Sample Corporate Notices of Meetings, Resolutions, Simple Stock Ledger & Certificate.

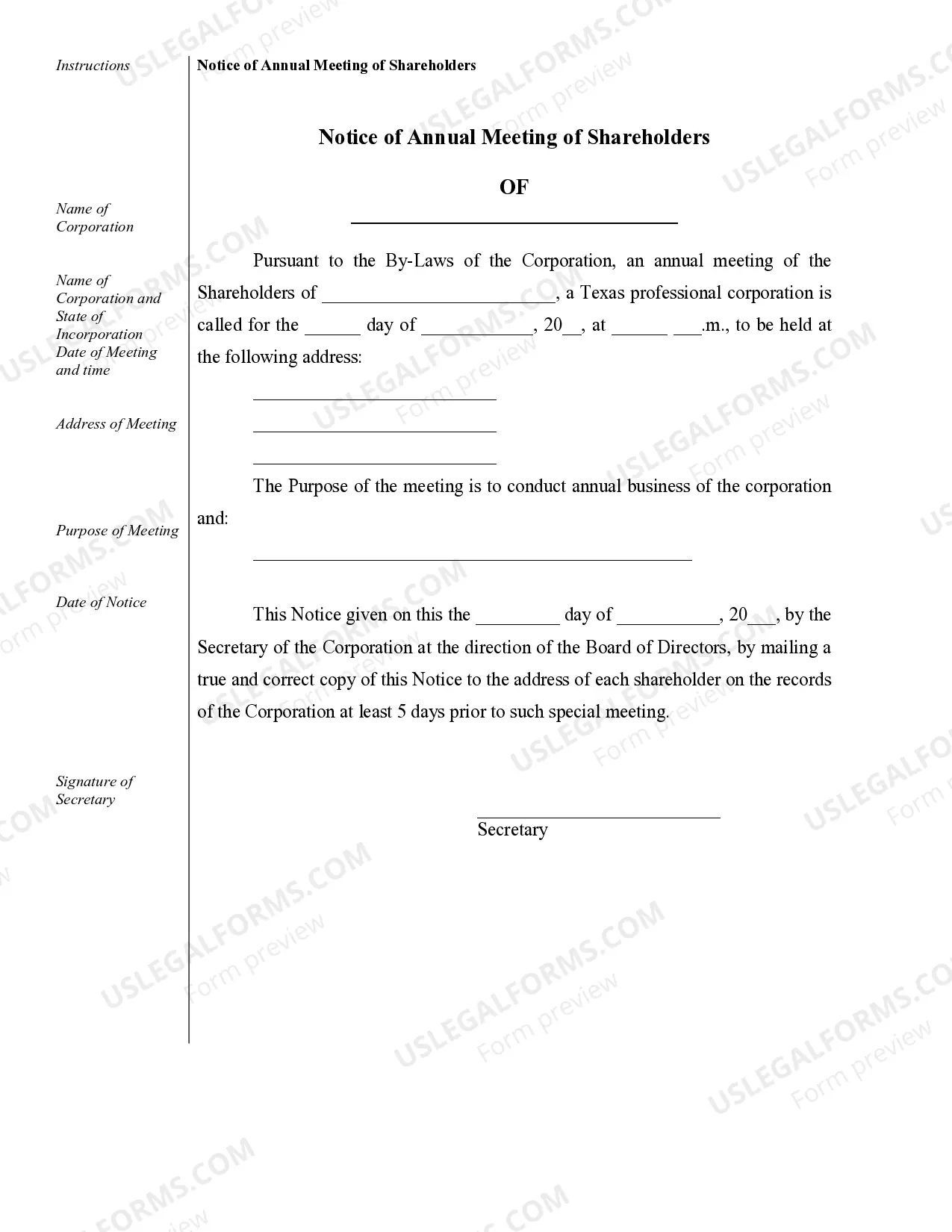

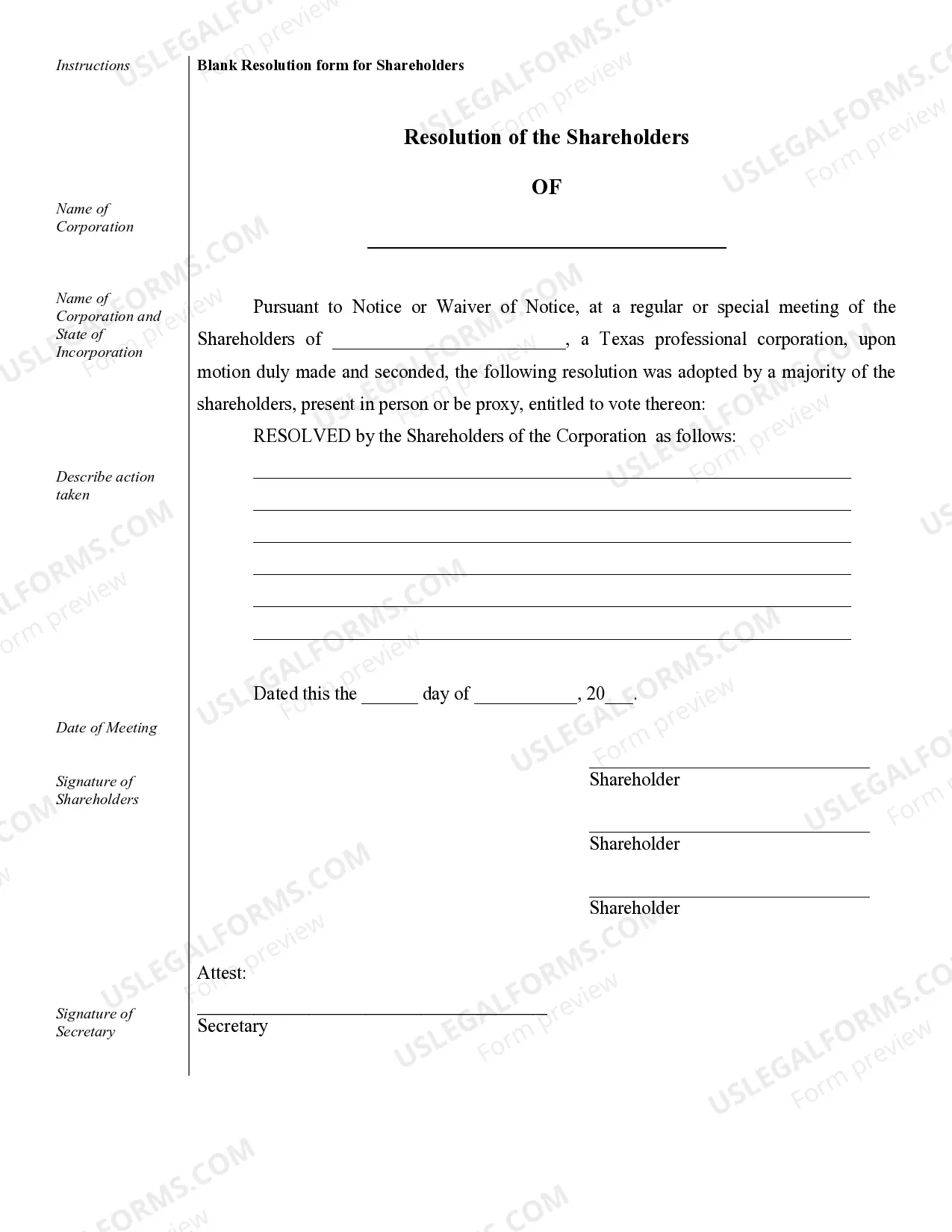

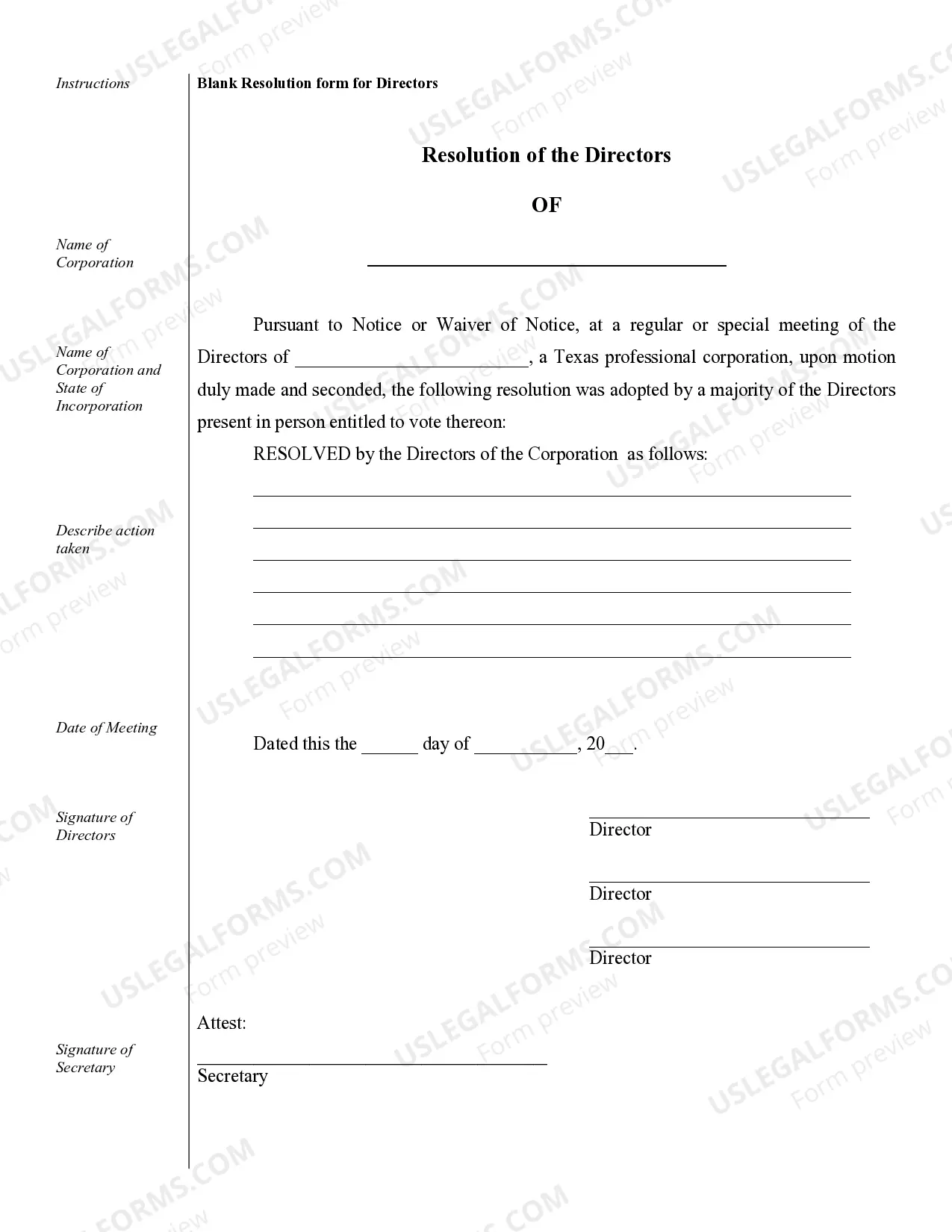

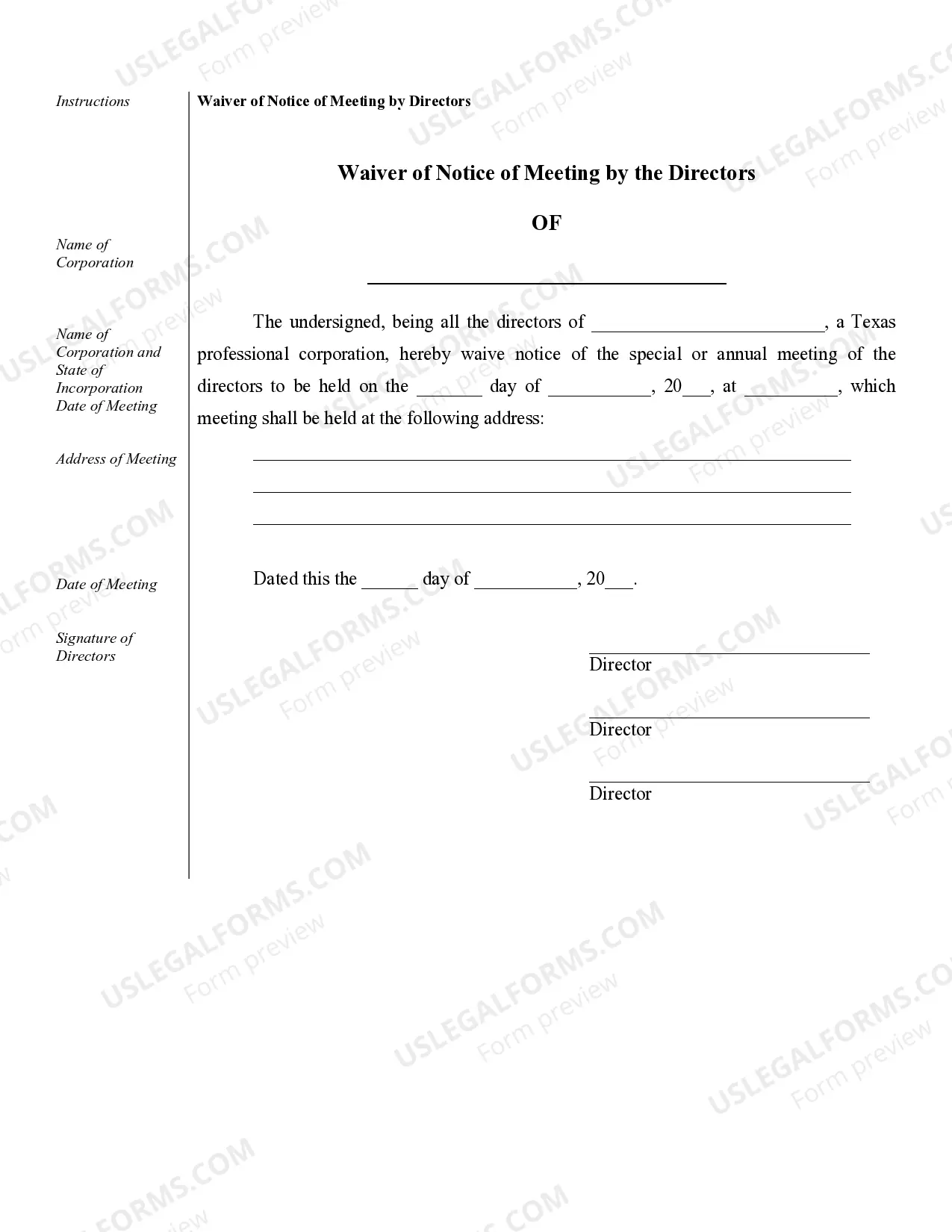

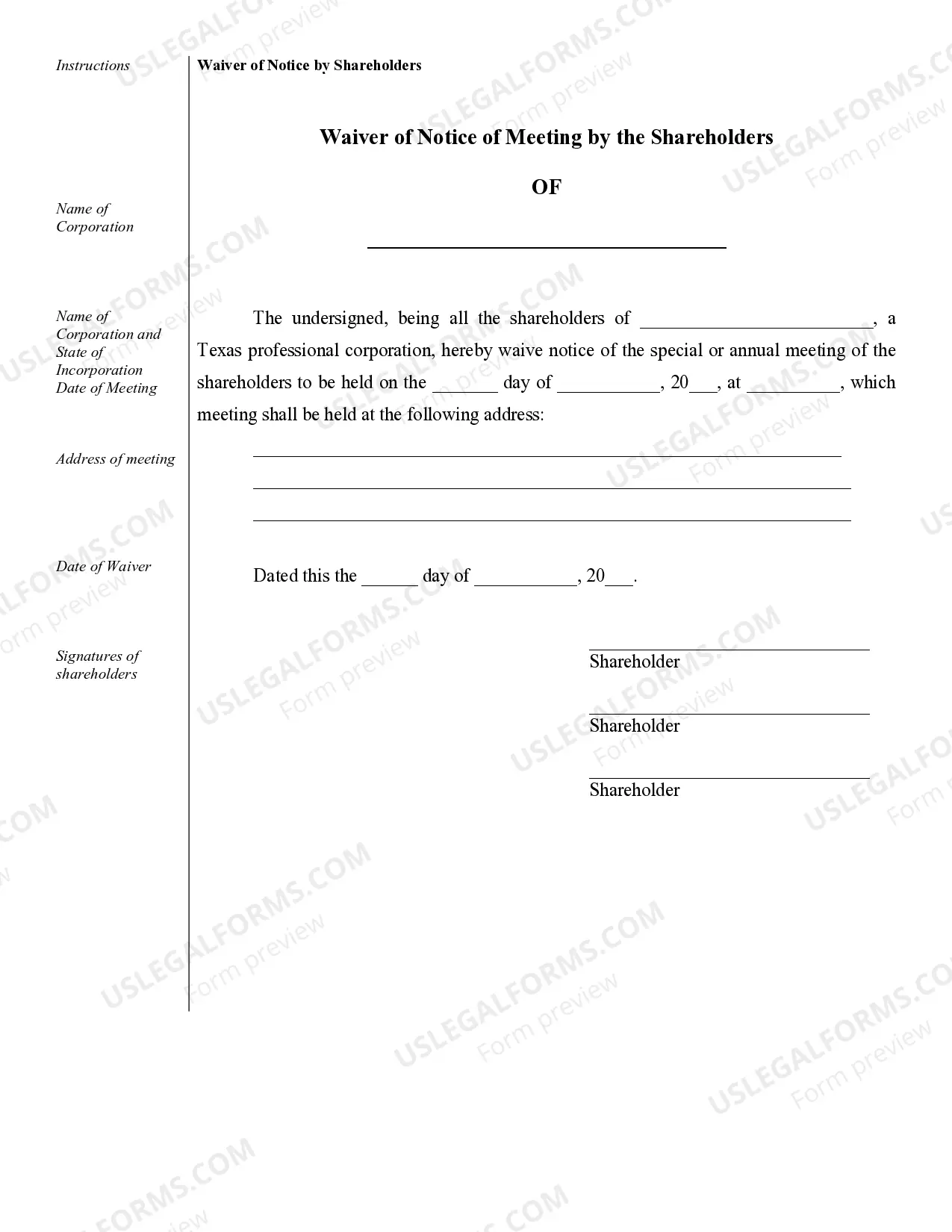

McKinney Sample Corporate Records for a Texas Professional Corporation are essential documents that help document the legal and financial aspects of a professional corporation based in Texas. These records ensure compliance with state laws and regulations and maintain transparency within the organization. Here is a detailed description of the different types of McKinney Sample Corporate Records for a Texas Professional Corporation: 1. Articles of Incorporation: This document is filed with the Texas Secretary of State and establishes the existence of the professional corporation. It includes information such as the corporation's name, purpose, registered agent, directors, and authorized shares of stock. 2. Bylaws: The bylaws outline the internal rules and regulations of the professional corporation. It covers matters related to shareholders, directors, officers, and meetings. It also defines the corporation's governance structure, voting rights, and procedures for decision-making. 3. Shareholder Records: These records include information about the professional corporation's shareholders, including their names, contact details, share ownership, and voting rights. Shareholder records also document any shareholder agreements, restrictions, or buy-sell provisions. 4. Director and Officer Records: These records maintain information about the individuals serving as directors and officers of the professional corporation. It includes their names, positions, addresses, and dates of appointment or resignation. 5. Stock Certificate Records: These documents validate the ownership of shares in the professional corporation. They specify the number of shares owned, the class of shares, and may include unique identification numbers. 6. Meeting Minutes: Meeting minutes are detailed records of formal meetings conducted by the professional corporation's shareholders, directors, or officers. Minutes summarize discussions, decisions made, and resolutions adopted during these meetings. 7. Financial Statements: These records provide an overview of the professional corporation's financial health and performance. They include balance sheets, income statements, cash flow statements, and other financial reports that comply with generally accepted accounting principles (GAAP) or other recognized accounting standards. 8. Tax Records: These records document the professional corporation's tax-related activities and compliance. These include records of tax returns filed, supporting documents, receipts, and other relevant information required for federal, state, and local tax obligations. 9. Contracts and Agreements: This category includes any contracts, agreements, or legal documents entered into by the professional corporation, such as client agreements, vendor contracts, employment agreements, or leases. These records ensure that the corporation fulfills its obligations and protects its rights. 10. Licensing and Regulatory Compliance Records: These records demonstrate the professional corporation's adherence to licensing requirements and regulatory obligations specific to its industry. It may include licenses, permits, certifications, or any other documents required by relevant authorities. McKinney Sample Corporate Records for a Texas Professional Corporation provide a comprehensive framework for organizing and maintaining the legal and financial aspects of such entities. These records serve as vital references in legal disputes, audits, inspections, or due diligence processes. Keeping accurate and up-to-date corporate records is vital for the success, credibility, and long-term sustainability of a Texas Professional Corporation.McKinney Sample Corporate Records for a Texas Professional Corporation are essential documents that help document the legal and financial aspects of a professional corporation based in Texas. These records ensure compliance with state laws and regulations and maintain transparency within the organization. Here is a detailed description of the different types of McKinney Sample Corporate Records for a Texas Professional Corporation: 1. Articles of Incorporation: This document is filed with the Texas Secretary of State and establishes the existence of the professional corporation. It includes information such as the corporation's name, purpose, registered agent, directors, and authorized shares of stock. 2. Bylaws: The bylaws outline the internal rules and regulations of the professional corporation. It covers matters related to shareholders, directors, officers, and meetings. It also defines the corporation's governance structure, voting rights, and procedures for decision-making. 3. Shareholder Records: These records include information about the professional corporation's shareholders, including their names, contact details, share ownership, and voting rights. Shareholder records also document any shareholder agreements, restrictions, or buy-sell provisions. 4. Director and Officer Records: These records maintain information about the individuals serving as directors and officers of the professional corporation. It includes their names, positions, addresses, and dates of appointment or resignation. 5. Stock Certificate Records: These documents validate the ownership of shares in the professional corporation. They specify the number of shares owned, the class of shares, and may include unique identification numbers. 6. Meeting Minutes: Meeting minutes are detailed records of formal meetings conducted by the professional corporation's shareholders, directors, or officers. Minutes summarize discussions, decisions made, and resolutions adopted during these meetings. 7. Financial Statements: These records provide an overview of the professional corporation's financial health and performance. They include balance sheets, income statements, cash flow statements, and other financial reports that comply with generally accepted accounting principles (GAAP) or other recognized accounting standards. 8. Tax Records: These records document the professional corporation's tax-related activities and compliance. These include records of tax returns filed, supporting documents, receipts, and other relevant information required for federal, state, and local tax obligations. 9. Contracts and Agreements: This category includes any contracts, agreements, or legal documents entered into by the professional corporation, such as client agreements, vendor contracts, employment agreements, or leases. These records ensure that the corporation fulfills its obligations and protects its rights. 10. Licensing and Regulatory Compliance Records: These records demonstrate the professional corporation's adherence to licensing requirements and regulatory obligations specific to its industry. It may include licenses, permits, certifications, or any other documents required by relevant authorities. McKinney Sample Corporate Records for a Texas Professional Corporation provide a comprehensive framework for organizing and maintaining the legal and financial aspects of such entities. These records serve as vital references in legal disputes, audits, inspections, or due diligence processes. Keeping accurate and up-to-date corporate records is vital for the success, credibility, and long-term sustainability of a Texas Professional Corporation.