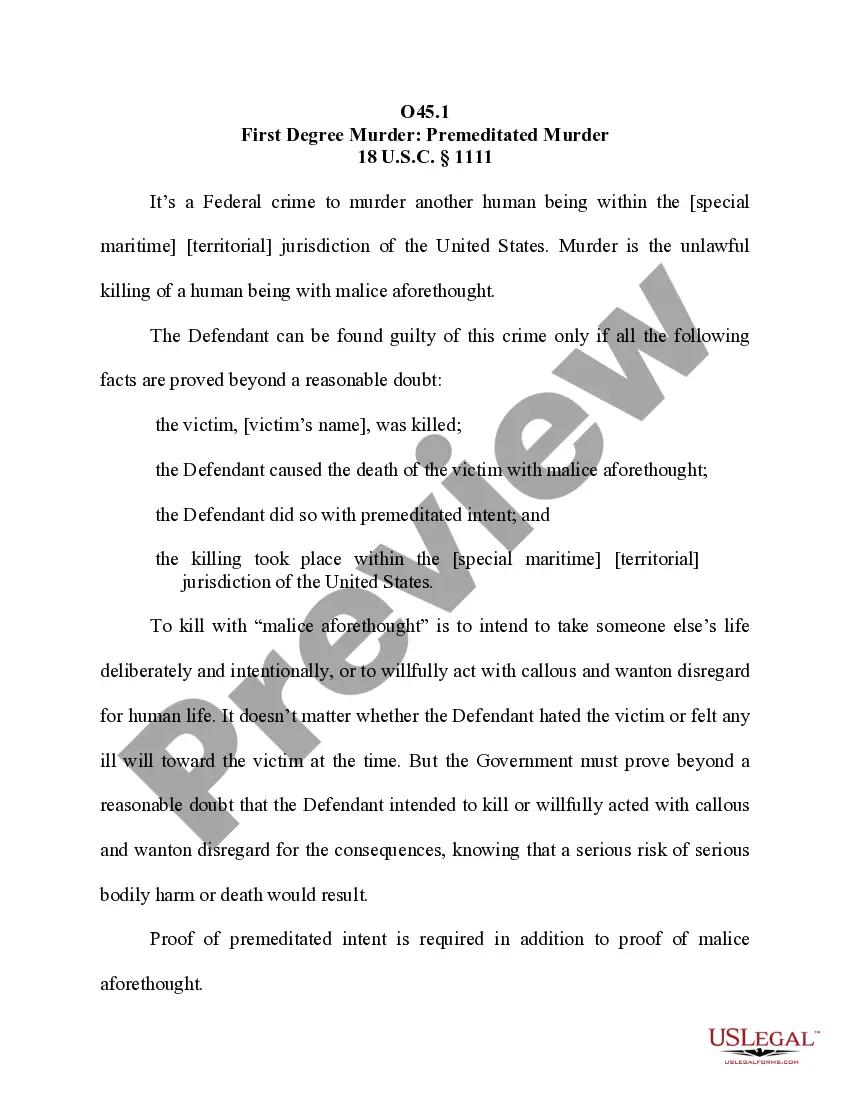

Organizational Minutes document the activities associated with the creation of the professional corporation.

San Antonio Organizational Minutes for a Texas Professional Corporation

Description

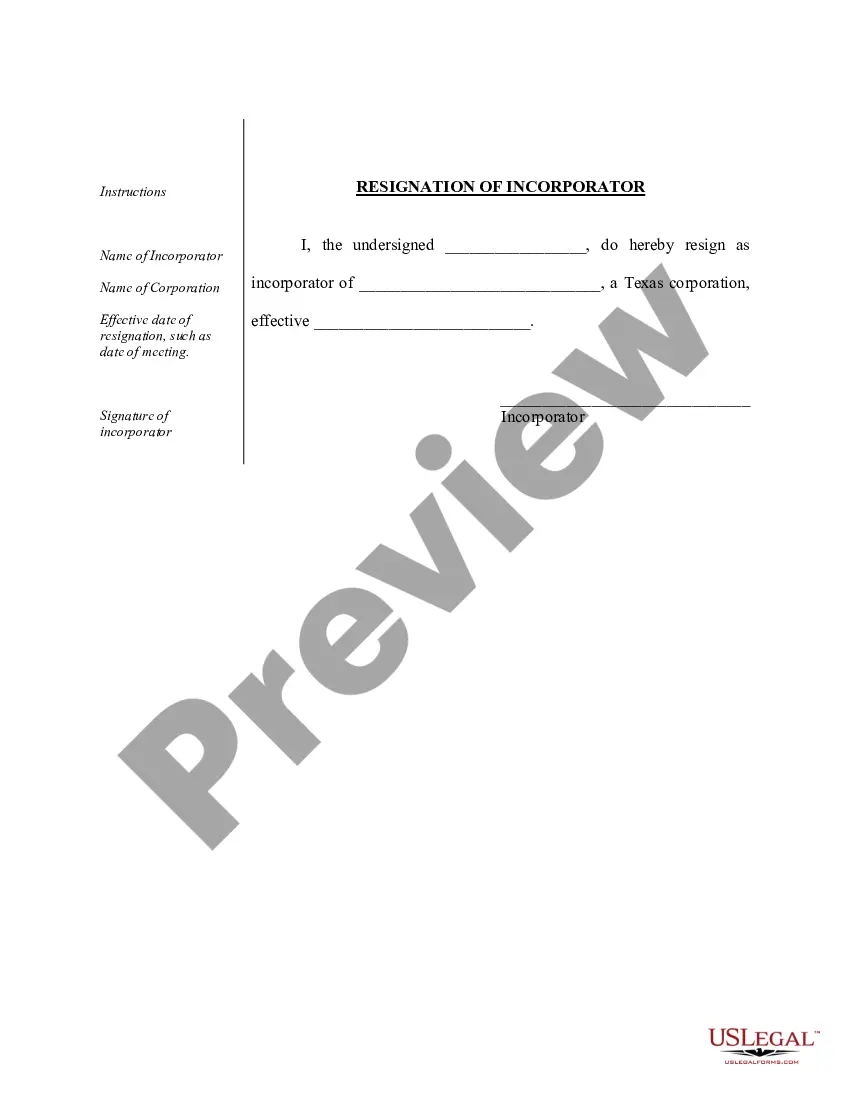

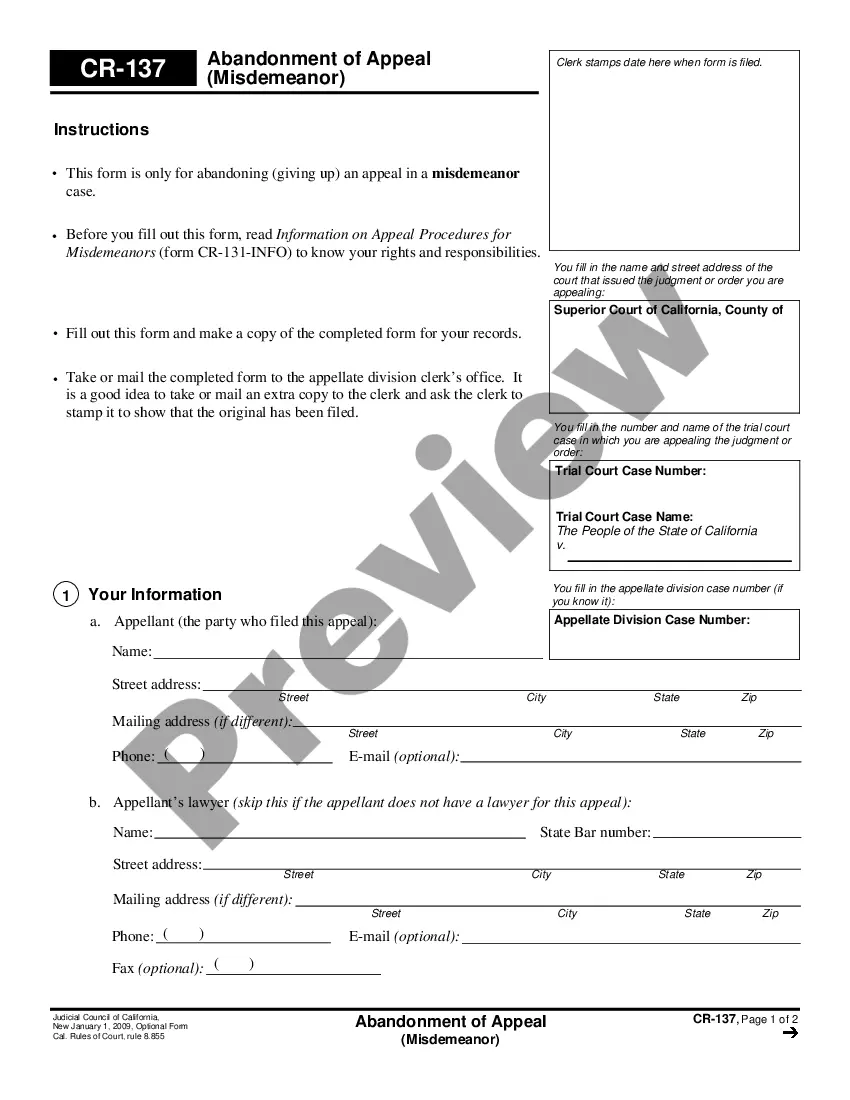

How to fill out Organizational Minutes For A Texas Professional Corporation?

Utilize the US Legal Forms and gain instant access to any form template you require.

Our advantageous website with countless document templates streamlines the process of locating and acquiring nearly any document sample you need.

You can export, fill out, and authenticate the San Antonio Organizational Minutes for a Texas Professional Corporation in just minutes instead of spending hours searching online for a suitable template.

Using our collection is an excellent method to enhance the security of your record submissions.

If you do not have an account yet, follow these steps.

Access the page with the template you need. Confirm that it is the form you were seeking: verify its title and description, and utilize the Preview feature if available. If not, use the Search field to identify the correct one.

- Our knowledgeable attorneys regularly assess all documents to ensure that the templates are applicable for a specific state and comply with new laws and regulations.

- How can you acquire the San Antonio Organizational Minutes for a Texas Professional Corporation.

- If you have an account, simply Log In to your account.

- The Download button will be activated on all the samples you view.

- Additionally, you can retrieve all the previously saved documents in the My documents section.

Form popularity

FAQ

A Texas partnership registered as a Texas limited liability partnership (LLP) is required to file an annual report with the secretary of state no later than June 1 of each year following the calendar year in which the application for registration takes effect.

Incorporation in Texas Also referred to as the Certificate of Organization, Certificate of Formation, and the Articles of Incorporation, this document essentially functions like a state license for the formation and operation of a business in the state.

Texas Franchise Tax Report Since LLCs, LLPs, and corporations aren't required to file an annual report, they instead submit an information report while paying yearly franchise tax. Such filing is submitted to the Texas Comptroller of Public Accounts (CPA).

To file articles of organization for your LLC, follow these steps: Contact your state's secretary of state or business filing agency.File your articles of organization.Pay the LLC formation filing fee.Receive a certificate of formation.Publish notice of formation, if required.

You can either file this document online through the secretary of state's SOSDirect website or submit it by postal mail, along with a filing fee of $300. The main purpose of the articles of organization is to give the state a written document to keep on file.

A new LLC that is being formed in Texas needs to file a Certificate of Formation?Limited Liability Company (Form 205) with the Texas Secretary of State, and pay a $300 filing fee.

You can either file this document online through the secretary of state's SOSDirect website or submit it by postal mail, along with a filing fee of $300. The main purpose of the articles of organization is to give the state a written document to keep on file.

The document required to form an LLC in Texas is called the Articles of Organization. The information required in the formation document varies by state. The Texas requirements include: Registered agent.

Annual Report Unlike most states, Texas does not require LLCs to file annual reports with the Secretary of State. However, LLCs must file annual franchise tax reports (see below).

Information Reports: Corporations, LLCs, Limited Partnerships, Professional Associations and financial institutions must file the Public Information Report (PIR). All other entity types must file the Ownership Information Report (OIR).