Sample Corporate Notices of Meetings, Resolutions, Simple Stock Ledger & Certificate.

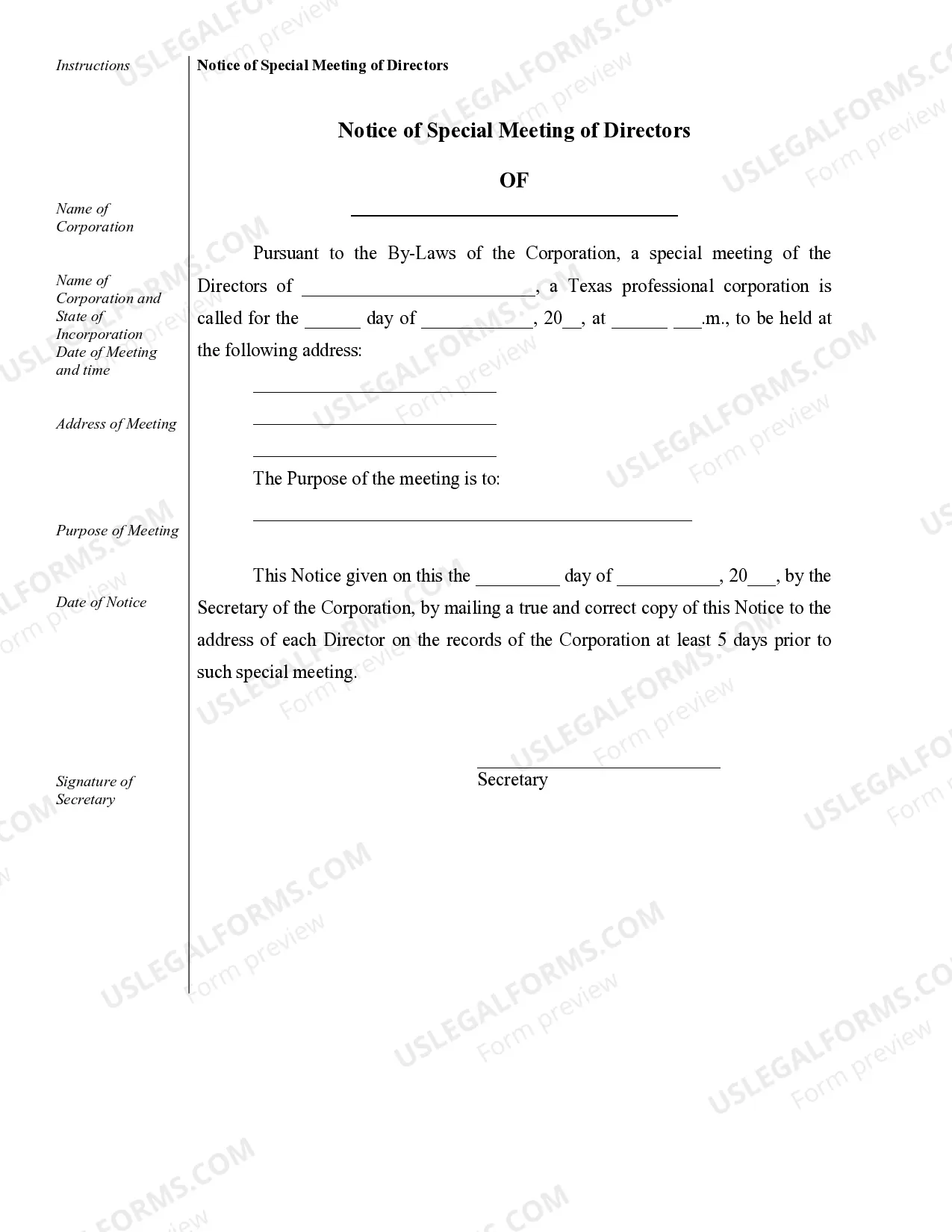

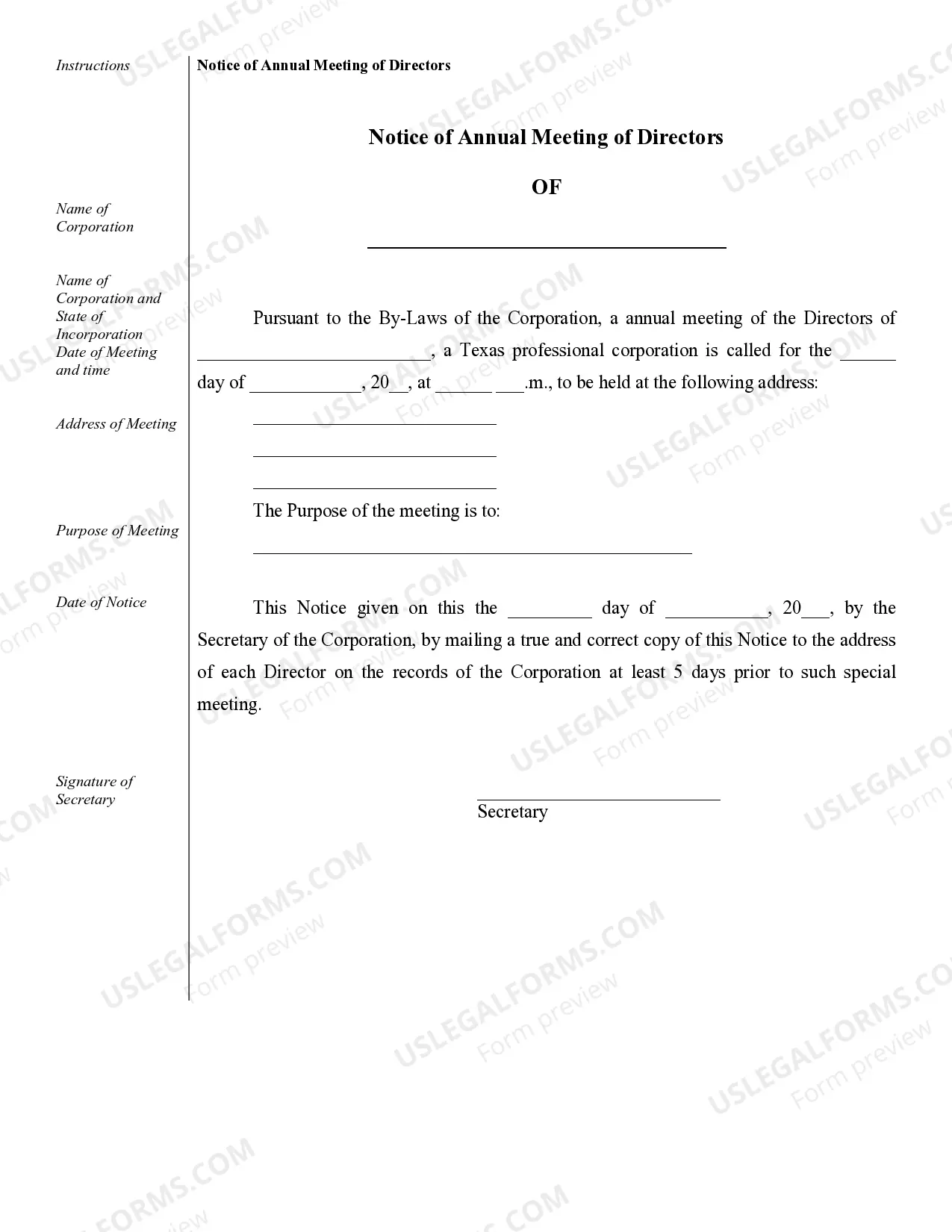

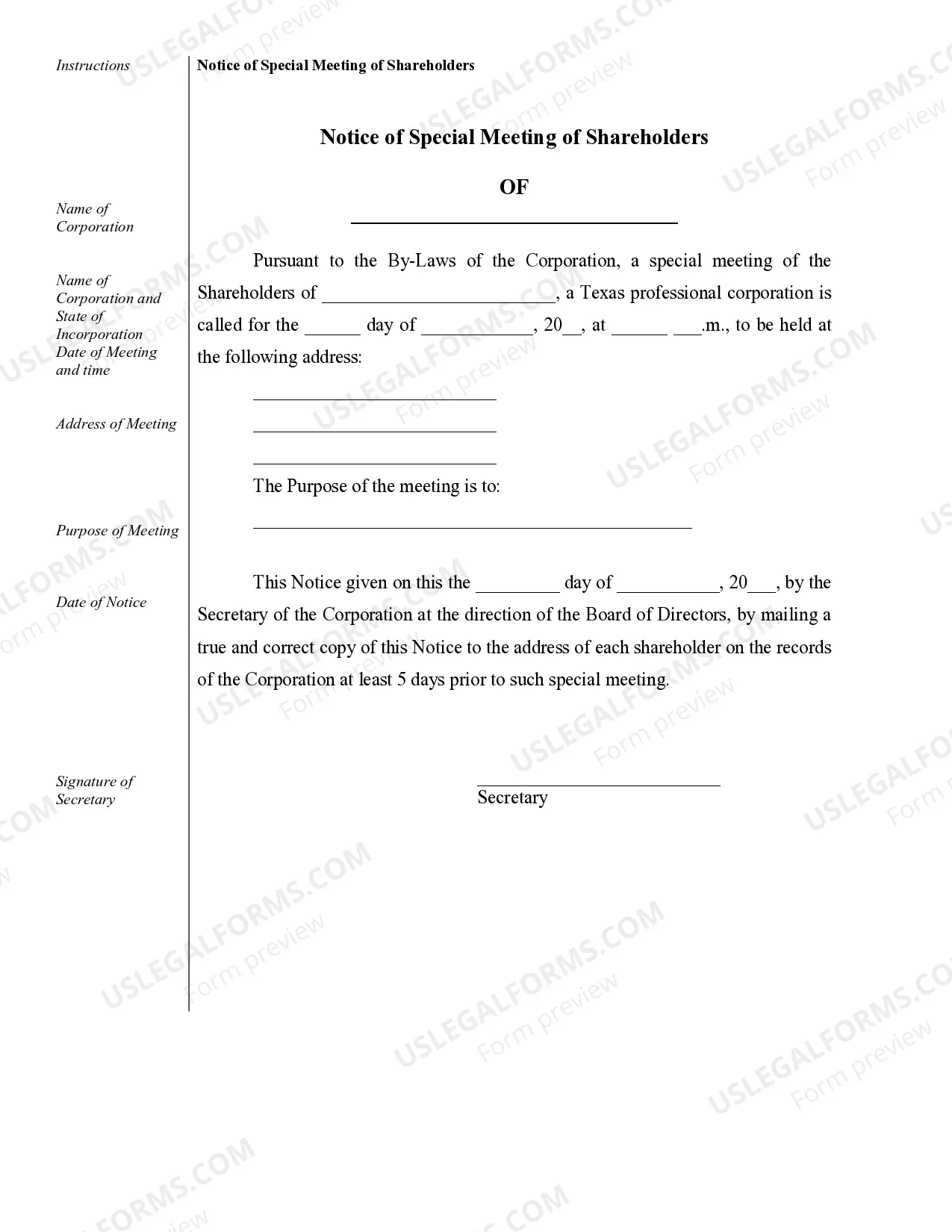

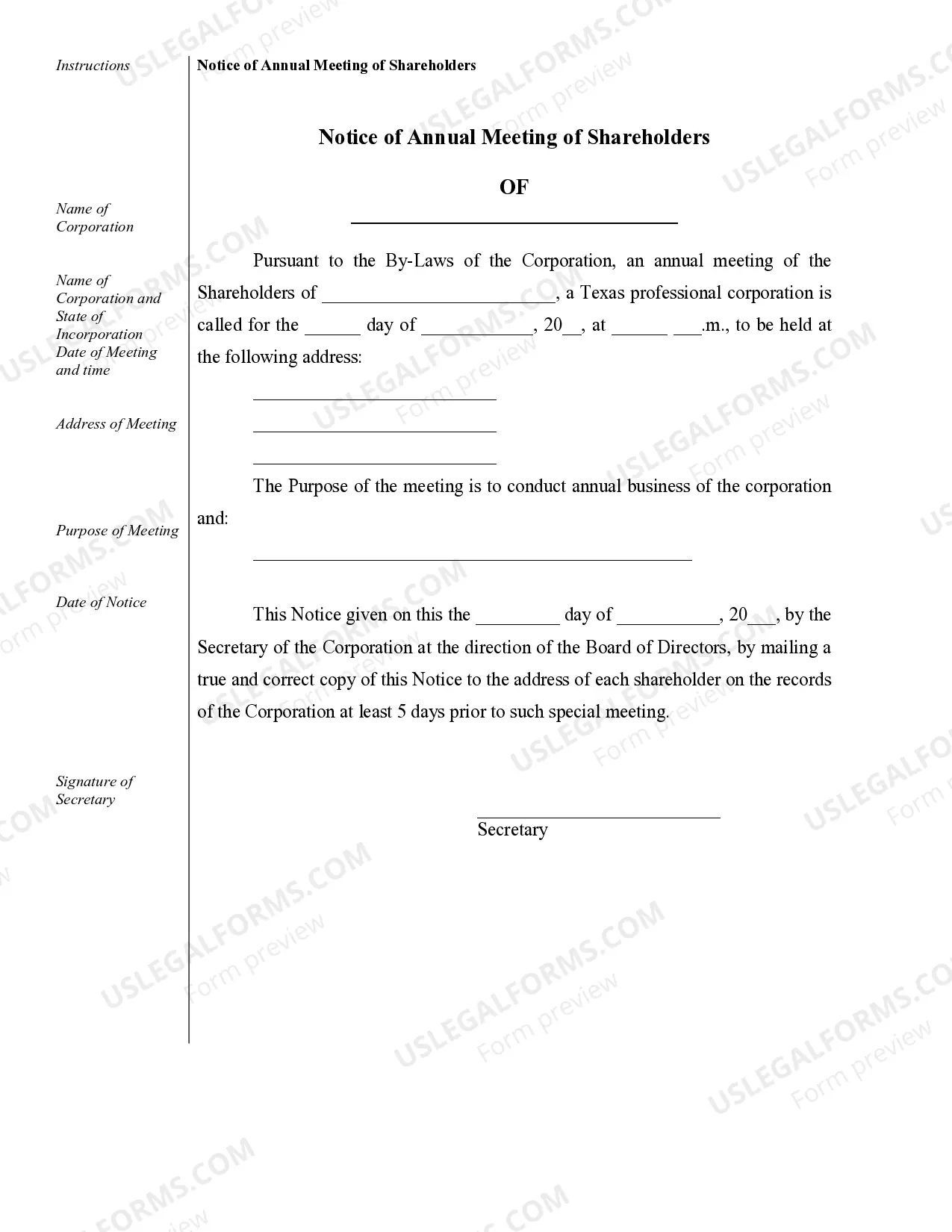

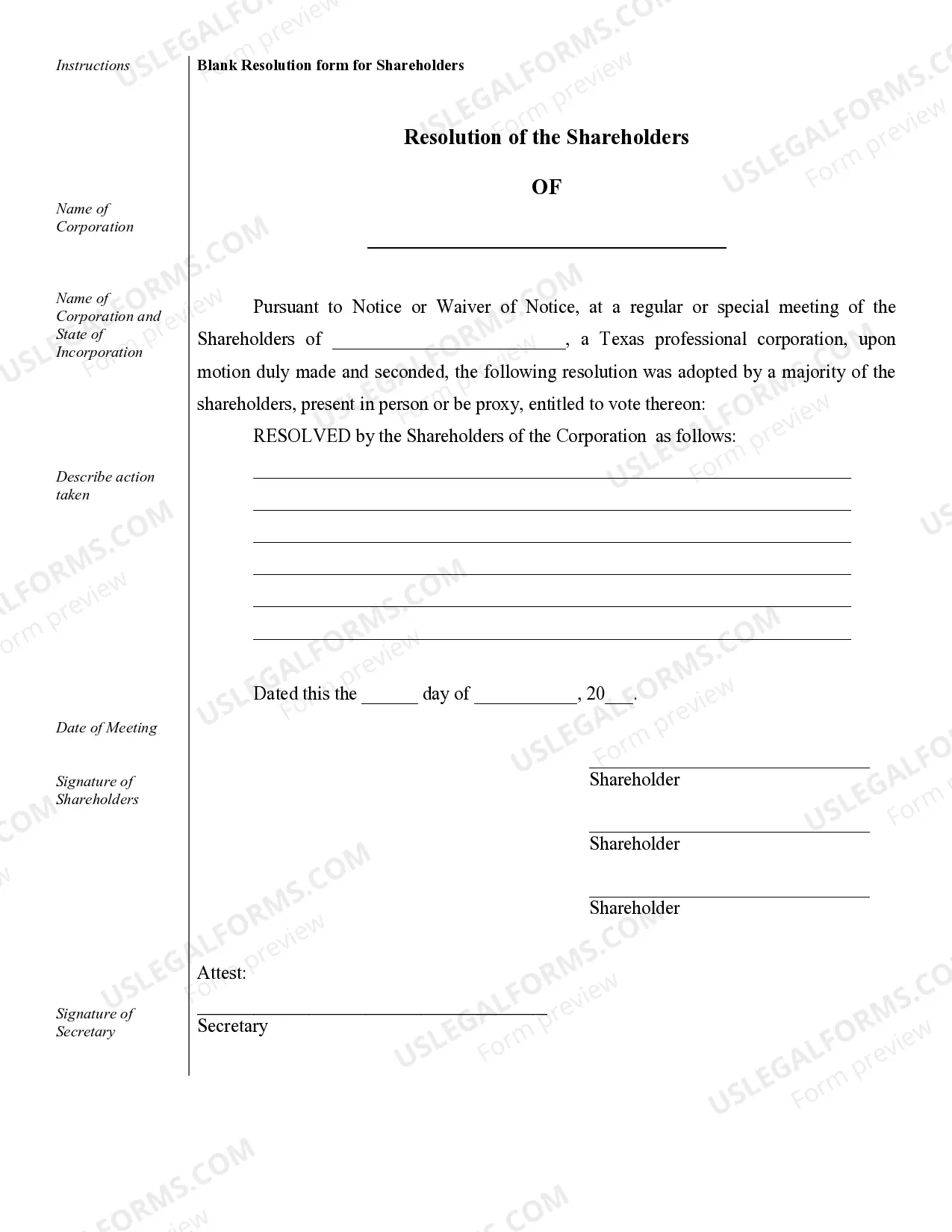

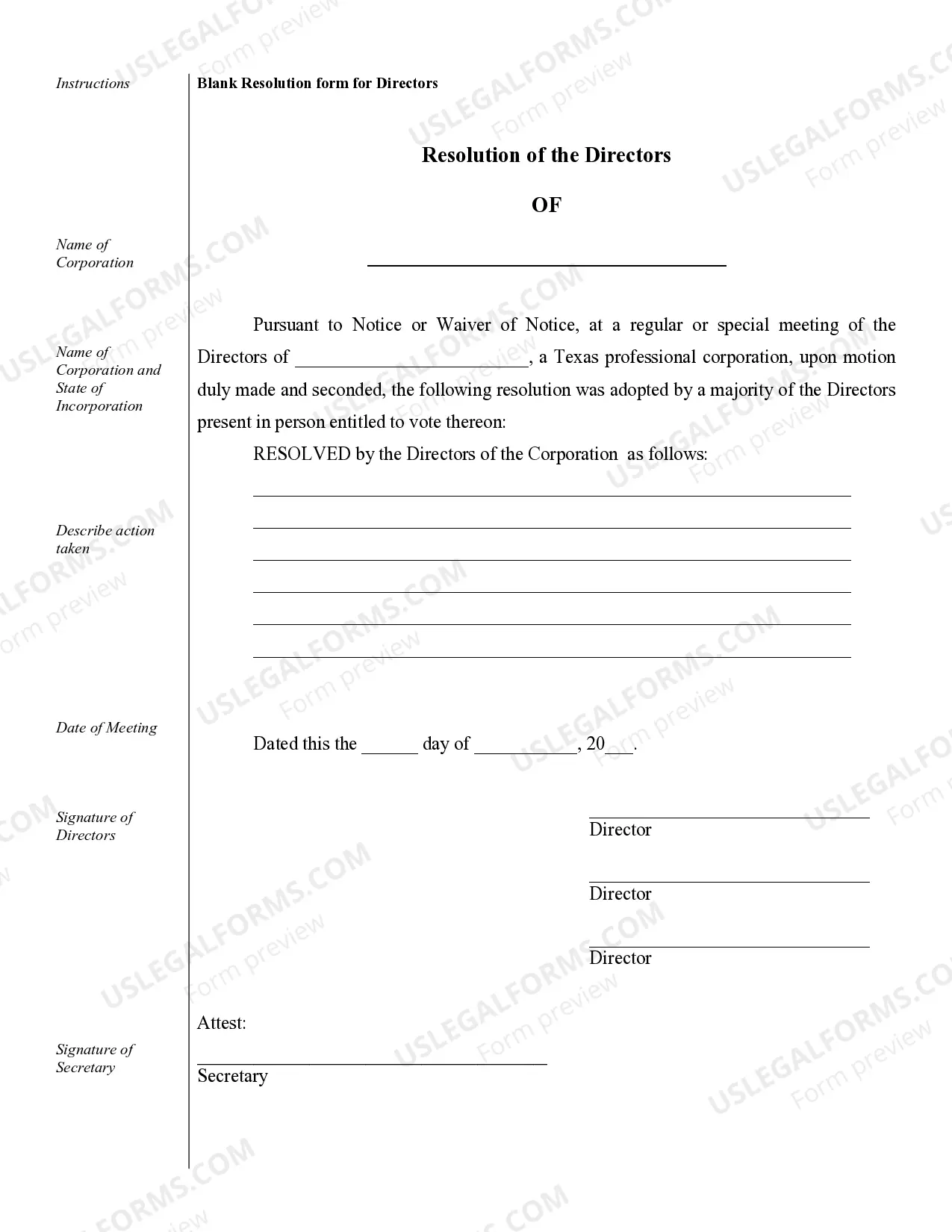

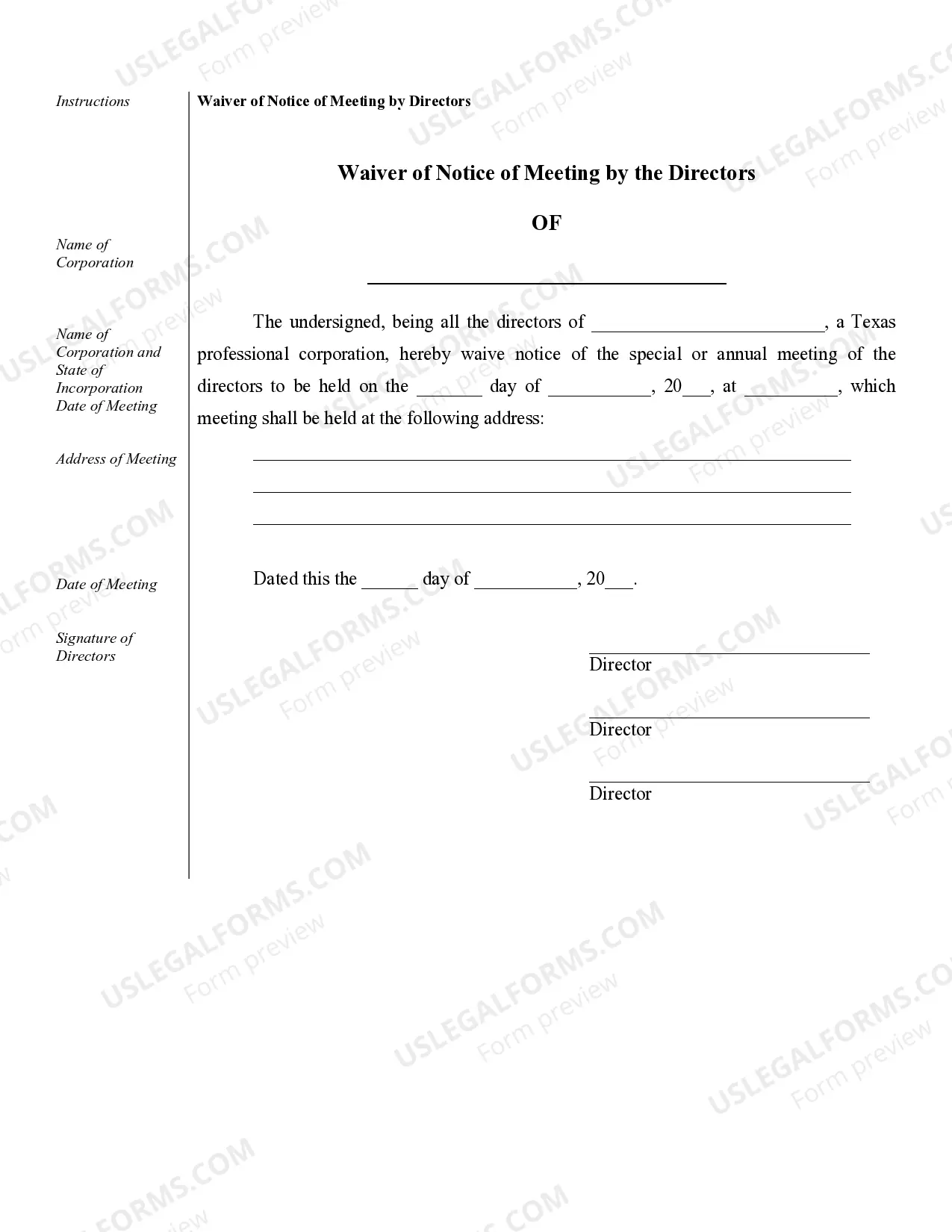

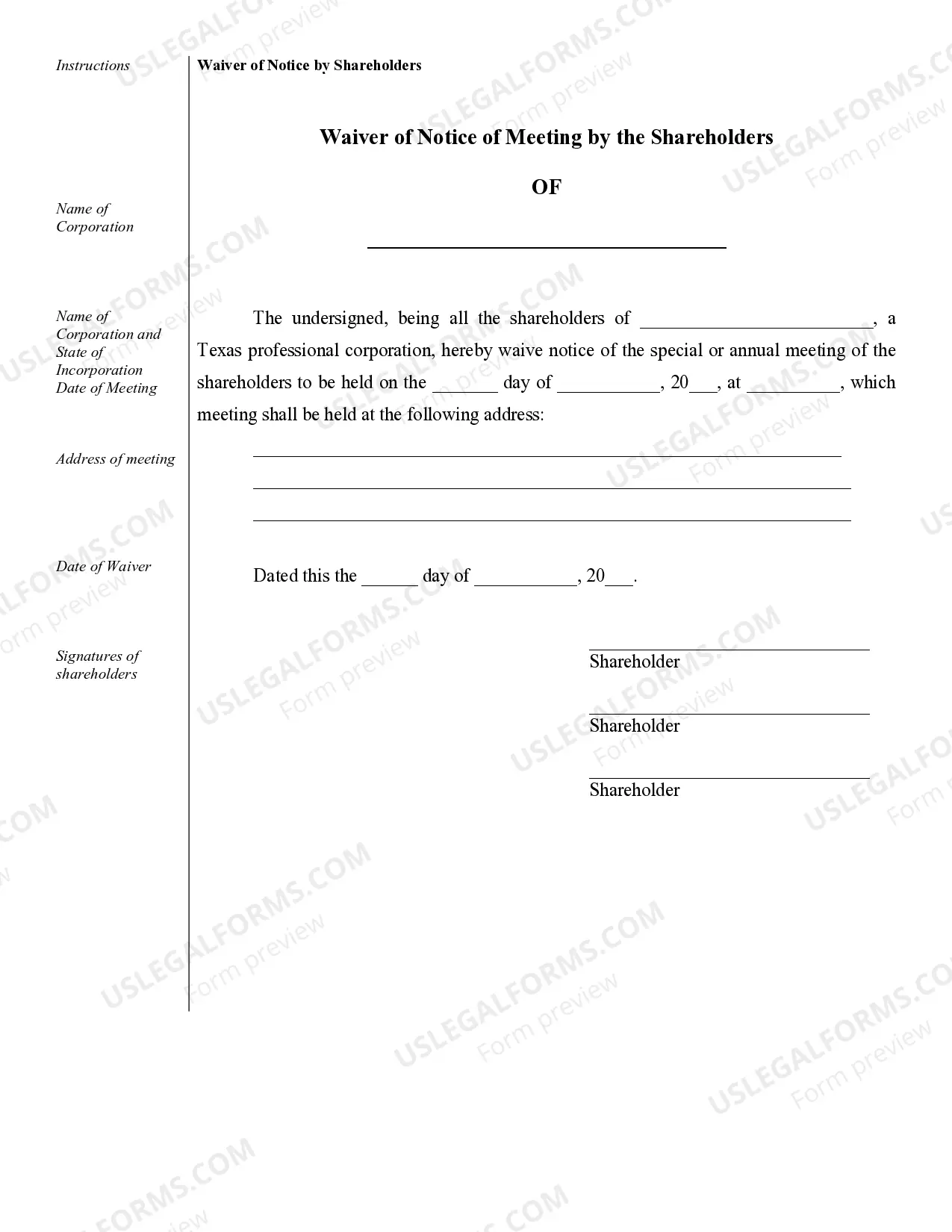

Round Rock Sample Corporate Records for a Texas Professional Corporation are an essential part of maintaining a well-organized and legally compliant business. These records serve as a comprehensive documentation of the corporation's activities, allowing shareholders, directors, and officers to understand the company's history, decision-making processes, and financial transactions. Here are some of the different types of Round Rock Sample Corporate Records for a Texas Professional Corporation: 1. Articles of Incorporation: This document outlines the initial formation of the corporation, including its name, purpose, registered agent, and registered office. It is a vital record that establishes the legal existence of the corporation. 2. Bylaws: The bylaws serve as the internal rules and regulations that govern the corporation's operations, including the rights and responsibilities of shareholders, directors, and officers. These records stipulate meeting procedures, voting rights, potential conflicts of interest, and other important matters. 3. Meeting Minutes: Detailed meeting minutes should be maintained for both directors' and shareholders' meetings. These records document the discussions, decisions, and votes taken during these meetings. Minutes should be comprehensive and include attendees, date, time, location, and a detailed account of the topics discussed. 4. Shareholder Agreements: Shareholder agreements are contracts that define the relationship between the corporation and its shareholders. These records outline the rights, responsibilities, and obligations of each shareholder, including issues related to stock ownership, transfers, buyouts, and dispute resolution mechanisms. 5. Stock Ledger: A stock ledger is a record of all the corporation's stock issuance, transfers, and cancellations. This document includes information such as the shareholder's name, address, number of shares held, and the corresponding stock certificate numbers. Maintaining an accurate stock ledger is crucial for tracking ownership and complying with state regulations. 6. Financial Records: A Texas Professional Corporation should keep detailed financial records, including income statements, balance sheets, cash flow statements, and general ledgers. These records provide a clear snapshot of the company's financial health, its assets, liabilities, and equity. 7. Contracts and Agreements: The corporation should keep copies of all contracts and agreements it enters into, such as employment contracts, lease agreements, client agreements, and vendor contracts. These records ensure compliance and serve as a reference in case of disputes or legal issues. 8. Annual Reports: Texas Professional Corporations are required to file annual reports with the Texas Secretary of State. These reports provide updates on the corporation's leadership, financial status, and any significant changes in its operations. By meticulously maintaining Round Rock Sample Corporate Records for a Texas Professional Corporation, the company can demonstrate its compliance with legal requirements, protect itself from potential disputes or litigation, and provide transparency and accountability to its stakeholders.Round Rock Sample Corporate Records for a Texas Professional Corporation are an essential part of maintaining a well-organized and legally compliant business. These records serve as a comprehensive documentation of the corporation's activities, allowing shareholders, directors, and officers to understand the company's history, decision-making processes, and financial transactions. Here are some of the different types of Round Rock Sample Corporate Records for a Texas Professional Corporation: 1. Articles of Incorporation: This document outlines the initial formation of the corporation, including its name, purpose, registered agent, and registered office. It is a vital record that establishes the legal existence of the corporation. 2. Bylaws: The bylaws serve as the internal rules and regulations that govern the corporation's operations, including the rights and responsibilities of shareholders, directors, and officers. These records stipulate meeting procedures, voting rights, potential conflicts of interest, and other important matters. 3. Meeting Minutes: Detailed meeting minutes should be maintained for both directors' and shareholders' meetings. These records document the discussions, decisions, and votes taken during these meetings. Minutes should be comprehensive and include attendees, date, time, location, and a detailed account of the topics discussed. 4. Shareholder Agreements: Shareholder agreements are contracts that define the relationship between the corporation and its shareholders. These records outline the rights, responsibilities, and obligations of each shareholder, including issues related to stock ownership, transfers, buyouts, and dispute resolution mechanisms. 5. Stock Ledger: A stock ledger is a record of all the corporation's stock issuance, transfers, and cancellations. This document includes information such as the shareholder's name, address, number of shares held, and the corresponding stock certificate numbers. Maintaining an accurate stock ledger is crucial for tracking ownership and complying with state regulations. 6. Financial Records: A Texas Professional Corporation should keep detailed financial records, including income statements, balance sheets, cash flow statements, and general ledgers. These records provide a clear snapshot of the company's financial health, its assets, liabilities, and equity. 7. Contracts and Agreements: The corporation should keep copies of all contracts and agreements it enters into, such as employment contracts, lease agreements, client agreements, and vendor contracts. These records ensure compliance and serve as a reference in case of disputes or legal issues. 8. Annual Reports: Texas Professional Corporations are required to file annual reports with the Texas Secretary of State. These reports provide updates on the corporation's leadership, financial status, and any significant changes in its operations. By meticulously maintaining Round Rock Sample Corporate Records for a Texas Professional Corporation, the company can demonstrate its compliance with legal requirements, protect itself from potential disputes or litigation, and provide transparency and accountability to its stakeholders.