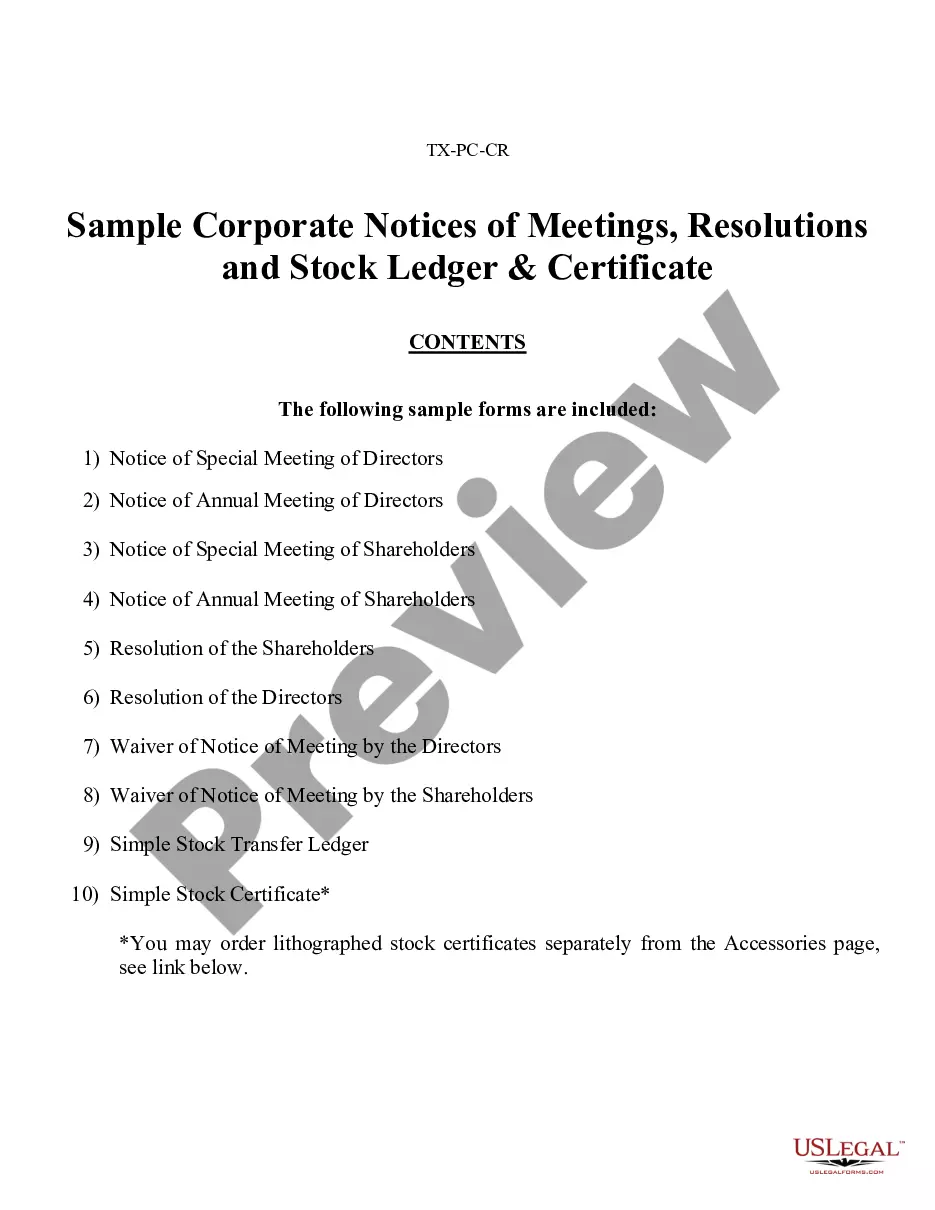

Sample Corporate Notices of Meetings, Resolutions, Simple Stock Ledger & Certificate.

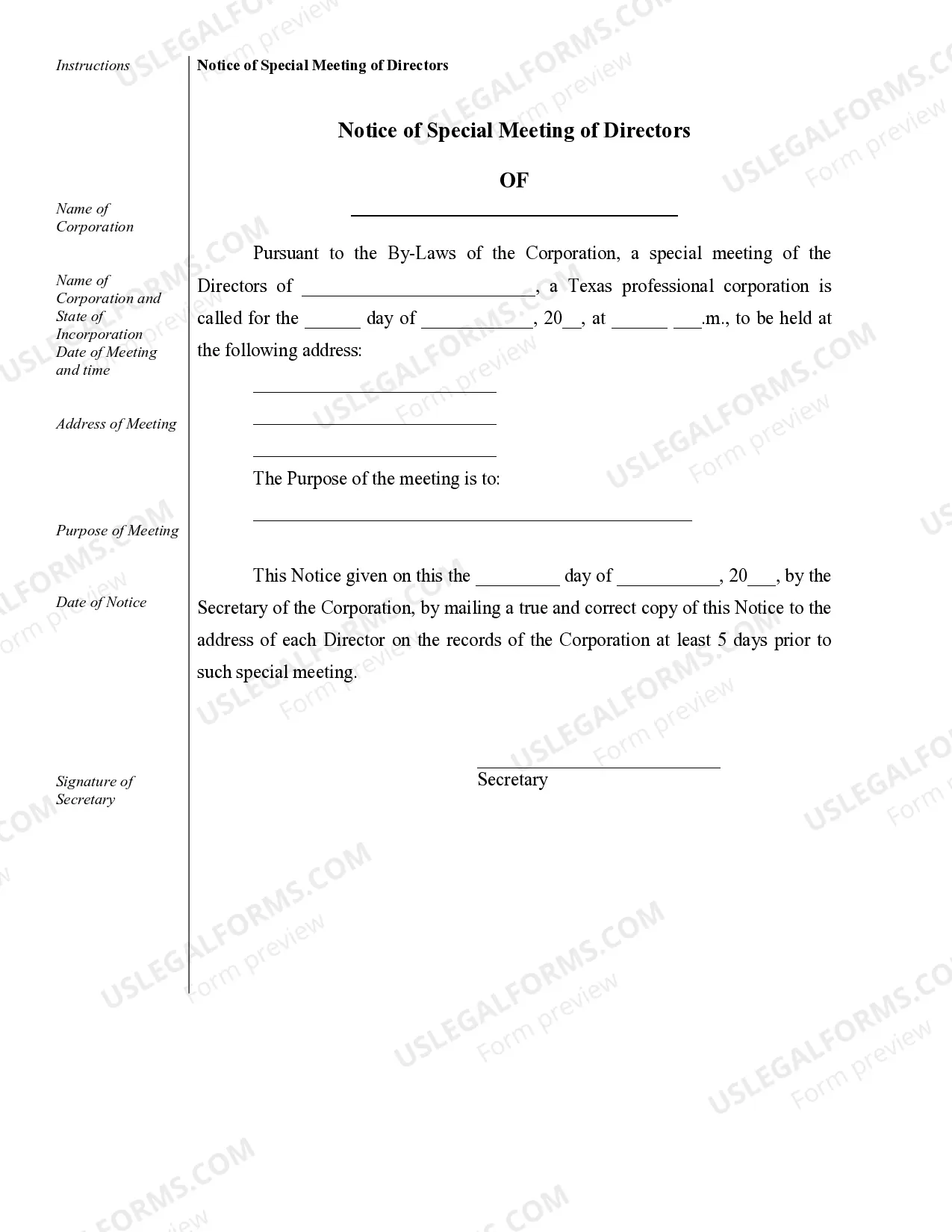

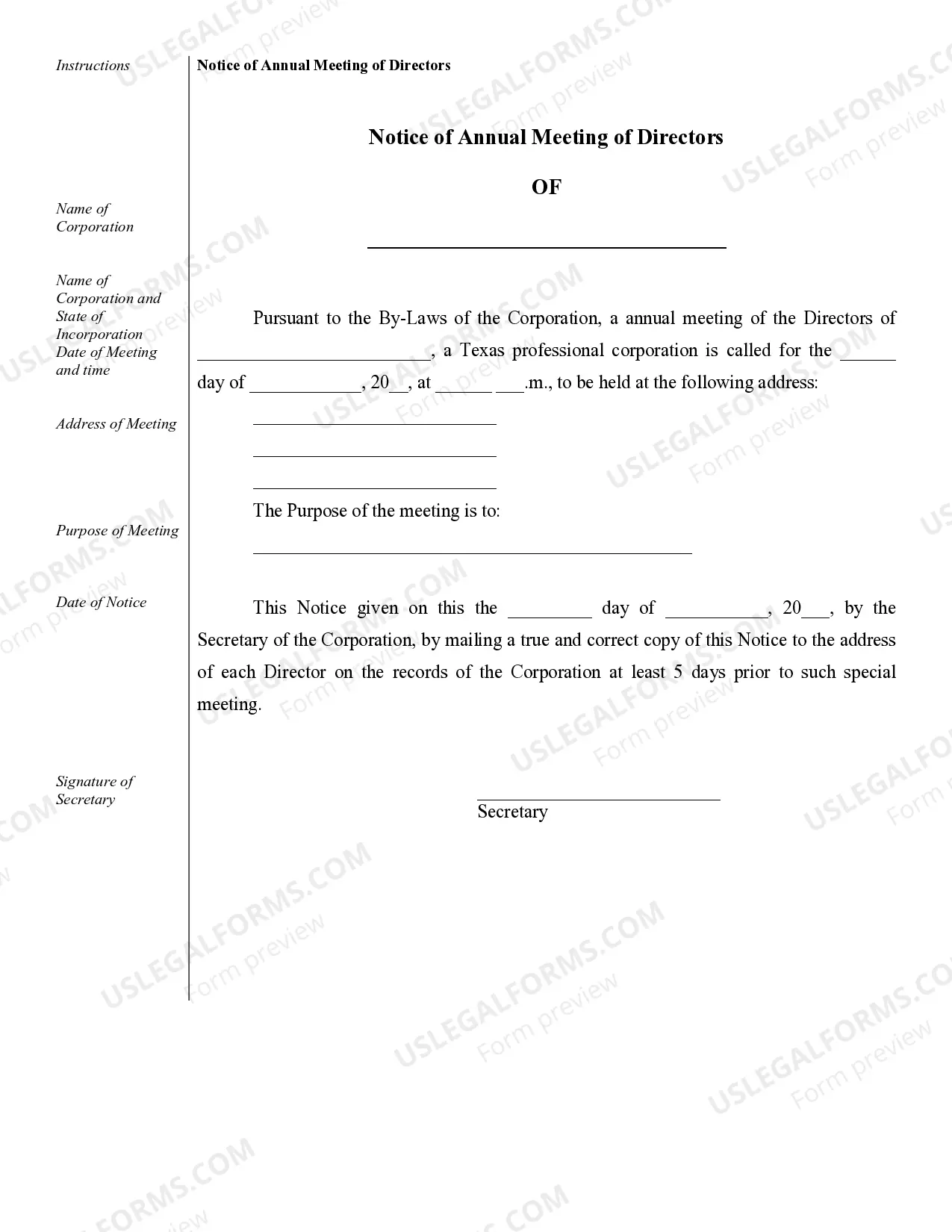

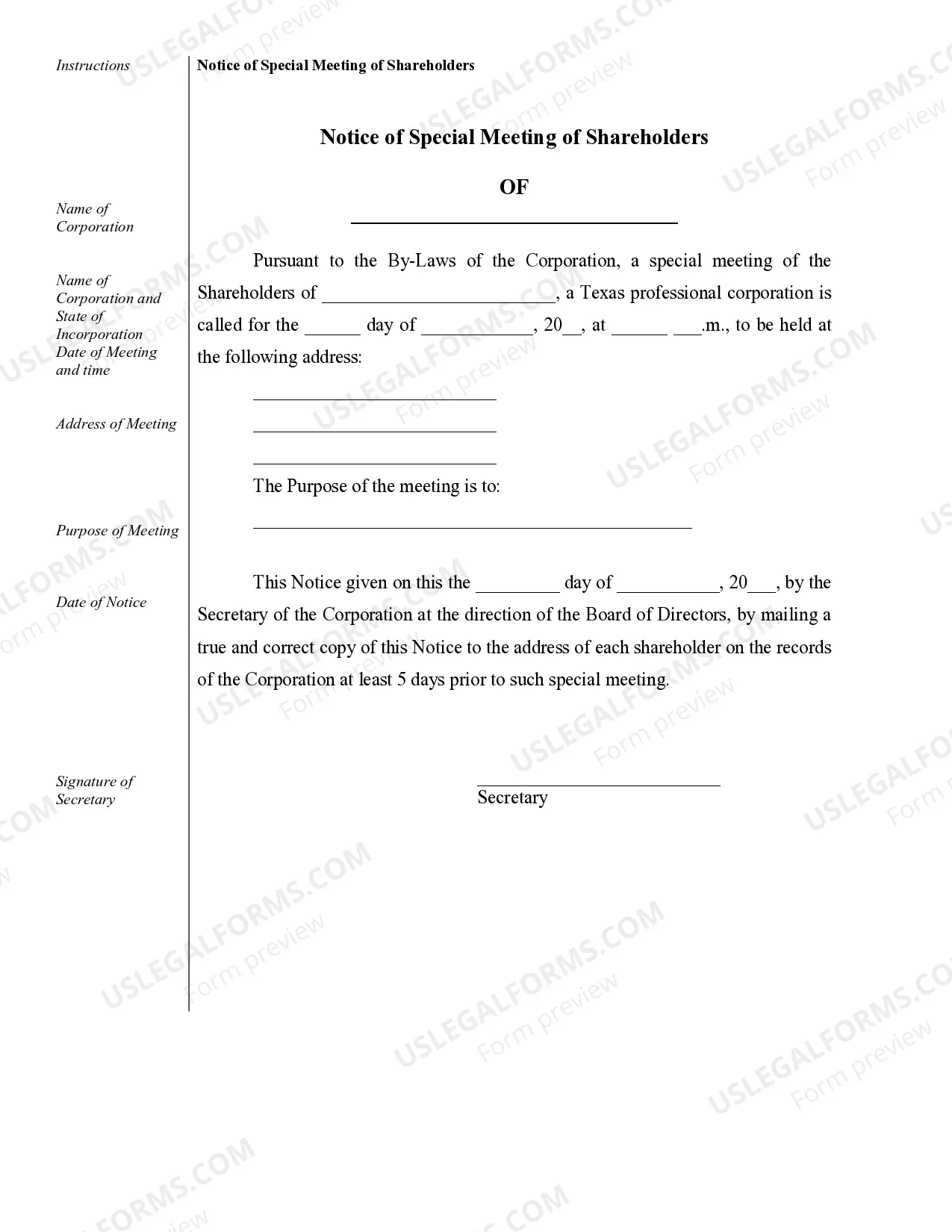

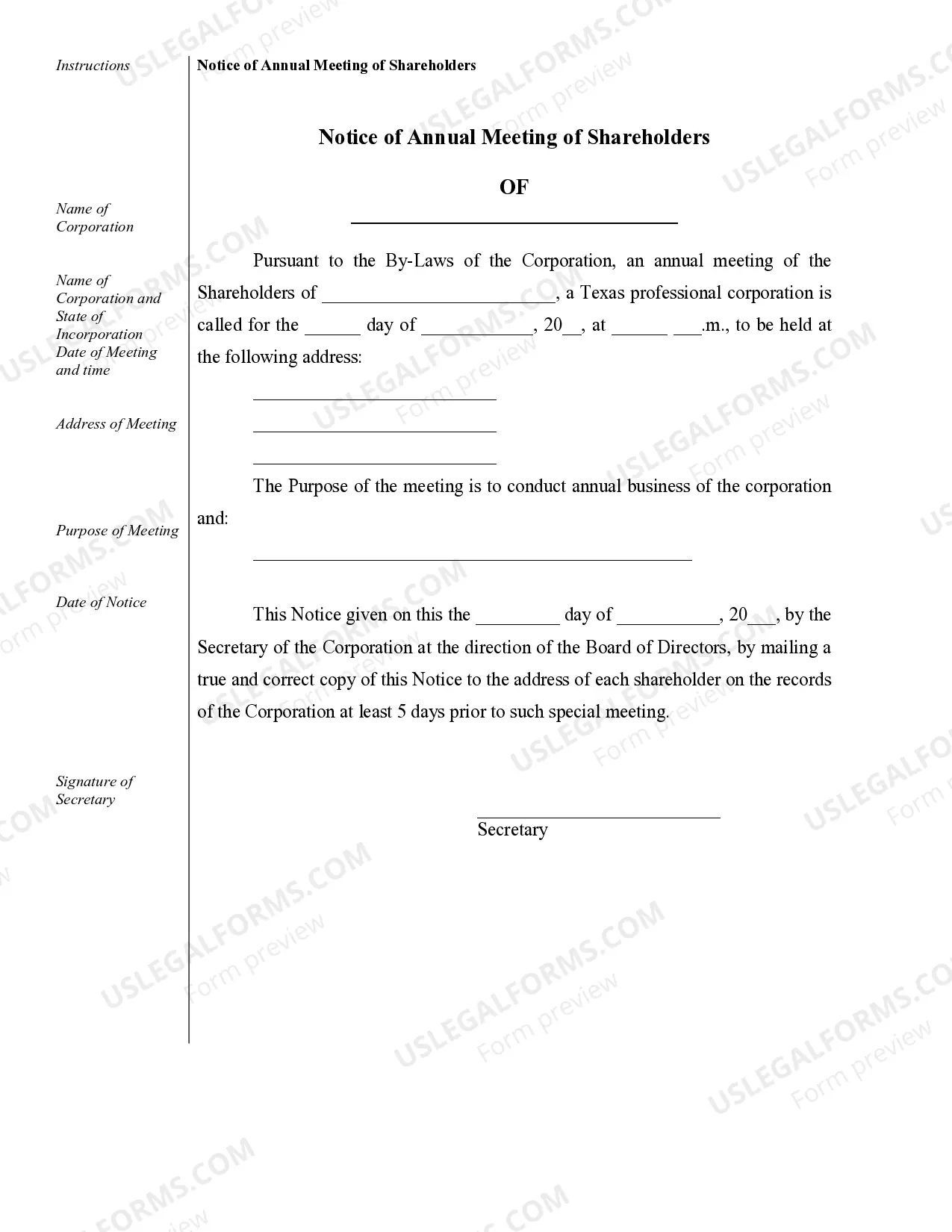

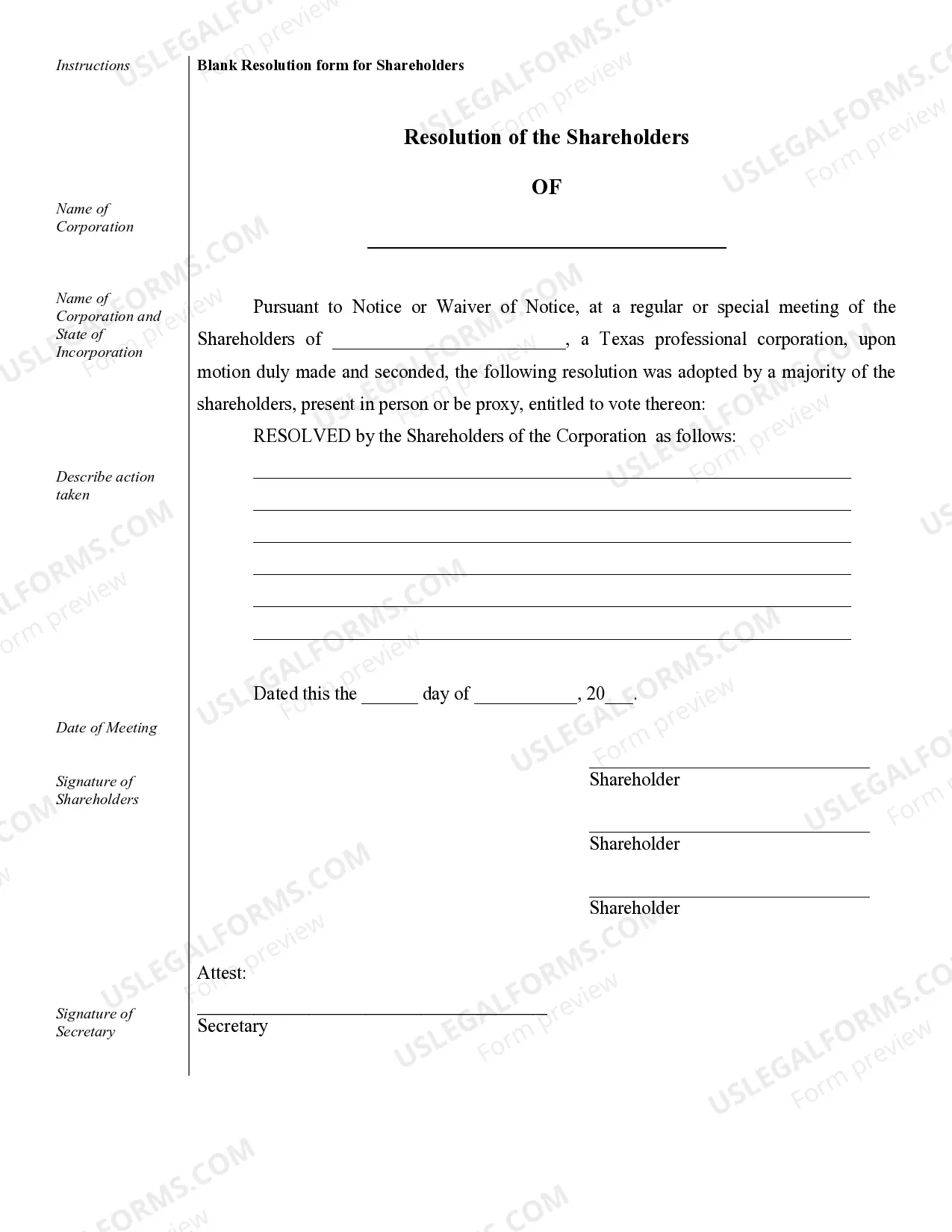

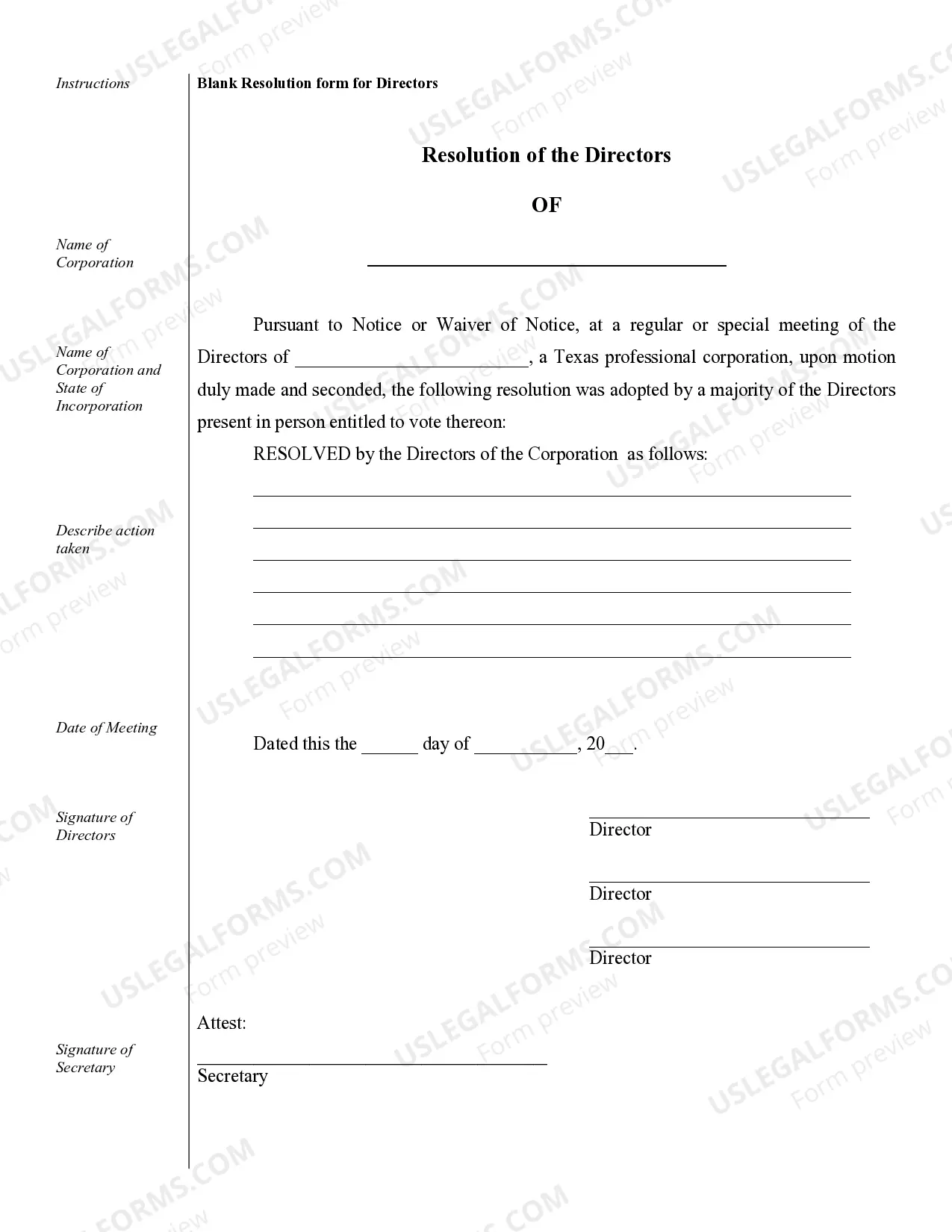

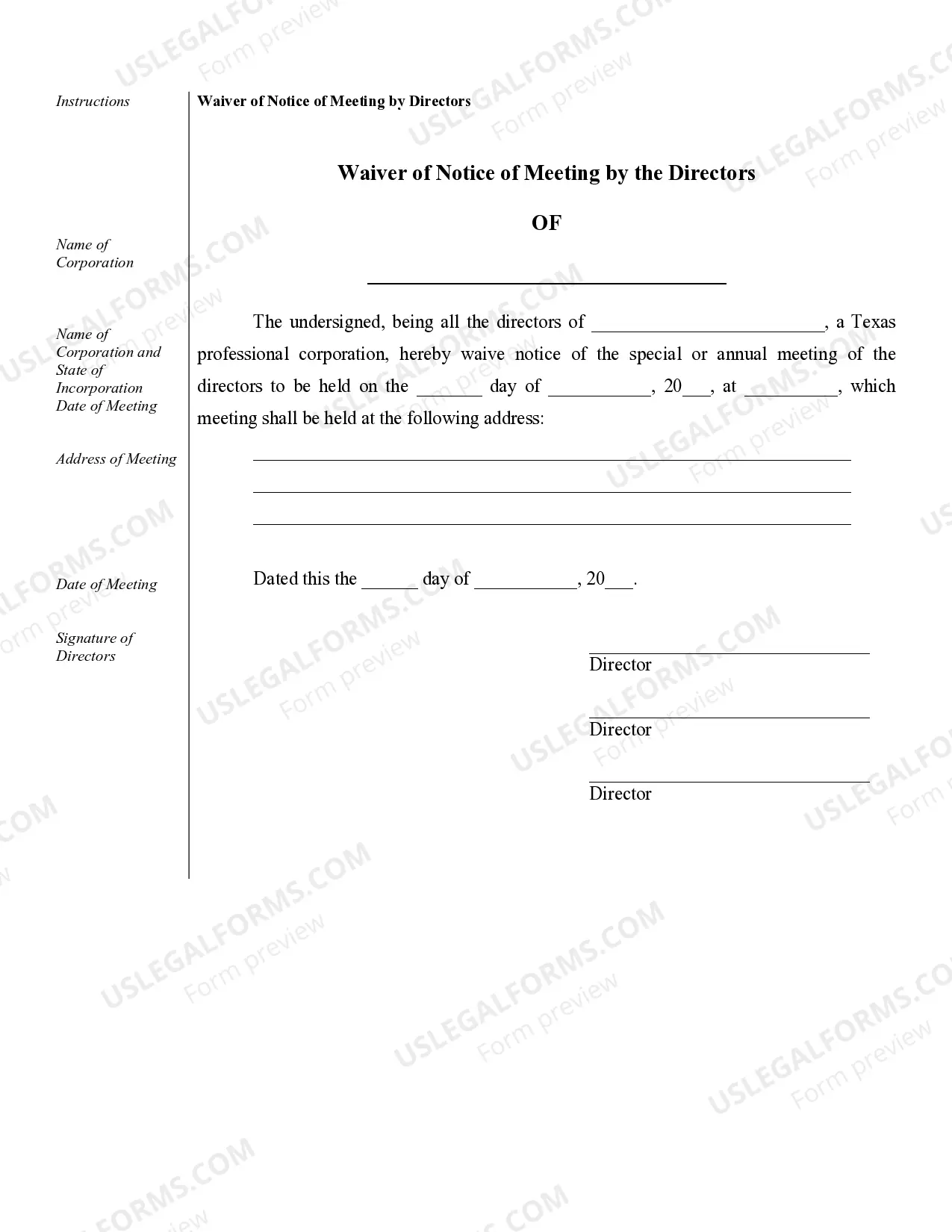

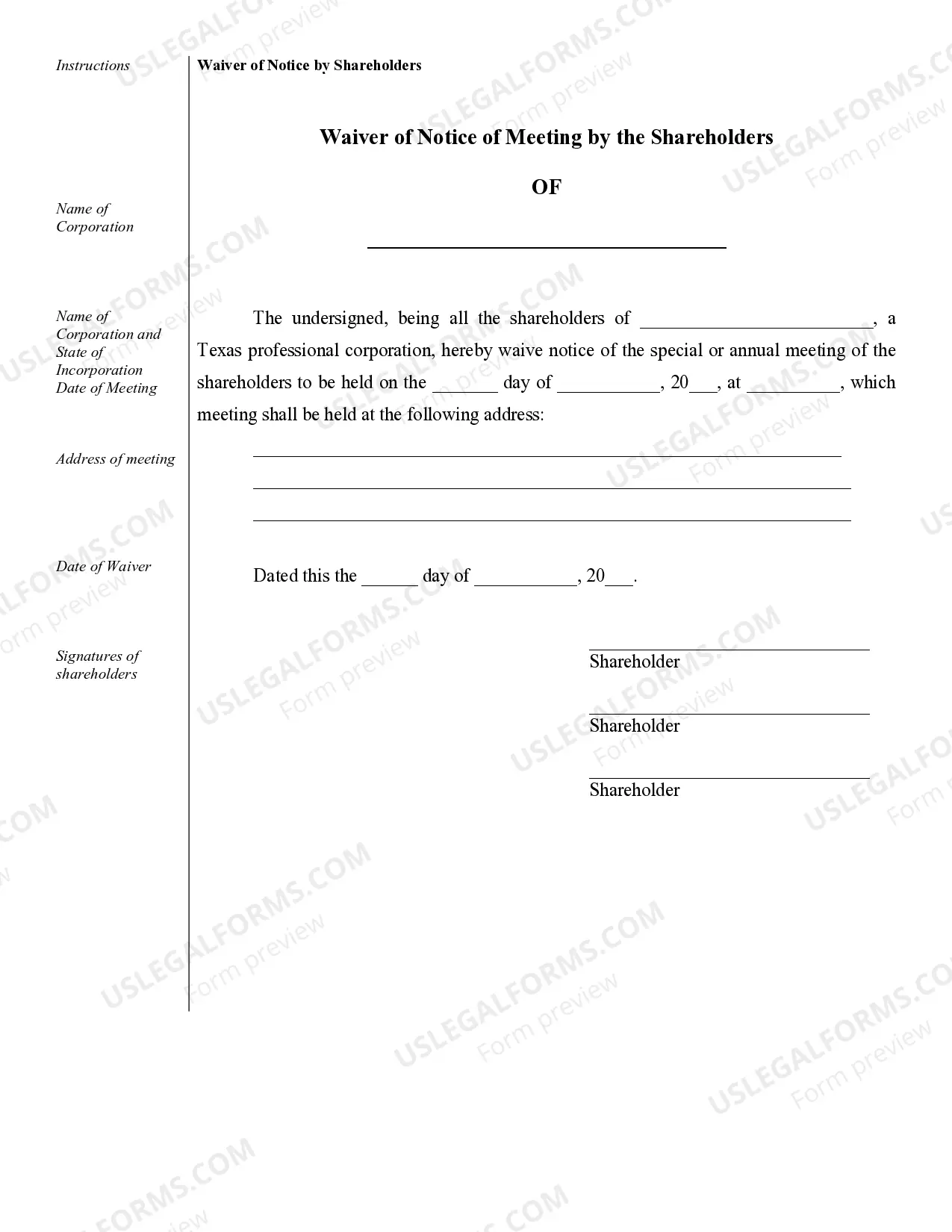

Wichita Falls Sample Corporate Records for a Texas Professional Corporation are essential documents that provide a comprehensive overview of the company's structure, operations, and legal obligations. These records serve as a valuable reference for shareholders, directors, and other stakeholders, aiding in corporate governance and ensuring compliance with regulatory requirements. 1. Articles of Incorporation: This foundational document establishes the existence of the professional corporation (PC) and outlines its purpose, registered agent details, stock information, and more. It serves as the legal proof of the PC's formation and must be filed with the Texas Secretary of State. 2. Bylaws: These detailed guidelines govern the corporation's internal affairs, specifying the roles and powers of directors and officers, meeting procedures, voting requirements, and stockholder rights. Bylaws ensure consistency and promote transparency within the PC's operations. 3. Shareholder Agreements: These agreements outline the rights and responsibilities of the shareholders, including provisions regarding share transfer restrictions, stock issuance, dividend distributions, and decision-making processes. Having a clear and comprehensive shareholder agreement is crucial to avoid disputes and maintain a harmonious business environment. 4. Minutes of Meetings: Detailed records of board of directors' and shareholders' meetings are indispensable for documenting decision-making processes, key discussions, and voting results. These minutes should include attendance, resolutions, and any important disclosures made during the meeting. 5. Stock Ledger: This record tracks the ownership of shares in the PC, including details such as shareholder names, addresses, share issuance dates, and numbers. Accurate stock ledgers are crucial for maintaining an up-to-date record of ownership and facilitating smooth share transfers. 6. Financial Statements: Regular financial reports such as balance sheets, income statements, and cash flow statements provide an overview of the PC's financial health and performance. These records are vital for both internal analysis and external reporting to regulatory authorities, investors, and lenders. 7. Tax Records: Documentation of the PC's tax filings, including federal and state returns, is essential to ensure compliance with tax laws. These records should be maintained in accordance with the requirements of the Internal Revenue Service (IRS) and the Texas Comptroller of Public Accounts. 8. Employment Agreements: Contracts with key employees, including officers and executives, are important records for clarifying terms of employment, compensation, non-compete clauses, and other employment-related provisions. These agreements protect the PC's interests and maintain a stable work environment. 9. Licenses and Permits: Copies of all necessary licenses, permits, and registrations obtained by the PC to operate legally in Texas should be included in the corporate records. This may include professional licenses required by specific industries or the PC's profession. 10. Contracts and Agreements: Copies of significant contracts, such as leases, vendor agreements, client contracts, and partnership agreements, are crucial records that illustrate the PC's business relationships and obligations. Maintaining accurate and up-to-date Wichita Falls Sample Corporate Records for a Texas Professional Corporation is vital for legal and financial compliance, facilitating effective governance, and ensuring transparency within the organization. It is advisable to consult legal professionals or corporate services providers to ensure adherence to specific requirements and best practices.Wichita Falls Sample Corporate Records for a Texas Professional Corporation are essential documents that provide a comprehensive overview of the company's structure, operations, and legal obligations. These records serve as a valuable reference for shareholders, directors, and other stakeholders, aiding in corporate governance and ensuring compliance with regulatory requirements. 1. Articles of Incorporation: This foundational document establishes the existence of the professional corporation (PC) and outlines its purpose, registered agent details, stock information, and more. It serves as the legal proof of the PC's formation and must be filed with the Texas Secretary of State. 2. Bylaws: These detailed guidelines govern the corporation's internal affairs, specifying the roles and powers of directors and officers, meeting procedures, voting requirements, and stockholder rights. Bylaws ensure consistency and promote transparency within the PC's operations. 3. Shareholder Agreements: These agreements outline the rights and responsibilities of the shareholders, including provisions regarding share transfer restrictions, stock issuance, dividend distributions, and decision-making processes. Having a clear and comprehensive shareholder agreement is crucial to avoid disputes and maintain a harmonious business environment. 4. Minutes of Meetings: Detailed records of board of directors' and shareholders' meetings are indispensable for documenting decision-making processes, key discussions, and voting results. These minutes should include attendance, resolutions, and any important disclosures made during the meeting. 5. Stock Ledger: This record tracks the ownership of shares in the PC, including details such as shareholder names, addresses, share issuance dates, and numbers. Accurate stock ledgers are crucial for maintaining an up-to-date record of ownership and facilitating smooth share transfers. 6. Financial Statements: Regular financial reports such as balance sheets, income statements, and cash flow statements provide an overview of the PC's financial health and performance. These records are vital for both internal analysis and external reporting to regulatory authorities, investors, and lenders. 7. Tax Records: Documentation of the PC's tax filings, including federal and state returns, is essential to ensure compliance with tax laws. These records should be maintained in accordance with the requirements of the Internal Revenue Service (IRS) and the Texas Comptroller of Public Accounts. 8. Employment Agreements: Contracts with key employees, including officers and executives, are important records for clarifying terms of employment, compensation, non-compete clauses, and other employment-related provisions. These agreements protect the PC's interests and maintain a stable work environment. 9. Licenses and Permits: Copies of all necessary licenses, permits, and registrations obtained by the PC to operate legally in Texas should be included in the corporate records. This may include professional licenses required by specific industries or the PC's profession. 10. Contracts and Agreements: Copies of significant contracts, such as leases, vendor agreements, client contracts, and partnership agreements, are crucial records that illustrate the PC's business relationships and obligations. Maintaining accurate and up-to-date Wichita Falls Sample Corporate Records for a Texas Professional Corporation is vital for legal and financial compliance, facilitating effective governance, and ensuring transparency within the organization. It is advisable to consult legal professionals or corporate services providers to ensure adherence to specific requirements and best practices.