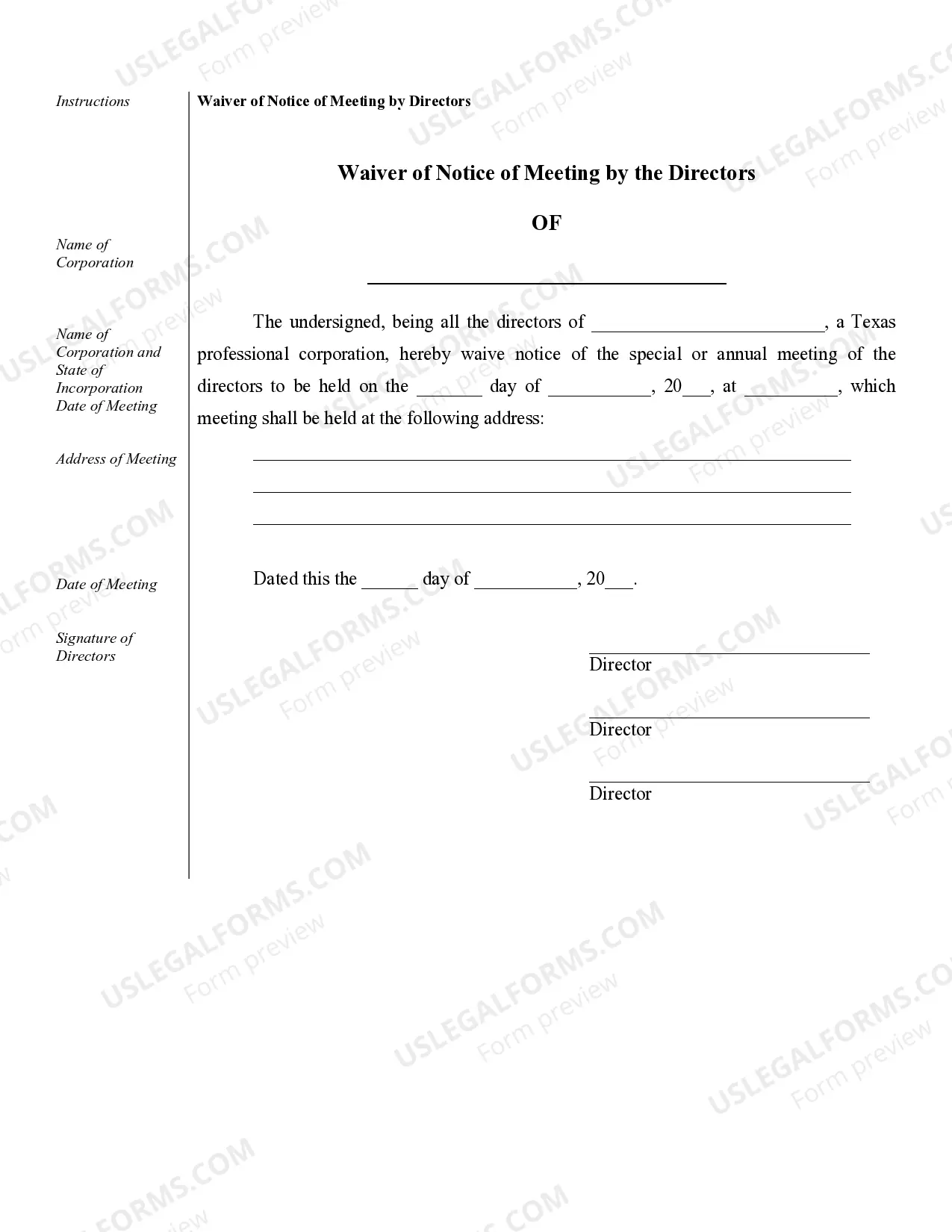

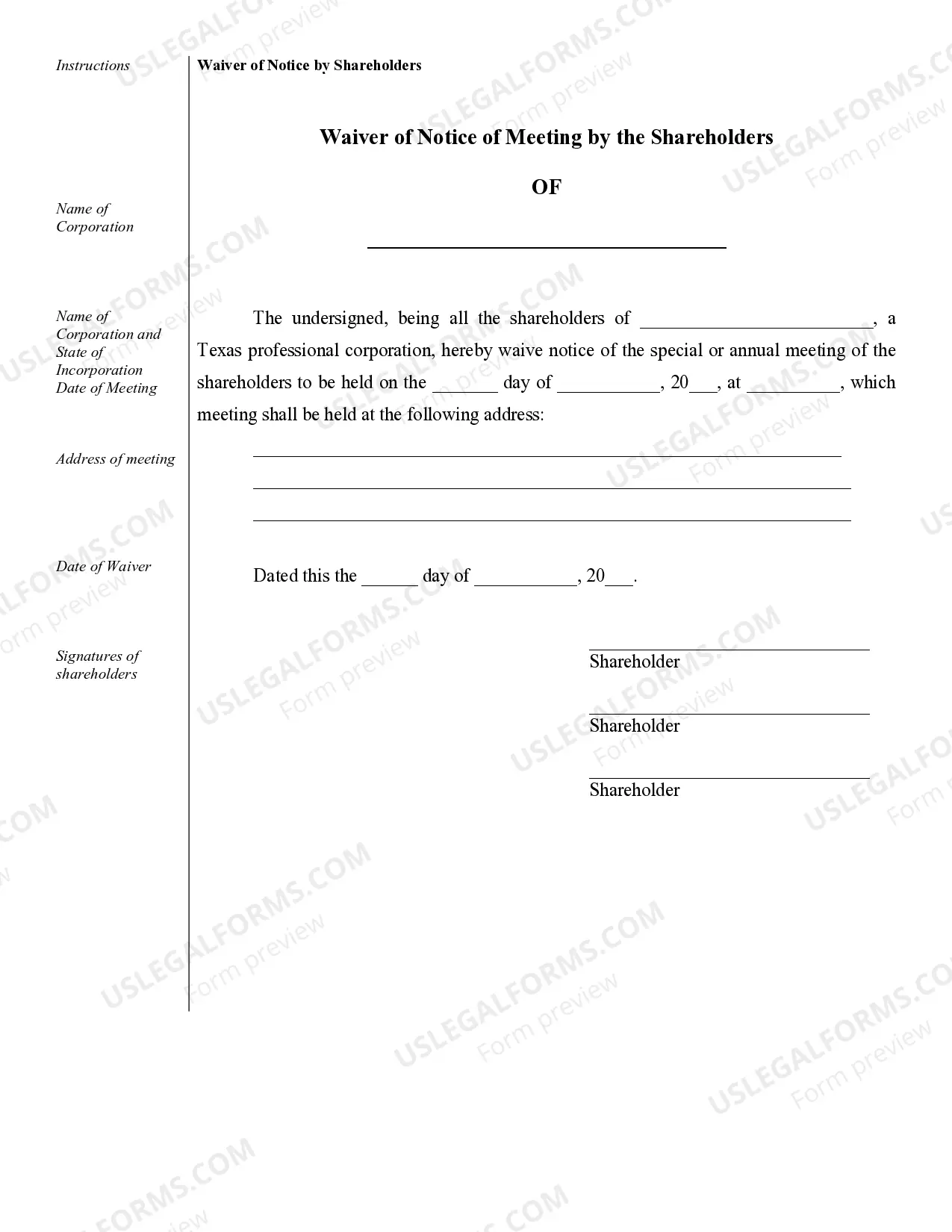

Harris Sample Corporate Records for a Texas Professional Corporation are essential documents that provide comprehensive and accurate information about the company's operations, structure, and legal obligations. These records serve as a crucial reference for internal management, external audits, legal compliance, and transactions involving the corporation. They are legally required and play an important role in maintaining transparency and good corporate governance. The various types of Harris Sample Corporate Records for a Texas Professional Corporation include: 1. Articles of Incorporation: This document establishes the legal existence of the professional corporation and contains essential details such as the corporation's name, stated purpose, registered agent, and the number of authorized shares. 2. Bylaws: These are the internal rules and regulations that govern the corporation's operations, including procedures for shareholder meetings, director appointments, and voting processes. 3. Shareholder Records: This set of records includes information about the individuals or entities who hold shares in the corporation. It outlines the number and class of shares held, their ownership percentages, and any transfer or voting restrictions. 4. Director and Officer Records: These records document the identities, positions, and duties of the corporation's directors and officers. They may also include information about their compensation, employment contracts, and any conflicts of interest. 5. Meeting Minutes: Detailed minutes of meetings, including those of the board of directors and shareholders, are documented and preserved. These minutes record the decisions made, discussions held, and voting results for future reference and legal compliance. 6. Financial Records: These records include financial statements, accounting documents, and budgets that provide an overview of the corporation's financial health and performance. They also encompass tax filings, invoices, receipts, and other financial transactions. 7. Stock Transfer Ledger: This ledger maintains a record of all stock transfers and issuance, including dates, details of the parties involved, and any restrictions or conditions associated with the transfers. 8. Annual Reports: Harris Sample Corporate Records may also contain annual reports that summarize the corporation's activity and financial status over the past year. These reports provide a comprehensive overview of the corporation's performance to shareholders and regulatory bodies. These various types of Harris Sample Corporate Records for a Texas Professional Corporation are crucial in ensuring the company's compliance with legal and regulatory requirements, facilitating transparency among shareholders, and preserving accurate records of its operations. It is essential to maintain these records consistently and keep them updated to support the corporation's smooth functioning and growth.Harris Sample Corporate Records for a Texas Professional Corporation are essential documents that provide comprehensive and accurate information about the company's operations, structure, and legal obligations. These records serve as a crucial reference for internal management, external audits, legal compliance, and transactions involving the corporation. They are legally required and play an important role in maintaining transparency and good corporate governance. The various types of Harris Sample Corporate Records for a Texas Professional Corporation include: 1. Articles of Incorporation: This document establishes the legal existence of the professional corporation and contains essential details such as the corporation's name, stated purpose, registered agent, and the number of authorized shares. 2. Bylaws: These are the internal rules and regulations that govern the corporation's operations, including procedures for shareholder meetings, director appointments, and voting processes. 3. Shareholder Records: This set of records includes information about the individuals or entities who hold shares in the corporation. It outlines the number and class of shares held, their ownership percentages, and any transfer or voting restrictions. 4. Director and Officer Records: These records document the identities, positions, and duties of the corporation's directors and officers. They may also include information about their compensation, employment contracts, and any conflicts of interest. 5. Meeting Minutes: Detailed minutes of meetings, including those of the board of directors and shareholders, are documented and preserved. These minutes record the decisions made, discussions held, and voting results for future reference and legal compliance. 6. Financial Records: These records include financial statements, accounting documents, and budgets that provide an overview of the corporation's financial health and performance. They also encompass tax filings, invoices, receipts, and other financial transactions. 7. Stock Transfer Ledger: This ledger maintains a record of all stock transfers and issuance, including dates, details of the parties involved, and any restrictions or conditions associated with the transfers. 8. Annual Reports: Harris Sample Corporate Records may also contain annual reports that summarize the corporation's activity and financial status over the past year. These reports provide a comprehensive overview of the corporation's performance to shareholders and regulatory bodies. These various types of Harris Sample Corporate Records for a Texas Professional Corporation are crucial in ensuring the company's compliance with legal and regulatory requirements, facilitating transparency among shareholders, and preserving accurate records of its operations. It is essential to maintain these records consistently and keep them updated to support the corporation's smooth functioning and growth.