Organizational Minutes document the activities associated with the creation of the professional corporation.

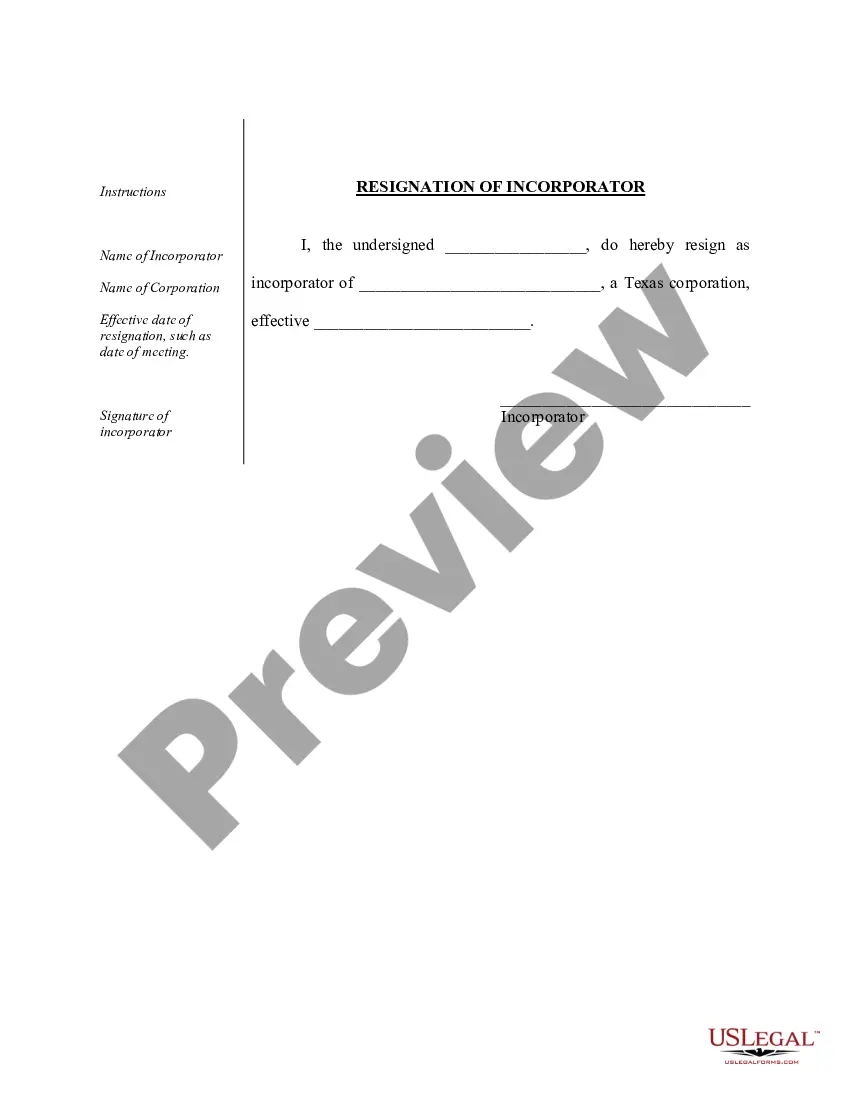

Plano Organizational Minutes for a Texas Professional Corporation involve the creation and establishment of important corporate documents. These minutes serve as a formal record of the proceedings held during the initial organizational meeting. They are essential for maintaining legal compliance and ensuring transparency within the corporation. Here is a detailed description of what Plano Organizational Minutes for a Texas Professional Corporation entail, along with relevant keywords: 1. Purpose: The primary aim of Plano Organizational Minutes for a Texas Professional Corporation is to lay the foundation for the corporation's operations. These minutes document the decisions made, actions taken, and resolutions adopted during the initial organizational meeting. 2. Legal Compliance: Plano Organizational Minutes ensure compliance with the Texas Business Organizations Code, specifically Chapter 21 governing professional corporations. Adhering to legal requirements is crucial for asset protection, safeguarding directors/officers' liability, and maintaining the corporation's legitimacy. 3. Meeting Details: The minutes typically include the date, time, and location of the organizational meeting. It is vital to record who presided over the meeting and who acted as the secretary responsible for taking notes. 4. Attendance: Listing the names of all participants, including directors/shareholders and any invited professionals like attorneys or accountants, is essential to establish the validity of the proceedings. 5. Apologies and Excuses: If any invitee or participant couldn't attend the meeting, their apologies or excuses should be duly noted. This ensures transparency and avoids any potential disputes regarding participation. 6. Ratification of Incorporation Documents: The minutes should record the unanimous ratification of the Certificate of Formation or Articles of Incorporation, which signify the establishment of the Texas Professional Corporation. 7. Bylaws Adoption: The adoption of the corporation's bylaws is a critical step. These bylaws outline the corporation's internal rules, governance structure, shareholder rights, and decision-making processes. The minutes should reflect the unanimous consent or any amendments made to the proposed bylaws. 8. Appointment of Directors and Officers: Plano Organizational Minutes document the appointment of the initial directors and officers who will manage the corporation's day-to-day affairs. This includes their names, positions within the corporation, and any specific responsibilities assigned. 9. Banking and Financial Matters: This section may cover important decisions related to opening bank accounts, selecting financial institutions, and appointing signatories for corporate banking transactions. 10. Business Licenses and Permits: If applicable, the minutes may address obtaining necessary licenses or permits required for the professional corporation to operate within the state of Texas. Different types of Plano Organizational Minutes for a Texas Professional Corporation may include variations specific to the corporation's industry or nature of practice (e.g., medical, legal, accounting). However, the core elements mentioned above remain applicable across all types. In conclusion, Plano Organizational Minutes for a Texas Professional Corporation play a vital role in establishing the foundational framework for the corporation's operations and compliance with legal requirements. Detailed minutes ensure transparent decision-making, protect shareholders, and facilitate the smooth functioning of the corporation's governance structure.Plano Organizational Minutes for a Texas Professional Corporation involve the creation and establishment of important corporate documents. These minutes serve as a formal record of the proceedings held during the initial organizational meeting. They are essential for maintaining legal compliance and ensuring transparency within the corporation. Here is a detailed description of what Plano Organizational Minutes for a Texas Professional Corporation entail, along with relevant keywords: 1. Purpose: The primary aim of Plano Organizational Minutes for a Texas Professional Corporation is to lay the foundation for the corporation's operations. These minutes document the decisions made, actions taken, and resolutions adopted during the initial organizational meeting. 2. Legal Compliance: Plano Organizational Minutes ensure compliance with the Texas Business Organizations Code, specifically Chapter 21 governing professional corporations. Adhering to legal requirements is crucial for asset protection, safeguarding directors/officers' liability, and maintaining the corporation's legitimacy. 3. Meeting Details: The minutes typically include the date, time, and location of the organizational meeting. It is vital to record who presided over the meeting and who acted as the secretary responsible for taking notes. 4. Attendance: Listing the names of all participants, including directors/shareholders and any invited professionals like attorneys or accountants, is essential to establish the validity of the proceedings. 5. Apologies and Excuses: If any invitee or participant couldn't attend the meeting, their apologies or excuses should be duly noted. This ensures transparency and avoids any potential disputes regarding participation. 6. Ratification of Incorporation Documents: The minutes should record the unanimous ratification of the Certificate of Formation or Articles of Incorporation, which signify the establishment of the Texas Professional Corporation. 7. Bylaws Adoption: The adoption of the corporation's bylaws is a critical step. These bylaws outline the corporation's internal rules, governance structure, shareholder rights, and decision-making processes. The minutes should reflect the unanimous consent or any amendments made to the proposed bylaws. 8. Appointment of Directors and Officers: Plano Organizational Minutes document the appointment of the initial directors and officers who will manage the corporation's day-to-day affairs. This includes their names, positions within the corporation, and any specific responsibilities assigned. 9. Banking and Financial Matters: This section may cover important decisions related to opening bank accounts, selecting financial institutions, and appointing signatories for corporate banking transactions. 10. Business Licenses and Permits: If applicable, the minutes may address obtaining necessary licenses or permits required for the professional corporation to operate within the state of Texas. Different types of Plano Organizational Minutes for a Texas Professional Corporation may include variations specific to the corporation's industry or nature of practice (e.g., medical, legal, accounting). However, the core elements mentioned above remain applicable across all types. In conclusion, Plano Organizational Minutes for a Texas Professional Corporation play a vital role in establishing the foundational framework for the corporation's operations and compliance with legal requirements. Detailed minutes ensure transparent decision-making, protect shareholders, and facilitate the smooth functioning of the corporation's governance structure.