Sample Corporate Notices of Meetings, Resolutions, Simple Stock Ledger & Certificate.

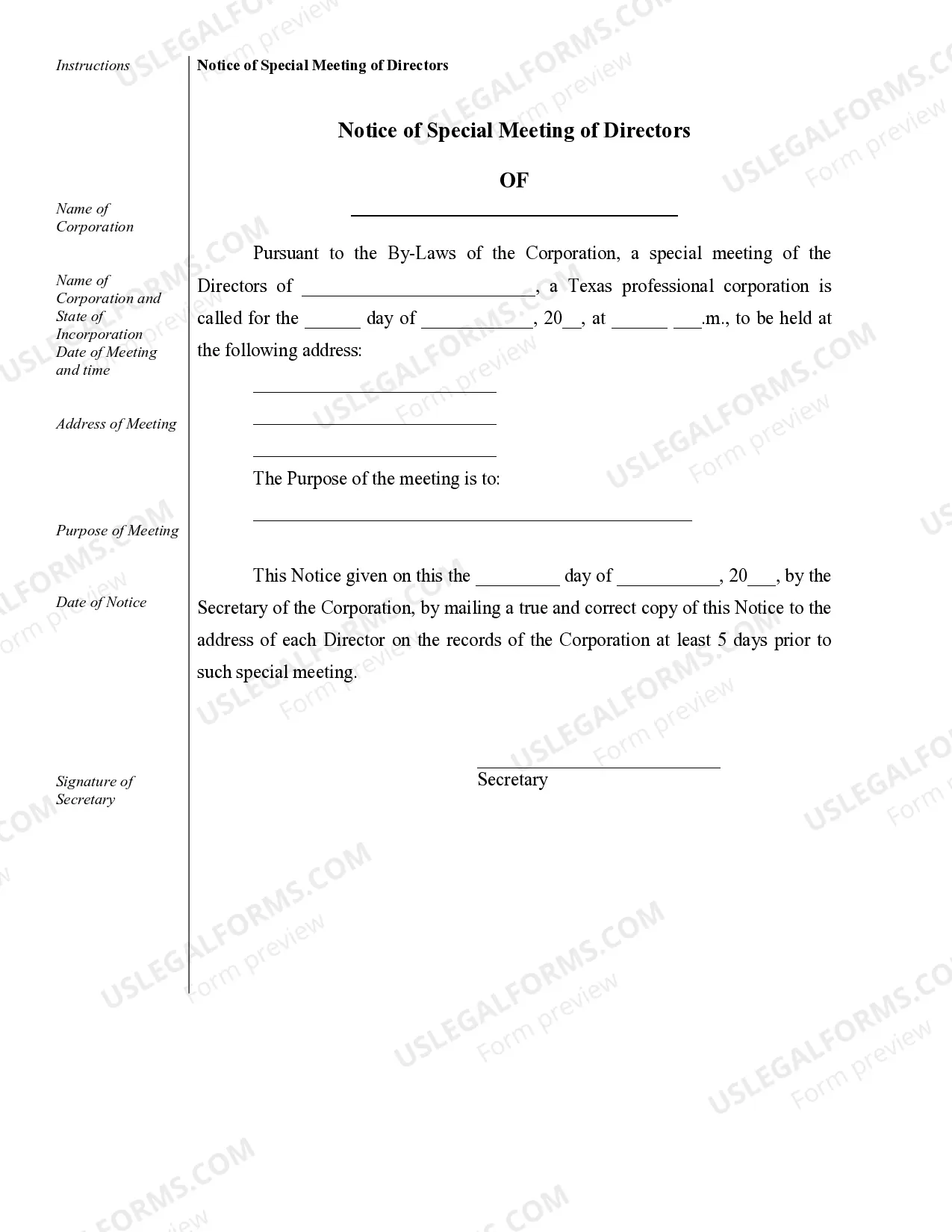

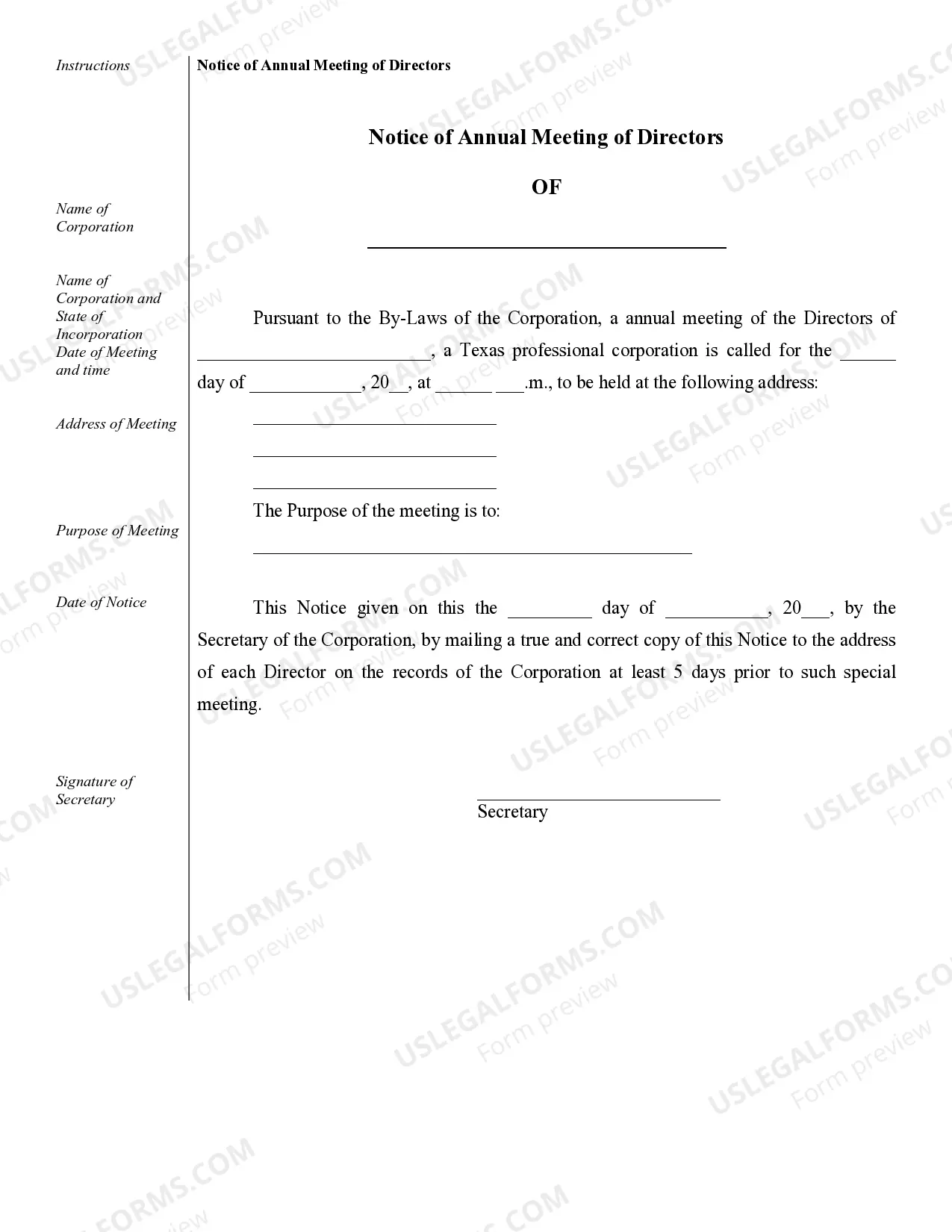

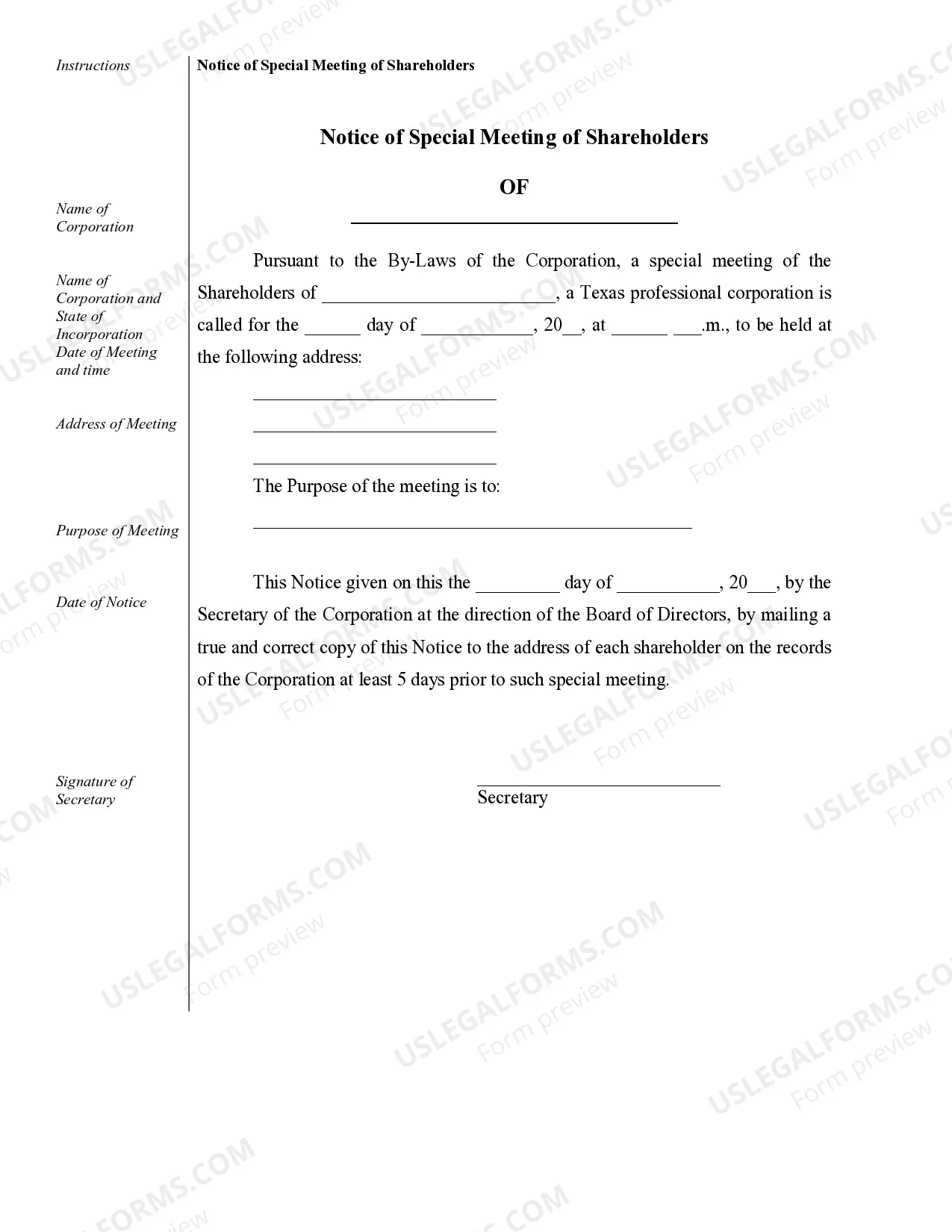

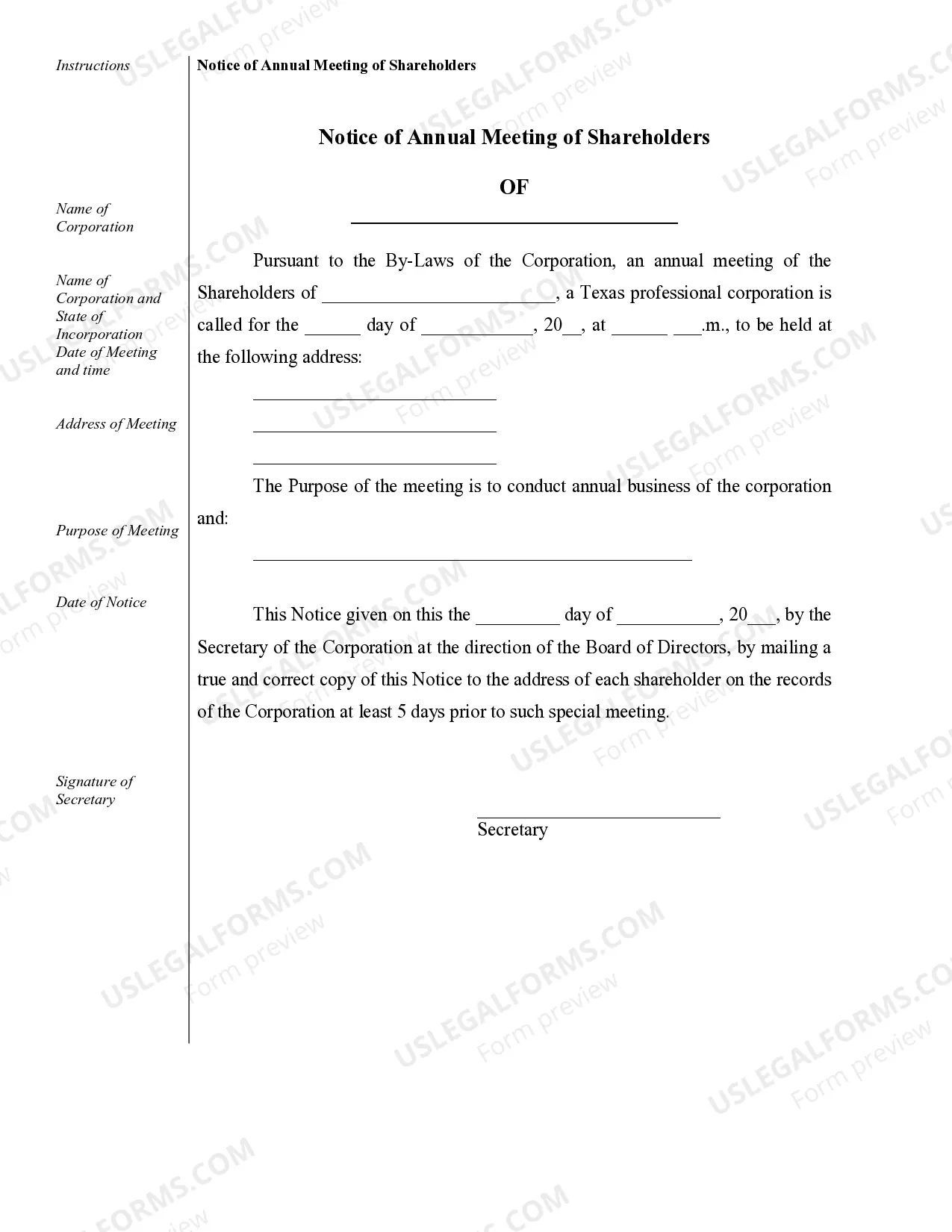

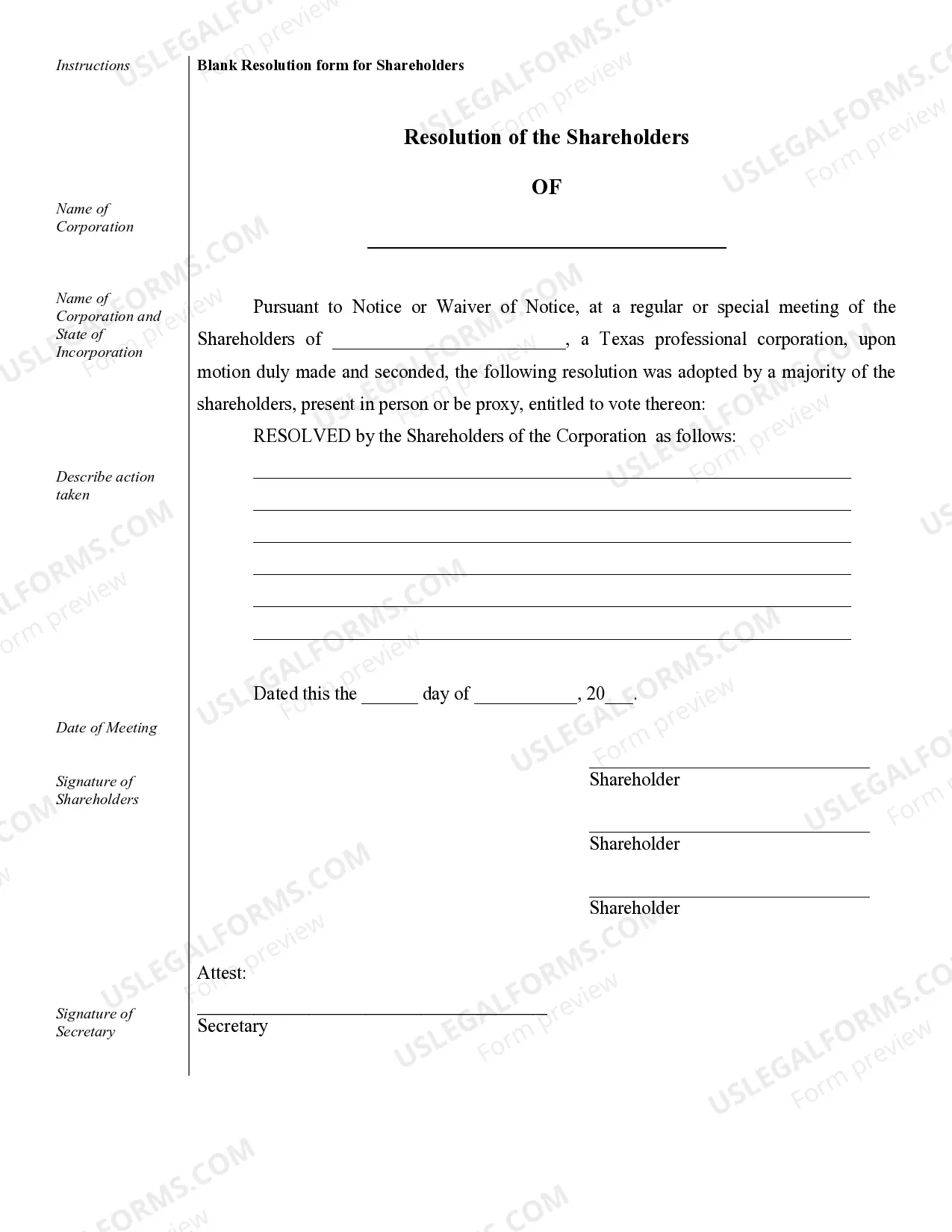

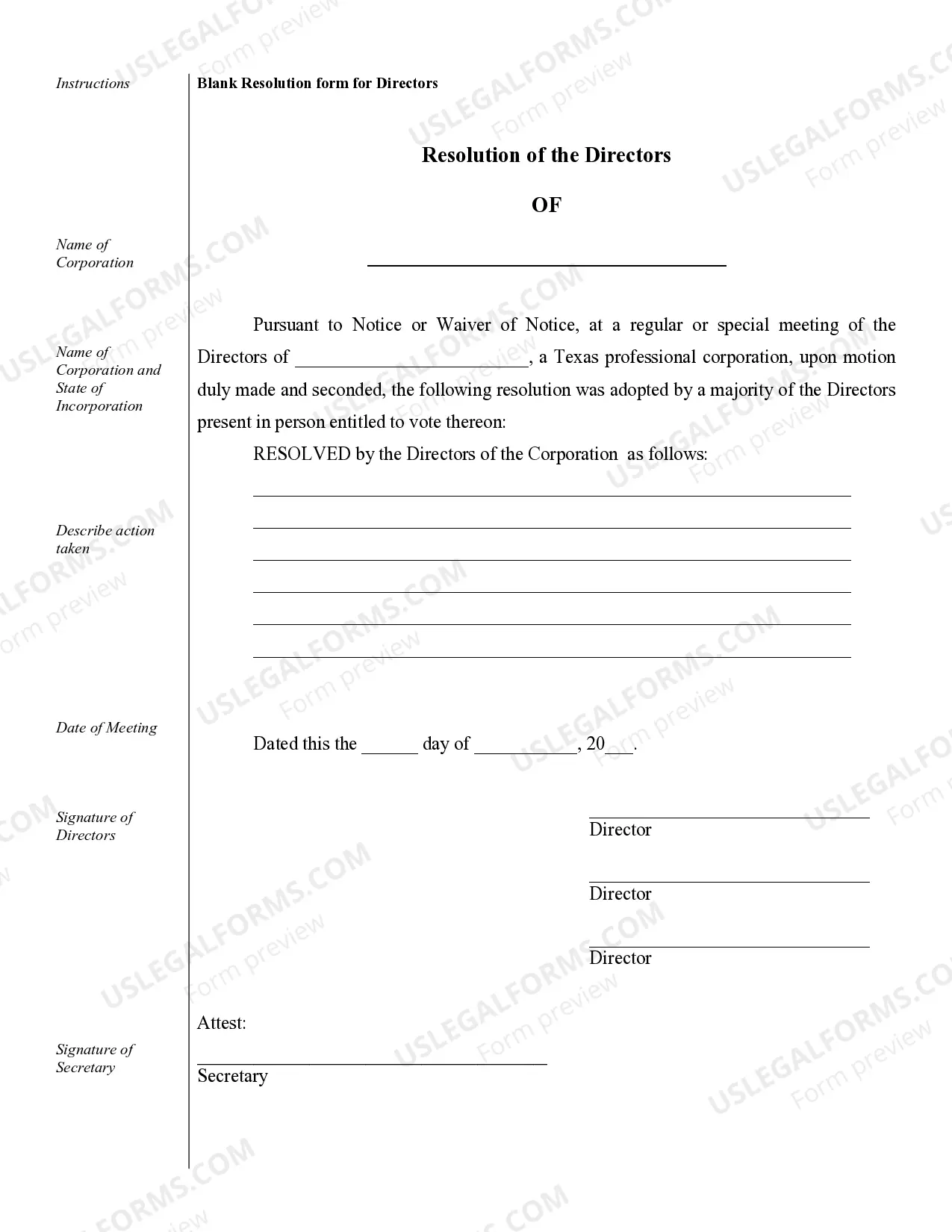

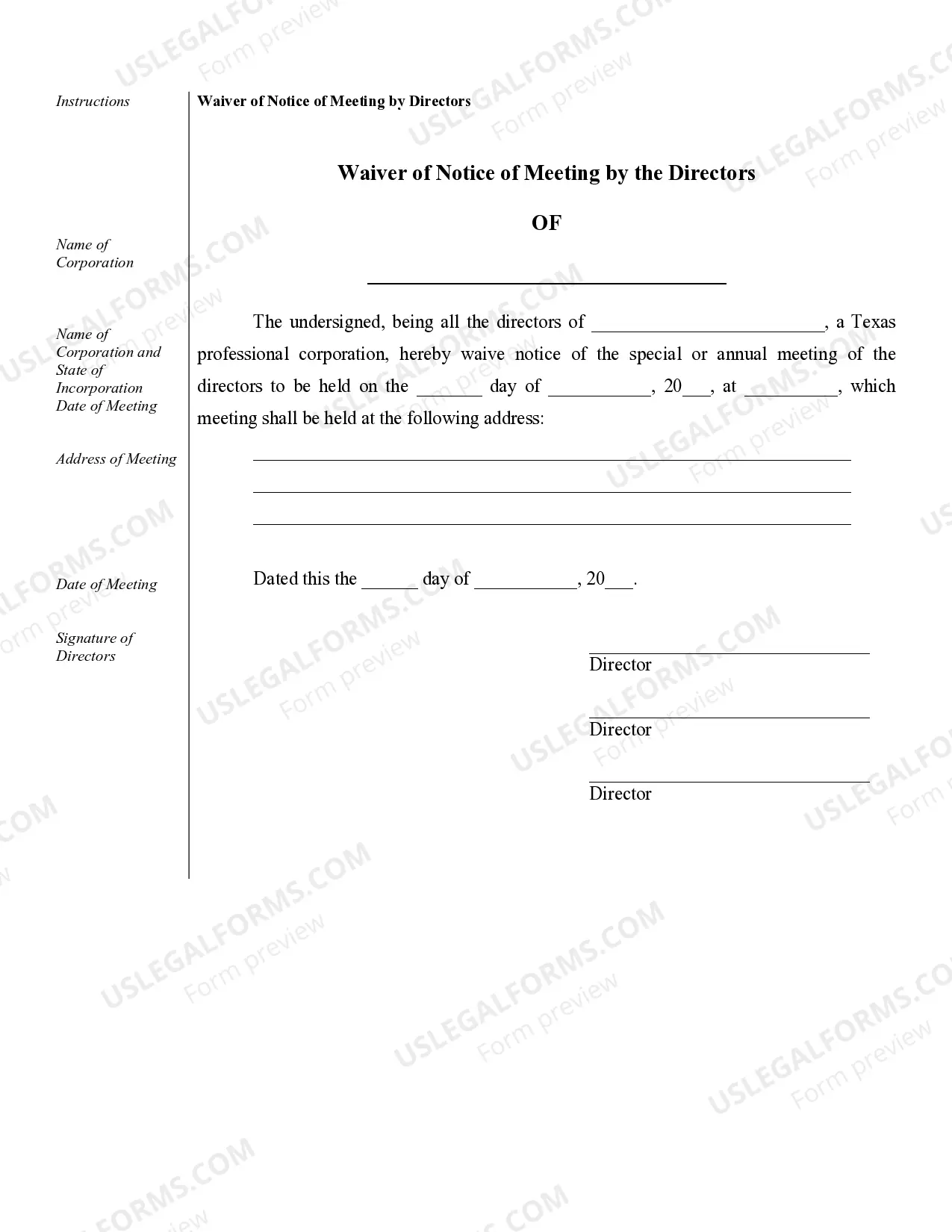

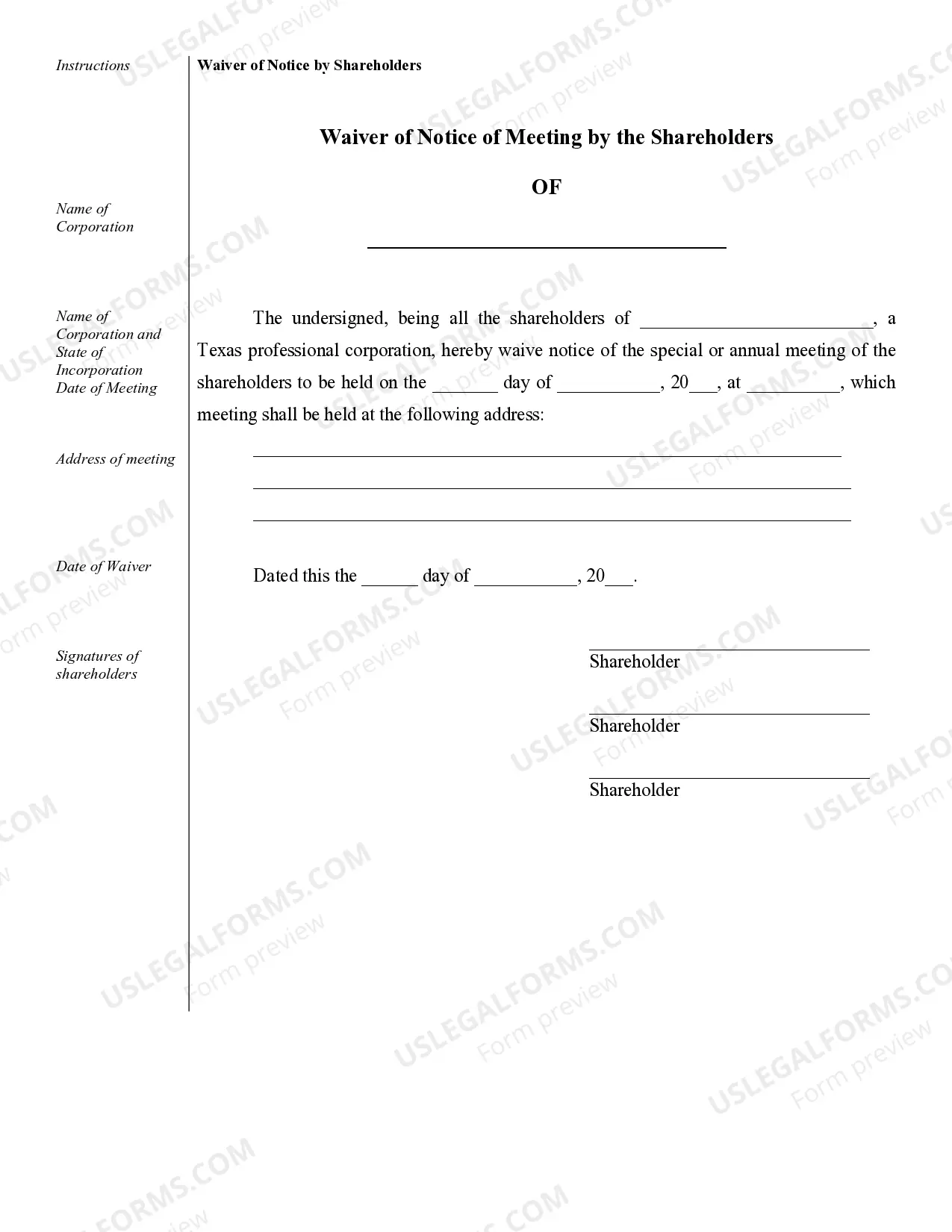

Pasadena Sample Corporate Records for a Texas Professional Corporation play a crucial role in maintaining the legal, financial, and administrative aspects of a business. These records serve as tangible evidence of the company's existence and can be referenced in various situations such as audits, legal disputes, or business transactions. Complying with the legal requirements set by the State of Texas, these records act as a comprehensive documentation of the corporation's operations, ownership structure, and official activities. 1. Articles of Incorporation: The Articles of Incorporation form the foundation of a Texas Professional Corporation. These records contain essential details such as the corporation's name, registered agent information, principal office address, purpose of incorporation, and the duration of the corporation. 2. Bylaws: Bylaws establish the internal rules and regulations that govern the operations of the corporation. These records outline guidelines concerning the roles and responsibilities of directors, officers, and shareholders, procedures for meetings, voting protocols, and other essential corporate formalities. 3. Stock Certificates: Stock certificates represent ownership interests in the corporation. These records are issued to shareholders and typically include details such as the shareholder's name, share class, number of shares held, certificate number, and the corporation's seal. Stock certificates serve as proof of ownership and can be transferred when shareholders sell or transfer their shares. 4. Shareholder Meeting Minutes: Detailed records are kept for all shareholder meetings. These minutes contain a chronological account of discussions, decisions, and resolutions made during the meetings. Topics covered may include major business decisions, changes in the corporate structure, election of directors, and approval of financial statements. 5. Director Meeting Minutes: Similar to shareholder meeting minutes, director meeting minutes provide a record of all discussions and decisions made during board meetings. Key matters covered may include strategic planning, major contracts or agreements, executive compensation, and corporate governance activities. 6. Financial Statements: Pasadena Sample Corporate Records for a Texas Professional Corporation include financial statements such as the balance sheet, income statement, and cash flow statement. These records provide a comprehensive overview of the corporation's financial health, detailing its assets, liabilities, revenues, expenses, and net income. Financial statements are crucial for evaluating the corporation's performance, facilitating tax compliance, and attracting potential investors. 7. Annual Reports: Annual reports present a summary of the corporation's financial performance, strategic developments, and major accomplishments over the course of a year. These documents are typically filed with the Texas Secretary of State and provide shareholders, stakeholders, and regulatory authorities with a comprehensive overview of the corporation's activities. Pasadena Sample Corporate Records for a Texas Professional Corporation are highly confidential and should be organized and stored securely. These records are not only essential for demonstrating compliance with legal requirements but also serve as a valuable resource for decision-making and ensuring the smooth operation of the corporation.Pasadena Sample Corporate Records for a Texas Professional Corporation play a crucial role in maintaining the legal, financial, and administrative aspects of a business. These records serve as tangible evidence of the company's existence and can be referenced in various situations such as audits, legal disputes, or business transactions. Complying with the legal requirements set by the State of Texas, these records act as a comprehensive documentation of the corporation's operations, ownership structure, and official activities. 1. Articles of Incorporation: The Articles of Incorporation form the foundation of a Texas Professional Corporation. These records contain essential details such as the corporation's name, registered agent information, principal office address, purpose of incorporation, and the duration of the corporation. 2. Bylaws: Bylaws establish the internal rules and regulations that govern the operations of the corporation. These records outline guidelines concerning the roles and responsibilities of directors, officers, and shareholders, procedures for meetings, voting protocols, and other essential corporate formalities. 3. Stock Certificates: Stock certificates represent ownership interests in the corporation. These records are issued to shareholders and typically include details such as the shareholder's name, share class, number of shares held, certificate number, and the corporation's seal. Stock certificates serve as proof of ownership and can be transferred when shareholders sell or transfer their shares. 4. Shareholder Meeting Minutes: Detailed records are kept for all shareholder meetings. These minutes contain a chronological account of discussions, decisions, and resolutions made during the meetings. Topics covered may include major business decisions, changes in the corporate structure, election of directors, and approval of financial statements. 5. Director Meeting Minutes: Similar to shareholder meeting minutes, director meeting minutes provide a record of all discussions and decisions made during board meetings. Key matters covered may include strategic planning, major contracts or agreements, executive compensation, and corporate governance activities. 6. Financial Statements: Pasadena Sample Corporate Records for a Texas Professional Corporation include financial statements such as the balance sheet, income statement, and cash flow statement. These records provide a comprehensive overview of the corporation's financial health, detailing its assets, liabilities, revenues, expenses, and net income. Financial statements are crucial for evaluating the corporation's performance, facilitating tax compliance, and attracting potential investors. 7. Annual Reports: Annual reports present a summary of the corporation's financial performance, strategic developments, and major accomplishments over the course of a year. These documents are typically filed with the Texas Secretary of State and provide shareholders, stakeholders, and regulatory authorities with a comprehensive overview of the corporation's activities. Pasadena Sample Corporate Records for a Texas Professional Corporation are highly confidential and should be organized and stored securely. These records are not only essential for demonstrating compliance with legal requirements but also serve as a valuable resource for decision-making and ensuring the smooth operation of the corporation.