Sample Corporate Notices of Meetings, Resolutions, Simple Stock Ledger & Certificate.

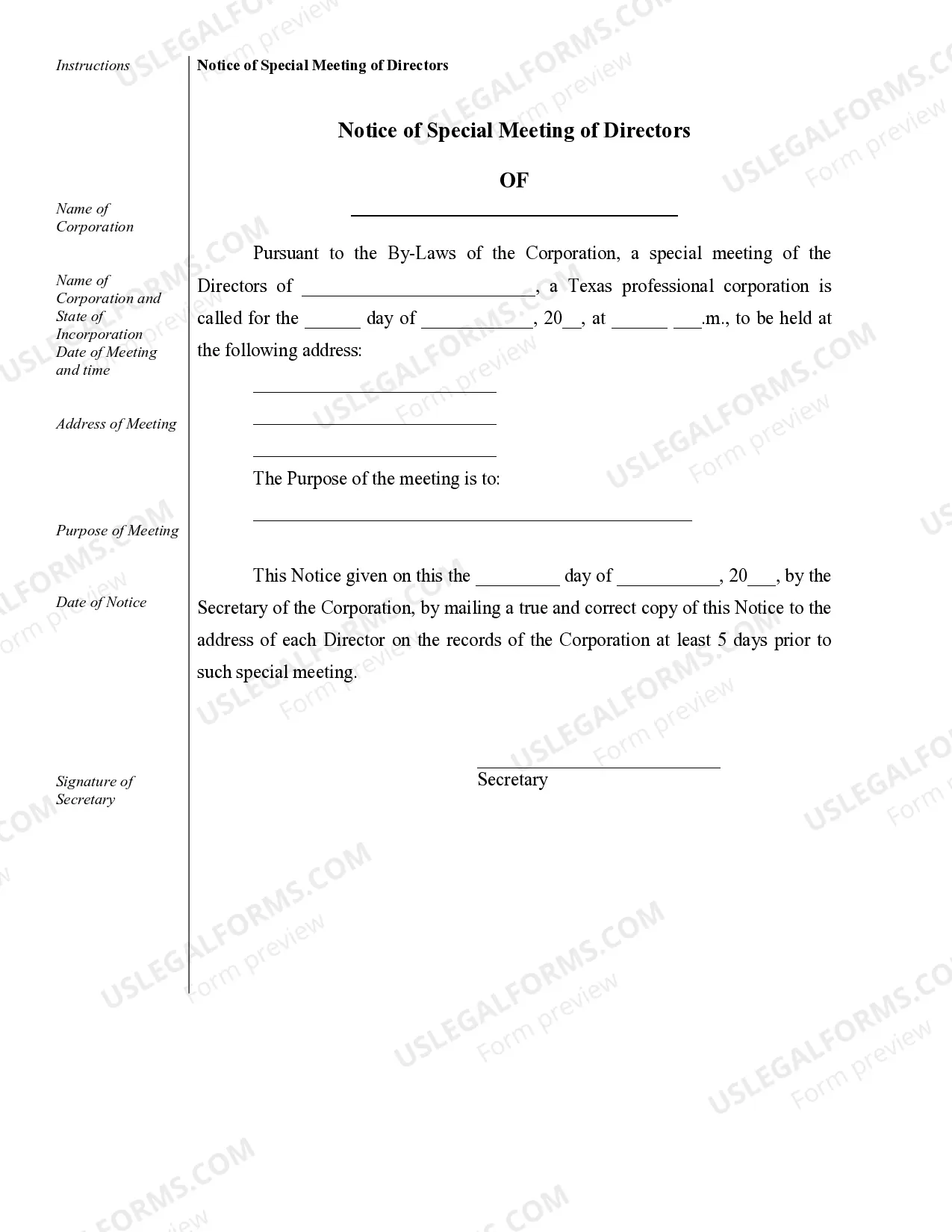

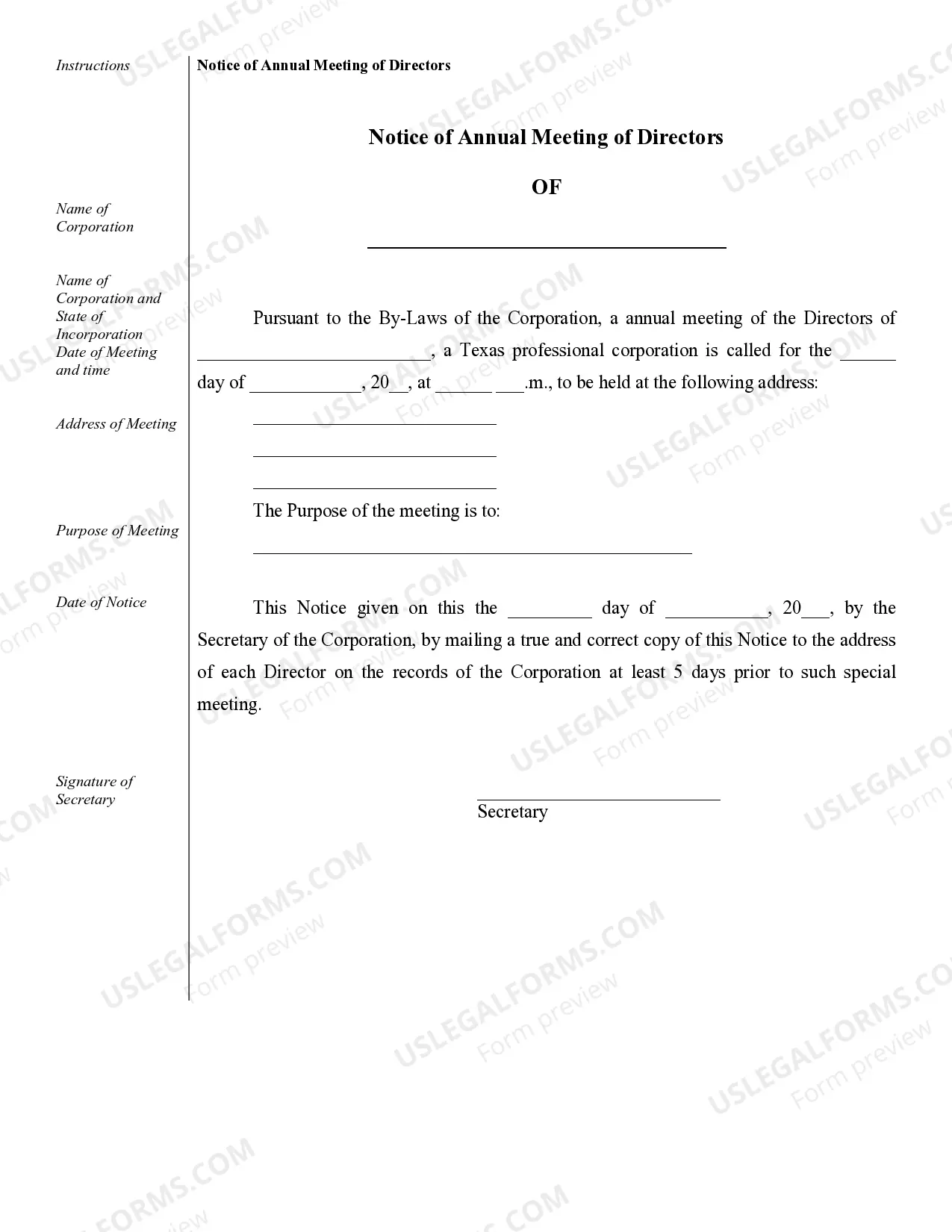

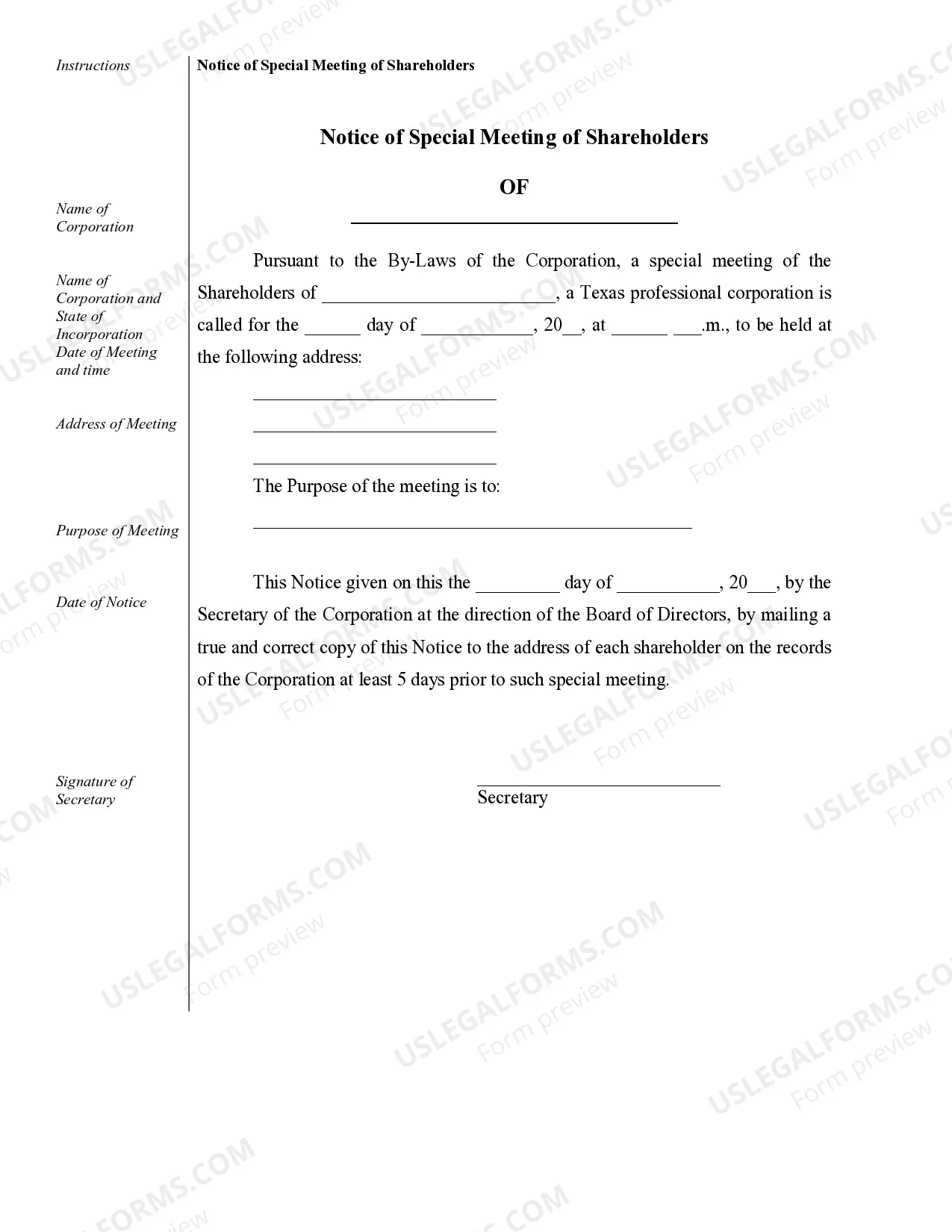

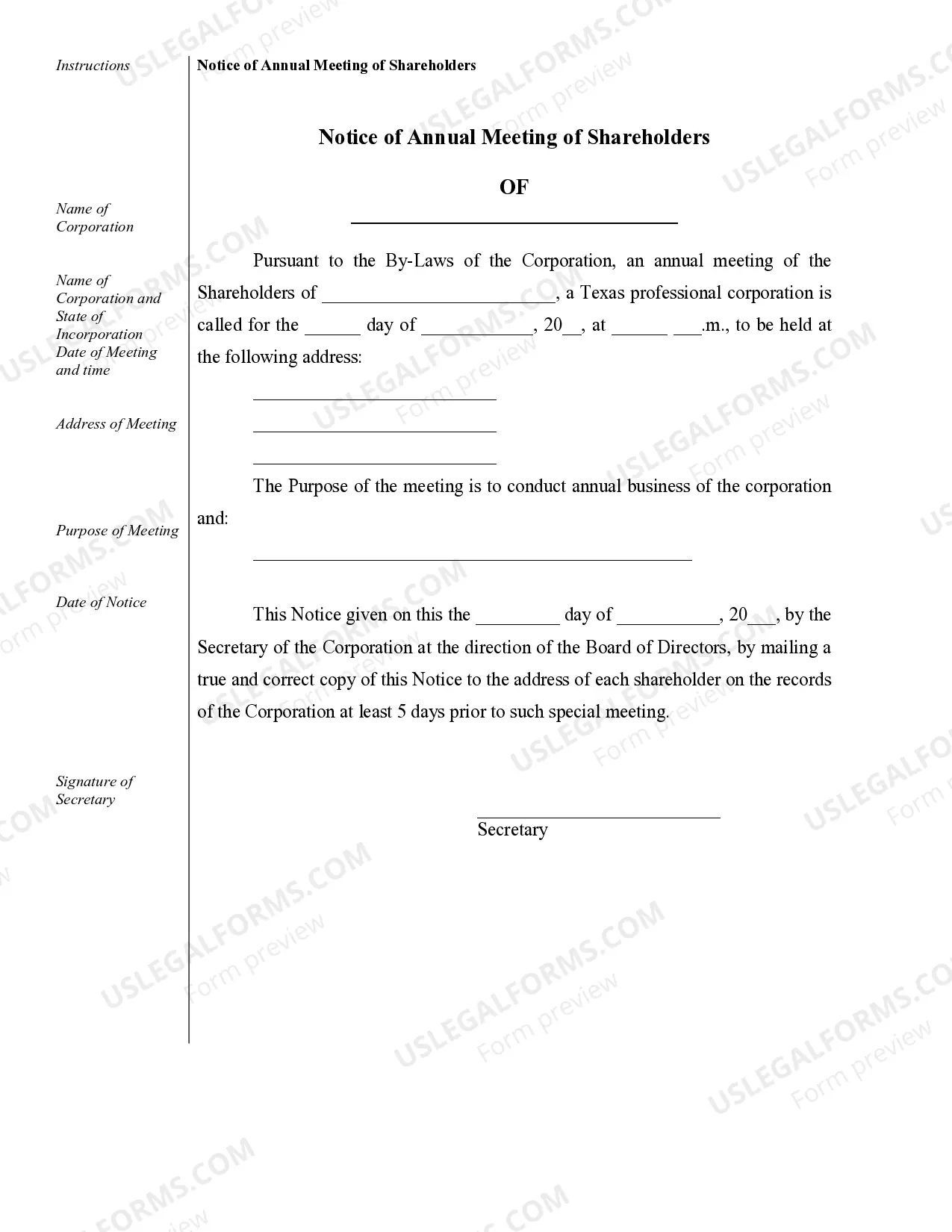

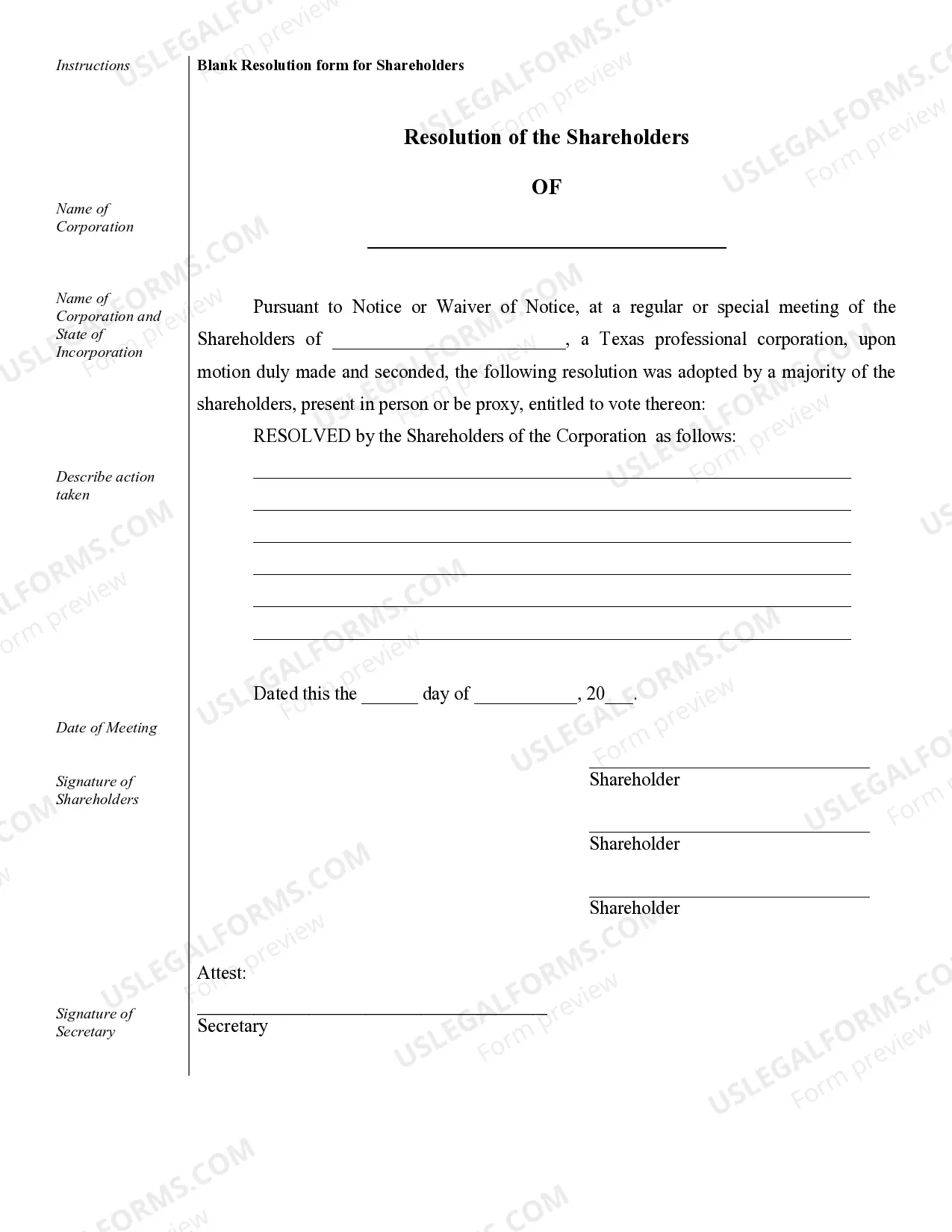

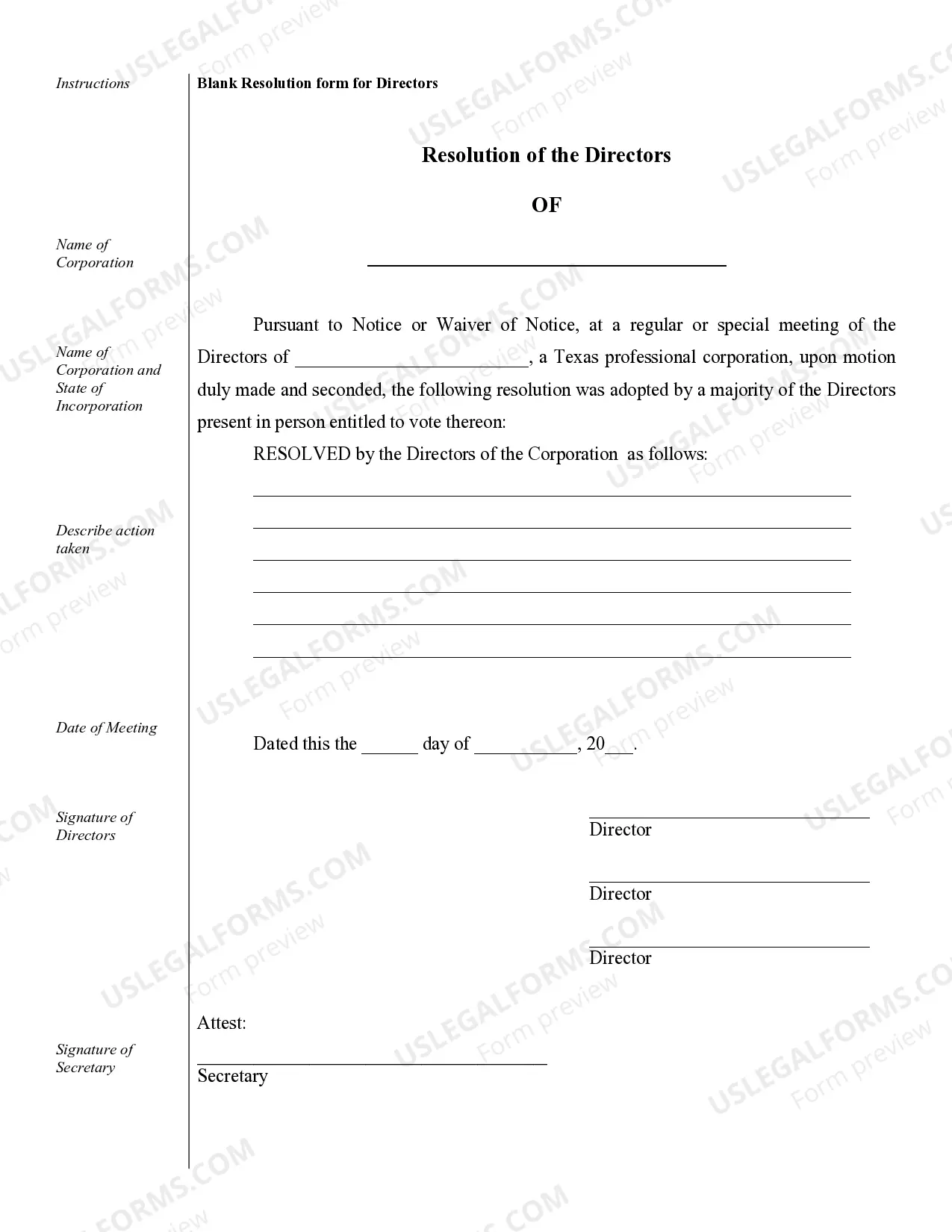

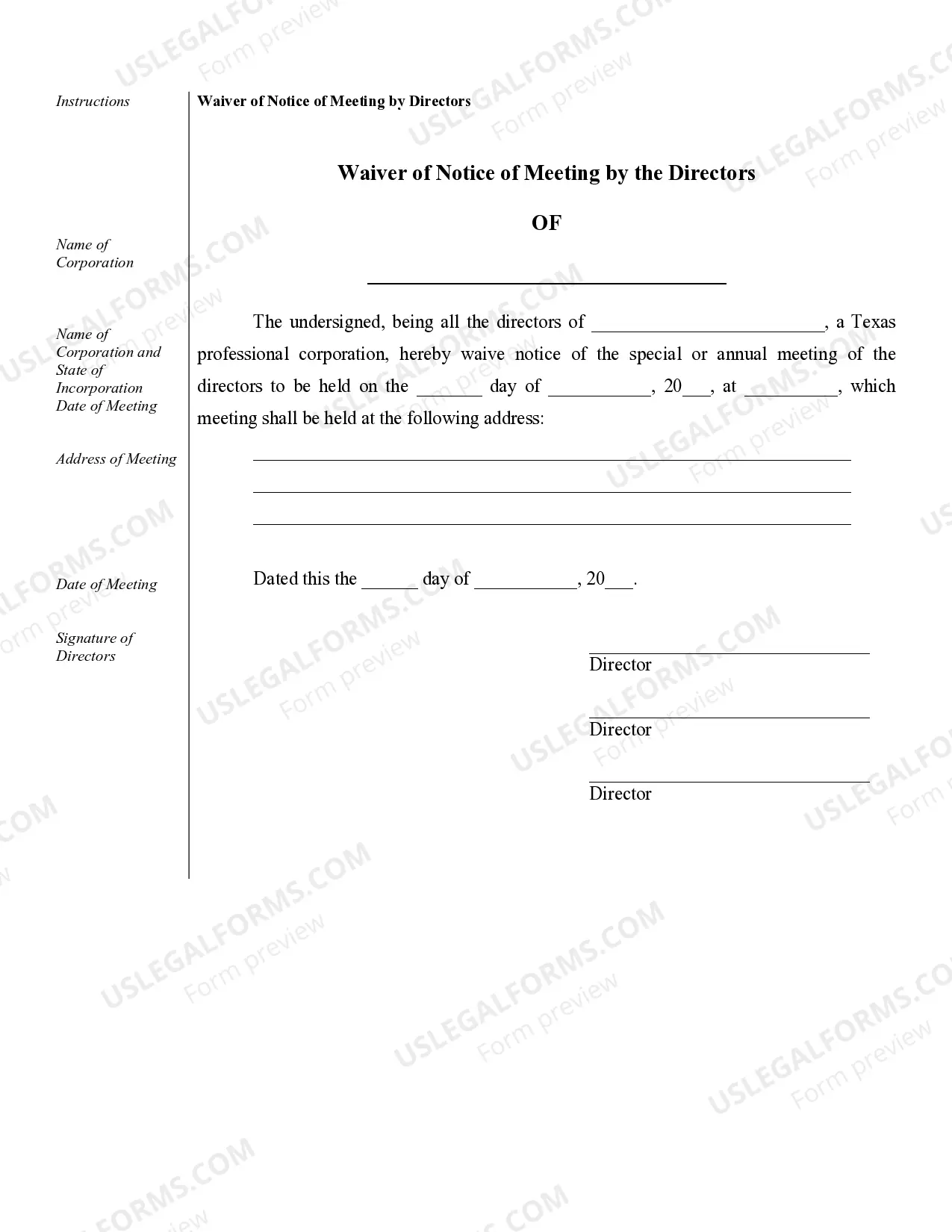

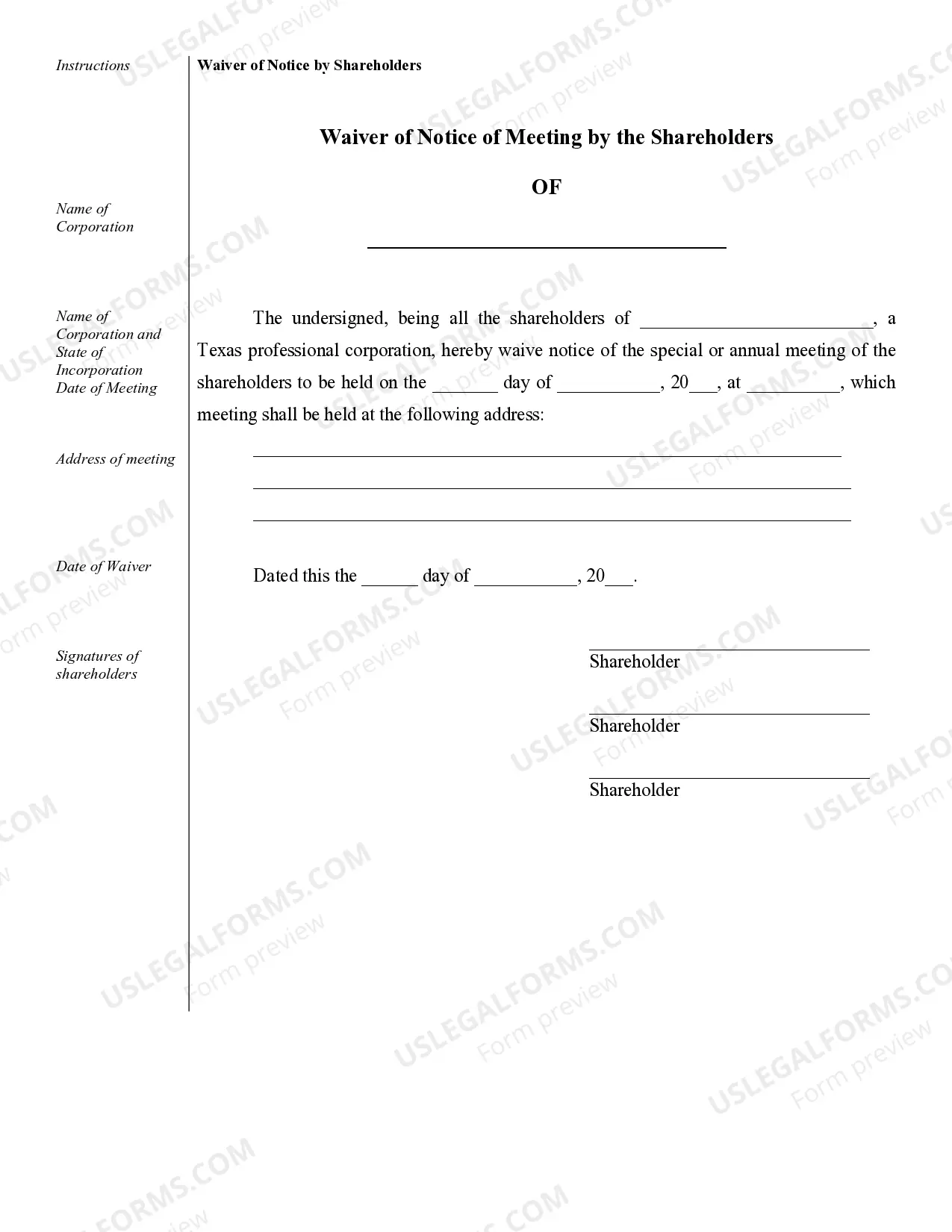

League City Sample Corporate Records for a Texas Professional Corporation play a crucial role in maintaining the legal and financial aspects of a business. These records serve as a comprehensive documentation of the company's formation, operations, and various transactions. Understanding the different types of corporate records applicable to a Texas Professional Corporation will ensure compliance with state regulations and facilitate effective management. 1. Certificate of Formation: This document initiates the formation of a Texas Professional Corporation and includes essential information such as the company's name, purpose, registered agent details, and contact information. It is an important record that signifies the legal establishment of the corporation. 2. Bylaws: Bylaws outline the internal rules and procedures that govern the corporation's day-to-day operations. These records typically encompass information about shareholder meetings, board of directors, officer roles, voting procedures, and other corporate formalities. They provide a framework for decision-making processes within the company. 3. Shareholder Agreements: Shareholder agreements are contracts that establish the relationship between the corporation's shareholders, outlining their rights, responsibilities, and obligations. These agreements often specify ownership percentages, voting rights, dividend distribution, stock transfer procedures, and dispute resolution mechanisms. 4. Meeting Minutes: Meeting minutes act as an official record of discussions, decisions, and voting outcomes conducted during shareholder and board of director meetings. These records are crucial for corporate transparency, accountability, and legal compliance. 5. Stock Ledger: A stock ledger is a register that maintains comprehensive details of the corporation's shareholders, including their names, addresses, share classes, and the number of shares held. This record helps track ownership and ensures accuracy when issuing dividends, stock certificates, or conducting stock transfers. 6. Financial Statements: Financial statements, including balance sheets, income statements, and cash flow statements, provide a snapshot of the corporation's financial health. These records indicate the company's profitability, assets, liabilities, and equity, assisting in decision-making, auditing, and complying with tax requirements. 7. Contracts and Agreements: Corporate records must include copies of significant contracts, such as lease agreements, client contracts, vendor agreements, and partnership agreements. These documents outline the terms and conditions of business relationships and help protect the corporation's interests. 8. Tax Records: Maintaining copies of tax returns, tax filings, and related financial documents is vital for a Texas Professional Corporation. These records ensure compliance with state and federal tax regulations and aid in completing audits or resolving tax disputes. 9. Licenses and Permits: Documentation of licenses, permits, and certifications held by the corporation is essential for legal compliance and ongoing operations. This may include professional licenses, business permits, and any specialized industry certifications. Creating and managing appropriate corporate records for a Texas Professional Corporation in League City is crucial for maintaining legal compliance, facilitating business transactions, and addressing potential legal issues effectively. Regular review and update of these records ensure accuracy and integrity while serving as valuable resources for corporate governance and decision-making processes.League City Sample Corporate Records for a Texas Professional Corporation play a crucial role in maintaining the legal and financial aspects of a business. These records serve as a comprehensive documentation of the company's formation, operations, and various transactions. Understanding the different types of corporate records applicable to a Texas Professional Corporation will ensure compliance with state regulations and facilitate effective management. 1. Certificate of Formation: This document initiates the formation of a Texas Professional Corporation and includes essential information such as the company's name, purpose, registered agent details, and contact information. It is an important record that signifies the legal establishment of the corporation. 2. Bylaws: Bylaws outline the internal rules and procedures that govern the corporation's day-to-day operations. These records typically encompass information about shareholder meetings, board of directors, officer roles, voting procedures, and other corporate formalities. They provide a framework for decision-making processes within the company. 3. Shareholder Agreements: Shareholder agreements are contracts that establish the relationship between the corporation's shareholders, outlining their rights, responsibilities, and obligations. These agreements often specify ownership percentages, voting rights, dividend distribution, stock transfer procedures, and dispute resolution mechanisms. 4. Meeting Minutes: Meeting minutes act as an official record of discussions, decisions, and voting outcomes conducted during shareholder and board of director meetings. These records are crucial for corporate transparency, accountability, and legal compliance. 5. Stock Ledger: A stock ledger is a register that maintains comprehensive details of the corporation's shareholders, including their names, addresses, share classes, and the number of shares held. This record helps track ownership and ensures accuracy when issuing dividends, stock certificates, or conducting stock transfers. 6. Financial Statements: Financial statements, including balance sheets, income statements, and cash flow statements, provide a snapshot of the corporation's financial health. These records indicate the company's profitability, assets, liabilities, and equity, assisting in decision-making, auditing, and complying with tax requirements. 7. Contracts and Agreements: Corporate records must include copies of significant contracts, such as lease agreements, client contracts, vendor agreements, and partnership agreements. These documents outline the terms and conditions of business relationships and help protect the corporation's interests. 8. Tax Records: Maintaining copies of tax returns, tax filings, and related financial documents is vital for a Texas Professional Corporation. These records ensure compliance with state and federal tax regulations and aid in completing audits or resolving tax disputes. 9. Licenses and Permits: Documentation of licenses, permits, and certifications held by the corporation is essential for legal compliance and ongoing operations. This may include professional licenses, business permits, and any specialized industry certifications. Creating and managing appropriate corporate records for a Texas Professional Corporation in League City is crucial for maintaining legal compliance, facilitating business transactions, and addressing potential legal issues effectively. Regular review and update of these records ensure accuracy and integrity while serving as valuable resources for corporate governance and decision-making processes.