Sample Corporate Notices of Meetings, Resolutions, Simple Stock Ledger & Certificate.

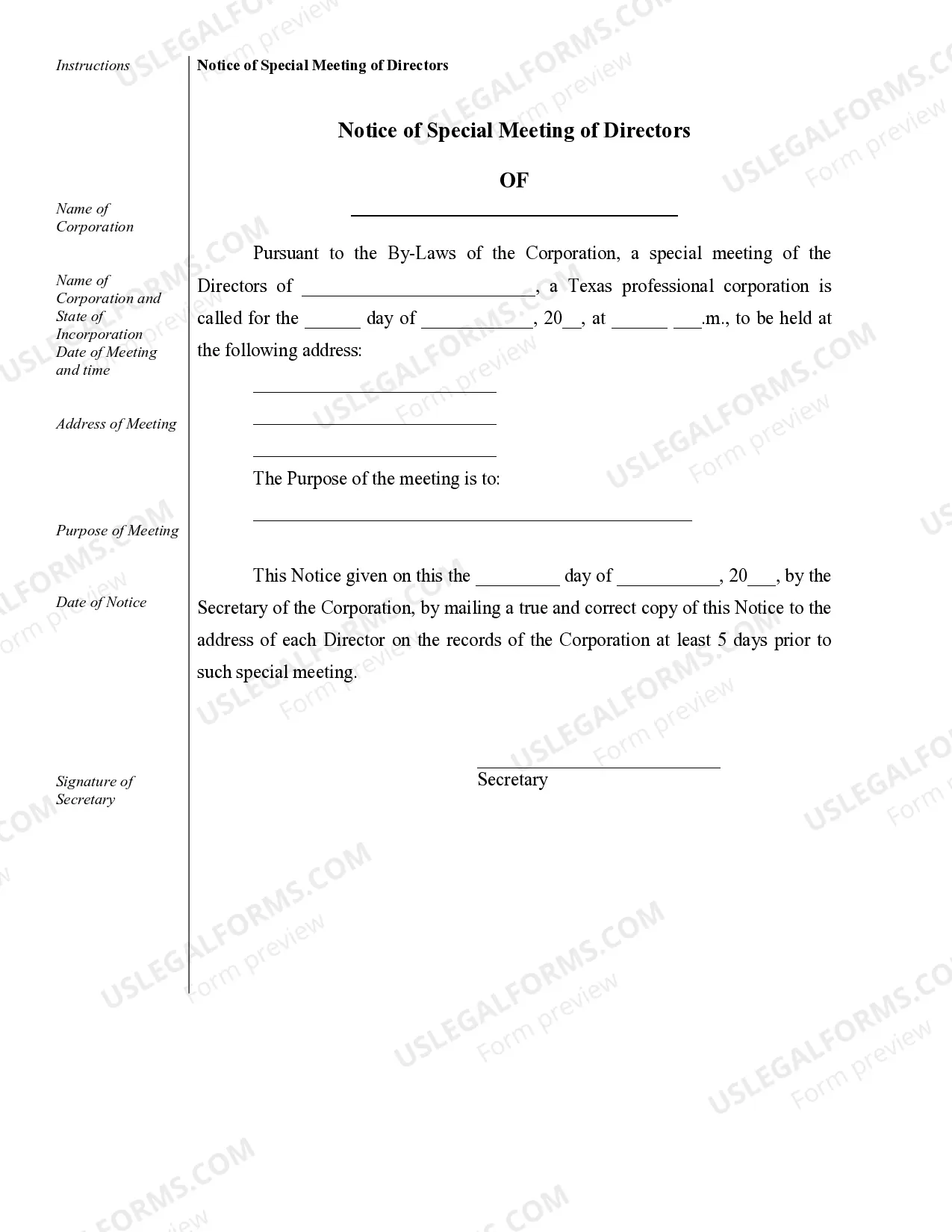

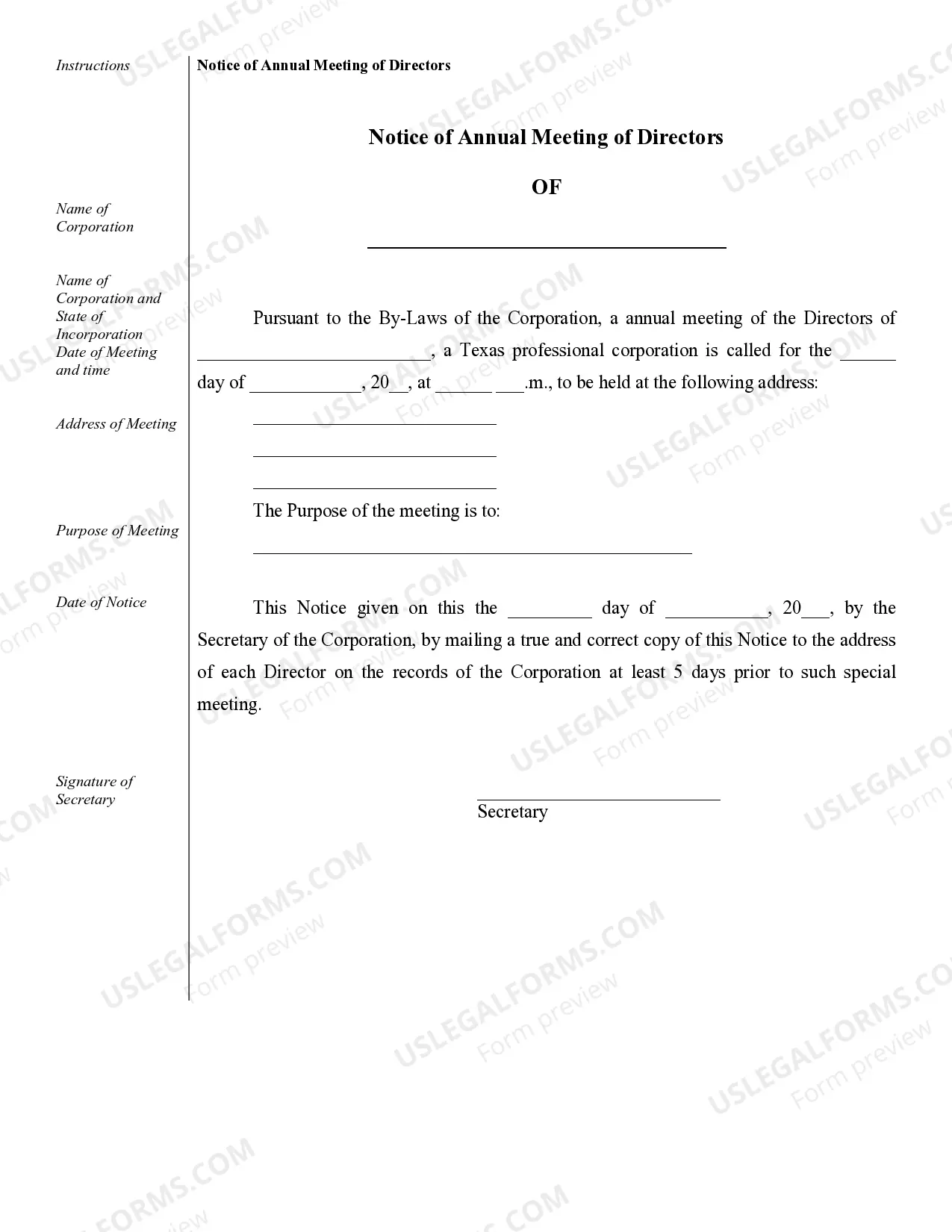

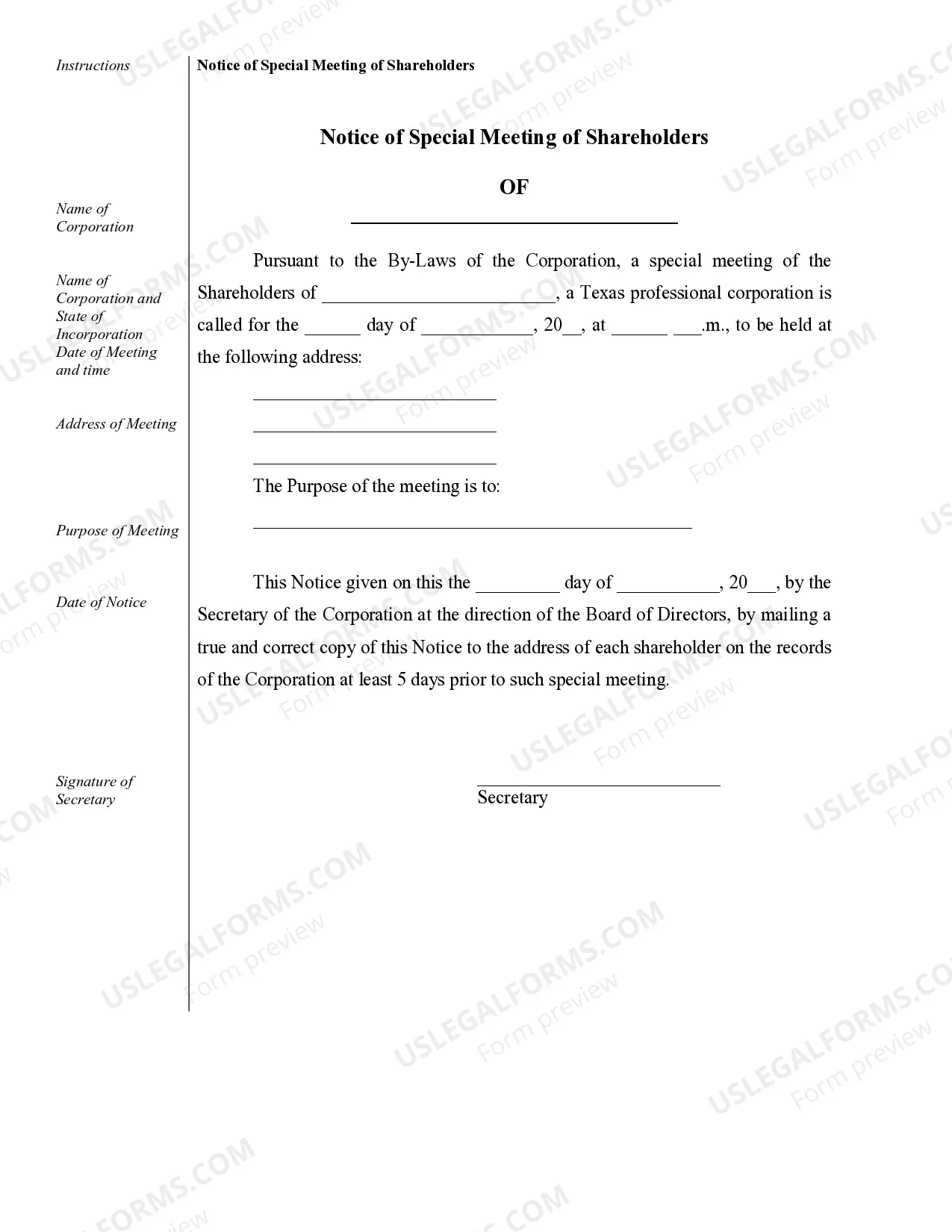

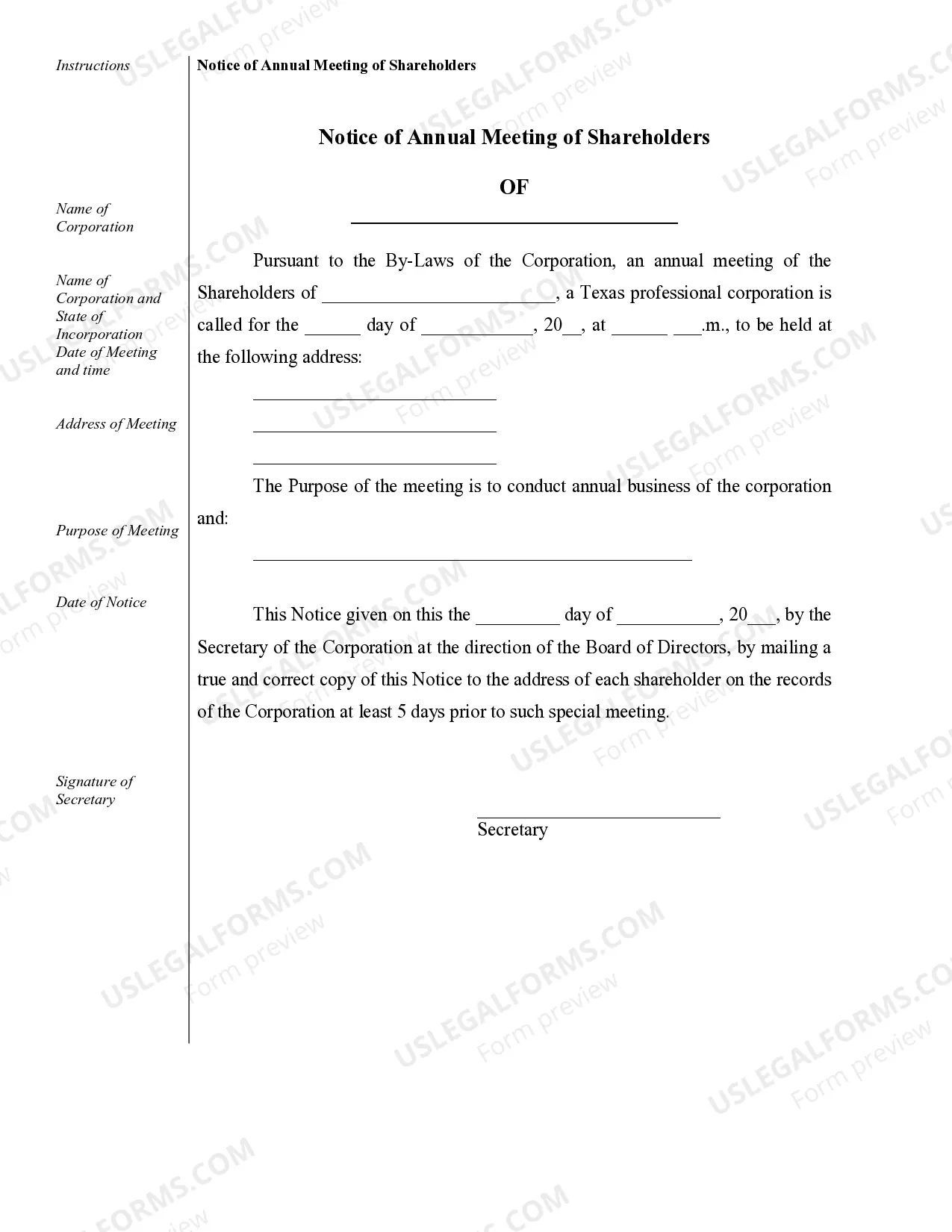

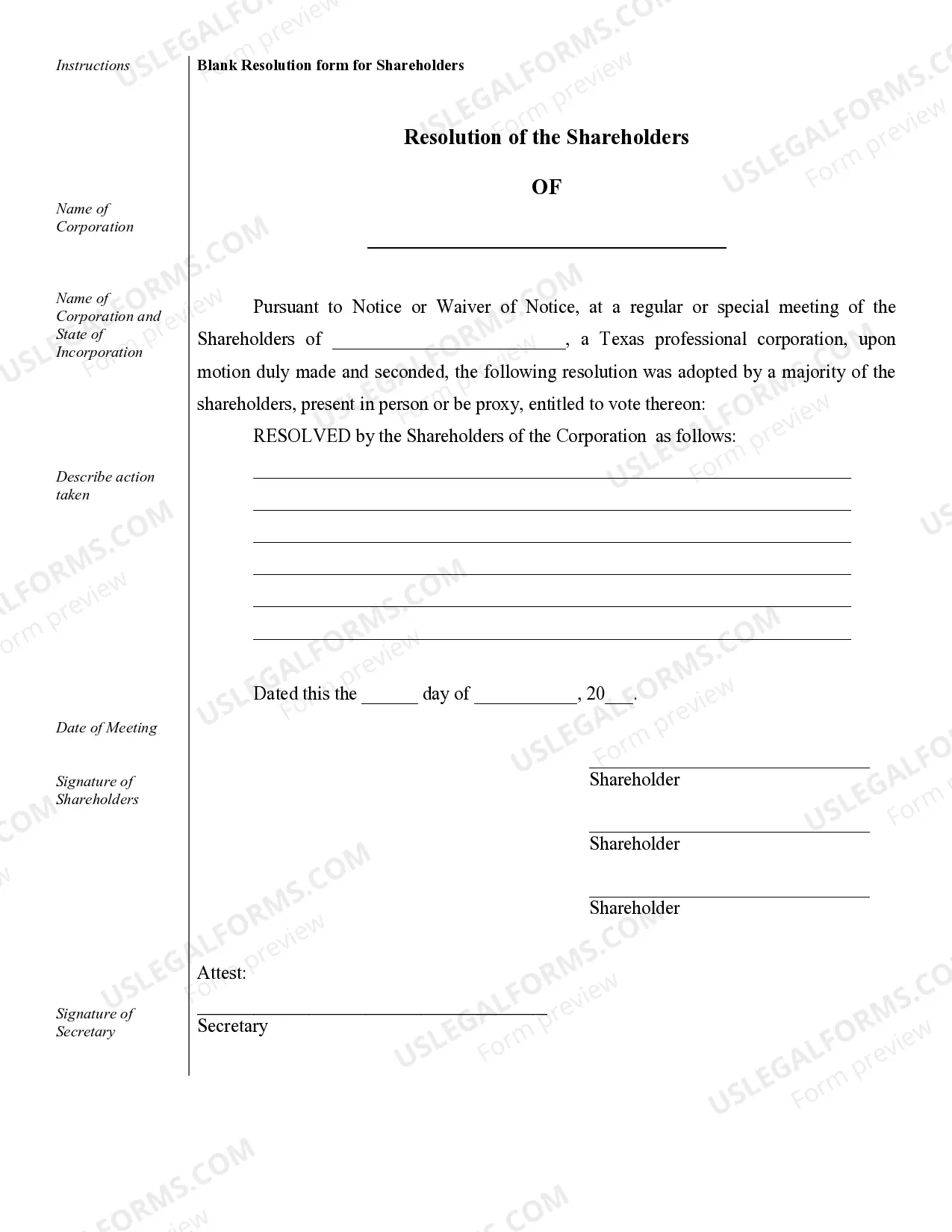

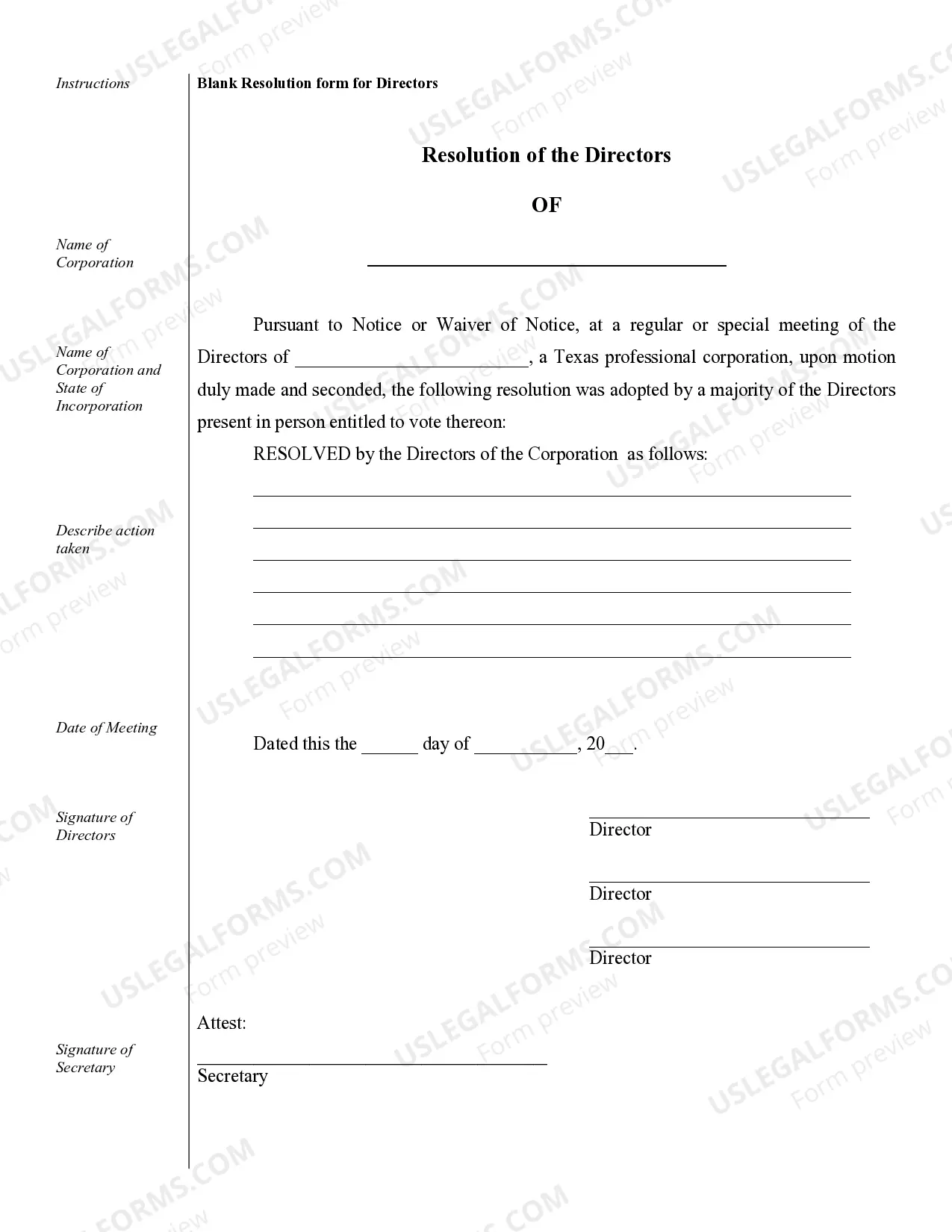

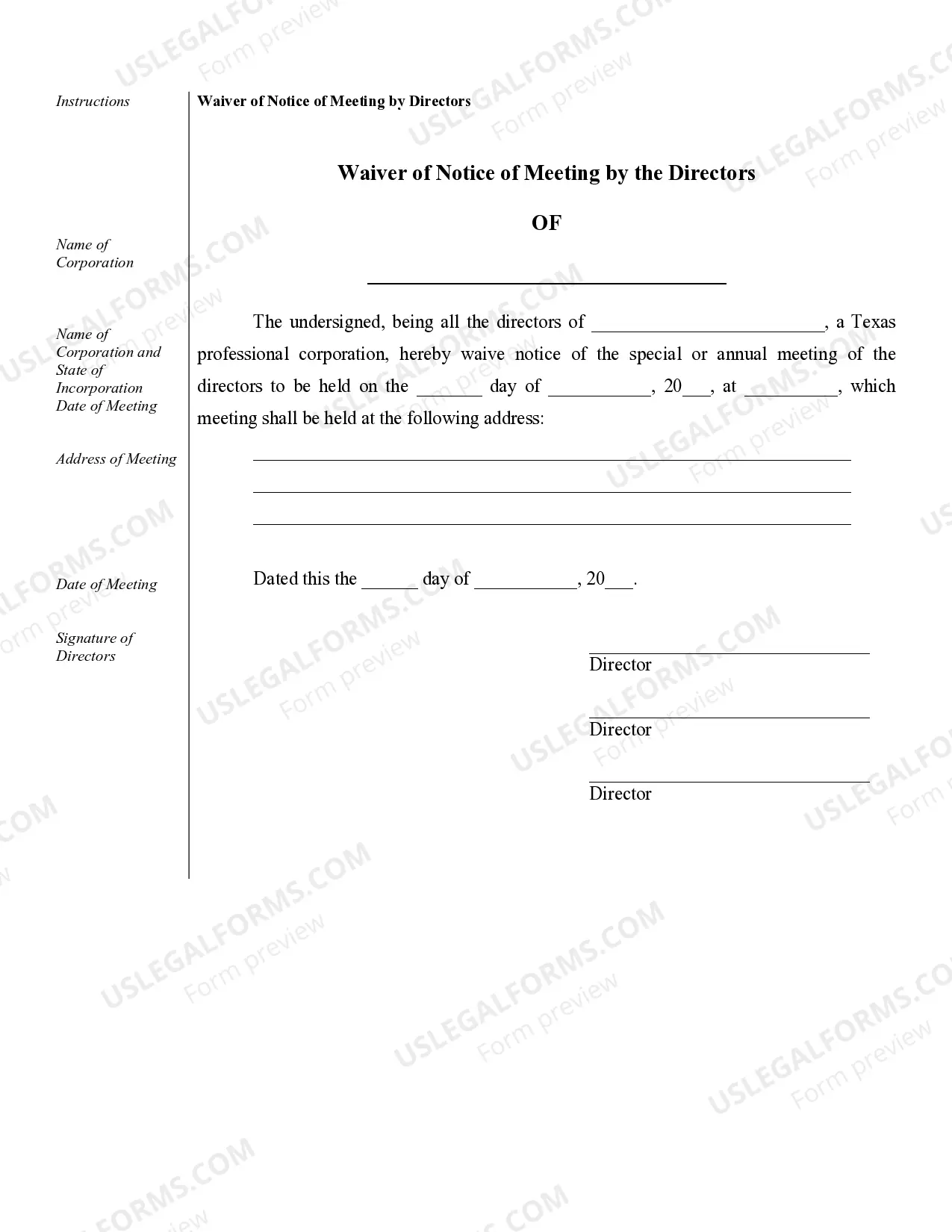

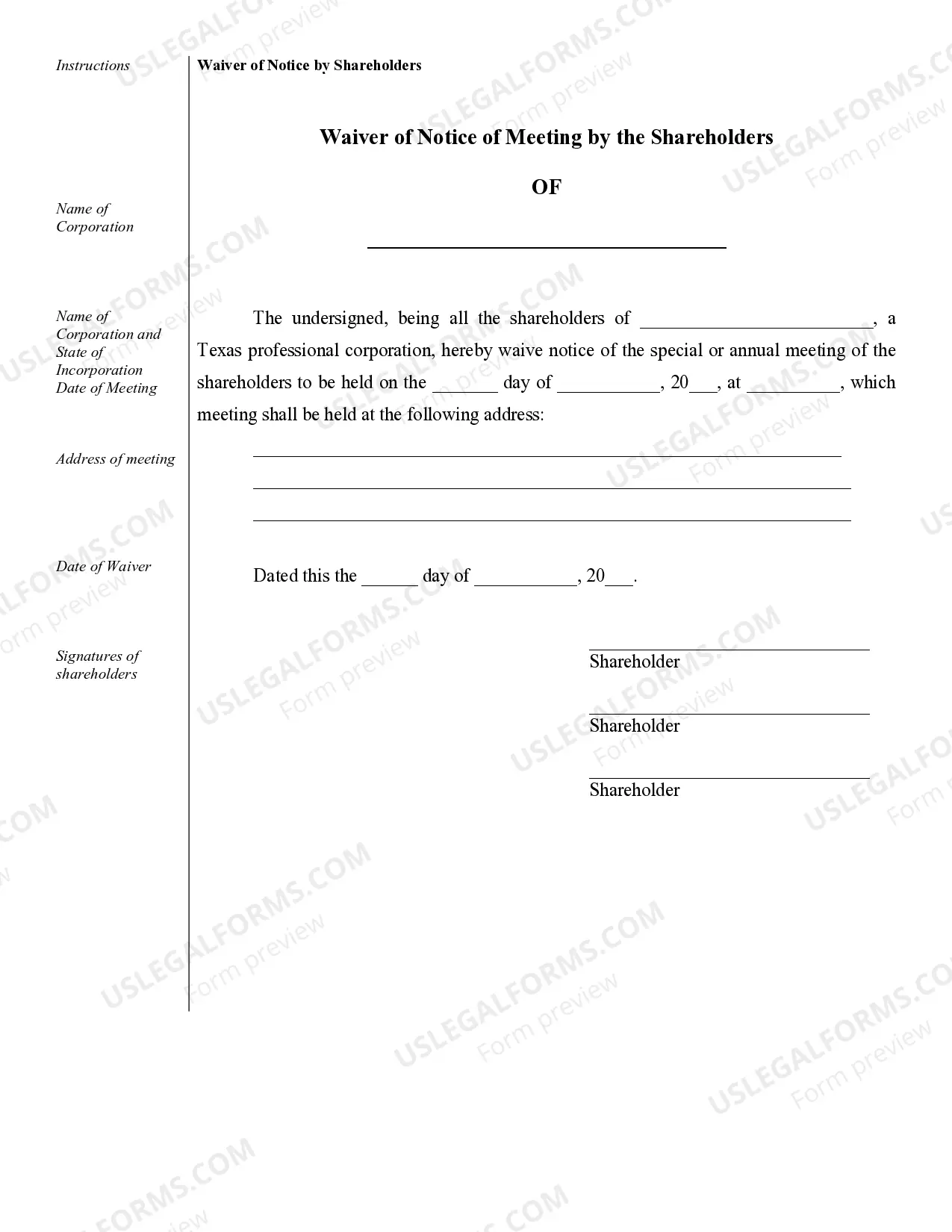

Tarrant Sample Corporate Records for a Texas Professional Corporation refer to the essential documentation that must be maintained by a professional corporation based in Tarrant County, Texas. These records are necessary to demonstrate the corporation's compliance with legal requirements and maintain its corporate status. Here are the different types of Tarrant Sample Corporate Records for a Texas Professional Corporation: 1. Articles of Incorporation: This record outlines the corporation's legal structure, including its name, purpose, registered agent, and shareholders' names and addresses. It is filed with the Texas Secretary of State. 2. Bylaws: These documents establish the internal rules and regulations that govern the corporation's operations, such as procedures for shareholder and board meetings, election of officers, and voting rights. 3. Shareholder Meeting Minutes: Detailed minutes of meetings held by the shareholders, including discussions, voting results, and resolutions passed. These minutes should be maintained for every shareholder meeting conducted by the corporation. 4. Board of Directors Meeting Minutes: Minutes of meetings held by the board of directors, including discussions on significant matters, decision-making processes, and voting results. These records should be maintained for every board meeting held. 5. Stock Certificate Ledger: A ledger that records all the issued shares of the corporation, including details such as the shareholder's name, address, the number of shares allocated, and the date of issuance. 6. Stock Transfer Ledger: This record tracks the transfer of shares from one shareholder to another, capturing details such as the transferor's and transferee's information, share certificates' serial numbers, and the date of transfer. 7. Financial Statements: Comprehensive records reflecting the corporation's financial performance, including balance sheets, income statements, cash flow statements, and notes to the financial statements. These statements should be prepared annually by a certified public accountant. 8. Registered Agent Information: Records that provide details of the corporation's registered agent, such as their name, address, and contact information. The registered agent is responsible for receiving legal notices on behalf of the corporation. 9. Tax Filings: Records related to the corporation's tax filings, including federal tax returns (Form 1120) and any relevant Texas franchise tax returns (No Tax Due or Franchise Tax Report). 10. Annual Reports: Yearly reports submitted to the Texas Secretary of State, providing updates on the corporation's basic information, such as the registered agent, principal address, officers, and directors. It is crucial for a Texas Professional Corporation to maintain accurate and up-to-date records of these documents to ensure compliance with state laws and protect the corporation's liability protections and legal standing. Professional guidance from legal experts familiar with Texas corporate laws and regulations is highly recommended ensuring the proper creation, organization, and maintenance of these records.Tarrant Sample Corporate Records for a Texas Professional Corporation refer to the essential documentation that must be maintained by a professional corporation based in Tarrant County, Texas. These records are necessary to demonstrate the corporation's compliance with legal requirements and maintain its corporate status. Here are the different types of Tarrant Sample Corporate Records for a Texas Professional Corporation: 1. Articles of Incorporation: This record outlines the corporation's legal structure, including its name, purpose, registered agent, and shareholders' names and addresses. It is filed with the Texas Secretary of State. 2. Bylaws: These documents establish the internal rules and regulations that govern the corporation's operations, such as procedures for shareholder and board meetings, election of officers, and voting rights. 3. Shareholder Meeting Minutes: Detailed minutes of meetings held by the shareholders, including discussions, voting results, and resolutions passed. These minutes should be maintained for every shareholder meeting conducted by the corporation. 4. Board of Directors Meeting Minutes: Minutes of meetings held by the board of directors, including discussions on significant matters, decision-making processes, and voting results. These records should be maintained for every board meeting held. 5. Stock Certificate Ledger: A ledger that records all the issued shares of the corporation, including details such as the shareholder's name, address, the number of shares allocated, and the date of issuance. 6. Stock Transfer Ledger: This record tracks the transfer of shares from one shareholder to another, capturing details such as the transferor's and transferee's information, share certificates' serial numbers, and the date of transfer. 7. Financial Statements: Comprehensive records reflecting the corporation's financial performance, including balance sheets, income statements, cash flow statements, and notes to the financial statements. These statements should be prepared annually by a certified public accountant. 8. Registered Agent Information: Records that provide details of the corporation's registered agent, such as their name, address, and contact information. The registered agent is responsible for receiving legal notices on behalf of the corporation. 9. Tax Filings: Records related to the corporation's tax filings, including federal tax returns (Form 1120) and any relevant Texas franchise tax returns (No Tax Due or Franchise Tax Report). 10. Annual Reports: Yearly reports submitted to the Texas Secretary of State, providing updates on the corporation's basic information, such as the registered agent, principal address, officers, and directors. It is crucial for a Texas Professional Corporation to maintain accurate and up-to-date records of these documents to ensure compliance with state laws and protect the corporation's liability protections and legal standing. Professional guidance from legal experts familiar with Texas corporate laws and regulations is highly recommended ensuring the proper creation, organization, and maintenance of these records.