Sample Corporate Notices of Meetings, Resolutions, Simple Stock Ledger & Certificate.

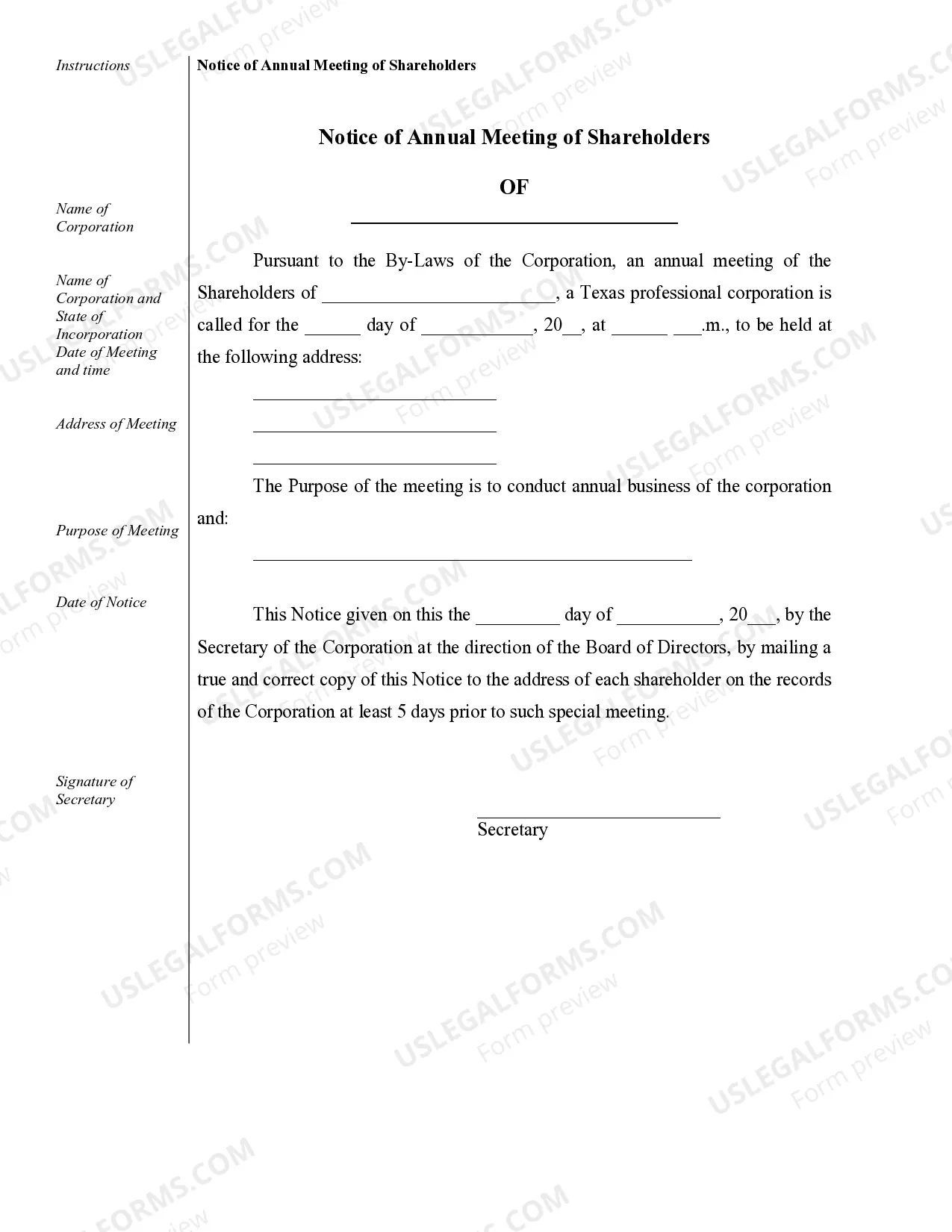

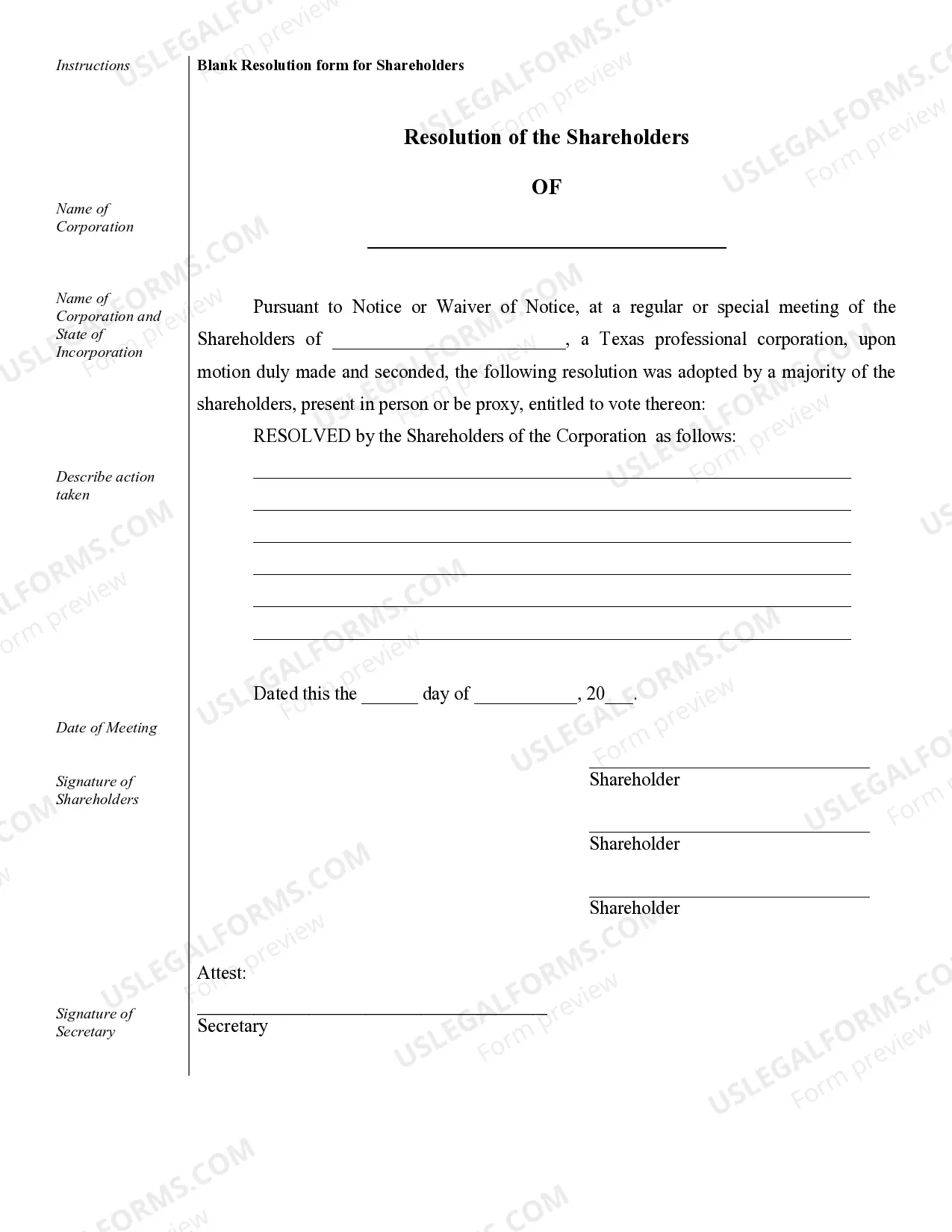

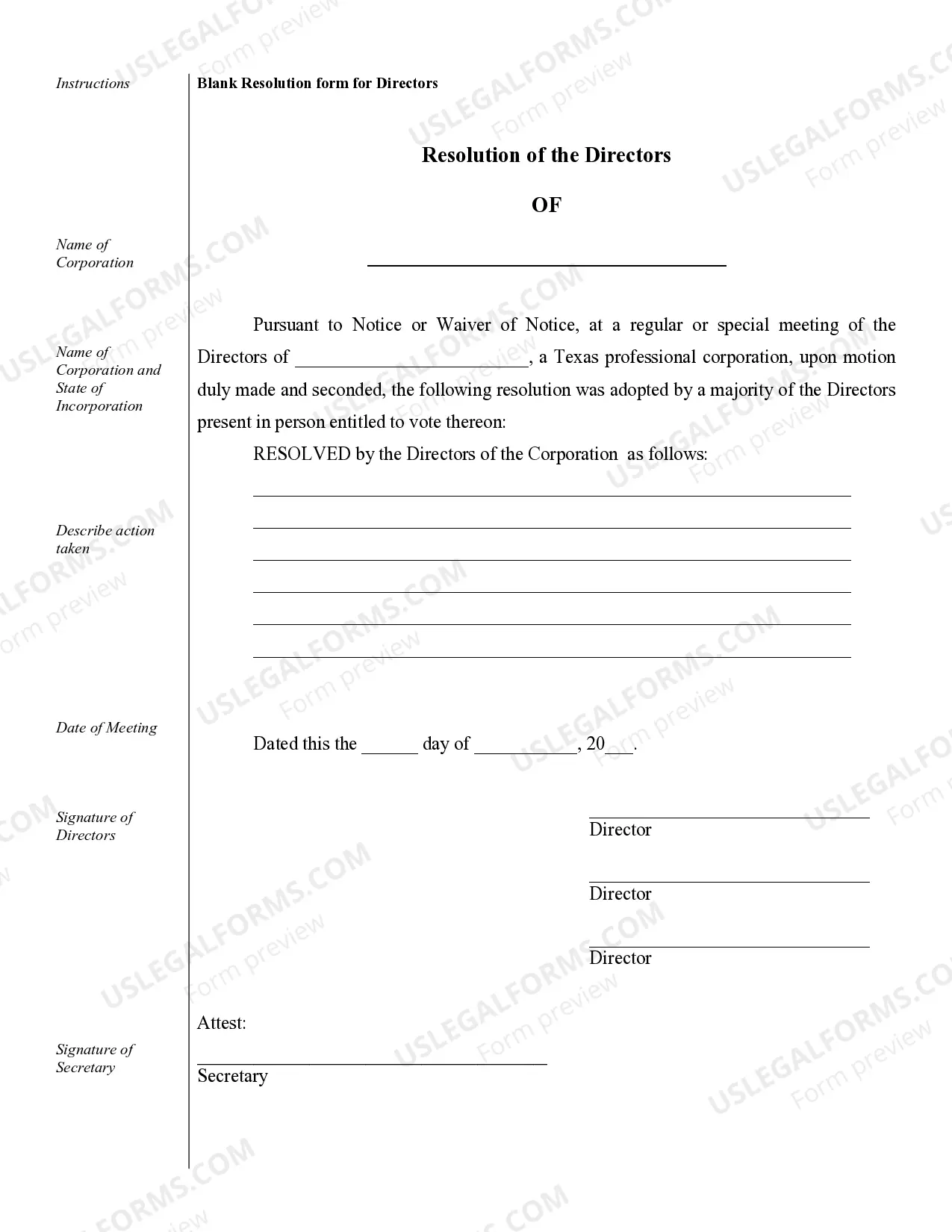

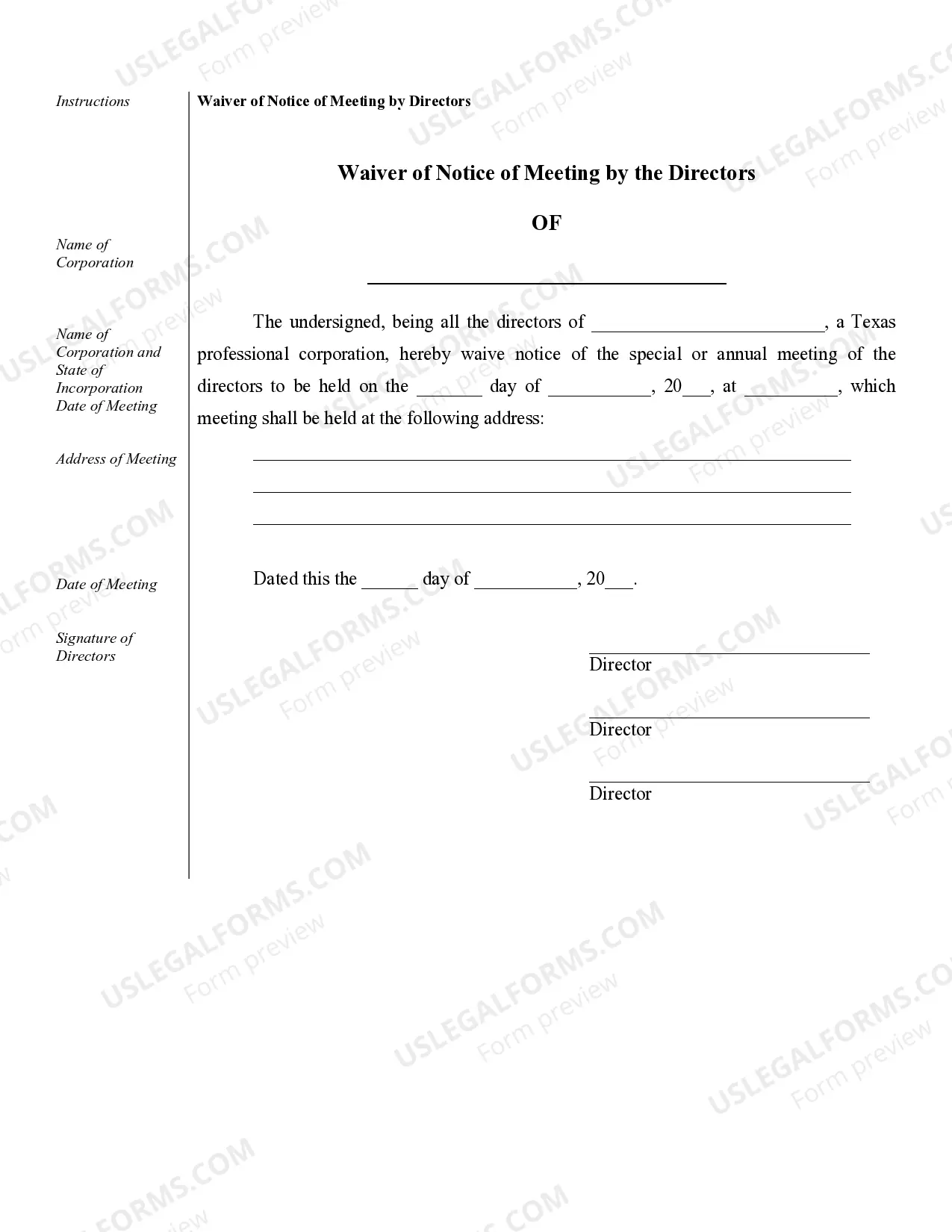

Pearland Sample Corporate Records for a Texas Professional Corporation: A Detailed Description Pearland Sample Corporate Records for a Texas Professional Corporation provide a comprehensive and organized documentation of a professional corporation's activities, transactions, and legal obligations in the state of Texas. These records play a crucial role in maintaining transparency, compliance, and accountability within the company. The following are some essential types of Pearland Sample Corporate Records for a Texas Professional Corporation: 1. Articles of Incorporation: This record signifies the formal establishment of the professional corporation and contains necessary information like the corporation's name, purpose, registered agent, capital stock, and duration. 2. Bylaws: Bylaws outline the rules and procedures that govern the internal operations of the professional corporation. It includes guidelines for corporate meetings, decision-making processes, appointment and removal of officers, and shareholder rights. 3. Meeting Minutes: Detailed records of meetings, such as board of directors and shareholder meetings, are maintained in meeting minutes. These documents provide a written account of the discussions, decisions, and actions taken during the meetings, ensuring transparency and preserving the corporation's history. 4. Stock Certificates and Ledgers: These records demonstrate the ownership of shares within the professional corporation. Stock certificates are issued to shareholders, and stock ledgers maintain accurate information regarding the shareholders, their respective holdings, and any transfers or changes in ownership. 5. Financial Statements: Comprehensive financial records, including profit and loss statements, balance sheets, and cash flow statements, are maintained to assess the financial health of the professional corporation. These records aid in monitoring revenue, tracking expenses, and preparing tax returns. 6. Tax Returns and Filings: Records concerning federal, state, and local tax filings, such as income tax returns, sales tax filings, and payroll tax returns, must be in order. Proper documentation is necessary to ensure compliance with tax regulations and avoid any potential legal issues. 7. Contracts and Agreements: Copies of contracts, agreements, and other legal documents the professional corporation enters into should be maintained. These include partnership agreements, employment contracts, client agreements, lease agreements, and vendor contracts. 8. Licenses and Permits: Records of licenses, permits, and certifications specific to the professional corporation's industry should be readily accessible. This includes state licenses, professional licenses, and any other permits required to conduct business legally. 9. Intellectual Property Records: Documentation related to trademarks, copyrights, patents, and trade secrets should be preserved. These records may include applications, certificates, renewal notices, and any legal correspondence connected to intellectual property protection. 10. Annual Reports: Professional corporations are generally required to file annual reports with the Texas Secretary of State. These reports provide updates on the corporation's business activities, provide an opportunity to make necessary changes or amendments, and ensure compliance with state regulations. In summary, Pearland Sample Corporate Records for a Texas Professional Corporation are essential for maintaining proper corporate governance and legal compliance. These records encompass various document types, such as articles of incorporation, bylaws, meeting minutes, stock certificates and ledgers, financial statements, tax filings, contracts and agreements, licenses and permits, intellectual property records, and annual reports. By diligently maintaining and organizing these records, a professional corporation can operate smoothly, protect its interests, and adhere to legal requirements in the state of Texas.