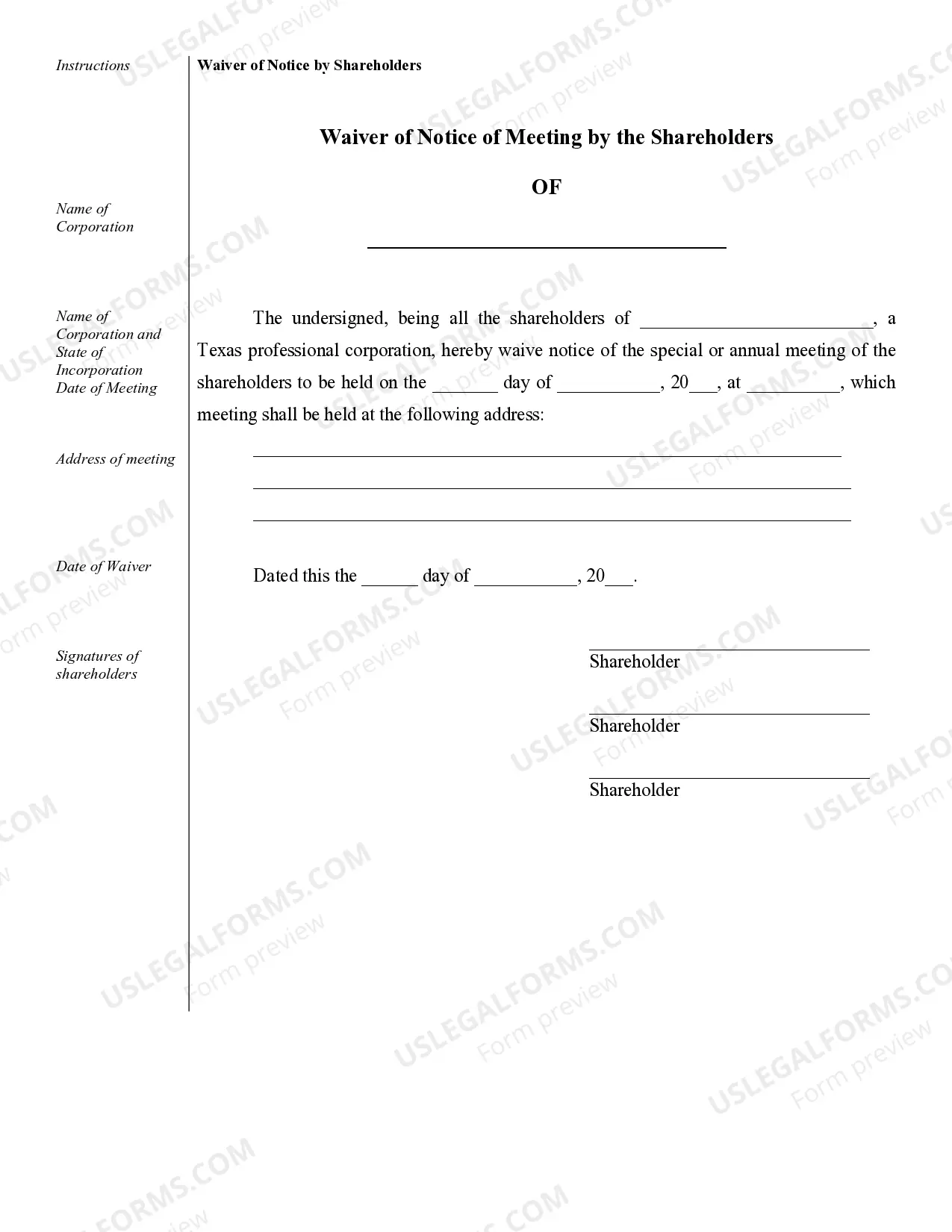

Sample Corporate Notices of Meetings, Resolutions, Simple Stock Ledger & Certificate.

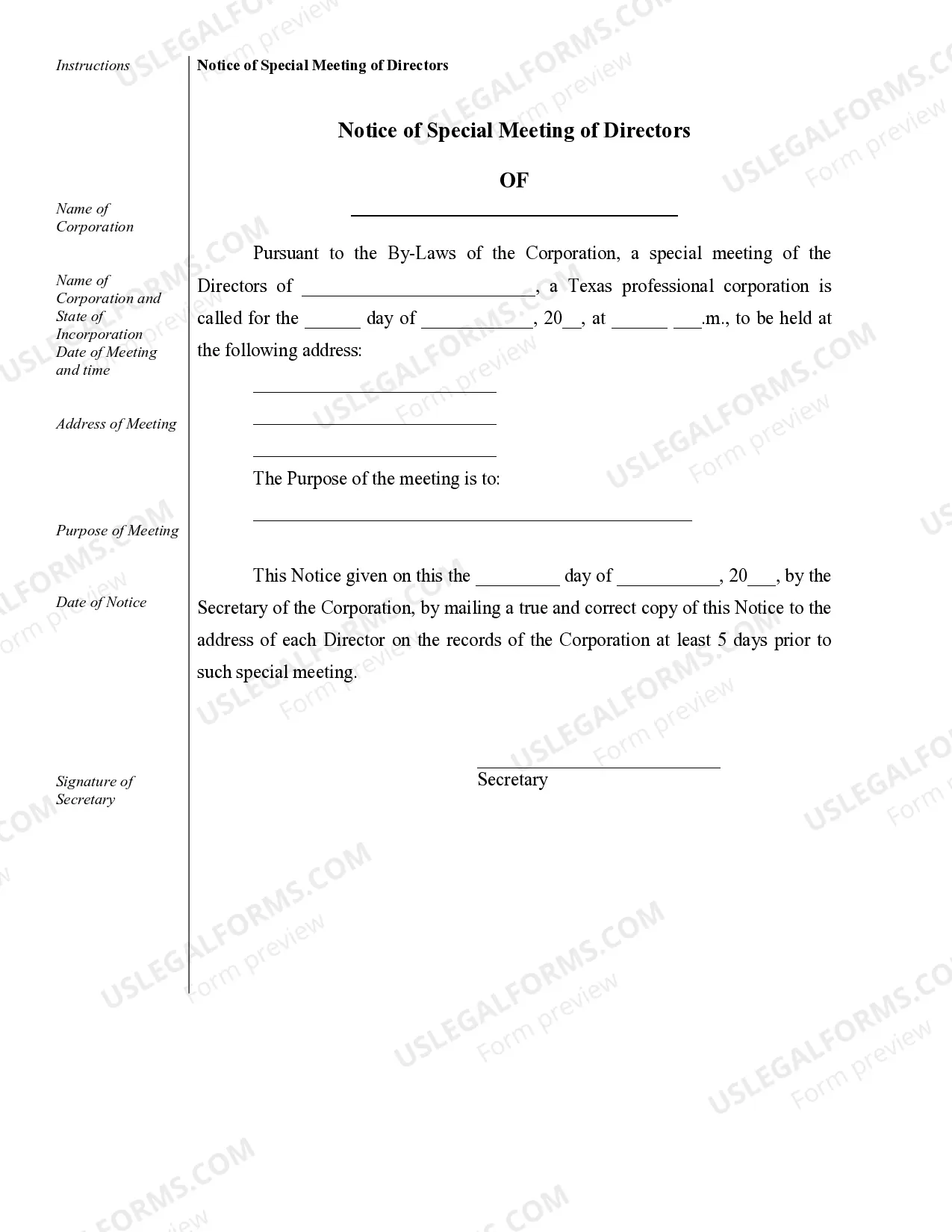

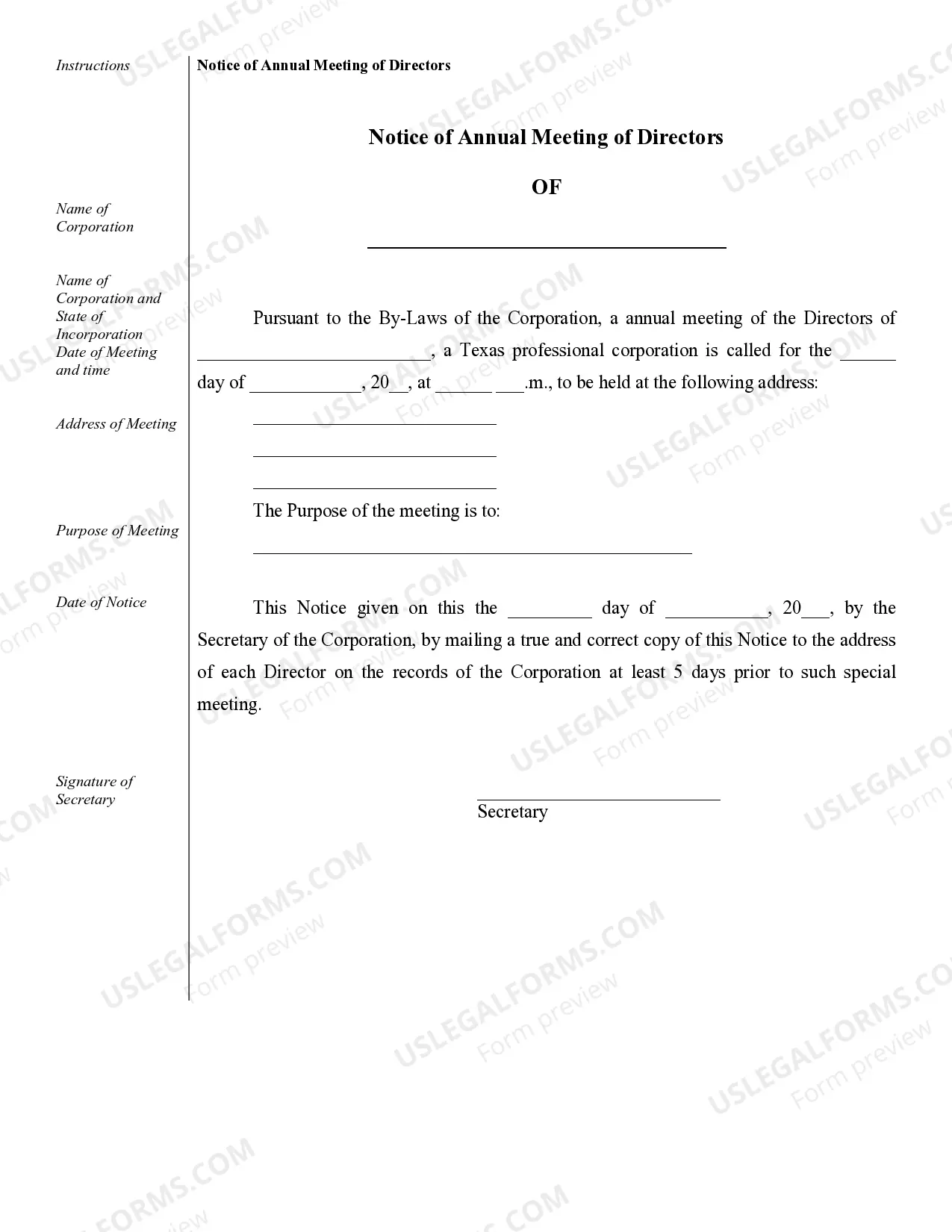

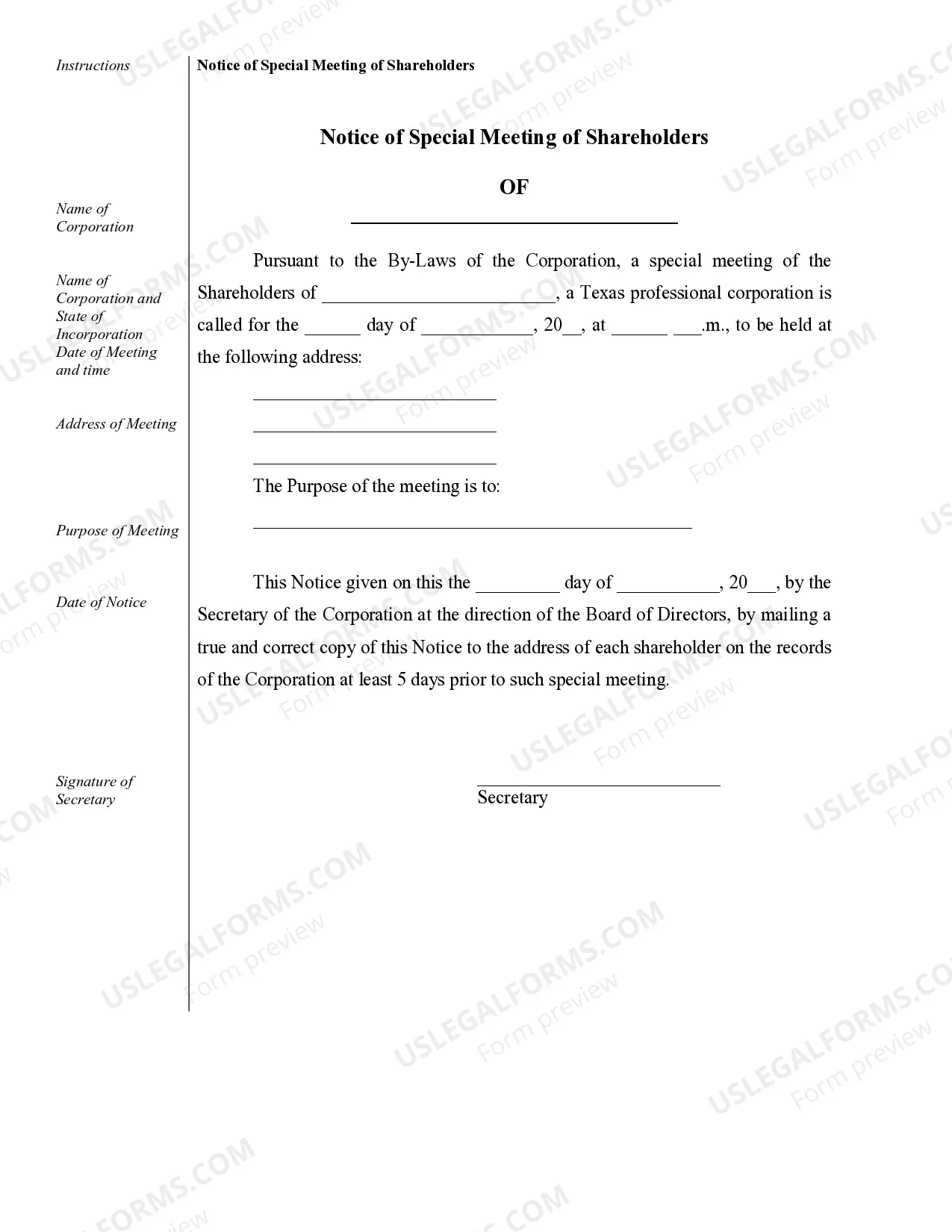

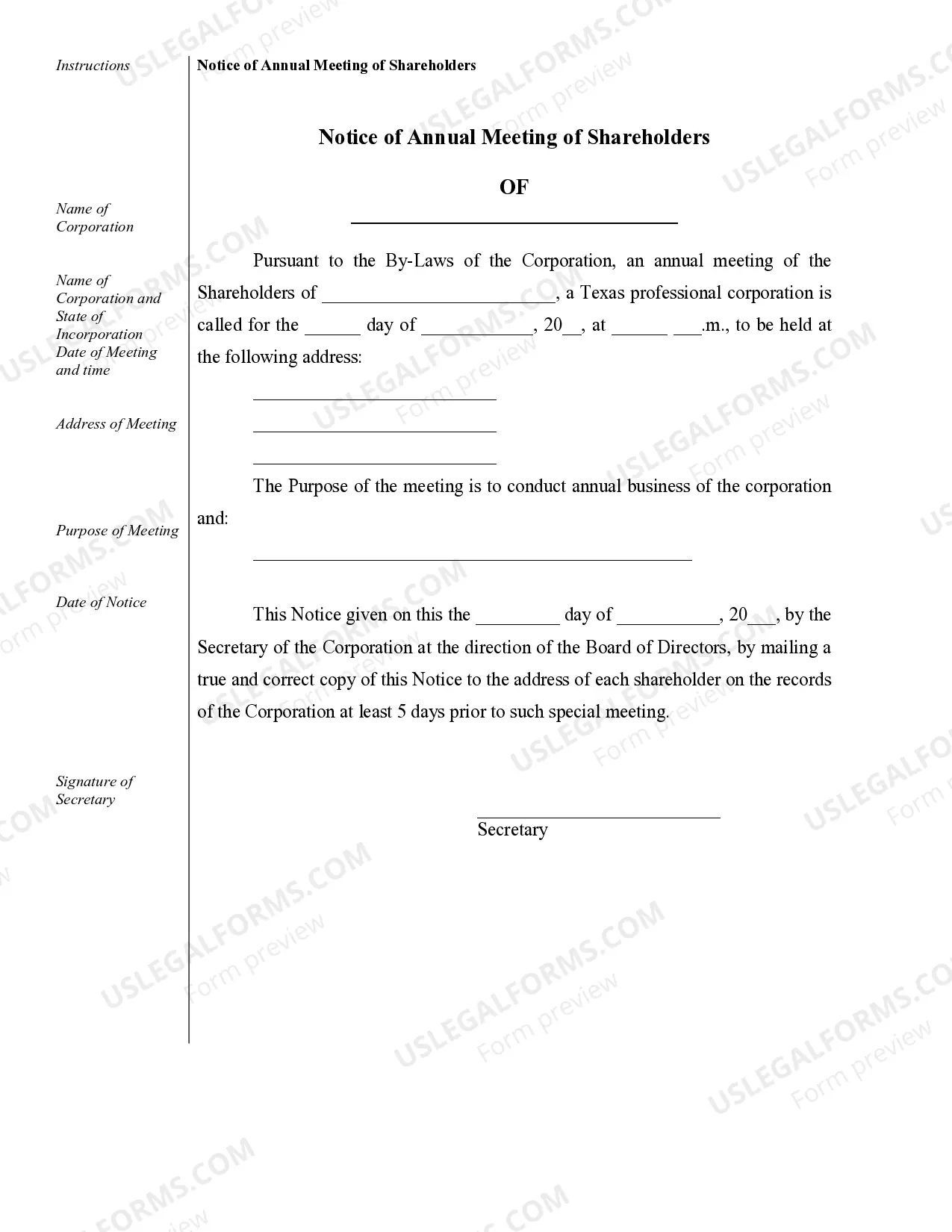

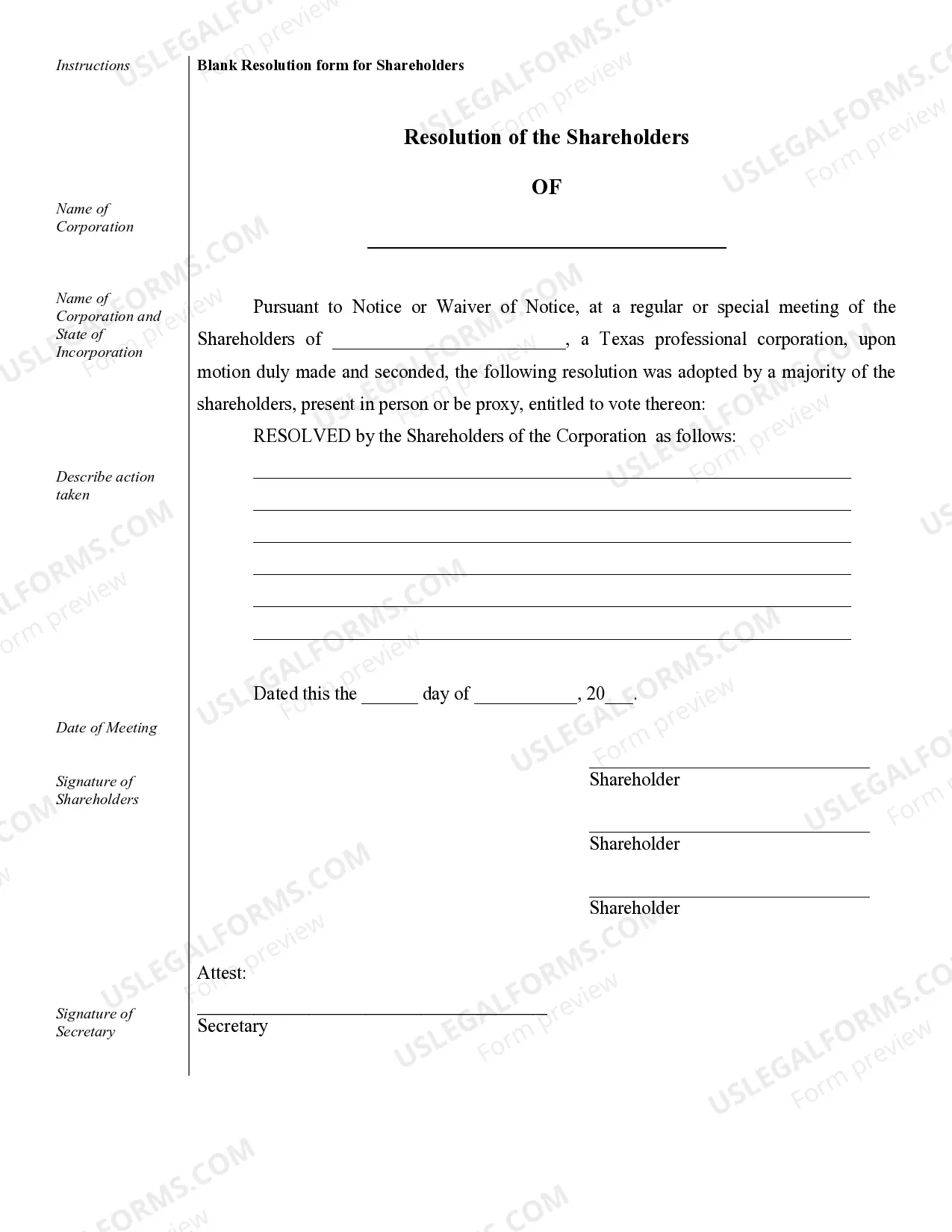

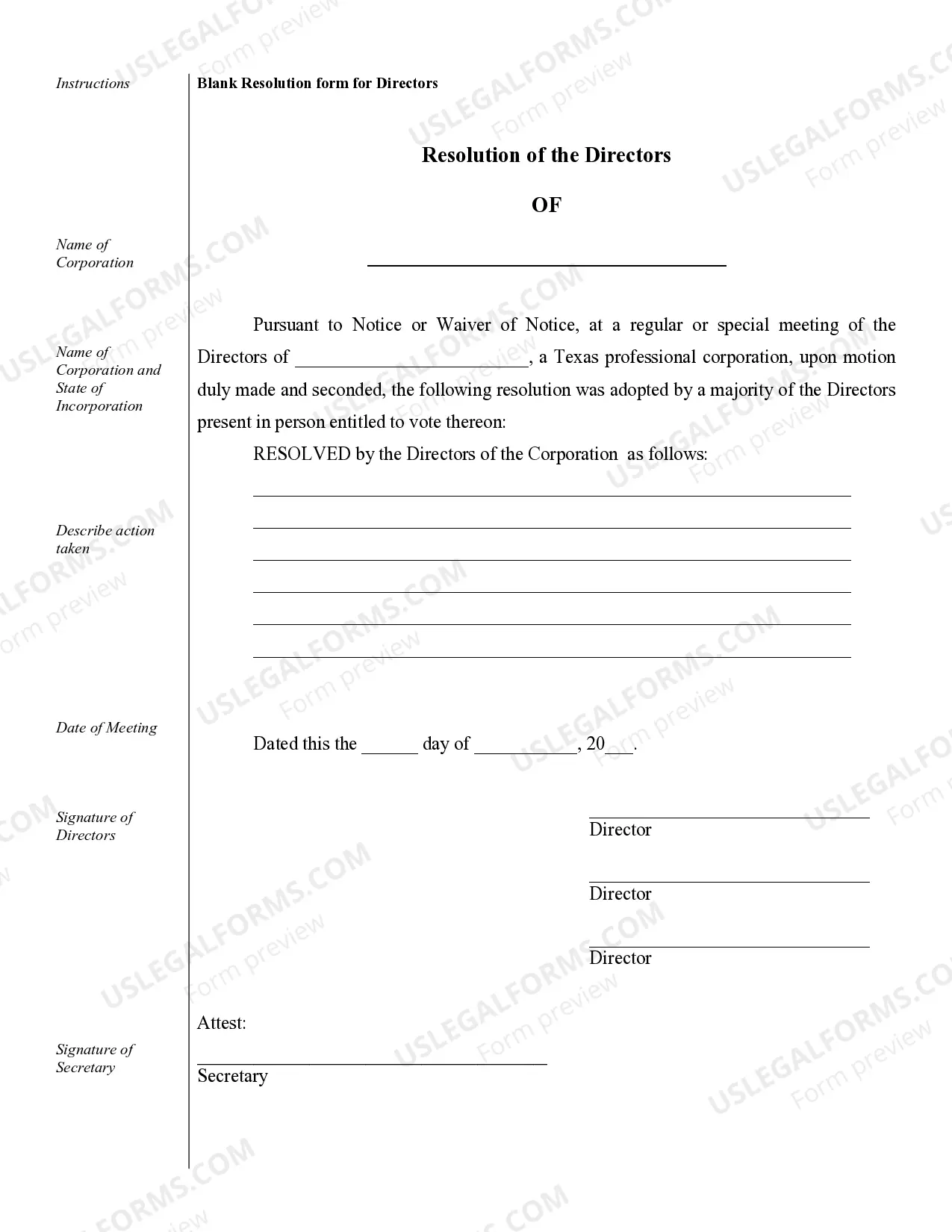

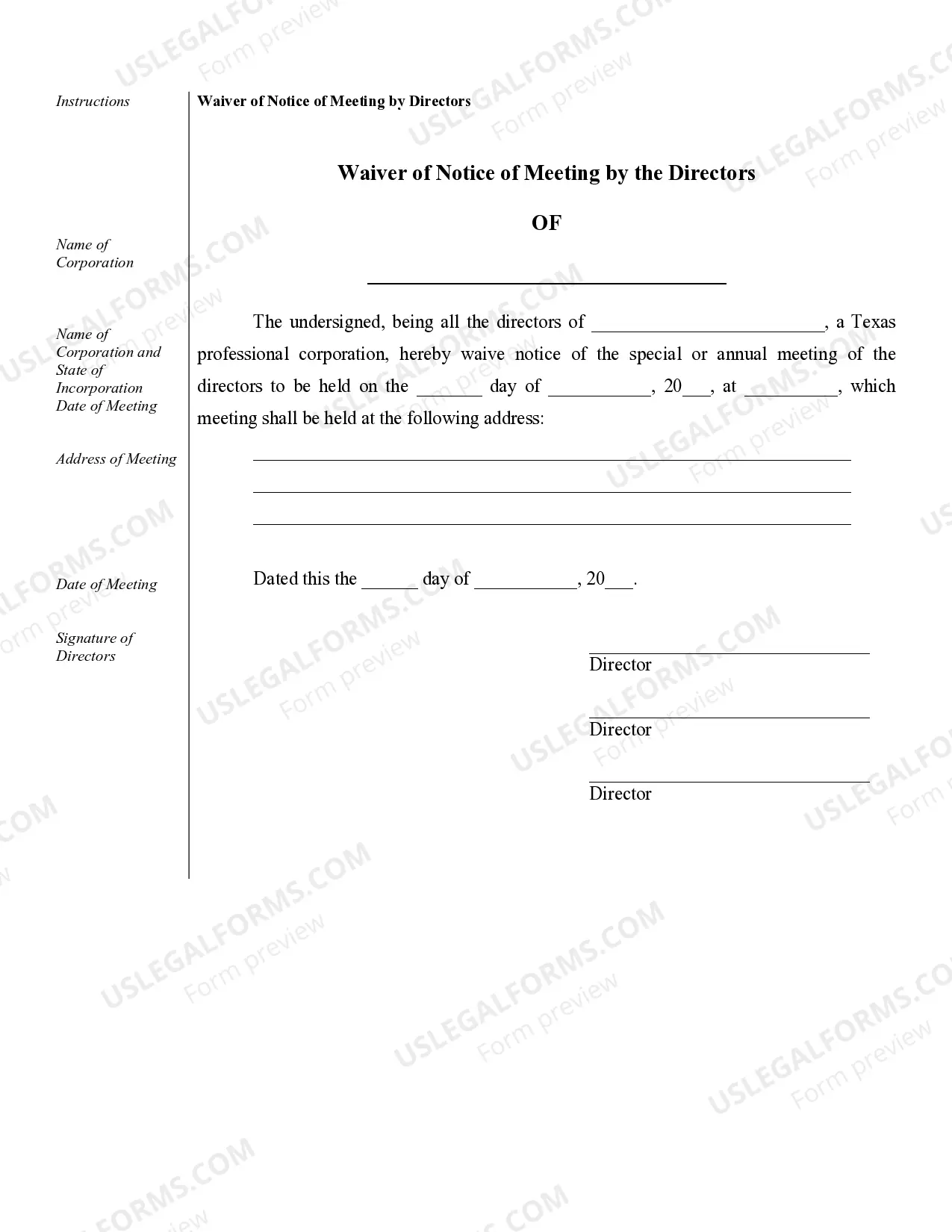

Irving Sample Corporate Records are comprehensive documents that pertain to the establishment, operation, and compliance of a professional corporation based in Texas. These records are essential for maintaining an organized and legally compliant business structure. One of the key types of Irving Sample Corporate Records for a Texas Professional Corporation is the Certificate of Formation. This document is filed with the Texas Secretary of State and includes crucial information such as the company's name, registered agent and office, board of directors, and the nature of business to be carried out. Another important record is the Bylaws, which outlines the internal rules and regulations that govern the corporation. Bylaws typically cover details regarding the appointment and removal of directors and officers, meeting procedures, voting rights, and various corporate policies. These documents help ensure smooth operations within the corporation and provide a framework for decision-making processes. To ensure compliance with state regulations, a Texas Professional Corporation must also maintain records of its meetings. Minutes of meetings document the discussions, resolutions, and voting outcomes of both board of directors and shareholders meetings. These records serve as evidence of corporate decision-making and allow for historical reference. Apart from meeting minutes, a Texas Professional Corporation also keeps track of its shareholders through a Shareholder Ledger. This record lists the names, contact details, and ownership percentages of all shareholders. It is crucial for tracking ownership changes, issuing stock certificates, and distributing dividends. To reflect any changes in the composition of the corporation's board of directors, a Sample Corporate Records may include Board Resolutions. These documents record any changes in the board's structure, appointments or resignations of directors, and delegation of powers. Additionally, a Professional Corporation in Texas may need to maintain financial records. These may include general ledgers, financial statements, and tax returns, which provide a clear picture of the corporation's financial status. These records are important for ensuring accuracy in financial reporting, making informed business decisions, and complying with tax obligations. Overall, the various types of Irving Sample Corporate Records outlined above are critical for establishing and maintaining a Texas Professional Corporation. They help ensure compliance with regulatory requirements, orderly decision-making, and effective governance within the corporation. Proper maintenance and documentation of these records contribute to the long-term success and legal standing of the professional corporation.Irving Sample Corporate Records are comprehensive documents that pertain to the establishment, operation, and compliance of a professional corporation based in Texas. These records are essential for maintaining an organized and legally compliant business structure. One of the key types of Irving Sample Corporate Records for a Texas Professional Corporation is the Certificate of Formation. This document is filed with the Texas Secretary of State and includes crucial information such as the company's name, registered agent and office, board of directors, and the nature of business to be carried out. Another important record is the Bylaws, which outlines the internal rules and regulations that govern the corporation. Bylaws typically cover details regarding the appointment and removal of directors and officers, meeting procedures, voting rights, and various corporate policies. These documents help ensure smooth operations within the corporation and provide a framework for decision-making processes. To ensure compliance with state regulations, a Texas Professional Corporation must also maintain records of its meetings. Minutes of meetings document the discussions, resolutions, and voting outcomes of both board of directors and shareholders meetings. These records serve as evidence of corporate decision-making and allow for historical reference. Apart from meeting minutes, a Texas Professional Corporation also keeps track of its shareholders through a Shareholder Ledger. This record lists the names, contact details, and ownership percentages of all shareholders. It is crucial for tracking ownership changes, issuing stock certificates, and distributing dividends. To reflect any changes in the composition of the corporation's board of directors, a Sample Corporate Records may include Board Resolutions. These documents record any changes in the board's structure, appointments or resignations of directors, and delegation of powers. Additionally, a Professional Corporation in Texas may need to maintain financial records. These may include general ledgers, financial statements, and tax returns, which provide a clear picture of the corporation's financial status. These records are important for ensuring accuracy in financial reporting, making informed business decisions, and complying with tax obligations. Overall, the various types of Irving Sample Corporate Records outlined above are critical for establishing and maintaining a Texas Professional Corporation. They help ensure compliance with regulatory requirements, orderly decision-making, and effective governance within the corporation. Proper maintenance and documentation of these records contribute to the long-term success and legal standing of the professional corporation.